Banking structures are quite complex, but at the same time they represent a promising and highly profitable idea. Speaking about how to open your own bank, it should be noted that an entrepreneur must have a wealth of knowledge in the chosen field and have a large start-up capital. The business will require large investments, so the best option is to attract investors to the business. You can also greatly simplify your work if you purchase a ready-made bank rather than opening one from scratch. This approach will reduce the time spent on confirming all licenses, training and hiring personnel, and further arrangement. In general, a banking institution is a specific area that is created by experienced entrepreneurs and usually does not act as the main business.

What's good about banking?

Why do many entrepreneurs set their goal to open a bank? — It’s very simple - they understand how profitable this event is. Opening such a business is a profitable business, but only with a competent approach and initial investment.

This type of business is very profitable, but it is very difficult to enter it. It is necessary to make significant financial investments, the total amount of which can be from 100 million rubles or more. In addition, you must have good connections and extensive experience in this field.

Business relevance

There are several reasons that determine the relevance of opening such a business:

- High income and profitability of the project - if you approach the creation of a business competently, it will pay off in 5 years of work and increase the owner’s income.

- Development prospects – banking services are constantly evolving, new services are being invented. Also, do not forget about possible expansion and creation of new branches.

- Prestige - an entrepreneur who owns a banking organization immediately receives a higher status, which affects his projects.

- Wide choice of directions - you can choose the target audience, format of work, list of services provided, and so on.

What is your own bank?

This is a financial institution that provides a number of services to individuals and businesses (making payments, servicing credit and debit cards, processing deposits, and so on).

Control of the bank’s activities and regulation of intrabank processes is the task of the Central Bank.

Recently, commercial financial institutions have become very popular, providing a wide range of services - issuing loans, selling securities, opening (maintaining) accounts, and so on. But here it is worth carrying out business planning in a commercial bank and strictly following the plan.

Documents and procedure for obtaining them

So, when starting to prepare the documentation, you need to follow this procedure:

- Register a business entity. For this purpose, the most often used is the opening of a joint stock company. According to the state classifier, banking activities are designated as “financial services that do not include insurance and pension services.”

- Collect and document complete information about the bank you plan to open. The package of documents must include the full name of the bank and its coordinates. All this must be sent to the Main Regional Directorate; each region has its own. It is he who should give you a signed work agreement. Until you pass this stage, you simply will not be able to move further. It is the Main Regional Directorate that will check your solvency and the availability of sufficient start-up capital.

- Also at this stage, there will be a deep check of the credit history of the enterprise (if you are buying an already operating small bank), and each of its founders individually.

- And if at least one of the bank’s shareholders has unresolved problems with their credit history, then you most likely will not see the signature until the conflict situation is completely resolved.

And now a little about the starting capital that you should have. The minimum amount of money that should be in the account of the future bank is 300 million rubles. Previously, this amount was 180 million rubles, but recently, due to the crisis, it was increased almost 2 times.

What should the format be?

Today, five types of banks can be distinguished: retail, settlement, market, credit and financial; the latter are more focused on interbank cooperation.

You have two options - choose one of the groups listed above or create a universal financial institution combining several types of banks.

But keep in mind that the complex option is the most difficult to implement. To simplify the task, you can study the example of a bank business plan, which you will definitely find on the Internet.

Bank business plan: who should start this type of business

Usually, truly experienced and reputable investors go to open their own banking organization. This is done in order to service and finance the main enterprise.

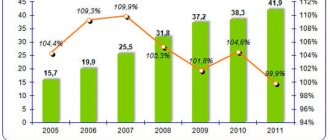

Today, the banking sector in Russia is represented by a large number of organizations: among them there are small, but only serious banks. It is immediately worth noting the high level of competition. However, we must not forget about the high level of demand - an increasing number of clients prefer banking products and services, which means this business has prospects for success. Opening a bank in the Russian Federation will not be easy due to serious bureaucratic red tape, the need for a large amount of investment, as well as the need to resolve many other issues. In this case, a well-thought-out business plan, which is based on analytics of enterprise development, comes to the rescue. The forecast should be carried out in several directions at once:

- external market;

- legislative framework in the segment;

- projected sales level;

- potential consumer of products and services;

- assessment of direct and indirect competitors;

- forecasting the position of a banking organization in the country's financial market.

A forecast can be made for the next few years, for example, 3 or 5 years. During this time, you need to set objective goals for yourself. This could be positioning the brand in the market and gaining a positive reputation among clients, expanding the range of services, creating your own credit policy, etc.

How to decide on the legal basis?

It is no secret that when conducting banking activities you need a license.

You will have to run around to sign a number of agreements, obtain licenses and constituent documents.

What papers will be required?

The list is very wide - licenses for conducting banking operations, for working with precious metals, as well as for conducting depository activities.

In addition, you will need a permit from the State Customs Committee, which gives the right to act as a guarantor at customs, a registration certificate, which will make it possible to carry out transactions with precious metals, attract deposits, conduct transactions with stones, and also act as a guarantor before the customs authorities.

But that's not all. You must register with the tax office and receive your TIN. The cost of obtaining licenses is from 200,000 rubles.

How to open your own bank from scratch in Russia: step-by-step instructions

First of all, it is necessary to draw up a business plan, which will detail each event necessary for opening. The opening algorithm should look something like this:

- Market analysis, identification of competition in the city, drawing up a portrait of the target audience.

- Studying all the necessary information - laws, regulations, the banking system as a whole.

- Selection of bank direction.

- Drawing up a business project.

- Selecting partners, searching for investors.

- Creation of an LLC, development of a charter, choice of the size of the authorized capital.

- Selection of premises for the main branch, search for places to install ATMs and terminals.

- Carrying out repairs in the premises.

- Purchase and installation of equipment.

- Selection of employees.

- Advertising campaign.

- Opening.

Necessary documents, licenses for opening

First of all, you need to register your business. According to the legislation of the Russian Federation, it will be necessary to register a legal entity, so the forms can be LLC, joint-stock company (public or non-public).

It is also necessary to indicate OKVED codes:

- 19 – monetary intermediation.

- 92 – provision of loans, credits, etc.

To create a bank, you will need to collect a package of documents, which includes:

- Application to the registration authority.

- The created charter of the organization.

- Business plan.

- Lease agreement or documents confirming ownership.

- Receipt for payment of state duty (for LLC – 4000 rubles).

- Constituent documents of the organization.

- Minutes of the meeting of founders.

- Documents confirming the founder's capital.

- Certificates for equipment and machinery, premises diagram, security agreement.

- Petition to the antimonopoly authority.

- List and characteristics of each bank founder.

To obtain a license, you need to contact the Central Bank of Russia; the issued document will contain a list of services that the bank can provide.

A license may permit work with foreign banks, precious metals, various currencies and categories of individuals and legal entities. The document is issued within 6 months from the date of application.

When preparing all the papers, it is recommended to contact a law firm that will quickly and efficiently collect them.

Selecting a room

An entrepreneur thinking about how to create a bank must understand what kind of premises and design he will need. To create such an enterprise, you need three main premises - the main office, a bank branch and places for installing ATMs.

Criteria for selecting the main office:

- Location in the city center.

- The size of the room is at least 150 square meters.

- Possibility to hang a sign in a visible place.

- Location near transport interchange.

- Availability of nearby parking and convenient access.

- Shopping and entertainment centers and large supermarkets should be located in the neighborhood.

It is usually customary to buy the main bank building, but it is better to rent the remaining offices and branches.

It is also worth taking care of the design. The room should not have bright, irritating colors; it is better to decorate it in calm colors. Do not overdo it in decorating departments; it is better to choose a minimal, discreet style. The furniture layout should leave free space in the room for easy movement between departments. Each office had to have a common design so that the client felt a connection between them.

Necessary equipment

To fully equip the main office and branches you will need to purchase:

- ATMs and terminals.

- Bill counters.

- Safes for documents and money.

- Currency detectors.

- Banknote packers.

- Trolley for banknotes.

- Computers.

- Office equipment (telephone, fax, printer).

- Furniture for workers and visitors (tables, chairs, benches, shelves and cabinets).

- Equipment for collection and cash storage.

- Video surveillance systems, fire safety.

- Service transport.

- Stationery.

Recruitment

The organizational structure of each bank is individual, depending on the number of branches, business format, and the license issued.

Hired workers must meet the following criteria:

- Responsibility.

- Good recommendations from previous jobs.

- Friendliness, ability to establish contact with people.

- Experience in a similar field.

- Ability to negotiate, basic persuasion skills.

- Ability to behave calmly in emergency situations.

- Strong-willed character.

- Organizational and communication skills.

- Availability of higher education.

- No criminal record.

- Punctuality.

- The desire to develop professionally.

Any state will need to hire:

- Managers and their deputies.

- Recruitment manager.

- Chiefs for each existing department.

- Chief accountant and his assistants.

- Lawyer.

- A senior cashier and regular cashiers in each branch.

- Hotline operators.

- Marketer.

- Economist.

- Financiers.

- Credit experts.

The number of employees varies depending on the size of the enterprise and the number of departments.

What services can the bank provide?

Once all the documents are in hand (licenses, certificates and certificates), you can move on to the next point - creating the services of your financial and credit organization.

To make it easier to decide, we will highlight the main services - making payments, opening and servicing accounts, collection, cash management services, money transfers, currency and depository operations, providing financial advice, lending, leasing, providing bank guarantees, and so on.

In addition, your bank can deal with money transfers, conducting transactions on the stock exchange, executing orders from brokers and with traveler's checks, and transactions with foreign currency.

Useful links to cases that will suit you:

Read a useful article: “Advertising business or how to start without money”? Read an interesting article: “From a simple driver to a millionaire, owner of an auto empire”!

Possible list of services

You already know what documents are needed to open a bank, as well as the procedure for implementing the project. Now you must determine for yourself the main direction for activity. The main goal of any financial organization is to increase income.

To implement it, there are the following methods:

- Increasing customer base.

- Expanding the range of services provided.

- Increasing market share.

The level of competition in the banking industry is very high, so scaling the business will be difficult. Based on this, the only way out is to provide as many services as possible.

Among the main ones are:

- Consulting on any financial issues.

- Cash flow management.

- Brokerage services.

- Management of client investment portfolios.

- Insurance services.

- Conducting trust, leasing and factoring transactions.

Having determined the main working points for yourself, you can begin to search for the answer to the question of how to open your own bank. The step-by-step instructions that we discuss in this article will help you do everything quickly, as efficiently as possible and without unnecessary problems.

Where should the office be located?

To begin with, it is enough to open one office, but over time, at least 5-6 branches should appear in your city. As your business expands, you can open branches throughout the country.

The optimal location of the bank is near transport interchanges, large retail outlets, and markets.

It is better to buy a room with an area of 100 square meters or more for the main office, make appropriate repairs, install the necessary equipment, organize workspaces, and so on.

The cost of purchase and re-equipment is from 3 million rubles. At the initial stage, you can get by with rent - from 2,000 rubles per square meter. To open branches, the usual rental of premises with subsequent renovation is suitable.

Organizational and legal issues

Before you start studying a business plan for opening a bank, and also start thinking about its internal structure, analyze your strengths and capabilities. First of all, it is important to understand that an entrepreneur is unlikely to cope with this process alone. As a rule, the work is distributed among several founders. Both you and the other founders must have a certain amount of money on hand.

The founders will be carefully vetted by government agencies. They must not have a negative credit history or criminal record. Remember that the organization’s personal account must contain 5 million euros: if this condition is not met, registration will not be completed.

Who to hire from the staff?

One of the most important and difficult issues is hiring staff. For the first time, you can hire graduates of financial universities for cash settlements and allow them to work after completing an internship and training.

For more serious positions, it is advisable to hire people with work experience. You will need a manager (possibly a deputy), heads of bank departments (customer service, security, credit department, and so on), specialists, 2-3 accountants, assistants, and so on.

At first you can get by with 10-20 employees. Over time, the staff will have to be expanded.

We must not forget that staff need to be trained, which will lead to additional costs - from 100,000 rubles per year.

The average salary of bank employees is from 20,000 rubles per month.

Table of the total number of banks by Federal Districts of Russia

Necessary costs and possible sources

According to experts, to open your own bank you need a starting capital of at least 300 million rubles. In addition, about 200 million will be spent on premises, staffing and other organizational needs. It turns out that you will need at least 500 million rubles to open your own bank from scratch.

In the future, investments and long-term assets will be made at the expense of own funds. Own funds include:

- Authorized capital of the enterprise

- Special and reserve fund

- Reserve for insurance

- Extra capital

- Profit that was not distributed during the year.

In our article you will learn how to open your own business from scratch with minimal costs.

Here you will learn how to open a hookah bar and make your business profitable.

What do you need to start your own business? You will learn about this in our material.

What equipment will be needed for a bank?

Opening a bank requires the purchase of specialized equipment - currency detectors, banknote sorters, banknote counters, payment terminals, cash register equipment, POS terminals, and so on.

In addition, you will have to equip the workplace of each employee. Here you will need tables, computers, telephones, and office supplies. Additional costs include certification of banking equipment, without which it is often impossible to carry out payment transactions and serve clients.

The total cost of purchasing and setting up equipment is from a million rubles.

About suitable premises and necessary equipment

The bank cannot be called an ordinary office, although it appears to be one at first glance. It performs several important functions:

- Customer and visitor service.

- Cash transactions.

- Storage of significant cash and material reserves.

This leads to a number of specific features that must be taken into account during the construction, reconstruction or repair of bank premises.

Thus, when drawing up a project, you need to pay special attention to external and internal decoration (the fundamental factor is corporate style), layout (a convenient client area and a functional back office are required) and technical strength in accordance with a number of regulatory requirements (security equipment and an integrated system, ensuring safety).

The main feature of construction is the requirement for mandatory equipment with engineering and technical means, the main purpose of which is protection and safety. The following institutions have their own requirements for banking premises: the Central Bank of the Russian Federation, the Ministry of Internal Affairs, the fire inspectorate and Rospotrebnadzor.

In general, design and construction can only be entrusted to experienced organizations with qualified specialists on staff.

The activities of the institution are daily associated with the processing of large amounts of cash, therefore, specialized equipment will be very useful. It allows you to count money, sort it depending on its denomination, and even check its authenticity. You can purchase several individual devices, or one multifunctional unit that can cope with each of the above tasks.

Of course, you can’t do without an ATM. By the way, it is desirable that he is not alone and is located in a passable place or in a compartment.

Do you need advertising?

Without advertising, a business will not make money. Your task is to form a positive opinion among a potential client, make the name of the bank recognizable, convince of its reliability, and so on.

This may require organizing advertising in public transport, sticking leaflets, issuing special brochures, opening your own representative offices in various cities of Russia, ordering advertising on radio and TV, creating a high-quality website on the Internet (required).

The advertising budget should be from 100,000 rubles per month.

Table of potential consumers of Bank services in Russia

Market description and analysis

Characteristics of the Russian banking sector of the economy:

- According to the Central Bank, as of February 2020, 572 financial and credit institutions were registered in Russia.

- There is high competition in the market.

- According to the survey, 63% of Russian citizens use the services of one financial institution, 22% use two, and 5% use three.

- Over the past five years, approximately 40% of the population have used a bank loan.

- About 20% of the country's citizens have high loan payments; they account for more than 30% of the total family budget. Approximately 8% of people give over half of their income to pay off debt to the bank. However, 32% of the population with credit debt pay amounts not exceeding 10% of their monthly earnings.

- Every fourth borrower faced the problem of being unable to make loan payments on time.

- 27% of people confirmed that they have savings in the form of: bank deposits, savings insurance policies, stocks, bonds and other securities.

- The popularity of consumer credit is growing. About every tenth citizen intends to use it.

- Bank deposits are in third place in terms of popularity/reliability after investing in real estate and gold/jewelry.

- The leader of the mortgage market is Sberbank OJSC; its share at the beginning of 2020 was 47.5%.

- The percentage of non-cash payments is increasing (from 5% in 2013 to 16% in 2015). Most often, this method was used to pay for: mobile communications, Internet, television, taxes, fines, loans.

- The leading player in the credit card market is Sberbank OJSC (as of the second quarter of 2020, it occupies 41.1%).

Photo gallery

Key participants in the mortgage market

Leading players in the consumer lending market

Methods of investing money according to degree of reliability

Leaders in the credit card market

Percentage of loans not repaid on time in total loans/borrowings (excluding VTB, Sberbank, Bank of Moscow)

Level of use of bank services by respondents, percentage of all respondents

The target audience

The client of a financial credit institution can be either an individual or an organization/enterprise.

Portrait of a typical user of banking services:

| Sign | Characteristic |

| Age | 35–54 years |

| Floor | Man Woman |

| Income level | Average |

| Social status | Main consumers:

|

| Psychogram | Characteristics:

|

Competitive advantages

The strengths of the bank should be the following points:

- positive image;

- profitable loan products;

- high interest rates on deposits;

- thoughtful pricing policy;

- good reputation of the main shareholders;

- competitive and balanced list of services;

- high quality of service provided;

- a sufficient amount of authorized capital/assets to guarantee the safety of customer deposits;

- presence of a currency/general license;

- stable customer base;

- extensive correspondent network;

- a sufficient number of ATMs in different areas of the city;

- thoughtful marketing campaign;

- optimal branch network;

- required qualifications of key employees and senior management;

- friendly service;

- no queues;

- Individual approach to each client;

- good material resources;

- focus on customer wishes/requests;

- introduction of new types of operations/services;

- availability of Internet banking, corporate website, mobile application, etc.

- well-thought-out infrastructure;

- convenient location of offices, ATMs, etc.

Advertising campaign

The development and implementation of the bank’s marketing program should be carried out by a professional company and/or in-house specialists.

The main objectives of the advertising campaign of a financial institution:

- make the organization recognizable among a wide target audience;

- convince potential users of the company’s reliability;

- create a sufficient customer base;

- form a positive opinion among the bank’s target audience, etc.

Marketing program activities:

- development and promotion of a memorable brand, logo, etc.;

- creation of outdoor signs/banners;

- printing leaflets, business cards, brochures, posters, calendars, notepads, etc.;

- placement of advertising information on billboards, billboards, superboards, arches, banners, lightboxes, LED screens, on public transport, etc.;

- broadcasting advertisements on television and radio, in newspapers and magazines;

- development of special offers for organizations, government agencies, small and large businesses;

- formation of a bonus and discount program;

- creation of a modern, informative and functional portal on the Internet, mobile offers, groups in popular social networks;

- acting as a sponsor of various public events (for example, in the field of sports and culture);

- organization of an advertising campaign on the Internet (contextual, targeted and teaser campaigns are often used).

To implement the above measures, at the initial stage of operation, a medium-sized bank will need an amount of about 500–600 thousand rubles. Monthly marketing expenses will be approximately 100,000–150,000 rubles.

The video is devoted to the problem of organizing electronic marketing for banking institutions. Filmed by the channel “Completo - System Electronic Marketing”.

Where can I get money?

Probably the key question is where to get the necessary amount to realize your plans. Obtaining permits, renting an office, purchasing banking equipment, advertising costs, paying salaries to employees, maintaining banking equipment - all this requires certain costs.

The main option is to attract investors to the project. But for this you cannot do without a clear business plan, an understanding of the business structure and optimization of business processes in the bank, the ability to prove the prospects of the project and present this information.

The backup option is a bank loan. But this is only possible if you have expensive real estate behind you that can act as collateral.

Video interview with Ivan Svitek, Chairman of the Board of Home Credit Bank

Here you can open an online cash settlement for an LLC or individual entrepreneur directly on the Otkritie Bank website.

RKO tariffs for legal entities at FC Otkritie are increasingly attracting new clients. The financial institution has been providing services to citizens for quite some time, including in the business segment. Entrepreneurs here are offered settlement and cash services on favorable terms. The consumer selects the program from the existing line. Using this service is a convenient way to manage financial flows and store money in a safe place.

Businessmen need a PC in a bank to make working with finances as convenient as possible. This allows a person running his own business in any industry to quickly, reliably and completely legally carry out the required manipulations with funds.

The financial organization described today operates five programs, the limits and conditions of which are formed according to the level of development of a particular business:

- for beginners, individual entrepreneurs and LLCs with small turnover;

- with active development of activities;

- companies that are constantly increasing their cash flow;

- clients conducting active foreign economic activity and capable of exchanging currency profitably;

- for a business in which very large sums are involved.

The range of tariff plans presented is so wide that every potential consumer will choose the option that ideally suits their needs. When making a choice, you should study customer reviews, pricing policies, and basic rules. If difficulties arise, bank specialists will come to the rescue via chat on the website or directly in the branch.

You should definitely look at the cost of the service per month and per year. If payment is provided in advance, the FI will make a significant discount.

Within any of the packages, additional options are available to legal entities:

- connection to the salary project;

- payment by card;

- deposit with an attractive interest rate;

- taking out a loan for elimination;

- personal online manager services;

- permanent banking protection;

- registration of individual entrepreneurs with the tax authorities;

- built-in accounting.

The range of functions is impressive, and the limits and benefits depend on the chosen tariff. The bank tries to take into account all client wishes. The products are adjustable and many options can be customized.

Online application

You can open a current account at any time of the day if you do it via the Internet. It is enough to send an electronic request, and then transfer the documentation to the financial institution and conclude an agreement with the required signatures. It's easier to follow the instructions:

- Consider the available products and choose the one that suits you.

- Click the “Open account” button.

- Provide a telephone number.

- Enter the name of the contact person.

- Write TIN, email address.

- Register the region in which the company is located.

- Agree to the processing of information and send the completed form.

After processing is completed, a manager will contact the user and schedule a meeting. The review process does not take more than one day. By late afternoon the details will arrive in your mailbox.

When opening a personal account, many people prefer to choose the optimal tariff plans through the Banki.ru portal. Here, all the necessary information is conveniently placed on one page, which allows you to quickly make a choice and immediately open an account online. Our service will help the visitor go through several necessary stages, and he will transfer documents and sign the agreement directly at the bank office.

Other banks:

Sberbank, Tinkoff Bank, PSB, Tochka Bank, Sfera Bank, Loko-Bank, VTB Bank, OTP Bank, UBRIR, FC Otkritie Bank, Raiffeisenbank, UniCredit Bank, Vostochny Bank, Bank of Kazan, DeloBank, URALSIB, Alexandrovsky, Delo Bank, Alfa Bank, For LLC, For Individual Entrepreneurs,

All offers displayed on this page are the best or most profitable only in the opinion of Banki.ru experts.

General results

Let's summarize:

- Initial opening costs – from 100 million rubles;

- Registration of licenses – from 500 thousand rubles;

- Security system – from 100,000 rubles;

- Purchase of an office and refurbishment – from 3 million rubles;

- Purchase of equipment for the main office and branches – from 1 million rubles;

- Advertising – from 100,000 rubles per month;

- Legal support – from 50,000 rubles per month;

- Security of objects – from 50,000 rubles per month;

- Payment and training of personnel – from 400 thousand rubles per month;

- Payback period is from one to five years.

Marketing and Security Issues

Taking into account that it is planned to organize a new banking structure, be sure to take into account the costs of its promotion. Here it is optimal to conclude a cooperation agreement with an advertising agency in order to conduct a large-scale and professional PR campaign. Advertisements and commercial articles in the media, outdoor advertising, as well as creating your own portal are appropriate. Here you should take a responsible approach to the matter and develop a system that makes it possible to provide remote customer service.

Initial investments in marketing can reach 600,000 rubles, and for the current advertising campaign, plan about 150,000 rubles.

The most important issue, on which the reputation of the establishment will depend, will be security. At first, the best option would be to cooperate with a security agency. Next, you can staff your own staff. As a rule, installation of video cameras, turnstiles, alarms and panic buttons will cost from 600,000 rubles, and regular maintenance – 55,000 rubles.

Professional security of the establishment - reputation and safety of your business

In addition, you should take care of the business reputation of the enterprise. Here you will need to enter into an agreement with a law firm so that its specialists can provide you with a full range of services and legal support for your activities. Such a service is usually priced at 60,000 rubles.

What are the conclusions?

If you have a desire to open a business like a bank, then be prepared for high costs and risks. But with proper organization, you can expect good income.

In any case, before opening a bank, it is necessary to conduct market research, think through a business plan, and make a forecast of likely changes in the financial and economic sphere.

Of course, any forecast is relative, because the banking sector directly depends on the political situation in the state, and this is already very difficult to predict.

406

How much money do you need to open a bank?

Here we are not even talking about an amount with six-digit zeros. No one will name the exact amount, since it will depend on the scale of the business, profile, staff qualifications, etc. The minimum amount for opening a small bank is 300 million rubles. This does not take into account the cost of equipment, software, staff, premises, advertising, security, etc. These costs will cost approximately the same amount.

Recent studies show that clients now prefer to be served in a bank with a developed infrastructure, a large number of ATMs, an office, and a good Internet bank. To create such a bank for 500 million rubles. unreal. According to some information, about 5 billion rubles will have to be shelled out for this. Even if the future owner has such amounts and is ready to open his own bank, you should be prepared that the business may become unprofitable. To pay off the bank you will have to work for at least 6-8 years and only then can you expect profit.

Possible risks

When creating any business plan, it is recommended to carefully analyze possible risks. Entrepreneurs need to foresee in advance any unfavorable development of the situation, and also understand how he will get away from them. Despite the fact that it is impossible to predict all negative situations, you can prepare for the most common ones:

- changes in government policy;

- changes in Central Bank rates;

- changes in external economic factors that will affect the exchange rate;

- insolvency of the borrower;

- poor preliminary analysis of competitors.

Opening your own bank is not an easy process. Knowing what risks await you in advance, you can forget about most of them.

Management system and organizational structure

We have already said above that in order to register, you will need to register a joint stock company. In most cases, it is the key management body of the organization. Some of his main tasks are control over activities, setting goals and monitoring their achievement. Meetings of shareholders are held several times a year, during which all current issues are discussed and a development strategy is adopted. The bank's activities will be managed by a board of directors. It is important to understand that the issues that are resolved by the meeting of shareholders and the meeting of the board of directors are separate.

Financial and economic issues will be resolved by employees of the audit commission. The board of the banking organization acts as the executive body of the government. It is these people who will directly report to other structural units, that is, branches of a credit institution in which the client can receive full service. In addition to the main structural divisions, each bank has additional ones. This could be a legal department that will resolve relevant issues, as well as a security service that checks employees and clients. There must be an internal control service.

The next step is to determine the list of services that will be provided from your organization to clients. The list of services must be regulated by licenses, that is, all types of services must be specified in the document. The main types of service include the following:

- opening and maintaining bank accounts;

- carrying out financial calculations;

- lending to the population;

- working with bank cards;

- work with securities, precious metals, shares, currencies;

- brokerage services;

- providing advice to clients.

Services are provided to both individuals and legal entities.

What problems and prospects will you have to face?

The last two decades have seen an active process of development of the banking segment in the Russian Federation. That is why today we see a very high level of competition. Finding a free niche in this area will be quite difficult, since popular areas are completely occupied. There are a lot of large market players with a recognizable name in this area: it is to them that clients, including your potential consumers, will give preference.

Is it possible to work successfully and profitably? The answer is yes, every entrepreneur has such an opportunity.

The main factor is to competently approach the process of organizing the bank system. The first thing you need to do is analyze your competitors' offers. Carefully study the types of service and the level of quality at which it is provided. Having done this, you will be able to understand whether you will meet the declared level. If you decide to create a classic package of banking products and services, then you are unlikely to stand out among your competitors. In order to attract consumers and significantly expand the client base, it is necessary to offer either favorable conditions or exclusive services for your region.

One of the most significant factors is bank secrecy. The organization must position itself as a reliable and conscientious partner, and not violate this strategy, because once its reputation is damaged, it will be very difficult to restore it.