2017 was marked by the beginning of the mandatory equipping of retail outlets with online cash registers. And at the legislative level. The essence of the innovation is that now the data is directly and immediately transferred to the tax office. In 2020, a massive transition to this system began. First voluntarily, and then compulsorily. Now everyone, even small entrepreneurs, are required to supply their business with online cash registers. This is regulated by the Federal Law No. 54.

And since the requirement to have an online cash register is now mandatory for everyone, everyone should understand the questions - what it is, how it works and what needs to be done with it.

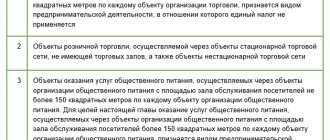

What is an online cash register

An online cash register means a special device that can simultaneously print checks and instantly transmit data about them to the tax authority.

This data is transmitted through the fiscal service operator. In fact, an online cash register is a terminal that combines cash register equipment, a fiscal drive (device memory that stores all information about checks and encrypts it), as well as a program that allows you to access the Internet to communicate with the tax office.

Contents of main innovations

The key changes to 54-FZ on the use of cash registers include the following:

- transfer of information about purchases made will now be sent to the tax authority via the Internet;

- the procedure for registering cash registers will become easier and faster - all you need to do is log into your personal account on the tax.ru website and fill out the registration form;

- many entrepreneurs currently operating without cash registers will have to purchase them and register them with the Federal Tax Service before July 1, 2018;

- the list of mandatory details of sales receipts and BSO has been expanded;

- a new participant in the “entrepreneur – tax” relationship has been introduced, we are talking about operators of fiscal information. These market entities will perform the functions of receiving, transmitting, processing and storing taxpayer fiscal data (intended for the Federal Tax Service);

- the equipment of the new cash registers will change - instead of EKLZ it will be necessary to use a fiscal drive;

- a list of business entities that will be allowed not to use online cash registers has been approved.

Speaking about the introduced terms, a fiscal drive will be called a type of cryptographic means of protecting fiscal information. This encryption innovation will be placed in a sealed case. Fiscal drives on online cash register systems will require periodic replacement from 2017:

- legal entities applying special tax regimes in the form of imputation, simplification and patent - every 36 months;

- all other businessmen will have to change drives at intervals of 13 months.

Responsibility for transferring data to the Federal Tax Service will be borne by the operator of fiscal information-data on purchases made (FDA), with whom the entrepreneur will enter into an agreement.

What is FZ-54

Federal Law-54 is a federal law designed to control businesses that deal with cash acceptance. The law itself is old – dating back to 2003. However, its new editions have made significant changes that have affected the entire business sector and, in particular, the retail business.

The main innovations concern how entrepreneurs will now interact with the federal tax authority. The purpose of the changes is to automate data transfer and reporting, and also to stop “gray” activities.

The tool for this, as you understand, is precisely online cash registers, which allow you to send tax receipts instantly and cut off the opportunity to “adjust” them in order to hide income.

Changes in the law

- The procedure for working with the Federal Tax Service (online mode of sending information) has changed.

- Online checks have been introduced that can be provided to customers.

- The requirements for cash register systems have changed (introduction of online cash registers).

- The range of businesses that must now use cash registers has expanded.

- The requirements for the method of generating a strict reporting form for individual entrepreneurs have changed.

The introduction of new requirements occurred gradually over three years. On July 15, 2016, a program of voluntary transition to new equipment was launched. This was followed by a ban on registering outdated ones, that is, all new businesses began to fall under the law.

The last stage was July 1, 2020. It was then that even self-employed people who operate in the trade industry and provide paid services to the population were required to install cash registers.

From now on, cash registers are mandatory for everyone, except for the exceptions specified in paragraphs 2 and 2.1 of Article 2 of the Federal Law No. 54.

How does data transfer to the tax office work?

- A check is punched using cash register equipment.

- The machine encrypts the check data using a fiscal drive.

- Next, the data is transferred to the FD operator.

- The OFD checks the data, sends a response to the device and forwards this data to the Federal Tax Service.

The operator keeps information about checks for up to five years.

If the online cash register device breaks down, the task of transferring the data to the tax office falls on the cash register manufacturer. That is, in fact, the manufacturer must extract data from the non-working device and send it to the tax service.

Main

With

Since 2020, 54-FZ applies to almost every business. To legally trade or provide services, you need to connect an online cash register.

2

Determine how much you are willing to spend at a time: if the business is stable, buy your own cash register; If you are just starting out or work seasonally, rent a CCP.

With

Determine what kind of fiscal storage is needed for your business. Buy a tax account and install it in the cash register - the easiest way is to take the “cash register + fiscal drive” kit.

With

Enter into an agreement with the OFD - this is a legal requirement. Choose an operator that has a tax license and additional capabilities for business analytics.

With

Buy an electronic signature. This is not necessary, but it changes life for the better: all communication with government agencies can be transferred online and save a ton of paper.

With

Register the cash register with the tax office. If you have an electronic signature, this can be done online through your personal account.

Why do you need a fiscal drive in online cash registers?

The essence of the cash register is that the fiscal drive signs the check with a fiscal sign (then the data goes to the operator, and then to the tax office).

If suddenly the point where the online cash register is installed loses connection to the Internet (interruptions, other problems), then it is the fiscal drive that saves all this data for transferring it after the connection problem is resolved. Data can be accumulated for thirty days.

The second task of the fiscal drive is to encrypt the transmitted data and generate a specialized code with which this data can be decrypted.

Depending on the model, fiscal drives have a shelf life of 13 or 36 months.

Important! After the expiration date of the fiscal drive, you need to replace it and re-register the online cash register!

Should I install a cash register in a taxi?

The use of such a concept as tax collection is found in many government documents. Legislative acts are issued to regulate it. According to Federal Law No. 54 , individuals or companies that offer services use fiscal devices with Wi-fi or mobile data transmission .

The interim period allowed checks or receipts to be provided in lieu. The forms are completed manually in two copies. One option remains with you, and the other – with the second person. It should include information about the entrepreneur (TIN, registration address and name of the individual entrepreneur), the date and name of the operation performed, the signature and name of the driver. They have a number on them, and the empty fields are filled with dashes. The presence of a seal is optional.

A confirmation indent is issued at the time the amount is deposited. In case of cash option, it is issued during the trip. Therefore, they install control in every taxi car. When performing a cashless procedure via card, the client receives a copy by email. In this case, it is not advisable to use the device.

Registration of the required equipment in accordance with all the rules and registration of it is only possible with the tax office. An electronic signature will significantly speed up this process, protecting you from long queues. You will be required to enter the exact coordinates at which the main object operates. If it is a car, then indicate that it is a taxi, make, color and registration number. The principle of operation of the technology is that it issues fiscal receipts and transfers them to the necessary authority. You can calculate the cost using the taximeter or enter the already known one. The menu has the option to generate a check by adding several services:

- expectation;

- Baby chair;

- landing.

Connecting to the network makes it possible to instantly transmit FDO information. If there are inconsistencies between the information from the declaration, a special service may request additional information.

Features of online cash registers

The devices must be able to send a check, which was previously issued to clients only in paper form, to email or phone. This position allows you to work in accordance with the requirements of the law.

Cash desks redirect data instantly. But there are also delays in case of communication problems. For example, cash registers can operate without a network connection for up to thirty days. Another thing is that the tax office is tracking these delays. And if they are frequent and periodic, you will be at risk of being audited.

The administrator who manages the cash register can always view through the terminal or the OFD personal account all the checks that have been issued in order to verify their accuracy with his own accounting system.

The receipts that the buyer receives after paying for a product or service can be checked on the official website of the Federal Tax Service. If it is not in the database, the store can be suspected of concealment or other fraud.

The goal of all automation is to facilitate activities and processes. It is easier for the entrepreneur to report, the buyer can be sure that his rights are respected, and it is easier for the supervisory authority to check.

Should I buy a cash register for an online store?

Sales on the World Wide Web do not provide for exemption from the implementation of the order “ On the use of cash register equipment .” This suggests the conclusion that modern innovation is unquestioningly implemented. It happens that one smart terminal is not enough. This is due to the fact that the courier has a mobile version when accepting payment, and at the pick-up point - the one that is registered by physical person. point address and so on. But there is an option to establish a service through “MySklad” . In this case, you can get by with one device that will allow you to issue receipts for online orders and for retail sales.

In the registration form, indicate the coordinates of the point and url of the warehouse. The courier no longer carries the device with him. He gives the customer a QR code to download the receipt. An additional feature of this service is that it can work on different tax systems . Thanks to this, you will reduce the risks of applying penalties to your business.

What should appear on receipts

The entry into force of the law on online cash registers has not yet led to the fact that paper checks become an optional element. They still need to be issued to customers. But sending an electronic version of the check by mail or via SMS is an optional service and is provided at the buyer’s request. This provision applies to everyone except representatives of online trading, where sending a check is a mandatory action.

The check displays the following information:

- date of payment

- Payment time

- Place of purchase (physical, or internet address if it’s an online store)

- The tax system of a company that sold a product or service.

- The value added tax rate at which the company operates.

- QR code

- Fiscal storage data.

How to conduct cash and non-cash payments with individual entrepreneurs and legal entities?

For non-cash payments with individual entrepreneurs and legal entities, an online cash register is not needed. The law has not made any changes to this issue. If money is deposited in cash, a cash register is needed. The issue of installation must be resolved on a general basis: whether there are workers or not, whether there is resale of goods or not.

As an example, let’s take individual entrepreneur Sidorov with the UTII taxation system. He has a whole staff of employees with employment contracts, so an online cash register needs to be installed.

- IP Sidorov sold Ogonyok LLC 100 cubic meters of edged boards. The buyer transferred money from his account through the bank. No check needed.

- IP Sidorov sold a wooden pole to IP Petrov. Petrov personally came to pick it up and paid in cash. I need a check.

- IP Sidorov sold ten wooden shelves to IP Ivanov. Ivanov sent a courier for them with a bank card. I need a check. Payment by credit card is not counted as a non-cash payment in this case.

Pros and cons of using an online cash register

We remind you that, despite the presence of some disadvantages, the law now obliges. Therefore, the information in this section is for informational purposes only.

Pros for entrepreneurs

If acquiring is connected, the seller of goods or services can accept payment through the cash register, both in cash and by bank transfer.

Maintenance of cash registers falls on the shoulders of the manufacturer.

It is possible to register and deregister cash registers online.

The personal account of the fiscal data operator allows the seller to analyze sales and make forecasts.

There is no longer any need to submit your cash register to the tax office for inspection every year.

Disadvantages for entrepreneurs

- Installing a cash register is an additional considerable expense (especially for micro-businesses), to which are added the costs of annual maintenance.

- The need to train employees to manage online cash registers (so-so minus, but still).

Pros for buyers

- The risk of purchasing counterfeit goods is significantly reduced.

- It is possible to receive a check electronically to your personal email or via SMS.

- Distribution of non-cash payment options.

There are no obvious disadvantages for buyers. The only thing that can be indicated is a slight increase in prices for goods, which will include the costs of online checkouts.

Self-employed citizens and cash register

The explanation to the government order regulates the payment of tax in the “ Professional Income Tax ” mode. To explain in simple words, register as self-employed. A clear example of such workers are tutors and nannies. It is prohibited to use such a service if the annual income exceeds a couple of million rubles, or has hired employees, or sells excisable and labeled goods. Preferences for the self-employed:

- documentation is not submitted. You just need to register online in the “My Excise” application;

- 4% deduction for cooperation with individuals and 6% for cooperation with legal entities. and individuals;

- no payment of VAT and insurance premiums.

Payment can be made both in cash and in the form of non-cash payment . Everything will be recorded with a receipt displayed in the application.

This innovation is not necessary for the self-employed. A special feature of this section is that if it is missing, you will not be able to accept card payments.

Receive a tax deduction via online checkout

Entrepreneurs were able to use this right starting from January 1, 2020. It is provided for individual entrepreneurs working on a patent or UTII.

The maximum tax deduction is 18,000 rubles for each device. You can apply for compensation both for purchased devices and for fiscal drives, software for online cash registers and payment for setup services.

An application for deduction is submitted in a form to the tax service. Entrepreneurs receive compensation in the form of a tax deduction.

Cannot receive a deduction:

- Entrepreneurs on the simplified tax system

- Entrepreneurs on a common system

- Entrepreneurs on the unified agricultural tax.

- Organizations working on UTII and patent.

Background: why did they adopt the law on online cash registers?

Officials decided to tighten control over cash payments in 2016. The tax office already knew about transactions in which entrepreneurs are paid into a bank account. Received information from banks, found contradictions with the amounts in the declaration and made demands for explanations. It was more difficult with cash: entrepreneurs conducted transactions unofficially and evaded paying taxes.

Companies on UTII, patents and services to the public worked without cash registers. Businesses on the simplified tax system and OSNO used the old cash registers. Payments were recorded on a special EKLZ tape, which cannot be verified without a personal meeting with the entrepreneur. Inspectors did not have enough time to visit all stores, so most companies broke the law without problems.

Officials looked to South Korea for a solution to the problem, which introduced online cash registers in 2005. They automatically transfer all payments to the fiscal data operator, and the OFD to the tax office. In 2016, Russia adopted amendments to 54-FZ, which obligated entrepreneurs to switch to new cash registers. At the same time, they decided to connect to them everyone who receives payment in cash and electronic money, but previously issued other documents instead of cash receipts - BSO or receipts. As a result, the tax office will see almost all payments made by entrepreneurs, automatically select the most suspicious ones and send them requests or come with an audit.

In 2020, companies using the simplified tax system that sell goods to individuals switched to online cash registers. In 2020, the time has come for UTII and a patent - but so far only for trade and catering that work with employees on staff. Until 2021, all others will switch to cash registers.

Fines related to online cash registers for individual entrepreneurs and legal entities

- If an online cash register is not used – from RUB 30,000. from ¾ to 1 size of the settlement amount.

- If violations are periodically repeated, activities are administratively suspended for up to 1.5 months.

- For using equipment that does not meet the requirements - a warning or a fine of up to 10,000 rubles.

- If information is not transmitted to the tax office or filing deadlines are violated, you will receive a warning or a fine of up to 10,000 rubles.

- If a check is not issued to the client - a warning or a fine of up to 10,000 rubles.

How to connect an online cash register

- First of all, we obtain an electronic digital signature. This can be done at a certification center, or from representatives (who can also provide online cash registers).

The number of required online cash desks does not affect the number of digital signatures; there is always one. Typically, documents such as a passport and SNILS of the management are required.

- Next, we connect the online cash register in the place where you think it should be located. The connection is either to the mobile Internet, or via Wi-Fi, or via a wire, depending on the capabilities of the device and the location.

- Next, we register the fiscal drive of the new cash register with the tax department.

How to register a cash register on the Federal Tax Service website

- Go to your personal account

- We send a registration request signed with an electronic signature.

- After checking the data, the Federal Tax Service carries out registration.

- After entering all the data, you will be able to receive a cash register registration card in your personal account.

Also, cash register registration services are provided by specialized companies that issue these machines (but not all).

- Next, you need to sign an agreement with the fiscal data operator (FDO).

Before this, you should already have an electronic signature, a cash register and software for it, as well as access to the Internet in the place where this cash register will be located.

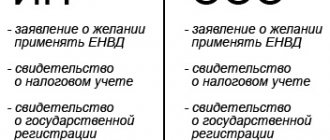

The procedure for registering new cash registers in 2020.

Registering a cash register online will save taxpayers from unnecessary worries - now the procedure is performed without visiting the Federal Tax Service and looks like this:

- the owner of the cash register creates and then opens his personal account on the website nalog.ru;

- fills out a request for fiscalization of cash registers;

- signs the application using his electronic signature (EDS);

- confirmation from the tax office is the transfer of registration data to the businessman, which is entered into the fiscal filler.

An agreement with the central service center is no longer required from 2020, nor is a regular visit to the Federal Tax Service. The cost of 1 cash register that meets the requirements of 54-FZ, according to experts, will be approximately 37 thousand rubles. If you modernize existing equipment, the re-equipment will cost a businessman 27 thousand rubles.

Online cash registers for online stores. How to connect?

Changes in Federal Law-54 entailed the need to “equip” online stores with equipment to meet all new requirements, just like all other types of trading business.

This became possible due to the fact that an electronic check was officially considered equal to a paper check.

Features of online cash registers for online stores:

- Equipment suitable for equipping an online business.

- Special software that allows you to integrate a fiscal registrar into the content of an online resource and interact with payment services.

- Software for retail sales now allows you to work with orders from several online points at once, and all of them can be on different engines - from InSales to WordPress.

- Now one online cash register can serve both a physical store and its online version.

In what case can you not use online cash registers?

The legislation defines a list of companies and entrepreneurs who, even from the 2nd half of 2020, have the right not to use online cash registers.

These include:

- Entities involved in the sale of goods from vehicles.

- Entities involved in the sale of goods in unorganized and unequipped markets and fairs.

- Selling goods from tank trucks.

- Selling magazines and newspapers at kiosks.

- Selling ice cream and drinks in unequipped kiosks.

- Subjects repairing shoes.

- Entities that repair and manufacture keys, etc.

- Renting premises owned by individual entrepreneurs.

- Pharmacy points located in rural clinics and paramedic stations.

- Enterprises and individual entrepreneurs whose economic activities are carried out in remote areas and localities. The list of such territories is determined by federal legislation.

You might be interested in:

Online cash register for an online store: which one to choose and how to work with them

It is important to understand that if a taxpayer carries out activities only using non-cash payments, that is, he does not have cash proceeds, he does not need to use an online cash register.

Attention! It is also allowed not to install online cash registers for credit institutions, enterprises on the securities market engaged in public catering in kindergartens, schools, and other institutions and educational institutions.

The new devices can be used on a voluntary basis by religious organizations, postage stamp sellers, as well as persons selling handicrafts.

Online cash registers and vending machines

According to Federal Law No. 192, in mechanical vending machines where payments are made exclusively in Russian rubles, it is allowed not to use online cash registers.

For the same machines that are considered electrified, a deferment was specifically introduced, allowing them to be converted and equipped with the necessary components for online cash registers. This must be done before February 2020.

This means that there will be no strict need to print a check or send it online to the client. It will be enough to install a screen that allows you to display a QR code containing fiscal data of the transaction.

Note: machines providing bottled water or milk do not require online cash registers at all. But it will be necessary to issue receipts on a mandatory basis to machines that sell excisable, technically complex products and products with mandatory labeling.

Who should use online cash registers from 2017

From 2020, new cash register machines could be used by any business entity on a voluntary basis. The new law determines who uses online cash registers from 2020. The deadlines for the transition of existing companies, as well as for new companies - when opening an LLC or registering an individual entrepreneur - have been agreed upon.

The rules established a transition period during which companies and individual entrepreneurs could switch to the new rules gradually. During this period, it was possible to use EKLZ, but registering cash registers with them and renewing their validity was already prohibited.

From the second half of the year, all taxpayers under the general and simplified taxation systems must use only online cash registers when accounting for cash income. This is primarily due to the fact that they keep records of actual income for tax purposes.

Attention! New changes in legislation have determined the obligation of alcohol sellers to purchase new devices from March 31, 2017. The same law first determined the obligation to install online cash registers for individual entrepreneurs on UTII and for companies on UTII. However, in a subsequent clarification, the deadlines for holders and applicators of the patent were postponed.

How to choose an online cash register for retail trade

First, you need to understand what the market generally offers. Because everyone's characteristics are different. And the main criterion for choosing these characteristics will be the specifics of your own business. What do you do - is it trade or services, do you have excisable goods in your range, what form of taxation do you have, how many employees.

Important! Not all online cash registers provide the ability to interact with the EGAIS system. Therefore, if alcohol is sold as part of your trade, you need to choose a cash register based on this need.

The flow of clients is also important. Since there are cash registers with low throughput. They are cheaper, but will not allow you to print many receipts per day.

A cash register must be purchased together with a storage device that is valid for 13 or 36 months. Next, an agreement is concluded with the operator (OFD).

Please note the subscription fee that will be charged for the cash register software. And also find out in advance what can be connected to the terminal as additional equipment (barcode scanner, card reader, etc.), whether it is possible to establish interaction with the commodity accounting program, and also whether acquiring is possible.

New technology for storing fiscal data

If previously all data on cash and financial transactions were stored directly with the owner of this cash register at EKLZ, now this information will be transmitted to the Federal Tax Service via the Internet through the OFD.

Since 2020, online cash registers have introduced a new term and a third party, which began to store, process and transmit all data on trading transactions to the Federal Tax Service of Russia. This person is the fiscal data operator. Now cash settlement operations are structured as follows:

- The cashier adds the item to the online cash register receipt. The client pays at the checkout for the selected product.

- This data receives a fiscal signature, which is a unique identifier, and is then sent to the fiscal data operator.

- The operator verifies this data and stores a copy on its server. Then sends confirmation to the terminal.

- After receiving confirmation, the transaction is considered completed and the client receives his check.

A cash register for an LLC began to have just such an important characteristic as communication with an operator via the Internet. A fiscal data operator or FDO is a third-party company that provides its servers for storing information. Such companies receive licenses from the state, must have the necessary technical resources and must ensure communication with connected cash registers and storage of all received data.

New terminal

Now you can find quite a lot of new online cash registers on the market. The standard online cash register kit consists of the following elements:

- A terminal, which is most often built on the basis of a tablet or POS computer. Special cash register software is installed in it, which controls the fiscal registrar.

- A fiscal registrar with a built-in fiscal storage device, which is responsible for printing checks and transferring them to the OFD. Essentially, the fiscal registrar is a cash register.

- Barcode Scanner. A similar device is needed to read barcodes that mark all products. Now it has become an almost mandatory element of the cash register. The new law requires printing the name of the product on receipts; if the assortment is large, you cannot do without a scanner.

- Scales. To sell products sold by weight, you will definitely need scales. They connect directly to the cash register, so you can quickly calculate the cost and add it to your receipt.

- Money box. Such an element is secondary in nature and this element can be purchased at will.

The configuration of the cash register is selected according to the requirements of the retail outlet. Any element can be quickly connected if required.

Online cash registers for individual entrepreneurs in 2020 also became one of the requirements specified in the updated 171-FZ and 54-FZ. If an individual entrepreneur sells beer, then you need to start using online cash registers in 2020, and if there is no beer for sale, then you can wait until July 2018.

New cash registers can replace a whole range of equipment for recording goods in retail outlets of entrepreneurs.

Software for new cash registers

The software is created on the basis of well-known operating systems and can be expanded to suit the needs of your business. In addition to simple sales, such programs can provide the following operational functions:

- Accounting for goods in warehouse

- Accounting for the sale of goods

- Store revenue

- Average bill

- Frequently sold products

- Personnel control

- Connection to the EGAIS system and other functions.

All these functions can be performed using a new cash register, and this can greatly facilitate the work of the store employees themselves.

Legislation often changes and puts forward new trade rules, for example, the EGAIS system has introduced many requirements for cash register software and accounting systems since 2020. Each owner of a new cash register receives cash register software, as well as update packages for it. It is important to receive these updates promptly. Clients of the MultikaS company receive updates automatically at the cash registers, and if necessary, they can always contact technical support specialists.

EGAIS system

In addition to the fact that new cash registers from 2020 must be able to connect to the Internet, they must also have such an important feature as connection to the Unified State Automated Information System (EGAIS) system. If an organization has alcoholic beverages for sale in a store, then the cash register must record each bottle of alcohol sold in the Unified State Automated Information System.

The EGAIS system was introduced in retail from the beginning of 2020, and by the middle of the year, organizations began to connect cash registers to EGAIS; in the summer of 2017, rural settlements connected cash registers to EGAIS. The Cash Register Act 2020 is yet another government measure to control business activities.

New federal laws that were adopted this year are based on the use of modern technologies and this helps make the trading process more efficient and effective. Despite the fact that organizations will have to spend some money on the purchase of new equipment, the new online cash registers have become an excellent solution for building modern reporting relationships that will take much less effort and time.

By contacting our company, you can receive a full range of necessary services:

- Electronic signature for registering an online cash register.

- Connection to OFD

- Registration of an online cash register with the Federal Tax Service

- Connection and support of EGAIS

- Subscriber support for Online cash registers

- Submission of declarations on alcohol and beer to FSRAR.

Rent an online cash register

The question is raised only if a one-time purchase seems like an unaffordable expense for you. Devices can be rented on a monthly basis.

Usually, when renting a cash register, you do not spend money not only on its purchase, but also on registration, software, and annual re-registration when it is necessary to replace the fiscal drive.

Typically, tariff plans for renting a cash register include maintenance services, indicating options for action in case of breakdown

FAQ

How to conclude an agreement with OFD

There are two main ways:

- There is an official register of OFD, which you can view on the tax service website. The contract is concluded directly with one of the operators.

- The second option is to conclude an agreement through an intermediary, which is the supplier of the cash register equipment. This can be done if he has entered into a partnership agreement with the operator.

Do you need an online cash register for an online store?

This is needed if the online resource accepts payments as payment. This is regulated by Federal Law No. 54. Exceptions are described in paragraph 2 of article 2 of Federal Law-54.

What to do if there is a pick-up point for orders for an online store?

According to the law, you can use one cash register. Moreover, today some online cash register options offer their own solutions to this issue.

What about couriers who accept payment?

According to the law, the check must be knocked out at the time of payment. Therefore, every courier accepting payment must have a mobile version of the cash register.

Clarification: you cannot issue a check before payment! You can issue a check in the office if the client has already made a payment remotely and bring it along with the goods. But no later than one day after payment is made.

Is it possible to register two legal entities for one cash register?

No. Two legal entities – two cash desks.

Is it possible to open two online stores with one cash register?

Yes. The main thing is that there should be one legal entity.

Is it possible to connect an online cash register to the mobile Internet?

Yes. Moreover, it is recommended to purchase a 3G modem in advance or think through other options in case of Internet outages.

If the goods are paid for using credit, do I need to issue an online cash receipt?

Now it is recommended to configure cash registers in advance according to the appropriate parameters, especially since the check has special details that display credit transactions.

When do you need to change the fiscal drive?

- In case of breakdown

- When the owner of the cash register changes

- When the drive's memory becomes full

- When does the expiration date expire?

- When the cash register is switched to unencrypted mode.

Note: the FN manufacturer is required to extract the information free of charge in order to send it to the tax department (and also send a copy to the entrepreneur) if the cash register breaks down.

Do cashiers need to be sent to specialized courses to learn how to use an online cash register?

No need. But the work needs to be regulated. This means that a new employee who will work with the cash register must:

- Receive instructions on labor protection (this equipment operates on mains power, which means, in theory, an employee can receive an electric shock).

- Must sign the PMO agreement.

- Read and sign the rules for working with the device.

- Read the instructions for the cash register and confirm your knowledge by signing.

- Obtain login information for the work program.

All of these steps together will help minimize errors.

Does the state help in purchasing online cash registers?

Yes, assistance is provided to individual entrepreneurs, except for those who work for PSN and UTII. All other individual entrepreneurs can apply for a deduction.

Where can I get my cash register repaired?

The entrepreneur himself can do the repairs. But you need to understand that if the seal is broken, the manufacturer’s warranty is lost. Therefore, it is better to contact the supplier.

If the payment was made remotely, what should you do with the check?

The law makes it possible to deliver a check to the buyer within 24 hours after payment for the goods.

How to choose online cash register software?

If you do not understand the topic, then the best option would be to purchase equipment with pre-installed software.

What is a smart terminal

This is the name of online cash register models that were released recently and are equipped with most of the necessary functions. An analogy can be drawn with phones and smartphones, which are distinguished by greater functionality and improved technical characteristics.

Is there a deferment for self-employed people using online cash registers?

After an experiment in four regions of the country on self-employed regimes, a bill is being developed that will exempt this category from the use of online cash registers until 2021.

What to do if there is no Internet? Not at all!

Russia is large, and in some populated areas the Internet is still not installed, and the signal from the towers does not reach there. But people do business there. The law takes this into account.

If in a populated area there is no connection to the global network at all, and this is confirmed by the authorities, the entrepreneur gives the clients a paper check in the old fashioned way, and it is no longer necessary to immediately transfer the data to the tax authority. But he still has to use the cash register.

In this case, the cash register must be switched to offline mode, otherwise the drive will be blocked after some time. The data from it is transferred to the tax office along with the submission of reports.

List of individual entrepreneurs and organizations exempt from the use of cash register systems

Article 2 of Law 54-FZ stipulates the circle of persons who are exempt from using cash registers. These economic entities are engaged in one of the following types of activities:

- sales of printed products through kiosks with a share of revenue from the sale of magazines and newspapers in total income of at least 50% (separate accounting of income is maintained for control);

- securities market participants;

- sale of travel tickets in public transport;

- organizing meals for students during classes in general education institutions;

- selling products at fairs, exhibitions and from street stalls;

- small retail trade in passenger carriages;

- ice cream kiosks and some other activities listed in Article 2 of 54-FZ.

The government body of a constituent entity of the Russian Federation may approve a list of territories recognized for all reasons as inaccessible. Businessmen in this area are exempt from using online cash registers, provided that the consumer is issued a properly executed sales receipt or BSO.

Also, quite recently, criteria were adopted for territories in which cash register equipment can be used without transferring data to the tax office. The main criterion for such a settlement is the number of residents, it should be less than 10 thousand people. Thus, regional authorities can approve a list of territories where entrepreneurs will be able to use cash registers offline - without necessarily concluding an agreement with the OFD and transmitting online data to the Federal Tax Service.