What is depreciation?

Depreciation is the process of periodically transferring the initial cost of a fixed asset or intangible asset to manufacturing, selling, or general expenses, depending on how the asset is used.

There are several methods of depreciation, but legal entities using the simplified tax system should probably choose the simplest one - the linear method of depreciation.

The straight-line method is that over the entire useful life of a fixed asset or intangible asset, it is written off in equal shares. Depreciation is charged monthly, starting from the next month after the property is put into operation, and until the original cost of the fixed asset or intangible asset is fully amortized.

Depreciation rate of fixed assets: concept and structure

During the production process, fixed assets are depreciated, gradually transferring their value to the produced goods, and depreciation is a monthly process of covering the wear and tear that inevitably arises.

The concept of “depreciation rate” is the percentage established by the legislator to cover the price of the worn-out part of the OS. With its help, it is easy to determine the total amount of deductions for the year. Consequently, the depreciation rate is the ratio of the amount of annual depreciation to the cost of the fixed asset or the inverse value of the SPI of the fixed asset object.

This indicator is not a fixed value. The depreciation rate is measured as a percentage. It is established and periodically changed at the legislative level. At the same time, the accepted standards for OS groups are the same for all organizations, industries, characteristics of activities and forms of ownership. By normalizing depreciation deductions, the state regulates the rate of reproduction in different industries, and by analyzing this indicator, it calculates the rate of depreciation and the rate of restoration of the object.

Until 1990, accounting practice was to charge depreciation for complete restoration and overhaul. Since 1991, adjustments have been made, in particular:

- Resolution of the USSR Council of Ministers No. 1072 of October 22, 1990 established new unified standards for depreciation charges, which have significant differences from previous regulations for certain groups of fixed assets. True, it is worth considering that this document should be applied taking into account the provisions of Chapter 25 of the Tax Code of the Russian Federation “Income Tax” and the regulations of the Government of the Russian Federation dated 01.01.02;

- Deductions for major repairs have been abolished. Repair work is carried out at the expense of the cost of the product or a separate repair fund;

- In order to encourage the company to renew its assets, the use of accelerated depreciation has been introduced for the active share of production, for example, transport, machinery and equipment. Accelerated depreciation stimulates the transfer of the cost of fixed assets to production costs. Therefore, we can say that the amount of the depreciation rate depends on the policy pursued by the state.

How can we calculate depreciation?

As you can see from the formula, you will need to determine the original cost and useful life to calculate the monthly depreciation amount. If there are no problems with the amount of the initial cost, then determining the period of use is sometimes a difficult task.

Do accounting in Elba

Accounting with Elba is easy!

Submit reports without accounting knowledge

Elba will prepare accounting reports for the LLC.

The service is simple: you don't need to know the wiring. Tax reports and reports for employees will also be generated automatically. Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Methods for calculating depreciation

- Linear depreciation method

- Reducing balance method

- Write-offs based on cumulative useful life

- Write-offs in proportion to the number of products sold

To calculate depreciation, the following data is required:

- Term of use

- Price

- Negatively affecting environmental factors

- Regulatory restrictions

For some long-term equipment (whose service life exceeds 20 years), only the straight-line method of calculating depreciation is permitted.

3.1. Linear

The first and easiest way to calculate depreciation is linear. Write-offs occur in equal payments every month. To calculate it, it is enough to know only the service life and cost of the equipment.

N = Agod/T × 100% Agod = [S - L + Z] / Ta × 100 N = [S - L + Z] / Ta × S × 100

Where

- N - annual norm of joint stock company, %

- C - initial cost

- L - liquidation value

- T - depreciation period (service life)

To calculate the monthly norm, you need to multiply the H indicator by 1/12.

pros

- Easy calculation

Minuses

- Does not show actual wear level

- Does not show obsolescence

- Inflation is not taken into account

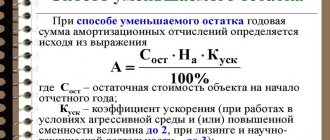

3.2. Reducing balance method

The calculation involves not the initial cost, but the residual value at the beginning of the year. An acceleration factor is also used to correct the correct calculation of equipment wear. However, it cannot be more than 3.

Example. The object costs 500,000 rubles with a period of 5 years. Acceleration factor - 2. Calculate depreciation of contributions using the reducing balance method

N = 1/5 × 100 × 2 = 40% Agod1 = 500 × 40/100 = 200 Agod2 = [500-200] × 40/100 = 120 Agod3 = [500-200-120] × 40/100 = 72 Agod4 = [500-200-120-72] × 40/100 = 43.2 Agod5 = [500-200-120-72-43.2] = 64.8

Determining the useful life

For an intangible asset, the useful life is determined by the company itself. This is the period during which the intangible asset will be used and thereby generate income.

For fixed assets in accounting, an enterprise can also set the period of use independently, but it would not be amiss to coordinate this period with already developed standards and classifiers.

Therefore, to determine the useful life, we recommend using the classifier of fixed assets by depreciation groups, approved by Government Decree No. 1 of 01.01.2002.

If a fixed asset belongs to several depreciation groups, we recommend choosing a useful life from the range of the groups to which it belongs, based on the expected service life of the fixed asset.

Thus, it will be possible to obtain the monthly depreciation amount.

If it is necessary to determine the amount of depreciation for a period, for example, as of 01/01/2019, then you should first determine the date of commissioning, and then calculate how many monthly depreciation amounts should have been made. Thus, the monthly depreciation amount can be multiplied by the number of months from the date of commissioning.

Linear and nonlinear methods in NU

The legally established procedure does not allow the cost of fixed assets and intangible assets to be immediately written off as expenses. In tax and accounting, depreciation serves this purpose. All depreciable objects are divided into groups (Article 258 of the Tax Code of the Russian Federation) according to their useful life (SPI). An important concept is also the depreciation rate (RA). Uniform repayment of the cost of fixed assets and intangible assets in the form of depreciation deductions in tax accounting is carried out in two ways: linear and non-linear.

Linear method formula: Am = Ps / SPI / 12, where Am is the amount of monthly depreciation, Ps is the initial cost of the object (instead there may be a replacement cost if it has been revalued), SPI is taken in years.

Art. 259-1 of the Tax Code of the Russian Federation describes the same method in a slightly different way. First, the monthly depreciation rate is determined as a percentage of Ps: K = 1 / SPI * 100%. SPI is taken in months. Next Am = Ps * K.

Example 1. The cost of the purchased milling machine is RUB 1,680,000. It belongs to the fifth depreciation group and can be used from 7 to 10 years. The SPI is set at 8 years 8*12=96 months. Calculation: 1/96*100% = 1.04167%, Am = 1680000*1.04167% = 17500 rub. Or 1,680,000/8/12 = 17,500 rubles. per month.

For your information! In this way, depreciation is calculated for each fixed asset or intangible asset. In practice it is used most often.

Nonlinear is another method permitted by the Tax Code of the Russian Federation. It is applied to a group of objects. It is not the initial value that plays a role, but their residual value. For each depreciation group, the balance of the value of objects is determined in total, and the calculation is made on every 1st day of the month. It will be reduced by the amount of group depreciation charges. Depreciation rates for this method are regulated and specified in Art. 259.2 clause 5 of the Tax Code of the Russian Federation.

Formula of the nonlinear method: Am = Bg * (K / 100). Here K is the monthly depreciation rate determined by the article, Bg is the balance for the group of objects.

Example 2. The initial cost of three milling machines is RUB 5,100,000. The norm for the fifth group is 2.7. In the first month, Am = 5,100,000*(2.7/100) = 137,700. 5,100,000 – 137,700 = 4,962,300. In the second month, Am = 4,962,300*(2.7/100) = 133,982.10 and so on.

Attention! Some objects from 8-10 depreciation groups can be depreciated for NC purposes only in a linear way (clause 3 of Article 259 of the Tax Code of the Russian Federation).

How to calculate the annual depreciation rate

The indicator calculated when calculating the deduction rate for depreciation for the year is the base that helps determine the percentage of the total price of fixed assets owned by the enterprise.

This percentage will be carried forward to the final price of the product or service to compensate for wear and tear. The basis for calculating deductions for depreciation is initially taken from the operating life of the funds, which is indicated in the relevant documents, as well as the depreciation rate established using the straight-line method.

The calculation formula looks like this:

Ag=((F – Fl)/Tn*F)*100

Agn is the annual deduction rate for depreciation, indicated as a percentage;

Tn is the service life according to the standard, indicated in years;

F is the book price of the object, which is determined at the time when it is put into use and contains the cost of its acquisition, as well as various costs associated with delivery, installation and further maintenance;

Fl is the liquidation price of a specific object. An amount showing the expected income from the sale of a fixed asset or its balances at the end of its service life. The indicator is calculated in rubles.

Conclusion

In the total system of financial resources of production, depreciation charges can be recorded in the category of internal production sources, which also contain that part of the profit that appears in the balance and is used by the enterprise to satisfy personal needs. The redistribution of material resources significantly affects the final monetary result of production activities.

Today it is customary to calculate depreciation not only within the framework established by accounting, but also on the basis of tax accounting. The state apparatus has the right to establish appropriate restrictions on depreciation charges. Such limits allow the company to reduce the total amount of tax imposed on profits.

In the meantime, the choice of the method of deductions from fixed assets falls on the shoulders of production, unless otherwise provided by law. Also, enterprises working with homogeneous groups of products or services need to remember that they will have to make depreciation charges based on a single chosen method.

Methods for calculating depreciation charges

Today, several methods are known that are used to account for funds related to the main ones:

- The linear accrual method was considered using the example of purchasing a car for an enterprise. Its essence lies in the uniform transfer of the price of the purchased car to the depreciation fund, including the material costs associated with its acquisition. To calculate the residual value, it is necessary to subtract from the original price of the vehicle the amount of depreciation funds that have been accumulated during the operation of each specific fixed asset;

- Annuity deductions, which are also known as reductions in balance, are carried out by determining the depreciation percentage and deducting it annually on the residual value. This method can be adjusted in each production taking into account individual characteristics;

- according to the volume of work that was performed by the tool. Here, the amount of depreciation directly depends on how heavily used the object was loaded during operation. When determining the load, established technical and operational standards are taken into account. Therefore, the residual price of a machine that was purchased but not used by the enterprise will be equal to the original cost. However, according to modern experts, the method is not sufficiently comparable with current realities, because at least inflation should be taken into account as a minimum;

- deduction of funds to the depreciation fund is made taking into account the length of the period during which the equipment was operated by the enterprise.

Because the residual price of a manufactured product and the depreciation fund are closely interrelated, the slightest market change, for example, an artificial reduction in the cost of similar products from competitors, will have a negative impact, increasing the time available for transferring the value of old assets. Therefore, any changes associated with lower prices are undesirable for the effective conduct of any business. Therefore, each production strives to extend the life of the assets at its disposal through their proper operation.

The percentage of deductions for depreciation also depends on the type of depreciation that affects fixed assets. If an object is simultaneously subjected to not one, but several types of wear, its coefficient will be maximum. Since wear and tear means the gradual loss of an object’s main characteristics and properties, the level of wear and tear depends directly on the intensity of use of fixed assets.

Modern economic theory distinguishes:

- physical deterioration;

- obsolescence.

For example, office equipment, which is also included in the list of assets of the organization, wears out both morally, since technology tends to become obsolete, and also physically. Therefore, all office equipment also falls under depreciation charges.

Algorithm for calculating the depreciation coefficient of fixed assets

The depreciation ratio of fixed assets (hereinafter referred to as KAOS) shows how much the fixed assets of an enterprise are worn out and how soon they will have to be repaired or updated. This indicator is calculated using the formula

KAOS = A / PSt × 100,

Where:

A - depreciation (account balance 02);

PSt is the initial cost of fixed assets (account balance 01).

You can also use the data from Form 5 from the notes to the balance sheet to calculate this ratio.

For an algorithm for filling out Form 5, see the article “Filling out the Appendix to the Balance Sheet (Form 5).”

An example of a balance sheet can be found in the material “Procedure for compiling a balance sheet (example).”

In this case, KAOS will be equal to:

KAOS = page 5,200 (data on depreciation) / page 5,200 (data on original cost) × 100.

This indicator is calculated for a specific date, most often at the beginning and end of the year.

KAOS is a conditional indicator and depends on the chosen method of calculating depreciation. Let's look at how it will change in 2015 using an example (for clarity, let's agree that the company has only one OS).

Example

in January 2012 I bought a machine at a price of 578,470 rubles. (including VAT RUB 88,241.18). It was put into operation the same month. The period of use is 8 years. Production capacity - 500,000 units. for the expected service life.

Postings:

Dt 08 Kt 60 — 490,228.82 rub. - OS arrived;

Dt 19 Kt 60 - 88,241.18 rub. — VAT;

Dt 01 Kt 08 — 490,228.82 rub. — OS accepted for accounting.

SALT for account 01 for 2020:

| Beginning balance | Revolutions | Balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| Machine | 490 228,82 | 490 228,82 | |||

T.I. Yurkova, S.V. Yurkov Enterprise Economics

Electronic textbook

| Previous | Table of contents | Next |

MODULE 2.4. DEPRECIATION OF FIXED ASSETS

Depreciation of fixed assets reflected in accounting accumulates throughout their service life in the form of depreciation charges in depreciation accounts. In each reporting period, the amount of depreciation is written off from depreciation accounts to accounts for recording production costs. Together with revenue for sold products and services, depreciation is transferred to the company's current account, where it is accumulated. Depreciation charges are spent directly from the current account to finance new capital investments in fixed assets.

Depreciation

- this is a systematic process of transferring the value of means of labor as they wear out to the product produced with their help. Depreciation is the monetary expression of physical and moral wear and tear of fixed assets. The amount of depreciation accrued during the operation of fixed assets must be equal to their original (replacement) cost.

Objects for calculating depreciation are fixed assets that are in the organization under the right of ownership, economic management, and operational management.

Depreciation is not accrued for the following types of fixed assets: · for fixed assets received under a gift agreement and free of charge during the privatization process; · housing stock (except for objects used for generating income); · objects of fixed assets, the consumer properties of which do not change over time (land plots and environmental management objects).

Depreciation policy is an integral part of the economic policy of any state. By establishing the depreciation rate or useful life, the procedure for calculating and using depreciation charges, the state regulates the pace and nature of reproduction in industries.

Useful life

is the average service life of objects of this type.

Depreciation rate

- this is the annual percentage of reimbursement of the cost of fixed assets established by the state.

In Russia, uniform depreciation rates are used to calculate depreciation. The depreciation rate is determined for each type of fixed assets.

The depreciation rate for complete restoration is calculated using the expression

where H in

– annual depreciation rate for complete restoration;

First

– the initial cost of fixed assets

; L

– liquidation value of fixed production assets;

D

– cost of dismantling liquidated fixed assets and other costs associated with liquidation;

T a

– useful life.

Depreciation rates are differentiated by groups and types of fixed assets. They also depend on the conditions in which fixed assets are operated.

Thus, for buildings they range from 0.4 to 11%, for power and working machines and equipment from approximately 3 to 50%, for heat exchangers in the production of plastics with a non-aggressive environment - 6.7%, for the same devices used in production of plastics with aggressive environments – 10%.

The depreciation rate is related to the useful life of the fixed asset. We can assume that the useful life is the reciprocal of the depreciation rate.

During the useful life of an object of fixed assets, the accrual of depreciation charges is not suspended, except when they are under reconstruction or modernization by decision of the head of the organization. The accrual of depreciation is also suspended for fixed assets transferred by decision of the head of the organization to conservation for a period of more than three months.

Depreciation on the cost of newly received fixed assets begins on the first day of the month following the month of their receipt. For retired fixed assets, depreciation ceases on the first day of the month following the month of their disposal.

Test control

1. Depreciation of fixed assets 2. Useful life is 3. The depreciation rate is set depending

| Previous | Table of contents | Next |