Home / Alimony / How individual entrepreneurs pay alimony

An individual entrepreneur is obliged to support his children in the same way as an ordinary employee. The same rules for collecting alimony apply to him: in the form of a fixed amount or in the form of a percentage of profit.

But unlike ordinary employees, responsibility for the correct calculation of alimony, which is determined by a voluntary agreement or court, lies not with the accounting department at the place of work, but with the individual entrepreneur himself. And many parent entrepreneurs do this properly and responsibly.

The main thing is to determine the collection procedure and correctly calculate the amount of alimony.

How to collect alimony from an individual entrepreneur?

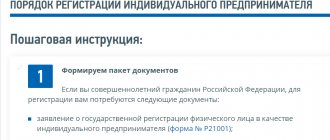

The law provides for two possible procedures for collecting alimony: voluntary and judicial.

A voluntary order takes place if the parents themselves enter into an agreement on the maintenance of children. In the agreement, they stipulate the amount of alimony, the method of calculating it and the procedure for payment. A parental agreement, drawn up in writing and certified by a notary, has the force of a writ of execution.

Judicial procedure – collection of alimony based on a court decision and a writ of execution issued by it.

Documents for collecting alimony

In order to collect alimony from an individual entrepreneur, a standard package of documents is required, including…

- Copies of passports;

- Copies of children's birth certificates;

- A copy of the marriage or divorce certificate;

- Certificates about family composition (claimor and payer of alimony).

These documents are needed to conclude an alimony agreement with a notary, as well as to file an appeal to the court, both with an application for the issuance of a court order and with a statement of claim for the collection of alimony.

If the collection of alimony occurs in court, some more documents will be needed, in particular, calculation of the amount of alimony, documentary support for the costs of maintaining children.

Executive documents

If an alimony agreement is concluded between the parents, it is an executive document that can be submitted to the bailiff service to enforce the collection of alimony (if the terms of the agreement are not fulfilled voluntarily).

If the alimony case was considered in court, the executive document will be a court order (issued in a simplified order) or a writ of execution (issued on the basis of a court decision in a lawsuit). You also need to contact the bailiff service with the writ of execution for further collection of alimony.

An individual entrepreneur who has a writ of execution in his hands can calculate and transfer alimony payments to the recipient himself. Appropriate notes about this are made in the executive document.

The amount of alimony from an individual entrepreneur

The collection of alimony from an individual entrepreneur is regulated by the Family Code of the Russian Federation. According to the general rules, alimony must be paid either as a flat sum or as a share of income.

- If the income of the entrepreneur paying alimony is not constant , if it is impossible to establish alimony as a percentage of income, if alimony as a percentage of income is not enough to support the children, collection is carried out in the form of a fixed sum of money.

- If the alimony payer entrepreneur has a permanent income, child support is calculated as a percentage of income, depending on the number of children:

- for one child - 25%,

- for two children – 33%,

- for three or more children – 50% of income (sometimes 70%).

The most important thing is to correctly determine the amount of income on the basis of which alimony will be calculated.

Alimony by law: amount and percentages

Russian legislation carefully protects the rights of the younger generation. Therefore, everything that concerns children is spelled out in particular detail. In particular, if we talk about alimony, the amount of payments depends on how many children the spouse left behind during the divorce.

- If alimony is paid for the 1st child, then the amount of the alimony payment will be equal to 25% of the individual entrepreneur’s income;

- if alimony must be paid for two children, then 33%;

- if the number of children is three or more, then the individual entrepreneur will have to pay half of his earnings for alimony.

From what amount should alimony from an individual entrepreneur be calculated: from income or profit?

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

Until recently, there were discussions about what amount to calculate alimony from - from the amount of total or “net” income. Only in 2013 was a legislative act regulating the procedure for collecting alimony from individual entrepreneurs approved. Based on this document, alimony is collected from the entrepreneur’s net profit , which remains at his disposal after covering expenses related to business activities and paying taxes.

In addition, this norm determines that alimony is not an expense item for an individual entrepreneur, since it has nothing to do with entrepreneurial activity, but is a personal, family monetary obligation.

How does an individual entrepreneur pay child support?

The main difficulty in collecting alimony from an individual entrepreneur is the correct determination of income. After all, the income of an entrepreneur is the income of his enterprise. Some of this income goes to cover expenses, and some goes to pay taxes.

Size

The main articles regulating the amount of alimony accruals are No. 81 of the RF IC and No. 83 of the RF IC. Following the content of their text, we learn about how and in what way an individual entrepreneur pays child support:

In shares of income:

- a quarter of all income to provide for just one child (payment of 25%);

- a third of all income to provide for two minors (33% payment);

- 50% to provide for three children or more. It is important to consider here that half the amount is not the limit at all. In some situations, alimony can be calculated up to 70% of all profits.

In a fixed amount of money - by the court or by agreement, a fixed amount of alimony is established, which is periodically indexed (as the cost of living increases).

Important! Payment of alimony in a fixed amount is applied in the case when payments are accrued to the wife (if she is in a position or on maternity leave). And, also, alimony in individual entrepreneurs is prescribed by law in order to provide for disabled adult children who need constant care and maintenance.

In a mixed version - when the payment is made in a “duet way”: simultaneously in shares and in a fixed amount. This payment method is used only when the defendant’s profit is very unstable and can come from various sources.

Note! A fixed payment cannot cause any misunderstandings other than its indexation. But the share deduction from the amount of earnings is an issue that gives rise to many disputes and disagreements.

How to correctly calculate alimony depending on the taxation of an individual entrepreneur?

Alimony from individual entrepreneurs on the general taxation system

If an individual entrepreneur works on the general taxation system, alimony is collected from the amount subject to income tax. The document confirming this amount is a tax return with the income indicated therein, a copy of which must be submitted to the court.

Alimony from individual entrepreneurs on a simplified taxation system

If an entrepreneur pays taxes according to the simplified tax system (USN), child support payments are also calculated from net profit. To calculate the definition of net profit and calculate alimony, an individual entrepreneur must maintain an income and expense book, including information about income and expenses.

Alimony from individual entrepreneurs on a single tax on imputed income, on a patent tax system

The single tax system involves paying taxes not on real income, but on imputed income. Alimony from an entrepreneur to UTII is calculated on the basis of the amount of real profit, since a tax return with the amount of a single tax on imputed, potentially possible income cannot serve as confirmation of the actual financial situation of the entrepreneur. Therefore, an individual entrepreneur who pays a single tax must submit to the court documents confirming real income and expenses, allowing one to determine real profit and calculate the amount of alimony.

The problem is that, in accordance with the law, an individual entrepreneur is not required to keep records of real income and expenses, so he may not have such documents. In this case, the court has the right to calculate alimony based on the average earnings in the Russian Federation. A similar situation arises for entrepreneurs in the patent taxation system.

If income and expenses are inconsistent

The calculation of alimony becomes significantly more complicated if the income and expenses of the entrepreneur are not constant, their amounts change from month to month.

Since alimony is paid from net profit, the absence or reduction of expenses affects the increase in income, and therefore alimony. Otherwise, if expenses increase, even if they exceed income, alimony is calculated based on average earnings in the Russian Federation.

An alternative to such a complex procedure for calculating alimony may be the conclusion of an alimony agreement, which will indicate a fixed amount of payments or stipulate a special method for calculating alimony (for example, a fixed amount and a percentage of profits, if any).

If the individual entrepreneur does not conduct business activities

It also happens that the alimony payer is registered as an individual entrepreneur, but does not conduct business and does not receive income. In this case, the calculation of alimony is based on the average earnings in the Russian Federation.

Voluntary agreement

Upon divorce, it becomes necessary to determine the place of residence of a minor child, and, consequently, which spouse will pay alimony for his maintenance.

Do not forget that court proceedings are long, nervous and expensive. Therefore, it is easier and cheaper to enter into a voluntary agreement under which alimony will be paid for a minor. In addition, alimony can be assigned not only to a child, but also, for example, to a spouse who is on maternity leave at the time of the divorce and cannot provide for herself.

A voluntary agreement must be drawn up in writing and registered at a notary’s office. Please note: all oral agreements will not be taken into account by the court; these are not evidence.

It is very important that the voluntary agreement contains the following points:

- Information about the person in respect of whom maintenance in the form of alimony is determined;

- The date from which the obligation to pay funds is determined;

- Method of payment of alimony;

- The order of fulfillment of obligations and the amount (this can be interest or a fixed amount or a combination of both).

- The period for which the agreement was concluded.

In the event that the amount of alimony is determined as a percentage of profit:

- One child 25%

- Two children one third;

- Three or more 50% of the profit.

If an agreement is reached on the payment of alimony in a certain amount, then it is necessary to clarify how the other party will receive the money:

- One-time payment;

- Monthly payments.

In addition, the agreement must provide for the actions of the parties in the event of delay in payments. In this case, the document can indicate interest for each day of delay, penalties or fines.

To protect the interests of the child, it is better to use a combined scheme (fixed amount + percentage of profit). In this way, you can receive stable payments that the child is guaranteed to receive.

And if the individual entrepreneur develops successfully, then the amount of payments will increase in proportion to the increase in profits. There are other ways of paying money for child support; they can be used by agreement of the parties if they do not infringe on the rights of a minor citizen.

By law, child support payments are determined until the child reaches adulthood.

Rubric “Question/Answer”

I want to open my own individual entrepreneur, how do I pay child support? I plan to engage in cargo transportation, because there will be costs for fuel and spare parts.

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

Costs for fuel and spare parts are not taken into account. They have nothing to do with alimony. For the calculation, the income of the alimony payer is taken, and in your case, the net profit from the business. In other words, how much money will you earn per month (income-expenses). In this case, taxes are also recognized as expenses, depending on the rate at which the individual entrepreneur operates.

How to collect alimony from the husband of an individual entrepreneur if we are married, but he himself normalizes family expenses? At the same time, their amounts are not always adequately assessed. We have three minor children. I support myself (doctor). There will be no voluntary consent on the part of the husband. She offered to allocate me an amount for the children so that I could manage it - a categorical refusal.

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

The best option is to enter into an agreement to pay child support. You can set the amount yourself, taking into account your needs. For example, 10,000 rubles per month or any other, not lower than the subsistence level for children. If your husband refuses, file a claim in court. Usually the average salary in the region is taken as a basis - the amount of child support is calculated from it. If the husband does not mind, you can submit an application to the magistrate. Then you will have a court order in your hands. With this document you can go to the bailiffs so that they can calculate alimony. Advice - try to agree on at least a fixed amount of money every month.

Hello! Please tell me if I can pay my own alimony while working for an individual entrepreneur. I plan to make transfers to another city via mail. Or should the entrepreneur pay my own alimony for me?

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

Hello! According to the general rules, alimony is transferred by the accounting department from the payer’s place of work. The basis is a writ of execution, an agreement or a court order. If your employer has such a document, then he himself transfers alimony. Of course, you can agree and transfer payments by mail. However, the individual entrepreneur has the right to refuse, since the responsibility for deductions from the salary lies with him - in case of delay in alimony payments, problems will arise.

Let us note that alimony is, first of all, payments for a child, so they are not “yours”. You, as the alimony payer, can control the transfers. To do this, you can request payment orders from the accounting department - when, to whom and what amounts were transferred from earnings.

Still have questions or need help with calculations? Get a free consultation from our lawyers. If you or the payer is an individual entrepreneur, you are obliged to transfer alimony - will lawyers tell you how and how much to transfer, what to do in case of non-payment? Leave requests on the website or call the hotline!

Watch a video about how to correctly calculate child support for a child with an individual entrepreneur:

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- FREE for a lawyer!

By submitting data you agree to the Consent to PD Processing, PD Processing Policy and User Agreement.

Anonymously

Information about you will not be disclosed

Fast

Fill out the form and a lawyer will contact you within 5 minutes

Tell your friends

Rate ( 6 ratings, average: 5.00 out of 5)

Author of the article

Irina Garmash

Family law consultant.

Author's rating

Articles written

612

What is the penalty for failure to pay child support?

Of course, if an individual entrepreneur fails to pay alimony one-time, then, most likely, he will only get away with paying a penalty or a fine.

Let's consider other manifestations of dishonesty of fathers-businessmen:

- If the ex-husband does not provide documents on income from individual entrepreneurship, then the bailiffs will collect alimony from him based on the average salary in the region of residence or in the country as a whole.

- If bailiffs catch an individual entrepreneur incorrectly calculating alimony, they may impose a fine on him. Fines vary from 1000 to 2500 rubles.

This is important to know: How to get alimony if your ex-husband doesn’t work

In order to receive criminal punishment for alimony, or rather for non-payment, the individual entrepreneur must be caught maliciously evading, which threatens him with imprisonment for up to 1 year (In exceptional cases, up to three years). You can read more in the articles:

Please note that Russian legislation is constantly changing and the information we write may become outdated. In order to resolve a question you have regarding Family Law, you can contact the site’s lawyers for a free consultation.