What is statistical reporting

Statistical reporting is a set of reports compiled according to approved forms by companies, enterprises, and organizations, which they are obliged to submit to regional statistical bodies within the established time limits.

The laws oblige organizations and individual entrepreneurs to submit the following types of reports:

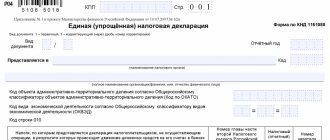

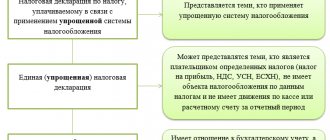

These responsibilities also apply to those organizations and individual entrepreneurs that use the simplified taxation system.

According to paragraph 4 of Article 346.11 of the Tax Code of the Russian Federation, organizations using the simplified tax system, along with others, are required to report to statistical authorities.

The only exceptions are small enterprises, for which selective statistical observation is provided in a simplified manner, therefore not everyone must report, but only those who have received a written request from the statistical authorities. Your statistics department will then send you the necessary forms and instructions on how to fill them out. To find out if you are included in the sample, you can contact the statistical office at your location.

If your organization (being a small enterprise) is not included in the “sample”, then you only need to send reports to Rosstat once every 5 years in accordance with clause 2 of Art. 5 of the Law “On the Development of Small and Medium Enterprises in the Russian Federation” No. 209-FZ, according to which continuous statistical observations of the activities of small enterprises are carried out only once every five years.

From 01/01/2013, in accordance with Article 18 of the Law “On Accounting” No. 402-FZ, organizations and individual entrepreneurs (including those using the simplified tax system) are required to submit an annual accounting (financial) copy to the state statistics body no later than 3 months after the end of the reporting year . Therefore, at the end of 2013, along with statistical information, Rosstat will also need to submit a balance sheet, a statement of financial results and appendices to them.

So, small businesses, like other organizations, are not exempt from statistical reporting. They quarterly submit Form No. PM “Information on the main performance indicators of a small enterprise” to the territorial statistical bodies (approved by Rosstat order No. 355 dated August 15, 2011). It is filled out with a cumulative total for the period from the beginning of the year and submitted to the statistics department no later than the 29th day of the month following the reporting quarter. Thus, for the period from January to September, the form must be submitted to the territorial body of Rosstat before October 29, 2012, and for the period from January to December - until January 29, 2013 inclusive.

Individual entrepreneurs who are not engaged in agriculture, based on the results of 2012, will have to submit to the territorial bodies of Rosstat form No. 1-IP “Information on the activities of an individual entrepreneur” (approved. Rosstat Order No. 355).

For microenterprises, Order No. 355 approved form No. MP (micro) “Information on the main performance indicators of a microenterprise.” All micro-enterprises must report on it, except those engaged in agricultural activities. Form No. MP (micro) is annual. Based on the results of 2012, it must be submitted to the statistical authorities by February 5, 2013.

For certain types of activities, special statistical forms are provided. For example, small trading enterprises additionally submit a quarterly form No. PM-torg (approved by Rosstat Order No. 328 dated July 19, 2011), and individual entrepreneurs engaged in retail trade - annual form No. 1-IP (trade) (approved by Rosstat Order No. 12.05 .2010 No. 185).

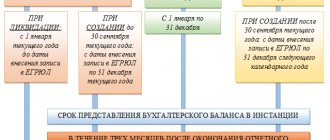

When should financial statements be submitted?

The deadline for submitting financial statements is three months after the end of the reporting period .

If the statements are subject to mandatory audit, the auditor's report is submitted electronically along with the statements. Or within 10 working days after the date of its signing by the auditors. The deadline is December 31 of the year following the reporting year .

Updated financial statements can be submitted no later than 10 working days from the day following the day of correction or the day of approval of the annual statements.

That is, the deadline for submitting a “clarification” for an LLC is 10 working days after April 30 , for a JSC – 10 working days after June 30 .

Changes made after approval of the statements are taken into account in the financial statements of the next period (Federal Law No. 247-FZ dated July 26, 2020).

Deadlines for submission and forms of statistical reporting

Collection of statistical reporting during the period of validity of Decree of the President of the Russian Federation No. 239

Large and medium-sized enterprises that continue to operate, including remotely, submit all reports within the usual time frame.

Small enterprises that continue to operate, including remotely, and are included in the sample, submit PM, PM-prom, and PM-torg forms within the usual time limits.

Small businesses do not fill out any more reports until April 30 inclusive. Whether this means a complete exemption from reporting due in April, or just a postponement of the deadlines, is still unclear. We recommend that you clarify this point with the territorial body of Rosstat.

The territorial bodies of Rosstat determine the list of statistical reporting forms. Below is statistical reporting information for:

- organizations and individual entrepreneurs that cannot be classified as small enterprises;

- organizations and individual entrepreneurs that are classified as small enterprises.

A specific list of reporting for your organization can be obtained on the website statreg.gks.ru. To do this, you need to go to the website and fill in the following data in the search card:

- notification type;

- TIN or OGRN of your organization;

- control code.

| Form name | Who provides | Deadline | Base |

Monthly reporting of organizations not related to small businesses | |||

| Form No. P-1 “Information on the production and shipment of goods and services” | legal entities (except for small businesses), the average number of employees of which exceeds 15 people, including part-time workers and civil contracts, their separate divisions | no later than the 4th day after the reporting period | Approved by Order of Rosstat dated August 11, 2016 N 414 |

| Form No. P-3 “Information on the financial condition of the organization” | no later than the 28th day after the reporting period | Approved by Order of Rosstat dated 05.08.2016 N 390 | |

| Form No. P-4 “Information on the number, wages and movement of workers” | legal entities (except for small businesses) | no later than the 15th day after the reporting period | Approved by Rosstat Resolution dated 08/02/2016 N 379 |

| Appendix No. 3 to Form No. P-1 “Information on the volume of paid services to the population by type” | legal entities (except for small businesses), the average number of employees of which exceeds 15 people, including part-time workers and civil contracts, their separate divisions, regardless of ownership and legal form, providing paid services to the population or possessing information about the volume of services provided to the population by third party organizations; | no later than the 4th day after the reporting period (the average number of employees exceeds 15 people) | Resolution of Rosstat dated 08/04/2016 N 388 |

Quarterly reporting of organizations not related to small enterprises | |||

| Form No. P-5(m) “Basic information about the organization’s activities” | legal entities (except for small businesses), the average number of employees of which does not exceed 15 people, including part-time workers and civil contracts. | no later than the 30th day after the reporting period | Resolution of Rosstat dated August 11, 2016 N 414 |

| Form No. P-2 (short) “Information on investments” | no later than the 20th day after the reporting period | Approved by Order of Rosstat dated July 17, 2015 N 327 | |

Annual reporting of organizations and individual entrepreneurs not related to small enterprises | |||

| Form No. 1-enterprise “Basic information about the organization’s activities” | legal entities (except for small businesses, budgetary organizations, banks, insurance and other financial and credit organizations) according to the list established by the territorial body of Rosstat; | April 1 - after the reporting period | Approved by Order of Rosstat dated July 15, 2015 N 320 |

| Form No. 12-F “Information on the use of funds” | legal entities (except for small businesses, banks, insurance and budget organizations) | April 1 after the reporting period | Approved by Order of Rosstat dated August 31, 2016 N 468 |

| Form No. 1-IP “Information on the activities of an individual entrepreneur” | individual entrepreneurs, according to the list established by the territorial body of Rosstat | 2nd of March | Rosstat Order No. 414 dated August 11, 2016 was approved |

Small business reporting | |||

| Form No. PM “Information on the main performance indicators of a small enterprise” quarterly | legal entities that are small enterprises (except for microenterprises), according to the list established by the territorial body of Rosstat | 29th day of the month following the last month of the reporting period | Approved by Order of Rosstat dated August 11, 2016 N 414 |

| Form No. PM-prom “Information on the production of products by a small enterprise” | legal entities that are small enterprises (except micro-enterprises) engaged in the production of products from mining, manufacturing, production and distribution of electricity, gas, water, logging, as well as fishing, according to the list established by the territorial body of Rosstat | 29th day after the reporting period | Approved by Order of Rosstat dated August 11, 2016 N 414 |

| Form No. MP (micro) “Information on the main performance indicators of a micro-enterprise” | legal entities - micro-enterprises carrying out economic activities (except agricultural) | until February 5 | Rosstat Order No. 414 dated August 11, 2016 was approved |

By Order of Rosstat dated 08/07/2015 No. 366 “On approval of the federal statistical observation form N TORG (micro) “Information on the turnover of retail trade and public catering of a micro-enterprise”, the annual federal statistical observation form N TORG (micro) is put into effect from the report for 2020.” Information on the turnover of retail trade and public catering of a microenterprise.”

The report is submitted by February 5 to the Rosstat body in the constituent entity of the Russian Federation by legal entities - micro-enterprises carrying out:

- retail trade (including trade in motor vehicles, motorcycles, their components and accessories, motor fuel);

- catering.

For micro-enterprises using the simplified tax system, the current procedure for providing statistical reporting is maintained (Tax Code of the Russian Federation, Article 346.11, clause 4). These enterprises provide Form N TORG (micro) on a general basis.

Deadlines for submission and forms of statistical reporting in 2020

Federal statistical observations of the activities of small and medium-sized businesses in the Russian Federation by virtue of Art. 5 of Federal Law N 209-FZ “On the development of small and medium-sized businesses in the Russian Federation” are carried out by:

- continuous statistical observations of the activities of these entities;

- selective statistical observations of the activities of individual small and medium-sized businesses based on a representative sample.

Note : continuous statistical observations of the activities of small businesses are carried out once every five years. The previous continuous observation was carried out in 2010, and the next one fell in 2020.

The following categories of business entities are subject to continuous monitoring of the activities of small and medium-sized businesses:

- legal entities that are commercial corporate organizations;

- consumer cooperatives (legal entities that are non-profit corporate organizations) included in the Unified State Register of Legal Entities;

- heads of peasant (farm) households who have passed state registration as individual entrepreneurs;

- individuals carrying out entrepreneurial activities without forming a legal entity, who have passed state registration as individual entrepreneurs and are included in the Unified State Register of Individual Entrepreneurs.

In order to collect primary statistical data for the continuous observation program for 2020, Rosstat issued Order No. 263 dated 06/09/2015. This Order approved the forms of federal statistical observation:

- MP-SP “Information on the main performance indicators of a small enterprise for 2020” (Appendix 1 to Order No. 263);

- 1-entrepreneur “Information on the activities of an individual entrepreneur for 2020” (Appendix 2 to Order No. 263).

Information service of Rosstat

The newly introduced reporting form will not be mandatory for all business entities. In more detail, and specifically for each subject, you can find out by using the new service, launched in accordance with the order of the authorized bodies of the Russian Federation dated April 22, 2015 No. 381. The created online service provides accessible and understandable data on the newly introduced reporting forms.

Using this service is quite simple. By going to the Rosstat website, through the personal user account, you enter the information of the enterprise: company name, INN or OKPO. Having correctly specified the information, the system produces the entire list of reporting forms, including new ones.

Information from statistical services about the introduced new reporting forms for business entities is free of charge. When an entrepreneur contacts Rosstat in writing for a list of updated reporting forms, all material is sent to the subject at the postal address or to the address indicated in the Unified State Register of Entrepreneurs.

Procedure for submitting statistical reporting

Any forms of statistical reporting are compiled in at least two copies - one is submitted to the territorial body of Rosstat, the second is kept in the affairs of the organization (IP).

Various Rosstat regulations provide for each type of reporting its own deadline for its submission.

Note : from January 1, 2020, changes made to the Law “On Accounting” will come into force regarding the procedure for submitting accounting (financial) statements, according to which the statements do not need to be submitted to the statistical authorities (except in certain cases), but it is enough to submit it in electronic form to the tax authorities (some organizations are exempt from submitting a legal copy of reporting to the tax authorities).

Reporting to Rosstat can be submitted on paper or electronically - via telecommunication channels (TCS).

That. You have the right to submit all reports to Rosstat:

- personally;

- through a representative;

- send it by mail or via the Internet (in this case, the submission of financial statements is carried out through specialized telecom operators).

If you send reports via the Internet, you must receive a receipt confirming its receipt.

.

When sending reports by mail or the Internet, the day of its submission to the tax authority is considered the day of sending.

The Rosstat TU is obliged to accept your reporting and put a mark on its acceptance on the second copy.

It is better to send reports by mail in a valuable letter (the item can be valued at a minimum cost, for example, 1 ruble) with a list of the contents and a receipt. If statistical reporting is sent by mail, the day of its submission is considered the date of dispatch, so there should be no fear that the deadlines established by law for submitting a particular reporting form may be violated. Proof that you sent the reports on time will be the copy of the enclosure inventory that remains with you, with a postmark on it indicating the date of dispatch, and an attached receipt for payment of the postage. Accordingly, the inventory must be drawn up in two copies, signed and sealed by the organization, handed over to the postal worker who accepts registered and valuable mail for stamping, then one copy of the inventory should be enclosed and sealed in an envelope with reporting, and the other copy must be kept.

Responsibility for late submission of reports

Responsibility for failure to submit financial statements

For failure to submit or untimely submission of financial statements to the territorial body of Rosstat, Article 19.7 of the Code of Administrative Offenses of the Russian Federation provides for administrative liability:

- for officials of the organization (director, chief accountant) - a fine of 300 rubles. up to 500 rub.;

- for a legal entity - a fine of 3,000 rubles. up to 5,000 rubles (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

Responsibility for failure to provide statistical reporting

According to Article 13.19 of the Administrative Code, violation by an official responsible for the presentation of statistical information necessary for conducting state statistical observations of the procedure for its presentation, as well as the presentation of unreliable statistical information before December 30, 2015, entailed the imposition of an administrative fine in the amount of 3,000 to 5,000 rubles.

Federal Law No. 442-FZ of December 30, 2015 amended Article 13.19 of the Code of Administrative Offenses, according to which, as of December 30, 2015, liability for failure to provide primary statistical data has been increased and now:

- Failure by respondents to provide primary statistical data to subjects of official statistical records in the prescribed manner or untimely provision of this data or provision of unreliable primary statistical data shall entail the imposition of an administrative fine on officials in the amount of ten thousand to twenty thousand rubles; for legal entities - from twenty thousand to seventy thousand rubles (part 1 of article 13.19 of the Administrative Code).

- Repeated commission of an administrative offense provided for in Part 1 of Article 13.19 of the Code of Administrative Offenses entails the imposition of an administrative fine on officials in the amount of thirty thousand to fifty thousand rubles ; for legal entities - from one hundred thousand to one hundred fifty thousand rubles (part 2 of article 13.19 of the Administrative Code).

It must be borne in mind that the offense for which liability is provided for in Article 13.19 of the Code of Administrative Offenses of the Russian Federation is not ongoing, therefore it can be fined only within two months from the date of commission (Clause 1 of Article 4.5 of the Code of Administrative Offenses of the Russian Federation). It turns out that the inspectors, having discovered in October that a small enterprise did not report for six months, will not be able to fine it, since two months from the moment when the information should have been submitted, that is, from July 29, have already expired. Nevertheless, you will still have to submit Form No. PM if you are included in the “sample.” In addition, the organization will have to compensate the statistical agency for correcting the results of the consolidated reporting. This follows from Article 3 of the Law of the Russian Federation of May 13, 1992 No. 2761-1.

When preparing the materials, materials from the magazines “Glavbukh” and “Uproshchenka” were used.

The article was written and posted on December 16, 2012. Added - 08/28/2015, 01/02/2016, 04/01/2016, 03/22/2017, 04/24/2017, 05/28/2019

Useful links on the topic “Statistical reporting of organizations and individual entrepreneurs”

- Where to submit reports:

- addresses, telephone numbers, websites, details of tax inspectorates of St. Petersburg

- addresses, telephone numbers, websites, details of Moscow tax inspectorates

- find out the address of your statistical inspectorate (other cities in Russia)

- Production calendar for 2020

- Tax calendar for 2020 - 2020

- Legal calendar for 2020

- Calculation of FSS benefits in 2020 - 2020

- Reporting Summary Table

- Insurance premiums in 2013 - 2021 in the Pension Fund, Social Insurance Fund, FFOMS (rates, tariffs, changes)

- Changes in insurance premiums from 01/01/2020

- Changes in tax legislation from 2020

- New KBK codes from 01/01/2020

- Which tax system should you choose?

- Transition to simplified tax system from OSN

- Transition from UTII to simplified tax system from 01/01/2013

- How to register your business yourself?

- Which is better: LLC or individual entrepreneur?

- General taxation system

- Simplified taxation system

- Patent tax system

- Taxation system in the form of UTII

- Tax reporting for the general taxation system

- Tax reporting for a simplified taxation system

- Tax reporting for the tax system in the form of UTII

- Tax liability for failure to submit a tax return

- Tax liability for unpaid taxes

- Tax liability for failure to appear when called to the tax authorities

- Directory of new fines of the Tax Code of the Russian Federation

- Find out if your organization (you as an individual entrepreneur) is included in the inspection plan for 2020

Cancellation of submission of accounting reports to statistics

Of course, the main change in statistical reporting in 2020 is that the legal copy of the financial statements for 2020 no longer needs to be submitted to the territorial body of Rosstat, but only to the tax authority. This obligation has been cancelled.

However, a special procedure is provided for organizations:

- whose accounting records contain state secrets;

- from a special list of the Government of the Russian Federation.

The corresponding changes were made to the Tax Code by Law No. 444-FZ of November 28, 2018 (hereinafter referred to as Law No. 444-FZ), and to the Federal Law on Accounting by Law of November 28, 2018 No. 447-FZ.

This innovation is associated with the introduction in Russia of a state information resource for accounting (financial) reporting, which is maintained by the Federal Tax Service of Russia.

The provisions of Law No. 444-FZ come into force on January 1, 2020. From this date, the Federal Tax Service of Russia begins, and Rosstat ceases, to exercise powers to form and maintain the state accounting register (GIRBO). In particular, Rosstat will stop collecting legal copies of financial statements, including revised ones, as well as audit reports on them for the reporting period of 2020 and reporting periods that expired before January 1, 2020.

For more information, see “The new law abolished the submission of accounting reports to Rosstat: details.”

The goals of this change are:

- reducing the administrative burden that organizations bear in connection with the fulfillment of obligations to submit their accounting records to government agencies;

- simplifying access for interested parties to such reporting.

Also see “What is GIRBO: explanations from the Ministry of Finance.”