Author: Maria Novikova

Money received by a person for the use of his intellectual or physical labor is his income. The state obliges citizens to pay a certain percentage of them to their budget. Officially employed workers

in the event of illness (their own or a family member in need of care), they can count on

compensation payment

. The same right appears for women on maternity leave.

The money for this comes from the Social Insurance Fund (except for the first 3 days of illness, paid for by the company). They are formed through monthly contributions

, which companies pay for their employees. But whether benefits are taxed and whether such insurance payments are considered a person’s income, and when to pay personal income tax on sick leave, find out in this current review.

Certificate of incapacity for work and insurance payments

Since 2020, issues related to pension and health insurance are regulated by the Tax Code

, namely

chapter 34

.

However, this did not affect the essence of the matter, and now, as in previous years, insurance premiums are not charged from sick leave. speaks about this .

422 clause 1.1 .:

“Not subject to insurance premiums for payers specified in subparagraph 1 of paragraph 1 of Article 419 of this Code

:

- state benefits paid in accordance with the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local government, including unemployment benefits, as well as benefits and other types of compulsory insurance coverage for compulsory social insurance.”

Contributions are not made to any government agency, including insurance against work-related injuries. This is evidenced by clause 1.1 of Art. 20.2 of Law No. 125-FZ

, the text of which repeats the Tax Code.

Attention

! Contributions are not accrued in any case, regardless of who pays the compensation, the employer or the Social Insurance Fund.

To whom and at whose expense is sick leave paid?

According to Article 2 of Law No. 255-FZ of December 29, 2006, temporary disability benefits are mandatory paid only to employees hired under an employment contract. Is sick leave subject to personal income tax in the case of payments to performers providing services under a civil contract? No, because these individuals cannot qualify for sickness compensation from the employer and the Social Insurance Fund, respectively, and tax withholding does not occur due to the lack of a tax base.

The benefit for the first three days of illness of an employee is paid at the expense of the employer, the remaining days until the restoration of working capacity or the establishment of disability - at the expense of the Social Insurance Fund. Insurance premiums are not charged on the benefit amount. The employer must accrue the money within 10 days from the date of presentation of the certificate of incapacity for work, and transfer it along with the payment of the next salary.

Exceptions

However, there are situations when contributions are still paid. Some organizations provide their employees with additional guarantees beyond those established by law.

These may include 100%

payment of sick leave to all employees, regardless of

length of service

.

For example, if an employee has short experience, which allows the law to receive benefits in the amount of only 60%

, the organization transfers compensation in full, paying the difference from its own funds.

Since such an additional payment is not a state benefit, insurance premiums are charged on it ( clause 1.1 of Article 420 of the Tax Code of the Russian Federation

).

Also covered by insurance premiums are benefits that cannot be credited to the Social Insurance Fund. This happens when:

- compensation was paid in violation of the law;

- there are errors that were made when filling out documents;

- There are no supporting documents ( Part 4, Article 4.7 of Law No. 255-FZ

).

The FSS does not recognize such payments, which means that insurance payments must also be transferred from them.

When to transfer income tax from sick leave

When to transfer personal income tax from sick leave in 2020? Before January 1, 2020, the deadlines for paying income tax on employee income were as follows:

- no later than the day of receipt of cash from the bank or transfer to the account of an individual;

- in other cases (for example, when paying income from proceeds) - no later than the day following the day of actual receipt of income.

By Law No. 113-FZ of May 2, 2020, this procedure was changed, and from January 1, 2020, personal income tax on sick leave and vacation pay must be transferred no later than the last day of the month in which such income was paid (Article 226 (6) of the Tax Code of the Russian Federation).

Don’t want to experience difficulties in maintaining accounting and tax records? Open a current account with Tinkoff Bank and get online accounting for free.

Certificate of incapacity for work and personal income tax

What about personal income tax - is income tax taken from sick leave or not in such situations? The ballot is issued

in two cases:

- due to illness, including illness of the employee’s relatives who need care;

- on maternity leave.

The reason for issuing the ballot determines who pays personal income tax on sick leave and in what situations. First, let's look at the first situation. Here, tax is withheld from the entire benefit amount ( Article 217 of Law No. 117-FZ

).

pilot project” has been implemented in some regions

» FSS, according to which the Fund independently transfers its part of the funds to the insured. In such cases, there will be two tax agents for one sick leave:

- enterprise paying for 3 days;

- FSS, which transfers benefits for the remaining days.

Each of them pays income tax independently on their payments.

Attention

!

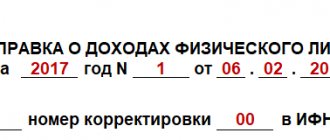

This point should be especially taken into account by persons who have tax deductions, for example property ones. 2-NDFL certificate

will not reflect information on Social Insurance Fund payments. Therefore, in order to return the tax paid by a government agency, you must contact the Fund branch for a certificate. An employee who uses his deduction from the employer when personal income tax is not withheld from wages will also have tax deducted from sick leave paid by the Social Insurance Fund.

Payments for sick leave can be considered the employee’s income; they are reflected in the corresponding certificate, in a separate code. Revenue code

sick leave in certificate 2-NDFL –

2300

.

Personal income tax on sick leave – pilot project

In some regions of the Russian Federation, there is a pilot project for employees to independently receive benefits directly from the Social Insurance Fund (list of participants in Government Decree No. 294 of April 21, 2011). In this situation, the enterprise is not involved in the calculations and should not charge personal income tax, since the formal tax agent is the territorial branch of the Social Insurance Fund, which actually pays the benefits. For employers, the functionality of settlements with staff and the budget is reduced: the obligation to pay sick leave for the first 3 days of illness remains mandatory. Then the sheet, along with income data, is transferred to Social Security.

Are payments on sick leave at the expense of the Social Insurance Fund for pregnancy and childbirth subject to personal income tax?

Taxation on maternity leave is regulated by the same article as on regular sick leave. The text of the law says the following:

«Not subject

The following types of income of individuals are subject to taxation (exempt from taxation):

- state benefits, with the exception of temporary disability benefits (including benefits for caring for a sick child), as well as other payments and compensation paid in accordance with current legislation. At the same time, benefits that are not subject to taxation include unemployment benefits, pregnancy and childbirth benefits.”

This means that maternity sick leave is not taxed. But personal income tax is charged on sick leave for child care.

Attention

! Employees registered under GPC agreements are not paid sick leave and, accordingly, are not subject to any payments, because the employer does not pay insurance premiums for them.

When personal income tax is not withheld from sick leave

Tax legislation also regulates the opposite situations, when sick leave is not subject to personal income tax. Specific categories of such periods of incapacity are contained in the stat. 217 NK:

- Maternity lump sums paid for pregnancy and childbirth.

- Children's monthly amounts paid until the child reaches 1.5 years of age.

- Cash compensation payments until the child reaches 3 years of age.

Is personal income tax withheld from sick leave for employees employed under GPA agreements? According to stat. 422 of the Tax Code of the Russian Federation, it is not required to pay the ESS from disability benefits; these are excluded amounts. In addition, sick leave is not calculated or paid under GPA agreements, which means there is no need to calculate personal income tax.

Deadlines for paying personal income tax on sick leave in 2020

The procedure for paying the benefit itself is established by Law No. 255-FZ

.

Compensation is accrued within 10 working days after the employee submits the ballot ( Article 15

).

Transfer of funds is made on the next day of salary payment ( Part 8, Article 13

).

The benefit tax is withheld at the time the money is transferred to the employee ( clause 4 of Article 226 of the Tax Code of the Russian Federation

).

Attention

! The employer takes on the tax payment function, because he is a tax agent. The employee himself does not need to list anything.

In the future, the withheld funds must be transferred to the regional budget. Information on how long it is necessary to pay personal income tax on sick leave is in the second paragraph of paragraph 6 of the same article of the Tax Code

:

“When paying a taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay, tax agents are required to transfer the amounts calculated

and

withheld

tax no later than the last day of the month in which such payments were made.”

If a “pilot project” has been introduced in the region in which the organization is located, then the procedure and deadline for transferring personal income tax from sick leave are somewhat different. The employer withholds tax and transfers it to the budget only from his part of the payments. The responsibility for paying tax on the rest of the benefit lies with the Social Insurance Fund; the organization does not need to worry about this.

Tax rate - 13%

.

However, since foreign workers (with the exception of HQS) have also been subject to compulsory social insurance since 2015, it will increase to 30%

for non-residents of the Russian Federation.

What is sick leave

A document recording the fact that an individual is not able to work due to deteriorating health is called a sick leave certificate. As a rule, such a document is issued by doctors of public hospitals or licensed private clinics to employees of various organizations who require it to be provided to the employer in order to receive financial compensation for treatment.

Attention ! A document indicating incapacity for work is issued to individuals not only in the event of illness, but also in the event of maternity leave, as well as in cases of forced absence from work due to caring for a sick relative.

How is it formalized?

Each doctor who has the authority to issue sick leave has a blank form of this document approved by law. Filling out this bank is the responsibility of the specialist, who must indicate the patient’s last name, first name, patronymic, date of birth, duration of his treatment, put a wet seal of the medical institution, his signature, and also enter some other data.

Since cases of issuing counterfeit documents of this kind have become more frequent on the territory of the Russian Federation, electronic sick leave certificates have been introduced since 2020. In 2020, a sheet confirming the absence of citizens’ ability to work, issued electronically, was given the status of a legal document.

After the employee has completely completed the course of treatment and taken sick leave, in order to receive the monetary compensation due to him, this document must be provided to the manager or employees of the accounting department. To determine the amount of payment, you need to multiply the employee’s average salary for one day by the period of time during which he was absent from the workplace.

What laws to follow

In order to find out general points regarding the issuance of sick leave, as well as to understand in what situations taxpayers need to pay income tax on benefits received and in which not, we advise you to familiarize yourself with Article 217, located in the Tax Code of Russia, which deals with profits not subject to personal income tax withdrawal. In addition, there is such a document as order of the Ministry of Health number 1345, in force since December 21, 2012, regulating the rules for issuing, filling out and extending sick leave.

As a general rule, benefits issued to temporarily disabled employees are subject to personal income tax, but not in all cases. In this regard, we propose to dwell on this topic in more detail.

Calculation example

The employee was sick for 5 days. The total income for the last two calendar years is RUB 548,650. Work experience - more than 20 years. The organization is located in Tatarstan, where a “pilot project” operates. Calculation algorithm:

- 548,650 / 730 = 751.58 rubles. — payment for one day of sick leave;

- 751.58 × 3 = 2,254.74 rubles. - amount paid by the employer;

- 2,254.74 × 13% = 293.12 rubles. — personal income tax, which is withheld by the organization;

- 751.58 × 2 = 1,503.16 - amount paid by the Social Insurance Fund;

- 1,503.16 × 13% = 195.41 - personal income tax, which is withheld by the Social Insurance Fund.

It turns out that the employee will receive compensation in the amount of 3,269.37 rubles for sick days. two payments: from the employer - 1,961.62 rubles. (2,254.74 - 293.12), from the Social Insurance Fund - 1,307.45 rubles. (1,503.16 - 195.41). The Employer and the Fund will pay taxes separately. The total amount will be 488.53 rubles.

Temporary disability benefits are considered employee income

, this confirms the inclusion of these payments in the certificate in form 2-NDFL.

Accordingly, it is taxed. The only exception is maternity leave

. The employer pays the tax; the employee himself does not take part in this process. No insurance premiums are transferred from the certificate of incapacity for work.

Rules for filling out lines in form 6-NDFL

The table below shows a clear example of how sick leave payment can be reflected in Form 6-NDFL. This report is prepared when income tax is collected on such payment.

Read also: Compensation for unused vacation in 2020

| Line | Action | Deadline | Norm of the Tax Code of the Russian Federation |

| 020 | Calculation of sick pay | Pay day | Art. 223 |

| 040 | Income tax calculation | clause 3 art. 226 | |

| 100 | Transferring money to an employee | Art. 223 | |

| 070, 110 | Withholding personal income tax | clause 4 art. 226 | |

| 120 | Transfer of tax payment to the budget | 28th, 30th or 31st day of the month in which sick leave is paid | clause 6 art. 226 |

Attention! If it coincides with a Saturday or other weekend, the transfer of personal income tax to the Federal Tax Service of the Russian Federation is postponed to the next specific working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Article 6.1 of the Tax Code of the Russian Federation “Procedure for calculating the deadlines established by the legislation on taxes and fees”

Filling out a report: example

Below is a clear example of how sick leave payments and the corresponding tax payment are reflected in Form 6-NDFL.

After recovery, worker Sidorov A.G. was issued a certificate of incapacity for work for the following period - July 13-26, 2020. Sidorov reported to work on July 27 and immediately gave this document to the accountant.

After making calculations for sick leave, on July 27, 2020, the employee was credited 24,500 rubles. This money was transferred to the employee’s salary card on the day the monthly salary was issued - August 7, 2017.

All of the above transactions were indicated in the 6-NDFL report for 9 months. 2017 They did it this way:

| Line | Meaning |

| 020 | 24 500 |

| 040 | 3 185 |

| 070 | 3 185 |

| 100 | 07.08.2017 |

| 110 | 07.08.2017 |

| 120 | 31.08.2017 |

| 130 | 24 500 |

| 140 | 3 185 |

Additional payment up to average monthly earnings

If, when transferring sick leave money to an employee’s salary card, an additional payment is made up to the average monthly earnings, then income tax is collected in the general manner (Articles 217, 226 of the Tax Code of the Russian Federation).

In this situation, personal income tax is withheld at a rate of 13%. Important! Supplement to average earnings is considered a legal procedure in which, if the employee’s salary level decreases, the employer pays him the required amount. As a result, the employee’s monthly income reaches a specific average value.

Payments for closed sick leave are calculated based on the average monthly salary of a worker for the last 2 years that precede the onset of illness (Part 1, Article 14 of Federal Law No. 255 of December 29, 2006). When calculating such a benefit, it is taken into account that the amount of wages for one year should not exceed the specific maximum amount of various insurance contributions to the Social Insurance Fund.

The provision of additional payment is indicated in the employment contract (agreement) with the employee or in a separate specific regulatory act.

Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

Taxation of sick leave for caring for a disabled child

Often, an employee is paid for a certificate of incapacity for work, which is opened in connection with caring for one or more disabled children. However, many parents do not know whether closed sick leave is subject to personal income tax.

Read also: Filling out a waybill

In Art. 217 of the Tax Code of the Russian Federation reflects a list of payments that are not subject to personal income tax. Sick leave issued when caring for one or more disabled children is not on this list. Accordingly, payments for such certificates of incapacity for work are also subject to taxation.