What are the distinctive features of an online cash register receipt?

With the entry into force of amendments to Law No. 54-FZ, according to which organizations and individual entrepreneurs became obliged to use online cash registers, new technical standards emerged that define the properties of cash register receipts. According to Law No. 54-FZ in its current edition, these checks are:

- ordinary paper ones (which are issued to the buyer in all cases - with the exception of purchases in an online store when paying on the website);

- electronic (which are sent to the buyer by phone or e-mail upon request, and in the case of selling goods online - mandatory).

Please note that these are the most general rules for issuing paper and electronic checks. In practice, they can be much more complicated: the procedure for circulation of checks depends on the content of trade legal relations in each specific case.

It is very important not only to issue the buyer a check in the required form in the required cases, but also to ensure that all required details are present on the cash receipt (both paper and electronic).

Let's consider what are the rules for determining the composition of such information.

What are cross, bearer and order checks?

In turn, the types of bank checks can be divided into crossed, bearer and order. A crossed security is translated as crossed out. It may contain a slash (one or two) or an inscription. However, there are also cases when a line and an inscription are used simultaneously. Both drawers and recipients can perform this crossing.

Crossing can be special or general. In the first case, such securities indicate the name of the financial institution responsible for issuing the book. This means that the bank that was specified during crossing is engaged in cashing or paying for such a check. In the second case, the name of the credit institution is also mentioned, but a new mark is additionally introduced - “bank”. However, these types of settlement checks are not cashable. The amount indicated on them can only be transferred to the recipient’s account. Of course, they can then be exchanged for domestic currency, but this will take time.

What mandatory details should an online cash register receipt contain starting from 2020?

IMPORTANT: Order of the Federal Tax Service of Russia dated September 14, 2020 No. ED-7-20/ [email protected] (LINK) makes changes to additional details and formats of fiscal documents. At the same time, the document cancels the effect of Order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/ [email protected]

There are two main regulations that establish lists of mandatory cash receipt details. In many ways, they duplicate each other, but the norms they contain do not compete with each other and, moreover, do not completely coincide. And therefore, having studied one normative act, one should consider the provisions of the second. We are talking about such sources of norms as:

- Law No. 54-FZ (LINK);

- Order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/ [email protected] (LINK).

It may be noted that Law No. 54-FZ establishes general requirements for the mandatory details of a cash receipt, and the specified departmental order determines the procedure for their reflection in the check in practice in accordance with the current formats of fiscal documents.

In accordance with the Decree of the Government of the Russian Federation dated April 16, 2020 No. 521 (), from April 20, 2020, cash register receipts (CSR) must contain one more mandatory detail - “product code”.

The new additional detail “product code” is used when selling goods that relate to personal protective equipment:

- face masks;

- surgical respirators;

- general purpose respirators;

- nasal and other sprays designed to protect against air pollution; various types of gloves, including examination and surgical;

- hygiene overalls;

- sets of hygienic clothing.

The required details of a cash receipt are listed in paragraph 1 of Article 4.7 of Law No. 54-FZ:

It should be borne in mind that the specified mandatory details are the same for both paper and electronic checks.

In turn, the procedure for their application according to Order No. ММВ-7-20/ [email protected] depends specifically on the type of cash receipts (and on many other factors). More on this later.

General concept of checks and books

How wonderful it is to watch on TV when a wealthy foreign citizen pays for a hotel room or other services with a check from a beautiful book. Another thing is that few people know about this concept. In particular, many are confused by the details of the registration of this operation. For our part, we will try to shed light.

So, let's take a closer look at the concept, types of checks and general characteristics of this payment system. The check form involves the use of certain securities at the disposal of the payer.

Moreover, all checks are stored in a special book. With its help, the check holder can make a payment in favor of the check recipient for the amount specified in it. It is noteworthy that only the financial organization in which the drawer previously opened an account can act as the sender’s bank. It is from him that funds will be debited in the future, but exactly for the amount indicated on the check.

What details of a cash receipt are established by the format of fiscal documents

The specified regulatory act establishing FFD and the procedure for their application (one of the aspects of which is the regulation of the reflection of details on a cash receipt) is huge in volume and very complex in structure. It is intended more for technical specialists responsible for setting up and ensuring the functionality of online cash registers than for ordinary cash register users. At the same time, it will be useful to become familiar with the key principles for reading and applying those rules that are defined in the formats of fiscal documents.

Additional information about fiscal document formats can be found in THIS ARTICLE.

If we are faced with the task of determining what details should be on the cash receipt of our enterprise, then we will need to have on hand:

1. Table 3 in Appendix No. 2 to Order No. MMV-7-20/ [email protected].

It contains the rules for the key attribute of the FDF - it sounds like “Mandatory.” That is, an attribute that determines whether it is necessary to include one or another requisite provided by the FFD in the composition of a cash receipt of one type or another.

The rules reflected in Table 3 operate in relation to a specific version of the FDF. There are 3 such versions installed, and in each of them the rules for using the “Mandatory” attribute are installed. can be very different.

So, if the online cash register is configured to generate receipts according to FFD 1.0 (this format will be used until the end of 2020), then the dependencies will be as follows:

- if the attribute is "Required" according to FFD is equal to 1, then the details must be included in the cash receipt;

- if the attribute is equal to 2, include only in cases reflected in the notes to the corresponding attribute;

- if the attribute is 3 or 5, it is recommended to enable it;

- if the attribute is 4 or 6, it is recommended to include it in the cases reflected in the notes;

- if the attribute is equal to 7, you don’t have to include the details in the check.

For comparison, in the case of using FFD 1.05 (the format does not yet have restrictions on the period of application), the rules will be as follows:

- if the attribute is 1 or 3, the details must be included in the check;

- if the attribute is equal to 2 or 4, the attribute must be included if provided for in the notes;

- if the attribute is equal to 5, it is recommended to include the details in the check;

- if the attribute is equal to 6, it is recommended to include the attribute in the check if it is provided for in the notes;

- if the attribute is equal to 7, the attribute may not be included in the check.

2. Table 19 of Appendix No. 2.

Table 19 contains a complete theoretical list of cash receipt details (column “Name of details”). Of these, you need to select those that must be recorded on the check. For these purposes, the table shows specific values for the “Mandatory” attribute. in relation, in fact, to the details of a cash receipt.

The table also has a noteworthy “Form” column, which reflects the specific format of the check - printed (shown by the letter P) and electronic (shown by the letter E), for which the rules for displaying details apply. If in the "Form" column If a combination of PE is indicated, this means that the rules apply to both types of checks simultaneously.

At the same time, in some cases, letters indicating the type of check are included in the “Obligatory” column. and show the obligation to use the details only for a certain type of check - printed or electronic.

From July 1, 2020, when making payments between organizations and (or) individual entrepreneurs, payment for which was made in cash or by card, a cash receipt must be generated containing the mandatory details “buyer (client)” (tag 1227) and “TIN of the buyer (client)” (tag 1228). Read more about this in THIS ARTICLE.

The remaining columns of Table 19, in principle, are not interesting to us - they are already for technical specialists.

Having at our disposal Tables 3 and 19 of Appendix No. 2, we can easily determine whether it is necessary to include this or that detail in a cash receipt - paper or electronic, at our enterprise.

For example, we are interested in whether it is necessary to include the cashier’s TIN in the cash receipt (it is included in the list of theoretical details in the column “Name of details” in Table 19). What to do?

First of all, we need to find out which FFD the online cash register uses. It’s better to ask technical specialists about this - usually solving the issue takes minutes. Let's agree that our cash registers operate on FFD 1.05.

Next, look at the attribute value in the “Required” column. opposite the “Cashier INN” detail in table 19. We see that it has a value of 7 - and this means (in accordance with table 3 - if we talk about FFD 1.05) that indicating the corresponding details in the check is not necessary, but is possible at the request of the owner online - cash desks.

In addition, in table 19 we look at the adjacent column “Form.” and we see the letter E there, and this means that the rules are established only for an electronic check. There is no need to include the “Cashier INN” details in the printed receipt.

Let’s take some “obvious” detail - let it be “Settlement Amount”. Attribute "Mandatory" for this attribute has a value of 1, which means the attribute is required according to FFD 1.05. In the "Form" column PE is indicated, and this means that the rule is established for both printed and electronic checks.

In Table 19 there is a notable detail “Additional check details”. Attribute "Mandatory" it has a value of 7 (that is, it can be applied or not applied at the discretion of the user), the rule is applicable to both printed and electronic checks. This detail officially gives the user of the online cash register the opportunity to include certain additional information in the check.

They could be, for example:

- store website address;

- advertising message;

- personal greeting to the buyer.

A small nuance: the maximum length of the props in question, in accordance with the formats, is 16 characters. If more space is needed for the required message, then it makes sense for the store to place information “outside the details” on the cash register receipt - that is, simply by printing it in the free space. This is possible based on the norm contained in paragraph 7 of Article 4.1 of Law No. 54-FZ. It says that the check can be supplemented with other details not provided for by federal law, taking into account the specifics of the trade enterprise’s field of activity.

Information “outside the details” can, in principle, be anything. This may not necessarily be text - it is quite possible to place, for example, a store logo or more detailed information about a promotion. It is important that the “mandatory” details are clearly visible on the check.

It is important not to confuse the concept of “Additional details” in the context of Table 19 (and paragraph 7 of Article 4.7 of Law No. 54-FZ) and the term “Additional details of fiscal documents” given in Appendix No. 1 to Order No. MMV-7-20 / [email protected ] In this case, we are talking about the mandatory details of those fiscal documents that are generated at the online cash register along with regular cash receipts - for example, these could be correction checks, reports on the opening and closing of a shift.

By the way, it is also important to comply with the FFD requirements established for such documents. Lists of details for specific types of FFD can also be determined in a “tabular way” (for example, details for a correction check are given in Table 30 of Appendix No. 2 to the order) - by analogy with the rules we discussed above in relation to determining the list of details for a regular check.

In cases provided for by law, an enterprise has the right to use details in a shortened list - let’s take a closer look at such cases.

What is a sales receipt?

In addition to the above, there are other types of sales receipts. In particular, these include paper media that private entrepreneurs use for reporting. In this case, we mean a sales receipt form, which is an excellent addition to the previously received cash document (receipt). Usually it does not belong to standard strict reporting forms because it performs an auxiliary function. However, it contains the following information:

- name and type of document;

- contact details of the entrepreneur;

- TIN;

- dates of receipt;

- form number;

- a complete list of goods and services;

- sum;

- signature and full details of the responsible person issuing the check.

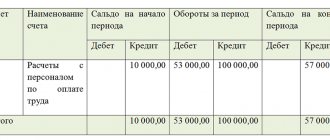

It is noteworthy that such a document records information about each of the purchased goods and services (taking into account its cost and weight). For greater convenience, various types of transactions with checks are recorded in the appropriate accounting notebook or cash book.

Requirements

Since a cash receipt is a type of payment document, it must meet certain requirements. These requirements determine the mandatory details on the online cash register receipt sample, as well as some conditions for its execution.

Information for the formation of a fiscal document comes from various sources. Some details come from the CCP software. Some of the details are supplied by the goods accounting system connected to other devices. The remaining part of the details comes directly from the online cash register: what was programmed when setting it up before starting work.