What are primary accounting documents

Primary accounting documents are mandatory forms that reflect the business activities of the company. They are carriers of primary accounting information and can be generated both within the company and received from third parties: suppliers, contractors, buyers and others. The list of forms is given in Federal Law 402-FZ “On Accounting”.

Capturing data

How long do you need to keep a primary employee in a company? The law requires the storage of primary accounting documents for five years, starting from the year following the reporting year. When checking a company or its counterparties, the tax office may request any necessary papers for this period. In this case, a register of seized papers must be compiled. In case of failure to provide, according to Article 120 of the Tax Code of the Russian Federation, a fine in the amount of 10,000 to 30,000 rubles may be imposed on the organization.* In addition, in the absence of a document confirming the company’s expenses, the tax inspectorate will oblige to recalculate the total amount of tax and pay the difference to the budget .

Primary documentation in the accounting department is compiled in accordance with the current legislation of the Russian Federation. Failure to do so is also subject to a fine. According to Article 15.11 of the Code of Administrative Offenses of the Russian Federation, a fine in the amount of 2,000 to 3,000 rubles is issued to the person responsible.*

Primary documents are available in both paper and electronic form, because more and more organizations are switching to using EDI. If the primary document is provided electronically, then it must be certified with an electronic digital signature.

Additional Information! The need for a primary document may arise in the event of litigation or disputes with counterparties, where they can serve as supporting documents.

Storage

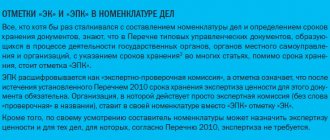

Storage periods for organizational and individual documents

Typically, the storage of documents is carried out by an accountant, human resources specialist, lawyer, and secretary. It’s good when there are several employees, and you can entrust one of them with maintaining and storing all this documentation.

And yet, even if the business is small, and the owner does not have time to devote a lot of time to this issue, it is necessary to think about the safety of documents. Here are the storage periods for the main groups of organizational and individual documents (see the List for the full list):

| DOCUMENTATION | STORAGE LIFE |

| Registration documents | constantly |

| Licenses and certificates of conformity | constantly |

| Annual financial statements | constantly |

| Accounting quarterly reporting | 5 years |

| Monthly accounting reports | 1 year |

| Accounting registers, working chart of accounts, accounting policies, correspondence on accounting issues | 5 years |

| Primary accounting documents, books and journals | 5 years |

| Accounting and tax accounting data for the calculation and payment of taxes, documents confirming income and expenses, as well as payment (withholding) of taxes | 4 years |

| Tax returns | 5 years |

| KUDiR for simplified tax system | constantly |

| Annual pay slips to the Social Insurance Fund | constantly |

| Quarterly payslips in the Social Insurance Fund | 5 years |

| Declarations and calculations for insurance contributions for pension insurance | 5 years |

| Agreements and documents related to them (except for leasing and collateral) | 5 years |

| Documents related to CCP | 5 years |

| Occupational safety documents | 5 years |

| Employment contracts | 75 years old |

| Personal files of the organization's leaders | constantly |

| Personal files of employees | 75 years old |

| Personal cards of employees | 75 years old |

| Documents of persons not hired (forms, applications, resumes) | 3 years |

| Original personal documents of employees (work books, diplomas, certificates) | on demand, and unclaimed - 75 years |

| Books, magazines, personnel records cards | 75 years old |

Why are primary accounting documents needed?

Every day the company carries out up to a hundred different operations: new contracts are concluded with customers, supplier bills are paid, money is issued to accountable persons, furniture and equipment are received, and so on. Primary accounting documents are used to reflect each transaction. They are compiled during a business transaction and serve as confirmation of the transaction.

Based on them, the company's accountant draws up entries; they serve to determine the tax base. The supplier is mainly responsible for the design. The buyer should closely monitor the correctness of preparation, since he will have to show them as his expenses and take them into account when calculating taxes.

List of documents

Primary documentation in the accounting department contains the following list, confirmed by the State Statistics Committee of the Russian Federation for 2020:

- Packing list. Contains a list of transferred inventory items. It is drawn up in two copies: one remains for the supplier, the second goes to the buyer. Both copies must contain the signatures of both parties and be certified by seals, if this is specified in the accounting policies of the organizations.

- Record of acceptance. Must be drawn up on the basis of work performed or services provided in two copies. Signed by both parties. It is confirmation of the fulfillment of obligations by the parties under the agreement in full.

- Payroll statements. Used to calculate payroll with company employees.

- Documents confirming transactions with fixed assets of the organization. This could be an Acceptance and Transfer Certificate of OS in the form OS-1, Write-off of an object in the form OS-4, Inventory list INV-1.

- Cash documents. Register the receipt and disbursement of funds from the organization's cash desk.

- Payment order. Confirms the transfer of funds to the supplier's bank account to pay off the debt.

- Advance report. Serves as confirmation of the expenditure of funds.

- The act of offsetting mutual claims. A document drawn up on the basis of termination of obligations under an agreement between organizations, drawn up to pay off mutual homogeneous claims.

- Accounting information. It includes transactions that are subject to additional reflection in accounting.

TORG-12

Accounting documents are drawn up by employees of the organization's accounting service for the purpose of preparing, ensuring, reducing and organizing accounting records, as well as for the purpose of preparing executive (exculpatory) and administrative documents for reflection in accounting. Such documents include payroll statements, depreciation statements, accounting statements, accounting calculations, accrual statements, etc. [p.148] Accounting documents are drawn up on the basis of administrative or source documents to systematize accounting records and determine the correspondence of accounts. They are attached to administrative or supporting documents and have no independent significance. Accounting documents are used separately in the case when the accountant draws up certificates and calculations based on [p.441]

| Rice. 16.8.Internal accounting document |

A comment.

Some facts of economic life related to the implementation of methodological calculations are determined by the accountant himself and it can be assumed that in this case a document is not needed to complete them. However, it is not. To comply with the principle of registration and the requirements of the law of sufficient cause, it is necessary to draw up an accounting document. All such documents must have the signature of the chief accountant. [p.180] Sometimes, instead of the term executive documents, the term supporting documents is used. This is a big mistake, because administrative documents and accounting documents are equally exculpatory documents. By the way, the first classification of primary supporting documents in our literature was given by E. E. Sivere. He identified four groups of documents: 1) mandatory decrees of government and public institutions, 2) orders of the owner, 3) mutual agreements between the owner and outside farms, 4) information about transactions that have actually already taken place [Sivere, p. 142]. [p.195]

Accounting documents do not have an independent purpose. Their role, on the basis of the submitted administrative and supporting documents, is to prepare in the future the appropriate records for processing for the purpose of further use in the accounting process. Therefore, they are compiled and used only in accounting. Thus, the statement of distribution of overhead costs serves to distribute the costs of managing the structural divisions of the enterprise between the individual types of products they produce. Various certificates and calculations drawn up in the accounting department serve as the basis for recording the amounts calculated to reimburse obligations to the budget, extra-budgetary funds, etc. [p.109]

Accounting documents are drawn up by accounting employees in cases where there are no other documents to record a business transaction, or for the purpose of preparing administrative and corroborative documents for reflection in accounting. For example, statements of distribution of general production and general business expenses, statements of accrual and distribution of depreciation charges, accumulative statements, calculations of actual production costs, calculations of deviations from standard costs, various types of certificates and calculations prepared by accounting, etc. [p.146]

According to their purpose, documents are divided into administrative, exculpatory (executive), combined and accounting documents. [p.137]

Accounting documents are compiled and used for accounting needs. These documents specify or explain the reflection in accounting of certain facts of economic activity or their consequences (certificates of errors found in accounting records, calculation of realized trade markups, etc.). [p.137]

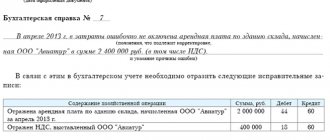

When correcting errors using additional posting and red reversal methods, the accountant draws up certificates in which, with reference to the primary document, he indicates when and what erroneous entry was made. Such certificates represent accounting documents and are the basis for correcting errors. [p.167]

The essence of the memorial order form of accounting is that, on the basis of primary documents reflecting business transactions, memorial orders are drawn up - accounting documents. These documents represent an instruction, signed by the chief accountant, on which synthetic and analytical accounts should be used to record the business transaction set out in the document on the basis of which the memorial order was drawn up. [p.170]

Accounting documents are compiled solely for methodological purposes on the basis of documents of the first three types. Such a document could be a certificate, a calculation of the amount of any tax, etc. [p.336]

Note that accounting documents can either precede or follow the FCD, but at the same time they do not express anyone’s will and do not justify anyone’s actions. [p.337]

In the first case, an order acts as an administrative document, in the second - a statement or order, and the order is an accounting document. But in both cases, the order also acts as an exculpatory document, since it is used to justify the cashier when dispensing cash from the cash register. [p.337]

So, when paying wages on the basis of pay slips, after the payment has taken place, a general expense order is issued. In general, most accounting documents are issued on the basis of primary documents that have already been recorded, one or a number of them. [p.342]

Specialized documents are designed to automatically generate entries for routine accounting operations. The prototype of these documents are accounting documents, widely used in manual technology, transcript sheets, accounting certificates and calculations, etc. With the help of specialized documents, you can accurately and quickly perform very complex and time-consuming calculations and generate all the necessary entries in the information base based on them. They allow you to solve the problems of generating entries when accruing depreciation of fixed assets and intangible assets, revaluing the ruble coverage of foreign currency balances on accounts and objects of analytical accounting, and generating financial results at the end of the month. Thus, in the 1C Accounting system, to perform the listed tasks, specialized documents such as [p.132] are used

Accounting documents include those compiled by accounting employees on the basis of administrative and supporting documents (for example, registers, cards, accumulative statements, etc.). [p.51]

Accounting documents [p.40]

Accounting documents are filled out by an accountant to justify entries, not [p.40]

What are accounting documents [p.50]

Accounting documents do not contain facts confirming the completion of business transactions. They are compiled by an accountant to prepare information for the purpose of reflecting it in accounting registers. [p.156]

Accounting documents are used for [p.168]

The memorial warrant form arose in our country in the 30s. It got its name from the accounting register - memorial order. Memorial orders are accounting documents that indicate transactions for business transactions. Each memorial order is assigned a permanent number, which allows you to create only one order per month for each group of similar transactions. The documents on the basis of which entries are made in the memorial order are filed with it. [p.174]

A memorial order is an accounting document containing instructions to record a business transaction on the appropriate accounting accounts. [p.22]

According to their purpose, documents are divided into administrative documents (power of attorney to receive inventory, a check to receive cash from a current account), supporting documents (receipts, invoices, payment requests, etc.) accounting documents (accumulative statements, all kinds of certificates and calculations compiled by the accounting department, etc.) combined (receipt and expense cash orders, payroll statements, etc.). [p.38]

ACCOUNTING DOCUMENTS - written evidence of business transactions or the right to carry them out, necessary for maintaining accounting records. They are the only basis for accounting records. According to their purpose, accounting records are divided into administrative documents - containing orders to carry out operations; justifying documents - accounting documents that have already been completed - compiled according to current accounting data (cost distribution sheets, reporting calculations, etc.) combined - including various features the above types of documents. According to the order of compilation, a distinction is made between primary financial statements, which directly document business transactions, and consolidated financial statements, which are compiled on the basis of primary financial statements. They are drawn up in accordance with the requirements of the Regulations on documents and records in the accounting of enterprises and business organizations, approved by the NKF of the USSR on January 25. 1946 All document details must be filled out. The content and forms of data security depend on the nature of the operations being documented. To register homogeneous transactions at various enterprises, unified standard forms of financial statements have been developed (for example, cash orders, invoices, advance reports, etc.). Simplification and reduction of primary documentation is one of the means of saving material and labor costs in the national economy. [p.161]

Accounting documents are drawn up when there are no standard documents for recording business transactions, or when summarizing and processing source documents and administrative documents. These include certificates, distribution sheets, etc. [p.95]

The memorial order form of accounting received its name from the accounting document - the memorial order. With it, analytical accounting is kept in books, on cards and in other accumulative registers. With this form, there is such a sequence of recording transactions in accounting registers based on primary data (from primary documents or accumulative statements) that constitute memorial orders. The latter are recorded in a chronological journal, where each order receives a serial number. From the orders, entries are made into synthetic accounts opened in the general ledger (sometimes in the checklist). Then, based on the specified primary data, entries are made in analytical accounting. At the end of the month, turnover sheets are drawn up, the final data of which is compared with the turnover and balances of the corresponding synthetic accounts. [p.30]

Cash issuance is carried out according to cash receipts orders signed by the manager and chief accountant. The warrant specifies the purpose of the extradition and its basis. Cash orders are unified documents, combined in content, since the order combines administrative, executive and accounting documents (corresponding accounts are indicated). [p.322]

Enter in the table. 3.1 type of primary document organizational and administrative (OR) supporting (O) accounting document (BO). [p.50]

Select from the documents below the primary accounting document, invoice [p.63]

Accounting documents are intended to justify entries that do not have other documentary evidence (accounting department certificate for reversing an erroneously made entry, statement of distribution of general business expenses, etc.). [p.94]

An accounting document is drawn up for it. In the journal-order form of accounting, this role is played by an accounting certificate. With the memorial order form of accounting, a memorial order is drawn up for additional entries. This method is used when the error is repeated in several accounting registers or is detected after calculating the totals. [p.149]

Secondary are accounting documents drawn up by employees of the accounting apparatus on the basis of primary documents, for example, a payroll for the payment of wages, which is compiled on the basis of time sheets, orders and other primary documents. [p.577]

ORDER - the name of a series of accounting documents. O. certain supporting documents are called, for example. documents used to register the receipt of materials (receipts), cash flows (cash receipts and expenditures) and certain accounting documents, for example, memorial records, journals. [p.128]

Combined documents contain features of several documents (for example, an expense cash order is simultaneously an administrative, an executive, and an accounting document). These include an advance report of the accountable person, a bill of lading, a requirement to receive materials, and a payment request. Combined documents play a positive role, since, by combining the characteristics of a number of documents, they reduce their total number, simplifying the work of the accounting apparatus. [p.45]

The memorial-order form of accounting has long occupied a predominant place in accounting. Let's consider its contents. With this form, on the basis of individual primary documents verified by the accounting department, and most often a group of homogeneous documents (in the order of their accumulation, groupings, summaries), a special memorial order is drawn up - an accounting document in which accounting records (entries) are indicated for the transactions reflected in this document or group of documents. Here is his form [p.53]

According to their purpose, accounting documents are divided into supporting (executive) and accounting documents. [p.94]

A document drawn up by the accounting department of an enterprise on the basis of calculations, calculations, etc. is called an accounting document. [p.95]

Combined documents combine the features of the documents discussed above. For example, after the manager approves the spent accountable amounts, the advance report acquires the force of an order for the accountant to take into account the specified amount, confirmed by supporting primary documents (accommodation receipts, travel tickets, etc.). The indication in the advance report of accounting entries for writing off this amount gives grounds to consider it as an accounting document. [p.109]

Accounting documents are documents with the help of which operations are recorded that were previously reflected in original primary documents, for example, accounting certificates on distributed profits, depreciation calculations, consolidated grouped statements, order journals, machine diagrams, etc. [p.88]

Accounting documents include grouping and distribution sheets, memorial orders, accounting certificates and other documents, which, as a rule, are compiled by accountants for the preparation of accounting records. For example, a grouping list of materials is compiled separately by receipt and expense according to document data grouped for each warehouse and balance sheet account separately, a sheet of distribution of shop expenses of industrial [p.577]

Accounting documents are usually created by the accounting department to simplify and speed up the accounting process, prepare accounting records, for example, a depreciation sheet, calculation of natural loss, various grouping and distribution sheets (for materials, wages), calculation of the amount of claims to the supplier, various accounting certificates (for account closure, error correction). These documents do not have independent significance, since they are compiled on the basis of other documents. However, their data is used for the corresponding accounting entries. [p.45]

After the transaction has been completed and completed, the documents are sent to the accounting department within the established time frame. Here they are checked and if inaccuracies are identified, they are returned. Correctly executed documents are subject to further verification in terms of the substance and legality of transactions, the presence of details, the absence of blots, as well as the accuracy of arithmetic calculations. After this, they enter accounting processing. They are first taxed (quantities are multiplied by prices), then grouped according to certain characteristics and grouping and summary statements are compiled. Next, based on the data received, accounting entries are made in special accounting registers. In some cases, entries are made on a document; sometimes an accounting document is drawn up - a memorial order (see p. 53). [p.47]

Content

Following paragraph 4 of Art. 9 of Law No. 402-FZ, enterprises can use both standardized forms and their own, developed for their specific needs. For example, there is no regulated form of the Materials Write-off Act, so companies are forced to develop their own options. In order for primary accounting documents to have legal force, they must necessarily contain the following details:

- Document's name.

- Date of preparation.

- The name of the organization that compiled the document.

- Name of the business transaction.

- Units of measurement such as weight, volume, quantity, monetary characteristics.

- Positions of persons responsible for drawing up and signing the document.

- Mandatory signatures of the two parties involved in the transaction.

For your information! Until 2020, seals of organizations were mandatory on documents, but according to Federal Law dated April 6, 2015 No. 82-FZ, for many enterprises having a seal has become optional. If the organization does not use a seal, this information must be recorded in the charter. The counterparty should be notified of this and provided with an extract from the accounting policy.

Act

Rules for filling out primary documentation

The rules for filling out primary documentation are established by law. All taxpayers must adhere to them. In addition to the fact that it is necessary to reflect all the information related to the information being committed, it must be done correctly. In particular:

- The document should not contain errors, blots, or strikethroughs. If an enterprise maintains electronic document management, there should be no typos;

- If filling is done by hand, you can use a pen with any color of paste - black or blue. But you need to make sure that there are no blots or smudges;

- “primary” is drawn up if an agreement has already been reached between the counterparties regarding a specific transaction. Otherwise, the document will have to be cancelled;

- All quantitative expressions of a business transaction must be written down in words. This also applies correctly to monetary terms;

- If there is not enough information to fill out the “primary form”, you need to put a dash. There should be no blank lines in the document.

Note! For incorrect completion of documentation, an administrative fine may be imposed on the company. The person responsible will also be punished.

The rules for filling out primary accounting documentation are established by law

Design rules

According to the Decree of the State Statistics Committee of the Russian Federation dated March 24, 1999 No. 20, primary documents in the accounting department can be combined. The organization has the right to take the regulated form as a basis and add the necessary lines to it.

All forms of primary accounting used in the daily activities of the company must be approved by its accounting policies. If the counterparty with whom the company cooperates also uses forms of its own design in its work, then this must also be indicated in the accounting policy.

Important! By law, an organization can use any form of primary documentation, but according to information from the Ministry of Finance of the Russian Federation No. PZ-10/2012, strict reporting cash forms must only have a unified form.

Receipt cash order

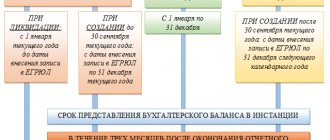

Registration documents of organizations and individual entrepreneurs

Let's start with the documents with which, in fact, the life of a legal entity begins or the acquisition of individual entrepreneur status by an individual. The list of registration documents for an organization is noticeably larger than for an individual entrepreneur:

- Charter of a limited liability company. To date, this is the only constituent document for an LLC. If changes have been made to the charter, it is advisable to store its previous editions with the note “invalid due to the adoption of a new edition of the charter dated ___.”

- Minutes of the general meeting of founders or the decision of the sole participant to create an LLC. Everything is clear here - this document is an expression of the will of the founders to create a legal entity.

- List of LLC participants. The list must contain current information about each participant (passport data of an individual or organization data), the size and value of each participant’s share, information about its payment. If there are shares owned by the company itself, then information about them is also indicated.

- Certificate of state registration of a legal entity or individual entrepreneur (issued until 2020).

- Certificate of registration with the tax authority (for individual entrepreneurs and LLCs).

- Entry sheet in the Unified State Register of Legal Entities (for LLC) or in the Unified State Register of Individual Entrepreneurs (for individual entrepreneurs). As for extracts from the Unified State Register of Legal Entities (USRIP), there is no need to store them. Usually a bank, notary, counterparties, etc. They request an extract that is no more than a month old, so if necessary, you need to get it again each time.

- Letter with information about statistics codes (for individual entrepreneurs and LLCs). You can obtain this information without contacting the statistical authorities personally, but through a form on the official website of Rosstat. You can find your statistics codes with our help. Just print a page from the site with your codes. Banks also accept such a document, but if you wish, you can also receive an official document with the seal of regional statistical authorities.