Who should pay for negative environmental impacts?

Legal entities and individual entrepreneurs operating on the territory of the Russian Federation, the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation must pay for the negative impact on the environment:

emissions of pollutants into the atmospheric air from stationary sources (hereinafter referred to as emissions of pollutants);

discharges of pollutants into water bodies (hereinafter referred to as discharges of pollutants);

storage, burial of production and consumption waste (waste disposal).

Part 1 of Article 16 of the Federal Law “On Environmental Protection”

Exception: Objects of negative impact on the environment of category 4 (Part 1 of Article 16.1 of the Federal Law “On Environmental Protection”).

Moreover, if a legal entity or individual entrepreneur simultaneously has objects of category IV and objects belonging to other categories defined by law (I, II, III), payment for the negative impact on the environment is calculated and paid for all objects, including objects of IV categories.

<Letter> of Rosprirodnadzor dated January 11, 2019 N AA-06-02-31/370 “On payment for environmental assessment”*

If you generate waste from the MSW group, then in this case your enterprise is not a payer of fees for negative impact on the environment. In this case, the payer is the regional MSW management operator, MSW management operators carrying out disposal activities (Article 16.1 of the Federal Law “On Environmental Protection”).

Where and how to pay advances for NVOS

Regarding the place of payment, the pollution fee is linked as follows (Clause 1, Article 16.4 of Law No. 7-FZ):

- for emissions and discharges it is paid to the budget at the location of the source of pollution;

- for disposed waste it is paid where the waste is disposed of.

That is, OKTMO for payment carried out for different types of polluting objects may turn out to be different. And this must be taken into account not only when drawing up the declaration, but also when making advance payments.

Depending on the type of pollution source, the values of the BCC indicated in the payment document will also differ.

For information on the BCC values used for payments for new environmental impact materials, see the article “BCC for negative environmental impact.”

How is the fee for negative environmental impact calculated?

Payment for negative impact on the environment is calculated based on the actual amount of emitted pollutants, discharged pollutants, disposed waste (Article 16.2 of the Federal Law “On Environmental Protection”) for the reporting period.

- Emissions of pollutants are taken into account for each operated source during the reporting period, according to the emissions logbook.

- Discharges of pollutants - according to the wastewater quality logbook. I would like to draw your attention to the fact that if the discharge occurs into centralized wastewater systems, then the payment is made by the organization receiving the wastewater from your enterprise. And you are already paying this organization its expenses.

- Placed waste - according to the waste logbook. Payment is not made for waste accumulated at the enterprise, for waste transferred for recycling or neutralization.

When calculating the negative impact fee, you must take into account the available permitting documentation:

- within the limits of emissions, discharges and above;

- within the limits of temporarily permitted emissions, discharges and above;

- within the limits for the disposal of production and consumption waste and above.

Excessive environmental pollution

Above-limit environmental pollution is a familiar term in everyday life, meaning exceeding standards and limits.

Permits for the emission of pollutants into the atmospheric air, limits for the emissions of pollutants, permits for the discharge of pollutants into the environment, limits for the discharge of pollutants, waste generation standards and limits for their disposal (hereinafter referred to as permits and documents) obtained by legal entities and individual entrepreneurs carrying out economic and (or) other activities at facilities that have a negative impact on the environment and are classified, in accordance with the Federal Law of January 10, 2002 N 7-FZ “On Environmental Protection,” as objects of categories I and II, up to January 1, 2020, are valid until the day of expiration of such permits and documents or until the day of receipt of a comprehensive environmental permit or submission of an environmental impact statement during the validity period of such permits and documents.

Article 11 of the Federal Law of July 21, 2014 N 219-FZ “On Amendments to the Federal Law “On Environmental Protection” and Certain Legislative Acts of the Russian Federation”

In essence, this provision of the law, after receiving a comprehensive environmental permit or declaration of environmental impact for ENVOS categories 1, 2, these documents are permits.

At facilities of categories I and II, until comprehensive environmental permits are obtained and an environmental impact declaration is submitted, temporarily permitted emissions/discharges are recognized as limits on emissions/discharges

Article 11 of the Federal Law of July 21, 2014 N 219-FZ “On Amendments to the Federal Law “On Environmental Protection” and Certain Legislative Acts of the Russian Federation”

Explanations for ENVOS category 3 - what I found:

With regard to emissions of pollutants, with the exception of radioactive ones, for objects of category III in accordance with Article 22 of the Federal Law of January 10, 2002 N 7-FZ “On Environmental Protection”, it is necessary to calculate the standards of permissible emissions for highly toxic substances, substances that are carcinogenic, mutagenic properties (substances of hazard class I, II). If it is impossible to comply with the standards for permissible emissions of such substances, an environmental protection action plan is developed and temporarily permitted emissions are established (Article 23.1 of Law No. 7-FZ).

Letter of the Ministry of Natural Resources of Russia dated September 20, 2019 N 12-47/22755 “On the implementation of industrial environmental control in the field of atmospheric air protection”

When calculating fees for the negative impact on the environment by legal entities and individual entrepreneurs carrying out economic and (or) other activities at category III facilities , the volume or mass of emissions of pollutants, discharges of pollutants, indicated in the report on the organization and on the results of the implementation of industrial environmental control are recognized as being carried out within the limits of permissible emissions standards, permissible discharge standards, with the exception of radioactive substances, highly toxic substances, substances with carcinogenic, mutagenic properties (substances of hazard class I, II).

Federal Law of July 21, 2014 N 219-FZ 19) “On Amendments to the Federal Law “On Environmental Protection” and Certain Legislative Acts of the Russian Federation” (as amended and supplemented, entered into force on January 1, 2020)

It turns out that for category 3 ENVOS the following rule applies:

- The amount of emissions and discharges of pollutants shown in the PEC report (with the exception of substances of hazard classes 1 and 2) is recognized as an amount within the limits of the standards.

- For substances of hazard classes 1 and 2, ENVOS of category 3 have calculations of standards; therefore, for these substances, excesses of standards are established based on these calculations.

Registration

Legal entities must independently submit applications for registration of objects that pollute the environment. If the application was submitted untimely or the business owner completely ignored this requirement, individual entrepreneurs and legal entities will have to pay a large fine in the amount of 30 to 100 thousand rubles, and officials from 5 to 20 thousand rubles. (Article 8.46 of the Code of Administrative Offenses of the Russian Federation). The basic rules for registering objects are given in Decree of the Government of the Russian Federation dated June 23, 2016 No. 572.

In accordance with paragraph 2 of Art. 69.2 of Law No. 7-FZ, registration of objects that have a negative impact must be carried out within 6 months from the date of their commissioning. Non-production facilities that are connected to the city sewerage system and do not have their own boiler houses are not registered. These include offices, commercial buildings, schools, kindergartens, etc.

Enterprises that pollute the atmosphere by emitting harmful substances or discharge pollutants into sewer systems or water bodies must be registered.

What is the procedure for state registration? First of all, the business owner must draw up an application in the form approved by Order of the Ministry of Natural Resources dated December 23, 2015 No. 554. The application should be submitted to the territorial body of Rosprirodnadzor or to the Ministry of Natural Resources of the region. Rosprirodnadzor registers enterprises that are subject to state environmental supervision.

Government departments have the right to refuse registration if the application does not contain all the required information. The decision on refusal, indicating the reasons, will be sent to the owner of the property within 5 working days from the date of receipt of the application. If department employees determine that the object should be registered, they will notify the person who submitted the application.

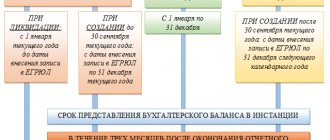

Payment for negative impact on the environment - terms

The fee for negative impact on the environment, calculated based on the results of the reporting period, taking into account the adjustment of its amount, is paid no later than March 1 of the year following the reporting period.

Art. 16.4 Federal Law “On Environmental Protection”

Wherein:

- Quarterly advance payments are made no later than the 20th day of the month following the reporting quarter.

- For the 4th quarter, advance payments are not made - the already adjusted annual fee minus 3 quarters is paid.

- Small and medium-sized businesses do not make quarterly advance payments.

Persons obligated to pay a fee have the right to choose one of the following methods for determining the amount of the quarterly advance payment for each type of negative environmental impact for which a fee is charged:

1) in the amount of one-fourth of the amount of the fee for negative environmental impact payable for the previous year - the simplest option ;

2) in the amount of one-fourth of the amount of payment for negative impact on the environment, in the calculation of which the payment base is determined based on the volume or mass of emissions of pollutants, discharges of pollutants within the limits of permissible emission standards, permissible discharge standards, temporarily permitted emissions, temporarily permitted discharges, limits on disposal of production and consumption waste;

3) in the amount determined by multiplying the payment base, which is determined on the basis of industrial environmental control data on the volume or weight of emissions of pollutants, discharges of pollutants, or the volume or weight of industrial and consumption waste disposed in the previous quarter of the current reporting period, by corresponding rates of payment for negative impact on the environment using the coefficients established by Article 16.3 of this Federal Law.

The deadline for submitting a declaration on payment for negative environmental impact is no later than March 10 of the year.

Are additional documents required for calculating payments?

Current legislation does not provide for the provision of related information for calculations in the NVOS declaration. In this case, Rosprirodnadzor may request, in order to verify the correctness of payment calculations, copies of documents such as:

- Agreement on lease or ownership of objects (this group may include premises, buildings, land plots for commercial and industrial purposes).

- Regulatory information for a specific organization.

- Waste transfer agreement.

- Documents that record the direct use of waste, etc.

This condition especially applies to large payers.

In some cases, representatives of Rosprirodnadzor may limit themselves to a certificate of production activity. Much depends on the territorial location of the units and specific local requirements. It is advisable to clarify additional information in the accounting department where the certificate of the type of pollution facility was obtained.