What is financial investment

Financial investment is a mechanism that redistributes money between people to those who need it most on a paid basis.

Who are these people?

Firstly, ordinary residents. They take out loans from banks at interest (for various purposes: mortgage, car, consumption), thanks to which the bank has the opportunity to make payments to depositors who have opened a deposit.

Secondly, businessmen and businesswomen. They start companies and borrow money from market participants by issuing shares or bonds.

Kinds

There are many types of financial investments. Each of them is suitable for solving a specific problem. Some are for quickly increasing capital, others are for preserving it. Any investor's goal can be achieved through financial investment.

The general classification of species is as follows:

- Mutual funds (suitable for passive investing)

- shares (income generating asset)

- bonds (capital preservation asset)

- futures, options (protective asset)

- precious metals (a balanced asset suitable for portfolio diversification)

- trust management (suitable for passive investing)

- bank deposits, savings certificates (fixed return, low risks, short investment horizon).

Many financial assets have an increased or high level of risk. This thesis forms the main rule of financial investment activity: competent portfolio diversification.

Today, such a “service” as capital management is widespread. By using it, a person can transfer his own funds to the management of professionals who will perform all the necessary operations for him and bypass all the difficulties that arise on the way to his goal. All that remains for the client is to make a profit and pay a commission for using the knowledge and time of specialists.

Authorized capitals

Let's say I decided to create a company called Makemoneyfromair. I wrote a business plan and sent it out by mail. Ivan Ivanov read it and became interested. We met in my office and started negotiations.

“Your business model is promising,” said Ivanov. — I want to participate in this business through investments. But only through the authorized capital.

- Great! Then you will become a co-founder.

Authorized capital is the amount of funds on the balance sheet of an enterprise that has passed state registration. The larger Ivanov’s share in the authorized capital of my company (now ours), the more profit he will receive, the wider his powers will be.

The process of investing in authorized capital is described reliably: businessmen really write business plans, meet, share part of their enterprise for the sake of money.

Real investment for legal entities

Before you start investing, it is worth remembering that this is done by professionals! From an investor, such investments require knowledge in the field of labor management, knowledge of markets for goods and services and the specifics of their expansion, knowledge and skills in the field of financial investments and financial management, and much more. Otherwise, there is a huge risk of losing all your investments!

In order to start making real investments, you need to take into account risks, write business plans, and calculate the rate of return, payback time and many different parameters. Well, if you deal with this matter seriously and thoroughly. It seems difficult, but I will try to describe the main points that will help you navigate real investing if you still want to do it.

Firstly, if you have your own enterprise/firm, you will have to make real investments in any case, because it is this kind of investment, unlike financial ones, that gives you huge competitive advantages, especially over time.

Secondly, in Russia there is Federal Law No. 39-FZ “On investment activities in the Russian Federation, carried out in the form of capital investments.” Before making real investments, you can familiarize yourself with this law, so that later there will be no questions either to the law or to yourself. He is not big.

Thirdly, you need to understand what goals you are pursuing when making real investments.

Objectives of real investment:

- Sometimes real investment is necessary when you simply cannot do without it in order to stay afloat - laws or circumstances dictate. An example of such an investment could be increasing the environmental safety of an enterprise and reducing the toxicity of waste, which the state may legally require of a company.

If these requirements are not met, it will be impossible to carry out activities in principle, so such investments become mandatory and necessary. The same investments include improving the working conditions of workers, if this is also required by the state by law.

- Increasing the efficiency of the enterprise. In order for a company to remain competitive, its equipment, technological processes, conditions and work procedures for employees also need to be changed and improved. For example, it often happens that you come to work in an organization (as a hired worker or simply to perform some technical or programming work), and the computers there are so old that managers do several hours of work that requires time, in a good way, several hours. minutes, half an hour, maximum hour. Efficiency is extremely low, and without updating the technical base, no matter how hard you try to train managers to work faster, nothing will work.

- If you are going to conquer new markets or increase your company's share in the current market, you will often have to make real investments to expand production volumes. If you produce a tangible product, then this is an absolute necessity for your business.

- If you are going to create a completely new product or a completely new service and want to create a new enterprise for this, then you will make real investments in creating new production facilities.

When you decide on the goals that you are pursuing in your enterprise and for the sake of which you are going to make real investments, it is worth studying the main forms of real investment.

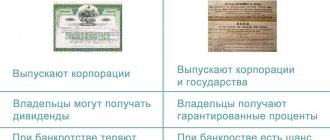

Securities

A share is its holder's share in a company. It is similar to a contribution to the authorized capital, but differs from it in that you do not need to talk to anyone: a computer and the Internet are enough to become a shareholder.

The stock brings two types of profit:

- speculative (bought low, sold high);

- dividend (received payment from the company).

To extract speculative/dividend profits, you need to buy preferred shares.

A bond is a debt security that obliges a company or government to pay interest to the holder and repay it at the nominal amount at the end of its maturity.

There are two types:

- state (OFZ);

- corporate.

Compared to stocks, bonds provide lower returns, but are guaranteed.

Characteristic

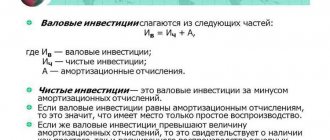

Real investments are investments in real assets of an enterprise, which can be divided into two subgroups: tangible and intangible. In textbooks devoted to the study of economics, real investments may be called capital investments, since they can exaggerate the amount of capital in the future.

Financial investments are a combination of monetary investments in securities, deposits and equity participations. Financial investments are investments in long-term financial instruments that can generate additional income in the future. Also, the purpose of such investments may be to protect them from various financial risks: inflation, crisis, theft. In fact, monetary investments are considered a rather complex category that needs to be considered in detail.

Deposits

Banks attract money from individuals and companies to then lend it out or trade in financial assets. They guarantee repayment of interest on the deposit, as well as a full refund of funds upon expiration of the period chosen by the client.

There are deposits in foreign currency, but practice shows that such investments are unreliable.

Two important aspects.

- In Russia, according to the law, the state will reimburse the full amount of the deposit in the event of a bank collapse, if it is less than or equal to 1,400,000 rubles.

- Now the best strategy is to choose a longer term, because the deposit rate follows the key rate, and the Central Bank intends to lower it.

What are the risks of real investment projects - an overview of the main risks

Real investments involve many risks that cannot be ignored at the stage of developing an investment plan.

Knowing the main risks will help you control them.

1) Financial risk

This type is associated with a shortage of investment resources needed to bring the project into reality, untimely receipt of money from borrowed sources, and increased costs at the implementation stage.

How to avoid: calculate the amount of investment accurate to the nearest ruble.

2) Risk of insolvency

The level of liquidity of current assets is prone to decline. As a result, an imbalance in time between positive and negative financial flows occurs in the investment project.

3) Construction risk

The construction of new facilities will pay off only if it is completed on time. And if construction work is carried out by unqualified contractors who also use outdated materials and technologies, the project will only bring losses.

4) Marketing risk

Incorrectly calculated volumes of profits from investments also lead to project failure. If at the planning stage you do not calculate future prices for products, do not take into account the level of inflation, or make a mistake with the quantity of goods, this will create a negative imbalance between costs and income.

5) Inflation risk

Inflationary economics leads to a depreciation of the real value of capital and a decrease in the expected income from the project. Since in modern conditions this risk is permanent, it must be taken into account.

There are other types of risks - tax, structural, crime, etc. Taking them into account requires professional work at all stages of planning and launching an investment project.

I recommend watching a video on the topic of financial literacy.

Assessment and analysis

Markets can be overbought and oversold. The P/E indicator is suitable for evaluating shares. If its value is less than or equal to 10, you need to buy, if it is greater than or equal to 30, you need to sell. You can find it for a specific security or index on the Internet.

In addition, it is necessary to analyze the companies themselves. You should look at:

- dynamics of net profit;

- level of profitability;

- debt level;

- duration of stay on the market (reputation).

Where can I get this information? All enterprises maintain accounting records and reflect these indicators in them.