From this article you will learn:

- Bank deposit as an investment instrument

- Types of bank deposits

- Investment deposits - how do they work?

- Pros and cons of investing in deposits

- Risks when investing in deposits

- Bank deposit insurance

- How to choose the right bank?

- What to look for when choosing a deposit?

Bank deposit as an investment instrument

A bank deposit is the easiest way to save your funds for the long or short term. The investor only needs to select the bank and the nature of the deposit, and then transfer the money to the proposed details. Interest will be accrued on the deposit, which will be income for the depositor. Perhaps this is the simplest type of investment, which is used by a huge number of people around the world.

To open a bank deposit, you only need a passport. The investment of funds is carried out in one visit to the branch.

Moreover, saving the time of their clients, many banks offer the function of opening bank deposits online. Some, in order to motivate depositors to make transactions through remote service channels, even offer increased rates when opening a deposit via the Internet or mobile application.

Despite its simplicity and accessibility, investments in bank deposits should hardly be considered as a full-fledged investment instrument. As history shows, inflation traditionally outpaces deposit rates.

Of course, in absolute terms, the amount on deposit will grow, but inflation will reduce the purchasing power of money. Therefore, professional investors try to invest in bank deposits only in the following cases:

- Everyday payments (for this you need either a deposit with the ability to withdraw funds without losing interest, or a savings account);

- Temporary storage of funds - until a good offer to purchase an asset appears on the market;

- Risk insurance (as a financial airbag).

At the same time, many prefer to keep deposits not only in rubles, but in at least three currencies - additionally in dollars and euros. In conditions when banks gave minimum rates on deposits in euros (2017-2018), and in general it was unclear what would happen to the main European currency, many split the “euro” part, choosing deposits in pounds sterling, Swiss francs, yen and yuan .

What is special about investment deposits at Sberbank?

This type of deposit differs from a regular deposit.

A simple deposit provides a predetermined return, while an investment deposit sometimes allows you to get much more than expected. But it is impossible to predetermine this, so this type of investment is considered riskier.

It happens like this:

- a citizen comes to the bank and expresses a desire to make an investment;

- he is offered a choice of one of three promising programs in which he can invest;

- after the conclusion of the relevant agreement and transfer of money, the funds are handled by a professional team working towards the development of the chosen program;

- when the work is completed, the investor receives his investment back with income.

The risk is that the program may not work as effectively as expected. In this case, there will be no additional money.

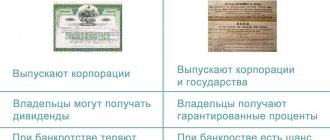

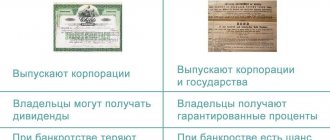

Types of bank deposits

By currency

Bank deposits can be classified according to several criteria. The simplest division: by currency:

- ruble - the most common, the maximum rate at the beginning of 2020 reached 9% per annum;

- foreign currency - most banks offer deposits only in dollars and euros; in other currencies you can only open a savings account with a purely symbolic rate of 0.01% per annum.

At the same time, deposits in exotic currencies with a yield of 0.4-2.65% can be opened in some large banks. At the same time, the client must also be large - for example, the threshold for entering deposits in British pounds at BCS Bank is 200 thousand units of currency, and at Novikombank - 50 thousand. You can only open a deposit in Chinese yuan in BBR Bank with a rate of 1.9% for an amount of 200 thousand “Chinese” or more.

By date

Another option for classifying deposits in banks is by maturity:

- Fixed - open for a specific period, for example, 5 years. Interest payments are usually made at the end of the deposit period. There is usually no capitalization, replenishment or withdrawal of funds. In short, they put the money on deposit for 2 years and forgot about it. Early withdrawal of funds risks loss of interest. For example, these are the deposits “Vostochny” from the Eastern Bank, “Term” from Credit Europe Bank (both - rate 8.1%), “Profitable” from Rosselkhozbank (8%, open for 4 years) or “Save” from Sberbank.

- Perpetual – most often they are called savings accounts. These are deposits that are opened without an expiration date, or are automatically extended when the deposit expires. The yield on them is usually lower than on fixed-term ones, but this is compensated by monthly interest accrual and the ability to withdraw/replenish the deposit.

An investor in a bank deposit who wants to constantly replenish his deposit is better off choosing the second option. If you won’t need the money for a long period of time, and at the same time you want to get maximum income, then it is better to invest in time deposits.

Other classification options

In addition, contributions are divided into the following categories:

- Permanent / Seasonal (for seasonal ones, for example, New Year or dedicated to Victory Day, higher rates are offered, but such deposits can be opened for a limited time);

- Replenishable / Non-replenishable ;

- With the possibility of early withdrawal / Without this possibility (note that sometimes withdrawals are made within the minimum amount);

- With capitalization / Without capitalization .

Deposits with capitalization are always more profitable, since interest is calculated on interest. There is a kind of reinvestment going on. As a result, the investment increases faster. Sometimes a deposit with capitalization is more profitable due to its long term, even if the nominal rate is lower.

For example, the “Replenish” deposit from Sberbank. When investing from 400 thousand rubles for 1 year, the nominal rate is 5.3% per annum, with capitalization - 5.43%. When investing for 3 years, the nominal rate is lower - 5.15%, but taking into account capitalization - 5.56%, i.e. higher. It is clear that investing for 3 years is more profitable.

It is also worth highlighting deposits by type of depositor:

- Children's - opened in the name of a child, the investor can dispose of them after reaching his 18th birthday;

- Social – open to veterans, disabled people and other vulnerable segments of the population, they usually offer higher interest rates and preferential termination conditions;

- Pension - valid only for pensioners who have a pension account or card with the bank.

Therefore, anyone who wants to invest in bank deposits should study all the bank’s offers and choose the most suitable ones for him.

How to close an investment deposit

Early termination of an investment agreement is unprofitable and is accompanied by losses. If, due to current circumstances, you still have to withdraw funds, you can do this by personally writing a statement. You must indicate the reason for this action.

The income received up to this point will be spent on paying for banking services. The invested funds will be returned in full if the money has been in the account for at least 2 years. When the deposit amount is up to 400 thousand rubles, the likelihood of returning an incomplete amount of investment increases.

At the end of the agreement, the account is closed if the owner of the investment decides to withdraw the money.

Investment deposits – how do they work?

Investment deposits are a type of deposit that allows you to receive additional income from the bank compared to the standard one. Income is generated due to the fact that the client arranges additional services or transfers capital to partial management to participate in some investment idea.

By the way, the latter is often called a “structured product,” but in essence it is a deposit, part of which is invested in stocks, bonds or options. In case of a positive outcome, the investor receives a guaranteed profit plus a percentage of the operation. If the idea does not justify itself - only guaranteed income. Sometimes a loss is allowed if the investor decides to increase the degree of participation to obtain potentially greater income.

However, investment deposits usually mean a simpler product. This is the same deposit, but with increased interest – i.e. without any risks. However, it becomes available only when purchasing additional products:

- Savings or investment life insurance policy

. For example, “Income Strategy” from Loko Bank with a yield of 8% or “At the Top” from Gazprombank with a yield of 9.2%. The deposit amount is usually equivalent to the size of the policy. - Purchases of

shares of an investment fund managed by a company from a banking group. For example, Rosselkhozbank offers an “Investment” deposit with a rate of 8.55% when purchasing shares of any mutual fund managed by “RSHB Asset Management”. - Opening an individual investment account or a brokerage account

with a manager from BCS Bank with 8.5% can be opened only with the simultaneous opening of a brokerage account with a BCS Broker. - Purchasing a premium package of services

. For example, the Leader deposit line from Sberbank offers +2% to the main rate when purchasing a package. - Purchasing special cards

. Thus, Sovcombank offers a “Maximum Income” deposit with a rate of 8% while simultaneously opening a “Halva” card.

Investment deposits are much more attractive in terms of profitability. When investing in bank deposits, you should definitely consider them as an alternative option. It is quite possible that you will like some of the proposals. Moreover, the opening of such a deposit can be combined with the purchase of other investment products.

Example of an investment deposit

Procedure for registering an investment deposit

An investment deposit can only be made in person at some Sberbank branches. This cannot be done remotely.

The investor chooses one of the methods offered by the bank:

- making an investment from a brokerage account

- investing with the help of a manager provided by the bank.

To make an investment in Sberbank, you need:

- choose a suitable department;

- visit it, have your passport with you;

- choose a fund in which the risk share of capital will be invested;

- enter into an agreement with the bank.

Moreover, depending on the strategy that the investor intends to adhere to, he acts in different ways:

- Brokerage individual investment account - transfer money from 1 thousand to 1 million to it and invest it:

- in Sberbank bonds (safe and profitable method with low risk);

- in any shares and other assets of the stock market;

- into ready-made investment developments.

Opening one investment account with trust management is a convenient way for those who do not have sufficient knowledge themselves. It is distinguished by high liquidity of assets, as well as the quality of fund management, which is ensured by the Sberbank team.- Use the minimal risk “Accumulative” strategy.

Money is transferred to the account in any convenient way, deposited in cash. After concluding an agreement, the client is provided with data for using Sberbank Online; money can be deposited remotely later. Account management is also carried out online.

It is recommended to obtain detailed consultation in advance, for which you can use any method of communication with specialists:

- by calling the hotline in Russia;

- by number for calls from another country;

- for feedback - for this you need to leave a request.

Pros and cons of investing in deposits

I will note the main advantages of investing in bank deposits:

- security - all deposits up to 1.4 million rubles are insured by the DIA (more on this below);

- simplicity of registration - a passport is enough to open a deposit; most deposits can be invested online;

- ease of management - money can be withdrawn at any time (though sometimes with loss of interest), replenishment (if possible) is carried out online without unnecessary movements;

- simplicity of calculations and guaranteed income - you always know how much you will earn;

- capitalization of interest - this allows you to receive more income;

- convenient additional options - for example, you can withdraw income from the deposit to a separate card or, on the contrary, set up automatic replenishment of the deposit when a salary is received.

Maybe

Risks when investing in deposits

There are very few key risks when investing in bank deposits:

- Bank bankruptcy or loss of license . In this case, investors will immediately receive compensation of up to 1.4 million rubles under insurance; the remaining funds can be received during bankruptcy proceedings when the organization’s assets are sold. The easiest way to mitigate risk is not to invest more than 1.4 million rubles in one bank.

- Risk of foreign currency deposits . If you open, for example, a dollar deposit, then if the dollar exchange rate decreases, you will receive less in rubles. For example, you put $1,000 at 1% per annum, and it fell by 5%. As a result, a loss in rubles is formed in the form of 4% (calculations are simplified, but the essence is clear). True, you will agree that the likelihood of such a situation occurring, especially over the long term, is extremely low. The ruble usually falls against major currencies, so this risk can, in principle, be eliminated.

- Fraud . You can accidentally end up on a fake bank website and transfer your money to an attacker. Or invest money in a non-existent bank - from time to time, websites of fake financial organizations appear on the Internet, collecting money from the population at a high interest rate.

To eliminate these risks, it is enough to follow simple rules of financial security:

- check the address of the site you are going to;

- set up SMS notifications about all account transactions;

- open deposits only in verified banks licensed by the Central Bank of the Russian Federation.

You can check the availability of a license on cbr.ru – the official website of the Central Bank.

Bank deposit insurance

As I wrote above, all bank deposits are insured by the DIA - Deposit Insurance Agency. This is a federal service created specifically to protect depositors. In the event of an insured event - revocation of a bank's license or bankruptcy - the DIA makes payments to depositors.

The amount of insurance compensation does not exceed 1.4 million rubles per depositor. If the investor had a foreign currency deposit, it is converted into rubles on the date of bank closure.

If the amount of investments in the bank exceeds 1.4 million rubles, then the balance is paid during bankruptcy proceedings. But it is not a fact that the compensation funds will be enough for all investors. Usually there is not enough even to pay priority queue creditors.

If the depositor had several deposits, then the payment is made from each in proportion, but so that the total amount does not exceed the threshold of 1.4 million rubles.

EXAMPLE

Ivanov had two deposits in a bankrupt bank: one for 1 million rubles, the other for 2 million. From the first deposit he will receive 466,666.6 rubles, from the second - 933,333.3 rubles, in total - 1,400,000. The remaining amount will be included in the bankruptcy estate.

Insurance is carried out automatically

. The bank pays 0.1% of the volume of deposits once a quarter to the DIA. The depositor himself does not pay anything and payments to the DIA do not affect the profitability of his deposit.

In principle, there is no need to check whether the bank has membership in the DIA. The bank does not have the right to accept deposits from the public if it does not make insurance contributions. Otherwise, it is the offending bank. The Central Bank vigilantly monitors this and immediately selects licenses. Therefore, if a banking institution accepts deposits, then it is a member of the DIA.

How to choose the right bank?

However, when investing in bank deposits, you need to choose your bank wisely. Of course, if you invest less than 1.4 million rubles, then you don’t have to worry too much. Even if the bank is closed, you will still receive a refund. But if you want to avoid unpleasant moments and loss of accumulated income, and also if you plan to invest a large amount, then pay attention to the following:

- Bank size (determined by the number of assets and the amount of equity capital) - the larger the organization, the better;

- Who is the owner - if they change frequently, this should be a concern, as well as dubious individuals at the helm of the organization;

- The bank’s activity in the interbank lending and investment market – if it is low, then the bank is clearly experiencing problems;

- Availability of other proposals - think: if a bank curtails its lending programs, then where will it get the money to pay off deposits;

- How are payments made on debt obligations - bonds, especially subordinated ones (when a bank has problems, it is the subordinated bonds that usually go under the knife first).

An alarming signal may be the inclusion of the so-called “deposit vacuum cleaner”, when the bank sharply increases deposit rates, or begins to offer some dubious products such as investment deposits or structured products with a guaranteed return of 20% per annum. It is clear that the owners of the bank are trying to make good money before closing their shop.

[adsp-pro-3]

Is it worth investing in Tinkoff Investments?

- Trading on the stock exchange is always a risk, so it's up to you to decide.

- It is quite possible to make money on the stock exchange, as well as to lose all the money invested.

- The platform is modern and convenient for trading; it has many advantages compared to other services.

- Tinkoff Investments has all the necessary licenses from the Central Bank of Russia.

How is an IIS different from a brokerage account?

- IIS (individual investment account) is a special account for individuals with restrictions that allows you to trade on the stock exchange and receive additional benefits.

- You can only have one IRA at a time.

- For IIS, unlike a brokerage account, there are two types of tax deductions.

- The maximum amount that can be deposited into an IIS is 1,000,000 per year. If you exceed this figure, use a brokerage account.

- You cannot replenish an IIS in foreign currency.

- It is also prohibited to pay for a purchase using a ruble bank card. But you can buy currency on the stock exchange and use it to pay for foreign securities.

Qualified Investor Status

To obtain the status of a qualified investor in Tinkoff Investments, you only need to fulfill one of the conditions:

- Own assets or have in accounts from 6,000,000 rubles (there are restrictions).

- Have 2 years of experience in a specialized organization that is a qualified investor, and 3 years in other cases.

- Receive an economic education at a university, have a certificate of a financial market specialist or one of the CFA, CIIA, FRM certificates.

- Over the last year, trade on the stock exchange with a turnover of 6 million rubles.

- Make at least one transaction every month.

- By law, only a qualified investor can purchase any securities and invest in all financial instruments.

- To obtain the status of a qualified investor, send supporting documents to your personal manager.

- Your application will be reviewed within 5 business days, and if you meet the requirements, you will be assigned the status of a qualified investor free of charge.

What to look for when choosing a deposit?

When investing in a bank deposit, when choosing a specific program, you should pay attention not only to the interest rate (although this is an important, I would even say, the key parameter of choice), but also to other conditions:

- duration of the deposit - calculate how soon you will need the money and act in accordance with these conditions;

- is it possible to replenish the deposit;

- is it possible to withdraw money without losing interest and within what limits - most banks limit withdrawals to a minimum amount tied, for example, to the amount of the initial investment;

- Is it possible to withdraw all the money from the deposit in an urgent situation and under what conditions - for example, deposits with Post Bank can be terminated after 181 days with the loss of only 1/3 of the accumulated income;

- is there any capitalization of interest;

- how often interest is accrued, can it be withdrawn to a separate account (if you want to feel like a rentier and live on interest).

Maybe