What types of investors are there?

Funds or individuals invest - business angels.

Business angels

Business angels are divided into two types: professional and “wild”. Professionals know what they are doing and build a portfolio of projects. “Wild” investors invest randomly and not in an industry close to them.

In 2014, the average investment from a business angel in Russia was $36,000, although there were angel investments of $10,000 and a million.

There are several associations of this kind of investors in Russia. For example, the National Association of Business Angels and the National Commonwealth of Business Angels. The most famous private investors: Konstantin Sinyushin, Arkady Moreinis and his “Dark Side”, Askar Tuganbaev. The publications Slon.ru, Firrma and the RVC Foundation compiled a list of the 27 most active Russian business angels in 2014.

Funds

Funds specialize in different stages of company development and are ready to invest different amounts. They usually invest at a later stage than business angels and are focused on investments from a million dollars. Determining how much a fund is ready to invest is quite simple: you can look at announcements of closed transactions and the amount of investment in them. If you have a super idea, but you need less than a million money for it, then you shouldn’t write to funds - their legal and time costs will be too large and will not pay off the “small” investment.

Process characteristics

Cash injection is a process characterized by 5 parameters:

- A specifically designated goal;

- Deadline for infusion of funds;

- Amount of investment;

- Profitability;

- Possible risks.

The purpose of the financial injection is determined by the specific amount of income that the investor wants to receive. Based on reliable data, this goal is prescribed in advance.

The injection period refers to the time of placement of funds; for short-term projects this time period is up to 1 year, medium-term investment objects require from 1 to 3 years, long-term projects - from 3 years and above. Based on the final period of the injection, the approximate profitability is calculated, a financial strategy is drawn up, and probable risks are prescribed.

The level of profitability of a project is the most important indicator that every investor should know before investing. The higher this level, the greater the likelihood of risks.

Risks are the likelihood of losing invested funds in an unfavorable scenario.

A successful investor must take into account all these important indicators when choosing an investment property and method. In order to properly invest and increase personal finances, you need to constantly keep your finger on the pulse, conduct a detailed analysis and objective assessment of the situation in order to leave the project on time.

Investments from the state

The state does not directly invest in startups; funds from it are allocated in the form of grants: the Bortnik Foundation (also known as the Fund for Assistance to the Development of Small Innovative Enterprises in the Scientific and Technical Sphere), Skolkovo, federal and regional target programs. There is no need to give away a share in the company.

It can also invest through funds with government participation. For example, RVC does not invest funds independently, but participates with capital in the creation of venture funds, which already operate practically like market players.

Main features

The main features of this type of investment, which distinguish this method of investing money from others, are:

- Budgetary funds are the main source of their education;

- They are performed on a return basis, i.e. with subsequent repayment of funds (for example, a loan);

- They are managed by the state, including the procedure for presentation and implementation;

- The amount of investment funds is subject to the adopted budget;

- The targeted expenditure of invested capital is carried out under the strictest control;

- Investments are protected by the state treasury. This is manifested in: protection of investor property rights; after paying all taxes, the ability to freely transfer funds to foreign accounts (in the case of foreign investors); the right to independently dispose of income received from investment activities, etc.

Funds are invested in economic development to equip production and develop the country's economy. Invested funds also play an important role in improving various kinds of government projects and programs. Examples of public investment in various areas are the following forms:

- Cultural – opening children’s and youth sports schools, financing tournaments and competitions;

- Social – maintaining a pension fund, transferring funds to medical, educational institutions, etc.;

- Scientific – construction of technology parks, investing in high-tech production;

- Infrastructure – construction and major repairs of roads;

- Defense - modernization of the military industry (development of the latest military equipment, weapons, uniforms, etc.);

- Construction – financial assistance in the construction of new houses (preferential loans for obtaining new housing);

- Ensuring internal security - financing all departmental structures (police, traffic police and others);

- Protecting the environment - creating nature reserves, recycling waste and others.

Who invests in Russia

If we talk about the field of information technology, then among the most well-known funds today are Almaz Capital, Runa Capital, and IIDF. At the same time, IIDF works starting from the early stages, Almaz and Runa get involved when it comes to millions of dollars of investment.

The largest number of funds and active business angels are in information technology, the Internet and related areas - about a hundred active players. For example, InVenture Partners, Life.SREDA, LETA Capital, Flint Capital, Altair, Vaizra Investments, iTech Capital, Run Capital, Maxfield Capital. Few people invest in the fields of medicine, energy, and biotechnology.

The most correct option for choosing potential investors is to look at several reports on the Russian venture investment market. For example, a study for the first quarter of 2014 from RMG Securities and from RVC for 2007–2013. Rusbase collects market reports on a separate page.

Many startups go through accelerators or incubators as a preparatory period before attracting investment.

Profitable investment niches

Many novice investors are wondering where to invest their finances with minimal losses? Here are the most profitable and reliable ways of investing:

Time bank deposits

This method of investing is safe and reliable. It is able to cover the current level of inflation. The disadvantage of this method is low profitability. Simply by opening a deposit account, a client can earn up to 8% per annum. Bank deposits are the main tool to combat inflation. The main mistake that many investors make is pouring funds into banks that are in leading positions in the Russian market. Here the interest rate for individuals is lower than in second-tier banks interested in raising funds.

It is much more profitable to invest in credit organizations included in the 50th rating. Among them, it is worth paying attention to Tinkoff, BinBank, SvyazBank, and the popular Otkritie. Credit institutions are interested in any finance raised and can offer a much higher percentage than other banks.

Investments in real estate

In Russia, real estate investments are a popular method of investing. Housing prices vary depending on the region. In any case, the owner of the property will receive a stable rental income. Domestic real estate annually increases in price by 5-6%, with the exception of moments of crisis in the economy. Many people are attracted to rental payments by their stability and reliability. At the same time, it is advisable to purchase housing in large cities where there is a constant dynamics of rising prices, for example in the capital.

For example, an apartment purchased in the capital for 6 million rubles gives a monthly rental income of 300 thousand rubles. Such an apartment will increase in price by 11% annually, which completely covers the current depreciation of the national currency.

Among the disadvantages of this investment method, it is worth noting the long payback period of investments and reduced liquidity of real estate. The invested funds will be fully returned in 8-10 years. Reduced liquidity means that the sale of the created asset at real prices will take quite a long time. If you need finance urgently, you will have to sell it below market value.

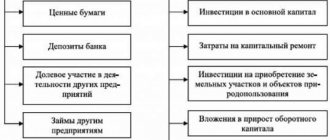

High yield stock market

Investing in the stock market is a profitable and risky way to make a profit. Investing in securities of domestic companies involves certain risks when doing so during periods of constant fluctuation. With a smart investment, you can get from 100 to 200% profit. Here everyone is moving in 2 directions: trading on the stock exchange and investing in stock exchanges. In the first direction, the purchase and sale of securities is carried out in order to make money on the difference in prices. These actions are very risky; they require certain skills, abilities and abilities to overcome risks.

Infusions in the securities market imply the acquisition of securities before maturity or for the purpose of stable receipt of royalties. An experienced investor creates a portfolio of securities that provides stable returns over a certain period of time.

Mutual funds

Abroad, investing in mutual funds is a profitable way of earning money for all citizens. But in Russia everything is somewhat different: there is practically no insurance for infusions, business is developing at a slow pace, many players have practically no opportunities to insure their own risks, investment funds do not have the same level of profitability as abroad.

There are about 1,500 mutual funds operating in Russia, 70% of them are completely closed and do not provide transparent reports on their activities.

Investing in these funds is a big risk. According to experts, in 5-10 years, the economy will transform into an investment model; this situation will increase the popularity of mutual funds and increase the safety of these injections.

Investing in collectibles

Some people believe that investing in various valuable items can bring decent profits: collectible drinks, vintage furniture.

These methods of injecting funds are quite popular, but their profitability is minimal, for this there are the following objective reasons:

- Closed niche;

- Inflated starting cost;

- High commission fees;

- Risk of purchasing low-quality counterfeit goods;

- Reduced liquidity of things.

Based on these reasons, we can make an objective conclusion that this well-known method of financial injections will be unprofitable for many years to come.

Venture capital investments in Russia

Venture investment in the Russian IT sector has particular promise. The venture investment industry is experiencing steady growth. Venture capital companies, teams or individuals involved in the development of new technologies can count on financial injections. Investments in such projects are made by special funds aimed at this type of investment, intermediaries or individuals with sufficient skills and the necessary finances.

How does an incubator differ from an accelerator?

The main difference between an incubator and an accelerator is their passage time. The accelerator is usually limited to a few months and only accepts teams with an existing product, albeit in its infancy. Even entrepreneurs who are just starting their journey will receive help in the incubator.

An incubator, unlike an accelerator, provides basic services (workplace, Internet, accounting services), but does not have sufficient expertise to help develop a business. The main task of the accelerator is to have sufficient expertise to help a business grow 10 times or more in a few months through experts, methodology, business experience and connections of the management team.

Incubators usually help startups free of charge; you only need to pay for a workplace, but the price is less than a full-fledged office rental. In the accelerator, the company will take a share and help bring the business to a mature state.

In other words, an incubator is primarily about reducing costs, and an accelerator is about a significant increase in companies’ turnover.

IIDF infographics about accelerators and incubators

Entrepreneur's risks when attracting investments

There are many risks for an entrepreneur:

Wrong partner

Just an investor with whom you will not be able to work effectively together for several years. Choosing an investor is like finding a wife - can you spend several years with him regularly discussing difficult issues?

Cardinal discrepancy between the goals and plans of the investor and the founder

These are constant conflicts and taking over control of the company.

Losing control

A professional investor will definitely want control over the company's work. A normal situation is when this control occurs through achieving unity of opinions in the board of directors, and not through imposing decisions.

Blocking deals with new investors

This can happen due to investor reluctance or an improperly structured deal in the previous investment step.