“How can you temporarily suspend the activities of an individual entrepreneur?“is a question that individual entrepreneurs often face when difficulties arise in their business or they want to take a short vacation. Many people believe that an individual entrepreneur has only two options - active work or its complete cessation in case of failure. But practice has shown that proper suspension of activities allows you to rethink many issues, and then resume the enterprise without the need to waste time and money.

○ Legislation in the field of business activities.

The current legislation has clear regulations for the procedure for registering the beginning and termination of the activities of an individual entrepreneur. Suspension of work at the request of a businessman is not provided for by law.

Opening or closing an individual entrepreneur is a citizen’s right. Once the status of individual entrepreneur is registered, a person can be deprived of it only in cases provided for by law. Lack of profit or actual non-conduct of business are not such grounds.

Clause 1 of Art. 22.3 Federal Law No. 129 of 08.08.2001 “On state registration of legal entities and individual entrepreneurs”:

State registration upon termination by an individual of activities as an individual entrepreneur in connection with his decision to terminate this activity is carried out on the basis of the following documents submitted to the registration authority:

- An application for state registration signed by the applicant in the form approved by the federal executive body authorized by the Government of the Russian Federation.

- Document confirming payment of state duty.

Please note that applications for temporary suspension of activities are not provided for by law.

How not to pay taxes and insurance premiums, and not close an individual entrepreneur

If you do not carry out an activity, then in general you do not have to pay tax (the tax base is zero). This does not apply, for example, to UTII or the patent taxation system. However, you can always switch to a general and simplified tax collection system by submitting an application to the Federal Tax Service. Accordingly, you don’t have to close your individual entrepreneur and not pay taxes. But there is another problem.

Individual entrepreneurs are required to pay insurance premiums “for themselves.” This means that even if an individual entrepreneur does not have employees, he must pay a certain amount of money annually (36,238 rubles in 2020). But there are ways to avoid paying such fees. In particular, they are not paid if:

- The IP was drafted into the army;

- The individual entrepreneur is on maternity leave;

- The individual entrepreneur takes care of a disabled child, a disabled person of group 1, an elderly person over 80 years old;

- The individual entrepreneur lives with her husband, a military man under contract, in an area where it is forbidden to do business;

- The individual entrepreneur does not live in the Russian Federation, but lives abroad with his spouse, an employee of a consular or diplomatic post.

Thus, it is impossible to suspend the activities of an individual entrepreneur, since no such legal mechanisms are provided. However, you can close an individual entrepreneur (through the taxpayer’s personal account for free), and then register it again for 800 rubles (or free online). This will help you avoid paying taxes and insurance premiums.

Even more materials on the topic in the section: “IP”.

○ Is it possible to simply “not work”?

A businessman may not actually operate, but he will not receive an exemption from his obligations under the law. He will also have to:

- Provide reports, declarations and other documentation to government agencies.

- Transfer mandatory contributions for yourself to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Thus, despite the lack of profit, you will still have to pay the prescribed insurance premiums. If this is not done, the citizen will be held administratively liable.

Additional costs arise if there are employees. In the absence of activity, they cannot be reduced, which means that the businessman is obliged to pay wages and fulfill other obligations to employees.

If work is suspended for a while, you can agree with employees to terminate the employment contract. If they do not agree, the dismissal will be considered illegal.

✔ Maintaining the tax burden.

Until the individual entrepreneur ceases to operate in accordance with the procedure established by law, he must report to the tax office and pay mandatory payments. The size of these payments depends on the applicable taxation system.

Thus, businessmen operating on OSNO or simplified tax system have the right to submit zero declarations, that is, there is no need to transfer any funds in the absence of profit. Entrepreneurs working on UTII or PSN must make mandatory payments, regardless of whether they are operating or not.

✔ Obligations to the Pension Fund.

Regardless of the presence or absence of employees at an individual entrepreneur, you will still have to pay contributions to the Pension Fund for yourself. There is no need to submit reports.

If an individual entrepreneur has employees, their rights cannot be infringed. When there is no activity and no wages are accrued, employees can be placed on leave without pay. In this case, reporting to the Pension Fund will be zero and there is no need to pay contributions.

The vacation option is not always possible. In such a situation, you will have to pay wages, and, therefore, calculate and pay taxes and contributions to funds.

What should an individual entrepreneur pay for during downtime?

It must be said that the problem of suspension of activities applies to a greater extent to individual entrepreneurs than to LLCs. The fact is that a temporarily non-working organization, if it does not have employees and taxable property, should not pay anything to the budget. It is enough just to submit zero reports on time.

But individual entrepreneurs have their own specific payment - insurance premiums for themselves. In 2020, the fixed amount of contributions is 40,874 rubles, which is a lot for non-working individual entrepreneurs.

In addition to contributions, in some cases you also have to pay taxes, even if the business does not generate income. This applies to UTII and PSN systems, where tax calculation is not related to actual turnover. In the simplified taxation system, OSNO and unified agricultural tax regimes, the suspension of the activities of an individual entrepreneur does not lead to the payment of taxes, because here only received, and not potentially possible, income is taken into account.

Entrepreneurs who stopped their activities due to the coronavirus quarantine have additional expenses. In particular, these are employee salaries and rent payments.

These expenses were partially reimbursed by the state. The package of measures to support particularly affected industries included subsidies for workers and individual entrepreneurs in the amount of the minimum wage, loans at preferential rates, tax write-offs, reductions in insurance premium rates, etc. And thanks to the adopted laws, tenants of commercial properties were able, if necessary, to terminate lease agreements without additional sanctions .

If we talk not about a crisis, but about a standard situation of suspension of an individual entrepreneur’s activities, then the main problem is related to the need to pay contributions for oneself and taxes on UTII and PSN. But here everything is not so simple.

○ Is closing an individual entrepreneur an option?

Closing an individual entrepreneur is the only way out to avoid paying taxes and fees. In the future, when circumstances change again, it will be possible to register again as an individual entrepreneur and resume activities.

It is important to take the necessary actions provided by law. There are not many of them.

✔ Putting things in order.

Before closing an individual entrepreneur, it is necessary to resolve all issues with employees, contractors and the tax office. You will need to list payments on all debt obligations and prepare the necessary papers.

Preparatory steps include:

- Payment of taxes, fines and penalties to the tax office.

- Dismissal and full settlement with employees, if the individual entrepreneur has them.

- Transfer of insurance premiums for yourself.

- Preparation and submission of declarations for the past period (even if this is not a full reporting year).

- Deregistration from the Social Insurance Fund (for individual entrepreneurs with employees).

- Closing a bank account.

- Deregistration of a cash register, if it was used.

After putting things in order, you can proceed to the next steps.

✔ Drawing up an application.

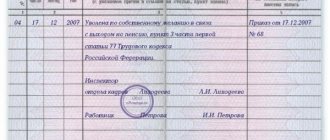

When closing an individual entrepreneur, the established application form P65001 is used. The document can be filled out by hand (in black ink in capital letters) or on a computer (Courier New font, 18).

The application will need to indicate your full name, INN and OGRNIP, as well as contact information and the method of submitting the document to the tax office. When submitting an application in person, the signature is placed in the presence of a Federal Tax Service employee.

✔ Providing a receipt for the fee.

In addition to the application, a receipt for payment of the state fee is required. Its size is 160 rubles.

You can generate a receipt on the official website of the Federal Tax Service. To do this you will need to fill in the required information. You can also get it at the territorial tax office.

The receipt is paid at bank branches, in the Internet banking system or through a terminal.

✔ Extract from the Pension Fund.

Previously, it was necessary to attach a certificate from the Pension Fund to the application and receipt. Now this requirement has been abolished, since the Federal Tax Service can request the necessary information on its own.

It does not matter whether you paid the contribution to the Pension Fund or not at the time of closure of the individual entrepreneur. According to tax legislation, payment can be made until December 31 of the current year.

Clause 1 of Art. 423 of the Tax Code of the Russian Federation: The billing period is the calendar year.

Suspending the activities of individual entrepreneurs without closing them - is this realistic?

Current legislation does not provide for the possibility of suspending the activities of an individual entrepreneur.

And even more so, you don’t need to assume that if you simply stop running your business for a while, you will be exempt from the need to fulfill obligations to pay taxes (as well as other similar payments) and submit documents required for carrying out business activities.

Thus, the answer to the question “how to suspend the activities of an individual entrepreneur?” there will be a categorical “no way.” In fact, you may not carry out your activities, but you are still required to submit tax reports, pay pension and insurance accruals. On the other hand, fulfilling these duties is not so difficult, especially since when submitting zero returns you will be exempt from paying tax (except for special cases, for example, the use of UTII). The only thing you have to pay is contributions to the Pension Fund. But this is only in your interests, since it directly concerns your future.

Recommendations

Before deciding whether it is better to close an individual entrepreneur or suspend its activities, you should determine the amount of losses in the event of maintaining the business and minimize it. For singles, the optimal solution would be to switch to a common taxation system if they are not ready for monthly payments. It is also necessary to worry about staff reductions, which must be done after a two-month period after he has been notified of the impending reduction. In any situation, you will have to submit reports to the authorized bodies, even with zero income. If it is not submitted, the entrepreneur will be subject to penalties.

Practical experience

Stopping an individual entrepreneur's business is illogical. The law does not establish deadlines for starting and finishing activities; the registration procedure may even be unlimited. While the case is stopped in fact, the law still obliges the business owner to fulfill his obligations.

If the individual entrepreneur has not worked for a long time, but this form of ownership is still registered, then there are obligations to submit reporting forms. Moreover, it is required to make fixed contributions to the Pension Fund, as well as transfer other amounts to the required accounts.

If the entrepreneur does not receive income, a zero declaration is submitted. If you have hired employees, you should not forget about the duties of a tax agent and respect the labor rights of employees.

If we talk about the consequences, then during the suspension of activities they were not observed. The main thing is that there are no violations of the current legislation. But in life there are various situations that force an individual entrepreneur to end his activities.

Is it possible to restore a business after its liquidation?

The law does not limit the rights of an individual to conduct business activities. Every citizen has the right to open a business and close it at any time convenient for him and at any working time for the Tax Service. Repeated registration of individual entrepreneurs is carried out according to the same scheme as the initial operation. The fact of previous liquidation does not have any effect on its algorithm.

Legal acts do not regulate the time period after which, after closing an individual enterprise, a person can reopen it. He has the right to do this at any time, even the next day after the end of the liquidation procedure. The question is only about the appropriateness of the individual’s decisions. There are also no restrictions on the number of times a business can be opened and closed.

Sample application and content requirements

If the documents are submitted independently, then it is enough to ensure that paragraphs 1 and 2 of the form are filled out and signed later. Form P26001 was adopted in July 2013. A sample application paper looks like this.

- The first line - strictly in the center - is the title of the document, the second line is an explanation. It is written “Statement on...”.

- Clause 1 - information about the individual entrepreneur - OGRN, full name, INN.

- Please issue the documents to the applicant or send them by mail. Provide contact information – phone number, email address.

- Information about the person who certified the authenticity of the signature by a notary - notary, deputy, official who has the appropriate authority.

Documents for download (free)

- Form P26001

- Sample form P26001