The activities of an individual entrepreneur always mean compliance with clear rules established by the state. Among other things, they ensure timely receipt of tax payments. If an individual entrepreneur wants to build the simplest possible mechanism for paying taxes, then he chooses the procedure that involves obtaining a patent. At the same time, this obliges the use of a special book in which income is recorded. And you don’t need to pay any expenses. This book is essentially a strict reporting form in which the individual entrepreneur enters income from activities in accordance with the patent.

Book's contents

A simplified method of paying taxes on a patent allows you to simplify the process of accounting for income and expenses as much as possible. But at the same time, the need to maintain a number of registers cannot be avoided.

The main document is the income book. How it is necessary to maintain and use it is described in the Tax Code (subparagraphs 2 - 5 of Article 346.53), as well as Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

According to these legal norms, the following requirements are imposed on the income register for individual entrepreneurs on a patent:

- title page indicating the commercial designation (name) and full name. merchant;

- Each sheet of the book is stitched and has a number;

- the amounts of funds received and the dates of operations and their names are entered in the columns;

- on the final page - an indication of the total number of sheets, etc.

You need to understand that an entrepreneur uses a book under a specific patent, which the tax authority issued for a specific period and for a specific type of activity.

Income book for individual entrepreneurs on a patent - rules for filling out:

- For each tax period, a new book form is created - the period must correspond to the period of issue of the patent. If an entrepreneur receives a new patent instead of an old one, a new KUDiR is formed.

- It is allowed to compile a book in paper or electronic form. In the first case, you need to pre-stitch and number all the pages, certify the document with the signature of the individual entrepreneur and a seal, if available. If the reporting is prepared by computer, the certification of the bound and numbered book is carried out after printing.

- There is no need to register KUDiR with the Federal Tax Service.

- All transactions are reflected in the book by cash method - the procedure for recording income is defined in clause 2 of Art. 346.53, that is, as they are, so to speak, produced. We received the money and reflected it in the book.

- There is no need to enter expenses into the book, only income in rubles in chronological order.

- Correction of indicators is possible if supporting documents are available - errors and corrections are certified by the signature/seal of the individual entrepreneur.

Note! The absence of a book is interpreted as a gross violation of legislative requirements for the rules for accounting for income/expenses and threatens the entrepreneur with penalties of 10,000-30,000 rubles.

How to keep a register

There are two acceptable ways to maintain a book of income on a patent:

- on paper sheets in the form of a bound book;

- electronic.

If you choose the first option, then after the patent ceases to be valid or the tax period ends, the merchant is obliged to submit this register to the Federal Tax Service, where it will be checked.

If we are talking about the electronic version, then they work with special files on the computer, where the individual entrepreneur types information about income. Under the same conditions as in the first case, it is necessary to print the document and submit it to the tax authority.

Regardless of whether the activities carried out by a merchant involve cooperation with foreign counterparties and clients, all records must be kept in Russian or must be translated into it.

If the entries were made in another language, then the translation is written in the next column. It is important that the entrepreneur certifies the adequacy of the translation using the date, stamp and signature. If it works without a seal, then an autograph and the corresponding date are enough.

The most important feature, which is also the main requirement that must be taken into account when maintaining a book, is strict adherence to chronological order. It is also important that the book is filled out without corrections and clearly. If the adjustment could not be avoided, then the reason must be indicated each time. But this is not enough: the fact that the accounting in the new way was correct must be confirmed by a financial receipt document signed by the individual entrepreneur.

Is the patent tax system beneficial or not?

The patent taxation system is a simplified way of doing business for an individual entrepreneur. It is an alternative version of paying tax, in which deductions are paid not on the profit received, but on the purchase of a patent. It is purchased for a period that is a multiple of a month, with a maximum validity period of 12 months, and begins on an arbitrary date within the interval of one calendar year.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

During the validity period of the PSN, it is impossible to transfer to another taxation system on your own initiative.

The cost of a patent depends on the period of validity and is considered by the inspector using the formula: Where P is the cost of the patent;

DB – basic profitability, calculated by tax authorities for each region separately. Represents the statistical coefficient of the received data in the direction of the patent for the previous year. Example: Let’s imagine that the average retail budget in the region was 700 thousand rubles per year. Then, the price of the patent is calculated as follows: P = 700,000 · 0.06 = 42,000 rubles. That is, the price will be 42,000 rubles per year. If you need to find out the cost of a patent for a certain number of months, then the result must be multiplied by the number of months for which the patent is purchased and divided by 12 (the number of months in a year). For example, the acquisition period is 8 months, then: So, in order to purchase a patent for 8 months, you will have to pay 28,000 rubles. But unfortunately, this is not all the costs. Since one entrepreneur may have several patents, this calculation must be made for each one. I would like to note that one individual entrepreneur has the right to simultaneously be on several taxation systems (STS, OSNO, etc.). The unusual method of toll collection brings both large profits and losses. An entrepreneur cannot accurately predict the development of a business in the near future, the maximum is to analyze the previous period, if any. So, statistical data have shown that trading with a patent is profitable, it’s time to switch to it.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

There are some areas of business that prohibit accounting on PSN. You can familiarize yourself with them in the classifier of types of activities (OKVED).

Unfortunately, not only individual entrepreneurs, but also inspection services worry about profit.

If it is discovered that the profitability threshold for the year has exceeded 60 million rubles, you will have to say goodbye to this taxation system. This also applies to having a staff of more than 15 people. If an individual entrepreneur has lost the right to use this system, he must report this to the tax office within 10 days. For PSN, it is sufficient to maintain a book of income records, but if the limits of the permitted requirements have been violated, primary documents for the period of validity of the patent will be needed to pay the tax at the basic rate. When such an event occurs, personal income tax is reduced by the amount spent on acquiring the patent. The advantage of this accounting system is the following:

- Fixed patent rate does not depend on the entrepreneur’s revenue.

- There are fewer mandatory reports to submit (VAT and personal income tax are not submitted) than with other types of taxation. There is no need to keep a book of expenses and income for an individual entrepreneur on a patent.

- Simplified accounting system.

- Save time.

- Installation of cash register equipment (CCT) is optional.

- There is no need to monitor expenses and their correctness.

If for some reason an entrepreneur has lost the right to use the PSN, or has ceased his commercial activities under a certain patent, then in the future he will be able to return to such a system only in the next calendar year.

Income documents

The execution and receipt of a number of documents automatically gives a signal about the need to enter the next income position into the register. So, the following financial documents can confirm your arrival:

- agreements that stipulate the receipt of financial resources such as prepayment or advance payment;

- cash receipts orders;

- checks and payment orders;

- invoices for the transportation of goods (TTN, if this is income);

- financial documents of strict reporting.

Let's say a few words about the nuances that may arise with an advance payment. If the transaction is successful, the advance received is shown in the financial statements as profit. However, it may happen that later for some reason it had to be returned. Then the merchant proportionately reduces the profit received. The main thing is not to forget to make adjustments to the income book. Such cases are within the bounds of the law.

Section 1 Income

The income book for individual entrepreneurs on the patent tax system has not only a title page, but also information about the receipt of income.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

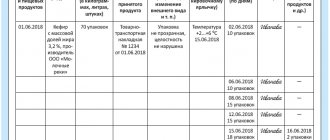

This information is recorded in “Section 1. Income” and consists of the following columns:

- The serial number of the operation.

- Date and number of the document according to which cash or non-cash funds were received (number of bank statement, payment order, Z-report).

- Brief content of the name of the document, as a result of which funds were received for the type of activity specified in the patent.

- Amount of income in rubles. If the profit is received in another foreign currency, then its recalculation at the exchange rate of the Central Bank for the current day is recorded in the accounting book. In situations where payment was made using a bill of exchange or other valuable document, its value is entered in the book.

- Total.

Payment documents include:

- Receipt cash order.

- Agreements, if they are the basis for prepayment.

- TTN.

- Receipts confirming payments.

- Receipt payment orders.

- Other financial documents resulting in the receipt of funds from the buyer.

- Advances received. Moreover, if a return occurs in the future, the operation is reversed, which reduces the entrepreneur’s income in the next period.

Despite the variety of possible transactions that relate to the income of an individual entrepreneur, there are also those that should not be included:

- interest accrued by the bank;

- fines, penalties;

- free receipt of material and intellectual values;

- loan interest;

- other income not related to the patent activity of the entrepreneur.

Entering data into the CUD should occur regularly, on the day of the operation.

The shelf life of the income accounting book according to the law of the Russian Federation is 4 years, but based on the order of the Ministry of Culture of Russia No. 585 of August 25, 2010, this document must be stored much longer. An income accounting book for individual entrepreneurs on a patent 2020, which you will need to download or purchase, is a mandatory form of reporting. For several years, it stores information about the income received under a certain patent, which the tax authorities will request during the first audit. Our goal, as entrepreneurs, is to give them the required document, filled out in accordance with all the rules, and to deprive them of the pleasure of fining yet another taxpayer.

Filling out the book

So, the income register of individual entrepreneurs is filled out in a certain order:

- the first column shows the serial number of the financial transaction, the receipt of which is recorded by the individual entrepreneur;

- the second column contains the number and date of the receipt document;

- the third column succinctly displays the content of the financial transaction;

- the fourth column shows the amount of profit received from the activity specified in the patent.

Keep in mind: it is prohibited to enter transactions that do not relate to this special regime in the income book on a patent. In cases where a businessman, in addition to the PSN, conducts part of his activities within the framework of another taxation system, he has to submit two types of different reports.

Procedure for filling

Business entities using the simplified (patent) taxation system must fill out the following columns, thus:

- the first column will indicate the order number of the financial transaction that is subject to registration;

- the second column will indicate the number and date of the mandatory financial document, which is the basis for the transaction that is subject to recording;

- in the third column, in a mandatory case, a brief content of the financial transaction that is subject to the necessary registration will be described;

- the fourth column will indicate the profit received from carrying out business activities, which is stated in the patent giving the right to such activities.

There is valuable advice on this matter, which is as follows. As stated earlier, the income book for patent activities is used only to record those monetary transactions that take place in the types of activities specified in the patent. No other operations can be indicated in it and this is strictly prohibited. If an entrepreneur conducts part of his activities under a patent, and the other part under the general taxation system, then he will submit two reports, the first for the patent, and the second for another type of activity.

Shoals with a book

In case of violations and incorrect reporting on a patent, one can expect a negative reaction from the state represented by the tax authority. Therefore, the income ledger will be the main focus.

If a tax audit reveals gross violations and inaccuracies in filling out and maintaining a book, this may result in a fine. If we are talking about a single violation, then the size of the sanction is set at 10,000 rubles. When the rules for working with a book were violated or ignored repeatedly over a long period, the treasury will have to pay 30,000 rubles (clauses 1 and 2 of Article 120 of the Tax Code of the Russian Federation). The complete absence of an income accounting book or its ignorance formally also falls under this norm.

Therefore, individual entrepreneurs with a patent can be advised to pay special attention to maintaining and correctly filling out the income book.

Despite the fact that the use of the patent system falls as easily as possible on the shoulders of the entrepreneur, it also has its pitfalls. Therefore, it is better to know about all the pitfalls in advance in order to avoid unpleasant situations with tax inspectors and penalties. Be careful with the patent system, rely on legal norms. In this case, many mistakes can be avoided.

An example of filling out the PSN income book

Purpose of the income ledger under the patent system

In accordance with Law No. 402-FZ, entrepreneurs are exempt from the need to maintain accounting records. Of course, this simplifies the company’s administrative paperwork, but does not eliminate the obligation to record revenue. According to paragraph 1 of Art. 346.53 of the Tax Code, accounting for sales income in terms of activities on the PSN is carried out in a special manner, namely in a special book, the form and procedure for filling which is regulated by the Ministry of Finance of the Russian Federation.

Certification of the book at the territorial office of the Federal Tax Service is not required, as is the preparation of tax returns (Article 346.52). However, despite the fact that when working on PSN, it is not the actual amount of income of an individual entrepreneur that is taken into account, but the conditionally possible one, maintaining KUDiR is necessary to comply with the revenue limits established by law. In 2020, those entrepreneurs whose total income does not exceed 60 million rubles have the right to work on a patent. from the beginning of the year (clause 6 of article 346.45). Business transactions when receiving income in terms of PSN are reflected in chronological order in the accounting book, which allows you to quickly check the amount of revenue for the current period.

The procedure for maintaining CUD for individual entrepreneurs in the patent system

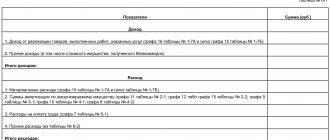

According to the general instructions for maintaining a CUD, it must have the following mandatory details:

- a title page indicating the full name of the business entity, as well as the accounting period;

- the income section, which contains mandatory fields for recording financial transactions (date, name, amount of income, document - basis, etc.);

- on the last sheet of the KUD the total number of pages is indicated.

At the end of the reporting period, the accounting book must be numbered and stitched, on the back of the last sheet it must be sealed with a “sticker sheet” with the signature of the individual entrepreneur. The reporting period is a calendar year.

How to keep an accounting book: methods, procedures and rules for filling out, documents and accounting nuances

First, let's figure out what methods of conducting KUDiR exist. Actually, there are only two of them:

- The accounting book can be purchased in paper form or simply take the template and print it. You can download the form, as well as clarify the procedure for its execution, by going from the portal of the Federal Tax Service of the Russian Federation to the basic official website of the Consultant via hyperlink. Different download formats may be offered:

- PDF - for optimal filling by hand;

- Excel - for saving on a computer and maintaining KUDiR in electronic form.

- Maintaining the Account Book in electronic form is much more convenient. After all, here you can always correct inaccurate information, add or remove extra lines, etc. The only difference in this format is that at the end of the reporting period, for submission to the Federal Tax Service (at the request of the tax authorities), the document is printed, all pages are numbered. Then the Accounting Book is stitched according to standard rules and endorsed by the entrepreneur. If the individual entrepreneur has a seal, its imprint is placed next to the signature of the responsible person.

Entrepreneurs who fill out their Book by hand have the opportunity to make corrections to the document. But such adjustments must be properly executed:

- It is forbidden to use correctors or erase data with an eraser;

- incorrect data is simply crossed out, and the date of correction and the entrepreneur’s visa are placed next to it;

- clarification of data must be supported by original fiscal documents;

- Please note that the presence of a large number of corrections may raise legitimate questions among inspectors, so it is recommended to avoid them.

As we have already said, this document was approved by the Ministry of Finance, the exact name of the form is Appendix No. 3 to Order of the Ministry of Finance of the Russian Federation No. 135n dated October 22, 2012. Do not confuse this template with Appendix No. 1, which is intended to be maintained by simplifiers on the simplified tax system. The template for a business applying a patent is simpler; it does not contain data and sections unnecessary for the report.

In the KUDiR, which is filled out by individual entrepreneurs on PSN, only income is taken into account

Step-by-step instructions for filling out the KUDiR form

As for the form of the Register of Individual Entrepreneurs on a patent and the algorithm for filling it out, everything is elementary. The form contains only 2 sheets - the title page of KUDiR and Section I - Income. Let's figure out what data is entered into the document and how:

- The title page of the Book of Income Accounting for individual entrepreneurs applying the patent taxation system is drawn up at the moment when the received patent comes into force.

- in our case - from the beginning of 2020. If a work permit under PSN was received, for example, from April 1, you need to put the corresponding day of the year (18_04_01) in the “date” block. Please note that the date format is defined as reverse: the last two digits of the year are put first, then the month and only then the day;

- in the block identifying the individual payer, the full name of the entrepreneur is written (as indicated in the passport or extract from the Unified State Register of Entrepreneurs), the numbers of the individual entrepreneur’s business identifier are entered in the TIN line;

- Next come: the region in which permission to carry out commercial activities under the patent was received, as well as the period for which it was issued;

- Filling out the residence address of an individual entrepreneur is not difficult; here you need to write the address according to the requirements of the Ministry of Communications of the Russian Federation: with a zip code and other postal details;

- in the lower left block all current accounts issued to the businessman are indicated. First comes the code number, then the name and location of the credit institution;

- The code of the municipality (OKATO) can be clarified in a separate tax service using the link. Everything is quite simple there: just find in the drop-down list the code of the municipality where the business activity will be carried out;

- OKEI code - data from the all-Russian classifier of units of measurement. When filling out the Accounting Book in our version, it will always be the ruble code - 383.

The title page of KUDiR contains information about the individual entrepreneur on the PSN and the patent he received. - Filling out Section I, which reflects the entrepreneur’s income, should not raise any questions:

- the first column contains the serial number of the registered primary;

- then put the date and number of the primary document;

- the name of the transaction and the amount received from a specific payment by the client or counterparty;

- many do not take into account (and the format of this column is not configured in the tax template) that the amount of income should be indicated in rubles;

- if the form is maintained electronically, the final line of the template - “total” - sets the autosum;

- In this case, do not forget to immediately set up the footer, which should indicate the page numbering. In our case - No. 1, but if there are many receipts per month, KUDiR can stretch over several sheets. It is important that the numbering of the pages is reflected when printing; an unnumbered Book will not be accepted by the tax authorities;

- It is necessary to note one more important point that is worth knowing: the page numbering, according to the document flow standard, does not include the title page of the Book, so section No. 1 begins from the first page.

In section I KUDiR, when receiving income, all four columns are filled in; if there is no income, the fields are left empty - The final page of the Book (regardless of the format in which it was kept) indicates the total number of completed sheets. The electronic KUDiR is printed and endorsed by the entrepreneur. Moreover, the signature must be personal. A book that is not signed by the owner of the business may not be taken into account during the audit.

So, if everything is obvious according to the algorithm for designing the title page of KUDiR (see step-by-step instructions above), then when drawing up the first section of the accounting document you need to know certain formal requirements. They are as follows:

- The KUDiR must reflect all the actual business income of the individual entrepreneur on the patent, these include both receipts of money to the current account or cash register of the individual entrepreneur, and funds received in kind, as well as profits in foreign currency. What needs to be taken into account here is that profits earned from business activities not covered by a patent are not included in this Book.

- Business expenses are not reflected in this document, which is logical, because they are taken into account in the tax accounting of this regime (there is not even a column for this in KUDiR).

- All entries in the register are made strictly in chronological order. This rule is regulated in subparagraph 1.1 of Appendix No. 4 to Order of the Ministry of Finance of the Russian Federation No. 135n.

- When opening a new patent, a new accounting book is opened for each new reporting period (see paragraph 1.4 of the specified Appendix). If an individual entrepreneur receives a new patent to replace the expired old one, it is logical that a new Book begins to be maintained, since, according to paragraph 2 of Article 346.49 of the Tax Code of the Russian Federation, the reporting tax period is the period for which the patent permit was issued.

- All data is entered into KUDiR based on the primary data. The list of primary documentation is closed; only the following documents can be included here:

- originals of individual entrepreneur contracts with contractors or individuals;

- cash receipt orders;

- fiscal checks, payment orders;

- invoices reflecting profit (so-called TTN);

- strict reporting forms (SRF).

- The income accounting book is compiled in a single copy.

- The storage period for KUDiR is determined by tax legislation and, as for all tax reporting, is 4 years. If papers are destroyed or lost, fines may be imposed on the private enterprise.

- When the business of an individual entrepreneur extends, including to foreign counterparties (clients), the register must be kept strictly in Russian, all fiscal documents must be translated into Russian.

- All amounts are entered in the registrar in rubles and kopecks;

- Since the reporting period of PSN payers is 1 calendar year or (if the patent validity period is shorter) the period for which the PSN permit was issued, the Book is maintained on an accrual basis without defining intermediate reporting periods (month, quarter, half-year). This is the difference between the Book of PSN-payers and the registers of other taxation systems.

The regulator will not notice if minor errors are made during the registration of KUDiR. The key requirement here is that the register is maintained regularly and contains complete data on all completed individual entrepreneur operations.