Hello! Today we’ll talk about the distribution of LLC dividends.

Opening a business is always aimed at obtaining a stable income for its founders. In all limited liability companies, the main method of distributing profits is the payment of dividends, which is regulated by a number of laws, as well as internal documents of the LLC itself. Therefore, owners may have many questions related to this complex process.

Content

- Types of dividends

- Source for calculating dividends

- How is the decision to pay dividends to an LLC made?

- When a decision cannot be made

- Deadline for dividend payment in LLC

- Dividend payment form

- How to receive dividends

- Calculation of LLC dividends

- How to pay dividends to the founder of an LLC

- Dividends on preferred shares

- Dividend payment

- Responsibility for non-payment of dividends

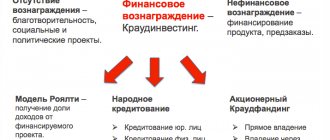

Types of dividends

Dividends are understood as an absolutely legal option for receiving profit from an investment in an enterprise. From the accounting and financial accounting perspective, dividends in an LLC are a certain part of the net profit received. It is almost always distributed between the owners and participants, according to the invested share in the authorized capital.

In economic practice, there are many classifications of this concept.

They are divided into the following types:

By type of shares for which accrual is made:

- For ordinary shares;

- For preferred securities.

By payment frequency:

- Menstruation (extremely rare);

- Quarterly;

- Semi-annual;

- At the end of the year.

By payment form:

- In monetary terms;

- In property or in kind.

By payment amount:

- Partial;

- Full.

As expected:

- Main results of the enterprise's work;

- Additional (special or extraordinary).

All these options for paying dividends to an LLC must be enshrined in the charter documents, regulating the subtleties of the distribution and payment procedure.

How often can an LLC pay dividends?

Dividends can be distributed quarterly, semi-annually or at the end of the year. The frequency of payments is prescribed in the company's charter.

The best option is payment at the end of the year. If dividends are distributed before the end of the financial year, they are called interim dividends. There is a risk of recognizing such dividends as remuneration if at the end of the year the profit turned out to be less. And in this case, insurance premiums will be charged on the amount of payments, which will have to be paid additionally.

Source for calculating dividends

The calculation and accrual of dividends is always made only from the amount of net profit remaining at the full disposal of the enterprise after withholding and paying mandatory fees and taxes. However, the legislation on LLC practically does not contain the concept of net profit. Therefore, the basis is taken from the accounting data of the enterprise, which is documented by the balance sheet and its annexes.

These documents contain a line in which retained earnings are displayed or an uncovered loss from activities in a certain period is indicated. The concept of “retained earnings” reflects the economic result from all types of activities minus mandatory expenses and taxes, including penalties (clause 79 of the Regulations on Accounting and Reporting in the Russian Federation).

There is a need to determine the amount for payment of dividends not only at the time of the meeting, but also immediately before the distribution of the amount. This is due to a possible change in net income due to accounting adjustments or additional changes to the balance sheet.

The amount shown on the balance sheet is the basis for calculating dividends. The founders decide what portion to pay. If the authorized capital of such a company has a communal or state share of funds, it must necessarily pay at least 30% of the amount of net annual profit.

How is the decision to pay dividends to an LLC made?

Accruing and paying dividends to all founders or participants of an LLC is a right, not an obligation, which is enshrined in the charter document. According to the generally accepted rule, the distribution of dividends from an LLC is made in proportion to the shares invested in its authorized capital (clause 2 of Article 28 of the LLC Law).

All answers to questions regarding the distribution of the company’s net final profit are contained in the documents:

- Charter provisions;

- Corporate agreement between all participants;

- Provision on profit distribution (internal).

The law does not prohibit making changes to documents and paying dividends disproportionate to the invested capital of participants. In practice, there are many situations when such a corporate agreement is revised and new persons are added to it who have the right to receive a part of the final profit. The main condition is to hold a general meeting to make appropriate additions to the agreement with the unanimous approval of all LLC participants. In this case, you can limit yourself to changing the corporate agreement without revising the charter (Civil Code of the Russian Federation, Art. 66.1 and Art. 67.2).

It is legally established that all potential participants must be notified of the meeting 30 days before it takes place. Payment will be made to all persons indicated in the register, regardless of their presence at the meeting.

All issues related to the amount and timing of payment of dividends are resolved only at a general meeting with the participation of the founders of the company (Law on LLC, clause 7, clause 2, article 33). This important function cannot be taken over by another organization (as well as putting pressure on the management of the company in the distribution of income).

To discuss and make a decision on the possibility of paying dividends:

- A general meeting is held at which financial documentation and accounting reports are presented;

- The share of income received for the payment of dividends to LLC participants is determined, and a decision is made on the procedure for distributing this amount;

- A collective decision is made on the timing and form of payments based on a mathematical majority from among the company participants present.

After the meeting, based on the signed minutes, the management of the LLC must issue an appropriate order.

When a decision cannot be made

Considering that the payment of dividends based on the results of work is only the right of the LLC, it may not make decisions and direct all income to the development or modernization of production facilities and other urgent needs.

But there are situations in which a decision is not made or may be considered illegal:

- Until the redemption of all issued shares at the request of the founders or shareholders;

- If the management of the company does not comply with the requirements for the required amount of net assets;

- Until full payment of contributions to the authorized capital of the LLC;

- At the slightest sign of bankruptcy.

If a decision is made that bypasses such situations, it can be challenged by any LLC participant in court.

What dividends can there be?

For convenience, we have collected all the information in a table:

| By payment method | By payment amount | By payment frequency | By type of shares | |||

| Cash bonuses | Enterprise property | Full | Partial | Quarterly, semi-annual, annual | Regular | Privileged |

| Payments are made in cash equivalent | The organization puts into circulation additional shares through transfer to shareholders | One-time payments | Paid in installments throughout the year | Dividends are distributed by the board of directors | Shares are enshrined in the charter of the enterprise, their profitability is higher and there are advantages in the order in which they are received | |

In what cases can a company not pay dividends?

According to the Law “On Joint Stock Companies”, declared dividends on shares cannot be paid in the following cases:

- the company has signs of bankruptcy;

- the company will go bankrupt when paying these dividends;

- the value of the company's net assets is less than the sum of its authorized capital and reserve fund;

- the value of the company's net assets will become less than the above amount as a result of the payment of dividends.

In fact, all this can be boiled down to one thing - dividends are not paid in the case where the payment will lead to serious consequences for the organization or an increase in the risks of such consequences.

Deadline for dividend payment in LLC

In a limited liability company, the frequency and timing of payment of accrued dividends must be regulated by the charter and internal regulations. In most cases, the decision to pay dividends to an LLC is made after summing up the results of work for the previous reporting year, but it can be quarterly or even monthly (Law on LLC, clause 3, article 28). Dividends that are accrued once a quarter or half a year are called interim.

Often, the payment period is included in the charter at the stage of establishing the enterprise. In any case, the maximum permissible period after the decision is made should not exceed 60 days. In individual cases, the founders provide for the possibility of deferring payments for up to 3 years. In such a situation, any LLC participant has the legal right to appeal to the courts and receive their share of the amount of undistributed profits (Resolution of the Federal Antimonopoly Service of the North-Western District dated January 21, 2013 N F07-7846/12).

Dividend tax for legal entities in 2020

A participant in a limited liability company can be not only an individual, but also a legal entity (Russian or foreign company). Taxation of dividends paid by legal entities in 2020 is carried out according to the standards established by Article 284 of the Tax Code of the Russian Federation.

| Tax rate on dividends in 2020 for organizations | |

| Russian organization | 13 percent |

| A Russian organization, if for at least 365 calendar days before the decision to pay dividends is made, it owns a share of at least 50% in the authorized capital of the organization that is the source of the payment. | zero |

| Foreign organization | 15 percent or other rate if provided for by an international agreement for the avoidance of double taxation |

As we can see, if a Russian organization has at least 50% in the authorized capital of another Russian company, then no income tax is levied on dividends received (zero rate). To confirm this benefit, the participant-legal entity must submit to the inspection documents confirming the right to a share in the capital of the organization paying the income.

Such documents may be:

- contract of sale or exchange;

- decisions to divide, spin off or convert;

- court decisions;

- agreement on establishment;

- deeds of transfer, etc.

Income tax on dividends in 2020 is also established for legal entities that operate under special regimes (USN, Unified Agricultural Tax, UTII). In relation to the income they receive from their activities, such legal entities do not pay income tax. However, exceptions are made for income received from participation in other organizations:

- for companies using the simplified tax system, the provisions of paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation apply;

- For companies on the Unified Agricultural Tax, the norms of paragraph 3 of Article 346.1 of the Tax Code of the Russian Federation apply.

These articles explicitly state that the special tax regime does not apply to profits received from participation in other enterprises. As for companies on UTII, although there is no such direct clause, the exemption from income tax applies only to income received from the types of activities specified in Article 346.26 of the Tax Code of the Russian Federation.

Thus, the tax on dividends of a legal entity in 2020 is paid in the form of income tax (at the rates indicated in the table), even if, in general, a company under a special regime is exempt from paying this tax.

As in the case of an individual participant, the tax agent obligated to withhold and remit income tax is the organization that paid the dividends. The tax payment deadline is no later than the day following the day of payment (Article 287 of the Tax Code of the Russian Federation).

Dividend payment form

In most cases, dividends to shareholders are paid in cash. But the charter may provide for payment in the form of other property. Almost always these are own shares or securities of subsidiaries. This economic practice is better known as “reinvestment” or “income capitalization.” It is increasingly used in the domestic economy and contributes to the development of enterprises, their expansion and modernization.

In some individual situations, payment of dividends in material form is provided in the form of property or products of the enterprise. It may apply to holders of common stock, but is also subject to tax.

Collection of taxes on dividend payments

It should be noted right away that taxes must be transferred the next day after receiving dividends.

If the amount of income is paid to an individual, then personal income tax is transferred to the budget. The tax rate is 13% for Russian citizens and 15% for non-residents.

Payments to founders - organizations are subject to income tax. In most cases, the tax rate is 13% for Russian organizations and 15% for foreign companies.

It should be borne in mind that when receiving dividends, income tax is paid by organizations that are subject to both general and simplified taxation systems.

How to receive dividends

All participants who were included in a special register at the time the decision on payment was made have the right to receive income and accrue dividends to the LLC. The issue with the founders is also resolved, but with regard to the latter there may be many nuances in the statutory documents.

The situation is more complex when distributing payments between holders of different shares. The latter must be included in a special register, drawn up in a list for a certain date.

Recent changes in legislation have an important nuance: when shares are sold after the day the register for dividend payments was compiled, their former owner retains the right to receive this type of income for the previous period.

The order depends entirely on the type of shares: for ordinary and preferred shares, interest on net profit is paid separately.

Is it possible to pay dividends from the profits of previous years?

Yes, you can. The fact is that Article 43 of the Tax Code establishes the deadlines for making a decision on the payment of dividends, but we are talking only about the profit of the reporting year - participants can make decisions on payments only based on the results of a quarter, half a year, 9 months or based on the results of the calendar year. At the same time, the distribution of profits from previous years as dividends is not regulated or limited in any way. Accordingly, participants are free to distribute such profits at any time and with any frequency.

Still, it is worth making one caveat. If the net profit was used to form funds provided for by the organization’s charter, then payments from it are not recognized as dividends. Only if the accumulated profit has not been directed anywhere, the meeting of participants or shareholders can distribute it in this capacity.

Calculation of LLC dividends

After holding the scheduled general meeting and resolving all organizational issues, management must accrue dividends in accordance with the adopted protocol and the issued order. If the accrual of dividends to the LLC was provided for share and proportional to the amount contributed to the authorized capital, then the formula can be applied:

Net profit × Participant's share (in%)

This is a simplified formula that explains how to calculate LLC dividends in most situations. It is valid and, if necessary, distribute dividends to the LLC under the simplified tax system. In other cases, the percentage per share or share will be regulated by the minutes of the general meeting.

To calculate the amount per share, you must use the dividend yield ratio:

DD= (Amount of dividends for the year / Market value) × 100%

All payments must be made by the time the register is closed. After which, personal income tax on dividends must be deducted from the amount. Currently it is 13%.

How to pay dividends to the founder of an LLC

According to the laws and charter of the company, the amount of dividends to the founders can be calculated without taking into account the percentage of its share in the authorized capital. However, such a possibility must be taken into account in the statutory documents and properly formalized. Otherwise, unpleasant controversial situations often arise when filing a personal income tax return with the tax office.

This feature is associated with the interpretation of Article 43 of the Tax Code of the Russian Federation, which defines dividends as the financial income of a company participant, which must be paid in an amount strictly proportional to the invested share. If the amount of interest received by the founder exceeds the specified amount and is not documented by the statutory documents, tax deductions for it will be carried out in an increased amount. The tax service has every right to equate such dividends to another type of income.

The legislation provides that a company can be created by one person. In this case, the resolution specifying the payment of dividends to the sole founder of the LLC is adopted by him alone. At the moment, there are no clear explanations on the form of the minutes of the meeting in this case, but all regulatory and inspection bodies insist on its presence.

Dividends on preferred shares

Preferred shares may provide their holders with certain advantages when paying dividends. In most situations, the percentage of payment when distributing profits is fixed in the company's charter, but may also depend on the par value of the share.

Main advantages over ordinary shares:

- They have a clearly fixed mechanism for calculating dividends;

- Certain frequency of accruals;

- Expanded list of sources for payment;

- Advantage in line to receive interest.

Some LLCs, during stable and profitable operation, create special funds in which they reserve part of the profit. In the event of a lack of financial resources, funds from such “reserves” are spent on paying dividends only on issued preferred shares (JSC Law, Article 42, paragraph 2).

At the same time, if a special rate is not established for preferred shares, their owners will receive dividends in an amount equal to ordinary shares. If the board of the company decides not to make payments based on the results of an unfavorable reporting period, the owners of preferred shares also do not have the right to receive their share.

Reflection of dividend transactions in accounting

Dividends may be distributed among the following groups of owners:

- If the founder is a legal entity, then the accrual of dividends is reflected by posting D84.03 K75.02. Since such members of the company must pay tax on dividends received, this will be an income tax and will be reflected in posting D75.02 K68.34. When dividends are paid, entry D75.01 K 51 is drawn up.

- The most common case is when the founders are individuals. If the founder works in the company, then the amount of dividends due is reflected by posting D84.03 K70. The personal income tax amount will be reflected in D70 K68.01. Payment of dividends, for example, through a current account, is reflected by posting D70 K51.

- The individual founder is not always an employee of the company. In this case, dividends are accrued according to D84.03 K75.02. The amount of personal income tax on income received is recorded by correspondence D75.02 K68.01. Dividends can be received by the founders in a form convenient for them, the postings will be similar. For example, a transfer to the owner’s account will be reflected by posting D75.02 K51.

Accounting is not difficult. The postings are identical to those made when distributing profits for the reporting year. The difference is in the subaccounts used to the 84th account, if they are used.

As we can see, dividends are currently paid both from the profit of the reporting year and from retained earnings received in previous reporting periods. In order for profits to be distributed, the owners of the company must make a decision on the payment of dividends, which is fixed on paper. The document is handed over to the head of the company, who issues an order to pay dividends and submits it to the accounting department for execution. Dividends are paid to the founders in ways convenient for them, which are fixed in the protocol (decision). Not only monetary amounts can be paid, but one can also receive one’s share in material assets, goods or property. All these nuances are prescribed in the organization’s documents. After receiving his share of income, the owner is obliged to transfer the tax to the budget in full and on time.

Dividend payment

Dividends for LLC members are often paid in cash.

The amount can be transferred to a person in two main ways:

- To an open account in any bank (non-cash method);

- Through the company's cash desk in cash.

If the date of the last day of payments coincides with a holiday or weekend, it must be moved to the next working day. The amount of dividends is transferred to accounts without taking into account withheld taxes.

Responsibility for non-payment of dividends

If a company violates the rights of shareholders and participants to pay dividends, the latter can go to court to enforce their collection. The statement of claim may also indicate interest for the entire period of delay. In some situations, such a violation of payments becomes an administrative offense (Administrative Code Art. 15-20).

Any limited liability company is in fact an economic entity, therefore court hearings are held only in an arbitration court (even when a claim is filed by an individual).

If an LLC participant has not received dividends for an objective reason (has not provided reliable information about the place of residence, current account or other clarification), he can demand them from the company within 3 years after the end date of payments. If a pre-trial audit reveals that the reason for non-payment was the lack of a decision on the distribution of dividends, the claim will be rejected.

We pay dividends: non-standard situations

Disproportional distribution

The charter of an LLC may determine that profits are distributed among participants not in proportion to their shares in the authorized capital, but in a different proportion.

This is permitted by paragraph 2 of Article 28 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies”. However, not everyone knows the consequences of such a disproportionate distribution of dividends. Let us recall that in a normal situation (when profits are distributed in proportion to the shares of participants), when paying dividends to the founders, the company, as a tax agent, must withhold and pay 9 percent of personal income tax to the budget if the founder is an individual. And in the case where the founder is a legal entity, the income tax rate is 0 percent or 9 percent. That is, the tax rate paid on dividends is preferential, be it personal income tax or income tax. Does the same rate apply to dividends in case of disproportionate distribution of profits?

To begin with, let us turn to the definition of dividend, which is given in paragraph 1 of Article 43 of the Tax Code of the Russian Federation. It says that a dividend is any income received by a shareholder (participant) from an organization when distributing profits remaining after taxation on shares (shares) owned by the shareholder (participant) in proportion to the shares of shareholders (participants) in the authorized (joint) capital of this organization.

From this definition, officials conclude: profit received by a participant in excess of his share is not a dividend in the sense of the definition given for tax purposes. This means that this amount forms another income of the founder, to which a general rate is applied: 13 percent when paying income to an individual, 20 percent when paying income to a legal entity (letter of the Ministry of Finance of Russia dated January 30, 2006 No. 03-03-04/1/ 65, dated June 24, 2008 No. 03-03-06/1/366).

Please note that the general rate (13 or 20 percent) does not apply to the entire amount of distributed profits, but to the excess amount. Although in practice, tax authorities may try to tax the entire amount at a higher rate. In this case, justice can be restored in court (resolutions of the Federal Antimonopoly Service of the North-Western District dated January 12, 2006 in case No. A44-2409/2005-7, FAS Ural District dated December 12, 2007 No. Ф09-10292/07-С2). But unfortunately, there are no examples in judicial practice where an organization managed to refute the position of the Ministry of Finance and prove that a preferential tax rate can be applied to the entire amount of a “disproportionate” dividend.

Who must pay the excess tax?

It turns out that in the event of a disproportionate distribution of profits, two rates will be applied to the participant receiving an inflated amount of dividends: 9 and 13 percent for personal income tax; 0 (9) percent and 20 percent for income tax. That part of the tax to which the preferential rate applies must be withheld by the company paying the dividends. The question arises: what should society do with the remaining amount of dividends that were not subject to taxation at a preferential rate? Also withhold tax, but at a rate of 13 (20) percent?

It all depends on who exactly is the founder who received an inflated dividend amount. If it is a legal entity, then the company does not need to withhold tax from this amount as a tax agent. The fact is that an organization that pays “dividend” income to its founders, legal entities, is a tax agent only in relation to dividends. And a dividend in the tax sense, as we noted earlier, is the amount of income corresponding to the participant’s share. The excess amount is not, in fact, a dividend; therefore, the company should not withhold tax on this amount.

Consequently, the tax on this income (at a rate of 20 percent) must be paid by the participant himself, including this amount in his non-operating income. True, if a participant owns more than 50 percent of the authorized capital of the company, then he can take advantage of the benefit established by subparagraph 11, paragraph 1 of Article 251 of the Tax Code of the Russian Federation and not be taxed on the excess amount.

If the participant receiving an inflated dividend amount is an individual, then it is the company paying the dividends that must withhold personal income tax on both parts: on dividends - at a rate of 9 percent, on the excess amount - at a rate of 13 percent. We made this conclusion based on Articles 214.1, 227 and 228 of the Tax Code, which describe situations when an individual independently pays tax on his income. The situation in question with disproportionately distributed dividends is not mentioned there. This means that the general rules apply and income tax is withheld from the source of payment of income (tax agent).

Refusal of dividends in favor of the company

The next non-standard situation is that the participant refuses dividends in favor of the company. Officials believe that in this case, despite not receiving dividends, the participant still has taxable income. Experts from the Ministry of Finance explain theirs by saying that “the possibility of a taxpayer refusing to receive dividends is not provided for by current legislation” (letter of the Ministry of Finance of Russia dated October 4, 2010 No. 03-04-06/2-233). The date of actual receipt of income, as noted by the Ministry of Finance, is the day the taxpayer refuses the dividends due to him in favor of the organization that pays them. Does the conclusion of the Ministry of Finance comply with tax legislation?

It is quite difficult to answer this question unambiguously. On the one hand, according to Article 210 of the Tax Code of the Russian Federation, when determining the tax base, all income (including dividends) of the taxpayer is taken into account, both actually received and those over which he has the right to dispose. In this situation, this norm confirms the conclusion made by officials. After all, we can say that the participant, by refusing to receive dividends, actually exercised his right to dispose of the income due to him. However, we must not forget that personal income tax is withheld by the tax agent from the taxpayer’s income upon actual payment. In this situation, the company simply has nothing to withhold tax from, since no payment of funds occurs to the participant.

In addition, the fundamental principle of determining income for tax purposes is enshrined in Article 41 of the Tax Code of the Russian Federation, according to which economic benefits in cash or in kind are recognized as income. In case of refusal of dividends, it is not entirely fair to talk about economic benefits.

In general, the situation is ambiguous, so in order to avoid risks it is better not to allow it. The founder does not have to refuse to receive dividends. It is necessary to distribute the net profit, but “forget” to transfer dividends to him. In such a situation, the company will simply have a debt to the participant, which, after three years from the moment when dividends should have been paid, will be restored as part of the company’s retained earnings.

Now let's change the situation a little. Let's assume that the company's participants decided to distribute the net profit in such a way as to transfer it to only one of the participants, making a corresponding decision at the general meeting and making appropriate changes to the charter. In fact, the remaining participants in this case (as in the situation described above) also refuse dividends, but not in favor of the company, but in favor of another participant. There are no longer any risks that arise when refusing dividends in favor of society. After all, such a distribution is permitted by current legislation, provided that such an order is determined by the charter of the company.

Veiled payment of dividends

Let's consider another non-standard option, which is often used in practice. The founder is a legal entity, and its share of participation in the company exceeds 50 percent. Let’s assume that the general meeting of the company’s participants decided that dividends will not be paid. At the same time, a decision is made to use the company’s net profit to replenish the working capital of the parent company. As a result, the founder will still receive income, but not in the form of dividends, but in the form of funds received free of charge.

Why is this being done? Then, in order not to pay tax on dividends. After all, no tax is paid on money received free of charge thanks to the benefit provided for in subparagraph 11 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation. According to this norm, when determining the tax base, income in the form of property received by a Russian organization free of charge from the organization is not taken into account if the authorized capital of the transferring party consists of more than 50 percent of the contribution (share) of the receiving organization.

However, this trick won't work. Officials believe that such amounts meet the criteria inherent in “dividend” income, which means they should be taxed as dividends (letter of the Ministry of Finance of Russia dated July 26, 2010 No. 03-03-06/1/485).

But it is possible to replenish the founder’s working capital at the expense of the company’s working capital, that is, without affecting the company’s net profit. The result is almost the same - the founder will receive his tax-free income, and there are no tax risks.