Bitcoin (BTC) is a payment system and digital currency that was initially not known to the general public, arousing interest only among computer geeks. But in recent years, its influence on the financial world has become so strong that it has attracted the attention of almost all categories of people. Many people began to wonder whether how to invest in Bitcoin and make a profit.

Technically, investing is easy - fortunately, there are a huge number of centralized and decentralized services that work with cryptocurrencies. From an economic point of view, it is somewhat more complicated - when investing in Bitcoin, you need to be fully aware of the risks, since Bitcoin is not an ordinary stock, but an extremely unstable asset.

Ways to invest money in cryptocurrency:

- Invest in BTC.

- Get into mining.

- Trade Bitcoin.

There are several ways to invest in Bitcoin, some of them are simple and suitable for beginners, others are very complex and require a lot of knowledge and skills.

Investment

The strategy of buying and selling Bitcoins and then making a profit is no different from the strategy of buying and selling stocks or commodities in traditional markets. An investor buys cheap and sells high, making money on the difference in exchange rate. Unfortunately, the BTC market is so volatile that it is extremely difficult to predict when its price will rise or fall. Therefore, any investment in Bitcoin involves risks.

How to buy Bitcoin

There are several ways to invest money in Bitcoin:

- Buy Bitcoin on a crypto exchange for another cryptocurrency, if you have one. More information about exchanges and working with them will be discussed below. After the purchase, it is recommended to withdraw funds to your wallet, since long-term storage on a centralized site is unsafe - exchanges are one way or another susceptible to hacking.

- Buy on a crypto exchange for fiat. Some platforms, now more and more of them, support working with fiat, that is, traditional currencies (dollar, euro, ruble, etc.). This is a convenient option for those who are entering cryptocurrency for the first time and want to purchase it with minimal inconvenience - for example, from a bank card.

- Buy through a Bitcoin exchanger. Such services provide the widest range of possible exchange directions. Aggregators like BestChange will help you choose a reliable exchanger that you can trust with your funds and that won’t ruin you on commissions. Using the exchanger is easy, just follow the instructions and enter your details.

Popular exchangers: 60cek, ProstoCash, Baksman, Kassa, Matbea, Nicechange, Mchange, Bitobmen and others.

Bitcoin exchanger 60cek - Buy on a p2p platform. The most famous of them is LocalBitcoins. On it, some users can post their advertisements for the sale of currency, and others can respond to them. The method is available for many countries and exchange directions; even a transaction using cash is possible if you find a counterparty from your city.

Exchange Localbitcoins - Buy through payment systems that support this function (ADVCash, WebMoney, Payeer, Epayments).

Advcash payment system

Residents of the United States and some European countries also have the opportunity to use a special ATM. The first such device was located in Vancouver and already carried out $100,000 worth of transactions in the first 3 days.

Where to store Bitcoin

It is not enough to simply invest money in Bitcoin; you also need to ensure that your savings are stored as securely as possible. The idea is to store private keys that give access to and management of the balance. Common options for cryptocurrency wallets for Bitcoin:

- Exchange. Involves using the cryptocurrency exchange balance directly. Examples – Binance, EXMO, Currency, Crex, Kucoin. Suitable only for short-term storage of BTC and in small volumes. The advantage is that you don't need to install any software. You buy coins and they immediately go to your account. And access to the exchange is carried out from anywhere in the world and from any device, just log in to the website.

Binance wallet - Desktop. It is an application for a computer or laptop. When used, private keys are stored directly on the user’s device, and not on the server side. This increases the level of security, although dangers can also lurk on the computer - viruses, Trojans, spyware. Desktop wallets come in “thick” and “thin” varieties. The first ones (for example, Bitcoin Core) take up a lot of hard disk space because they download the entire blockchain onto it and periodically synchronize with it. The latter (for example, Jaxx, Exodus, Electrum) do not download the blockchain and take up very little space, but their level of security is slightly lower.

Exodus wallet - Web wallet. Bitcoin can be stored using online services. These include exchanges and individual resources - Matbea, Blockchain, Green Address, Coinbase, etc. Private keys are stored on the server, which reduces the level of reliability, but such sites are convenient to use, logging in from any device. The main thing is to choose reliable, proven services based on reviews and reviews. The Matbi multicurrency crypto wallet has proven itself best on the Russian market. There are also “cold” wallets for reliable safe storage of cryptocurrencies, as well as a built-in online exchanger for instant exchange of digital currencies into rubles and back.

- Mobile. This option is suitable for storing small amounts due to its functionality and security being reduced to a minimum. May be suitable for those who often need to transfer funds on the road or in other places where there is no access to a main computer. This is not a good option for storing large and long-term investments. Example: Coinomi, Jaxx, Exodus.

- Hardware. But this option, on the contrary, is used by investors very often. Externally, a hardware wallet is similar to a flash drive, but only stores information about the keys that give access to cryptocurrency management. To transfer funds, you need to connect the device to a computer with software installed on it. But even if the device is lost or stolen by an attacker, you need a PIN code to use it. When the wallet is not connected, it does not connect to the Internet, so it is completely protected from hacker attacks. The two most famous companies that produce such wallets are Ledger and Trezor.

Trezor wallet - Paper. This method is also characterized by increased security. QR codes are printed on paper, in which the keys are encrypted. You need to scan them to be able to use Bitcoins. There are special services (BitAddress) for printing a paper wallet in a beautiful form. It is then recommended to laminate it and, of course, store it in a safe place.

Bit Address paper wallet

How to transfer Bitcoins: address and private key

There are such concepts as a private address (key) and a public address (key). It is their combination that makes Bitcoin the safest decentralized currency. To understand why these concepts are needed, we can give an example from real life.

There is a physical mailbox where you receive mail (letters, notices, etc.). It has a specific address and number. The postman needs to know the house and apartment number in order to deliver mail.

And you have a key to the mailbox, thanks to which he can open it and pick up the letters he received. This key is not given to anyone unknown and is kept secure at all times so that the confidentiality of the contents of the box is safe.

The same thing happens in the Bitcoin world: the public address must be known to the person who is going to send you cryptocurrency. And to use the funds received, you need a private key to the wallet. It is kept in a safe place and not shared with anyone.

From a technical point of view:

- Private key is a password consisting of letters and numbers, a long 256-bit number that is randomly generated at the time the wallet is created. The degree of randomness is determined by cryptographic functions. An example of the appearance of a private key: KyLAyw1DwaBjx9Cab5jWSFGKU1NJjGszRQ2M8b4L4jEMYBNnGmJu. Private keys are used to make irreversible transactions, providing a mathematical signature for each transaction that prevents it from being copied.

- A public key or address is another number that is generated from the first using cryptographic functions (but decryption in the opposite direction is impossible, that is, no one can recognize a private one, having only a public address). In "base 58" encoding, it starts with "1" or "3" and is 33-34 characters long. An example of the appearance of a public address: 1Nv7aDqDmRKnUgGtgQzhMYYxK3mSmXqh95. This address is needed by the one who transfers Bitcoins. It is noteworthy that an unlimited number of public keys can be linked to one private key.

Reviews about cryptocurrency

When deciding to invest in BTC, choosing a place to store or purchase a token, it is important to study user comments. By paying attention to the opinions of people leaving reviews about the Bitcoin cryptocurrency, it is easier to navigate the digital network. Comments must be real.

User reviews help in solving various problems:

- Choosing a broker, exchanger or exchange platform.

- Finding a place to buy cryptocurrency.

- Deciding on the best place to store BTC.

- Making profitable purchases online and so on.

Mining

You can invest in Bitcoin by purchasing mining equipment or cloud mining contracts.

Mining is the process of finding a new block of transactions that is added to the blockchain. For each block found, miners receive a reward in the form of BTC coins. To find a block, you need to make certain calculations. If in the first days after the creation of Bitcoin, an ordinary computer was enough for this, now the complexity of calculations has increased so much that it requires expensive equipment to purchase and maintain.

Thus, mining Bitcoin is not always profitable, but this does not stop many enthusiasts from trying. Let's consider what you need to do if you want to try this method of investing.

How to invest in Bitcoin mining

First of all, create a wallet where your earned BTC will be transferred. Further:

- Use the mining calculator to calculate your potential profit. Keep in mind that mining equipment is expensive and consumes a lot of electricity. By playing with the settings in an online calculator (for example, cryptocompare.com/mining/calculator), you can understand whether it’s worth starting at all. Try to provide as much information as possible, including the cost of electricity in your city and the mining pool's commission.

- Buy an ASIC miner and a power supply for it. This is an application integrated circuit designed specifically for Bitcoin mining. It is a computer chip that is run using a power supply. ASICs vary in price, power and energy efficiency. Even at the stage of working with the calculator, you should have chosen a device that would give the fastest payback and income (taking into account energy costs).

ASIC Bitmain - Connect the device to the power supply and to the router. The wireless connection is not stable enough, use cable E. In the router settings, find the miner’s IP address and paste it into the browser to access the parameters.

- Download the mining program. The most popular are CGminer and BFGminer, but they can present a challenge for those who are not command line savvy. With a graphical interface, there is EasyMiner for Windows, Linux and Android - its interface is intuitive even for a beginner.

- Join the pool. This is a group of miners who, in order to extract BTC faster, combine their power. Only by being in a pool can an ordinary person compete with large corporations with enormous equipment capacities. Joining the pool is free, but then it will charge a 1-2% commission. Reliable established pools – BitMinter, CK Pool.

hashrate distribution between pools - Configure the ASIC to work in a pool. Specify the IP address of the mining pool, worker name and password. After saving the settings, the device will start working. Progress can be monitored on the pool website. True, the first information will not appear there immediately, but in about an hour.

Regularly withdraw mined Bitcoins from the pool to your wallet. Some pools have a specific payout schedule (including automatic ones), some allow you to do this at any time.

Cloud mining

There are several different cloud mining service providers on the market today (IQmining, Genesis, Hashflare, etc.). All of these companies provide computing power for rent. You can buy them from anywhere in the world and receive income from mining, which is physically carried out on the other side of the planet.

How to invest money in Bitcoin through cloud mining:

- Choose the appropriate service. Carefully research what terms it offers. If a service guarantees too good conditions at minimal cost, then these are most likely scammers. Make sure the organization is legitimate and has a positive reputation. You can also study reviews, but only on trusted sites.

- Choose a contract that suits the price, time and rental capacity. While the contract is active, you will receive passive income with the exception of commissions from the cloud mining service itself, which are needed for equipment maintenance and other expenses.

- Withdraw money to your wallet. The contract begins to work from the moment of purchase. As soon as you have accumulated a sufficient amount for withdrawal, you can send it to your BTC wallet. Some platforms support automatic withdrawals based on the schedule.

How to make money on Bitcoin?

Or not. Let's start from the very beginning. Is it possible to make money on cryptocurrencies and, in particular, Bitcoin? The answer is obvious - definitely yes. If you really want to try it, it will all depend on the method you choose.

There are several ways to make money on bitcoins. Let's start in chronological order.

- Create your own cryptocurrency. Yes, I understand that at the moment the technology is not accessible to ordinary people, but have you noticed the fact that various cryptocurrencies appear with enviable regularity? I think this is no accident. The only thing left to do is to make friends with those who create them.

- Mining. Create your own farm to generate “cryptocurrency”, and then sell your “mined” hard-earned money for real money. The meaning here is clear: we buy expensive equipment and move on. Just remember that it makes sense to calculate the profitability first. Will you be able to recoup the money invested, since the complexity of the calculations increases every month?

- Investing and/or speculating in Bitcoin. Let's be honest: buying a product to resell it in the short or medium term is not investing, it is speculation. I have a very positive attitude towards this term since the days when I took courses on Forex trading. The meaning is also clear: buy cheaper, sell more expensive.

- Hype. Yes, you can make money from this too. But here I would divide it a little. There are cryptocurrency investment consultants (those who advise others when to buy and when to withdraw money), there are crypto investment consultants (those who advise those who advise others to buy or not to buy). And there are those who simply make money on what is in demand among miners and crypto investors. For example, many companies have made a business selling processors and video cards for computers.

If you want my personal opinion, then those who created it and those who bought it as early as possible, ideally in the same 2008, make money on bitcoins.

Actually, these are all the ways you can make money on Bitcoin. If you know another way, write in the comments below. I think that this will be interesting to many, as it is to me personally: maybe I forgot something. But let's pay a little more attention to the fourth way to make money.

Trade

The option is considered the most difficult. Only experienced traders who understand how the market works, understand technical and fundamental analysis and other subtleties can invest in Bitcoin in this way and receive income.

Types of trade

There is far more than one type of BTC trading. Crypto exchanges are used as platforms for transactions. Most exchanges are focused on 1-2 types of trading.

Spot

EXMO exchange interface

The spot market is characterized by trading in financial instruments (in particular, cryptocurrencies) with the condition that the asset will be immediately transferred to the buyer. The exchange of funds is called delivery, and transactions and prices in such a market are also called spot.

The current price of Bitcoin is called the spot price. This is the price at which you can purchase cryptocurrency right now and on this exchange. The spot price is formed when buyers and sellers place their buy/sell orders. On highly liquid exchanges, the price therefore changes every second, while old orders are executed and new ones appear.

Futures

Bitcoin futures are a derivative financial instrument that can be described as a contract with the following conditions: the asset will be sold at a certain date in the future, but at the price that is currently available. During the creation of the contract, the price of the coin is fixed.

Futures are either “deliverable” or “settled”. Delivery is simpler - this means that if the purchase of Bitcoin at the current price in a month is agreed upon, then it will be so. And settlement futures do not imply any delivery at all. When the contract expires, profits and losses are recalculated between the participants, as a result of which they receive or lose funds.

Exchanges for trading perpetual futures contracts:

- Bitmex.

Bitcoin futures trading on Bitmex - Bybit.

Bybit exchange - Binance.com.

futures on Binance

Marginal

margin on Binance

Margin trading is the conclusion of exchange transactions using borrowed funds. Not entirely at their expense, but only with use, that is, in order to use this function, the trader must have a certain minimum amount of funds in his account and provide them as collateral.

Using margin gives a trader the opportunity to open positions for amounts much larger than he could with only his own assets. This type of trading is also called trading with leverage. Leverage is the ratio between a market participant’s own funds and the amount available to him to open a position. For example, if an exchange offers a leverage of 1:10, this means that you can trade volumes that are 10 times greater than the trader’s capital.

Bitcoin cannot be counterfeited

Btc cannot be stolen in the same way that banks steal money from people. Agree, it is not uncommon for some banks to suddenly close, and then a line of puzzled depositors forms at its doors demanding the return of their hard-earned money. So, with btc this is impossible! It cannot be stolen because it is stored on different computers around the world. And in order to possess it, it is enough to have a “key”. If I destroy one “computer”, this cryptocurrency will remain on millions of others!

“Bitok” can be bought for fiat (regular money), but they can also be mined (mining)! The number of Bitcoins is limited (21 million) and you can mine them by solving complex mathematical solutions on a computer (of course, this will not be done by you, but by your hardware).

Risks when investing in Bitcoin

Despite all the noise around cryptocurrencies, some experts are of the conservative opinion that Bitcoin is a bubble and a mirage. To form your opinion, it is worth at least considering certain risks that you need to be aware of before investing in Bitcoin:

- Experimental phase. The concept of cryptocurrency itself is innovative, it is only 10 years old. This is too short a time to assess how much you can trust her. Something unexpected can always happen. True, Bitcoin is already less in the experimental phase than newer cryptocurrencies.

- Technological risks. The development of the cryptocurrency world is proceeding at a rapid pace, and there is a possibility that a currency more economically and technically advanced than Bitcoin will soon appear or has already appeared. As a result, it may lose value.

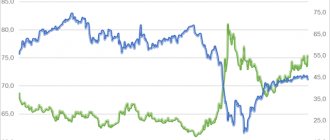

- Price volatility. The value of BTC in the short term is completely unpredictable. It is virtually impossible to predict exactly how much it will be valued tomorrow.

- Lack of consumer protection. The transaction cannot be canceled; all that remains is to convince the recipient of the funds to voluntarily return them if they were transferred by mistake. The investor should also be aware of this danger, although it is in the field of investment that the irreversibility of transactions is not so significant.

- Possibility of theft or loss. To do this, an attacker just needs to gain access to the private key. As practice shows, not everyone treats its safety with due care.

- Problems with legislation. Different countries have different approaches to regulating BTC. There is no single well-thought-out system, and therefore it is unknown what awaits cryptocurrency in the future.

What is Bitcoin in simple words and how to make money on it?

Oh, that's it...) I decided to talk about Bitcoin - what it is in simple words and how to make money on it. Trend, you ask? Trend, I will answer. And really, am I personally annoyed by these, what are they called, crypto-investors? Okay, let them be crypto investors. In general, the topic of Bitcoin is a fashionable topic. Worse than MLM or MMM in the nineties.

Do you know what prompted me to write this material? How one of these crypto investors called himself a “financial advisor.” At this point I couldn’t resist... My fingers themselves began to tap on the keyboard, typing this text.

- What are you doing...!? Or what is Bitcoin in human terms?

- Blockchain or where do cryptocurrencies come from?

- Why is Bitcoin so expensive?

- How to make money on Bitcoin?

- “Financial literacy” specialists are already waiting

- Is Bitcoin a scam or not?

- Why doesn't anyone want to explain it simply?

- Future or reality?

Let’s try to crack this walnut called Bitcoin and identify for ourselves the reason, I’m not afraid of this word, the hype and who can really make money on it. Well, according to tradition, all the most interesting things are at the end of the article. Should I motivate you to read everything to the end?)

Let's start, perhaps, with the actual reason for such excitement. What kind of currency is this that can “lay golden eggs” even for pensioners?

Bitcoin analogues

What did you think? That Bitcoin is the world's only cryptocurrency?

In fact, when he appeared, this may have been the case. But now there are hundreds, if not thousands, of cryptocurrencies. Each person can take and play with their own virtual money.

I won’t spend a lot of time discussing which cryptocurrencies are the best and how to evaluate their quality. I’ll just give you a list of the most expensive ones (excluding Bitcoin).

TOP 10 most expensive cryptocurrencies in the world

- Bit20 - at the time of writing (August 27, 2020), the cryptocurrency was worth $238,350.

- Project-X - $23,897.

- 42-coin – $20,806.

- bitBTC – $11,070.

- bitGold - $1926.

- BitcoinCash - $1343.

- PrimelBase - $1293.

- IDEX Membership - $170.

- Litecoin - $73.

- Internet of Things - $33.

History of appearance

How did bitcoin appear?

It is clear that it does not come out of thin air.

On October 31, 2008, a certain Satoshi Nakamoto published an article on the Internet describing a new cryptocurrency and the principles of its operation.

On January 3, 2009, he made a program freely available that could be used to mine bitcoins, and created the first 50 “coins.”

In May 2010, the first ever purchase took place. American Laszlo Hanyecz bought 2 pizzas with delivery for 10,000 bitcoins.

You heard right. Today, with these bitcoins, he could easily live the rest of his life on the seashore, surrounded by luxury and attractive girls.

Volunteers made attempts to find out who Satoshi Nakamoto was.

His P2P Foundation profile stated that he was born in Japan on April 5, 1975. Nobody, of course, believed this. Because Satoshi spoke perfect English, and his date of birth was like a subtle hint - in 1975, US dollars ceased to be backed by gold.

Some believe that Elon Musk is hiding behind the name of the creator of Bitcoin. Others - Nick Szabo. Third - Craig Steven Wright. The fourth are little green men who flew to Earth to take control of the global economy and take over the world.

On January 1, 2020, a group of miners decided to create a fork of Bitcoin - Bitcoin Cash.

For what?

Because they were tired of the delays that occurred during Bitcoin transactions. Although I suspect they just wanted more cryptocurrency.

Bitcoin Cash is currently selling for $307 apiece.

Why Bitcoin is so expensive - 5 reasons

So. We figured out what Bitcoin is and how it came to be. Now let's think about why it is so expensive and why people buy it.

Reason #1 - Legend

The legend is truly beautiful.

The creator of the cryptocurrency is shrouded in mystery. Bitcoin is not controlled by anyone and stands in the crosshairs of bankers, governments and monetary funds. After all, they are used to the fact that they control all the money in this world.

They said: “Every year you will be charged 30% on the loan,” and there is no way to argue against them.

They printed a couple more billion green pieces of paper, and nothing can be done.

They said: “Today a dollar will cost 70 rubles. Tomorrow - 100,” and even if you go bald, you won’t be able to change anything.

With Bitcoin, you kind of help the mysterious Neo fight for justice and, in addition, get rich.

Reason #2 - Supply and demand

There are only 21 million Bitcoins. There are many more people who want to receive it. In Russia alone, 90 thousand people enter the query “bitcoin” into the search bar every day. How many other countries are there besides Russia?

You tell me:

— It’s clear that there aren’t many bitcoins, Lyokha. Why do people want them?

And I answered:

— Why do people collect stamps and pay millions of dollars for some of them? It looks like ordinary pieces of paper. No better than the ones you write on or wipe yourself with in the toilet.

Scarcity always creates demand.

Let’s even take gold as an example. Why is it so valued?

Does it make strong products? No!

Is it very durable and wear-resistant? Not again!

So why?

Because it is rare and shiny. Rare - deficiency. It shines and pleases the eye.

Reason No. 3 - Network business

Currency exchangers are willing to pay for you to advertise them, and people go to them to exchange bitcoins for real money.

Reason No. 4 - The desire to make money quickly

I remember it was June 2020.

It's a warm summer outside. The grass is turning green. Cows are walking around the village. Outside the window, children are laughing and playing catch, and I am sitting at the computer and writing an article on bitcoins.

I don't remember what exactly it was about. But then I went to Yandex, entered “bitcoin - how many rubles” into the search bar and saw that one “coin” cost 120,000 rubles ($2,000) at that time.

I looked. I was surprised how virtual currency could cost more than 5 of my laptops. And I went on typing.

And after 5 months, Bitcoin already cost 19,000 bucks. 9 and a half times more than in June.

It turns out that I could sell the house, buy bitcoins, live with friends for several months and buy 9 of the same houses in the winter. Or spend the winter abroad.

His mother. Bitcoin.

Of course, then the rate plummeted. Then it rose again to somewhere around 12-14 thousand dollars and is still jumping.

And people hope to make money quickly by buying Bitcoin.

Reason #5 - Anonymity

That is.

Even if you are declared bankrupt and sent to prison for non-payment of debts, you may still have a dozen bitcoins left in your account. Investigators will have no way of finding out about them, much less getting to them.