Italy is a state that is part of the European Union, located in the south of Europe. The north of the country has developed industry, while in the south the main activity is agriculture. This must be kept in mind if you want to start your own business there.

- Italy is a country washed by the waters of the Mediterranean Sea, a member of the EU and NATO. If you want to open your own company on the Apennine Peninsula, you need to know that in the northern regions priority is given to industrial enterprises, while the south is a zone of vineyards and wheat fields.

Despite some problems associated with the crisis and increased unemployment, thanks to its favorable location and the presence of a good sales market, Italy remains a very promising place for starting a business, including for Russian entrepreneurs. Read our article about the peculiarities of doing business in Italy, as well as how to organize your own business there.

Features of doing business in Italy

This country is the dream of many residents of the former USSR. The country's residents are quite temperamental, and this quality affects all aspects of life, including business immigration. It is important to understand that a significant part of enterprises are family-owned. Great-grandparents and great-grandchildren can work in the same coffee shop.

- If you have to choose who to hire - your own careless nephew or a competent foreigner, preference is given to the first. Cause? Mentality. Local families are friendly and united.

Official documentation is kept in Italian. But negotiations can take place in French, German, and English. This applies to a greater extent to residents of northern regions with a developed industrial sector.

Business culture

When thinking about whether to start your own business in this southern country, you must first take into account the national characteristics of the local population and their attitude to the work process.

- Italian business etiquette is very different from the Russian culture of business communication. Dating and connections play a significant, if not key, role here. More than 80% of companies in the country are family-owned, passed on from generation to generation, and have a small staff. Local manufacturers are ready to make a good discount for their own person, while they may simply not want to deal with a stranger on the street. The hot Southern mentality brings a lot of subjectivity to business relationships.

- The locals are not in the mood to make all the money in the world. Their life flows smoothly. No one will work overtime, on holidays or lunch breaks. Being late for a business meeting by half an hour or more is common. In addition, in business it is not customary to immediately “take the bull by the horns”; first there is a conversation on extraneous topics, for example about the weather. You need to keep all this in mind, be patient and be willing to wait.

- Most issues are resolved in a personal meeting. There is no need to wait for specific information over the phone, let alone email. And there is a high probability that you will have to remind yourself more than once if you were promised to learn or clarify something.

Despite the fact that all of the above makes doing business in this country very difficult, the quality of local products is still worth importing, and the living conditions in the republic are worth doing business there.

Destination: Italy. What kind of business is profitable to open in Italy?

“Italy is felicita,” said the famous song played on repeat in every Soviet apartment for many years.

A song that only the lazy would not sing - I really wanted to feel the taste of that very distant dolce vita. Italy is the country with the maximum number of famous brands per capita. 2/3 of Europe's cultural values are concentrated in Italy. Italian pizza is recognized as an intangible heritage by UNESCO. Today, living in Italy is not an ephemeral dream for many, but a planned reality. Increasingly, questions arise not “how to immigrate to Italy”, but “where” and “when”.

However, Italy is not only Maserati, Prada and Martini. It is a country with an attractive climate, including a business climate that is conducive to starting a business in Italy. In the current World Bank Doing Business 2019 ranking, the country is in the TOP 40 with the “very easy” category. Italy is the second economy of the EU and the seventh economy of the world with GDP per capita 1.5 times higher than in Russia. Italy is among the world's TOP 10 exporting countries.

Italy has 60,000,000 consumers with high purchasing power and a capacious market.

In recent years, the government has taken measures to attract private foreign investment to Italy, protect the rights of investors and expand their business. The “Destinazione Italia” program adopted in 2013 is in effect, which, in particular, made an investment visa possible.

All these facts are sufficient grounds for a Russian to open a business in Italy and join the Made in Italy quality standard, broadcasting it to the whole world.

Immersion in the business environment: cold shower or thermal spring?

The fact that the tax burden in Italy is one of the highest in the EU can cool down the ardor of a future business immigrant. Indeed, the Total Tax Rate (the percentage of the total tax burden and profit) in Italy for small companies reaches 68.5%, while in France - 65.7%, in the USA - 46.7%, in the UK - 35.8% . However, what is a threat at the input becomes an opportunity at the output. This feature of doing business in Italy will give an advantage to those who are ready to engage in strategic business planning, including in the field of taxes.

Before opening a business in Italy, it is necessary to study the highly competitive environment. Every sixth Italian is an entrepreneur. According to Istat, this number is growing by 20% annually. Of the 375,000 new businesses, 200,000 companies have no employees. And this is an important feature of Italian business. However, statistics confirm: in Italy, 99% of businesses are classified as small and medium-sized, unlike, for example, France, where more than 50% of all business is concentrated in the hands of large international corporations. In Italy, these are most often family businesses in which business owners work alongside employees. Wage labor in Italy, as indeed throughout Europe, is expensive. Therefore, when opening, for example, a small restaurant, an entrepreneur must be ready to stand at the cash register, do the purchasing and make coffee. It is not easy for a business immigrant to build relationships with local employees due to differences in mentality and ignorance of the nuances of Italian labor legislation.

Competition in all sectors of the economy, expensive hired labor and significant guarantees of social protection for workers from the state are an integral part of the Italian business environment. However, these aspects can become your opportunities rather than threats when opening a business in Italy. The greatest chances of achieving success in Italy are those who take into account potential risks and minimize them. There is no need to abandon staff - you need to optimize their work and build competent relationships. You should not give up doing business in Italy in a highly competitive area. Seek advice and entrust the assessment of business prospects to professionals.

To become successful in any country in the world, do what you really like.

How to implement business immigration to Italy

For a foreigner wishing to settle on the peninsula, you need to know the following:

- The government treats both residents and non-residents equally. Residents of Russia can open their own small business even before crossing the border.

- To open your own business, you need a type D visa. Until this point, the activity will be considered illegal. The punishment is deportation without the right to enter.

- The application for registration of an enterprise and the subsequent receipt of a residence permit is considered individually. A person who wants to move here will have to prove that his activities are useful for the country.

- Formally, there are no requirements for the financial status of a business immigrant, but preference is given to those who have at least 100 thousand euros in the bank. It should be understood that the country's banks are not too willing to lend to visitors. Subject to certain conditions, subsidies are issued from the EU, for example, for the development of southern regions that lag significantly behind the north.

Organizing a business in Italy

In this country, there are many legal forms for different companies. The most common, just like in Russia:

- open and closed joint stock companies;

- limited liability partnerships;

- IP.

Let's take a closer look at each of them.

Private Limited Liability Company (SRL)

This choice will be the most successful solution for small and medium-sized businesses. The minimum authorized capital when opening this form of ownership will be 10,000 euros.

When registering, you must contribute 100% of the entire amount in cash or in kind if there is only one shareholder. In the case where there are several holders of securities, 25% is sufficient to register the company in the Register.

The number of founders is not limited, and responsibility is divided in proportion to the contributed share. Management is carried out by the Board of Directors or the singular director. He can also be a shareholder if this is stated in the organization’s Charter. If a foreign citizen is chosen as director, he is required to obtain the appropriate permission. In addition, SRL organizations have the right to issue registered shares, which cannot be sold to third parties without the approval of the founders.

Public Joint Stock Company (SPA)

This legal form is more often used when organizing large companies. This differs from the previous form of ownership in the minimum amount of authorized capital; here it must be at least 120,000 euros. Also, such companies can issue both registered and bearer shares, their director can be a shareholder without any reservations, and tax and audit requirements for these organizations are stricter than for all others.

Partnerships with limited liability by shares (SAS), as well as with unlimited liability (SNC)

Such organizations do not require a fixed authorized capital; with proper planning, they are taxed preferentially. Managed by general partners, one of whom must be an EU resident.

Individual entrepreneur (II)

Becoming an individual entrepreneur is easier and cheaper than opening a limited liability company. Such entrepreneurs have the right to flexible taxation, and they are not prohibited from working for hire at the same time. But it should be remembered that the owner is responsible for the obligations with all his property.

Small and medium-sized businesses are one of the pillars of the Italian economy. Based on the number of employees, firms can be classified as follows:

- micro-firms – they employ no more than 20 people;

- small – with the number of employees from 20 to 100;

- medium - the number of employees is from 100 to 500.

The first companies account for up to 40% of all sales. In general, profits from small businesses account for 52% of the country's GDP.

Despite the fact that the share of such enterprises is very large, small businesses in Italy have problems. The main one is competition from China, where manufacturers copy branded products and put them on the world market at significantly lower prices.

Organizational forms

An investment in a business will be profitable if it is properly planned. First you need to choose the legal form that the company will take:

- LLC (Societa per azioni) - business in Italy for Russians in this format implies an authorized capital of 120 thousand euros. 25% of that amount must go to the company's account as soon as it is registered. The number of founders is not limited. Management can be carried out either by the board of directors or by a single director appointed at the general meeting of shareholders. Directors can also be shareholders of the company. The issue of registered shares and bearer shares is permitted. Societa per azioni is obliged to appoint a full-time auditor to maintain current accounting and a board of independent authorized auditors. It is the most popular form, but is not entirely suitable for foreigners, since it requires the employment of at least 50 employees.

- CJSC (Societa a responsabilita limitata) – the authorized capital limit is 10 thousand euros, which are deposited into the account immediately after registration. The issue of only registered shares is permitted, which cannot be freely transferred to third parties without the approval of the general meeting. A Societa a responsabilita limitata can be managed by a board of directors or a single director. The company must have an auditor on its staff.

- Shareholder partnership (Societa in accomandita per azioni) - does not give the company legal status and therefore does not provide for the contribution of authorized capital.

- General partnership SNC (Societa in nome collettivo) - allows any number of founders. This form is more suitable for micro-companies with an annual turnover of up to 2 million euros and a staff of up to 10 people. The disadvantage of SNC is the highest tax compared to other forms.

For those interested in small business in Italy, individual entrepreneurship is more suitable. Opening an individual entrepreneur will not cost much, and in the process of work you will be able to use a flexible taxation system. A foreign citizen will have to obtain a work permit, which will give the right to simultaneously engage in business and work for hire.

How to open an individual entrepreneur in Italy

An individual entrepreneur in all countries of the world is a person engaged in entrepreneurial activities without forming a legal entity. And the individual entrepreneur is responsible for his debts with all his property.

But despite all the similarities of concepts, there are also differences when it comes to Italy. The following must be taken into account:

- The specialty in which you received your education is the one in which you will have to work. Accordingly, in order to open a pizzeria, you will have to confirm the qualifications of the cook.

- To become an individual entrepreneur, it is necessary to obtain confirmation from the licensing authorities that this particular person can engage in the declared activity, and that there are no compelling reasons for refusing registration.

- A resident of Russia needs to confirm his qualifications, even if this was done previously in one of the EU countries. In some cases, permission from the relevant ministry is additionally required (if we are talking about medicine, legal practice). A positive resolution from the General Directorate of Civil Affairs is needed for journalists and people involved in sociology, geology, accounting, agronomy, and chemistry.

- Certification. Specialized specialized organizations assess the ability of this particular person to engage in the declared type of activity. The availability of the necessary equipment, suitable premises, and concluded supply agreements with third parties are also taken into account.

To register an individual entrepreneur in Italy you need to pay approximately 3,500 euros. This is less than when registering an LLC or OJSC. But at the same time, the number of permitted activities is significantly reduced, and responsibility increases.

Taxation

The tax system in the country is quite complex and confusing. The payment of more than 40 taxes is regulated by more than 350 relevant legislative acts. However, as in many other European countries, progressive rates apply to some fees.

In general, all taxes can be divided into federal and regional.

Three fees bring the main profit to the treasury:

- VAT – its rate in 2020 is 22%, for some goods and services there is a reduced rate of 10 and 4%.

- Federal income tax.

- Regional income tax.

Keeping in mind that the share of small businesses in Italy is 90%, it is not difficult to calculate that the main income from mandatory contributions to the treasury comes from these enterprises.

The taxation of state-owned companies has an interesting feature. The fee is only calculated for them, without a money transfer from the organization, but funding from the state is already reduced by this amount.

How to open a business in Italy

The whole process is implemented in several steps:

- obtaining a business visa;

- obtaining a residence permit;

- registration of the company with the relevant authorities.

Business visa

To start your own business, you must first obtain a business visa. This will allow you to legally conduct business in the country. Usually a long-term national visa (D) is sufficient, which will allow you to stay in the republic for more than three months.

To complete it you will need the following documents:

- Applicant's questionnaire.

- Two color photographs for documents measuring 3.5x4.5.

- Copies of civil and foreign passports.

- Medical insurance.

- Certificate of company registration in Italy.

- Certificate of income.

- A document confirming the availability of a place of residence (for example, a lease agreement).

Resident card

After arriving in the country, no later than 8 days you must apply for a residence permit. This can be done by sending the required package by mail. Usually, it takes about 2-3 months for the authorities to review the application. Entrepreneurs are enthusiastically welcomed here, however, subject to certain conditions:

- If you want to engage in activities related to high technology or innovation, you must have a starting capital of at least 50,000 euros.

- If you have a business idea in any other area, the required minimum initial investment is 4962 Euros, but in practice no less than 10,000-20,000 Euros. At the same time, it is necessary to bring real benefits to the economy, create jobs for the local population, and the direction itself must be interesting for local authorities. Even if these conditions are met, the entrepreneur needs to confirm an annual income of 8,400 euros.

Company registration

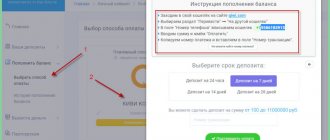

Once the residence permit has been received, you can begin collecting documents for company registration. To do this, you need to submit an application through a special website. In addition to this you will have to:

- Open an account at a local bank.

- Have all statutory documents of the organization certified by a notary.

- Create books for financial statements.

- Pay the state fee.

- Notify the labor office that employees are being hired at least one day before they start work.

- Obtain a license to conduct certain types of activities.

The cost of registration itself is 220 euros, plus costs for additional services. If all the papers are in order, information about the company will be entered into the register at the local branch of the Chamber of Commerce and Industry.

It can be very difficult for a foreigner to understand all the intricacies of registration on his own, so the country has very developed services of business intermediaries who will help register a case in the shortest possible time.

Applying for a business visa to Italy

To travel to Italy for business purposes, a Russian must open a business visa. It can be open for a short period of time, covering only the stated time of the visit, or it can be valid for 5 years. Such an entry permit is issued on the basis of an invitation from the Italian side. Without this document, obtaining a business visa is impossible.

The invitation must be submitted to the consular department in its original form, so you should take care of receiving it in advance by choosing a time-appropriate method for delivering the letter from Italy.

A business visa allows a Russian citizen to stay in the country for a long time. He will be able to stay in Italy for at least 3 months out of every 6. It should be remembered that after the six months are over, all unused days for the visit will disappear. They do not carry over to the next 6 months.

Consideration of an application from a foreigner for a business visa takes 4-10 days. The time it takes to make a decision largely depends on the stated purpose of the trip and the completeness of the documents provided.

The set of documentation that must be submitted to the visa center or consular department must include the following papers:

- A foreign passport, the validity of which will not expire within 3 months after the owner returns from the trip.

- Old canceled passports, if they had Schengen visas attached to them.

- Internal Russian passport in original and copies of pages with personal data and registration.

- The photograph measures 3.5 by 4.5 cm.

- Application form filled out in English or Italian.

- Certificate of income received from the employer.

- A bank statement confirming the availability of funds sufficient to cover expenses during the trip.

- The original invitation from the Italian side, which indicates the personal details of the guest, the period of his stay in the country, and the purpose of the visit.

- Confirmation from the inviting party about the financial support of the guest during the trip, if she has such intentions.

- A photocopy of the passport of the representative of the Italian side who signed the invitation letter.

- Copies of registration documents for the company on whose behalf the invitation is issued.

- Hotel reservation covering the period of a foreigner’s stay in the country, unless the invitation specifies a different place of residence.

- A certificate received by the employer from the Chamber of Commerce no earlier than 3 months before issuing the invitation.

The applicant must submit documents in person. But if, during the 5 years preceding the trip, he has already submitted biometric data at any of the embassies of the European Union countries, documents can be submitted for him by a representative acting on the basis and within the framework of a power of attorney.

Business ideas for entrepreneurship in Italy

Of course, when planning to open your own business abroad, you must first of all clearly understand what you would like to do. In addition, it is necessary to analyze the state of the area where the activity is planned: how many competitors can be found there, whether the proposed service will be in demand, who the offer is aimed at, etc.

Restaurants, hotels, and shops, especially those located in resort areas, are considered profitable businesses in Italy.

A fairly free niche in the field of software creation. Here the profitability can reach 200%.

The areas of construction and repair of real estate, metal-mechanical production, and trade in fuel and lubricant petroleum products may become promising.

When choosing a region, one must take into account that industry is highly developed in the north of the country, while in the south the main focus is on agriculture. Here we can also mention language specifics. If in large cities and northern regions proficiency in English is enough, then in the south you cannot do without knowledge of the Italian language.

Italians have high demands on the quality of their products, so it will take a lot of effort to meet local standards.

Also, great attention is paid to advertising. To promote their product or company, they resort to the services of PR specialists. Image in this country is very important, as is presentable appearance.

What areas of business are relevant for foreigners?

Italy is a resort country. Therefore, it is worth thinking about the hotel business. This business is quite profitable, but not cheap either. There are both small hotels, which are chosen mainly by locals, and large hotel complexes for foreign tourists who are accustomed to comfort and luxury.

You can invest your money and effort in agriculture. In Italy this is a very profitable business; Italian wines are incredibly popular all over the world. You can buy vineyards here, but be extremely careful, because few people will want to sell a really good plantation. Do not skimp on using the services of consultants.

Another profitable area of activity in Italy is the restaurant business. This can be either a small cafe or a chain of restaurants or bars. Italians, like tourists, love to visit such establishments.

Business in Italy for Russians

A mandatory condition for registering a new enterprise is the presence of a legal address. For almost any type of activity, you can register at your place of residence. For a store or industrial enterprise, you will have to select suitable real estate.

Important: premises do not have to be purchased. It is quite enough if a lease agreement is attached to the registration documents.

An accountant can be hired outsourced so as not to increase the company's staff.

- The registration fee is not fixed. The Chamber of Commerce has the right to assign any amount depending on the intended type of activity and form of ownership.

If you plan to work for hire at the initial stage, then the main problem will be confirmation of qualifications and passing a language proficiency exam. Since Russia is not a member of the EU, automatic confirmation of the diploma does not work. In addition, you must present documents from your bank confirming that the candidate for relocation earns at least 9 thousand euros per year.

Business immigration to Italy can only be the first step on the path to prosperity in Europe. But don't expect it to be very easy. Competitors are not liked anywhere.

Tax system

To understand this issue, at the initial stage of development it is also better to turn to specialists. Taxes in Italy can reach half of earnings, regardless of the type of activity and form of business ownership.

The latest tax figures correspond to the following data:

- income tax – 23-43%, depending on the amount of income;

- income tax – 27.5%;

- value added tax – 21%;

- regional tax on production activities – 1.2-2.03%.

How to open a store in Italy

There are a large number of shops with fashionable clothes, delicious pastries, wine and other delicacies. And many foreigners believe that the best investment would be opening your own store. But, you need to consider:

- Not all cities are overrun with tourists. Local residents are quite conservative and are not very willing to change their usual bakery, where the owner bakes buns and sells them himself, for a new fashionable supermarket opened by a foreign company. Therefore, if we are talking about opening a store, you should focus on large cities that are interesting for visitors.

- Renting premises. Unlike Russia, where apartments on the first floors are everywhere being converted into shops, here no one will be allowed to convert residential premises into non-residential ones. At the same time, renting a specialized premises in Rome or Milan will cost 40 thousand euros or more. This must be taken into account so as not to end up at a loss.

- If you buy premises in a new building, you should prepare for significant expenses: up to 20% of various duties and fees. Plus, many developers install utility networks into non-residential premises at the expense of the owner.

- If you rent out store premises, you need to be prepared for the fact that up to 40% of the amount received will go to the budget as taxes. In addition, different regions introduce their own fees and excise taxes. It’s better to find out which ones before opening, so as not to pay fines later.

If we talk in general about opening a store in Italy, then we should focus on tourists and the sale of high-quality branded items. It is better to choose cities filled with visitors or near ski resorts.

The opening procedure will look like this:

- Obtaining a D visa, which gives the right to carry out activities.

- Renting or purchasing premises.

- Concluding agreements with suppliers. There are usually no problems with the latter, since there are many sellers and few buyers. If you are willing to pay cash, they will sell you whatever you want.

Then all that remains is to hang up the sign and try to attract customers to your own store.

Purchasing a ready-made company is an opportunity to quickly start in new conditions

Every investor, when investing money in a new enterprise, thinks about possible risks and future profits. For example, the hotel business in a country with such a developed tourism sector as Italy is one of the most profitable. However, not everyone can start from scratch. In this situation, the most reasonable option is to purchase an already operating hotel with an established reputation and clientele.

Advantages of buying an existing business

· Save time on registration and obtaining tax code (Codici Fiscale). You can receive income from your acquisition almost immediately because your company is already registered in all the necessary registers

· No need to obtain a VAT number (VIES). In the hotel business, having this number is especially important because without it you cannot bill your customers.

· The minimum capital required to open a company has already been invested

· No need to pay tax for registration

· The company has a bank account

· You can start working immediately after the purchase transaction is closed

Buying an existing business is one of the most convenient forms of investment. Its procedure, accompanied by reliable local lawyers, does not take much time. Usually it consists of several stages.

Stages of purchasing an existing business in Italy

· Checking the financial and legal viability of the company you want to buy. This includes checking tax arrears, arrears in paying bills, and the relevance of registration. It is after this that it is easiest to understand whether you are buying a profitable business or not.

· Signing the document appointing a new director. From this moment you can start working.

· Transfer of ownership rights to the new owner. If it is a joint stock company, the shares are transferred to new shareholders. This takes place in the notary's office.

When buying a ready-made hotel or any other business in Italy, it makes sense to know the types of companies that exist here. The most popular are limited liability companies and joint stock companies.

Main types of companies in Italy

· Limited liability company (società a responsabilità limitata, srl),

The authorized capital is divided into shares, which may (or may not) be issued in the form of shares. Used by average sized businesses.

· Simplified form of limited liability company (società a responsabilità limitata semplificata, srls)

Most often used in small businesses. By law, only residents can be investors, and the authorized capital must not exceed €10,000. Unlike other types of companies, the Charter of this company cannot be changed.

· Joint stock company with a limited number of shares (società per azioni, spa)

Authorized capital of at least €120,000 divided into shares. Shares can be traded on a stock exchange. Mainly used in large businesses. Shareholders' liability is limited to the number of shares they own.

Buy a ready-made business in Italy

As has been emphasized many times, business here is a family affair. But advertisements for the sale of a store or restaurant still sometimes appear. And here it is important to pay attention to the following:

- The owner may say that he is tired, that he wants to retire, or that he is moving to another city. But it is worth understanding that in most cases, an unprofitable enterprise is implemented.

- A significant part of activities require the purchase of a license. But a non-resident cannot purchase it in his own name. Accordingly, it is necessary to hire an Italian director and draw up the necessary documents for him. If one day he quits, it will be along with his license. You take a loss.

- What objects are in the immediate vicinity, how is the traffic flow organized. If there are plans to relocate roads or build an expressway or a large shopping center in the immediate vicinity, it is difficult to expect shoppers to run to a small restaurant or store. Traffic will go the other way.

Directly regarding restaurants. Local residents can go to their neighbor’s “eatery” for years and decades and immediately turn away from their usual establishment if the owner becomes a foreigner.

If the desire to buy a restaurant is overwhelming, it is important to consider the following:

- It is mandatory to hire an experienced auditor to review the statements. Italians are great masters at “composing” reports. Revenue figures may be inflated to sell the business at a higher price.

- Inspection of surrounding areas, checking competing restaurants and traffic in them.

- The best option is to open your own company, obtain the necessary licenses and then purchase the material base of the restaurant being sold. It is not recommended to buy a legal entity. You will buy all debts and licenses that may expire in a week or two.

In order not to end up with nothing, it is better to trust the selection of a business to a proven lawyer - an EU resident.