Grouping of expenses according to law

The main document defining how expenses should be formed in a commercial structure is PBU 10/99. According to clause 5 of this legal regulation, material costs are associated with the implementation of the main activity.

All expenses incurred by the organization can be divided:

- for expenses for ordinary activities;

- other expenses.

For proper accounting, it is necessary to ensure the grouping of all costs incurred in accordance with their economic content. According to clause 8 of PBU 10/99, material costs are included in the enterprise’s costs for ordinary activities, which also include wages, contributions to social funds, depreciation and other costs.

This legislative act does not provide a clear list of material expenses. The company determines the content of each article itself, taking into account the specifics of its work aimed at making a profit. To fully analyze information about the results of work, it is necessary to take into account all expenses incurred.

To help with this, you can use PBU 5/01, which contains a list of materials and raw materials used in the production of products intended for sale and management of business activities.

The costs of an enterprise in accounting are included in the cost of production and participate in the formation of the financial results of the reporting period to which they relate.

By what principles are costs grouped in accounting, read the article “List of the most frequently used cost items in accounting.”

Analysis of direct expenses

Managing direct costs is the key to reducing product costs and increasing profitability. By analyzing such expenses, determining their part in the cost and final price of the product, it is possible to study the characteristics over time and determine the reserves for increasing profitability.

Similar articles

- Classification of production costs

- Production costs

- Fixed and variable production costs

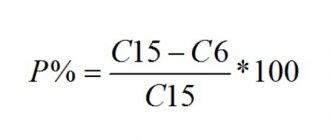

- Material costs: formula

- Direct and indirect production costs

Material expenses in tax accounting

A significant part of the costs in the economic activity of an enterprise is material costs. The amount of income tax depends on their correct accounting. To form the tax base, it is necessary to use the Tax Code, according to which not all costs incurred can be included in expenses.

In tax legislation, expenses are recognized as economically justified (aimed at making a profit) and documented (documented in accordance with the law) expenses incurred by the taxpayer. They share:

- for the costs of production and sales of products;

- non-operating expenses.

Material costs are included in the group associated with production and sales and are described in detail in Art. 254 Tax Code. These include everything that has a material and monetary characteristic, is used in the production of products and the provision of services, as well as all costs aimed at sales: packaging, transportation, storage, etc.

When writing off materials and raw materials into the cost of production, an enterprise has the right to independently choose and apply one of the methods (clause 8 of Article 254 of the Tax Code of the Russian Federation):

- at the cost of receipt of the unit;

- at average cost;

- according to the FIFO method - write-off according to the order of arrival.

The methods for applying these valuation methods are similar to those used in accounting and are described in paragraphs. 16-19 PBU 5/01 “Accounting for inventories” and paragraphs. 73-76 Methodological guidelines for accounting of industrial production (order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n).

A comment

The term “material expenses” is used in taxation (corporate income tax). In accounting, a similar term is used - material costs.

Material expenses in tax accounting

Material expenses are one of the types of expenses associated with production and sales, along with labor costs, amounts of accrued depreciation and other expenses.

Material costs include the actual material resources used in the production of products (works, services), as well as costs associated with the circulation of material resources. The list of material expenses is specified in paragraph 1 of Article 254 of the Tax Code of the Russian Federation (TC RF). Material expenses, in particular, include the following expenses of the taxpayer (clause 1 of Article 254 of the Tax Code of the Russian Federation):

1) for the acquisition of raw materials and (or) materials used in the production of goods (performance of work, provision of services) and (or) forming their basis or being a necessary component in the production of goods (performance of work, provision of services);

2) for the purchase of materials used:

for packaging and other preparation of manufactured and (or) sold goods (including pre-sale preparation);

for other production and economic needs (testing, control, maintenance, operation of fixed assets and other similar purposes);

3) for the purchase of tools, fixtures, equipment, instruments, laboratory equipment, work clothes and other means of individual and collective protection provided for by the legislation of the Russian Federation, and other property that is not depreciable property. The cost of such property is included in material costs in full as it is put into operation;

4) for the purchase of components undergoing installation and (or) semi-finished products undergoing additional processing from the taxpayer;

5) for the purchase of fuel, water, energy of all types, spent on technological purposes, production (including by the taxpayer himself for production needs) of all types of energy, heating of buildings, as well as costs of production and (or) acquisition of power, costs of transformation and energy transfer;

6) for the acquisition of works and services of a production nature, performed by third-party organizations or individual entrepreneurs, as well as for the performance of these works (provision of services) by structural divisions of the taxpayer.

Works (services) of a production nature include the performance of individual operations for the production (manufacturing) of products, performance of work, provision of services, processing of raw materials (materials), monitoring compliance with established technological processes, maintenance of fixed assets and other similar work.

Works (services) of a production nature also include transport services of third-party organizations (including individual entrepreneurs) and (or) structural divisions of the taxpayer itself for the transportation of goods within the organization, in particular the movement of raw materials, tools, parts, workpieces, and other types of goods with base (central) warehouse to workshops (departments) and delivery of finished products in accordance with the terms of agreements (contracts);

7) related to the maintenance and operation of fixed assets and other property for environmental purposes (including costs associated with the maintenance and operation of treatment facilities, ash collectors, filters and other environmental facilities, costs for the disposal of environmentally hazardous waste, costs for the purchase of services from third-party organizations reception, storage and destruction of environmentally hazardous waste, wastewater treatment, formation of sanitary protection zones in accordance with current state sanitary and epidemiological rules and regulations, payments for maximum permissible emissions (discharges) of pollutants into the natural environment and other similar expenses).

The following are equated to material expenses for tax purposes (clause 7 of Article 254 of the Tax Code of the Russian Federation):

1) expenses for land reclamation and other environmental measures, unless otherwise established by Art. 261 “Expenses for the development of natural resources” of the Tax Code of the Russian Federation;

2) losses from shortages and (or) damage during storage and transportation of inventories within the limits of natural loss norms approved in the manner established by the Government of the Russian Federation;

3) technological losses during production and (or) transportation. Technological losses are losses during the production and (or) transportation of goods (work, services), caused by the technological features of the production cycle and (or) the transportation process, as well as the physical and chemical characteristics of the raw materials used;

4) expenses for mining and preparatory work during the extraction of mineral resources, for operational stripping work in quarries and cutting work during underground mining within the mining allotment of mining enterprises.

Direct material costs

Material costs determined in accordance with paragraphs. 1 and 4 paragraphs 1 art. 254 of the Tax Code of the Russian Federation refer to direct expenses for income tax (Article 318 of the Tax Code of the Russian Federation):

- expenses for the acquisition of raw materials and (or) materials used in the production of goods (performance of work, provision of services) and (or) forming their basis or being a necessary component in the production of goods (performance of work, provision of services) (clause 1, clause 1 Article 254 of the Tax Code of the Russian Federation);

— expenses for the purchase of components undergoing installation and (or) semi-finished products undergoing additional processing from the taxpayer (clause 4, clause 1, article 254 of the Tax Code of the Russian Federation).

Taxpayers have the right to expand the list of direct expenses in their accounting policies and, for example, classify other material expenses as direct expenses.

Features of tax accounting of material expenses

The Tax Code of the Russian Federation establishes a rule (clause 6 of Article 254 of the Tax Code of the Russian Federation) that the amount of material costs is reduced by the cost of returnable waste.

The procedure for recognizing expenses (including material ones) using the accrual method is regulated by Art. 272 of the Tax Code of the Russian Federation.

Thus, in terms of raw materials and materials attributable to manufactured goods (work, services), the date of material expenses is recognized as the date of transfer of raw materials and materials into production (clause 2 of Article 272 of the Tax Code of the Russian Federation).

The transfer of raw materials and materials into production is the beginning of the use of raw materials and materials for the production of goods, works or services.

Guidelines for accounting of inventories, approved. Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n clarifies (clause 90) - “The release of materials for production means their issue from a warehouse (storeroom) directly for the manufacture of products (performance of work, provision of services), as well as the release of materials for the management needs of the organization .

The release of materials to warehouses (storerooms) of organizational units and construction sites is considered as internal movement.”

Example

The production organization transfers materials for production from the warehouse to the workshop using an internal invoice. Such a transfer is considered a transfer to production. The amount of expenses for materials on this date is written off as expenses (in accounting, debit account 20).

Write-off of expenses for material resources

When determining the amount of material expenses when writing off raw materials and materials used in the production (manufacturing) of goods (performing work, providing services), in accordance with the accounting policy adopted by the organization for tax purposes, one of the following methods for assessing the specified raw materials and materials is used (clause 8 Article 254 of the Tax Code of the Russian Federation):

— valuation method based on the cost of a unit of inventory;

- average cost valuation method;

— valuation method based on the cost of the first acquisitions (FIFO);

Read more: Write-off methods (by unit cost, by average cost, FIFO, LIFO)

Material costs under the simplified tax system

Material costs are recognized when applying the simplified tax system and are specified in paragraphs. 5 p. 1 art. 346.16 of the Tax Code of the Russian Federation and are taken into account taking into account clause 2 of Art. 346.16 Tax Code of the Russian Federation.

The list of material costs for the simplified tax system is indicated in the same article. 254 of the Tax Code of the Russian Federation, as for enterprises using the general taxation system.

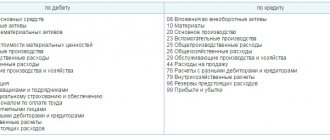

Material costs in accounting

In accounting, a similar term is used - “material costs”. Thus, clause 8 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved. Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n indicates that when generating expenses for ordinary activities, their grouping should be ensured according to the following elements:

— material costs;

labor costs;

contributions for social needs;

depreciation;

other costs.

15.08.2017

Results

An enterprise has the right to make expenses necessary for its activities, which will significantly reduce the actual profit, but not all expenses can be taken into account to determine the tax base.

To properly differentiate them, the accepted accounting methods must be reflected in the accounting policies. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Types of material expenses

As it was said, what material expenses can be taken into account under the simplified tax system, the list is taken from the Tax Code of the Russian Federation. And it can be duplicated in the accounting policy of a business entity.

Generally speaking, here is what is included in material costs under the simplified tax system:

- The cost of purchased raw materials and supplies that are necessary to carry out the production process.

- Payment of bills for packaging materials, containers.

- Conducting pre-sale preparation.

- Expenses for the purpose of implementing a cycle of product testing and quality control.

- Maintaining operating fixed assets in working condition, carrying out their maintenance, etc.

The category of material expenses, due to which the tax base can be reduced, also includes expenses for the purchase of tools and special equipment, for providing employees with special clothing and protective equipment. In material expenses under the simplified tax system in 2020, non-depreciable assets can be included at full cost. They must be taken into account during commissioning.

Also see “Depreciation under the simplified tax system “Income minus Expenses” (relevant in 2020).

The category of material costs also includes the purchase of components and semi-finished products that are needed for construction and installation work or additional technological processing.

If water and various types of energy are used in the production process, the funds spent on settlements with suppliers of such resources can be offset when forming the tax base. Perhaps the most striking example of material expenses of the simplified tax system is the cost of housing and communal services as part of activities under this special regime.

Transfers of funds in favor of contractors who perform production work for the taxpayer must be reflected in accounting as part of material expenses. This category of services includes:

- production of spare parts;

- execution of individual production stages and control functions;

- Carrying out technical inspections of equipment.

Separately, it is necessary to show in accounting transportation costs and identified losses that fit into the standards of natural loss.

Also see “Transportation costs under the simplified tax system “Income minus Expenses”.

Inventory accounting

At large enterprises that use a wide range of materials in the production of several types of products, it is advisable to use standard or coefficient methods to write them off. This will make it possible not only to more accurately determine the cost of different types of products, but also to determine discrepancies (overexpenditure) of certain material assets. One of the recommendations is periodic inventories. Also, in the case of a long production cycle (for example, when purchased semi-finished products are used in several stages of the production process), it is necessary to maintain an operational balance of the movement of parts in production, based on the principle “the more detailed, the better.”

Identifying discrepancies between standard and actual consumption of materials, as well as analyzing the reasons for this situation, will help minimize costs, which will ultimately have a positive impact on the overall financial condition of the enterprise. And in the future, it will provide the opportunity to competently structure the entire production process, conduct a correct pricing policy, and, therefore, competently take into account material costs, based on the experience gained.