Concept and types of production costs

Production costs include those parts that are closely related to the company's main production.

That is, these are direct costs that go into creating products, and the costs of auxiliary areas that support the main production, and costs indirectly related to the production process, as well as losses due to defects.

As for the types of the phenomenon under study, the following are distinguished:

- Labor remuneration;

- Raw materials and material costs;

- Depreciation deductions;

- Payment for services of third-party companies;

- Tax deductions;

- Other.

Types of business expenses

Costs that arise outside of production, but are directly related to the product, can be divided into several categories:

- transport services;

- containers and packaging material;

- commission payments to intermediaries;

- advertising campaigns;

- product storage;

- other costs associated with the sale of goods;

- administrative expenses (for trading enterprises).

Thus, selling expenses are a set of costs that arise after the finished product is delivered to the warehouse and occur before sale. Trading enterprises also include general business expenses (administrative, management) in this article.

It should be remembered that not all amounts can be taken into account as non-production expenses. For example, if the costs of containers or other packaging material according to the contract are reimbursed by the buyer, the amounts are taken into account as part of the accounts receivable from buyers (account 62), and not as business expenses. Any reimbursement of costs agreed with the customer must be taken into account in the same way.

Composition and structure of production costs

For competent accounting, in-depth analysis and high-quality planning of production costs, various classifications are used.

The most popular among them are two – by elements and by costing items.

The first option - element-by-element - involves dividing costs into groups based on their economic essence. At the same time, the places where costs arise and the directions of their use are not taken into account.

In the element-by-element classification, the following types of costs are distinguished:

- Materials and raw materials;

- Salaries;

- Depreciation;

- Others.

The costing grouping just involves taking into account costs by location of their occurrence, which makes it possible to calculate the cost of each product in companies characterized by a wide range of products.

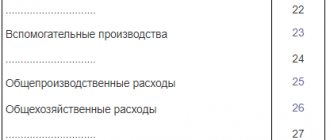

Enterprises usually use the following list of costing items:

- Materials (excluding returnable waste).

- Labor remuneration of production personnel.

- Payments for social needs.

- Costs for the maintenance, use and maintenance of production machines.

- General production costs.

- Losses due to marriage.

- General expenses.

- Business expenses.

All these items together form the total cost of the product, and points 1-7 – its production cost.

Types of production costs

By grouping production costs, we can distinguish their main categories by place of origin, types of expenses and cost carriers.

In the first principle of grouping, data is collected from homogeneous structural units (shops, sites, production facilities). This allows you to track the internal production organization and the functioning of each department.

Cost carriers are homogeneous groups of products and services of a company. This information is used to analyze unit costs. And by type, costs are collected into groups according to costing items and economically homogeneous elements.

Element-by-element cost classification

As mentioned above, element-by-element classification involves the allocation of cost items in accordance with the economic essence of these expenses. A complete list of such expenses is also presented in the previous paragraph. Let's take a closer look at the contents of the most significant items on the list.

Material costs

This group of costs includes funds paid for:

- Purchase of materials and raw materials that are an integral part of manufactured products or necessary to ensure the process of their production;

- Purchase of packaging materials;

- Purchase of semi-finished products and spare parts, which are then subjected to installation and other processing methods;

- Remuneration of contractors hired for production purposes;

- Payment for fuel and energy resources received from suppliers used for production.

Important!

The amount of returnable waste is subtracted from the amount of material costs. These include resources that are underutilized in production and suitable for further exploitation for technological purposes. Although, perhaps, their initial consumer properties change somewhat. Accordingly, returnable waste is valued differently - not always at the price of the original materials.

Contributions for social needs

This article takes into account deductions at the current rates from the wage fund to state funds: Social Insurance Fund, Pension Fund, Employment Fund. The specific amount of this part of the costs, accordingly, depends on two factors:

- The amount of rates applicable to a company in a particular field of activity;

- The size of the organization's salary fund.

Depreciation of fixed assets

This reflects the amounts of depreciation charges calculated based on the goal of fully restoring the cost of equipment used during production. The amount of these expenses depends on the depreciation method chosen for the relevant objects, the cost of the objects themselves, their useful life and depreciation rates.

Shop and factory costs

shop costs - administrative and economic expenses of the Shop. In Ts.r. includes: costs of maintaining managerial and economic personnel of workshops (basic and additional wages with social insurance contributions); depreciation amount; costs of maintenance and ongoing repairs of buildings, structures and equipment included in the workshop's fixed assets; costs of testing, experiments and research, as well as rationalization and invention; expenses for labor protection measures; the amount of wear and tear on low-value and fast-wearing household equipment of workshops and the costs of its repair and restoration during operation; other expenses, as well as some non-productive costs.

General plant expenses include basic and additional wages (with deductions for social needs) of employees of the plant management apparatus and general plant services, travel expenses, office and postal and telegraph expenses, maintenance and depreciation of the plant management building, as well as the buildings of the plant’s material warehouses, finished goods warehouse products, factory laboratories, entertainment expenses.

Management accounting by cost centers and places of their occurrence.

Cost centers are objects of analytical accounting of production costs by economic elements and cost items. Cost centers are divided into production, service and contingent. Production usually includes workshops, sections, and teams. Servicing departments, management services, warehouses, laboratories. Conditional places of origin include costs that are not associated with specific structural divisions (for example, administrative and management costs in general or some part of them may also be shop costs that are not related to specific services of the shop). Production cost centers consist of many places where resources are consumed at different technological levels. The main ones manufacture products, perform work, and provide external services. Auxiliary - serve internal technological processes. In the main responsibility centers, costs are taken into account in the context of objects of cost accounting and calculating the cost of products, works, services, in service centers - in an element-by-element breakdown of costs. Income centers as centers of responsibility are structural units, divisions, the managers of which are responsible only for the income received by this division, but cannot control profit if the center for implementing performance results is beyond their competence. Profit centers as responsibility centers are divisions whose managers are responsible not only for costs, but also for the financial results of their activities. These are usually individual enterprises within an association, branches, subsidiaries, sales offices, stores, etc. Control and management centers are a sphere, an area of activity that ensures responsibility for specific types of activities and their results. These centers often have only costs that are difficult to compare with the results they control. Responsibility centers must be separated according to the principle of production functioning - supply, production, sales, management. Thus, the supply center controls not only the costs of procuring raw materials, materials, fuel, but also the volumes, size and quality of material reserves. The degree of cost control depends entirely on the specifics of the activities of the cost center and responsibility center. It’s one thing if it’s a production workshop, and quite another if it’s a department or service for production preparation and management.

Cost carrier.

Cost carriers are those factors that directly influence the amount of costs for a particular object.

All cost carriers can be divided into three groups:

- product composition (what you produce and from what);

- technology and business processes (how you produce and sell products);

- management and company structure (how you manage and how your company is structured).

Management cost accounting allows you to create a real-time cost control system to track deviations and find reserves for cost reduction.

Cost accounting should be:

Planned - by planning, including costs in the estimate, you create conditions for controlling and managing costs when implementing business activities. If you have an idea of how much you can spend to get the intended profit, then if the planned amount of costs is exceeded, you will be able to quickly react and find out the reasons for this circumstance and its impact on the enterprise as a whole;

Significant - the costs of the enterprise should be considered based on their significance. Costs that are essential for the operation of an enterprise are considered in separate cost units, less significant costs are considered as groups of costs;

Expedient - the cost accounting system should be built in such a way that it meets the needs of the decision-making process of enterprise management;

Timely —Cost information must be received in a timely manner. Information for analysis must also be provided to decision makers in a timely manner;

Well presented - it should be possible to quickly find relevant information in the incoming array of cost information;

Accurate - the degree of reliability of information should allow economically sound decisions to be made based on this information;

Consistent - A uniform cost accounting system means applying the same methods, principles and techniques throughout the enterprise. A single system allows you to compare costs across departments, products, customers, employees, and so on, and thereby identify and eliminate inefficiencies.

Cost accounting can be carried out:

- by type of cost

- by product

- by cost responsibility centers

- according to their places of origin

- by business processes

- by cost carriers.

Cost Analysis Methods

To identify costs that can be reduced, the following main types of analysis are used:

- cost structure analysis;

- comparative analysis;

- factor analysis;

- analysis of cost objects;

- ABC and XY2 analysis.

In order to analyze the cost structure of an enterprise, vertical, horizontal and trend analyzes are used.

Using vertical analysis, the cost structure is determined: the share of each cost item in the total cost of the enterprise is calculated and the most significant items are identified.

And the basis of horizontal analysis is a comparison of each item by cost item with the previous period (month, quarter, year), i.e., deviations of the indicators of the reporting or planned period from the previous one are determined.

After carrying out vertical and horizontal analysis, trends in changes in cost items should be analyzed, i.e., a trend analysis should be carried out.

Comparative analysis . This analysis is based on comparing the most significant cost items with similar indicators of competitors or with internal indicators for other business units.

Cost structure analysis and comparative analysis make it possible to determine areas for cost optimization.

For a more in-depth study of the reasons for changes in the level of costs, factor analysis should be used . It allows you to determine the factors influencing the level of certain costs and the quantitative impact of each factor on the resulting indicator. And, therefore, it allows us to draw a conclusion about what factors should be influenced in order to reduce the value of the resulting cost indicator.

In most cases, the range of costs is so broad that modeling and thoroughly analyzing each item using previous methods is difficult.

You should start streamlining costs by structuring them using standard logistics analysis techniques, in particular ABC analysis. The ABC method is associated with a statistical pattern, which is called the “Pareto Rule “20 to 80”. The essence of the ABC method in relation to costs is that, in accordance with the purpose of the analysis, a classification characteristic is selected, then the costs are ranked in descending order of this classification characteristic.

Typical grouping of costs by costing items

This grouping involves accounting for expenses by place of origin and destination.

With its help, the cost of production is determined both for workshops and for the company as a whole. A typical list of costing items is given above. It can be modified depending on the scope of the company. Let's take a closer look at the main points of the grouping.

Raw materials and supplies, purchased products, semi-finished products, fuel and energy for technological purposes

The title of the article speaks for itself. This takes into account the material costs needed to produce a specific product. Returnable waste is deducted.

Labor costs for production workers

In the calculation grouping of costs, this item is included in several items at once: this is the remuneration of the main production personnel, and part of general and general production costs, and a component of the costs of operating and maintaining equipment.

Contributions for social needs

This is also a complex item, as it includes the costs of paying obligatory contributions to state funds, which are charged from the wage fund. And employee remuneration, as mentioned in the previous paragraph, is an element included in the structure of several costing items at once.

Expenses for the maintenance and operation of machinery and equipment

This includes costs such as:

- Maintenance of equipment and mechanisms;

- Repair of machines, machine tools, vehicles, tools;

- Depreciation charges calculated for fixed assets;

- Wear and tear of "low value".

General production expenses

This is a complex item consisting of costs of various economic content. What they have in common is that they belong to ordinary activities, and their main purpose is to service the main and auxiliary production areas of the company.

General production costs, for example, include:

- Expenses for maintenance of equipment and mechanisms;

- Salary of service personnel;

- Payments to landlords;

- Supporting materials;

- Lighting/heating costs;

- Depreciation deductions;

- Insurance of objects used in production, etc.

This article also includes non-production costs - for example, losses during downtime, payment of shortages.

Losses from marriage

It is customary to consider defective products if their quality characteristics do not meet accepted standards, as a result of which they cannot be used for their intended purpose.

The article under consideration includes the cost of units of products finally recognized as defective, as well as the amount of damaged materials and the cost of correcting the defect.

General running costs

This comprehensive article brings together costs related to the management of the company and the organization of the reproduction process itself. This, in particular, includes such elements as expenses for the maintenance of the AUP, maintenance of premises and mechanisms for general business purposes, as well as certain types of material costs (for example, office supplies), etc.

Business expenses

These are the costs of financing loading and unloading activities, costs associated with the storage and sale of goods, costs of marketing campaigns and other costs related to pre-sale preparation and sale of products. The article is complex in nature, it includes costs that differ in economic nature: these are materials, and salaries of the relevant categories of personnel, and the costs of operating certain types of non-current assets.

Possibility of regulation

The costs of any enterprise can be divided into controllable and uncontrollable. This classification is necessary for managers to understand what they can influence and what they cannot.

The regulated group is assigned to specific control centers. They are controlled by purchasing managers, warehouse managers, heads of production preparation groups, etc.

Regulated costs include costs associated, for example, with violations of labor discipline or production technology.

Almost all costs fall into this general group. Only their control centers differ in their area of competence. Global issues are decided by the head of the enterprise. Control over site costs is exercised by shop managers who cannot influence general production decisions.

Uncontrollable costs are costs that managers cannot control. This is, for example, depreciation of premises and equipment.

This division makes it possible to clearly define the area of competence of each manager.

Direct and indirect costs of production of products

The classification of production costs is not limited to element-by-element and calculation groupings. There are other types of characteristics - for example, expenses are often divided into types depending on the method of attributing certain product items to direct and indirect costs.

Direct costs directly correlate with the size of products produced or with the time spent on their production. There are three groups of such expenses:

- Direct material - payment for resources, which subsequently become an integral part of manufactured products;

- Direct labor - remuneration of personnel directly involved in the production of one or another type of product;

- Direct overheads - the resources on which these funds are spent do not become a structural part of the released product, but this type of costs still directly depends on the volume of output (this may be payment for electricity necessary for the operation of workshop equipment).

Indirect costs are more general in nature. Their dependence on the quantity of goods produced is very conditional (an increase in production volume to a certain level does not affect them in any way). Indirect costs are also divided into three groups:

- Indirect material - payment for by-products not used directly for the manufacture of products, but necessary for organizing the production process itself (various lubricants, office supplies, etc.);

- Indirect labor - remuneration for the work of auxiliary workers, office staff, storekeepers, employees servicing machines and equipment, etc.; This also includes losses from downtime and overtime work for key personnel;

- Indirect overheads – maintenance of the AUP, rental payments, expenses for the development of innovations, etc.

If direct costs are directly attributed to the cost of certain types of products, then indirect costs need to be distributed proportionally to some base. Typically this is the salary of production employees, but there are other options.

Attribution to cost

The volume of total costs is divided according to the method of attribution to the cost of direct and indirect. The latter cannot be attributed directly to a unit of production.

Indirect costs accumulate over the entire period, and are then taken into account in the cost of all finished products. These include the labor costs of operating personnel, the cost of auxiliary components, and maintenance of production facilities.

Direct costs can be charged directly per unit of production. They arise during the manufacture of a certain type of product. The greater the share of direct costs in the total number of them for the enterprise, the more accurately you can determine the value of its cost. The analysis of costs in the current and planned periods depends on this.

Analysis of the production cost structure using an example

Analysis of the cost structure allows you to see which resources are consumed in the greatest quantities during the operation of the company. If these are materials, then production is considered material-intensive, if the main share in the cost structure belongs to wages - labor-intensive.

The cost structure is a list of the ratios of individual types of costs to their total amount. This point is largely determined by the industry in which the company operates.

Analysis of the structure involves comparing the shares of the main types of costs over time. The goal is to identify the causes of changes, study their impact on the efficiency of the company, and also search for reserves for reasonable cost reduction.

Example. Data on expenses of EURASIA LLC for two years are shown in the table.

| Indicator name | Last year | This year | ||

| Amount, t.r. | Specific gravity. % | Amount, t.r. | Specific gravity, % | |

| Output | 468 410 | – | 327 195 | – |

| Spending | 288 023 | 100 | 220 140 | 100 |

| Of them: | ||||

| Material costs: | 136 007 | 47,22 | 90 275 | 41 |

| raw materials | 129 384 | 44,92 | 82 943 | 37,68 |

| fuel | 3 068 | 1,06 | 4 722 | 2,14 |

| energy | 3 555 | 1,24 | 2 610 | 1,18 |

| Salary | 82 245 | 28,56 | 73 100 | 33,21 |

| Contributions for social needs | 38 138 | 13,24 | 35 100 | 15,95 |

| Depreciation | 972 | 0,34 | 865 | 0,39 |

| Other expenses | 30 661 | 10,64 | 20 800 | 9,45 |

The table shows that in the reporting year there was a decrease in the amount of costs. This is largely due to a reduction in production output. Perhaps this moment was also influenced by measures to reduce the cost of manufactured products.

In both periods under review, the greatest weight in costs is occupied by material costs and wages. The share of labor costs increased (from 28.56% to 33.21%). The share of material costs, on the contrary, decreased. Accordingly, first of all, one should look for reserves for reducing costs precisely by salary items.

An increase in the weight of depreciation charges signals a decrease in capital productivity. An increase in the share of other costs indicates changes in their composition: for example, an increase in bank interest on loans, an increase in tax rates, a change in rental rates, etc.

Assessment of the implementation of planned targets and the dynamics of the cost of commercial products

Analysis of production costs includes activities aimed at assessing achievements against planned indicators and studying the dynamics of product costs.

Actual cost of production

When analyzing the actual cost of production, three main indicators are usually used:

- Z0 – unit cost of goods for the previous year;

- Z1 – cost of the same unit of goods in the current year;

- Zpl is the planned cost of this unit of production.

Example. At the plant, the cost of manufacturing one object according to the plan should be 150 thousand rubles, but the actual costs this year amounted to 159 thousand rubles, and in the previous year - 155 thousand rubles. A total of 150 such products were manufactured, while 200 were planned.

Let's calculate a number of analytical indices.

Plan index = Zpl/ Z0 = 150/155 = 0.97 = 97%

That is, it is planned to reduce expenses by 3%.

Plan execution index = Z1/ Zpl = 159/150 = 1.06 = 106%

That is, the above-plan cost increase was 6%.

Dynamics index = Z1/ Z0 = 159/155 = 1.0258 = 102.58%

That is, the actual increase in costs was 2.58%

It turns out that with a planned reduction in the cost of the facility by 3%, it increased by 2.58%. The actual amount of overspending for the entire number of objects (150 in the example) was:

(Z1 – Z0)*Q1 = (159 – 155)*150 = 600 thousand rubles.

The reduction in actual cost is calculated using the following formula:

(Z1* Q1/ Z0* Q1)*100 – 100 = 102.58 – 100 = 2.58%

Costs did not decrease, but increased by 2.58%, the task was not completed.

Absolute amount of actual cost

The absolute amount of actual savings is calculated as follows:

Z0* Q1 – Z1* Q1

If we take the figures from the example above, then the absolute amount of actual savings was: 155*150 – 159*150 = – 600