To crush or not to crush - that is the question

The transition from the OSN to the simplified tax system is possible only once a year, subject to notification of the tax service before December 31 of the current year.

The advantages of simplification are obvious:

1

Reducing the tax burden. Simplified residents are exempt from 4 taxes: profit, property, VAT and personal income tax (for individual entrepreneurs).

2

The tasks of the accounting department in maintaining tax and accounting records are simplified. For example, invoices are not prepared and there are no income tax registers.

3

The right to choose one of 2 options for paying a single tax: “income 6%” or “income minus expenses 15%”, which is paid in advance payments quarterly, and the final amount is paid at the end of the year.

There are exceptions in the Tax Code of the Russian Federation and in regional legislation, which you need to pay attention to before switching to the simplified tax system.

Features of the transition from OSNO to simplified tax system

The main feature is the formation of a rolling tax base. In terms of income, consider the following:

- Receiving an advance before switching to a simplified system. The advance amount is included in income on the date of regime change.

- Amounts received after becoming a simplifier, but which you previously took into account when calculating income tax, can no longer be recognized as income.

Certain difficulties arise with expenses. True, only those who have chosen the simplified tax system “income-expenses” will have to bother with this. It will be most difficult in such situations:

- Before switching to the simplified system, you made expenses, but received supporting documents after the switch. Then you take these expenses into account when calculating the simplified tax system based on the date of receipt of the documents.

- Similar to income accounting. Having recognized expenses when calculating income tax, but paid them later - after switching to the simplified tax system - you cannot take them into account as part of the simplified tax.

Accounting for fixed assets and intangible assets in a simplified mode is very different from accounting for OSNO. Therefore, attribute their residual value to expenses according to the simplified tax system. To do this, follow these steps:

- Calculate the residual value as of December 31 of the year before becoming simplified. You will indicate this amount in the notification.

- Simplified people do not depreciate their property. Instead, you can write off the residual value over a specified period. Within 1 year - with a useful life of up to 3 years. If the period exceeds 3 years, then in the first year attribute 50% of the cost to expenses, in the second - 30% and in the third - 20%. For a period of more than 15 years, expenses will be written off evenly over 10 years.

Special mode is not for everyone

The conditions for the transition from the OSN to the simplified tax system are established by law in the Tax Code. It is possible to change the tax system if the organization meets 2 main conditions for the revenue limit and staff size:

- number of employees is less than 100 people;

- income and residual value of fixed assets as of October 1 do not exceed 150 million rubles.

For organizations and individual entrepreneurs, the transition from the OSN to the simplified tax system is further complicated by the presence of branches, the share of participation of other companies above 25% and income over 112.5 million rubles. based on the results of 9 months before filing an application to change the tax regime.

In addition to the above, the law establishes a ban on simplifying the nature of activities for such organizations as banking, microfinance, insurance, budgetary organizations, agricultural producers, non-state pension funds, pawnshops and a number of others (more details here).

Filling out the transfer notice

The content and form of the notification is specified in the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] dated 02.11.2012. You will not have any difficulties filling out the form. In the notification, in addition to your identification data, the date of submission of the notification and the transition to the simplified tax system, indicate the object of taxation “Income” or “Income-expenses”. The tax rate will be 6% or 15% respectively (less in some regions, please check).

You will also have to show the tax authorities that you comply with the terms of the transition. Indicate revenue for the previous 9 months and the residual value of fixed assets. The tax office does not require disclosure of information about employees or the structure of the authorized capital, but this is not a reason for deceiving it. Tax authorities will learn all other information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs or during an audit.

You will not wait for a reaction from the Federal Tax Service to the notification; you can immediately begin activities using the simplified system. For your peace of mind, you can send a request to the tax office to confirm the fact that the simplified procedure has been applied. The tax office will provide you with an answer within a month.

Splitting your business is tempting, but is it safe?

Exceeding the income limit over 150 million rubles. forces big business to split the organization into several independent companies or open an individual entrepreneur under the simplified tax system. However, tax inspectors are constantly looking for illegal tax benefit schemes from “special regimes”, especially in cases where simplified organizations are engaged in the same types of activities.

The courts are inundated with appeals from entrepreneurs trying to prove that the division of business was not a violation of the law. Over the past 3 years (2016-2018), more than 450 cases on similar issues have passed through Russian arbitration courts. An average of 30 million rubles was recovered from taxpayer organizations that sued the Federal Tax Service. At risk are large companies whose income has grown to the maximum limit for the simplified account.

At the same time, judicial practice shows that you can win in proceedings with tax authorities if you approach the transition to a special regime correctly. Our company, which has experience in participating in such courts, offers legal support and accounting services for businesses during the transition period.

Confirmation of transition to simplified tax system

According to the requirements of the Tax Code of the Russian Federation, an organization should not wait for confirmation from the Federal Tax Service about the transition to another tax regime. After providing notification, you can begin working on the new system. But it is better to make sure that the actions are legal. You can go to the official website of the Federal Tax Service and see information about the transition to the special regime in your personal account.

If you still need a supporting document from the Federal Tax Service to conduct business activities, you must send a request. Within 30 calendar days, the tax office is required to provide a response letter indicating that the organization submitted a notification and has the right to apply the “simplified tax treatment.”

How to prove the legality of business division?

The following actions will help you avoid additional tax assessments under OSN:

1

Organizations transferred to the simplified tax system actually existed, carried out activities, and independently paid taxes under a simplified system.

2

The optimal division of technological processes between companies will be evidence in court. The scale of business division (into 2 companies or 10) does not matter.

3

Business is not only divided between companies, but they conduct various types of business activities independently of each other, have their own management apparatus and make independent administrative decisions.

4

Newly created enterprises have their own suppliers, business partners and clients, different from the parent company, use the services of other service organizations, have personal certificates, licenses, all the necessary permits, have their own equipment and their own staff.

5

The Federal Tax Service's accusation that a group of companies (general director) has a single management cannot become grounds for deprivation of rights to a special regime.

These and other actions proposed by our company when transferring part of the business from the OSN to the simplified tax system, features

HR and management decisions for a newly created company will help you calmly conduct business without tedious lawsuits.

The transitional stage needs good legal support

, the price of which is hundreds of times lower than a possible tax penalty.

How fixed assets are accounted for and written off

Accounting for fixed assets during the transition from OSNO to simplified tax system has the following features (for the “income minus expenses” base).

If, before the simplification comes into effect, the fixed assets are fully paid for and are actively used, then on the date of transition to the simplified tax system they are entered in the amount of their residual value, which is calculated according to the formula (paragraph 1, clause 2.1, article 346.25 of the Tax Code of the Russian Federation):

S = P – ƩA,

where: P is the purchase price of the OS;

ƩA is the amount of accrued depreciation.

The procedure for transferring fixed assets to expenses in this case depends on their useful life (hereinafter referred to as SIP):

- If it is less than 3 years old, then the OS is written off in the first year of operation on the simplified system.

- If the period is from 3 to 15 years, then write-off occurs in stages: in the first year of work on the simplified tax system, 50% of the cost of the operating system is minus, in the second - 30%, in the third - 20%.

- Write-off of fixed assets, the SIP of which is more than 15 years old, occurs within 10 years of application of the simplified system in equal amounts.

IMPORTANT! Fixed assets contributed to the authorized capital are not included in expenses (letter of the Ministry of Finance of Russia dated April 11, 2007 No. 03-11-04/2/99).

If the fixed assets are used, but at the date of commencement of validity the simplified payments have not yet been finally paid, they can be written off only after final payment to the seller (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 04/03/2007 No. 03-11- 04/2/85).

Examples of common mistakes

Example No. 1. Court decision A50-10873/2017

The founders formally divided the LLC into 2 organizations using the simplified tax system. The organization suffered losses in the form of penalties from the Federal Tax Service of more than 40 million rubles.

Where is the mistake?

They used common labor resources, common software, and common material resources. The dependent company did not have permission to carry out the work. The companies also had an excess of the limit of employees for the special regime of the simplified tax system (more than 100), the same suppliers and buyers. After analyzing the movement of funds and interrogating employees of both companies, tax officials proved the presence of intent to evade taxes.

H3: Example No. 2. Judgment A59-2443/2017.

The construction company involved 5 interdependent companies using the simplified tax system for work under a contract. According to the court decision, the company had to pay over 226 million rubles to the budget. additional tax payments.

Where is the mistake?

The counterparties did not have their own production bases, warehouses, vehicles, etc. The construction company had accounts receivable to contractors, did not have its own working capital to pay off the debt, and also lacked its own funds for financial stability.

Who can switch to the simplified tax system and who can’t

In order to work under the simplified tax system (from the moment of opening or for the transition subsequently), entrepreneurs need to meet certain criteria (see table 1). Most of them relate to the scope of their activities, the economy and the size of the business.

To switch to the “simplified” system from 01/01/2019, the amount of the company’s income from the OSN for 9 months of 2020 should not exceed 112.5 million rubles. This does not apply to individual entrepreneurs; they have this opportunity regardless of the size of their income.

The income limit for applying the “simplified tax” in 2020 for individual entrepreneurs and organizations was 150 million rubles. The OS limit for using the simplified system in 2020 is also 150 million rubles.

Table 1

| Index | Limit value | How to count |

| Relevant for individual entrepreneurs and legal entities | ||

| Amount of income received for the reporting (tax) period * | 150 million rub. | Calculate this indicator based on all income from business in “simplified terms”. At the same time, take into account sales revenue and non-operating income. Do not include in the calculation income that is not taken into account under the simplified tax system (Clause 4.1 of Article 346.13 of the Tax Code of the Russian Federation) |

| Average number of employees for the reporting (tax) period | 100 people | Determine the total indicator of the average number of employees, the average number of external part-time workers and the average number of employees who performed work under GPC contracts (subclause 15, clause 3, article 346.12 of the Tax Code of the Russian Federation, clause 77 of the Instructions, approved by Rosstat order No. 428 dated October 28, 2013) . This does not include persons who worked under copyright agreements (letter of the Ministry of Finance of Russia dated August 16, 2007 No. 03-11-04/2/199) |

| Residual value of fixed assets** | 150 million rub. | Calculate the cost according to accounting data (the original cost of the fixed assets minus the amount of depreciation accrued on them). Take into account objects with an initial cost above 100 thousand rubles. (Clause 16, Clause 3, Article 346.12 of the Tax Code of the Russian Federation) Their useful life must be more than 12 months. |

| Relevant only for organizations | ||

| Share of participation of other organizations in the authorized capital of the company on the simplified tax system | 25 % | Determine the share based on an extract from the Unified State Register of Legal Entities (clause 8, article 11 and article 31.1 of the Federal Law of 02/08/98 No. 14-FZ). This restriction does not apply to companies listed in clause 14, clause 3 of Art. 346.12 of the Tax Code of the Russian Federation. For example, for non-profit organizations, including consumer cooperation organizations and business societies, the only founders of which are consumer societies and their unions |

| Availability of branches | 0 | Information about the presence of branches of the company is indicated in its charter (clause 1, clause 3 of Article 346.12 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 29, 2009 No. 03‑11‑06/3/173). In this case, the company may have representative offices |

* If these conditions are not met from the beginning of the quarter in which the excess occurred, the “simplified” person must return to the general taxation regime (clause 4 of Article 346.13 of the Tax Code of the Russian Federation).

** A limitation on the residual value of fixed assets upon transition is established for organizations and individual entrepreneurs. If the limit on the residual value of fixed assets is exceeded, then the right to use the “simplified tax” is lost (clause 4 of Article 346.13 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated January 18, 2013 No. 03-11-11/9).

If even one of these conditions is violated, and also if the type of commercial activity does not correspond to the list permitted for the simplified tax system, you cannot count on the application of a simplified taxation system.

How to switch from general to simplified tax system? Check your performance before applying. When registering a company, it is worth considering whether you will subsequently be able to meet these requirements.

According to Art. 436.12 clause 3 of the Tax Code of the Russian Federation, the following individual entrepreneurs cannot operate on the simplified system:

- producers of excisable goods;

- extracting and selling minerals (except for common and accessible ones);

- those employed in the gambling business;

- agricultural producers transferred to the Unified Agricultural Tax (Chapter 26.1 of the Tax Code of the Russian Federation).

This also includes:

- foreign companies;

- budgetary institutions;

- organizations engaged in banking, microfinance, and insurance activities;

- private recruitment agencies;

- lawyers and notaries;

- investment and non-state pension funds;

- pawnshops;

- professional participants in the securities market;

- gambling organizers.

If a taxpayer goes beyond the limits, does not switch to OSNO on time and applies the simplified tax system without legal grounds for doing so, if this fact is revealed, additional taxes will be assessed on him, as on OSNO. He will pay VAT, profit tax (or income tax), property tax, fines and penalties on these taxes, and will also be required to submit missing declarations and reports.

Becoming a simplifier couldn't be easier

The method of transition to simplified taxation is not complicated. If an organization or individual entrepreneur fits the conditions of the regime, it has no restrictions under Art. 346.12 of the Tax Code of the Russian Federation, then the entire further process consists of submitting a notice of application of the simplified tax system in form No. 26.2-1 to the tax service at the location of the business. When switching from the OSN to the simplified tax system, the deadline for filing an application is established by law - from October to December 31 of the current year.

The notification form is available on the Federal Tax Service website and can be downloaded. If any difficulties arise, our company can assist in filling out this form.

Transition deadlines

To switch to the “simplified” system in 2020, you must submit a notification to the Federal Tax Service by the end of this year. The form was approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. MMB-7-3/ [email protected] , and the electronic format was approved by Order of the Federal Tax Service of the Russian Federation dated November 16, 2012 No. MMB-7-6/ [email protected]

to submit a notification about a change in tax regime :

- personally;

- through an authorized representative;

- by registered mail.

When submitting a notification personally or through a representative, the filing date will be considered the day the form is received by the Federal Tax Service. If the document is sent by mail, the date indicated on the postal stamp.

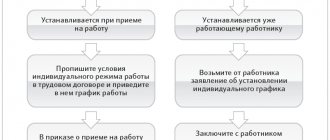

The regulations for the transition to the simplified tax system are enshrined in Art. 346.13 of the Tax Code of the Russian Federation. Deadlines for submitting notifications for switching to the simplified tax system:

| New LLC or individual entrepreneur | Operating organizations and individual entrepreneurs | Payers of the single tax on imputed income |

| Simultaneously with the submission of documents for state registration or no later than 30 calendar days from the date of registration with the tax authority | No later than December 31 of the current year | Within 30 calendar days from the date of termination of the obligation to pay UTII |

| clause 2 art. 346.13 Tax Code of the Russian Federation | clause 1 art. 346.13 Tax Code of the Russian Federation | clause 2 art. 346.13 Tax Code of the Russian Federation |

Companies that are ready to switch to the simplified tax system next year will be able to use their right to switch only until the end of 2019 , otherwise the opportunity to switch will only appear from January 1, 2021.

Organizations that already use the simplified tax system can continue to work under it next year without additional notification to the tax office.

Are there any disadvantages to switching to simplified language?

Among the negative consequences of the transition from the OSN to the simplified tax system are the following:

- the need for a transition period and possible difficulties in translating financial statements;

- the requirement of tax authorities during the transition from the OSN to the simplified tax system to restore VAT, first of all, input;

- for large deliveries - a decrease in income due to the departure of large clients working with VAT.

In a situation where the company is operating at a loss, the general regime becomes more profitable than the simplified one:

| Loss-making enterprise rates | |||

| OSN | simplified tax system "income" | Simplified tax system “income minus expenses” | |

| Income tax rate | 0 | 6% (depending on region) | 1% |

| VAT | 0 | No | No |

When switching from the OSN to the simplified tax system, it is necessary to adjust the VAT in contracts concluded before the new taxation. Starting from the new calendar year, simplifiers indicate the price with the note “VAT not subject to.”

Loss of the right to use the simplified tax system

Switching to a simplified system is not so difficult, but not every business can survive on the simplified tax system. If your activity no longer meets the criteria that allow you to apply the simplification, you will be forced to switch to OSNO. This can happen if the number of employees has grown or revenue has increased beyond acceptable limits. The taxpayer is obliged to track this event himself and notify the Federal Tax Service. The transition to OSNO will occur from the quarter when the activity ceased to meet the criteria of the simplified tax system. The taxpayer will have to take a number of actions:

- Notify the Federal Tax Service of the violation of the rules of the simplified tax system and the forced transition to OSNO. This is done within 15 days after the end of the quarter in which the violation of the requirements occurred.

- Submit the declaration within 25 days after the end of the quarter in which the requirements were violated. The tax calculated according to the declaration is paid within the same period.

Communication with the Federal Tax Service when changing the tax regime is of a notification nature. The most important thing is to carefully approach the issue of translating accounting and tax reporting in order to avoid mistakes and fines based on a more advantageous simplified translation.

Kontur.Accounting is a comfortable online service for organizations and entrepreneurs on the simplified tax system, OSNO and UTII. Get acquainted with the capabilities of the service for free for 14 days, keep records, pay taxes and send reports using Kontur.Accounting.

Try for free

conclusions

The tightening of tax legislation since 2020, expressed in 78 changes that also affected simplifiers, suggests that fiscal services are not going to calm down. After the release of No. 163-FZ of July 18, 2017, according to Article 54.1 of the Tax Code of the Russian Federation, the Federal Tax Service took up arms against entrepreneurs with even greater tax audits. The task of tax services is to combat business fragmentation and replenish the budget with additional funds.

The features of the transition from OSN to simplified taxation require a balanced decision. How to escape or avoid being targeted by tax inspectors? Contact MCOB. We will conduct an internal audit of accounting and organize business support. We work - you can easily develop your business!

When can you switch to the simplified tax system in 2019-2020?

LLCs or individual entrepreneurs that are not subject to the above restrictions have the opportunity to start working under a “simplified” approach from the very beginning of their activities. To do this, you need to notify the tax authorities about this in a timely manner.

How to switch to the simplified tax system after registering an individual entrepreneur? Within 30 days after making an entry in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs, you must submit an application to the tax office. You can write it freely or use form 26.2-1. This form contains all the necessary fields to fill out, so it will simplify your work.

If an entrepreneur does not meet the deadline of 30 days from the date of registration, it will be possible to switch to the simplified tax system only from the beginning of next year.

It is not necessary to wait for the entry itself to be made in the state registers of the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs. It is permissible to send a notification to the Federal Tax Service at the same time as the registration documents. There is no need to indicate TIN and KPP in the notification due to their absence.

If an LLC or individual entrepreneur does not fall under the restrictions specified in Art. 346.12 of the Tax Code of the Russian Federation, you need to fill out a notification in Form 26.1-1 and send it to the tax service.

The timing of the transition to the simplified tax system depends on your previous taxation system.

- Transition from OSNO and Unified Agricultural Tax

Let's consider the question: is it possible to switch to the simplified tax system with OSNO and Unified Agricultural Tax? The answer is as follows: from OSNO and Unified Agricultural Tax you can switch to the “simplified” system only at the beginning of the calendar year. The deadline for sending the notification is December 31 of the previous year.

The notice must indicate:

- Income as of October 1 of the current year. (If the amount exceeds 112.5 million rubles, you will receive a refusal (clause 2 of article 346.12 of the Tax Code of the Russian Federation)).

- Residual value of fixed assets as of October 1 of the current year. How to switch an LLC to the simplified tax system? The rules for the transition to a simplified system for LLCs in 2020 indicate compliance with the income limit of 150 million rubles.

This paragraph of the article talks about organizations; there is no mention of individual entrepreneurs. Thus, entrepreneurs can switch to the simplified tax system without complying with the income limit. There is no need to indicate income for 9 months. Individual entrepreneurs will subsequently be required to comply with an income limit of 150 million rubles. per year in order to reserve the right to apply the simplified tax system.

This limitation is established by clause 16, clause 3 of Art. 346.12 of the Tax Code of the Russian Federation. This only applies to organizations. According to the explanations of the Ministry of Finance, individual entrepreneurs can switch to the simplified tax system without observing the limit on the cost of fixed assets, but in the process of applying the preferential regime they are required to comply with this limit, otherwise they lose this right.

As we have already found out, only organizations indicate the amount of the residual value of fixed assets as of October 1 of the year preceding the transfer to the simplified tax system in notification 26.2-1 for the tax authorities.

After submitting a notification from January 1 of the new year, organizations and entrepreneurs can already work according to the simplified tax system.

- VAT restoration when switching to the simplified tax system from OSNO

Having made the transition from the general regime to the simplified tax system, individual entrepreneurs and LLCs begin to work without value added tax (VAT), and they need to restore it according to the deductions specified in paragraph 3 of Art. 170 of the Tax Code of the Russian Federation.

VAT on goods and materials stored in the warehouse is subject to recovery, fixed assets in proportion to the residual value and advances paid. Only those amounts of VAT that have already been deducted are subject to restoration.

VAT is restored in the tax period that precedes the transition to “simplified taxation”. That is, if an organization begins to apply the simplified taxation system from January 1, 2019, then it needs to restore the VAT amounts in the fourth quarter of 2018.