What is the explanatory note used for?

The explanatory note must be prepared, as a rule, in writing, and supporting documents must be attached to it. So, if you received a letter from the tax office demanding clarification, this means that the inspector was not satisfied with something in the report. Basically, requirements are sent out during desk audits. The “camera camera” is carried out using special programs in automatic mode.

Let's consider cases when the tax authority has the right to demand clarification:

- If errors or discrepancies between the tax information and the data in the report are identified in the submitted declaration;

- If the tax amount in the updated declaration is less than in the original one;

- If an income tax return is submitted with a loss.

When tax reports actually contain errors, organizations and entrepreneurs can immediately send an updated declaration, rather than an explanatory note (Tax Code 81, clause 1, article 81).

Any explanatory note is written in free form; there are no strict forms for writing it. A note is submitted on paper in one of the following ways:

- in person by contacting the tax office;

- by mail.

In relation to explanatory notes, as well as reporting, the following method of presentation applies: electronic. But it only applies to the VAT explanation and only if your company submits the VAT return electronically.

Why do you need to respond to demands?

A tax requirement comes to an enterprise in different ways:

- by mail;

- through an electronic document management system;

- on purpose.

According to current legislation, starting from 2020, the company is obliged to respond to requests from the Federal Tax Service. If previously inspectors recommended not to ignore their requests, since such companies could arouse increased interest on the part of control authorities, then from 2020, the absence of an explanatory note to the tax office upon request within the period established for the response will lead to the imposition of a fine of 5,000 rubles for the first offense . Repeated delay in response within a year increases penalties to 20,000 rubles. In addition, the Federal Tax Service may block the company’s bank accounts.

Explanatory note on the simplified tax system declaration

The requirement to provide explanations on the simplified tax system declaration is mainly due to discrepancies in the data on the amount of income in the report with the receipts in the organization’s current account. Tax authorities currently have access to the current account of an organization or entrepreneur. And in cases where the results in the inspection and the results in the declaration diverge, this requires explanation. Such discrepancies in amounts may be associated with receipts to the current account that are not taken into account when calculating the company’s income, for example, a return of payment from a supplier, assistance from the founders of the organization, loans, etc.

If a VAT claim has arrived

If you are “lucky” to receive a request regarding value added tax, then most likely errors and inconsistencies were found in the submitted declaration. Since 2020, all correspondence regarding VAT is conducted electronically through telecommunication channels. The inspector will not accept a paper response, as this is prohibited by law. If errors are detected in the declaration, the taxpayer is obliged to submit an updated calculation with the attachment of books of purchases and sales within the time limits established in the requirement.

In addition, he must upload a scanned copy of the clarifications. A sample explanatory note to the tax office regarding a VAT claim must contain the following justifications:

- reasons for errors and inconsistencies;

- the taxable difference affected by the adjustment;

- the tendency of taxes to result in arrears or overpayments;

- promise to correct the declaration;

- list of attached scanned copies of documentary evidence, if available.

Documentation is uploaded to TKS in separate files in accordance with the affiliation and details. We must remember that the electronic delivery method does not exempt copies from being certified according to all the rules.

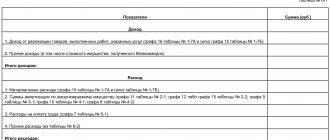

Explanatory note on losses

When tax authorities require an explanation of a loss in a declaration, it is necessary to justify the reason for its occurrence. Therefore, it is necessary to provide documentary evidence of income and expenses, explain how the calculation took place, and also justify the occurrence of this loss. Extracts from accounting registers, contracts with suppliers, contracts with clients, etc. are suitable for documentary evidence.

The more carefully you prepare your explanation, the fewer additional questions the tax office will have.

Can personal income tax be checked?

The sample explanatory note to the tax office upon request for personal income tax must also correspond to the requested information. Unlike VAT reporting, personal income tax certificates are not tax returns, so the Federal Tax Service cannot conduct desk audits. However, she has the right to check the correctness of the preparation of certificates and tax calculations.

If an organization receives a request for personal income tax, it means that errors were made in the calculations when drawing up the certificates. Such errors could be:

- discrepancies between calculated, withheld and paid taxes;

- incorrectly applied deduction;

- a significant reduction in personal income tax compared to the previous period.

When responding to a request from the fiscal authorities, it is necessary to make corrections to the certificates and indicate this in the note. In this case, you will have to list by name each employee for whom the error was made and make adjustments to the accounting records.

Errors in drafting an explanatory note

In order to avoid possible mistakes when drawing up an explanation, you need to clearly understand what exactly the tax office requires of you. Since there are no clear requirements for writing a note, the task is simplified, but you should remember a few points:

- Like any outgoing document, you must register the note under a specific number;

- The explanation must contain the name of the authority to which you are sending this note. This must be the tax authority at the place of registration of the organization or individual entrepreneur;

- The note must indicate the number of the request that the tax office sent you;

- In the text of the note, it is advisable to highlight sections, subsections, paragraphs and subparagraphs;

- Attachments to the note must be properly completed.

If the error indicated by the tax authorities really exists in the report, but it does not affect the final result and does not underestimate the tax base, the organization or entrepreneur can do the following: indicate in the explanatory note that “the specified error does not underestimate the tax base and does not reduce payments to the budget, the correct consider the value _______”, or immediately submit an updated declaration.

Response to counter check

When writing responses to requests, you must comply with certain conditions related to the nature of the requirement. If a company receives a request for a counter-verification, the company is obliged to provide the necessary documentation. In this case, a sample explanatory note to the tax office at the request of a counter audit will look like a list of copies of the submitted materials. Of course, it is necessary to mention the name, INN/KPP of the company, and the period being checked.

It is not recommended to provide information that is not asked for, even if you want to share. The responsible person must answer the questions very briefly and clearly, strictly according to the points of the requirement. A lot of bewilderment is usually caused by the desire of tax officials to find out the nature of the counterparty’s activities, additional contacts, and staffing.

Lawyers do not recommend providing such information, citing the fact that the organization is not obliged to be aware of what is happening with the counterparty. Therefore, in the explanatory note to the tax office, upon request, the sample will be a reference to the information contained in the agreement with the counterparty.

Tax burden: explanation

If the tax authorities ask you for clarification due to the fact that your tax burden is low compared to the industry average, then you can answer them something like this:

“In the declaration for such and such a tax for such and such a period, there is no incomplete reflection of information or errors that would lead to an underestimation of the tax base. In this regard, the organization has no obligation to clarify tax liabilities for the specified period.

As for the tax burden on the main type of activity of the organization, its decrease in such and such a period is caused by the following circumstances: a decrease in income and an increase in the organization’s expenses.”

And then state how much the amount of revenue has decreased and expenses have increased for the requested period compared to previous periods. And what caused this (decrease in the number of buyers, increase in purchase prices, etc.).

We talked in more detail about the clarifications requested by tax authorities in connection with the reduction of the tax burden in a separate consultation, where we also provided a sample format for the corresponding clarifications.

Why establish rules for accounting for income and expenses?

All costs that are not classified as direct expenses in the accounting policy and are not non-operating expenses are recognized as indirect expenses.

In your explanations, clearly state the reasons why revenues have decreased so noticeably or expenses have increased. Let's say your company is expanding its product range, and this requires purchasing new equipment and investing in advertising campaigns. Or your company has a seasonal nature of work. In any case, describe all the circumstances in detail and truthfully.

The share of indirect costs in the total cost for the first half of 2009 is 11 percent higher than the same figure for the first half of last year. This is caused by a decrease in production volume for the main items of manufactured products.

Indirect ones include:

- General production expenses. These are the costs of organization, maintenance and production management. For example, a certain amount was allocated for the repair of a machine, which was reflected in indirect costs.

- General running costs. These costs directly affect the production process.

Indirect costs are costs that cannot be directly attributed to specific types of products (works, services).

In general, no. But if you claim a benefit, the auditors will ask you to confirm your right to use it ().

For example, the gratuitous transfer of goods (work, services) (Subclause 1, clause 1, Article 146, clause 2, Article 154 of the Tax Code of the Russian Federation) or the transfer of goods (performance of work, provision of services) for one’s own needs (Subclause 2, clause

In the primary VAT return for the first quarter of 2020, a VAT deduction in the amount of 1000 (One thousand) rubles was not taken into account. Changes were made and an updated declaration was submitted.

Explanation from the Federal Tax Service on VAT

Submitting explanations to the Federal Tax Service regarding VAT has its own characteristics. As we have already noted, explanations for VAT must be submitted electronically if the payer’s responsibilities include submitting an electronic declaration (clause 3 of Article 88 of the Tax Code of the Russian Federation). In addition, these explanations must be presented in the approved format (approved by Order of the Federal Tax Service dated December 16, 2016 N ММВ-7-15/ [email protected] ). And if the payer submitted explanations electronically, but in the wrong format, then he was threatened with a fine (clause 1 of Article 129.1 of the Tax Code of the Russian Federation). True, in September 2020, the Federal Tax Service issued a decision (Federal Tax Service Decision dated September 13, 2017 No. SA-4-9 / [email protected] ), which states that the payer should not be fined for the incorrect format of explanations.

If you have the right to submit a VAT return on paper, then it is more convenient to give explanations using the forms developed by the Federal Tax Service (Appendices 2.1-2.9 to the Letter of the Federal Tax Service dated July 16, 2013 No. AS-4-2/12705). But using these forms is a right, not an obligation.

If necessary, you can attach copies of individual invoices, extracts from sales and purchase books to the explanations.

Procedure upon receipt of a request

After the taxpayer receives requests for clarification, he must check the documents submitted to the tax office with the data in his hands.

First of all, when checking a VAT return, the amounts indicated in it are analyzed (for their compliance with the amounts for all incoming and outgoing invoices). Next, dates, invoice numbers, and other details (TIN, KPP, addresses, etc.) are examined in the same way.

If questions arise regarding the simplified taxation system declaration or income tax , you should analyze all the amounts of expenses and income that were accepted for their calculation. All other types of documents that raise questions from the tax inspectorate are also checked using the same algorithm as above.

After the error is found, you need to submit updated tax reporting with corrected data - but this only applies to amounts. If the error does not relate to the financial part, then there is no need to submit a “clarification”; it is enough to provide the necessary explanations.

Attention: the law does not say that explanations must be given in writing, i.e. this means that they can also be provided orally. However, in order to avoid further disagreements, it is better to take care of drawing up a written response.

Explanations during the desk audit

To submit explanations, you have 5 working days from the date of receipt of the request from the tax office (clause 3 of Article 88 of the Tax Code of the Russian Federation). If you do not provide an explanation, you will face a fine of 5,000 rubles. (Clause 1 of Article 129.1 of the Tax Code of the Russian Federation).

If you decide that there are errors in the reporting you submitted, instead of explanations, you can submit an updated tax return (calculation). And in this case, there will certainly be no fine for failure to provide explanations.

You can submit clarifications to the tax office:

- or by submitting it in person through the office;

- or by sending a letter by mail with a list of the contents;

- or by sending via TKS.

How to write explanations to the tax office

There is no officially approved sample explanatory letter sent in response to the Federal Tax Service's request for clarification. Explanations can be made in any form, indicating the following information:

- name of the tax authority and taxpayer, his INN/KPP, OGRN, address, telephone;

- heading "Explanations";

- mandatory reference to the originating number and date of request from the tax office,

- direct explanations on the requested issue with their justification,

- if necessary, list attachments to the letter confirming the correctness of the reporting indicators,

- manager's signature.

If an error made in reporting did not lead to an understatement of tax, the explanatory note to the tax office must contain this information. Write about this, indicating the nature of the error (for example, a typo or technical error) and the correct value, or provide an updated declaration or calculation. An error due to which the tax amount was underestimated can be corrected only by submitting a “clarification” - mere explanations for the tax authorities in this case will not be enough.

When, in the taxpayer’s opinion, there are no errors in the reporting, and therefore there is no need to submit an “adjustment”, it is still necessary to provide explanations to the tax authorities, indicating the absence of errors in the declaration or calculation.

Suspicious losses

Income tax raises many questions for the Federal Tax Service, especially if the declaration shows a loss instead of profit. If the loss is one-time in nature, it usually does not attract the attention of regulatory authorities. But in case of permanent losses, the organization should expect quarterly requests from the Federal Tax Service. Such results of commercial activity seem suspicious to tax authorities, especially if the company does not intend to begin bankruptcy proceedings.

Factors influencing the unprofitability of an enterprise can be very different. In most cases, this is due to a high share of non-operating expenses not related to making a profit. For example, an organization has a large amount of overdue accounts receivable and is required by law to create a reserve, the amounts of which are included in non-operating expenses.

The explanatory note to the tax office on the claim for losses must contain explanations about the reasons for the excess of expenses over income. If the results were influenced by macroeconomic factors, it should be written that the company is unable to change the economic situation in the region, the exchange rate, inflation rate, etc. At the same time, it is advisable to promise to optimize costs in the near future.

We must remember that the company is suspected of illegal actions and has the right to summon management to a commission if the answer is not sufficiently substantiated. Explanations are written in free form.

Computers How to change the language in Bluestacks to English: detailed instructions

Many interesting games and applications have been created for the Android operating system. The list of new programs is constantly updated. Therefore, many computer owners would like to try playing Android games without...

Technologies How to change the date on Galaxy S II: detailed instructions

Sooner or later, every mobile phone owner thinks about how to change the time or date in the device. This is especially true in Russia, where clocks no longer change to winter and summer time. Many residents of this…

Home and family Analysis of classes in preschool educational institutions according to the Federal State Educational Standard: sample, table

How does the introduction of the Federal State Educational Standard affect children attending kindergartens? This question worries every parent. Previously, the priority of the educational process in preschool institutions was preparation for school. Those who...

Law Service under contract in the FSB. Regulatory requirements, salary

At all times, the state power of any country, empire or kingdom needed support. It could be carried out by both the people and the nobility. But a wise ruler knows that one can only hope for...

Internet All the details on how to search Google using an image

In addition to the usual search for text information, we may need to find a number of similar pictures to write an interesting article or something else. The search for information itself is always labor-intensive, especially when there is a lack of...

Education Technological map of the lesson according to the Federal State Educational Standard. Preparation of a technological lesson map in accordance with the requirements of the Federal State Educational Standard

The introduction of the latest standards in the education system led not only to adjustments to the curriculum, a new list of recommended teaching methods and techniques, but also significantly influenced the amount of required doc...

Education Biology Lesson Plan. Development of a biology lesson in accordance with the requirements of the Federal State Educational Standard

A very important cycle of subjects within the school curriculum is natural science. After all, it is he who gives an idea of nature, its phenomena, living beings, and their relationship with humans. Geography, biology, physics and chemistry...

Education Explanatory note for the project - design requirements

An explanatory note to the project is considered one of the fundamental documents when performing course work or dissertation work. This is where all the necessary information about the rationale for the chosen design, its description is collected...

Finance Balance sheet: explanatory note to the balance sheet. Form, sample

In accordance with PBU 4/99 “BU”, statements of profits, cash flows and capital are supplemented with notes. The balance sheet is no exception. Explanatory note to the balance sheet &...

Finance Explanatory note to the balance sheet and its role in reporting

The explanatory note to the balance sheet is a mandatory part of the financial statements. This is regulated by paragraph 5 of Accounting Regulation No. 4/99 “Accounting statements of the organization.” In this document I disclose...

Lately we have been receiving a lot of calls from clients about the same question - what answer to give to the tax authorities based on reporting data submitted more than three years ago.

Reporting discrepancies

Quite often there are situations when the same economic indicator has different values in the presented forms of fiscal reporting. Such discrepancies are caused by the fact that for each tax, fee, contribution, individual rules for determining the taxable base are established. And if tax authorities require you to provide an explanatory note on this issue, provide explanations in free form. In the text, indicate specific reasons why the discrepancies arose. Also, the reason for such inconsistency may be different norms and rules of tax accounting in relation to a number of specific situations. Write down the circumstances in an explanatory note. It is welcome to provide explanations with references to the norms of the current fiscal legislation. Even if the company is wrong (incorrectly interpreted the norms of the Tax Code of the Russian Federation), the Federal Tax Service will provide detailed explanations, which will help avoid larger mistakes and fines in future activities.

Errors and discrepancies regarding VAT

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Value added tax is the fiscal liability where accountants make the most mistakes. As a result, discrepancies and inaccuracies in reporting are inevitable. The most common mistakes are when the amount of tax accrued is less than the amount of the tax deduction claimed for reimbursement. In fact, the reason for this discrepancy can only be the inattention of the person responsible for issuing invoices. Or a technical error when uploading data. In the explanatory note, please include the following information: “We inform you that there are no errors in the purchase book, the data was entered correctly, timely and in full. This discrepancy occurred due to a technical error when generating invoice No.____ dated “___”______ 20___. Tax reporting has been adjusted (indicate the date the adjustments were sent).”