What do investment products mean?

Investment products are certain objects that an investor purchases or invests money in in order to make a profit. The choice and number of types of such objects is quite extensive: here you can invest in securities, shares, open an individual investment account, as well as PAMM accounts. Based on their capabilities, experience and acceptable risks, everyone can choose the most suitable and safe option.

When choosing investment products , the following criteria are usually taken into account:

- The reliability of the company making an offer for the investor to invest money in something. If the ratings are extremely low, and the organization is at the bottom of the rating list, then undoubtedly this is an indicator of low reliability. As a result, cooperation with it is associated with high risks of loss of savings;

- Securing the investment declaration at the legislative level. For an investment product, this is a mandatory component, indicating its essence and fact of existence. If this criterion is missing, then the product is not registered and is not supported by anything.

- Quality of service, which can often create a negative impression of the company, as well as discourage the desire to work with it.

Let's go through the main types of investment products in banks and stock markets.

What is a structured product

It may have different names (investment deposit, structured note, indexed deposit or deposit with capital protection), but there is only one name.

Do you want to earn 20-30% in just 1 year, and if you’re lucky, then the entire 40-50% profit.

And without any risk. The worst-case scenario for you is a full refund of the deposited funds.

As much as you put in, that much will come back. 100% capital protection.

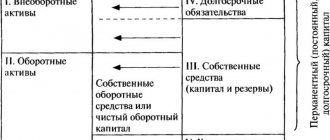

The principle of operation of structured products is perfectly illustrated by this diagram.

The client chooses one of the proposed scenarios for the development of events or investment ideas. Invests money. And... waiting for his finest hour and money in the form of profit.

The scenario usually includes growth (but there may also be a fall) of the underlying asset:

- gold;

- oil;

- ruble/dollar;

- individual shares;

- stock indices;

- and so on and so on.

For example, an idea to increase gold prices throughout the year. There will be an increase of 20%, the client will receive 10-20-30%. Here the rate of return will depend on the investment period and other conditions. There will be no growth; the client will be refunded the initially invested amount.

The range of investment products depends on the bank or broker. From modest 1-2 to 10-20 trading ideas. Plus, it is possible to assemble your own product with specified parameters.

Agree, it sounds like a fairy tale! This is the source of wealth!

Stop! But vague doubts are beginning to overcome me. There is some catch here.

There's no catch. Everything is fair, without deception from the wizard Suleiman.

Kidding.

What the hell is Suleiman if he is Ahmed. And not a wizard. And so, a magician.

Okay, let's be serious, like in a lesson at school or at a lecture at the university.

When it comes to money. Especially your own, honestly earned ones. I would like to fully understand the method of investing. And despite the beautiful wrapper, look what's inside.

And it often happens that the more beautiful the wrapper, the more likely it is that inside there will be not chocolate, but ordinary cheap caramel. Law of energy conservation. Or money. Some people lost money and, by a strange coincidence, others’ wallets immediately became thicker.

What are shares and the stock market?

Shares are units or pieces of a company. Each share allows you to own a piece of the company. Investors have two ways to make money through stock ownership. The first way is through capital gains. The second way is to receive dividends.

Taking into account capital gains, when the price of your shares becomes higher than the price at which you bought them, you can sell them for a profit. Let's say you bought a stock for $10, and the next week the stock went up to $14. When you sell them next week, the profit made is $4.

Read: Tinkoff investments: tariffs and operating principle.

What drives stock prices day to day? Stock market (also called secondary market). The stock market is where buyers and sellers of stocks come together and exchange shares for money.

All risks are on the client

A structured product is a very expensive story for an investor. Here we get a non-symmetrical distribution of risk; if the market does not move in a direction that was not predicted in advance, the investor bears 100% of the losses; when the market moves in a good and profitable direction, the profit is distributed unevenly. An investor can receive 10%, and a financial company can receive 90%. This is due to the fact that the client’s profit is limited by the terms of the structured product. The commission will be paid in any case, even if the joint venture does not work well.

Financial consultants and bank representatives often refer to the fact that structured products are often popular in the West and in the USA. It is necessary to understand that the difference between the two markets is significant; Western structures are more flexible, since the market is developed and there are more offers, therefore firms are forced to adjust products. As a result, you need to fight for your client.

In Russia, this market is developing slowly, products are being formed, already lagging behind the current market conditions.

There is a category of products that are tailored to the investor. In this case, the entry threshold is excessively high.

Investment products - dividends.

The second way to generate income is dividends . Dividends are when companies decide to allow investors to share in the company's annual profits. For example, companies like Apple pay dividends quarterly (every 3 months). To put it simply, let's say Apple earned $10 in 2020 and decides to issue a $2 dividend to its investors. The company now distributes part of its profits to its shareholders.

Not all companies pay dividends because, based on the company's business, it may be necessary to retain some profits for reinvestment in the future.

Mutual funds.

These types of securities work from people who pool their funds and invest their money in a variety of stocks, bonds, and other products. The investment manager manages the fund and decides what to buy and sell and must follow the mutual fund's investment objective.

Investing in a mutual fund provides benefits because an investment professional invests on your behalf. In addition, there is diversification from investing in various stocks and bonds. When an investor owns 10 different securities in bonds and stocks, the risk is reduced because not all stocks will move the same way. As a result, when one stock falls, another may maintain its value.

The downside to mutual funds is their expensive fees. In the last couple of years, there has been a trend of investors moving away from mutual funds due to high fees. In general, most fees are now 2.5 percent, which makes a difference, especially when fees are still being charged when the mutual fund isn't making money.

Another disadvantage of mutual funds is their lack of liquidity. Investors cannot trade them as freely as they can with stocks.

Services

Investment services are provided by various financial market entities. These could be banks, consulting agencies, brokerage companies.

In particular, consulting agencies specialize in collecting, analyzing and providing information about a particular investment asset or entity. The services they provide are very diverse. For example, specialists from a consulting agency can undertake the development of an investment strategy, which will include an assessment of the characteristics of the industry chosen by the investor, the level of potential risks and other indicators.

Investment services provided by banks require a separate serious discussion. Let's look at a specific example. This type of service includes the purchase or resale of shares (bonds, other securities). In this situation, the bank can act as an intermediary and guarantor of security for the issuer placing shares or for an investor who wants to buy them.

Brokerage companies provide services to private investors regarding the formation and trust management of their money. In particular, the broker can, on the customer’s instructions, create and manage an investment portfolio. Such services are necessarily specified in an agreement between the parties, which stipulates all the terms of cooperation and the commission for the work.

Hedge funds.

Like mutual funds, hedge funds also pool the capital of various investors and invest it. The only difference here is that hedge fund managers typically invest with little to no restrictions because they think these people should be able to invest where they can maximize the fund's returns. They charge funds high fees for their expertise. This hurt the hedge fund industry when promised returns never materialized.

What are investment goods

The capitalist world for modern man dictates special requirements that are directly related to money.

Thus, the basic rule is to rationally use the material resources that have been accumulated during a specific period of activity. The principle of operation involves the use of free capital to increase assets and generate additional income. For this purpose, there are various investment directions, among which the investor can choose the most effective option for himself. For example, invest in deposits or shares of a large and actively developing company. Today, a huge selection of goods, products and services are offered that can bring high income. Each of them has its own characteristics, advantages and level of profitability.

Investment product is one of the fundamental terms in general economic practice. According to experts, this concept is intended to be taken literally, which means it defines goods that were purchased with funds from investments. Their main goal is to replace, renew and improve the quality of basic resources. Investors use such methods to improve production technologies. Products most often include funds received as a result of construction and engineering activities.

With the help of investment goods, the enterprise is modernized, production capacity is increased, and the number of manufactured products is increased. Among them it is worth highlighting the main varieties:

- Constructions and buildings of various designs and technical characteristics. These can be workshops, factories, electrical installations, warehouses, offices and others. The group includes multifunctional buildings that provide conditions for the full functioning of the enterprise.

- Transport routes. This type of communications includes roads for road and rail transport, as well as pipelines for pumping oil, gas and petroleum products.

- Production Possibility Lines. This category includes a complex of industrial equipment and mechanical components used in the enterprise for the production of products.

- Source materials and raw materials. The group includes all kinds of resources that a plant or workshop accepts for the production of final consumer goods.

You can start investing in goods only after studying the basic concepts of the financial sector. Lack of skills and practice can lead to unprofitable investments and loss of capital. Also, the investor’s task is to familiarize himself with the key characteristics of the objects of the activity under consideration, in particular the industries in which it is intended to invest funds.

Exchange Traded Funds (ETFs).

ETFs are securities that track an index, bonds, or basket of assets. These are very similar to mutual funds, but the difference is that ETFs are traded on a stock exchange. This is why ETFs have higher liquidity than mutual funds. This type of security also has lower fees, making it very attractive to individual investors.

Exchange-traded funds with similar stocks and mutual funds can generate dividends and capital gains.

ETFs are also safer than stocks because they are diversified from investing in a basket of assets. Each ETF has different types of investment strategies, so there is risk between different ETFs.

Investment products - bonds.

Bonds are debt instruments whereas mutual funds, bonds, ETFs are equity investments. Stock investors typically own the asset or company they are buying. Bonds involve lending money to another company. Therefore, when an investor buys government or corporate bonds, he is essentially borrowing money. Bonds are greatly affected by rising and falling interest rates. Bond prices move in line with interest rates.

Read: Online cryptocurrency course.

Bond investors or bondholders earn their income from interest and sale of bonds for more than what they paid. As an investor, bonds are useful because they are generally safer than most stocks. While stocks can move up and down depending on the markets, bonds have less fluctuation than stocks and are considered safer. Another advantage of buying bonds is that if a company goes bankrupt, the bondholders will be the first to get their money back before the shareholders.

How to increase personal capital

Any person thinks about how to increase money .

Banking organizations come to the rescue, sometimes offering quite favorable terms of cooperation, as well as microfinance companies (MFCs), which attract clients with high rates. Investing in an MFO is similar to bank deposits - you provide the company with your money for temporary use in order to generate additional income. To avoid falling prey to scammers, you should cooperate only with trusted companies. You will find a list of reputable banks and microfinance organizations on our website. These organizations are included in the state register of the Central Bank of the Russian Federation and have all the necessary licenses to conduct financial transactions.

Investments in microfinance organizations

The popularity of investments in microfinance organizations is growing along with the development of the market. The interest of citizens is associated, first of all, with the high profitability of this type of capital accumulation. You can invest and increase your funds by placing them at a rate of more than 30% per annum. There are several ways to invest in microfinance organizations:

- Concluding an agreement with a company for a fixed annual rate and depositing funds is the most common option.

- Purchasing bonds of a selected financial institution for the amount of the deposit is a reliable and profitable way.

- Issuing online loans on the MFO Internet platform is the fastest way to increase your money (available only in some companies).

Investors' risks are insured for the entire amount and the entire term of the contract in the insurance company with which the MFO cooperates. Information about the partner company can be found on the website or directly from the manager. This way the client can increase their income and not fear for the safety of their finances.

Note! The new law on raising funds states that only MFOs with MFC status can accept savings and financial investments at interest from both individuals and legal entities. MCC has the right to raise any amounts only from the owners of companies. Simply put, MFCs (microfinance companies) can both issue loans and accept deposits; MCC (microcredit companies) - only engage in lending.

In addition, all microfinance organizations are allowed to carry out remote identification of clients, in which the borrower is not required to visit the selected organization to resolve financial issues.

Types of bank deposits

There are many different banking savings products available in the market. about how to increase money by cooperating with a financial institution. The procedure for opening a deposit is available to all of them. An agreement for the placement of funds is allowed to be concluded with several banks at once.

For the convenience of clients, there are several types of deposits:

- Poste restante. It features the lowest yield and minimum interest rate. Money is placed indefinitely and can be withdrawn by its owner in part or in full at any time.

- Urgent. The agreement specifies the time period for which funds are reserved. You cannot withdraw part of the money before the expiration date. If the client decides to withdraw his capital earlier, then the payment is made taking into account the reduced rate (as in the “on demand” option). Time deposits are divided into three subtypes: - savings - you cannot make additional deposits or withdrawals, they have the highest interest rates, which are accrued at the end of the term; — accumulative — periodic replenishment of the cash deposit is available, depending on the terms of the agreement, capitalization of interest is possible; - settlement - it is allowed to spend the placed funds up to the established minimum limit, in some cases it is permissible to replenish the amount, the interest rate is lower than that of savings and savings options.

In addition to the main classification, save and increase funds using special deposits. They differ by type of currency (ruble, foreign exchange, multi-currency), by audience (children, youth, pensioners) and by intended purpose (mortgage, charity, insurance, etc.). The choice is up to the client.