Individual entrepreneur is an individual or legal entity

In order to understand that an individual entrepreneur is a legal entity or an individual, it is necessary to study the relevant codes of laws that set out the definition of the concepts of a legal entity and an individual entrepreneur.

Important! The Civil Code of the Russian Federation (Article 23, paragraph 1) states that a citizen has the right to independently engage in his own business, without creating a legal entity. To do this, he will need to obtain individual entrepreneur status.

The full definition of the concept of individual entrepreneur is given in the Tax Code of the Russian Federation (Article 11, paragraph 4): An individual entrepreneur is an individual who is registered with the Federal Tax Service in this status and runs his own business without forming a legal entity.

What is IP - a question troubling the masses

To put it simply, an individual entrepreneur is an individual who has the same rights to conduct business as a legal entity. No matter what this form of activity is called: a private entrepreneur or an entrepreneur without the formation of a legal entity, it is still only an individual.

Almost every citizen of Russia can become an individual entrepreneur, but he will definitely need to fulfill all the legal requirements for this form of activity.

Any Russian has the right to become an individual entrepreneur

Anyone who decides to engage in commercial activities on a small scale needs to acquire the status of an individual entrepreneur. There are several good reasons for this:

- Without registration of business rights, any activity will be considered illegal. It takes place only in the Federal Tax Service (as of 2020).

- Upon receipt of individual entrepreneur status, an individual registers with the tax service and chooses the tax payment system that he will follow.

- After the registration procedure, the individual entrepreneur assumes full responsibility for all his actions to the state.

- A person does not have the right to hire employees if he does not have the status of an individual entrepreneur, while an individual entrepreneur can do this absolutely freely. He signs employment contracts with them, signs their work books, and therefore pays them a standard salary. This is very important in modern society.

Thus, the answer to the question of whether an individual entrepreneur is an organization or not is clear. This is only an individual.

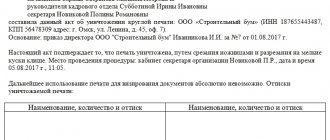

A certificate of state registration of an individual entrepreneur confirms the legality of a citizen’s commercial activities

Main differences between the two categories of persons

Today, there are five main differences between these categories of persons:

- The initial appearance of the face . An individual is a person who is born naturally; his birth does not depend on legislation. Law firm (person) – is created in accordance with all the rules of the law; the emergence of such a person without registration with a law firm is impossible.

- Rights and capacity of persons . A legal entity receives all its rights and can be considered legally capable at the very moment when it is registered with a government agency. For an individual, everything is much more complicated. An individual receives his rights after birth, partial legal capacity is achieved at the age of 14, and after turning 18 years old, this person is considered fully capable.

- Number of people . A natural person can never be plural. A legal entity, in turn, can be not only in the singular (this happens very rarely), but also in the plural (a certain group of people working in the company). Also, a legal entity has an orderly organizational structure, while another category of persons does not have such a structure.

- The impact of business risks . During the creation of a company, and, accordingly, a legal entity, its participants reduce their risk by making their own contribution. This investment is a separate property of the company. Each member of the firm risks losing only his own share. Another group of people does not divide property into categories, and accordingly they risk losing all their property, and not just part of it.

- Responsibility of persons . A legal entity can only be brought to administrative and civil liability. Individuals may also be subject to disciplinary and criminal liability.

Concept and characteristics of an individual

An individual is a citizen who has the rights and obligations granted to him by the Constitution and other laws. According to the Civil Code of the Russian Federation, since 1994, people as subjects of civil law are called citizens (individuals). This addition is given in parentheses, since a citizen is a person who has citizenship of the Russian Federation, and an individual may not have citizenship, but can freely reside in the country and carry out legal activities within the framework of the law.

The characteristics of an individual are as follows:

- identification in the state system by last name, first name, patronymic;

- no obligation to undergo additional registrations other than those required of all citizens of a rule-of-law state;

- he has the rights to conduct transactions and conclude contracts with both individuals and legal entities in various sectors of the economy.

Important! An individual acts exclusively on his own behalf and has no obligation to create and register an organization, enterprise or firm.

Transactions between individuals do not require registration as a general rule

○ The concept of an individual entrepreneur.

Legal entities can enter into contracts and make legal transactions, participate in court hearings as defendants or plaintiffs. They can also exercise their rights and fulfill these obligations.

A legal entity is vested with rights after registration and entry into the register. An individual has rights from the moment of birth until death. Partners in commercial or non-commercial activities can participate in resolving only administrative and legal matters. Individuals have more rights and responsibilities.

Individuals and legal entities have a number of significant differences. First of all, they are manifested in the peculiarities of activity, the use of their property and capital, and the acquisition of responsibilities. The norms establish certain requirements for these categories and explain the criteria by which a subject belongs to any of them.

However, this possibility is realized if the person additionally has legal capacity. It is understood as the ability of people to obtain and exercise civil rights enshrined in the norms, create legal obligations for themselves and implement them in relation to other entities. Legal capacity appears with the onset of adulthood.

Concept and characteristics of a legal entity

According to Article 48 of the Civil Code of the Russian Federation, a legal entity is an organization that has personal, separate property on the basis of ownership, economic management and operational management. It acts on its own behalf and bears full responsibility for all its property.

The characteristics of a legal entity are as follows:

- Speaking in civil proceedings on one’s own behalf. A legal entity has the ability to acquire rights, be responsible for its actions, and be considered a separate entity in court.

- Separate property. This sign indicates that a particular organization has its own property, which is separated from the property of any other organizations, as well as individuals (including its founders). It must be separated by ownership, economic management or operational management. Its presence and condition must be checked regularly. All assets are subject to accounting both in the economic department and in the balance sheet.

- Organizational unity. This means that any legal entity must have its own internal structure and management bodies. This feature is enshrined in the charter, or the constituent agreement and charter, or the standard regulations of a particular organization.

- Independent property liability. The meaning of this sign is quite simple to decipher - the company is independently responsible for its debts and obligations. Neither the founders nor the owners have the right to do this for him.

The responsibilities of a legal entity are as follows:

- Each organization must have a registered official address, which will be the place of state registration. It is regularly indicated in all documents with which the legal entity works.

- Any organization is required to have its own name, which contains an indication of its form within the legal framework.

- The names of all non-profit and some commercial organizations must contain an indication of the nature of the legal entity’s activities.

- A legal entity with a registered name has all rights to use it.

Important! If an outside individual or legal organization uses the name of a registered legal entity, it is obliged to immediately stop doing so and compensate for all damages caused.

Legal entities are always managed by several persons, and not by one, like individual entrepreneurs

What is a legal entity?

A legal entity is a company that was formed by a citizen of the country and was registered with a government agency.

Firms, and accordingly this category of persons, can be divided into:

- Commercial.

- Non-profit.

This person has the right to enter into various contracts and transactions, to take part in legal proceedings (they can act both as a defendant and as a plaintiff).

There are also a number of negative aspects when transforming into a legal entity:

- Before becoming a legal entity, you need to study a lot of different information. This is due to the fact that companies have different directions, so when registering a company with a certain focus, you need to know all the nuances regarding its further promotion.

- It is very difficult to liquidate a legal entity, and therefore a company. If the company has not given the desired results, and its existence is no longer necessary, you need to go through some government authorities again so that the person or group of people is removed from the state register of legal entities.

What is common between individual entrepreneurs and individuals

Individual entrepreneurs and individuals have the following common characteristics:

- According to the law, these two forms have identical civil legal meaning.

- In both cases, we are talking about a specific person, who is identified in the database by personal data (last name, first name and patronymic), as well as an identification number.

- In both cases, there is an official place of residence, at which registration of both the citizen and the individual entrepreneur must take place.

- There is a general scope of rights, responsibilities and legal capacity.

- A business entity that is registered as an individual entrepreneur can act not only as an individual entrepreneur, but also as an individual. This is provided for by the legislation of the Russian Federation.

- Both entities have the right to organize and conduct business operations, execute transactions and enter into most contracts.

- Both an individual entrepreneur and an individual have the right to sign contracts with legal entities and engage in legal activities, acting under their own name.

- Both bear administrative responsibility for the relevant offenses.

- If it happens that debts arise, they are liable with all their property, with the exception of that which cannot be recovered by law. When a citizen is unable to satisfy all the material demands placed on him, then by decision of the arbitration court he may be declared bankrupt.

Important! Before registering as an individual entrepreneur, a citizen needs to fully analyze the situation: choose the type of activity he will engage in, calculate all possible risks, find out whether this activity is subject to licensing, what method of taxation is expected to be used, whether he will have to open bank accounts, familiarize himself with bank accounts proposals.

Concluding an agreement is one of the fundamental rights of individual entrepreneurs and individuals.

But there are also differences between these two concepts, despite the fact that the wording in the legislation is very vague:

- In essence, an individual entrepreneur is equal to an individual who is at the same time endowed with the rights of a legal entity. He has the legal capabilities of the latter and the former. A legal entity has no rights to either one or the other.

- The status of an individual entrepreneur allows you to extract legal profit from your business and make various transactions with others. An individual does not need a stamp or a bank account; his financial activities are much simpler.

The status of an individual entrepreneur is prescribed in the Civil Code of the Russian Federation; it says the basics about his rights and powers.

What is IP

Registration as an individual entrepreneur does not imply opening a legal entity

An individual entrepreneur or individual entrepreneur is a person who has been registered with the tax authorities and is engaged in the provision of services or the production of goods. Registration as an individual entrepreneur does not imply opening a legal entity.

The law specifies who has the right to become an individual entrepreneur:

- a person who has citizenship;

- a foreigner permanently residing in the country legally;

- a person who has reached 18 or 16 years of age (the second option requires consent to conduct business by legal representatives).

An individual entrepreneur is not an enterprise, but a person’s status that allows him to legally engage in systematic profit-making. In relations with counterparties, he bears personal liability with property.

In practice, the following signs of IP are distinguished:

- acquisition of formal status;

- desire for profit;

- lack of authorized capital;

- the presence of risks (there is no full guarantee of the fulfillment of obligations by other parties, the sale of the planned volume of goods, services, etc.);

- a limited number of employees who are allowed to be hired (depending on the tax regime used - from 15 to 100 people, with the exception of OSNO);

- application of some simplified forms of taxation.

Conducting business involves formalizing relationships in the form of contracts. Including the implementation of state or municipal orders.

An individual entrepreneur has the right to do whatever he wants, subject to restrictions, for example, obtaining a license. But the right to conduct certain types of activities is directly limited to individual entrepreneurs. For example, a security company operates only in the form of an LLC.

The law and business practice do not prohibit combining activities as an individual entrepreneur and regular employment.

Advantages and disadvantages of individual entrepreneurs

One of the main advantages of this form of commercial activity is the simplified procedure for submitting tax and financial reporting

Let's start with the advantages of this type:

- simplified registration process;

- lack of authorized capital (although its presence has become a formality);

- lack of a legal address, the address of the place of residence is equivalent to it;

- simplified procedure for submitting tax and financial reporting;

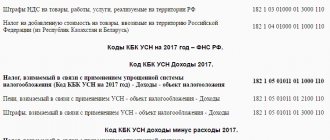

- exemption from a number of taxes when using a simplified taxation system;

- reduced insurance premium rates if activities are carried out without the involvement of employees;

- the right to carry out payments in some cases without using cash registers;

- the right to do business without opening bank accounts;

- free disposal of funds received from activities;

- simplified procedure for termination of status.

What is common between individual entrepreneurs and legal entities

To define the concept of individual entrepreneur and legal entity, you need to know their similarities and differences.

The similarities are:

- Both forms are created exclusively for conducting business activities that will generate profit.

- All rights (property, economic, personal) are exercised in one’s own name.

- For the full implementation of economic legal relations, state registration with the relevant authorities is required.

- There may be identical tax systems and temporary income.

- Hiring of employees is carried out in the same way. It is necessary to make an entry in the work book. Also, payments are made to the Pension Fund for all employees and taxes are paid for each of them.

- Both forms work based on the articles of the Code of Administrative Offenses of the Russian Federation.

- It is possible to have a current account. It is mandatory only for organizations, while individual entrepreneurs can be registered at will. From the point of view of banks, an individual entrepreneur becomes a legal entity when making non-cash payments through a current account.

- Both an individual entrepreneur and a legal entity have the right to act in court on their own behalf.

- Both forms of doing business can be fined by employees of the Federal Tax Service and other regulatory authorities.

Working with a Federal Tax Service employee is a common pattern in the activities of a legal entity.

How do these two forms differ:

- A legal entity is always an organization, and an individual entrepreneur is an individual, that is, a specific person.

- An individual entrepreneur is registered at his place of residence, and a legal entity is registered at his legal address.

- Property separation and responsibility for assets are the main differences. If an organization has its own property, which is separated from the assets of its leaders, then an individual entrepreneur has one and the same property.

- An organization has a name, but an individual entrepreneur does not always have one.

- Organizations are able to conduct any activity and carry out all transactions, but there are restrictions for entrepreneurs.

Important! Legal entities are required to have a charter.

Model company charter

Advantages and disadvantages

The difference between an individual entrepreneur and a legal entity is that an entrepreneur does not need:

- undergo complex registration;

- write accounting reports;

- report on the use of income;

- have an independent estimate.

Also, “IP employees” enjoy simplified cash transactions, reduced tax rates and are simplified by the tax office. All this is a huge plus, but there are also significant disadvantages:

- the scope of entrepreneurial activity is narrow;

- Contributions to the Pension Fund are required in any business situation;

- not many entrepreneurs are ready to cooperate with individuals;

- inability to sell your activities to cover losses.

The sole responsibility of an individual entrepreneur, and with all his property, makes this business more risky.

Advantages and disadvantages of doing business as an individual entrepreneur (in comparison with other forms)

Most often, if you want to run a business, the question arises in what form it is better to register it: as an LLC or an individual entrepreneur. To answer this question, you need to know all the pros and cons of both forms in comparison with each other. If difficulties arise, it is better to seek help from a consultant.

| Criterion | Individual entrepreneurship | OOO |

| Decor | Simple, small package of documents | Registration takes longer and requires a large amount of documentation |

| Registration | At the citizen's registration address | To legal address |

| State duty amount | 800 rub. | 4000 rub.* |

| Initial capital | Not required | 10,000 rub. Each of the founders contributes their share, income is distributed according to the invested funds. |

| Responsibility | All property of a citizen | Each founder loses only his share in the general property of the LLC |

| Kind of activity | There are a number of restrictions | Allowed to conduct any activity specified in OKVED |

| Accounting | Not necessary | Accounting, tax accounting, and reporting are required |

| Ability to manage finances | Free disposal of any finances that are property | There are only 2 options for income: dividends (for founders) and salary, or bonuses for company employees. |

| Possibility of obtaining a loan | Low interest rate, consumer loans acceptable | Possibility of opening a credit line |

| Re-registration and sale | No | Yes |

| Liquidation | Simple process | Complex, but there is a possibility of sale or change of founders |

The table shows that everything depends on the situation, on what kind of business you want to open, since for companies there is wide scope for activity, while for private entrepreneurs the choice is significantly less.

Thus, the question of whether an individual entrepreneur is a legal entity or an individual is obvious. When starting a business, you always need to compare your capabilities, abilities, and calculate not only the expected profit, but also the possible risks. The status of an individual simplifies many procedures, but also imposes some restrictions.

*Amounts are current as of February 2020.

General information for Legal entities and Individuals

The page is dedicated to comparing the advantages and disadvantages of individual entrepreneurs with legal entities. The topic is relevant, since any businessman at the beginning of his journey, and sometimes later, is faced with a choice: what to register - an entrepreneur or an enterprise. And this is not a simple momentary question. Future prestige, name, money, in the end, depend on his decision.

More than 90% of enterprises registered in Ukraine can be considered small and medium-sized businesses in Ukraine. The recent economic crisis has seriously decimated the ranks of small businesses. There was a massive withdrawal of domestic business “ into the shadows .” The main reasons for this phenomenon include political instability and citizens’ distrust of all branches of government; as well as a complex tax system and government corruption.

However, in recent years, businessmen have begun to open more and more new business entities. Apparently due to the fact that Ukraine has an incomparable advantage over developed countries. And it lies in the fact that in Ukraine there are still many unoccupied niches that are in demand by society for the development of small businesses. First of all, small businesses and entrepreneurs are registered. Therefore, the question of comparison remains relevant. We also recommend that you read the article “Mistakes of Entrepreneurs or How to Find Your Rake.”

| Individual entrepreneur YuLRRO VAT | Designations: - Individual entrepreneur - Legal entity - Registrar of Settlement Transactions - Value added tax |

Comparison of Legal and Individual

| What is the accounting procedure? | |

| A simplified accounting system , which practically boils down to maintaining an Income Book or an Entrepreneur’s Book of Income and Expenses | Obligation to maintain accounting and tax records |

| Do I need to register a PPO? | |

| RRO is registered only by entrepreneurs on the general taxation system, “unit entrepreneurs” are exempt | Mandatory registration for cash payments |

| Is it necessary to register VAT?? | |

| Mandatory when exceeding UAH 1,000,000. for the last 12 months (on the general taxation system) Voluntary - optional | Mandatory when exceeding UAH 1,000,000. for the last 12 months (on the general taxation system) Voluntary - optional |

| Making cash payments? | |

| Availability of the ability to withdraw cash from a current account without documentary evidence | Intended use of cash with mandatory documentary evidence |

| Do you need a stamp and a current account? | |

| A seal and a current account are not required for individual entrepreneurs. Entrepreneurs who pay VAT must have a seal. | Stamp and invoice required |

| What is the extent of liability? | |

| Liability is not limited . The entrepreneur is responsible with all his property | Liability is limited to the share in the authorized capital of the company, except for exceptions, for example: limited partnership |

| What are the benefits? | |

| - the ability to work with cash without registering RRO (entrepreneurs on a single tax); - simplified accounting; - the ability to use personal property in activities without additional registration. | - limited liability of the founders; - “prestige” of the organizational and legal form; - attractiveness for investors, the possibility of various forms of investment and cooperation |

| What are the disadvantages? | |

| - increased level of responsibility (with all the property of the entrepreneur); - registration only at the entrepreneur’s registered address; - low level of interest for investors; - unsettled legislative framework | - restrictions when working with cash payments; - complexity of accounting and reporting; - the presence of additional restrictions (the size of the authorized capital, the presence of a legislative and executive body); |

The main accents have been set, the shortcomings have been revealed. The questions are covered in more detail on individual pages of the site. The decision is yours. If anyone needs our help, please contact us - we can help you calculate a business plan, find advantages and weaknesses.

If you have any suggestions, write, we always welcome your suggestions or criticism.

Source: https://www.buhuslugi.com.ua/ru/informatsiya/obshchaya-informatsiya.html