What is OS conservation?

Fixed assets are the property of the company. These include land plots, buildings, equipment, etc. Conservation of fixed assets is a set of measures to temporarily shut down the operation of one or more fixed assets. The main feature of the event under consideration is the introduction of the OS into operation after the period specified in the documents.

The essence of the procedure is explained by its name. Conservation means preservation. The purpose of the event is to preserve the quality and characteristics of the OS, the amount of funds in current accounts. At the same time, operating costs are also reduced or eliminated altogether. At the same time, the OS does not bring any profit.

IMPORTANT! The maximum conservation period is 3 years. In some cases it can be extended.

In what cases is conservation carried out?

Conservation is relevant in the following circumstances:

- Seasonal work has ended, and therefore the equipment ceases to be used until the next season. For example, the company uses snow removal equipment in winter. Naturally, it is not used in the summer. In this case, conservation becomes relevant.

- Temporary downtime at the enterprise. For example, an insufficient number of threads was supplied to production. Due to this, work cannot continue. Until the threads are delivered in full, the operation of the equipment is suspended.

- Due to lack of funds and economic inefficiency, cuts were made. For example, a workshop closed.

- The OS broke down and was sent for repair.

That is, conservation is needed when the OS is temporarily not in use for various reasons.

Reporting

The enterprise is obliged to record operating systems according to the degree of their use:

- in operation;

- in reserve (stock);

- in temporary non-use and so on.

This rule is established in Guidelines No. 91n. You can record the state of the OS in accordance with their use with or without reflection on the account. 01 (03). If conservation of fixed assets is carried out for a period of more than 3 months, it is advisable to show them in a separate sub-account. When releasing the OS back into production, the following should be reflected:

Db 01 (03), subaccount. "OS in operation"

Kt 01 (03), subaccount. "OS on conservation"

- re-opened.

In the process of carrying out these procedures with assets, costs may arise. For example, these could be material costs for packaging, installation/dismantling of equipment, and so on. If such costs appear when the disposal and conservation of fixed assets is carried out, the postings will be as follows:

Db 91-2 Kt 10 (23, 68, 60, 69...)

— expenses for depreservation, preservation and storage of OS are included.

Consequences of conservation of fixed assets

Conservation is divided into two main stages:

- Actual completion of operation.

- Recording information in relevant documents, as well as in the accounting program.

Conservation involves documentation. This is a voluntary procedure. That is, the entrepreneur does not have to draw up documents. You can simply stop using it. On the other hand, it is beneficial for a person to carry out full conservation. Let's consider the consequences of this procedure:

- Income tax is reduced. Expenses for maintenance, wages, depreciation, etc. can be included in non-operating expenses. The tax base is reduced by the amount of these expenses on the basis that the operating system ceases to be used for the purpose of making a profit.

- Depreciation will not be charged for storage lasting 3 months or more. The basis for determining the company's property tax will not be reduced due to the fact that the residual value of the fixed assets does not decrease.

- The useful life is extended by the duration of depreciation.

- It becomes more convenient to do accounting. The accountant opens subaccount 01 “OS on conservation”. In 1C it is possible to disable depreciation charges for unused operating systems.

Conservation has more advantages than disadvantages, and therefore it is used quite often.

Accounting for mothballed objects

Material assets that are under conservation continue to be included in fixed assets (paragraph 2, clause 7 of the GHS “Fixed Assets”).

When conservation of property for a period of more than three months and its subsequent re-conservation, accounting entries for the corresponding analytical accounts of account 101 00 “Fixed assets” are not made, only the corresponding entry is made in the inventory card (clause 10 of Instruction No. 162n).

At the same time, in order to reflect additional data in the reporting, when forming its accounting policy, the institution has the right to provide additional analytics for account 0 101 00 000 in relation to objects under conservation (Letter of the Ministry of Finance of the Russian Federation No. 02-07-07/84237).

Also, to reflect in accounting the transfer of fixed assets to conservation for a period of three months or less, it is necessary to provide for this in the accounting policy of the institution (clause 6 of Instruction No. 157n).

From 01/01/2018, mothballed property is depreciated according to new rules. According to paragraphs. “b” clause 8 of the GHS “Impairment of Assets” conservation is one of the internal signs of asset impairment. Therefore, if an item of fixed assets is idle and not used, depreciation on it is not suspended (clause 34 of the GHS “Fixed Assets”). The exception applies only to objects whose residual value has become zero.

Taking into account the above, it is necessary to charge depreciation for all fixed assets that are under conservation.

If the object was mothballed before 01/01/2018 for a period of more than three years and, in accordance with the previously valid provisions of Instruction 157n, depreciation was not accrued for this object, then from 01/01/2018 it must begin to be accrued (Letter of the Ministry of Finance of the Russian Federation No. 02-07-07 /84237).

Clause 85 of Instruction No. 157n, in force until 01/01/2018, provided for the suspension of depreciation when transferring an asset to conservation for a period of more than three months.

Example.

The fixed asset facility was mothballed from 01/01/2017 for 2/3 years. Its useful life is 7 years, book value is 115,000 rubles, before conservation, depreciation on it was accrued in the amount of 57,500 rubles. The object was preserved for 1 year (12 months). During this period, no depreciation was accrued on it.

As of 01/01/2018, the remaining period of conservation of the object is 1 year (12 months), and the remaining useful life of the object is 2.6 years (30 months). The institution decided to resume depreciation from the specified date. The accounting policy provides for the straight-line method of calculating depreciation.

The program must reflect the following correspondence:

Dt 1 401.20 271 – Kt 1 104.34 411 in the amount of RUB 1,917.

The monthly depreciation charge for a mothballed object is reflected based on its residual value and remaining useful life ((115,000 - 57,500) rubles / 30 months).

What fixed assets are subject to conservation?

You can preserve any object that belongs to the OS. That is, which is recorded on account 01. To indicate an item on this account, the following conditions must be met:

- The OS is used as part of production; it is required either for the operation of the company or for managing it. For example, a company car belongs to the OS, but a marble monument does not.

- The facility has been in operation for more than a year. That is, objects of short-term use (packaging, etc.) will not be classified as fixed assets.

- The company has no plans to resell the item. For example, property acquired for further sale is not classified as fixed assets.

- The object is expected to bring benefits. For example, the company’s land is used for planting vegetables for their further sale.

Fixed assets will include buildings, service vehicles, equipment, office equipment, and natural resources.

ATTENTION! Natural resources are not conserved because they are not subject to depreciation. That is, the motivation to carry out the event is lost.

Other costs

The question often arises whether it is possible to include utility bills, lighting and security costs for a building under conservation in the calculation of income tax. Yes, these expenses are included in non-operating expenses. This provision is present in Art. 265, clause 1, sub. 9 NK. The enterprise, therefore, has the right to reflect in tax reporting the costs aimed at preserving mothballed OS in proper condition. At the same time, according to Art. 252, paragraph 1 of the Tax Code, it is necessary to have documentary evidence and economic justification for these expenses. The costs that entail the conservation of fixed assets aimed at servicing farms and production should be reflected separately.

The procedure for registering conservation of fixed assets

The registration of conservation is regulated in detail for budgetary and government agencies. The procedure for commercial organizations is less strict. Conservation is divided into the following stages:

- At the general meeting, a decision on conservation is made.

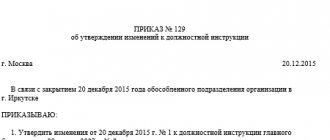

- Based on the decision, an order is drawn up.

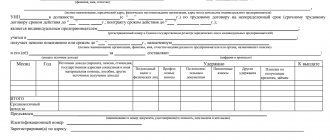

- An inventory of fixed assets is carried out.

- An act of transferring the OS for preservation is being carried out.

- The changed status of the property is recorded in the 1C program.

An order is drawn up to transfer the OS into conservation. It is needed to record the intentions of management. This is the required paper. It must bear the signature of the head of the company. The document contains the following information:

- Reasons for transferring an object to conservation.

- Preservation period.

- Persons responsible for the procedure.

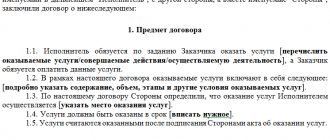

A conservation act is also drawn up. It is needed to record a procedure that has already been completed. Compiled at the request of the manager. The document is signed by the commission members and the head. It contains the following information:

- List of objects that are conserved.

- Start date of the procedure.

- Expenses for conservation.

The document is drawn up in any form.

Depreciation

When removing the OS from the active state for a period of more than 3 months. it is not credited. It will be possible to resume the calculation of depreciation after putting it back into operation. Accounting for the conservation of fixed assets is carried out in accordance with Rules 6/01 and Methodological Instructions. There is no provision for extending the useful life period by more than three months. But in accounting, depreciation can be calculated even after this time. In this regard, after the return of fixed assets to the asset, calculations are carried out in the same way as before their withdrawal.

Nuances of paying taxes

As part of conservation, both transport tax and property tax are paid. If the organization is on OSNO, the tax burden is reduced by this amount. There is no need to reinstate VAT. However, sometimes such a need arises:

- Mothballed fixed assets are transferred to the authorized capital of another company.

- The company switches to a different tax system.

- The property, after the termination of conservation, will be used in work that is not subject to VAT.

In all these cases, you need to look for primary documentation and then restore VAT.

08.10.2020Is it possible to take into account the cost of renting apartments for posted workers?

An organization can take into account the costs of renting an apartment to accommodate employees while on a business trip for income tax purposes both if the rental agreement was concluded by the organization itself and by its employee.

08.10.2020Separate accounting of the redemption price

It’s not for nothing that accountants are wary of leasing agreements. There are a lot of pitfalls in them, the redemption price alone is worth it. Especially when it is paid not at the end of the contract, but in parts - as part of monthly payments. Let’s figure out how to properly take into account the redemption price of the leased property for the lessee.

08.10.2020Corporate fraud. How to protect a company?

In 2020, when companies experience a shortage of resources for the successful operation of their business, it becomes very important to effectively manage the assets that the enterprise already has. Calculation magazine found out how you can protect your business from corporate fraud?

08.10.2020The company feeds employees on its own initiative. Should insurance premiums be calculated?

An employer has the right to pay for meals for its employees, not based on legal requirements, but on the basis of the provisions of employment contracts concluded with employees or additional agreements thereto.

08.10.2020Features of drawing up invoices by separate departments

The presence of separate divisions in a company does not in any way affect the procedure for paying VAT, nor the procedure for applying deductions, nor reporting. The parent company is responsible for everything. There are special features only when drawing up invoices if a separate division acts as a real consignor or consignee. Let's remember how this is done.

08.10.2020How to pay personal income tax when sending employees for long-term work abroad?

When it comes to working abroad and taxes, the first step is to find out your tax residency. Many questions arise. One of these is what to do with the personal income tax of employees who work outside the Russian Federation for a long period?

08.10.2020Property tax on capital investments in leased property

The Ministry of Finance provided clarifications on how to tax capital investments in leased real estate with property tax after termination of the lease agreement, if they are not reimbursed by the lessor, in letter dated September 24, 2020 No. 03-05-05-01/83771.

08.10.2020New insurance premium rates: how to calculate?

SMEs can take advantage of reduced insurance premium rates administered by the Federal Tax Service of Russia. A preferential payment procedure has been established as part of state assistance to small and medium-sized businesses under quarantine restrictions.

08.10.2020“Exotic” reasons for dismissal

One presented the employer with a fake education diploma, another “embellished” his work experience and completed his job in a large company, the third divulged a trade secret. If the deception is revealed, you can try to fire such employees, although this will be difficult.

07.10.2020October, what changes await us with the beginning of the new month?

The beginning of the second autumn month, in addition to traditional reports and tax payments that were postponed during the pandemic, will bring a number of significant changes in the work of the accounting department. We decided to briefly talk about the main ones.

07.10.2020Pilot project to reduce VAT delays: technology of application

The Federal Tax Service has launched a new pilot to reduce the period of desk audits for VAT to 1 month. Details of the work of tax officials within the framework of this project were disclosed by the Federal Tax Service of Russia in a letter dated 10/06/2020 No. ED-20-15/ [email protected]

07.10.2020How to improve financial performance or Why should net assets be greater than authorized capital?

The importance of net assets in the annual balance sheet should not be underestimated. If their value becomes less than the authorized capital, this means that the company has lost its financial stability and can be liquidated - at the initiative of the tax inspectorate. There are several ways to improve your performance.

07.10.2020Individual entrepreneurs were allowed to take into account expenses when calculating contributions to compulsory pension insurance

The Federal Tax Service has allowed individual entrepreneurs using the simplified tax system “income minus expenses” to deduct expenses when calculating contributions to compulsory pension insurance. The Service announced its new position on this issue in a letter dated September 1, 2020 No. BS-4-11/14090; the editors of the Calculation magazine carefully read the document.

07.10.2020Is a woman working part-time entitled to sick pay during maternity leave?

While on maternity leave, an employee can work part-time or from home. The question of whether she has the right to temporary disability benefits was clarified in letter No. 14-15/7710-3972l dated September 16, 2020 from the Ministry of Regional Development of the Federal Social Insurance Fund of the Russian Federation.

07.10.2020Exemption of material assistance from personal income tax and insurance premiums: there are similarities

Among the payments exempt from personal income tax and exempt from insurance premiums, there are three similar payments. Everything is related to financial assistance. But this is where the similarities in the lists of tax-free payments end. Therefore, no matter how much one would like to draw an analogy with the imposition of salary taxes, this will not yet be possible. Every time you pay employees money, you need to check it against two lists - for personal income tax and for contributions. What payments are the same?

07.10.2020Withholding remuneration for services rendered: should CCP be used?

Cash register systems must be used for cash and non-cash payments in a number of cases, in particular, when offsetting advance payments and prepayments.

07.10.2020Are penalties charged for arrears identified during tax monitoring?

Tax monitoring is a way of information interaction between an organization and tax authorities, to whom the organization provides real-time access to accounting and tax data.

07.10.2020How to account for costs when switching to partial remote work?

From October 5, 2020, in the capital of our country, employers must transfer at least 30% of employees to remote work. How to take into account income tax expenses with such a partial transition to remote work? We will find the answer to this question in the letter of the Ministry of Finance of Russia dated September 24, 2020 No. 03-03-06/1/83636.

07.10.2020“Pre-bankruptcy” counterparty – how to find out?

In fact, many companies are now in a pre-bankruptcy state. And the chances of things getting better are slim. These may include your counterparties with whom you have planned long-term cooperation and on whom you rely. Or they owe you money, which they keep planning to give back and still nothing... So will they return it or not? Fortune telling with chamomile is archaic; there are other methods of “predictions” that are much more accurate.

06.10.2020How to confirm company expenses for transactions with individual entrepreneurs without a cash register?

An individual entrepreneur without employees can work without cash registers.

But accountants of companies with which an entrepreneur enters into transactions have a question: what documents should be used to confirm the expenses they incurred to calculate income tax? The editors of the Calculation magazine studied the letter from the Ministry of Finance, in which the department answered this question. 1 Next page >>

The process of completing conservation

It is important not only to correctly enter an item into conservation, but also to remove it from conservation.

Re-preservation is carried out when a decision is made about the need to operate the facilities or upon expiration of the conservation period. This decision must be formalized using an order to terminate conservation.

After re-opening, depreciation begins to accrue. Accrual begins on the first day of the month following the month of issuing the order to terminate the preservation of the object.