How to find out the tax details for paying the simplified tax system

You can find out the tax office details for paying tax according to the simplified tax system using the “Determination of Federal Tax Service Details” service on the tax office website. With its help, you can find the necessary data, knowing only your registration address.

If you know the tax office number, you can also directly go to its official page from the search engine by asking a request indicating the Federal Tax Service number and region. In the “Official Inspection Details” section there will be a link “Inspection Payment Details”.

In the new version of the individual entrepreneur’s personal account, the section “Address and payment details of your inspection” is located in the “Applying to the tax authority” service. It opens in the general list when you click on the “All services” button on the main page of your personal account.

We recommend reading: What kind of reporting does an individual entrepreneur submit to the tax authorities and funds: types, rules, dates and deadlines.

Receiving a receipt through the government services website

Receiving a receipt on the government services website is similar to a similar service on the tax service website. It is necessary to register on the web resource www.gosuslugi.ru in the prescribed manner.

After logging in to the website, go to the “Government Services” section and click on the “Tax Debt Check” button to get a list of unpaid taxes. Use the “Pay” button to make a payment using the chosen method or print a receipt. The list of possible forms of payment on the portal is constantly expanding.

How to correctly fill out an individual entrepreneur’s payment slip on the simplified tax system “income”

Basic details can be divided into several groups.

1. Information about the taxpayer

You must indicate your last name, first name, patronymic, tax identification number and registration address. It is necessary to indicate the address; without it, the bank will not miss the tax payment. The payment order also indicates the taxpayer's current account, the bank where it is opened, his BIC and correspondent account, the checkpoint remains blank.

For additional identification of the taxpayer status, indicate in the fields:

- 101 - code 09;

- 105 - OKTMO code corresponding to the municipality where you are registered.

2. Information about the payee

The details are filled in taking into account the information received about the payment details of the tax office.

Despite the fact that the funds are intended for the tax inspectorate, the actual recipient of the payment must indicate the federal treasury department for the corresponding region, and the name of the specific inspection must be written in brackets.

The correspondent account number is not filled in.

3. Payment information

Basic data is entered in the fields:

- 6 and 7 - payment amount in words and numbers, respectively;

- 24 - purpose of payment;

- 104 - KBK;

- 106 - basis for payment;

- 107 - tax period;

- 108 and 109 - document number and date.

The BCC determines the type of tax payment. For the simplified tax system “income” the following codes are used:

- 182 1 0500 110 — basic amount of tax;

- 182 1 0500 110 - tax penalties;

- 182 1 0500 110 — interest on tax;

- 182 1 0500 110 - fines for late tax payment.

The most common reasons for payment:

- TP - payments within the established payment period;

- ZD - repayment of overdue debts on a voluntary basis;

- TR - repayment of debt after a requirement issued by the tax authority.

For other cases, specific codes are provided; they can be clarified on the tax website or using reference services.

The tax period when paying an advance according to the simplified tax system is a quarter, when paying the last payment - a year. If payment is made in response to a demand for repayment of a debt, the due date specified in it is set.

The document number and date are entered in accordance with the received request. When the payment grounds are TP and ZD, zeros are placed instead.

The received request may also indicate the UIN; it must be reflected in field 22.

We recommend reading: Transition of individual entrepreneurs from UTII to simplified tax system: transfer rules, deadlines and necessary documents.

Let's sum it up

- Income tax is paid only by organizations before March 28 of the year following the reporting year.

- In addition to the annual tax, organizations must pay advance payments. The frequency of their transfer (once a quarter or monthly) depends on the chosen method of calculating advances.

- The amount of calculated tax is divided between budgets: 3% goes to the federal budget, 17% to the regional budget.

- Since the tax is divided between two budgets, there should be 2 bills for its payment.

- BCC for tax transfer to the federal budget - 182 1 01 01011 01 1000 110, to the regional budget - 182 1 0100 110.

If you find an error, please select a piece of text and press Ctrl+Enter.

Where to get a receipt for payment of the simplified tax system

A payment order allows you to pay tax from an individual entrepreneur’s current account. You can also make payments from your personal account. person or through a bank cash desk, for this you will need a payment receipt with correctly filled in details.

A receipt for payment of tax according to the simplified tax system can be generated using:

- service “Payment of taxes and duties” on the Federal Tax Service website;

- accounting programs for individual entrepreneurs;

- Internet banking.

Procedure for paying income tax

Income tax taxpayers pay:

- Tax for the year. The payment deadline is no later than the last day for filing a profit tax return - March 28 of the following year (clause 1 of Article 287 of the Tax Code of the Russian Federation, clause 4 of Article 289 of the Tax Code of the Russian Federation).

- Advance payments (for 1 quarter, half a year, 9 months). The procedure and timing of advance payments depend mainly on the amount of revenue for the previous 4 quarters.

Find out more about the procedure for calculating and paying advance payments

Payment of income tax to the federal budget is made at the location of the organization without distributing the amount among separate divisions (Clause 1 of Article 288 of the Tax Code of the Russian Federation)

Let's take a closer look at the procedure for generating a payment order and paying income tax to the federal budget in 1C.

On April 30, 2020 (rescheduled from April 28), the accountant prepared a payment order for the payment of income tax to the federal budget in the amount of RUB 152,700. The tax was paid on the same day using a bank statement.

Payment of income tax to the budget

After paying income tax to the budget, based on the bank statement, you need to create a document Write-off from current account transaction type Tax payment . A document can be created based on a Payment Order using the link Enter document debited from current account . PDF

The basic data will be transferred from the Payment order . It can be downloaded from the Client-Bank program or directly from the bank if the 1C: DirectBank service .

It is necessary to pay attention to filling out the fields in the document:

- Date - the date of tax payment, according to the bank statement.

- According to document No. and from - the number and date of the payment order.

- Tax - Income tax, federal budget , selected from the Taxes and Contributions directory and affects the automatic completion of the Debit Account and Budget Levels .

- Type of liability - Tax .

- Reflection in accounting : Debit account - 68.04.1 “Calculations with the budget.”

- Types of payments to the budget - Tax (contributions): accrued / paid .

- Budget levels - Federal budget .

Postings according to the document

The document generates the posting:

- Dt 68.04.1 Kt - debt to the budget for income tax has been repaid.

Payment order for payment of income tax

General details

A payment order for the payment of income tax is generated using the Payment order document in the Bank and cash desk section - Bank - Payment orders - Create button.

In this case, it is necessary to correctly indicate the Type of transaction Tax payment , then the document form takes the form for payment of payments to the budget system of the Russian Federation.

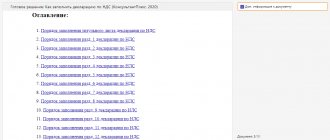

You can also quickly generate a payment order using the Tax Payment Assistant :

- through the section Main - Tasks - List of tasks;

- through the section Bank and cash desk - Payment orders using the Pay button - Accrued taxes and contributions.

Please pay attention to filling out the fields:

- Tax - Income tax, federal budget , selected from the Taxes and Contributions directory.

The income tax of an organization is predetermined in the Taxes and Contributions directory. The following parameters are specified for it:

- corresponding KBK code;

- text template inserted into the Payment purpose ;

- tax account.

If an element is predefined in the directory, then deleting it or changing its parameters is not recommended. If necessary, BukhExpert8 advises creating a new element in the Taxes and Contributions , to which you should specify your settings.

- Type of liability - Tax . The choice of the type of obligation affects the BCC, which will be indicated in the payment order.

- The order of payment is 5 Other payments (including taxes and contributions) , filled in automatically, as for all tax payments to the budget paid on time (clause 2 of Article 855 of the Civil Code of the Russian Federation).

Recipient details - Federal Tax Service

Since the recipient of the income tax is the tax office with which the taxpayer is registered, it is its details that must be reflected in the Payment order .

- The recipient is the Federal Tax Service, to which the tax is paid, and is selected from the Counterparties directory.

- Recipient's account - bank details of the tax authority specified in the Recipient .

In the 1C program it is possible to use the 1C: Counterparty service, which allows you to automatically fill in and monitor the relevance of the details of government bodies.

If the details are no longer relevant, the 1C:Counteragent will offer to update them in the Counterparties directly from the payment order form. PDF

- Recipient's details - TIN , KPP and Recipient's name , this is the data that is used to print the payment order. If necessary, the recipient's details can be edited in the form that opens via the link.

Payment details

The accountant needs to control the data that the program fills in using the Payment details .

In this form, you need to check that the fields are filled in:

- KBK - 18210101011011000110 “Organizational income tax (except for consolidated groups of taxpayers), credited to the federal budget.” KBK is entered automatically from the Taxes and Contributions directory.

If the KBK is unknown for any payment to the budget, then you can use the KBK Designer by following the link to the right of the KBK .

- OKTMO code is the code of the territory in which the Organization is registered. The value is filled in automatically from the Organizations directory .

- Payer status - 01-taxpayer (payer of fees) - legal entity .

- UIN - 0 , because UIN can only be specified from information in tax notices or requests for payment of tax (penalties, fines).

- The basis of payment is TP payments of the current year .

- The tax period is quarterly payment , since income tax is paid for the reporting period - the first quarter.

- The year is 2018 , i.e. the year for which the tax is paid.

- Quarter —1.

- The document number is 0 , because the document on the basis of which the payment is made is a declaration, and it does not have the Number .

- The document date is 04/30/2018 , i.e. the date the declaration was signed.

Find out more about the details of payments to the budget in the article Payment order details

- Purpose of payment - filled in automatically using a template from the Taxes and Contributions directory. The tax period of payment is filled in according to the Year and Quarter in the Payment details to the budget . The field can be edited if necessary.

You can print a payment order by clicking the Payment order . PDF

Checking calculations with the budget for income tax

To check budget calculations for VAT, you can create the Account Analysis report 68.04.1 “Budget Calculations”, section Reports - Standard Reports - Account Analysis.

The settings for Account Analysis 68.04.1 are as follows: click the Show settings on the Selection to set:

- Budget levels - Equal to - Federal budget .

As you can see, there is no balance in account 68.04.1 “Settlements with the budget” for income tax to the federal budget.

See also:

- Calculation and payment of income tax and advance payments throughout the year

- Cheat sheet for calculating income tax and advance payments for the first quarter

- Cheat sheet for calculating income tax and advance payments for the first half of the year

- Cheat sheet for calculating income tax and advance payments for 9 months

- Cheat sheet for calculating income tax and advance payments for the year

- Payment of income tax (RB)

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge