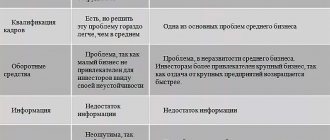

Classification

According to the current legislation, in 2020 the following types of customs duties are distinguished:

- Import customs duty. This payment is also called import payment.

- Export customs duty. Often this payment is called an export payment, since it is paid for the export of products outside of Russia.

Most goods are subject to import customs duties. This is primarily due to the fact that Russia in 2020 is actively “receiving” export products into its territory.

Import duties are imposed on all groups of goods imported into Russia. But it is worth remembering that according to customs rules, there are a number of goods allowed for import in a certain quantity. If they are imported in quantities exceeding the established norm, then customs duty is always paid.

Customs duty

The collection of customs duties on imported goods protects the domestic market of the Russian Federation from competition. Customs duties on imports are transferred to the Russian state budget. In recent years, it is these types of duties and taxes that have made up the bulk of the Russian Federation budget.

Customs duties and fees for the export of products are necessary to regulate the country’s foreign economic activity. They also replenish the Russian state budget.

Return to contents

Tax

A tax should be considered a mandatory payment made to the state budget by both individuals and legal entities.

This concept can be roughly characterized by the following features:

- mandatory, since every citizen of Russia must pay tax, as stated in the Tax Code of the Russian Federation;

- gratuitous payment of funds, since when paying tax the payer receives nothing in return;

- payments do not have a designated purpose, that is, funds received by the state treasury are not used for specific purposes, for example, for education or healthcare, but are used for general government needs;

- since the tax is primarily considered as the financial basis for the country’s activities, the payment of this payment must be made on an ongoing basis;

- Only cash should be received into the state budget; other types of payments as payment of taxes, according to the law, are not accepted.

All mandatory tax payments are divided into 3 main groups:

- Federal – payment is considered mandatory and is valid throughout the country.

- Regional - the amount and amount of payment is established and put into effect by the constituent entities of the Russian Federation.

- Local payment is established, according to the law of the Russian Federation, by local regional authorities; payers pay amounts of money at their place of residence.

The main functions of the mandatory contribution are:

- distribution of monetary resources through transfers from the state treasury in favor of low-income or less protected Russian citizens;

- the funds received after paying the tax help regulate the state economic process;

- Having information on mandatory payments, government authorities can control the timely and complete receipt of tax payments.

What is allowed to be imported without paying duty?

If a person carries with him personal funds, not counting a car, the total amount of which does not exceed 500 euros, then he is not required to pay a customs duty. In this case, the total weight of goods or products cannot exceed 25 kilograms. This applies only to those goods that are transported by land (by car or train). These rules are in effect from January 1, 2020. If a person travels by air, then he can import goods worth up to 10,000 euros duty free.

Additionally, a person can carry:

- 50 cigars or two cartons of cigarettes. An alternative to cigarettes and cigars is tobacco in an amount of 250 grams.

- Three liters of alcoholic beverages.

In other words, if a person wants to import four or more liters of alcohol, then he is obliged to pay 10 euros to the Russian budget for each “extra” liter of alcoholic drink brought. But it is worth considering that you cannot transport more than five liters of such products for personal consumption. If a larger quantity of alcohol is transported, then the cargo is already considered commercial: additional documents must be submitted for it and an additional VAT of 18 percent and excise tax must be paid.

If the cargo is considered commercial, then the rate for alcohol is 0.6 euros for each liter of alcoholic beverages.

Return to contents

Types of bets

Unfortunately, it is impossible to single out a single payment, since there are different types of customs duty rates, which, in turn, are divided by product type.

Lesson 7. Calculation of payments (columns 47, B) and completion of filling out the DT

According to the law, there are the following types of customs rates:

- ad valorem;

- specific;

- combined.

The ad valorem rate is often called the cost rate. It does not have a fixed amount. The customs rate is calculated as a percentage depending on the customs value of the product. For example, a TV worth 2,000 euros is imported and the interest rate on this product is 20 percent. Thus, the customs payment is 400 euros.

The specific rate is set in clear monetary terms for a specific unit of production. It is worth remembering that this rate is expressed in euros. For example, a box of wine (12 pieces) is transported. For one bottle you need to pay five euros. Thus, the import duty on a box of wine will be 60 euros.

The combined rate is presented as specific and ad valorem. In other words, it combined the last two rates, so the amount of duty is calculated based on the cost and quantity of goods transported.

For example, sports shoes are imported. Since a combined rate is applied, 15 percent of its customs value is paid for each pair of shoes transported, but the amount paid cannot be less than four euros.

Most often, combined bets are used.

It is worth remembering that customs rates exist for all categories of goods. Therefore, it is simply impossible to single out a basic single rate, since it differs depending on the product. All import customs duty rates are approved in accordance with decisions of the EEC Council, and export customs duties are regulated by the Russian government.

Import customs duty rates are calculated based on the CCT. CCT is a single customs tariff that was adopted in accordance with the rules of foreign economic activity of the Eurasian Economic Union.

Return to contents

Difference between tax and duty

The fee, according to Art. 333.16 of the Tax Code of the Russian Federation - a type of collection. The fee is charged for services provided by the state apparatus or actions with legal force performed by local government institutions or officials. The article also states that other fees for the listed actions are prohibited

.

An approximate list of services for which duties are paid:

- registration of a legal entity;

- consideration of the case in court;

- Notary Services;

- Civil registry services;

- registration of citizenship;

- registration of medicines, medical devices;

- issue of securities;

- the right to use proper names “Russia”, “RF” and words derived from them.

The amount of the duty, unlike the fee, cannot be established by the constituent entity of the Russian Federation independently; it is established exclusively at the federal level. Unlike taxes, failure to pay a duty cannot result in any fine or penalty.

, the only adverse consequence is the failure of government employees to provide appropriate services.

There is one nuance regarding the difference between fees and duties: the first concept is often used not only in relation to government services, but also to individuals and companies. For example, airport tax and fuel surcharge on an airline ticket.

For some types of duties, benefits are provided for certain categories of individuals and legal entities.

Additional information on the difference in taxes and fees is presented in the video below.

Taxes, fees and mandatory insurance contributions are mandatory cash payments to the state

from citizens and organizations.

From the government's point of view, the difference between taxes, fees and contributions is very significant. Taxes, fees and contributions are collected by various government agencies. They are also spent by different government agencies (not necessarily the same ones that collect them) and for different needs.

Relationships arising regarding the collection of taxes, fees and compulsory insurance contributions between payers and government agencies are regulated by various legislative acts. For taxes and fees, the main legislative act is the Tax Code

.

And for compulsory insurance contributions - the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”.

Despite the fact that the Tax Code

regulates the calculation of not only taxes, but also fees, fees are not mentioned in the title of the code. This is due to the fact that for the state fees are of secondary importance, and for the payer the difference between taxes, fees and contributions is small.

The purpose of collecting a payment, that is, the state needs for which this or that tax, fee or contribution will be spent, is perceived by the payer as an abstraction. The main significance for the payer is the size of the amount of money withdrawn from him. Usually the payer treats all these payments as inevitable and is interested in paying less.

The state understands this interest of the payer and tries to counteract it. The legislation provides for a whole system of control over payers of taxes, fees and mandatory contributions. Enforcement and punishment measures are provided for non-payment and underpayment.

However, from the point of view of the payer, there are small differences (rather of a formal nature) between taxes, fees and contributions. The main difference is that regarding the payment of taxes, fees and mandatory insurance contributions, the payer interacts with different government agencies.

Regarding taxes and fees, the payer most often interacts with the tax inspectorate

of the Federal Tax Service

.

The Federal Tax Service itself is subordinate to the Ministry of Finance of the Russian Federation

,

which, in turn, is subordinate to the Government of the Russian Federation

.

The Federal Tax Service is a structure of the federal level of government. Nevertheless, it is responsible for collecting payments to budgets at all levels: federal, regional and local.

There are no similar structures at the regional and local levels of government. This is explained by the desire of the state to organize the system of public administration rationally, without duplicating functions. Such a structure of public administration structures is also convenient for payers of taxes and contributions.

If taxes and fees are calculated on trade transactions with a foreign partner (export or import), then the payer interacts with customs

– territorial division

of the Federal Customs Service

.

This service reports directly to the Government of the Russian Federation.

Fees may also be collected by other government agencies in cases where they provide specific services to citizens and organizations. Such a fee may look like payment for a service.

When paying mandatory insurance premiums, the payer interacts with the following extra-budgetary state funds:

Pension Fund of the Russian Federation

;

Social Insurance Fund of the Russian Federation

.

Mandatory insurance contributions are also paid to the Federal Compulsory Health Insurance Fund

.

However, the payer of contributions does not interact directly with the specified fund.

The state side in paying contributions to these funds is represented by the Pension Fund. Such a wise (without irony) government decision can be explained by the following considerations:

The scheme for calculating contributions to the Federal Compulsory Medical Insurance Fund is similar to the scheme for calculating contributions to the Pension Fund, and the amount of contributions to the health insurance fund is significantly less;

The state is trying to simplify the interaction of citizens and organizations with government agencies.

Rice. 2

Despite the fact that regarding the payment of taxes and fees, on the one hand, and mandatory insurance contributions, on the other, the payer interacts with different government agencies and on the basis of different legislative acts, the technique of this interaction is similar. The measures of coercion and punishment applied to a payer who evades his obligations are also similar.

All this allows us to save effort on self-education by combining taxes, fees and insurance premiums into one concept - mandatory payments to the state

– and studying these types of payments in parallel, in one book.

An economically active member of society who wishes to produce and sell goods or provide services to other members of society must interact with a very large number of government agencies. But our book discusses only those structures with which you have to interact regarding the calculation of taxes, fees and mandatory insurance contributions.

Economic literature contains the concepts of “tax” and “fee” inseparably from each other, implying their common nature. This is quite logical, because both terms imply some kind of obligatory budget payment. However, there are differences that characterize their purpose and essence.

Types of customs duties

Customs duties in the Russian Federation are divided into two types: seasonal and special.

Seasonal customs tariffs apply to agricultural products and other goods that are seasonal. In other words, there is a period of time in the year when, instead of the usual customs duty, a seasonal customs rate is applied to agricultural products.

For example, the established interest rate for tomatoes in 2020 is 15%, but not less than 0.08 euros per kilogram of product. Moreover, if tomatoes are imported into the country from May 15 to May 31, as well as from June 1 to October 31, then a seasonal rate of 15% is applied, but not less than 0.12 euros per kilogram.

Special customs tariffs and duties are classified as follows:

- special.

- anti-dumping.

- compensatory.

The use of customs duties of a special type is necessary for non-tariff regulation of foreign economic activity. They are used to protect Russian manufacturers of various types of goods.

Return to contents

What is import customs duty?

Import customs duty, otherwise known as import duty, is a type of mandatory payment levied by Russian customs authorities when goods are imported into the country. This type of fee is levied all over the world and, despite significant differences in numbers and percentages, there is a general trend that each country follows when forming payments: minimum duties on imports of raw materials for their manufacturers and maximum duties on products that compete with domestic ones. The document regulating the procedure for paying import duties on the territory of the Russian Federation, as well as other countries of the Customs Union (CU), is the Customs Code of the CU.

Import duty is the main type of fee levied on the importer of a product. However, in addition to this, there are so-called indirect import payments, which also need to be made during customs clearance of goods imported into the territory of the countries of the Customs Union. From a legal and economic point of view, all payments can be classified as formed on the basis of the Labor Code - fees and duties, and on the basis of the Tax Code of the Russian Federation - VAT, excise taxes.

- VAT

(value added tax). The payment procedure is regulated by the tax legislation of the Russian Federation and the Labor Code of the Customs Union. - Excise taxes

are regulated by the same documents as VAT. Apply only to the import of excisable goods: tobacco products, alcohol, fuels and lubricants, motor vehicles, etc. A detailed list is in the Tax Code of the Russian Federation. - Customs duties

(payments for customs clearance). These fees are levied by the customs authority for actions to import goods into the country.

Import customs duties are imposed only on products intended for foreign trade. Cargo imported for personal use has quantitative restrictions, but is not subject to these fees (with the exception of cars and some other groups of goods).

VAT and excise taxes

The system of Russian customs rules in 2020 provides for the payment of not only import duties, but also VAT when importing products. VAT is paid on the import of products, taking into account that they will be sold on the territory of the Russian Federation. VAT is an indirect tax. The procedure and deadlines for paying VAT are regulated by the Customs Code of the Customs Union.

Thus, according to the norms of the Tax Code of the Russian Federation, the following are required to pay VAT:

- organizations;

- enterprises;

- individual entrepreneurs.

Also, do not forget about excise taxes. Excise taxes are paid when the following groups of goods are sold:

- Ethyl alcohol. But it is worth remembering that excise duty is not paid on cognac alcohol. This is the only exception.

- Products that contain alcohol in an amount of more than nine percent.

- Alcohol products (vodka, wine, liqueurs, cognac and others). But if the product contains less than 1.5 percent ethyl alcohol, then no excise tax is paid.

- Beer.

- Tobacco products.

- Cars.

- Some types of motorcycles.

- Gasoline intended for refueling cars.

- Diesel fuel.

- Oils for different types of engines.

Return to contents

Facts about the duty

By duty , if you follow the norms of the legislation of the Russian Federation, it is customary to understand a payment that:

- charged to citizens and legal entities when applying for certain types of services provided by government bodies, such as, for example, registering an enterprise, issuing a foreign passport;

- is collected from citizens and legal entities when importing certain types of goods from abroad or exporting them outside the Russian Federation.

Payment of duties is a voluntary procedure. But without their preliminary transfer to the budget of the Russian Federation, a citizen or organization will not be able to use the relevant government services, and in some cases, transport goods across the border.

Payment of duties, as a rule, is one-time and not periodic. In general, these payments are not returned by the state - only if they are deposited into the budget accounts by a citizen or organization by mistake.

Duties are only federal - regardless of which specific government authority is levied.

Car import rates

To import a car you need to pay VAT, excise tax and customs duty on the car.

But it’s worth noting right away that the amount of customs duties on a car depends on the following characteristics of the car:

- What is its customs value?

- Legal status of the person who imports: natural or legal person.

- Engine volume.

- Power in kilowatts.

- Vehicle weight (vehicle weight is calculated in tons).

- Engine type.

- Year of manufacture (in other words, age).

How to clear a car through customs - customs auto calculator

There are only four ages:

- less than three years;

- from three to five years;

- from five to seven years;

- more than seven years.

In the latest amendments to the bill, it was decided to make a single rate for cars based on age and engine size.

So, if the car is less than three years old, then a combined rate of 54% applies. This does not apply to cars that were manufactured in the Russian Federation. But it is worth considering that the minimum bet is 2.5 euros.

Table. Calculation of customs duties based on engine volume for cars less than three years old.

| Price for 1 cm cube. (In Euro) | Minimum cost of the car (in rubles) | Maximum cost of the car (in rubles) |

| 2,5 | 325 000 | |

| 3,5 | 325 000 | 650 000 |

| 5,5 | 650 000 | 1 625 000 |

| 7,5 | 1 625 000 | 3 250 000 |

| 15 | 3 250 000 | 6 500 000 |

| 20 | 6,500,000 or more |

For cars that were manufactured in the Russian Federation, a single rate applies. It is equal to one euro per cm3.

Table. Calculation of customs rates based on engine volume for cars over five years old.

| Price for 1 cm cube. (In Euro) | Minimum engine capacity (in cm3) | Maximum engine capacity (in cm3) |

| 3 | 1000 | |

| 3,2 | 1000 | 1500 |

| 3,5 | 1500 | 1800 |

| 4,8 | 1800 | 2300 |

| 5 | 2300 | 3000 |

| 5,7 | 3000 or more |

For yachts, other categories of cars, boats, a single tariff rate of 30% of the cost of equipment is applied. For example, if the estimated value of the yacht is 20,000 euros, then the payment amount is 6,000 euros.

Return to contents

Customs fees when paying duty. Will they change?

No, if you exceed the limit, you will, as before, need to pay a customs fee of 250 rubles . In addition, when paying duties at Russian Post, you will have to pay a transfer fee in accordance with the tariffs.

- up to 1000 rubles – 40 rubles + 5% of the transferred amount;

- 1000-5000 rubles – 50 rubles + 4%;

- 5000-20000 rubles – 150 rubles + 2%;

- more than 20,000 rubles – 250 rubles + 1.5%.

Latest news in customs legislation

According to amendments to customs legislation, from May 16, 2015, an import customs duty of 0% will be introduced on caviar. This means that certain types of fish caviar can be imported duty free.

From October 1, 2020, the export duty on grain was 50 percent. But according to the law, 6,500 rubles will need to be subtracted from the resulting amount. It is worth noting that each “extra” ton cannot cost less than 10 rubles. This decision was made by the government to maintain exports and strengthen the position of the Russian market on the world stage.

Return to contents

Benefits for payment of import customs duties

Tariff benefits and preferences - exemption from import customs duties for goods from developing countries or least developed countries that form a free trade zone together with the Russian Federation. A foreign trade participant can confirm the right to such a benefit by providing the customs authority with a certificate of origin of the goods (General Form, Form A, ST-1 or ST-2).

Rates of customs duties may be reduced or even canceled if the goods:

- Refers to humanitarian assistance;

- Books, paintings, costumes intended for cultural exchange;

- Produced in the CIS countries, Georgia, Vietnam, Serbia;

- Falls under the preferences established by the government of the Russian Federation;

- Has a cost of up to 200 Euro for legal entities;

- Does not exceed the established import standards specified in Decision N107 for individuals.

Seasonal duties are called seasonal due to the frequency of application: they are introduced for a certain time of the year, but for no more than 6 months. They replace regular duties during the sale of vegetables, fruits, etc. This is a measure of agricultural support.

Special, anti-dumping and countervailing duties are designed to selectively protect domestic producers when foreign competition could harm them.

Special duties are a measure to limit increased imports into Russia. They are used to protect against such foreign goods, the supply of which can cause significant damage to the country’s economy.

Anti-dumping duties are additional duties on foreign goods applied to combat dumped imports. For example, ball bearings with the largest outer diameter up to 30 mm for industrial assembly, code “8482101001” are subject to an anti-dumping duty of 41%.

Countervailing duties are applied when domestic and imported goods need to be treated on an equal footing.

Customs rates for other goods and food products

The rates of import customs duties in 2020 directly depend on the quantity and cost of products. Thus, for brushes, whisks, shaving brushes, nail files, combs, mops, shoe brushes, sieves, sieves, travel kits, pens, ribbons, lighters, an ad valorem customs rate of 20% of the customs value of products of one item is applied. The total quantity (kg) is calculated for ivory, corals, materials of plant origin, accessories, etc. The bid price is equal to 20% of the cost of the goods.

Table. Calculation of customs duties for 2020

| Name of product | Customs duty |

| Furniture | |

| Desks, cabinets, beds, plastic, metal furniture, mattresses | 20%, but not less than 1 euro per 1 kilogram |

| Rattan, bamboo furniture | 20%, but not less than 1.3 euros per 1 kilogram |

| Lighting equipment | 5 % |

| Weapons and ammunition | |

| Revolvers, pistols, cannons, howitzers, mortars, grenade launchers, launchers, flamethrowers, rifles, gas guns | 20 % |

| Cartridges, cases | For 1000 pieces 20% of their cost is paid |

| Swords, sabers, bayonets, pikes | 20 %. |

| Equipment | |

| Cables, fibers, filters | 15 % |

| Lenses, eye glasses, weapon sights, navigation systems | 5% of the cost of 1 piece |

| Binoculars, cameras, movie cameras | 15% of the cost of 1 piece |

| Products | |

| Locks, keys, latches, hinges, gongs, photo frames, blocks, rivets, mirrors, plugs, caps, covers, electrodes | 20 % |

| Sharp objects | |

| Forks, rakes, pruners, scissors | 15 % |

| Saws, circular blades, blowtorches. | 5 % |

| Animals (live) | |

| Horses, mules, heifers, pigs, goats, turkeys, geese | 5% of the cost of 1 animal |

| Meat | |

| Cattle | 15%, but not less than 0.2 euros per 1 kilogram of weight |

| Pork | 15%, but not less than 0.25 euros per 1 kilogram of weight |

| Lamb, goat, horse meat | 15%, but not less than 0.15 euros per 1 kilogram of weight |

| Vegetables | |

| Old potatoes | 5 % |

| Young potatoes, onions, cabbage, cauliflower, turnips, carrots, asparagus, eggplant, celery and others | 15 % |

| Tomatoes cucumbers | 15%, but not less than 0.08 euros per 1 kilogram |

| Gherkins | 15%, but not less than 0.12 euros per 1 kilogram |

| Fruits and nuts | |

| Nuts | 5 % |

| Dried dates | 10 % |

| Citrus fruit | 5%, but not less than 0.02 euros per 1 kilogram |

| Satsuma, tangerines, tangerines | 5%, but not less than 0.03 euros per 1 kilogram |

Return to contents

Rates on alcohol and tobacco products

Table. Rates on alcohol and tobacco products in 2020

| Name of product | Bet size |

| Mineral water | 15%, but not less than 0.07 euros per 1 liter |

| Non-alcoholic beer | 0.6 euros per 1 liter |

| Malt beer | 0.6 euros per 1 liter |

| Sparkling wines, including champagne | 20 % |

| Vermouths, wines | 20 % |

| Undenatured ethyl alcohol with an alcohol concentration of less than 80 vol. | 100%, no less than 2 euros per 1 liter |

| Cognac, brandy, whiskey | 100%, no less than 2 euros per 1 liter |

| Tobacco with unseparated midrib | 5 % |

| Cigarettes, cigars | 30%, but not less than 3 euros of the cost of 1000 pieces |

| Smoking tobacco | 20 % |

Return to contents

Payment deadlines

Import customs goods upon import are paid within the first 15 days from the date of presentation of the products to the control authority. The deadlines for payment of customs duties are regulated by the Customs Code of the Russian Federation. According to the law, the deadline for paying customs duties cannot exceed the day on which the declaration was submitted. In cases of exception, payment of customs duties is carried out on the day of submission of declaration documents. Within the established deadlines for payment of customs duties, the entire amount of customs duties is paid, including VAT and excise tax if necessary.

Return to contents

Table

| Tax | Duty |

| What do they have in common? | |

| Both types of payments are made to the budget of the Russian Federation | |

| What is the difference between them? | |

| Paid upon receipt by the taxpayer of income, profit, or acquisition of an asset with a significant market value | Paid for receiving government services, for the opportunity to transport goods across the border |

| Required | Generally voluntary |

| Can be federal, regional, municipal | There are only federal ones |

| Typically are periodic payments | Typically one-time payments |

| Can be returned as a deduction in cases provided by law | Can only be refunded if payment is made in error |