Why do you need a receipt, what is a cash receipt, in what cases is a promissory note drawn up, how to draw them up correctly? What is the difference between an IOU and a cash IOU?

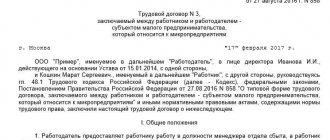

Drawing up a debt (cash) receipt is necessary when concluding a loan agreement. The possibility of receiving money from it in the future depends on how correctly the receipt is drawn up. Such a receipt can be used in court as evidence of the loan of money and the terms of the loan agreement.

|

A cash receipt must also be drawn up when concluding a written loan agreement, including a notarized one. It is the receipt that will confirm the fact of transfer and receipt of money by the borrower. If you have a correctly drawn up receipt on hand according to a sample prepared by a professional lawyer, it will be difficult for the borrower to deny his debt.

We advise you to read

Do you want to protect yourself when borrowing money?You are reading: Loan agreement, loan of funds

Why do you need a receipt?

A receipt is a document confirming receipt of something. As a rule, the receipt is drawn up by hand or printed. The receipt indicates who received what and for what. The date and signature of the recipient are included.

The receipt is a one-sided document, that is, it is drawn up and signed by only one person. The person who receives the item. The receipt is given for storage to another person, the one who transfers the thing. The receipt is a supporting document.

If necessary, it can be confirmed as evidence of a completed agreement.

The most common are receipts for receipt of money. Such a receipt confirms that the money was actually received. Money can be transferred under a housing rental agreement, a car purchase and sale agreement, a real estate sale agreement, a lease agreement, a contract agreement, an agreement for the provision of legal services and other types of agreements. A receipt can be used to confirm receipt of alimony and compensation for damages. receipt can confirm. that the employee received material assets or cargo for reporting.

And in all these cases, the receipt will act as proof of the relevant agreements.

Form and contents of the receipt

It is logical that the receipt should be in writing. Notarization is not necessary, but it can provide significant benefits in the future (no challenge, clean transaction).

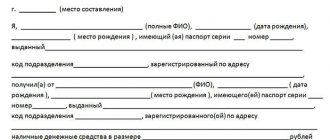

The receipt must state:

- who transfers money, who receives it (full name, passport details, registration addresses, telephone numbers);

- the amount of the transferred amount;

- date of writing;

- return period;

- other conditions (interest, interim repayment schedule, etc.).

Promissory note form

It should not be forgotten that monetary relations are permissible only between legally capable persons. Minor citizens do not participate in transactions. For this reason, to avoid misunderstandings, the date of birth of both parties should also be indicated.

Many different registration rules can be reduced to one simple receipt form for receiving funds. Its form itself is posted on this website.

What is the difference between a promissory note and a cash receipt?

If we talk about a receipt confirming a loan of money, then the terms cash or promissory note are equivalent. However, these concepts can be used in other situations. Thus, a cash receipt can transfer money in general, and not just as a loan (for example, a cash receipt confirms the repayment of a debt or the transfer of money for sold property). Not only money, but also other things can be transferred under a promissory note. From this we can derive the following definitions:

- A promissory note is a document confirming the existence of a debt under a loan agreement.

- A cash receipt is a document confirming the transfer of funds.

A promissory note can be used to lend money, things or securities. Using a cash receipt, money can be transferred both as a loan and to repay a debt or pay off other obligations.

Therefore, it would be correct to draw up a promissory note specifically to confirm the loan, and a cash receipt for other cases of confirmation of the transfer of money.

Rules for writing a receipt for debt repayment

The rules that apply to a debt receipt also apply to a debt repayment receipt:

- The requirement for written form should be taken literally. A receipt typed using technical means increases risks, since there is practically no handwritten text in it. Writing a document by hand will allow for a graphological examination, which will eliminate forgery and falsification. An autograph affixed to a prepared form is not sufficient for identification.

- Be sure to indicate the name of the debt that is repaid. If the money covers any contract, the full name and number of the contract must be noted. If the transferred amount is a payment for services rendered, it is necessary to describe the service provided in as much detail as possible. The absence of a transcript of the repaid debt creates ambiguity: the money could have been transferred just like that.

- Payment of interest and/or penalties is indicated in the receipt as a separate item.

- The currency of the refund must be indicated taking into account the current exchange rate (Civil Code Art. 317).

- Maximum information about the participants in the transaction simplifies the identification of individuals.

- The debt repayment date allows you to verify the correct payment of interest and the groundlessness of claims for penalties for overdue debt.

The limitation period for a promissory note is 3 years (Civil Code Art. 196, 200). An application for debt collection will be accepted even after 3 years, since the limitation period is applied by the court only when a party is indicated, but not by default (Civil Code Art. 199).

Requirements for a receipt for the transfer of money

Let's consider 5 mandatory requirements for a promissory note:

- It is necessary to indicate the place of its preparation (the locality where the money is transferred).

- Write down the name of the document being drawn up - Debt Receipt or Cash Receipt

- The full last name, first name and patronymic of the person borrowing money and the person lending it must be indicated. The data is indicated without abbreviations, they must correspond to those indicated in the passport, it is possible to indicate the full passport data of the parties.

- The loan amount is indicated (the specific amount that is transferred from hand to hand is indicated in rubles and kopecks; it is better to duplicate the digital data in written text).

- The date when the money was received is indicated (the date is indicated in full, that is, day, month, year).

- At the end of the receipt, the signature of the borrower is required (the signature must be written in full, correspond to the full signature of the borrower under normal conditions. If the document is printed on a computer, it will be correct if the borrower at the end of the receipt handwrites his last name, first name and patronymic without abbreviations and signs) .

There are 2 additional requirements for the receipt, which are indicated at the request of the parties:

- The period when the money will be returned (repayment of the debt can be in parts or the entire amount). The date may be specified specifically as “DD-MM-YYYY” - this will be the correct option to avoid confusion, or a specified period of time. If the date is not specified on the cash receipt, the money will be returned 30 days after the creditor submits the claim.

- The amount of interest for using money (usually the amount of interest is indicated for a month, but it is allowed to indicate interest for any period) and the amount of interest (fine) for violating the terms of repayment of the loan (usually the amount of interest is indicated for each day of delay).

Typical sample

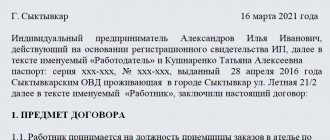

If a debt repayment receipt is being drawn up for the first time, it is better to use an example of such a document. This will allow you to reflect all the necessary information and avoid errors.

A sample promissory note for the return of funds can be found on the Internet on thematic websites. It is recommended to download, then print and fill out the form for such a document. This will greatly simplify and speed up the registration procedure.

A sample receipt for repayment of debt to an individual is given below.

Debt repayment receipt

Moscow December 10, 2020

I, Evgeny Anatolyevich Orlovsky, born on May 18, 1986, passport series 4058 No. 658254, issued on May 23, 2000 by Department 23 of the Department of Internal Affairs of Russia, Moscow, registered and live at the address st. Patriotic 117, apt. 84, when writing this Receipt, I received from Gavrilov Anatoly Petrovich, born on April 14, 1975, passport series 3584 No. 389452, issued on April 18, 1989 by Department 15 of the Department of Internal Affairs of Russia, Moscow, registered and residing at the address st. Leningradskaya, building. 48, apt. 27, previously transferred to him funds in the amount of 20,000 (twenty thousand) rubles, which were issued against a Receipt dated November 15, 2020.

The debt was repaid in cash in full and within the agreed time frame. Claims against A.P. Gavrilov I do not have.

12/10/2020 (signature) E.A. Orlovsky

A sample receipt for the repayment of a debt of funds is available.

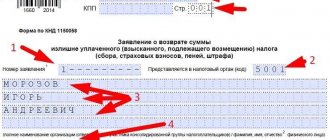

How to get money back from a promissory note

When you issue a receipt, you should think about how to get the money back later. It’s good if a good and trusting relationship has been established between the parties, and no force majeure events occurred during the loan, no one got sick, no one lost their job or other income. But no one is immune from these troubles in life.

When transferring money by receipt, you should in any case limit the transferred amount to the available capabilities, so that later non-repayment does not lead to bankruptcy of the borrower.

When drawing up a receipt for receiving money, carefully read all the data indicated in it so that there are no errors. Pay special attention to the correct spelling of the surname, first name and patronymic of the borrower and debtor (it is better to check with the passport), as well as the amount of money indicated in the receipt (it is better if, in addition to numbers, the amount is written down in words). The promissory note must indicate that the money is being transferred as a loan.

We advise you to read

In case of delay in repaying the debt according to the receipt, or violation of the terms of the loan agreement, a Statement of Claim for collection of the debt under the loan agreement is filed with the court.

General requirements

There is a service market whose specialists offer to issue receipts and help fill out other documents. If you plan to transfer a significant amount or there are difficulties with the formulation, it is imperative to seek the help of professionals.

For complete confidence in the purity and correctness of the transaction, you can use the services of a notary. The notary's office will check the appearance and legal personality of the parties, and will attest to the fact of the transfer of money and the validity of the signatures. However, the notarial form is not mandatory.

The only regulatory requirement is an imperative indication of the need to issue a receipt for a loan amount exceeding ten thousand rubles (clause 1 of Article 808 of the Civil Code of the Russian Federation). Although we strongly recommend that you draw up a written document for smaller amounts, so as not to lose them irrevocably.

As with any transaction, drawing up a receipt requires going through several stages: determining the order of preparation, checking the counterparty, generating the correct document, and securing legitimacy.

Requirements for compilation

If you still intend to draw up documents yourself, you should understand that the main condition for the legitimacy of a receipt is its personal signing by those persons designated on it.

You can write the document yourself or prepare printed text on a computer, but in the latter option there is a risk that one of the parties will declare non-involvement in the formation of such a document.

If the entire text is handwritten by the person who received the money, it will be much more difficult to “get out”. In any case, to eliminate risks, you must remember that the “Full name” section is always written in your own hand. and, naturally, the signature itself is affixed.

To avoid unnecessary questions from the other party and to avoid having to rewrite the text, you need to draw up a receipt in the presence of both the borrower and the lender.

Required checks

The most important point is identity verification. A document confirming the presence in front of you of exactly the person named in the receipt is a passport. The list of identity documents is extensive, but only a passport contains all the necessary information.

So, the first rule: a receipt must be issued only if both parties have passports.

The second main rule: do not give money to someone who already owes a lot to others. To prevent possible delays, you should check your borrower against the database of enforcement proceedings on the bailiffs website.

Witnesses

To ensure the possibility of judicial collection of debt in the event of non-payment, a mandatory condition must be met - to certify the receipt with the signatures of witnesses. At the same time, they must also be legally capable and have a passport with them.

Witnesses must be present both when the receipt is drawn up and when it is signed. The number of certifiers must be at least two. They put their signatures after the signature of the borrower and the lender.

When lending an amount in excess of 10,000.00 rubles, you need to be more careful about all the rules for issuing a receipt. If the amount is less, you can limit yourself to the minimum necessary for your own memory - “who, to whom, when, how much, for how long.”

What to consider if the receipt is written by hand

Handwriting is the preferred method in terms of the authenticity and reality of the receipt. However, there are a number of nuances that are worth considering.

A debt against receipt is issued by a party who is in a risky position, having already fulfilled its part of the obligation (issuing money). Therefore, the person who wrote the receipt must be the recipient of the money.

Be sure to write legibly so that the written document can be read. This is especially true for key parts - these parties, amounts and deadlines.

As such, there is no legislative form of writing, as well as requirements for paste color, font, etc. The main thing is to be reasonable - do not write with a pencil.

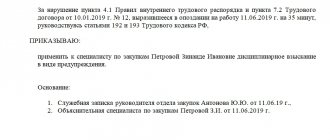

Mistakes often made when drawing up a debt receipt

As judicial practice shows, quite often there are cases of incorrectly executed debt receipts, which make it difficult or even impossible to collect the amount of debt from the borrower. Let's list the main ones.

Error 1. The promissory note does not identify the person who received the sum of money. For example: “This receipt was given by me, Petrov Petrovich, that I received a sum of money in the amount of 25 thousand rubles as a loan from Marina Ivanovna Ivanova.” Often, such errors in promissory notes can be found in the case of a loan between persons who are in friendly or family relationships, and as a rule, the attitude towards the document is a pure formality. However, if a dispute arises regarding the repayment of the debt, to prove that it was this Petrov Petrovich who received the loan, you will have to undergo a handwriting examination. Another example of this error is the fact that there is no information about the creditor in the promissory note. For example: “This receipt is given by me, Petrov Petrovich, born XXXX, a native of the city of XXX, passport XXXX No. XXXXXX, issued by XXXXXXX, registered at the address XXXXX that on May 1, 2014 I received a sum of money as a loan in in the amount of 25,000 rubles with a return period until May 1, 2020.” The proposed wording of the text for the promissory note in the event of legal proceedings regarding the repayment of the debt may suggest that the debtor can submit to the court a completely different loan agreement, with a similar date and amount, but indicating other data about the borrower (for example, one of his relatives or friends). Having reported that the document that was presented by the plaintiff, and which was directly related to this agreement, was lost by the lender, but the loan took place.

Error 2. The promissory note was drawn up without indicating the fact that a certain amount of money had been received by a specific borrower. For example: “This receipt is given by me, Petrov Petrovich, born XXXX, a native of the city of XXX, passport XXXX No. XXXXXX, issued by XXXXXXX, registered at the address XXXXX that on May 1, 2014 I agreed with Ivan Ivanovich Ivanov on a loan a sum of money in the amount of 25,000 rubles.” Such wording of the promissory note may lead to the fact that an unscrupulous borrower in the future, when the debt obligation to repay the sum of money is due, will claim that the loan was agreed upon, but not at all about its receipt. Based on Art. 812 of the Civil Code of the Russian Federation, the borrower has the right to challenge the loan agreement due to its lack of funds, presenting in court arguments proving the absence of the fact of transfer of money. If the court accepts the borrower's position, the loan agreement (promissory note) will be declared invalid and the lender will be refused to satisfy the debt collection requirements.

Error 3. When drawing up a promissory note, the purpose, term and conditions for repaying the amount of money received as a loan may not be indicated. For example: “This receipt is given by me, Petrov Petrovich, born XXXX, a native of the city of XXX, passport XXXX No. XXXXXX, issued by XXXXXXX, registered at the address XXXXX in that on May 1, 2014 I received from Ivan Ivanovich Ivanov XXXXX .b., a native of the city of XXX, passport XXXXX No. ХХХХХХ, issued by ХХХХХХ, registered at the address ХХХХХ in the amount of 25,000 rubles.” This wording of the promissory note fully allows the borrower, in the event of a dispute, to claim that the amount specified in the document was received as payment for any action (sale agreement, received as a gift, etc.), and subsequently become the main reason for the impossibility of returning the money. funds to the lender.

Error 4. When the terms of the loan are not noted in the promissory note, namely: whether the loan is targeted/non-targeted; debt repayment period; The interest rate or loan is interest-free. So, if the loan was provided to the borrower for some specific purposes, but they were not covered in the promissory note, the lender does not have the right to demand repayment of the amount ahead of schedule, even if these funds were spent for other purposes. If the receipt does not contain a deadline for the return of funds, on the basis of Part 2 of Art. 314 of the Civil Code of the Russian Federation, the borrower is obliged to repay the loan within 7 days from the moment the lender submits demands for its repayment. If the borrower does not make contact and avoids meeting with the lender, it will be very difficult to prove the fact of filing demands for the return of funds and the existence of an overdue loan repayment period. The absence in the debt receipt of information about the interest rate for the use of other people's funds can also lead to controversial proceedings, including in the case of debt collection in court.

If there is no note in the debt receipt indicating the borrower’s obligation to pay a penalty if there is a delay in repaying the debt, the lender has no right to demand payment from the debtor, which is regulated by Art. 331 of the Civil Code of the Russian Federation, which states that, regardless of the form of the main debt obligation, the agreement of the parties to pay the penalty must be made only in writing.

Error 5: The promissory note was typed on a computer. This form of drawing up a document may lead to the borrower challenging the fact of signing with his own hand, and in the future, the need to conduct a handwriting examination. This error, accordingly, will entail a delay in debt collection and unnecessary financial expenses. In addition, if the borrower’s signature includes a small number of symbols, the expert may well issue a conclusion that it is not possible to establish the correspondence of the symbols on the receipt to the borrower’s (debtor’s) signature.

Error 6. There are corrections in the promissory note written in the borrower’s own handwriting. Remember that any corrections in documents relating to cash loans may subsequently negatively affect the proof of the reliability of information data, namely: the loan amount, the repayment period and the amount of interest.