Lifetime dependent support

Often a citizen or even an entire family does not have their own home and is not able to save up for real estate. The ideal option to solve the problem would be a rent agreement with the condition of lifetime maintenance of the owner.

The contract is concluded with pensioners on the condition that people take on an elderly person as a dependent. Before signing an official document, you should read all the details very carefully. What responsibilities will the owner take on? Most often, this is payment for housing and communal services, payment for food, treatment, purchase of clothing for a dependent, etc. The contract is of an unlimited duration and terminates after the death of the apartment owner. Thus, you won’t be able to count your expenses.

Who can buy real estate in Moscow with a mortgage?

Not everyone can take out a mortgage on an apartment. Banks only approve applications from solvent clients, as they do not want to bear the risk of non-payment of the loan. Specific requirements depend on the financial institution, most often the borrower must meet the following characteristics:

- presence of Russian citizenship - foreigners cannot apply;

- age – from 21 to 75 years at the time of loan repayment;

- official employment and work experience in the last place for at least six months;

- high income - the monthly mortgage payment should not exceed 40% of the family budget;

- positive credit history and no overdue loans.

Registration at the place of residence (not necessarily in Moscow) and a mobile phone for communication are required. Under certain programs, for example, social mortgages with state support, only special categories of borrowers can apply for a loan, including military personnel, young families, parents with two children, etc.

State support

There are a number of well-established government programs that help you purchase real estate without money.

These include:

- "Young family";

- "Maternal capital";

- "Dwelling";

- “Providing housing for young families.”

State support is designed for various categories of citizens, but priority is given to:

- large families;

- people who do not own any housing;

- people whose living conditions do not meet space requirements;

- if a family with a child lives under the same roof with a citizen with mental disorders.

Housing programs

For people who are in dire need of improving their living conditions, special government programs have been developed. To become a member of one of them, you need to meet certain requirements.

Here are examples of some of them:

| State program "Young Family" | Designed for young married couples whose age does not exceed 35 years. The size of the discount varies depending on the region of residence and the presence of minors in the family. It is 30-40%. |

| Subsidies for the poor | For those segments of the population whose total income does not exceed the subsistence level. The benefit is calculated in accordance with the category of the needy and depends on the amount of housing purchased. Also, low-income families may be offered to live in an apartment without the right to privatize it. |

| Large families | The state allocates a certain amount of funds with which it will be possible to expand the existing living space, purchase or build new housing. |

| For disabled people | Funds from the budget allow people with disabilities to receive a discount on the purchase of housing. |

| For military personnel | After serving for a certain time, you can qualify for free housing or receive a discount when applying for a mortgage. |

Mortgage

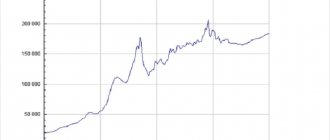

The most popular way to buy a home without money is a mortgage loan. More and more Russian citizens are taking out a mortgage. For reference, in 2020 the mortgage lending market is expected to increase to 3 trillion rubles. But what to do if there is no money for the down payment, which is usually 15-20%?

Attention! There is a simple solution. You just need to take out another loan from the bank and make this money as a down payment. At the same time, it is not necessary to go to another bank for a consumer loan; everything can be processed in one bank. This scheme is called double credit.

The only barrier that may arise is that banks give loans only to solvent clients. Therefore, this method will work if you have a good “white” salary.

Installment plan

Currently, there are many offers for registration of new housing without a down payment. The program is intended for buyers who have not saved up funds but are looking to purchase their own home.

It should be noted that the interest rate for this type of interest-free loan is quite high. But:

- no need to document proof of income - suitable for people who receive wages “in an envelope”;

- there are no guarantors;

- work experience is not taken into account;

- no down payment required;

- To purchase housing in the capital, you do not have to be registered there.

New housing in installments

Developers who are just starting out are trying with all their might to establish themselves well and attract clients. They sell real estate, offering various discounts, promotions, and bonuses. Developers offer to buy an apartment in installments - that is, pay some part of the money at the first stage, and pay the rest over a certain period of time. An installment plan is not a loan, so no interest is expected to be paid. Thus, this is another method that allows you to buy real estate without money.

Before you put your signature on the installment agreement, you should pay attention to 2 nuances:

- what will happen if the amount is not paid on time;

- how the process of transferring ownership from the seller to the buyer will take place.

Goal setting and visualization

It would seem that everything is very simple. It is enough to set a goal for yourself - to buy an apartment, hoping that thoughts are material and very soon the rich uncle will leave the property. The option is not bad, but it will take a lot of time, often without bringing results.

You can use fashionable visualization, but again, sitting on a chair and intensely imagining the color of linoleum will not achieve the effect.

You can spend an incredible amount of time on a detailed description of your future apartment and not move a single step. Therefore, it is worth combining visualization and internal desire.

The simplest example. A citizen wants to buy an apartment close to work, next to a park and a kindergarten within walking distance. He opens the Internet and selects an apartment with the necessary parameters. You can involve real estate agents, but the cost of the apartment will increase significantly. In this example, we combine desire, visualization and specific steps to make a purchase.

ATTENTION! Visualizing a goal works great if a person thinks through every little detail, but is absolutely ineffective without the slightest steps towards implementation.

For example, you can find your dream apartment in a glossy magazine, hang it in a prominent place, and seeing your dream every day will strengthen the achievement of your dream. Let's look at specific general points that are worth mentioning when visualizing a dream:

- Apartment location . For lovers of peace and driving, a country house is suitable, and for people who cannot imagine their life without shops and cinemas, an apartment is suitable. The most interesting thing is that the price may not vary much, although a lot depends on the wishes of the owner.

- Purchase option . The market offers a lot of options when it comes to purchasing housing. Mortgage loan, cash purchase, pledge, rent, installment payment, depositing funds using maternity capital.

- Cash at the moment. A very important point where you should decide on the specific amount of money that you have today. Perhaps the young family was left with 100-200 from gifts given for a wedding or personal savings, savings of relatives. This is exactly the amount you should start from.

- Apartment characteristics . The first step is to decide on global characteristics: number of rooms, area, floor, type of building (apartment, house), quality of housing (apartment in a new building or secondary housing), etc.

Such qualities determine needs and desires. For example, a person does not accept a combined bathroom and toilet. The option is immediately cut off. Or he denies secondary housing where strangers lived for various reasons.

Much depends on your marital status. If a person is married and his wife loves to cook, it may be worth considering the option of a spacious, bright kitchen. Or an option when children love pets and will have to take care of the comfortable living of their four-legged friends.

In the summary table we note the positive and negative purchases of housing in a new home or secondary housing:

What do you need to know?

When considering options for purchasing an apartment when there is no money, remember the following tips and recommendations:

- You should not break the law, trying to get a free apartment - this will certainly lead to disastrous consequences.

- After the wedding, the couple can apply for a cross loan. Its essence lies in the fact that a woman is given a loan for a down payment, and a man takes on the obligations for a mortgage loan.

- By putting a third of your income into a deposit, you can save up for a down payment on a mortgage in an average of 2 years.

- It is more profitable to save money for 8-10 years for an apartment than to take out a mortgage loan.

How to apply for a consumer loan for housing

The selection and assessment of real estate is paid separately (by the borrower), its cost depends on the type of object and can reach 30 thousand rubles.

The insurance contract must also be drawn up, taking into account interest. It is issued only by an organization accredited by the bank. It includes title insurance (for a limitation period of 3 years) for loss of property, as well as for real estate, life and health, and disability.

After receiving the package of documents, the credit institution makes a decision within a week and sends the client a positive or negative conclusion.

The next step is to negotiate with the bank and the seller or contractor to finalize the deal. The method of payment for the housing loan is selected (cash or to the contractor’s account).

The most common choice is to store money in a bank safe deposit box. Access to it is possible only if the conditions specified in the cell rental agreement are met.

After successfully registering the purchase and sale agreement with Rosreestr (which takes up to four months), the seller brings the documents and receives the money in person.

The second method is a letter of credit, when money is immediately transferred to the seller’s account, but is blocked until the documents are provided from Rosreestr. This is considered more reliable; in both cases, the borrower also bears the costs, so he makes the choice himself.

What is more profitable: to build a house or buy an apartment?

To purchase a one-room apartment in Moscow, most Russian residents will have to save money for half their life. Don’t eat, don’t drink, don’t travel, don’t buy clothes, but save absolutely all the money you earn. Experts from the World of Apartments portal have calculated that by denying themselves everything, the average Russian will have to save for the average one-room apartment in Moscow for 20 years, and for the minimum one - 10. Here is the data for some regions.

How many years will it take a resident of the regions to save up for a one-room apartment in Moscow?

| Region | Average salary, rub./month. | How many years to save for Wed. sq. | How many years to save for min sq. |

| Yamalo-Nenets Autonomous Okrug | 82769 | 8 | 4 |

| Magadan Region | 72966 | 9 | 5 |

| Moscow | 69847 | 9 | 5 |

| Saint Petersburg | 53874 | 12 | 6 |

| Moscow region | 46271 | 14 | 7 |

| Krasnoyarsk region | 40134 | 16 | 8 |

| Leningrad region | 38568 | 17 | 9 |

| Novosibirsk region | 32574 | 20 | 10 |

| Penza region | 26380 | 25 | 13 |

| Kirov region | 24810 | 27 | 14 |

| Ivanovo region | 22939 | 29 | 15 |

| Altai region | 22609 | 29 | 15 |

| Ingushetia republic | 20667 | 32 | 16 |

| Dagestan republic | 20308 | 32 | 17 |

| Average | 33607 | 20 | 10 |

The authors of the rating assumed that such savings would be made by a family in which two people work: you can live on one salary and save the second.