What is a business transaction journal

The business journal is the most complete accounting register; it contains records of all transactions relating to the activities of the organization.

Essentially, this document contains a list of all transactions reflected in accounting in chronological order. Since the amount of information recorded in the log can be large, this document is not convenient for analyzing or sorting data. However, if you need to track all transactions for a certain period or find a posting by date, a business transaction journal is indispensable.

Currently, an increasing number of organizations keep records using software, so compiling a log of business transactions has become much easier. However, to this day there are organizations, sometimes even quite large ones, with manual accounting. In our article we will analyze filling out an electronic and paper journal.

An example of filling out a journal of business transactions for account 99 “Profits and losses” can be viewed in ConsultantPlus. Get trial access to the system and study the material for free.

Filling out a journal of business transactions in 1C

Basically, accountants prepare entries in accounting programs only by electronically filling out primary documents in sections of the program related to various areas of business activity; in this case, entries are generated independently and automatically enter the journal of business transactions. However, there are atypical transactions that can only be reflected directly in the business journal. Let's look at this using the example of 1C:Enterprise.

To open the transaction log, go to the “Accounting” tab and select the “Transaction log” tab.

This journal contains a list of all transactions of the organization. One operation may correspond to several transactions, which can be seen in the second part of the journal if you click on the operation. In this register, you can add a new transaction, which will be documented in an accounting certificate. To do this, select the “Actions” and “Add” tabs, then fill in all the fields to complete the transaction. You can also upload the log as a list to print it - to do this, select “Actions”, “Output list”.

1C also has a journal of transactions - it does not have a breakdown into operations; transactions are shown as a list in chronological order. In journals, you can select and filter the necessary transactions. Selection parameters and time interval selection are made through the “Actions” tab.

Procedure for drawing up and filling out

There are no basic requirements for journal keeping, but there are a number of generally accepted rules, the maintenance of which is mandatory for each type of documentation:

- All transactions are recorded strictly by date: from the beginning of logging to the last entry. Random filling of dates is strictly prohibited.

- Any business activity is recorded in the journal, regardless of the scale and level of influence on the company’s work.

- Postings should refer only to primary documentation.

- The numbers in the journal are written in words (for example, “six thousand five hundred eighty-three copies”). This will help avoid mistakes when entering the required amount incorrectly and falsifying information. However, recently, company employees have been neglecting this rule and entering data into the register in numbers.

There is also no general form of journaling, since the scope of its use is quite extensive. Most often, each enterprise creates a form that is convenient for itself, which includes all the necessary points and sub-points. For example, in a company engaged in organizing weddings, there will definitely be an item “expenses” (how much money was spent on materials - balloons, ribbons, flowers, etc.) and income transactions (how much was received from individuals for the entire work). This is also permitted by the Law “On Accounting”.

The journal is kept either in paper form - this is an ordinary book, stitched and numbered, or bound, which is filled out manually. Or in electronic form using special accounting programs. Here, most of the information is filled in automatically when you first specify the settings.

Mandatory for each journal are: transaction number, date, explanation (description of the transaction), the amount of each transaction. Additionally, the following may be indicated: debit, credit and information about the primary documentation or order journal (the place where the transaction was recorded). Each new entry must begin on a new line to avoid errors and misunderstandings in further actions.

Nowadays, electronic versions of journals are most often used - it is much more convenient and faster, however, the policy of some enterprises allows filling out such documentation only manually. This is a longer and more labor-intensive process: it is important to be as careful as possible.

On paper

A paper journal is most often kept in small enterprises with a small turnover; filling out all items manually in multimillion-dollar companies is almost impossible due to constant changes.

The journal is filled out with a pen with dark blue ink and neat handwriting: it is especially important to clearly display the digital designations in order to avoid ambiguity in the interpretation of a particular number and errors during further verification of the calculation results. It is also recommended not to make any blots in the text - most likely, the authorities will require you to redo the page again.

The procedure for filling out the paper version is as follows:

- The new line indicates the number of the operation with its details (date, content, type). Additionally, it is possible to indicate on the basis of which documents this operation is carried out.

- Next, the amount of the transaction is indicated - financial profit and financial loss.

- The debit is indicated - how much other persons owe the company and how much they paid for this operation.

- The credit is indicated - what the company owes to other persons and how much it ultimately received.

- A signature and decryption of the signature are placed.

- If necessary, repeat everything from the beginning.

The signature and its decoding are mandatory, because if an error is made in the journal or there are misunderstandings on a particular issue, company representatives will immediately be able to find out who filled out this form and who is able to decipher what was written.

In 1C

If the journal is kept in electronic form (most often it is “1C: Accounting”), then the following is done:

- The “1C: Accounting” program is launched (or another accounting program used; the “Accounting” tab opens).

- In this tab, open the “Business Operations” sub-item and click the “Add” button.

- The following data is entered: date, type, details, amount.

- Additionally, it is possible to add a sub-item “From whom”, as well as indicate debit and credit (this action is performed if necessary in connection with a banking action: loans, receipts or outflows of funds). Here you also select the required bank document and click the “Approve” button. Next, this document is automatically linked to the operation.

- Saving is in progress.

- If necessary, everything is repeated again.

The business transaction log also has a function that is added to the context and additional menu. This feature will allow you to find a record by transaction number (the most detailed description of each action). To search for a record by transaction number, select the corresponding command from the context or additional menu: a window will appear that allows you to enter the transaction number in the field.

The business transaction journal is most often created automatically by an accounting program, based on previously entered documents. In fact, the entire journal of business transactions should be created automatically, without human intervention, but often certain documents still have to be filled out manually.

An accountant will have to enter less data manually if the accounting program contains many different functions and is correctly configured for the work of a particular enterprise.

We fill out the business transactions logbook in paper form

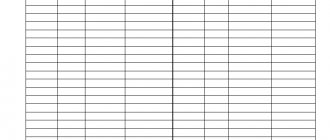

The journal of business transactions is compiled in the form of a table. This table should contain the following information: serial number, date, the transaction itself (Dt and Kt), transaction amount, description of the transaction, document on the basis of which the posting was made. You can view the business transaction log on our website.

In addition, on our website you will find a completed sample log of business transactions.

Journal of business activity facts for small enterprises

Detailed recommendations on accounting have been developed for small businesses. They were approved by order of the Ministry of Finance of the Russian Federation dated December 21, 1998 No. 64n. The book (journal) for recording the facts of economic activity in form No. K-1 (hereinafter referred to as the Book) is recommended to be used as the only register for recording all transactions by small enterprises with a small number of transactions, the type of activity of which is not related to material-intensive production. According to Order No. 64n, such accounting is called a simple form of accounting. You can find books on our website.

What is a small business entity and what are the criteria for classifying an enterprise as a small one, learn from the article “Features of accounting in small enterprises.”

Based on the data in the Book, you can prepare financial statements and determine data on assets and liabilities. Depending on the type of activity, the organization independently determines the necessary list of accounting accounts used and, in accordance with this, draws up the names of the columns of the Book intended for indicating the accounts. The book can be designed separately for each month or made common for the year. The first entry in the Book is the amount of account balances at the beginning of the period. At the end of the month, the totals for the debit and credit turnovers of all accounts are calculated, their sum should be equal to the total in column 4. Next, the final balances for the accounts are displayed. A sample of filling out the Book can be downloaded from our website.

In addition, another recommendation has been developed for keeping records by small businesses, approved by the decision of the Presidential Council of the NP “Institute of Professional Accountants and Auditors of Russia” (Minutes dated April 25, 2013 No. 4/13). These recommendations have been approved by the Ministry of Finance and are an improved and expanded version of Order No. 64n with examples of register design. These recommendations define three types of simplified accounting for small businesses:

- full form, in which a recommended list of various accounting registers is used;

- a shortened form in which these registers are not used;

- simple form only for micro-enterprises when double entry is not used.

An analogue of the simple form of accounting according to Order No. 64n is the abbreviated form according to the recommendations of the NP “IPB of Russia”. In the abbreviated form, the combined accounting register is the Book (journal) of recording facts of economic life in form No. K-1MP. This form repeats Book No. K-1 and is filled out in the same way. Form No. K-1MP can be found at https://www.ipbr.org/accounting/small-business-accounting-recommendations.

We also note that if it is not enough for an organization to maintain one register in form No. K-1 or No. K-1MP, then it can use other recommended registers, for example, for accounting for wages, fixed assets, settlements with counterparties, etc.

To learn how reporting is simplified for small businesses, read the article “Simplified accounting reporting for small businesses for 2020.”

Individual entrepreneurs must keep a book of income and expenses and business transactions of an individual entrepreneur. Find out how to fill out the document correctly in ConsultantPlus by getting trial access to the system for free.

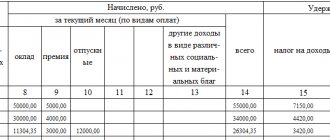

Prepare accounting entries for the following business transactions

- 1) Issued from the cash register to the employee on account for business expenses of 1,000 rubles.

- 2) A package of accounting software was purchased using funds in the current account in the amount of 8,000 rubles.

- 3) From the current account, suppliers were paid for received materials in the amount of 4,000 rubles.

- 4) Personal income tax has been calculated and withheld from the accrued salary in the amount of 3,500 rubles.

- 5) The debt to social insurance authorities in the amount of 3,750 rubles was transferred from the current account.

- 6) Proceeds from the sale of goods in the amount of 12,000 rubles were transferred to the bank account from buyers.

Journal of business transactions for the current period.

| Amount, rub. | Debit | Credit | |

| 1. Issued from the cash register to account for business expenses | |||

| 2. Payment from a current account for a package of accounting software |

|

|

|

| 3. Payment of invoices to suppliers for materials received |

|

|

|

| 4. Personal income tax is calculated and withheld from wages | |||

| 5. Social payments from the current account. Insurance | |||

| 6. The accountable amount was returned to the cashier | |||

| 7. Proceeds from the sale of goods were transferred to the bank account from buyers |

|

|

|

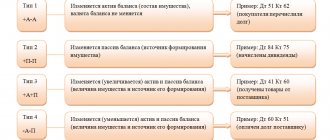

We open those accounting accounts that are present in the balance sheet at the beginning of the month and the journal of business transactions.

Active accounts reflect the initial debit balances from the asset balance at the beginning of the month, and passive accounts reflect the initial credit balances. Then, in the accounts, as turnovers, the amounts that go through transactions in the business transactions journal are recorded.

Correspondence of accounting accounts.

To maintain accounting records, the double entry rule is used, which is as follows: any business transaction is reflected simultaneously in two accounts - in the debit of one account and the credit of another account.

Accounting accounts for business transactions.

Active accounts have the following features:

- · they reflect the presence and movement of economic assets and property of the enterprise;

- · the opening balance is always debit and shows the availability of funds at the beginning of the reporting period;

- · the final balance is always a debit balance and shows the balance at the end of the reporting period.

The final balance is calculated using the following formula:

Sk = Sn + Od - Ok.

Account 50 "Cashier"

| Debit | Credit |

| balance | |

| operation | |

| operation | |

| turnover | |

| balance |

Account 51 “Current account”

| Debit | Credit |

| balance | |

| operation | |

| operation | |

| operation | |

| operation | |

| turnover | |

| balance |

Account 97 “Deferred expenses”

| Debit | Credit |

| balance | |

| operation | |

| operation | |

| turnover | |

| balance |

Account 26 “General business expenses”

| Debit | Credit |

| balance | |

| operation | |

| operation | |

| turnover | |

| balance |

Account 20 “Main production”

| Debit | Credit |

| balance | |

| operation | |

| operation | |

| turnover | |

| balance |

Account 10 “Materials”

| Debit | Credit |

| balance | |

| operation | |

| turnover | |

| balance |

Account 41 “Goods”

| Debit | Credit |

| balance | 83 079 |

| operation | |

| turnover | |

| balance |

Passive accounts can be characterized as follows:

- · on passive accounts, records are kept of the sources of formation of the enterprise’s economic assets, i.e. capital and liabilities (debt) of the enterprise;

- · the initial balance is always a credit balance and shows the amount of capital or the presence of liabilities of the enterprise at the beginning of the reporting period;

- · debit turnover shows a decrease in the capital or liabilities of the enterprise;

- · loan turnover shows an increase in the capital or liabilities of the enterprise;

- · the final balance is always a credit balance and shows the amount of capital or liabilities of the enterprise at the end of the reporting period.

The final balance is calculated using the following formula:

Sk = Sn + Ok - Od.

Account 70 “Calculations for wages”

| Debit | Credit |

| balance | |

| operation | |

| turnover | |

| balance |

Calculation 68 “Calculations for taxes and fees”

| Debit | Credit |

| balance | |

| operation | |

| turnover | |

| balance |

Account 69 “Calculations for social insurance”

| Debit | Credit |

| balance | |

| operation | |

| turnover | |

| balance |

Active-passive accounting accounts keep records of settlements with various organizations or individuals, i.e. accounting of receivables and payables. If an enterprise uses attracted or borrowed funds, then it has accounts payable to other organizations or individuals who are creditors of this enterprise.

If the enterprise is owed by other organizations or individuals, then these debtors are called debtors, and their debt to the enterprise is called receivable.

Debtors owe the enterprise, and creditors owe the enterprise itself. The word “debit” is derived from the Latin word debet, which means “should,” and “credit” is derived from the Latin word credo, which means “to believe.”

Account 71 “Settlements with accountable persons”

| Debit | Credit |

| balance | |

| operation | |

| operation | |

| turnover | |

| balance |

Account 60 “Settlements with suppliers and contractors”

| Debit | Credit |

| balance | |

| operation | |

| operation | |

| turnover | |

| balance |

Account 62 “Settlements with customers”

| Debit | Credit |

| balance | |

| operation | |

| operation | |

| turnover | |

| balance |

Account 99 “Profits and losses”

| Debit | Credit |

| balance | |

| operation | |

| turnover | |

| balance |

Account 90 “Sales”

| Debit | Credit |

| balance | |

| operation | |

| operation | |

| turnover | |

| balance |

Please note that when making payments on accounts, three options are possible:

- 1) there is an initial balance on the account (from the balance at the beginning of the month) and there was movement on the accounts (according to the business transactions journal), i.e. there are turnovers, so the accounts are 10,41,50,51,60,71,62,68,69,70,99;

- 2) the account has an initial balance (from the balance at the beginning of the month), but there are no turnovers, since there was no movement of funds on the account (according to the business transactions journal), this is how accounts 01,04,66,76,80,96 are drawn up;

- 3) there is no opening balance on the account, since it is not in the balance sheet at the beginning of the month, but there are turnovers, since there was a movement of funds in these accounts (according to the business transactions journal), this is how accounts 20,26,90,97 are drawn up.

We prepare a turnover sheet for the current month. The balance and turnover for each account on which calculations were made are recorded in the lines of the turnover sheet.

Turnover sheet for the reporting period.

The turnover sheet has two purposes.

Firstly, it is used for control. If all calculations on the accounts are carried out correctly, then the turnover sheet should have three pairs of equalities: the initial debit balance is equal to the initial credit balance, the debit turnover is equal to the credit turnover, the final debit balance is equal to the final credit balance.

The first pair of equalities follows from the balance sheet at the beginning of the month, since the data in the first and second columns are the assets and liabilities of the balance sheet at the beginning of the month.

The second pair of equalities follows from the double entry rule, since the same amount goes through both the debit and credit of the accounts. Therefore, the total amount of turnover in the turnover sheet must be equal to the sum of all transactions in the business transactions journal.

The third pair of equalities has a control value and shows that the calculations on the accounts were performed correctly.

Secondly, based on the turnover sheet, a balance sheet is drawn up at the end of the reporting period. The final balance on the debit side of the accounts in the turnover sheet is data for the assets of the balance sheet, and the final balance on the credit side of the accounts is recorded in the liability side of the balance sheet.

Results

The register containing complete information about the activities of the organization, reflected in the accounting accounts, can be called the “Journal of business transactions” (or transactions, or facts of economic activity - this will not change its function). Modern accounting software allows you to create such a register automatically, which can help you find the necessary records in a large amount of information by applying filters and sorting.

Sources: order of the Ministry of Finance of the Russian Federation dated December 21, 1998 No. 64n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Form and sample filling

Similar articles

- Classification of accounting documents

- Business transactions in accounting: examples

- Accounting Basics

- Systematic entry in accounting

- Cashier operator's journal for online cash register