Inventory list of goods and materials

The inventory list of goods and materials, form INV-3, was approved by Decree of the State Statistics Committee of August 18, 1998 No. 88. Registration of INV-3 is necessary for the purpose of recording the actual availability of inventory in a particular organization. In this case, goods and materials mean:

- goods;

- finished products;

- production or other inventories of the company, etc.

Valuables may be stored in specially designated places (warehouses, boxes, hangars, etc.) or be at any stage of movement in connection with the activities of a legal entity. Thus, the information entered into the INV-3 form is determined during the ongoing procedures of recalculation, weighing, and measurement exclusively at the location of the inventory items.

Inventory of the attachment “Russian Post” - What is it?

An inventory is a list of materials inserted into correspondence before dispatch.

A list is compiled on a unified form (form 107), approved by order of the Federal State Unitary Enterprise “Russian Post” No. 114-p dated May 17, 2012. According to this order, the inventory can be drawn up in:

- Parcels

- Parcels

- Valuable message.

What is so attractive about sending correspondence with a valuable letter?

When receiving a message, an employee of the operator room of the Russian Postal Service puts a stamp on the inventory with the date of dispatch.

Note. The date of receipt of valuable correspondence with an inserted inventory is considered the date of transmission of the report.

Therefore, if an entrepreneur is late for some reason to submit reports on time, he can even send the report on the final day by mail with an inserted inventory, insuring himself from the accrual of a penny and a fine from the tax service for not submitting the report on time.

( Video : “Form 107 Russian Post (Inventory of attachment)”)

Mandatory details of INV-3

When using a unified inventory form during an inventory, employees of the inspection commission need to know what mandatory details must be filled out. The INV-3 inventory list must contain:

Page 1 of the inventory - receipt

Filling out the inventory begins with entering the required details into the receipt:

- In the fields “Organization” and “Structural unit” the full or abbreviated corporate name of the organization is entered in accordance with its constituent documents.

If the staffing table does not provide for division into structural departments of the company, the corresponding field remains blank. - As the basis for conducting an inventory, an internal administrative document of the executive body of the company (resolution, order, instruction), the date of its preparation and registration number are indicated. Unnecessary document names must be crossed out.

The frequency of inventory is determined by the management of a particular legal entity. The inspection can be scheduled or carried out urgently. Inventory records of inventory items during a planned inventory are no different in form and content from those compiled during an unplanned inspection.

- In the fields “Inventory start date” and “Inventory end date”, calendar designations corresponding to the time of inventory actions are entered.

- The document number and date of its preparation are filled in in accordance with the organization’s current policy for maintaining and recording internal document flow.

- In the column “Type of inventory assets” the name of the goods or other industrial products subject to accounting is indicated.

- The next ordinal field must contain information about the type of ownership on the basis of which the legal entity. a person uses or disposes of goods and materials - ownership, rent, storage, processing, etc.

- The positions and personal data of employees who are entrusted with the responsibility for maintaining records and taking inventory of valuables are indicated as financially responsible persons. Such an obligation may be provided for in an employment contract, order, regulation, agreement on the assignment of duties to ensure the safety of inventory items, job description, etc.

- At the end of the receipt, the actual date of removal of the remaining goods is indicated.

INV-3: sample of filling out 2-4 pages of inventory

The inventory list of inventory items (pages 2, 3, 4) is presented in the form of a table, which includes the following information:

- numbers of accounts and subaccounts;

- name and information characterizing the inventory items;

- number of values, unit of measurement, item number;

- unit cost;

- information on the actually identified quantity of inventory items and on the reflected volumes according to accounting data.

The inventory list of inventory items in the final line is filled in, according to all information, figures and amounts, exclusively in words.

All members of the commission specially created for the inventory sign the inventory form. In addition, the inventory is certified by the signature or signatures of the employees financially responsible for the safety of valuables, and is also endorsed by the chief accountant, confirming the comparison operation.

Mandatory items of the investment inventory

A valuable item that ensures 100% delivery of correspondence to the recipient. In addition, documentary evidence of sent messages is required. This confirmation includes an inventory of the enclosed papers, which is considered an important circumstance in legal terms and becomes evidence in legal disputes.

Here are the items in the inventory of the “Russian Post” attachment, which are mandatory:

- Take a standard form (form 107), which already has the name “Inventory”

- The recipient's address is displayed.

- The name of the institution to which the letter is sent is indicated.

- A list of documents is recorded in the table, displaying the item number, the name of the document, the number of sheets in it and the established value.

- Finally, the total number of sheets and the total estimated amount are summed up.

- Information about the sender with full name displayed. or company name and signature.

- Mark from the communications worker who accepted the letter.

- Branch stamp.

An employee of the communications department checks the contents of the papers in the message and compliance with the inventory of the inserted correspondence. After checking, a stamp is placed on the second copy of the form and the form is handed over to the author of the message.

Obligation to use the document

The use of a unified inventory form, starting from the beginning of 2013, is not the responsibility of business entities. In order to comply with the norms of the law on accounting, organizations can use an independently developed form for inventory of inventory items. A sample of a self-developed form must contain the mandatory details listed above. The exception is budgetary organizations, the obligation of which to use a unified inventory form is enshrined at the legislative level.

Before starting an inventory of goods and materials, the initiator of the inspection creates a special commission of employees of the organization. The inventory list of inventory items itself is compiled on paper in 2 copies: 1 is submitted to the accounting department for drawing up a matching sheet, 2 remains at the disposal of persons who are financially responsible.

If the commission identifies goods that are not taken into account by the accounting department, all data on such goods and materials are subject to mandatory reflection in the inventory list of inventories.

For materials related to material assets, but which have lost their properties for further use (spoiled or unsuitable for production), appropriate acts are drawn up.

Inventory of attachment F-107 on WORD form - fill out online

If you are looking for a WORD form for an inventory of investments F-107, try the Pochtum.RF service. Filling out the form online has become even more convenient. The service will generate a fully prepared form in the Russian Post format. In addition, all recipients and senders will be saved, and totals by quantity and declared value will be calculated. Batch printing of documents is supported. You can select multiple recipients, generate a document for each of them, and print with the click of a button. Batch printing is especially convenient if you have many recipients with the same description for everyone. In this case, just fill out the table for one of them and click the “Make the same for all” and “Print all” buttons.

In what cases is it necessary to create an inventory?

To establish the correctness of determining the tax base, the inspectorate has the right to request a package of papers from taxpayers. In response to a received request for documents, an entrepreneur or organization prepares the requested forms and draws up an inventory. It is included in the general package.

In some cases, the documentation is sent to the tax office by mail. In this case, you will additionally need to create an inventory of the investment. What is the difference between these forms?

- Inventory of attachments – a generalized list of transferred forms.

- Inventory of documents - the specific composition of the package with papers for transfer.

The Tax Code (clause 1 of Article 126) obliges taxpayers to transfer all data upon request of the inspectorate. Otherwise, the company may be subject to a fine.

What does the list of documents for the 3-NDFL declaration for property deduction look like?

If the payer wants to take advantage of a property deduction, for example, for the costs of purchasing an apartment under an equity participation agreement (hereinafter referred to as the DDU), he lists in the inventory:

- 3-NDFL;

Find out how to fill out the 3-NDFL declaration for property deduction here.

- 2-NDFL;

- DDU;

- Act of Handover;

- payment documents;

- application for distribution of deductions (on joint or common property);

- application for personal income tax refund.

A sample of how to make an inventory of documents for the tax office will help you deal with this issue. Thus, an inventory of property deductions, combined with an application for a deduction, can be downloaded on our website.

For information on the property deduction and documents to support it, see the publication “Documents for obtaining a property tax deduction.”

We compile an inventory of documents for the tax office

Let us recall that in the absence of strict requirements for the form of the inventory, its structure and content are still specified. To understand the validity of these requirements, it is necessary to understand the task assigned to this document.

The list of documents for transfer to the tax office (a sample is given below) is not only a meager list of attached documents, first of all, it is “insurance” for the taxpayer in a situation if disagreements arise with the inspectorate, or during the tax authorities’ work with documents any of the documents are lost them. In these cases, a correctly compiled inventory to the tax office will help to avoid liability for failure to provide the necessary documents and the accrual of penalties.

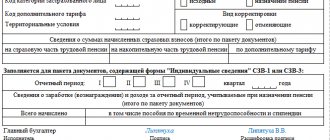

The accompanying inventory for submitting documents to the tax office refers to administrative documents, and as a general rule falls under the standard of documents of this group, and therefore must contain:

- outgoing number and information about the date of registration of the document;

- in the upper right corner - information about the addressee (IFTS) and the business entity (full name, INN, KPP, OGRN, legal address, contact phone number);

- the name of the document is “Inventory of documents for transfer to the Federal Tax Service”;

- preamble;

- list of documents indicating the number of sheets bound;

- an indication of the total number of sheets;

- manager's signature;

- date of compilation, stamp (if available).

The most important sections of the inventory are the preamble and the list of documents. Let's look at them in more detail.

Preamble is a part of the text in which the taxpayer indicates the requirement of the Federal Tax Service, according to which this package of documents is provided.

The list of documents is the main section of the inventory. When forming it, you should indicate:

- serial numbers of inventory items;

- name of the documents listed in it;

- format of each document – (original, photocopy, certified copy);

- registration data of the document (if available - own number, outgoing number, etc.);

- number of sheets for each document;

- total number of applications and sheets.

The list of documents to the tax office is drawn up in two copies, one of which is submitted along with a package of supporting documents to the tax authorities, the second copy, on which the Federal Tax Service specialist must put the date the documents were accepted for consideration and the incoming registration number, is kept by the taxpayer.

When sending a package of documents by mail (valued letter), an accompanying list of the letter to the tax office is also drawn up, on which the number and nomenclature of attachments is confirmed by the signature of the postal operator.

Read also: How to certify copies of documents for the tax authorities