Free legal consultation by phone:

8

If a product loses its marketable appearance or its expiration date expires, the company’s employees must draw up an act to reduce its value. It is compiled by the head of the enterprise and a specially assembled commission.

The act is drawn up on three pages. Completing the third page containing the table is the key point in completing the act.

Read the article about the situations in which it is necessary to draw up an act, the procedure for its execution and the provisions that it should contain.

Free legal consultation by phone:

8

It is important to know…

- Drawing up an act of acceptance of materials: form M7

- Drawing up a contract for the purchase and sale of building materials

- How to draw up a contract for the exchange of goods?

- How to submit an application for a refund for a product?

- How to fill out a power of attorney in form M2?

- Drawing up a purchase and sale agreement for petroleum products

Markdown of inventory items

Markdown of inventory items is a reduction in their previously established value. It occurs as a result of mechanical damage to goods, a decrease in their quality due to improper or prolonged storage, as well as due to a decrease in consumer interest or obsolescence of products.

Important ! It is not enough to simply tell the buyer a lower price than the previously set one. To carry out a markdown, you must go through a rather labor-intensive registration procedure.

Certificate of revaluation of goods sample in Excel

5,00

5

| Reviews: | 0 | 8918 |

| 1 | n/a |

File type Text document

Document type: Act

?

Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

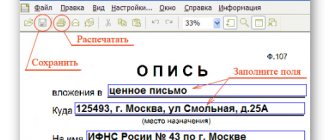

Appendix No. 2 to the Instructions on the procedure for processing commission transactions and maintaining accounting records in the commission trade of non-food products, approved by Order of Roskomtorg dated December 7, 1994 No. 99 ACT OF MARKETING “___” ______ 20___

the commission agent represented by ________________________ (last name, first name, patronymic) and the principal _________________________________________ made a markdown (last name, first name, patronymic) of the following goods. ——————————————————————— Date¦ Name ¦No.

contract¦ Price according to ¦Percentage¦Price after ¦ goods ¦ ¦ contract ¦ markdown¦ markdown —-+—————+————+—————-+——-+———— —-+ —————+————+—————-+——-+———— —-+—————+————+—————-+——- +———— ——————————————————————— Commission agent ______________________ (signature) Committent _________________________ (signature): ———— The markdown of things is formalized by an act drawn up by the commission agent in one copy (Appendix No. 2), and is recorded in the list. At the same time, the new price and markdown date are indicated on the product label attached to the item. The markdown act is transferred by the financially responsible person with the product report to the accounting department.

Download the document “Report of Markdown of Goods”

Preparation for registration of the act of revaluation of goods

In order for the act to acquire legal force, it is first necessary to form a separate commission (through a separate order) and select the chairman of this commission. Also, the act must be based on something, refer to something. To do this, the manager issues a special order to revaluate the goods.

The last paper should describe the reasons why the organization resorts to revaluation of goods. Motives can be very diverse. A number of legally acceptable ones include, for example:

- A change in demand or supply for any product sold by an organization. For example, there is a seasonal demand for a product, increasing at the beginning and decreasing towards the end. Along with the level of demand, the price of a product may also change.

- If the supplier produced and delivered a product of lower quality than expected.

- Expiration of the shelf life and sale of goods in the warehouse.

- Changes in the VAT rate or other parameters related to legislative adjustments.

- Moral obsolescence of unsold goods in the warehouse.

- Inflation. Increases in the prices of goods can be directly related to the annual inflation of the currency in which they are sold.

- Screening of individual units as samples on the sales floor.

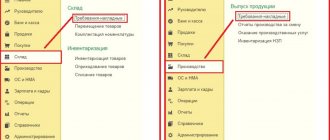

Revaluation of goods in 1C 8.3

Revaluation of goods is the determination of the difference between the cost of goods at previous retail prices and the newly introduced price for the goods. When the new price is lower than the previous one, the product is marked down; if it is higher, then it is revalued.

https://www.youtube.com/watch?v=anY7F9rG1U8\u0026list=PLnR7MRqErVvRd5A9oSyt9YWe_Y47ttvqf

Revaluation of goods during markdown can be associated both with low consumer demand for the goods being sold, and with ongoing promotions, or, for example, due to a decrease in the quality of the goods, due to obsolescence, when the functional properties of the goods do not keep up with progress, and many other reasons. Revaluation may occur, for example, for reasons of purchasing similar goods at higher prices.

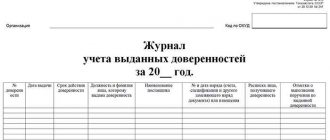

Commodity revaluation is drawn up in a document in which you need to indicate the name of the product, its quantity, storage unit, previous and new price.

All changes in prices, according to the law, must be carried out only on the basis of an order from the head of the company. The amount of data that has to be manipulated during such procedures can be significant.

The functionality of the 1C:Accounting software product helps the accountant to re-evaluate or mark down goods in the warehouse in the shortest possible time and without headaches.

In “1C: Accounting”, revaluation is done using the document “Revaluation of Goods”, from which you can print a form containing information about the revalued product indicating the new price entered.

Commodity revaluation is carried out only in companies that have organized accounting of goods at sales prices on account 41.11 “Goods in retail trade” (in the “Automated point of sale at sales price”). Such goods are taken into account in a warehouse with the “Retail store” type.

Fig. 1 Warehouse with the “Retail store” type

The goods can be delivered either directly to the retail warehouse or to the wholesale warehouse.

In the first case, it is necessary to immediately set retail prices for incoming goods using the document “Setting item prices”. When it is carried out, a markup will immediately be allocated for the goods sold at retail.

For example, a retail warehouse received 200 pieces of goods. at the admission price of 170 rubles. We set the retail price at 250 rubles. When posting the receipt, the program is credited to 41.

11 goods at a purchase price in the amount of 34,000 rubles, and the difference between the purchase and sale prices in the amount of 16,000 rubles. will be reflected in account 42.01 “Trade margin in automated retail outlets.” As a result, on account 41.

11 the goods will be listed at the retail price, and the markup will be on account 42.01.

Fig. 2 As a result, the goods will be listed on account 41.11 at the retail price, and the markup will be on account 42.01

Source: https://OrenRabota56.ru/dokumentaciya/akt-mh-15-obrazec-zapolneniya.html

The procedure for marking down inventory items

In order to correctly carry out the procedure for marking down goods, you must first correctly draw up the appropriate order. It should include the requirements for markdown and its features. This order must be approved by the company management. Then the management’s order to carry out a markdown of inventory items is brought to the attention of the employees involved in it. Only after this can measures be taken to mark down certain products, including the following actions:

- Carrying out an inventory, which allows you to understand how much goods to be written off are in the warehouse and/or at the point of sale;

- Collection and approval of the composition of a special commission to determine the cost of goods in conditions of market competition;

- Carrying out a procedure to determine the market value of goods subject to discounting;

- Recording of all collected information in a specialized document - depreciation act of goods and materials N MX-15.

Download for free the act of markdown and damage to goods: sample and form – How to build your own business

In the process of performing an inventory, not only the accounting of goods takes place, but also its visual, qualitative assessment, since stale products cannot be suitable for sale at current prices. If such products are available, a markdown or damage report is drawn up.

What is a markdown act

This is a document recording the fact of a decrease in the price of a product or property. The formation of this document is necessary for:

- Markdowns on goods that have been lying around in a warehouse or store are not in demand;

- The product does not have a marketable appearance, it or its packaging is defective;

- The product has lost consumer demand because it is obsolete.

How to properly re-evaluate and discount goods - watch this video:

When and by whom is it formed?

A document is drawn up during the inventory process by the commission that conducts it. The document must be signed by all its members, as well as financially responsible persons, and must be approved by the head of the organization. Here you will find out what rules are used to draw up an inventory report.

Form and rules of compilation

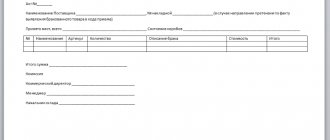

The document is generated according to the unified form TORG-15 and consists of the following pages with the following content:

- 1st page - intended for entering the details of the organization and the document, indicating what property it is filled in, its price before and after revaluation. You can find out what the individual entrepreneur’s details are and where you can view them by following the link;

- On its reverse side, it is necessary to indicate the conclusions or recommendations of the commission regarding the destruction of products that cannot be restored, and the signatures of all members of the commission.

Document MX-15 contains 3 sheets:

- Title to indicate details, dates and signatures;

- 2nd page – for product description;

- 3rd page – a complete description of the markdown process and the cost of goods after it has been carried out.

But since unified forms have been completely abolished since 2013, enterprises can independently generate such a document, indicating the necessary details in it:

- Details of the enterprise, date and number of the inventory order;

- Accounting information for goods subject to markdown;

- Original price, markdown amount and value after markdown;

- The commission’s conclusions about the reasons that led to the deterioration of the goods and the degree of guilt of the financially responsible persons;

- Signatures of the commission members and approval by the director.

This document will serve as the basis for accounting to write off the company’s losses. Here you will learn how to write off accounts payable with an expired statute of limitations.

Form for an act of damage to goods and materials.

What is an act of damage

Such a document is drawn up in various situations:

- As a result of damage, dents, cracks and breakages;

- The occurrence of damage as a result of flooding of the premises when office furniture is damaged;

- The occurrence of damage as a result of careless intentional or accidental handling of the employee’s property.

A document is required for official written confirmation of property damage. In addition, this document is the basis for applying penalties to the culprit of the incident.

When and by whom is the document generated?

An act is drawn up upon the occurrence of damage by the responsible person who is charged with such actions. In addition, there must be a person as a witness to the fact of the occurrence of damage, as well as a specialist who can confirm the extent of damage to the mechanism.

Form, structure and highlights

The paper does not have a unified form, so the enterprise has the right to draw it up according to the chosen sample, and it is necessary that when forming it the following structure is observed:

- The header of the document is the date and place of preparation, the number and title of the act, the details of the enterprise.

- The main part is the essence of the damage caused, its nature, as well as the number and name of the damaged values, the approximate amount of damage:

- When creating a document for several types of property, it is better to use a table;

- In addition, it is necessary to indicate information about the culprit of the incident, his data, position, information about the cause of the damage;

- If there is no specific person who caused the damage, this fact must be indicated.

- Next, you should indicate the commission’s conclusions and recommendations.

- If supporting documents exist, their availability must be indicated.

- The document must contain the signatures of the originator, the participants in the process and the culprit; if you refuse to sign, you must draw up an act to this effect.

It is permissible to form a document on a blank sheet of paper or company letterhead, then there is no need to form a header, fill it out by hand with a ballpoint pen, or create it on a computer.

The procedure for marking down goods when a defect is discovered.

- The document is drawn up in 2 copies, one is intended for accounting, since the damage needs to be written off, and the second is handed over to the person responsible for the incident.

- If private property is damaged, the act is formed in the same order and under the same circumstances, with representatives of the housing and communal services or the Ministry of Emergency Situations acting as a commission.

- Important: drawing up must take place within the first 12 hours after the flooding; if authorized persons do not appear during this period, you must draw up the document yourself in the presence of neighbors and the person at fault.

Conclusion

- But at the same time, all required standards must be observed, most importantly the presence of an authorized commission and a complete description of the condition of the goods.

- You can find out how food products are marked down in the program here:

Source:

Act of markdown of goods. Form, sample 2019

The act of markdown of goods, the form of which can be downloaded below, is one of the most popular primary documents. On three pages of the act, changes occurring in the price of goods are described in detail, reasons are indicated, etc.

FILES Download a blank form of a goods markdown act .xlsDownload a sample goods markdown act .xls

The legislative framework

First of all, it should be clarified that the act is a unified form of MX-15. It was approved by Resolution of the State Statistics Committee No. 66 of August 9, 1999. For a long time it was the only way to mark down certain goods.

However, recently the requirements regarding accounting forms have been significantly relaxed. Because of this, the unified form has become a recommendation, but it still remains the most popular. This is due to the fact that inspection organizations are inert; their employees are accustomed to seeing a certain way of presenting data and being guided by it.

Also, the convenience and functionality of the act of marking down goods in this particular form are the reasons why this form is so popular and widespread.

Components

The data in the document is located mainly in the form of tables, so it is preferable to use Excel to work with it.

The act is usually printed on three pages. Their boundaries are highlighted in the attached samples and forms.

First page

On the top sheet of the act there is a link to the 1999 Resolution. It's in the upper right corner. When filling out this page, you need to pay attention to the following columns:

- Name of the organization and structural unit. The second is indicated if available.

- Grounds for drawing up the act. The form spells out two possible options: an instruction or an order. The one that does not fit must be crossed out with one horizontal line (so that it can be read).

- OKUD form. This column of the unified form is already written in the form - 0335015. An important nuance: if at least one column to be filled out is changed, the document will cease to be a unified form and the OKUD code will no longer be applicable to it.

- OKPO code.

- Type of activity of the organization according to OKDP. Expressed as a numerical value.

- The number and date of drawing up the order or instruction, which is the basis for creating a markdown act. Naturally, the document described must be published earlier and attached to the act.

- Type of operation performed. In most cases, this column remains empty. It is not required to be filled out.

- The number of the goods markdown act and the date of its preparation.

- Executive visa. It is located separately, in the upper right corner, just above the name of the act.

- Mention that the paper was drawn up by a special commission for the markdown of goods. And also that all inventory items were relabeled.

In the form provided, all three sheets are located one after the other. The places separating the sheets are marked. It is along this border that the page should be printed.

Second page

This sheet contains a table that tells about the general characteristics of the product. It has columns with the following names:

- Serial number.

- Date of receipt of the discounted item.

- Product release date (with attached documentation).

- The number and date of the invoice according to which the goods arrived at the organization’s warehouse.

- Characteristic. This column is divided into four parts. It is assumed that all four can be filled. For normal paper circulation, one or two characteristics of the item will be enough. They are necessary to understand the scope of application of the samples in question.

- Units of measurement indicating OKEI code. If goods are measured in pieces, then this value will be 796.

- The total number of discounted goods listed in the act.

The sheet is for informational purposes only, but is an integral part of the MX-15 form. The results are summed up right below it. In this case, you need to clarify whether they are summed up by page or by act by crossing out one of these words on the form (“by page” or “by act”, both are written).

The number of serial numbers of products is written down separately in words (in order not to cross out empty lines if there are any). There is a column to indicate the quantity of goods in physical terms.

Third page

The last part of the act is entirely devoted to the detailed development of the markdown itself: reasons, quantity. For convenience, on the third page there is a table with the following columns:

- Markdown percentage.

- Unit price before and after markdown.

- How much is the difference in price per unit before and after markdown.

- The total amount by which a particular category of goods is discounted. The price indicated here is not for one unit, but for all available ones.

- Reason for markdown. This could be a loss of quality, obsolescence, a drop in demand, etc. If there is a code for the reason for the markdown, then that is indicated as well.

- Signs of a decrease in the quality of inventory items, the code of these signs, if such a system is in effect in the organization.

- Note. Any fundamentally important additions regarding the described product items: packaging, delivery time, etc.

The amount of markdown for all items is written in numbers at the bottom of the table, as well as in words in the “Amount” column below it.

The act of marking down the goods is completed with the signatures of all members of the commission, headed by the chairman. In addition to signatures, the document must contain their transcripts, as well as positions.

If the discounted product is not returned to the supplier, but remains at the storage location, then after the signatures of the commission, the person financially responsible for storing this product must sign. For example, a storekeeper.

The form and sample of the act must contain information about warning the commission members that signing an act that describes unreliable data will result in punishment.

Instances

The act of marking down the goods is drawn up in two copies. The first remains with the financially responsible person. The second copy is received by the organization’s accounting department along with the inventory report (if possible) and the basis - an order for markdown (or inventory).

Source: https://kmb-chr.ru/sposoby-zarabotka/skachat-besplatno-akt-utsenki-i-porchi-tovara-obrazets-i-blank.html

Composition of the markdown act MX-15. Sample and example of filling

An act of markdown of goods is a document reflecting a decrease in the value of goods for one reason or another. It can be compiled using the form developed by the organization’s own employees, however, it is much more convenient to use the form of the existing form of Act N MX-15. You can download it by following this link.

Form MX-15 consists of two parts, each of which is presented on separate sheets.

The first part is the title page. It requires the following information:

- Full name of the organization;

- Company addresses: legal and actual;

- Reason for carrying out the markdown procedure.

Also on the title page there is a place for approval of this act MX-15 by the head of the organization upon completion of the markdown procedure. Until this moment it should remain empty.

The second part - the second and third pages of the MX-15 form are devoted to the product itself, subject to markdown. They indicate its characteristics and appearance. You must also provide the following information here:

- By what percentage of the cost is the markdown made;

- The initial cost of the goods and the final price;

- The difference between the initial and final cost;

- The reason for the markdown.

A sample of filling out this act can be downloaded by following this link.

When is a depreciation report drawn up?

During an audit in a store or warehouse, the commission not only counts the quantity of goods, but also visually evaluates it. Based on the results of the inventory, an inventory list and statement are compiled, which records the discrepancy between the accounting and actual quantities of goods.

However, the goods that are actually in stock may be expired or have any defects. In such cases, either a markdown act or a write-off act is drawn up. The document lists the name, quantity, price of the rejected goods, indicates the cause of the incident and the perpetrators.

The following options are possible:

- The product is hopelessly damaged. In this case, the trading organization draws up a “Certificate of Write-off of Goods” (TORG-16);

- The product has lost its appearance (the packaging is damaged, there are chips) or the sales period is close to the end, but it is still possible to sell it. In such a situation, it is necessary to mark down the goods in order to be able to sell them as quickly as possible. For these purposes, trade organizations draw up an “Act on Damage, Damage, Scrap of Inventory and Material Assets” (TORG-15);

- If your product is fabric, then there is a separate document “Act on the markdown of the flap” (form TORG-25);

- Another trivial situation is possible. In the warehouse, the goods (products or inventory items) are in stock and have no visible defects. But it is not in demand at all, it is morally outdated. To implement it, a markdown is simply necessary, which is formalized by an act of form MX-15 (form MX-15 is a warehouse document and is used both in trade and in production and other enterprises).

Rules and procedure for drawing up a depreciation act

The act is drawn up by the financially responsible person in the presence of a specially created commission in two copies. One of them is transferred to the accounting department, so it must be supported by inventory documentation.

The financially responsible person in charge of the markdown procedure keeps the second copy.

In this case, both copies must first be completed by the organization’s management.

Important ! It is necessary to mark down a product before it is sold at a reduced price, and not after that.

When is it needed?

Markdown of a product is a procedure for reducing its actual value.

Product markdown occurs in the following situations:

- demand for it decreases;

- its moral significance is outdated;

- the price was reduced at market level;

- the expiration date has expired;

- the presentation was damaged.

The main purpose of markdown of goods is to sell them at a reduced price to minimize losses. Most often, markdowns occur due to expired shelf life.

The procedure for marking down goods:

- An order is drawn up. It contains the requirements and features of the process of reducing the actual value of a commodity item.

- Inventory. Before reducing the price of a product, it is necessary to analyze its quantity and condition.

- Determining the value of a product on the market. A commission is appointed to determine it. It includes:

- experts who determine the quality of a discounted item;

- logisticians;

- employees of the enterprise whose responsibilities include checking the commodity item and its quantity.

A markdown act is a paper drawn up to record the reasons why a product is marked down.

It should be remembered that such a process with real estate occurs very rarely, and you should not count on it, for example, when drawing up an acceptance certificate for the transfer of a construction site to a contractor.

How to correctly carry out markdown of goods and materials

> > In the contract, fix the conditions, frequency and size of possible markdowns (clause 30 of the Rules, approved by the Decree of the Government of the Russian Federation of June 6, 1998

No. 569). As you mark down, reduce the cost of the goods reflected on account 004.

Document the markdown in an act according to form No. KOMIS-3. As you sell goods, write off their cost from account 004 (clause 158 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001.

No. 119n). Confirm the sale of the goods with a certificate in form No. KOMIS-4. An example of reflecting in accounting the markdown of goods accepted for commission. The organization accepts goods from citizens for commission for subsequent sale. In February, Hermes Trading Company LLC accepted furniture (kitchen set) from a citizen for commission.

The sale price of the headset agreed with the consignor was 50,000 rubles.

Important It is also important to reflect what sources of information the organization uses to determine the current market value of the goods when creating a reserve.

Create a reserve for each unit of goods reflected in accounting. Include the amount of contributions to the reserve as part of other expenses.

As you sell goods for which a reserve was created to reduce their value, or as their market price increases, show the created reserve as other income. At the end of the year, show the cost of discounted inventory items in the balance sheet minus the created reserve.

The basis for such actions is clause 25 of PBU 5/01. In tax accounting, reserves for reduction in the value of goods are not created.

If there are bulk goods, they are weighed and taxed by multiplying the cost of the measuring unit and the resulting weight. The next stage of the inventory involves comparing the obtained data with the accounting indicators of the accounting department.

If the data does not match, a matching statement of form No. INV-18 is drawn up.

Goods identified during the process that are subject to revaluation are included in a separate act.

Attention The document contains information sufficient to enter corrective data into accounting.

Data Description Nomenclatures Names, quantities of goods Revaluation amounts The percentage by which the product is discounted or revalued.

Product price Data from the old price before revaluation and the new price after the change. The total amount of the trade markup is RUB 3,500.

(2966 RUR + 534 RUR). At the beginning of March, the monitors were not sold. According to the conclusion of the marketing department, due to the emergence of new models, these monitors are obsolete and their market price has decreased.

In March, by order of the director of the organization, monitors were discounted by 40 percent of the trade markup, that is, by 1,400 rubles.

each (RUB 3,500 × 40%). The total amount of the markdown was 14,000 rubles. (RUB 1,400 × 10 pcs.). In April, the monitors were sold at a price of 10,100 rubles.

a piece. The following entries were made in the accounting records of Hermes. In January: Debit 41 Credit 60 - 80,000 rubles. (RUB 8,000 × 10 pcs.) – monitors are capitalized; Debit 19 Credit 60 – 14,400 rub.

– input VAT is reflected; Debit 68 “Calculations for VAT” Credit 19 – 14,400 rub.

Third page

The last part of the act is entirely devoted to the detailed development of the markdown itself: reasons, quantity. For convenience, on the third page there is a table with the following columns:

- Markdown percentage.

- Unit price before and after markdown.

- How much is the difference in price per unit before and after markdown.

- The total amount by which a particular category of goods is discounted. The price indicated here is not for one unit, but for all available ones.

- Reason for markdown. This could be a loss of quality, obsolescence, a drop in demand, etc. If there is a code for the reason for the markdown, then that is indicated as well.

- Signs of a decrease in the quality of inventory items, the code of these signs, if such a system is in effect in the organization.

- Note. Any fundamentally important additions regarding the described product items: packaging, delivery time, etc.

The amount of markdown for all items is written in numbers at the bottom of the table, as well as in words in the “Amount” column below it.

The act of marking down the goods is completed with the signatures of all members of the commission, headed by the chairman. In addition to signatures, the document must contain their transcripts, as well as positions.

If the discounted product is not returned to the supplier, but remains at the storage location, then after the signatures of the commission, the person financially responsible for storing this product must sign. For example, a storekeeper.

The form and sample of the act must contain information about warning the commission members that signing an act that describes unreliable data will result in punishment.

How to mark down goods - procedure and accounting

Hello.

Info Goods stored in a company's warehouse or retail outlet may be revalued.

Today you will learn:

- What are markdowns on commercial products?

- For what purpose do they use markdowns?

- How is the markdown procedure carried out?

When visiting any large store, you can see counters on which discounted products are placed.

In this article we will talk about what markdown is and why it is necessary.

But what does markdown mean? It is necessary to take into account that markdown of goods is a procedure in which the cost of commercial products is reduced. At the same time, buyers are fully confident that this is a completely simple procedure for the manufacturer. But what could be simpler than reducing the cost? In fact, not everything is as simple as it seems from the buyer’s side.

Markdown is a complex procedure that requires documentation taking into account generally accepted requirements.

It turns out that the manufacturer simply cannot change the price of commercial products, since it is necessary to follow a special markdown procedure. You cannot simply reduce the price of a product, since there are a number of reasons for this.

Let's note the most common ones:

- When demand decreases;

- When market value decreases;

- Partial loss of presentation;

- Expiration date.

- Obsolescence of commercial products;

In practice, the store reduces the price of the product only if the expiration date expires.

So that he places the goods in the center of the hall on a special rack.

At the same time, a special bright price tag is made, which is sure to attract the buyer’s attention and he will pay attention to the discounted product.

Well, don’t forget about the well-known ones, when in the center of the trading floor a representative of a store or shopping center offers to purchase one product and get a second one at a reduced cost.

Few people think that a product at a reduced cost is a discounted product that sells beautifully. Buyers can, even without paying attention to expiration dates and appearance, “sweep” products off the shelf. As for the partial loss of presentation, in most cases this is torn packaging.

This often happens when loading and unloading goods. It should be taken into account that both sales representatives and non-trade organizations can carry out markdowns. The main mission of cost reduction is to sell goods at a reduced price in order to make a profit and reduce costs.

As a result of this procedure, goods are sometimes sold at a price lower than the purchase price. If you need to mark down an item, do not worry, as this is a simple procedure that requires attention and adherence to generally accepted rules.

Let's look at how to properly reduce the cost of a necessary product:

- Drawing up an order.

Before starting the cost reduction procedure, it is necessary to prepare a document that establishes the requirements and features of a specific markdown. In practice, the manager is obliged to prepare an order and convey it to employees, who only after this can take a number of measures aimed at reducing the price of a particular product.

![My business [CPS] RU](https://disagroup.ru/wp-content/uploads/moe-delo-cps-ru-330x140.jpg)