TIN - meaning and application

The identification number is assigned to taxpayers once. This code is unique and consists of 12 digits. It is used for the following purposes:

- individual accounting of tax deductions and pension savings;

- receiving a deduction when filing a tax return 3-NDFL;

- opening your own business with individual entrepreneur status.

Even if the certificate is lost and restored, the individual number is retained. It can be assigned at any age if you have the necessary documents. Persons over the age of 14 who have received a passport receive a certificate on their own; before this age, a parent or legal guardian is required for registration.

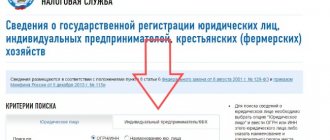

All identification numbers are entered into the Unified State Register of Real Estate. This register is the database of the Federal Tax Service. Thanks to it, you can find out your personal taxpayer code. Proceed according to the following algorithm:

- Go to the official website of the Federal Tax Service https://www.nalog.ru/rn43/.

- In the list of services section, find “Information about the TIN of an individual.”

- Confirm your consent to the processing of personal data.

- Fill in the required fields - last name (indicate the one for which the TIN certificate was issued), first name and patronymic, date of birth. Select the type of identification document, enter its series and number. Additionally, you can enter your place of birth with the date of issue of your identity document, but these fields are optional.

- If the data is filled out correctly, a field with the Taxpayer Identification Number (TIN) will appear on the screen.

It is important to note that the request on the official website is free. Third-party resources may provide information for a fee, and entering passport data on them is unsafe.

Forced liquidation of individual entrepreneurs

In cases where, by a citizen’s own will or at the request of his creditors, a bankruptcy procedure is initiated against an individual entrepreneur and bankruptcy proceedings are introduced with the appointment of an arbitration manager, the individual entrepreneur is closed on the basis of a judicial act.

In the event of a court injunction, business activity is terminated

A ban on carrying out business activities may be a consequence of violations by the individual entrepreneur of tax or other legislation. In the event of a court injunction, the activities of the individual entrepreneur are terminated.

There is a category of entrepreneurs who were forced to close their business due to objective circumstances. But if the situation improves, they would like to continue business on more favorable terms. Such citizens are concerned about the question of whether it is possible to restore or reopen an individual entrepreneur after closure, as well as how soon the law allows this to be done.

Restoration of TIN in the tax service

To obtain a duplicate certificate, it is better to contact the nearest branch of the Federal Tax Service . Its official website will help you save time. On it you can apply, study the recommendations for filling it out and pay the state fee online.

It is impossible to organize the entire procedure remotely, therefore you must come to the tax office in person, providing a certain package of documents.

The first time the certificate is issued free of charge; upon renewal, a state fee of 300 rubles is paid . It takes up to 5 working days to produce a duplicate TIN .

You can speed up the process by paying an additional 300 rubles.

If you live in another city, you can send documents to restore your TIN by mail, contact the tax office at the temporary registration address, or another convenient location. Even the lack of registration is not an obstacle to restoring the certificate.

Main parameters

Current legislation establishes that if the certificate of state registration of an individual entrepreneur is lost or damaged, a duplicate must be obtained. To restore the document, each entrepreneur must contact the inspectorate where the certificate was received with a free-form application. The request must indicate the reason for providing the duplicate.

To obtain a document, you must pay a state fee, the amount of which is 300 rubles . The maximum period allotted for issuing a duplicate is 5 days from the date of acceptance of the relevant application for processing.

It is worth noting that you can receive a duplicate urgently, the next day. However, in this case the tariff will be noticeably higher.

Only the entrepreneur himself can receive a new document. To do this, he must provide a passport of a citizen of the Russian Federation to the department of the Federal Tax Service within the time period agreed upon when submitting the application. It is recommended that when receiving a duplicate, you carefully read all the information contained in it.

The document itself is an original copy, which contains the official state seal, secured by the signature of the official who provided the document.

Many may think of covering a document with a special protective layer. It is worth noting that the tax authorities do not welcome such an action, since the document will be very difficult to verify its authenticity. The quality of possible copies may also be reduced.

Package of documents

If you contact the Federal Tax Service office to restore your TIN in person, you will need:

- completed application, prescribed form;

- identification;

- document confirming registration at the place of residence;

- a receipt confirming the paid state duty.

An application for TIN restoration can be submitted by a representative. In this case, the list of documents is the same, but a photocopy of the document is additionally required to confirm authority.

When sending papers by mail, you must include an application and a receipt for payment of the state duty. The remaining documents from the list must be photocopied and certified.

How to restore the TIN of an individual in the territorial inspection

In order to receive a certificate geographically, you will need to come to the tax office. You can do this personally, or with the help of your official representative, if necessary.

The application must be drawn up in accordance with a unified form, the terms of which are prescribed by law and fully approved by the Federal Tax Service. It is for this reason that experts advise not to rush to fill it out, but to do it right on the spot under the guidance of a specially trained person who will accept all your documents to obtain a personal code.

Your passport will look at information not only related to your last name and date of birth, but also important information about your place of residence. Since it is she who determines which authority you should contact. Therefore, if for some reason your passport does not have this mark, you may be required to provide an extract of your registration.

If you personally cannot be present at the tax office for any reason, a person authorized by you can make a statement and pick up your code. But, it is worth paying attention that in confirmation of these actions the object must have notarized documents confirming your will.

In addition, you can pick them up by mail. But, if at first glance it seems to you that these functions will make your life easier, you are mistaken, since each of them may contain special pitfalls, such as ridiculous accidents and additional unforeseen expenses.

So, first of all, you will have to draw up an application for a lost TIN yourself, without errors. In addition, you will need to pay 200 for the procedure itself, and also to a notary who will help you certify copies of documents about your identity, as well as registration. And this will certainly entail additional costs.

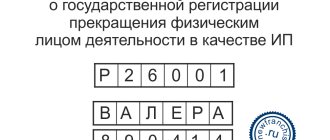

Application for TIN restoration

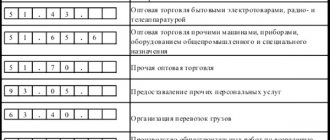

You can visit the official website of the Federal Tax Service after registration. The form can also be found on third-party resources. You can submit an application only on form 2-2-Accounting; other options will not be considered. When filling out the form, you must consider the following rules:

- use a ballpoint pen, the paste can be blue or black;

- Only block letters are allowed, each in its own square;

- all data must be reliable and legible;

- corrections are not allowed;

- the application consists of three pages, each printed on a separate sheet;

- All dates should be indicated in numbers.

It is possible to fill out the application in electronic format. This option is only available to persons with an electronic signature. For filling, use Courier New font, size 16.

The recommendations on the Federal Tax Service website will help you fill out the form correctly. They can be viewed online. When filling out the form at the tax office, samples can be found on stands. The form will be issued on site, so there is no need to print it in advance.

If a mistake is made when filling out the application, you need to ask (print) a new form . You should not deliberately leave erroneous data, as the request will be rejected during verification.

Sample and form

Application form for TIN restoration.doc Sample of filling out an application for TIN restoration.doc

If the individual entrepreneur has lost documents

The legislative framework of the Russian Federation has an approved procedure for actions in case an individual entrepreneur loses documents. Despite the constant recommendations from government officials to store accounting documents separately from others, not everyone is in a hurry to listen to this. Statistics show that some applications for document restoration are submitted by individual entrepreneurs (IPs) who have become victims of a natural disaster or criminal attacks. Regardless of the cause of the incident, the entrepreneur is required to fulfill a number of legal requirements.

Recovery conditions

restore your TIN in the following ways:

- personally submit the application and package of documents to the tax office, and pick up the completed duplicate there;

- contact the MFC;

- entrust the entire matter to an authorized representative;

- send a package of documents by mail.

Submitting the necessary documents by a representative or sending them by mail is an excellent alternative to visiting a tax office in person, since this is not always possible. In any case, no more than 5 working days will pass from acceptance of the application to the availability of the duplicate.

Papers should be sent by mail with acknowledgment of receipt. The person receives the finished duplicate at the tax office in person or through an authorized representative. If the applicant (representative) fails to appear for the certificate in person, it will be sent by registered mail.

Each accepted application for TIN restoration receives a unique code. It allows you to control the process. It is enough to go to the official website of the Federal Tax Service and enter this code to find out the stage of processing of the application or its readiness.

Due Process

The law provides for 2 possible options. In the first case, the individual entrepreneur has the right to cease his activities due to the fact that he has no desire to restore the lost papers. To do this, it is necessary to pay all contributions for the reporting period to the Pension Fund of the Russian Federation and the tax inspectorate. It is imperative to visit the Social Protection Fund. The inspector will tell you how to close an individual entrepreneur if documents are lost.

Mandatory deductions that the individual entrepreneur is required to pay are calculated individually. After completing all settlements with the treasury, you can submit the package of documents required for closing.

In this case, you must attach a previously received certificate confirming the fact of destruction or loss of accounting documents for various reasons. The applicant must know how to close an individual entrepreneur if documents are lost. To complete this task, you need to collect the following papers:

- IP passport and its copy;

- application (if not submitted independently, it must be certified by a notary);

- a certificate confirming payment of the state duty;

- all accounting documents remaining in the hands of the individual entrepreneur.

The standard period for consideration of an application for termination of activity due to complete or partial loss of documents is 10 working days. If the applicant wishes to continue working, then he needs to submit an application for the issuance of duplicates of lost documents for individual entrepreneurs.

Restoring TIN through MFC

The MFC is only an intermediary between the citizen and the Federal Tax Service, so the process may take longer. It may take up to 7 business days from submitting an application to receiving a duplicate.

You should know that not every MFC branch provides such a service. You can find out more information about a specific department by phone. Contacts are listed on the official website of the MFC (https://mfc.rf). Just select “sign up in queue”, find your locality and the desired branch.

You must contact the MFC in person . Provide standard documents. You can make an appointment in advance or pick up a ticket on the spot and wait for your turn. The employee who accepts the documents will issue a notification receipt. In it you can see the approximate date of readiness of the duplicate. They issue it in the same department.

An authorized person can submit documents and pick up a completed duplicate at the MFC. This requires a notarized power of attorney. The package of documents should not contain the passport of the person who lost the TIN, but a certified photocopy of it.

Restoring a TIN involves obtaining a duplicate of a previously issued certificate. The unique code is retained. The recovery process takes only a few days and can be carried out in different ways. The package of documents is minimal, and the state duty is small. You can find out the TIN online before issuing a printed duplicate.

Possible obstacles

Any possible obstacles to the resumption of activities can only be observed when the entrepreneur conducted his activities illegally, he evaded his mandatory contributions and payments. Restoration of the registration certificate is not provided for by law. Such a document is canceled as part of the closure of the business.

If the business was closed on its own initiative, then the entrepreneur will be able to start a new business almost immediately. There is one more nuance about whether it is possible to open an individual entrepreneur after its complex and problematic closure. The main condition is that he does not have any debts. For entrepreneurs who are interested in how to close an individual entrepreneur when no activity was actually carried out, this is especially relevant. There are no financial manipulations, which means there are no problems with further business registration or cancellation.

In cases where the issue of closing a business is decided at a court hearing, it will not be possible to start a new activity soon. Such an entrepreneur will be able to resume work in at least a year.

Is it possible to close an individual entrepreneur and open it again if there are debts?

Restoring a closed business – when is this possible?

It will not be possible to renew an old IP with its previous status. Law No. 129-FZ of 08.08.2001 regulated the activities of individuals. If the business ends within this period of time, the businessman is excluded directly from the Unified State Register of Individual Entrepreneurs, and the legal status is cancelled, the individual entrepreneur will have to be registered again and go through the standard stages. In this case, the written application in form No. P21001 indicates the business direction if it has changed. How to register an individual entrepreneur after closure and when can this procedure be repeated?

Restoring the status of an individual entrepreneur is possible, as is its re-registration in the case when:

- the previous business was honest;

- reporting was provided in full;

- The company has no debts.

Businessmen are interested in re-registration of individual entrepreneurs after closure, its conditions and legal nuances. Let's try to analyze the main points of the procedure.

Important. If an individual entrepreneur is closed at the initiative of the business owner, re-opening is possible on the same day. There are no time restrictions at the draft level.

How many times can you open and close an IP?

Re-registration of individual entrepreneurs is carried out the required number of times in full and complies with all approved stages. The subject has the right to close and resume his personal business as much as he deems profitable and appropriate.

To close an individual enterprise and then restore it, you will need to go through the following steps:

- Repayment of unpaid fees, penalties and taxes.

- Submission of documentary reports to government agencies - Social Insurance Fund, Federal Tax Service, Pension Fund.

- Deregistration of a company.

- Closing a bank account.

- Removal of KKM from state accounting.

- Preparation and submission of relevant documentation.

After economic difficulties or a number of other reasons, you can easily re-open an individual entrepreneur in any direction. Business reconstruction is thought through to the smallest detail. A businessman should evaluate the profitability of the business, seek advice from competent people, and perhaps change the strategy and tactics of doing business.

Only companies that have proven themselves in the market and are in demand can continue the work of the old brand without changing the concept. If an organization was liquidated due to financial problems, then most likely its internal mechanism was thought out incorrectly and requires transformation.

The process of registering a new individual entrepreneur or restoring an old one is identical; an individual does not have benefits and goes through all the general procedures. When re-opening an old business, you can expect some “indulgences” from the tax and other government authorities. They are familiar with your activities and have enough information to determine your physical identity.

Important. Re-opening an individual entrepreneur is possible if the entrepreneur has has not been declared bankrupt, there is no ban on opening a business, there is no current conviction for serious or especially serious crimes. The full list of restrictions can be found in paragraph 4 of Article 22.1 of the Federal Law.