What are the ways to find out the FSS registration number using the TIN?

The registration number of a company or individual entrepreneur in the FSS can be found out from the registration notice issued by the fund, and if such a document is missing:

- by contacting the department;

- through a specialized online service that allows you to find out the Social Insurance Fund number assigned to a business entity.

In the first method, you need to write a request to social security to issue a duplicate of the registration notice.

The second method is more efficient and in many ways more convenient. To do this you need:

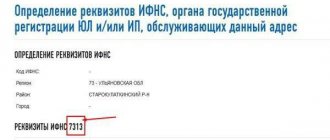

- Go to the search page of the FSS website using the link.

- In the search form, enter the TIN of the company or individual entrepreneur and click the “Search” button.

If the business entity is registered with the Social Insurance Fund, the corresponding number will appear on the page.

But there may be cases when the required details will not be in the FSS database. With what it can be connected?

Registration number in the Pension Fund of Russia and the Social Insurance Fund, how to find out

The registration number of the Pension Fund of Russia or the Social Insurance Fund is the individual number of your organization in the Pension Fund of Russia or the Social Insurance Fund. It is assigned to the company at the time of registration with the territorial branch of the fund.

Having found a site on the Internet that provides electronic statements, placing an order and quickly paying for it, I received an extract to my email, which contained the coveted registration numbers of the Pension Fund of Russia and the Social Insurance Fund. I calmly filled out the necessary reports and sent them on time, thereby avoiding future problems (fines, explanations, etc.).

It is impossible to find out the FSS number using the TIN: what is the reason?

This usually happens in two cases:

- the procedure for registering a payer with the Social Insurance Fund and assigning a number to it in this department has not yet been completed or the database is being updated (but such cases are observed extremely rarely and are not systematic);

You can find out how and when policyholders register with the Social Insurance Fund in ConsultantPlus. Trial access to the legal system is provided free of charge.

- if an entrepreneur conducts business as an individual entrepreneur and initially does not have employees.

The fact is that an individual entrepreneur is required to have a FSS number only if he:

- is an employer (subclause 3, clause 1, article 2.3 of the Law “On Compulsory Social Insurance” dated December 29, 2006 No. 255-FZ).

- wishes to receive benefits for temporary disability and maternity (in this case, registering a relationship with the Social Insurance Fund voluntarily).

At the same time, according to Art. 6 of Law No. 125-FZ of July 24, 1998, when hired employees appear, the entrepreneur must register with the Social Insurance Fund within 30 days from the date of concluding at least 1 employment contract or civil contract with the hired employee (if it specifies accident insurance and occupational diseases).

Once an individual entrepreneur is registered with the FSS, he will be able to find out his number assigned by the department at any time using his TIN via the Internet.

In the Ready-made solution from ConsultantPlus, you can find out how to issue a certificate of no debt for injuries. Study the material by getting trial access to the K+ system for free.

How to register with the FSS?

It’s easy to register with the Social Insurance Fund; just a few documents are enough:

- Statement.

- The policyholder's employment contracts with employees and copies of their work records.

- Copies of the registration certificate of the enterprise itself and the tax certificate of registration of this legal entity.

- A document from the bank (statement) confirming the existence of a current account.

The personal registration number is sent to the organization (the document arrives by mail) after some time. But if you need to find it out urgently (or if data is lost), this is easy to do.

Some people wonder what the policyholder registration number is for? Thanks to these registration numbers, the FSS in Russia can monitor the performance of duties of all commercial organizations. That is, quarterly reporting (form 4-FSS) and timely payments. Without this, the fund would not be able to take care of health improvement and pay benefits.

If an entrepreneur stops working, he must inform the fund about this so that he can be deregistered.

Results

You can find out the registration number in the FSS by TIN of a company or individual entrepreneur in literally a couple of minutes using a special service on the FSS website. If an entrepreneur runs a business as an individual entrepreneur, then he needs to keep in mind that by default, information about him is not registered by the FSS and may not be in the department’s online database.

Find out also how to determine the FSS subordination code by registration number.

For the amount of fines for failure to submit reports to the Social Insurance Fund, see this article.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

PFR Program Latest Version 2015 Download Free Spu Orb Orenburg

Free legal advice · Useful services. The Spu orb program can download the latest version of which you can follow the link. Keep track of the latest versions of the software product. Applicable for programs that prepare reports to the Pension Fund and others. Program for preparing reporting documents for the Pension Fund of Russia “Spu. Program “Spu What kind of program is this? Where to download the latest version. PC PERS (persw) is a free official program from the Pension Fund of Russia branch.

Program for preparing reporting documents for the Pension Fund of Russia “Spu. Here you can enter, print and upload batches of entered documents. The program works with the following forms of documents: SZV-6-1, SZV-6-2, SPV-1, SZV-6-3, ADV-6-2, ADV-6-3, ADV-1, ADV-2, ADV - 3, ADV- 8, ADV- 9, SZV- 1, SZV- 3, SZV- 4- 1, SZV- 4- 2, ADV- 1. Virtual Disk Daemon Tools Program Download more details.

We recommend reading: Not paying child support for a year

What is policyholder registration number

Other funds do not transmit information via telephone or Internet. But some FIUs accommodate payers halfway and therefore dictate data over the telephone. To do this, you will need to know your tax identification number or checkpoint.

Registration is carried out by legal entities. If an individual entrepreneur independently conducts its activities, it may not make deductions. In this case, he is personally responsible for his own health in the event of industrial accidents.

How to get a number

The number is obtained automatically upon registration of an individual entrepreneur or legal entity.

Moreover, the latter does not need to take any action - the tax office sends information about the subject to the Fund, and it assigns this code independently. Afterwards, information about the assigned number must be sent to the entrepreneur (or organization) by mail to the address specified during registration. However, often the notification does not arrive or this process takes too much time, so it is possible for an economic entity to independently determine its number.

Individual entrepreneurs will receive a number only if they intend to hire employees. In other cases, obtaining such a number is not necessary. However, if desired, this can be done; no prohibitions are established in this case.

If the individual entrepreneur worked alone, and then decided to hire workers, then he will need to independently submit an application for registration as an insurer to the Social Insurance Fund. Moreover, this is done even if only one employee is hired. At the same time, requirements have been established for the timing of registration - it is 10 days after signing the employment contract.

For violation of this requirement, penalties may be applied to the individual entrepreneur. Their size depends on the number of days of delay and the type of contract concluded with employees.

If the entrepreneur is a woman, then, subject to registration, she can qualify to receive payment for labor and child care leave.

The code for a specific entrepreneur or legal entity is assigned only once and does not change in the future, regardless of whether changes occur in any performance indicators.

In the event that an individual entrepreneur decides to cease his activities, he must be deregistered from the Fund. To do this, you need to provide the Fund with some documents within three days :

- evidence that all employees have been fired: relevant orders, copies of employees’ work books (dismissal records must be made in them);

- a certificate from the Federal Tax Service office confirming the absence of tax debts;

- copies (certified) of deregistration from tax registration.

The deregistration procedure takes about two weeks on average.

We will also tell you how to register with the Social Insurance Fund.

An example of filling out a company's staffing table can be found here.

How to work with the FSS search and monitoring system: https://pravovedovich.com/poiskovo-monitoringovaya-sistema-fss.html

Procedure for filling out 4 FSS

The report to this form is submitted starting with reporting for 9 months of 2020, so the “new” form can be called very conditionally. Thus, Form 4 FSS for the 3rd quarter of 2020 should be used to submit reports. You can download the new form

This is interesting: According to the Constitution of the Russian Federation, he has the right to only one

The title page and tables 1, 2 and 5 are required to be submitted. They must be submitted in any case, even if the policyholder did not have any accruals for “injuries” during the reporting period. The rest is filled in only in cases where the corresponding indicators exist.

How many digits should there be in the FSS registration number?

— Last year, before Law No. 212-FZ1 came into force, our branches did not have the right to accept reports without paper.

But starting this year, large enterprises with more than 100 employees (there are 82,500 of them in Russia) are not only able, they are required to submit electronic reports. The rest are optional. — Sergey Stanislavovich, FSS employees now have more work to do. After all, they will have to check not only the expenses declared by policyholders, but also the correctness of the transfer of contributions. How has the Foundation prepared for new challenges? Have the rules for selecting candidates for verification changed?

How many digits should there be in the FSS registration number?

What are the deadlines for submitting a report on Form 4-FSS for the 2nd quarter of 2020? Which form should I use: old or new (after July 9, 2020)? How to fill out the 4-FSS form for employers participating in the FSS pilot project? How to generate zero reports on contributions “for injuries”? Here is a completed example of 4-FSS for the sample. We will also answer the most pressing questions of the reporting campaign for the first half of the year.

Let us say right away that individual entrepreneurs who do not have employees and who pay insurance premiums exclusively “for themselves” do not have to submit a 4-FSS report for the 2nd quarter of 2020 (since in the first half of the year they did not have indicators for reporting).

Search for the queue of beneficiaries to receive a voucher

This site service is intended for citizens of preferential categories who have submitted documents to obtain a voucher for sanatorium-resort treatment. This service will allow you to find out your queue number to receive a voucher.

This is interesting: Should a traffic police inspector, when drawing up a protocol, go to inspect the crime scene if he was not there?

To do this, you need to enter the SNILS number in the format “xxxxxxxxxxx”, where instead of “x” there should be the numbers of your document without hyphens and spaces. You only need to enter numbers in the form fields; after entering, click the “Find” button. This input format is required!