What is an MFO

A microfinance organization is a legal entity engaged in microfinance activities and information about which is included in the state register of the Central Bank of the Russian Federation. In essence, an MFO is an ordinary legal entity (LLC, JSC, PJSC), but with a certain status

, received from the Central Bank of Russia.

MFO conducts professional activities in providing consumer loans. Unlike banks that provide loans to the population, obtaining a loan from an MFO does not require a huge number of documents, as well as certificates confirming income.

Also, a significant difference between consumer loans in MFOs and conventional loans is the interest condition and the term of the loan. Interest on microloan agreements is accrued daily

, and the period for concluding such agreements rarely exceeds one year. At the same time, MFOs can issue microloans only in rubles.

Earnings

Lending is a profitable business. There are many nuances that affect the profitability of a business. Microloans are in demand among the population who do not have deep knowledge of the financial sector and the principles of operation of credit institutions. Therefore, increased rates are considered a feature of microcredit. The high cost of credit is due to the fact that clients often do not fulfill their obligations. For this reason, risks are compensated by increased rates and small amounts.

When creating a microloan business plan, 10-20% will be indicated as losses from unreturned funds. This indicator is standard. If loans are issued quickly with minimal verification, then 30 or even 40% of unrepaid funds will be problematic.

The result of the MFO’s work is also influenced by the interaction with debtors. Typically, these services do not have their own security service and lawyers, so work with defaulters is transferred to third parties. Collection firms are engaged in the repurchase of debts with a coefficient, so it is important to properly organize the process of doing business so that there is high optimization at minimal costs.

Types of MFOs in 2020

In practice, there are 9 forms of doing business in the form of a microfinance organization: a clearing company, a management company of a mutual investment fund, a joint-stock investment fund, an insurance organization, a non-state pension fund, a credit organization.

Depending on the area of activity and the volume of services provided, MFOs are of two types:

1. Microcredit company (MCC)

is an organization engaged in issuing microloans.

The name of the organization must include the phrase “Microcredit organization”

and its legal form.

To provide microloan services, MCC does not have the right to attract funds from individuals and individual entrepreneurs, with the exception of the own funds of the founders of MCC. Also, MCC cannot issue bonds, issue physical microloans for individuals in the amount of over 500,000 rubles, issue loans through the online system. According to the law, it is possible to open an LLC with a minimum capital of 10,000 rubles.

2. Microfinance company (MFC)

is an organization that carries out microfinance activities subject to the restrictions established by federal legislation and regulations of the Bank of Russia. To operate as an MFC, an authorized capital of at least 70 million rubles is required. The name must indicate that it is a microfinance organization and its legal form.

To carry out its activities, the IFC can attract funds from individuals and entrepreneurs in the amount of at least 1.5 million rubles. It is also possible to issue microloans online. Microloans for individuals individuals and individual entrepreneurs should not exceed the amount of 3 million rubles.

IFC can issue bonds with a face value of less than 1.5 million rubles. for purchase by investors and with a nominal value of more than 1.5 million rubles for all citizens. At the same time, the Bank of Russia monitors compliance with economic standards for the adequacy of own funds and liquidity of the IFC issuing bonds.

How much does it cost to open a microfinance organization?

To answer the question of how much it costs to open an MFO, you will need to calculate the amount of capital and monthly investments.

Capital expenditures:

- funds for providing loans - 900 thousand rubles;

- purchase of equipment and installation of a security alarm - 100 thousand rubles;

- purchase of equipment and consumables - 50 thousand rubles.

Regular costs:

- payment for office rent - 20 thousand rubles;

- wage fund - 120 thousand rubles;

- advertising - 50 thousand rubles;

- additional expenses - 30 thousand rubles.

In total, the amount of capital investment is 1 million 50 thousand rubles. Monthly costs - 220 thousand rubles.

Is it profitable to open an MFO?

To imagine whether it is profitable to open an MFO, let’s calculate the approximate profit of the enterprise. When assessing income, up to 50% of non-refundability should be taken into account. To cover regular expenses, you must provide loans in the amount of 700 thousand rubles per month. If the project develops successfully, it will pay for itself within a month. Over the next year, you will cover expenses and be able to generate capital for further business expansion. The organization's income will be 500 thousand rubles. per month.

If the project develops successfully, opening an MFO will pay for itself within a month.

Business plan

A business plan that is adequate to the market situation will help you accurately calculate the size of the initial investment, the payback period and profitability. You can compile it yourself, download a ready-made standard project from the Internet, or order the development of a financial instrument from a specialized organization. The latter method, although more expensive, eliminates risks for the entrepreneur.

Registering a legal entity (LLC)

The procedure for registering an LLC for the activities of a microfinance organization is no different from registering a regular company. The only thing worth paying attention to:

- in the application for registration, OKVED code 64.92.7 is indicated as the main type of activity;

- The name of the organization must contain the phrase: “Microfinance.

Note

: the phrase “Microfinance” can be used in the name of an LLC without MFO status only during the first 90 calendar days from the date of registration of the LLC.

Tips for beginners ↑

As a rule, a microfinance organization is opened by those who know the specifics of this business quite well or have sufficient capital or ways to attract it.

It is not surprising that, given the large number of microfinance organizations, many newcomers also seek to create their own microfinance company.

Each of them has his own vision of development or does it according to a ready-made scenario, but in all cases, without exception, some advice would not hurt them:

- Competitive advantages. At the current stage of development of this market, it is very difficult to stand out with any innovations in microcredit. Many companies follow a proven path and operate according to established business models.

This could be a completely remote lending service, a network of regular cash pick-up points, or another option.

To get ahead of competitors, you need to create a very extensive network, a very fast and trouble-free online service, or come up with your own innovation, which will allow you to offer the market “exclusive” without significant investments. This option could be, for example, a partnership agreement with another retail company.

- Before opening your own microfinance organization, you should try to plunge into this business from the inside. To do this, you can go through several similar companies and try to get a loan.

After several organizations, it will be possible to compare approaches to working with clients or evaluate the technical capabilities of the service.

- Don’t try to beat all competitors, but try to concentrate on a certain segment and become the best in it. Many large companies are already operating on the market and, having learned their weaknesses, you can easily determine your priorities for further development.

It would be a good idea to familiarize yourself with the terms of the loan and the requirements for borrowers of the Lime microloan. Also on our website you can read an article about the Vivus microloan. More detailed information is collected here.

And if you are interested in the Moneyman microloan, then we recommend reading the article about this microfinance organization.

Necessary documents for registering an LLC in 2020

To register an LLC, you need to prepare the following documents:

- Application for registration of an LLC according to form P11001 – 1 copy.

- Decision of the sole founder (if there is only one founder) – 1 copy.

- Minutes of the meeting of founders (if there are several founders) – 1 copy.

- Agreement on the establishment of an LLC (if there are several founders) – 1 copy.

- LLC Charter – 2 copies.

- Receipt for payment of the state fee for registering an LLC in the amount of 4,000 rubles.

- Letter of guarantee for the provision of a legal address – 1 copy.

Prepare LLC documents for free

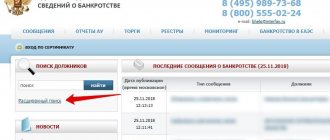

Necessary documents for registration of microfinance organizations with the Central Bank

To obtain MFO status, you must submit the following documents to the Central Bank:

- Application from the manager for inclusion of the LLC in the register of microfinance organizations.

- Receipt for payment of the state fee for registering an microfinance organization in the amount of 1,500

rubles. - A copy of the charter and decision on registration of the microfinance organization.

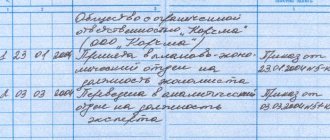

- A copy of the order appointing the director.

- Information about the founders of the LLC.

- Certificate of no criminal record of the manager and founders.

- Information about the legal address of the LLC.

- Internal control rules.

- An extract from the Unified State Register of Legal Entities about the LLC with the signature of the director and seal (in most cases, the Central Bank requests it from the tax office on its own).

Franchise or your own business?

How to open microloans from scratch? There are 2 ways to start a business:

- Use the well-known name of companies offering franchise work.

- Open your own microfinance organization.

It is important to familiarize yourself with each method in detail. The first option is simpler and does not require large investments. But the franchise conditions are different in each one. Some are provided with support, software, training, while others are limited to little participation. But due to simplicity, the income is usually less. Typically, new members pay fees for work using a well-promoted brand name.

Opening your own microloan business is considered a long process. A businessman must go through all stages: from developing a business plan and calculating it to interacting with problem borrowers. In this case, you will have to pay a lot more money and spend a lot of time. In addition, there are many risks, but with careful development the income will be much higher.

How to open microloans from scratch if you have no experience in this field? You can use a franchise. Business under a well-promoted brand is an attractive business, although there are some restrictions. Typically, an entrepreneur needs to pay once for the use of a trademark, after which he can begin working with clients.

Read more: How to open an online watch store - business selling watches, open an online watch store

But payment may be required regularly or set as a percentage of income. There are also differences in franchisee support. The company may provide access to the software. Branded promotional products and uniforms are also provided to employees, and assistance is provided in their work. A franchise can be purchased from such companies as “Money to Paycheck”, “Momento Money”, “Miladenezhka”, “Fast Finance”.

In Russia, franchising arose about 20 years ago. Now all entrepreneurs in Russia have begun to pay even more attention to this method of creating a business, which is fully tested and actually profitable in all areas.

A franchise is the acquisition of a ready-made, well-promoted and popular brand. Today's market happily offers different franchises. This includes fast food, the financial sector, and cosmetics.

Today, many microfinance organizations offer their own franchise. What do you need to know to make the right choice?

Firstly, an inexpensive franchise is, of course, better than an expensive franchise. Secondly, you should choose offers from popular areas of the economy. Due to the rapid growth of the market, business is rapidly moving forward.

Microfinance is the fastest growing in the modern market. Purchasing a microloan franchise has minimal risks with effective benefits. For example, clients receive favorable loan terms. And you are a ready-made business that is firmly on its feet. It is easier to manage such a business according to a developed scheme based on an intensively growing market.

In general, opening your own microloan business is profitable and simple if you know all the pain points in the world of finance and credit. If you are confident in your abilities and have long dreamed of opening your own microfinance organization, then go ahead!

Attention! Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below:

There are no big problems in opening your own microloan company from scratch. You can create your own microcredit business quickly and in a short time. Opening a microloan company is the same as opening an LLC, but before that you need to enter the unified state register. This today includes all small financial institutions. Without this, you will not be allowed to open at all.

In order for the name of your company to be published in this register, contact the Russian Ministry of Finance and provide:

- a statement that you want to include your company in the state. registry;

- notarized photocopies of the company certificate (registration, date, all data), as well as all constituent documents;

- photocopies of the decision of all the founders of the company certified by the owner that your microfinance organization was created;

- relevant documents on the appointment of a director or head of one of the founders of a microloan company;

- all contact and detailed information about the opening company;

- if the founder of the company is a foreign citizen, then a certificate is submitted to the Ministry of Finance of the Russian Federation stating that the legal entity. the person is on a foreign register;

- payment of state duty - receipt for 1000 rubles.

However, if you do not know in what form to submit the application and documentation, then you will find samples of them in the application published on the website of the Ministry of Finance (dated 03/03/2011 No. 26n). Within 14 days, information about your company will be entered into the register. You will be given a corresponding conclusion. From this day on, you become an official microfinance company that can issue microloans to borrowers.

Registration deadline for microfinance organizations in 2020

MFOs are registered within 30 working days

from the moment of submission of documents. Within 14 working days, the documents and information contained in them are checked, based on the results of which the documents can be returned for revision.

Information about new microfinance organizations is entered into the state register within 30 working days

from the moment of submission of documents. Within 14 working days, the documents and information contained in them are checked, based on the results of which the documents can be returned for revision.