The difference between a tax and a fee

Current as of: February 28, 2020

In order to find the differences between a tax and a fee, you need, first of all, to analyze their concepts as disclosed in the Tax Code of the Russian Federation.

A tax is a mandatory, individually gratuitous payment levied on organizations and individuals in the form of alienation of money belonging to them for the purpose of financial support for the activities of the state, as well as municipalities (Clause 1, Article 8 of the Tax Code of the Russian Federation).

A fee is a mandatory contribution collected from organizations and individuals, the payment of which (clause 2 of article 8 of the Tax Code of the Russian Federation):

- or is one of the conditions for the performance of legally significant actions in relation to the fee payer by authorized bodies and officials, including the granting of certain rights or the issuance of permits (licenses);

- or due to the conduct of certain types of business activities within the territory in which the fee is introduced.

What are the similarities and differences between tax and collection? You can immediately notice that both the tax and the fee:

- are obligatory for payment;

- are collected from organizations and individuals.

But then the differences begin.

State duty to the arbitration court as expenses for individual entrepreneurs

Payers of the state duty are individuals (citizens of the Russian Federation, foreign citizens and stateless persons) and organizations in cases where they apply for the performance of legally significant actions or the issuance of documents.

Let’s try to analyze further in the article what is the difference between a tax and a fee and whether such a concept can be considered equivalent.

The Resolution of the Constitutional Court of the Russian Federation dated December 17, 1996 N 20-P notes that the requirements of the tax authorities and the tax obligations of the taxpayer follow not from the agreement, but from the law.

Economic literature contains the concepts of “tax” and “fee” inseparably from each other, implying their common nature. This is quite logical, because both terms imply some kind of obligatory budget payment. However, there are differences that characterize their purpose and essence.

A fee is a payment to the budget of various levels, the purpose of payment of which is to obtain some service from state and municipal bodies. Essentially, this is a one-time voluntary payment. If it is not paid, the person simply will not receive the necessary service, however, no one will demand payment from him against his will. State duty is a fee levied by authorized bodies or officials for carrying out legally significant actions, including the issuance of documents, their copies and duplicates. The Tax Code of the Russian Federation stipulates that the state duty is charged when the payer applies...

Payment of fees implies an individual remunerative relationship between the payer and the state. The fee is paid in connection with a public law service, but not for the service itself.

All the norms that form the backbone of Russian tax legislation are collected in one legal act - the Tax Code of the Russian Federation. But some taxation issues, due to the peculiarities of the country’s government, can be resolved at the regional and local levels.

see also

- Tribute

- Washed out

- Inducta

- Tax

- Chinsh

- Iron

- Wash

VAT • Excise tax • Personal income tax • Unified social tax • Corporate income tax • Fees for the use of wildlife and for the use of aquatic biological resources • Water tax • State duty • Mineral extraction tax

Transport tax • Gambling tax • Organizational property tax

Land tax

Unified agricultural tax • Simplified taxation system • UTII • Taxation system for the implementation of production sharing agreements

Tax Code • Federal Tax Service • Customs duties

Property Tax | Income tax | Mining Tax | Transport tax | Land tax | Water tax | Tax on biological resources | Gambling tax | Childlessness tax | Capital gains tax

Value added tax | Sales Tax | Excise taxes | Environmental tax

Unified social tax | Apartment tax | Animal feed | Chimney Tax | Public toilet tax

Duality | Lesson | Yasak | Zabozhnichye | Submit | Tax | Prodrazvyorstka

State duty | Customs duties | Washed out | Iron | Inducta | Shield money | Stamp Duty | Garnets fee

Danish money | Reparations | Restitution

Taxation | Tax | Penya

Insurance premium | quitrent | Chinsh | Farming

In our economically developed world, there is a tendency among the country's population to study information that relates to financial issues. In particular, everything that relates to likely expenses is useful, including information about taxes and fees. Although, for example, the average person does not always understand the difference between a tax and a fee. After all, these concepts carry different meanings.

Fee rates for each animal object - 2020 (Tax Code of the Russian Federation Article 333.3)

—> Tax Code of the Russian Federation Article 333.3. Fee rates

1. The fee rates for each animal object are established in the following amounts, unless otherwise established by paragraphs 2 and this article:

| Name of animal object | Fee rate in rubles (per animal) |

| Muskox, a hybrid of bison and bison or livestock | 15 000 |

| Bear (except for Kamchatka populations and white-breasted bear) | 3 000 |

| Brown bear (Kamchatka populations), white-breasted bear | 6 000 |

| Red deer, elk | 1 500 |

| Sika deer, fallow deer, bighorn sheep, Siberian mountain goat, chamois, aurochs, mouflon | 600 |

| Roe deer, wild boar, musk deer, lynx, wolverine | 450 |

| Wild reindeer, saiga | 300 |

| Sable, otter | 120 |

| Badger, marten, marmot, beaver | 60 |

| Kharza | 100 |

| Raccoon | 30 |

| Steppe cat, jungle cat | 100 |

| European mink | 30 |

| Capercaillie, stone capercaillie | 100 |

| Ular Caucasian | 100 |

| Saja | 30 |

| Pheasant, black grouse, water rail, small crake, tiny crake, crake, large crake, moorhen | 20 |

2. When removing young animals (under the age of one year) of wild ungulates, the fee rates for the use of wildlife objects are set at 50 percent of the rates established by paragraph 1 of this article.

3. The fee rates for each animal object specified in paragraph 1 of this article are set at 0 rubles in cases where the use of such animal objects is carried out for the purposes of:

protecting public health, eliminating threats to human life, protecting agricultural and domestic animals from diseases, regulating the species composition of fauna, preventing damage to the economy, fauna and its habitat, as well as for the purpose of reproduction of fauna, carried out in accordance with permission of the authorized executive body;

studying reserves, as well as for scientific purposes in accordance with the legislation of the Russian Federation.

(as amended by Federal Law dated July 24, 2009 N 209-FZ)

(see text in the previous edition)

4. Fee rates for each object of aquatic biological resources, with the exception of marine mammals, are established in the following amounts, unless otherwise established by paragraph 6 of this article:

| Name of the object of aquatic biological resources | Collection rate in rubles (per ton) |

| Far Eastern Basin (internal sea waters, territorial sea, exclusive economic zone of the Russian Federation and the continental shelf of the Russian Federation in the Chukchi, East Siberian, Bering, Okhotsk, Sea of Japan and the Pacific Ocean) | |

| Pollock of the Sea of Okhotsk | 3 500 |

| Pollock from other fishing areas | 2 000 |

| Cod | 3 000 |

| Bering Sea herring | 400 |

| Herring of the Sea of Okhotsk in the spring-summer fishing period | 400 |

| Herring from other areas and fishing periods | 200 |

| Halibut | 3 500 |

| Terpug | 750 |

| Sea bass | 1 500 |

| Coal | 1 500 |

| Tuna | 600 |

| Smelt | 200 |

| Saira | 150 |

| Char | 200 |

| Pink salmon | 3 500 |

| Chum salmon | 4 000 |

| Amur chum salmon autumn | 3 000 |

| Coho salmon | 4 000 |

| Chinook | 6 000 |

| Red salmon | 20 000 |

| Sima | 6 000 |

| Pinch the cheeks | 200 |

| Sturgeon <*> | 5 500 |

| Flounder, navaga, capelin, anchovy, likodas, grenadiers, cod, lemonema, gobies, dog fish, gerbil, sharks, rays, mullet fish, others | 10 |

| Kamchatka crab of the western coast of Kamchatka | 35 000 |

| North Sea of Okhotsk Kamchatka crab | 35 000 |

| Kamchatka crab from other fishing areas | 35 000 |

| Crab blue | 35 000 |

| Equal-thorn crab | 20 000 |

| Birdie snow crab from the Sea of Okhotsk | 35 000 |

| Birdie snow crab from other fishing areas | 13 000 |

| snow crab opilio | 35 000 |

| Snow crab angulatus | 8 000 |

| Red snow crab | 8 000 |

| Verrilla snow crab | 200 |

| Snow crab tannery | 200 |

| Cowesi crab | 200 |

| Spiny crab of the southern Kuril Islands | 25 000 |

| Spiny crab from other fishing areas | 13 000 |

| Hairy quadrangular crab of the south-eastern Sakhalin and Aniva Bay zone of the Sea of Okhotsk and south-western Sakhalin zone of the Sea of Japan | 20 000 |

| Four-cornered hairy crab from other fishing areas | 9 000 |

| Angled tail shrimp | 200 |

| Northern shrimp | 3 000 |

| Northern Bering Sea shrimp | 200 |

| Grass shrimp | 2 600 |

| Crested shrimp | 5 000 |

| Other types of shrimp | 200 |

| Squid | 500 |

| Squid of the Primorye subzone | 200 |

| Octopuses | 1 000 |

| Trumpeter | 12 000 |

| Scallop | 9 000 |

| Other shellfish (mussel, spizula, coobicula and others) | 20 |

| Trepang | 30 000 |

| Cucumaria | 300 |

| Sea urchin gray | 6 000 |

| Black sea urchin | 2 600 |

| Other sea urchin (fawn, many-spined, green and others) | 6 000 |

| Seaweed | 10 |

| Other aquatic biological resources | 200 |

| Northern Basin (White Sea, internal sea waters, territorial sea, exclusive economic zone of the Russian Federation and the continental shelf of the Russian Federation in the Laptev Sea, Kara and Barents Seas and the Spitsbergen archipelago area) | |

| Cod | 5 000 |

| Haddock | 3 500 |

| Atlantic salmon | 7 500 |

| Pink salmon | 200 |

| Herring | 400 |

| Czech-Pechora and White Sea herring | 100 |

| Flounder | 200 |

| Halibut black | 7 000 |

| Sea bass | 1 500 |

| Saida | 50 |

| Whitefish | 1 800 |

| Vendace, smelt, navaga, catfish | 200 |

| Arctic cod, capelin, lumpfish, European sand lance, star stingray, polar shark, whitefish, others | 20 |

| Kamchatka crab | 30 000 |

| Northern shrimp | 3 000 |

| Shrimp bear | 2 000 |

| Other shrimps (euphausiids) | 20 |

| Scallop | 9 000 |

| Other shellfish | 20 |

| Green sea urchin | 3 000 |

| Cucumaria | 300 |

| Seaweed | 10 |

| snow crab opilio | 35 000 |

| (introduced by Federal Law dated November 24, 2014 N 366-FZ) | |

| Baltic Basin (internal sea waters, territorial sea, exclusive economic zone of the Russian Federation and continental shelf of the Russian Federation in the Baltic Sea, Vistula, Curonian and Finnish Lagoons) | |

| Salaka (herring) | 20 |

| Sprat (sprat) | 20 |

| Atlantic salmon (Baltic salmon) | 7 500 |

| Cod | 2 500 |

| Whitefish | 1 500 |

| Flounder turbot | 400 |

| Flounder of other species | 50 |

| Acne | 10 000 |

| Lamprey | 7 000 |

| Zander | 1 500 |

| Rybets (cheese) | 1 800 |

| Perch | 400 |

| Vendace, bream, pike, burbot, stickleback, roach, smelt, ruffe, smelt, sabrefish, rudd, silver bream, others | 20 |

| Caspian Basin (areas of the Caspian Sea in which the Russian Federation exercises jurisdiction over fisheries) | |

| Sprat (anchovy, bigeye, common) | 20 |

| Herring (Dolginskaya, Caspian belly, big-eyed belly, anadromous blackback) | 20 |

| Large particles (mullet, silverside, bream, carp, catfish, silver bream, pike, others, with the exception of pike perch and kutum) | 150 |

| Zander | 1 000 |

| Kutum | 1 000 |

| Vobla | 200 |

| Sturgeon <*> | 5 500 |

| Rudd, tench, perch, crucian carp, and other freshwater bycatch | 20 |

| Azov-Black Sea Basin (internal sea waters and territorial sea, exclusive economic zone of the Russian Federation in the Black Sea, areas of the Azov Sea with the Taganrog Bay in which the Russian Federation exercises jurisdiction over fisheries) | |

| Zander | 1 000 |

| Flounder-kalkan | 2 000 |

| Mullet of all types | 1 000 |

| Bream | 150 |

| Taran | 150 |

| Anchovy | 20 |

| Tulka | 20 |

| Sprat (sprat) | 20 |

| Rybets (cheese) | 1 800 |

| Barabulya | 1 800 |

| Herring | 450 |

| Pilengas | 450 |

| Sturgeon <*> | 5 500 |

| Stingray, saberfish, dogfish, horse mackerel, silverside, gobies, scafarka, whiting, others | 10 |

| Other aquatic biological resources (shellfish, algae) | 10 |

| Inland water bodies (rivers, reservoirs, lakes) | |

| Sturgeon <*> | 5 500 |

| Atlantic salmon (Baltic salmon, salmon), chinook salmon, autumn Amur chum salmon, coho salmon, nelma, taimen, sockeye salmon, eel | 5 000 |

| Chum salmon, masu salmon, brown trout | 3 000 |

| Baikal white grayling, whitefish, muksun | 2 100 |

| Kundzha, Dolly Varden, Char, Palia, Trout of all kinds, Lenok, Whitefish, Omul, Pyzhyan, Peled, Barbel, Blackback, Vimbrella (Cheese), Asp, Grayling, Shemaya, Kutum, Catfish, Lamprey | 1 200 |

| Grass carp, asp, silver carp, catfish. Volga | 150 |

| Large particles (except pike perch) | 150 |

| Zander | 1 000 |

| Rhipus, ram, roach, vendace | 80 |

| Artemia | 2 000 |

| Gammarus | 1 000 |

| Cancers | 1 000 |

| Other objects of aquatic biological resources | 20 |

(clause 4 as amended by Federal Law dated November 29, 2007 N 285-FZ) (see text in the previous edition)

———————————

<*> The fee is charged in case of permitted fishing.

5. The fee rates for each object of aquatic biological resources - marine mammals are established in the following amounts, unless otherwise established by paragraph 6 of this article:

| Name of the object of aquatic biological resources - marine mammal | Collection rate in rubles (per ton) |

| Killer whale and other cetaceans (except beluga) | 30 000 |

| Belukha | 7 000 |

| Pacific walrus | 1 500 |

| Sea seal | 10 |

| Ringed seal (Akiba) | 10 |

| Lionfish | 10 |

| Sea hare (sealed bearded seal) | 10 |

| Larga | 10 |

| harp seal | 10 |

| Caspian seal | 10 |

| Baikal seal | 10 |

(Clause 5 as amended by Federal Law dated November 29, 2007 N 285-FZ)

(see text in the previous edition)

6. The fee rates for each object of aquatic biological resources specified in paragraphs 4 and this article are set at 0 rubles in cases where the use of such objects of aquatic biological resources is carried out when:

(as amended by Federal Law dated December 6, 2007 N 333-FZ)

(see text in the previous edition)

fishing for the purpose of reproduction and acclimatization of aquatic biological resources;

(as amended by Federal Law dated December 6, 2007 N 333-FZ)

(see text in the previous edition)

fisheries for research and control purposes.

(as amended by Federal Law dated December 6, 2007 N 333-FZ)

(see text in the previous edition)

7. Fee rates for each object of aquatic biological resources specified in paragraphs 4 and this article for city- and settlement-forming Russian fishery organizations included in the list approved by the Government of the Russian Federation, as well as for Russian fishery organizations, including fishing artels ( collective farms) are set at 15 percent of the collection rates provided for in paragraphs 4 and this article.

For the purposes of this chapter, city- and settlement-forming Russian fishery organizations are recognized as organizations that meet the following criteria:

carry out fishing on vessels of the fishing fleet owned by them, or use them on the basis of charter agreements (bareboat charter and time charter);

registered as a legal entity in accordance with the legislation of the Russian Federation;

in the total income from the sale of goods (works, services), the share of income from the sale of aquatic biological resources obtained (caught) by them and (or) other products from aquatic biological resources produced from aquatic biological resources obtained (caught) by them is at least 70 percent for the calendar year preceding the year of issue of the permit for the extraction (catch) of aquatic biological resources;

the number of workers, taking into account family members living with them as of January 1 of the calendar year in which the permit for the extraction (catch) of aquatic biological resources is issued, is at least half the population of the corresponding locality.

For the purposes of this chapter, fishery organizations are recognized as organizations engaged in fishing and (or) production of fish and other products from aquatic biological resources (including on fishing fleet vessels used on the basis of charter agreements) and selling these catches and products, provided that in the total income from the sale of goods (works, services) of such organizations, the share of income from the sale of their catches of aquatic biological resources and (or) fish and other products from aquatic biological resources produced from them is at least 70 percent.

(Clause 7 as amended by Federal Law dated December 30, 2008 N 314-FZ)

(see text in the previous edition)

8. Lost power. — Federal Law of December 30, 2008 N 314-FZ.

(see text in the previous edition)

9. Fee rates for each object of aquatic biological resources specified in paragraphs 4 and this article for individual entrepreneurs who meet the criteria provided for fishery organizations in paragraph seven of paragraph 7 of this article are set at 15 percent of the fee rates provided for in paragraphs 4 and this articles.

(Clause 9 introduced by Federal Law dated 04/21/2011 N 70-FZ)

The difference between a tax and a fee: legislative framework

Article 8 of Part 1 of the Tax Code of the Russian Federation spells out the exact designations of the concepts of “tax” and “fee”. These definitions were subject to debate at the legislative level beginning in the nineteenth century before the current formulations were adopted. As a result, organizations and individuals in our country pay taxes and fees, the common and distinctive features of which can be determined based on the characteristics of each of these concepts.

Main features of the tax:

- Tax is a mandatory payment in accordance with Article 57 of the Constitution of the Russian Federation. That is, in the case when the state approves the need to pay a tax, an organization or individual is obliged to pay it regardless of their own desire;

- The tax is personally gratuitous, because the taxpayer does not receive anything in return. Regarding society as a whole, taxes are a financial resource for implementing various practical measures aimed at improving the conditions of the entire population of taxpayers;

- The meaning of the tax is to provide the state and its subjects with the opportunity to perform the functions and tasks assigned to them;

- A tax is the alienation of funds from one entity to another.

Main signs of collection:

- The fee is a mandatory contribution. The obligation is affirmed by the same Article 57 of the Constitution of the Russian Federation, and the wording “fee” emphasizes the one-time payment;

- The fee is considered one of the requirements for the implementation of legally significant actions performed in relation to the payer of the fee.

Now, if we consolidate all the characteristics of these terms, we can clearly determine how a tax differs from a fee.

Legal definition

Tax refers to funds transferred free of charge by a subject for the purposes of the state or municipalities. This payment is mandatory and is paid in accordance with the Tax Code of the Russian Federation.

A fee is the amount that is paid to the budget for performing legally significant actions against persons. In some cases, funds are paid for conducting business activities, which may be determined by local legislation.

Tax and fee: similarities and differences

Difference between tax and fee:

- A tax is a payment, it is expressed in monetary terms, while a fee is a contribution that can be made not only in money;

- Tax payments imply a certain periodicity, while collection is a one-time obligation;

- Unlike a fee, a tax is not a fixed payment. Tax amounts are calculated according to legal norms based on the financial situation of the taxpayer. The fee is the same for everyone;

- It is believed that the difference between a tax and a fee is also expressed in the gratuitousness of the first, while for a fee, in fact, they receive some kind of response. Most often, the amount of the fee differs significantly in value terms from the amount of the government's response service. Therefore, the theory of tax law agrees that a fee, like a tax, is gratuitous;

- For non-payment of the fee, the payer will simply not receive the service he needs, while non-payment of tax is subject to administrative and even criminal liability;

- Tax may not be paid by mistake based on incorrect accounting calculations. The fee may not be paid only intentionally. The payer is aware of the need to pay a fee and the possible consequences of refusing to do so.

Similarities between tax and fee:

- Both the tax and the fee are mandatory (Article 57 of the Constitution of the Russian Federation);

- Both the tax and the fee are levied on organizations and individuals;

- Gratuitousness, which is the difference between a tax and a fee. The similarities and differences of these concepts include this feature, since in some cases the fee is still considered a reimbursable contribution.

This is how a tax differs from a fee, although the definition of a fee includes one more concept. A duty is one of the types of collection, approved only at the federal level and applied specifically for the commission of actions by state authorities. For example, for registering property rights, for providing notary services, etc. Whereas the fee also includes a fee for having a special right to something.

Depending on the current situation, organizations and individuals are charged a tax, fee, or duty. The similarities and differences of these alienations are determined by the standards of tax law, and their application is regulated by the Tax Code of the Russian Federation.

"Duty" and "fee"

A tax is a payment, that is, the alienation of property, carried out in cash. The solution to the question of the form of alienation of property during taxation in the science of financial law was predetermined not only and not so much by the level of development of financial and legal doctrines, but by the state of the state’s financial system at a particular historical stage.

So, the first sign of collection that should be highlighted in this definition is the sign of obligation. In this way, the fee is similar to a tax.

However, if the legislation provides for the use of only notarized forms of actions (documents), then the fee is charged at rates corresponding to the state duty rates. The notary himself pays income tax on the funds received on the basis of the Law of the Russian Federation “On Income Tax from Individuals”.

State duty is one of the most common payments used by the state as a source of revenue for its budget and, to a certain extent, to regulate social relations (by establishing high amounts or exemptions from payment, etc.). It has a long history of development and is widely used in countries around the world. Currently, this basis for the differentiation of duties and fees has been lost. Nowadays, the fee is mainly called payments for the possession of a special right (fee for the right to trade, fee for the use of local symbols, etc.).

Let's clarify the definitions

The state defines a tax as a payment that is made to the budget in the form of a certain amount of money by both individuals and legal entities. Features of this type of payment:

- gratuitousness - money is paid without the expectation of receiving anything in return;

- mandatory – citizens have no choice whether to make this payment or not;

- compulsory – the amount will be withdrawn without fail, and sanctions are provided for failure to do so in a timely manner;

- belonging to a specific budget - the withdrawn funds are intended to meet the needs of the state at the level of a federal unit, region or local authorities;

- calculability - the amount of each payment depends on the base taken as a basis and the established interest rate.

The elements of the tax are:

- legally defined basis - base;

- interest rate;

- object of taxation;

- period;

- procedure and terms of collection.

A fee is a contribution that is made as payment for actions performed by a government agency, that is, the provision of one or another public service that is significant from a legal point of view. Theoretically, the fee is a voluntary contribution, but since paid services in the vast majority of cases are necessary for further business activity, and this is enshrined in legislation, one has to pay for them one way or another. The fee amount is fixed. The payer of the fee intends to enter into legal relations with the state, wishing to receive:

- certain right;

- a license for a particular activity;

- action in the legal field (for example, registration).

Only payers and taxation elements (in each specific case) are considered to be elements of collection.

Objects of taxation

Fees are levied on objects of fauna and aquatic biological resources, named in Article 333.3 of the Tax Code of the Russian Federation, the removal of which from their habitat is carried out on the basis of an issued permit.

Article 333.3 of the Tax Code of the Russian Federation lists animals, birds, fish and other inhabitants of water bodies, which are thus recognized as subject to these fees.

Fees are not imposed on objects of fauna and aquatic biological resources, the use of which is carried out:

- to satisfy personal needs by representatives of indigenous peoples of the North, Siberia and the Far East of the Russian Federation (according to the list of the Government of the Russian Federation);

- persons permanently residing in places of traditional habitat and management of small-numbered indigenous people, if hunting and fishing are the basis of their existence.

There are limits on the use of wildlife and aquatic biological resources; they are established by executive authorities of the constituent entities of the Russian Federation.

Tax and fee: they have a lot in common

- Both deductions are legally enshrined in the Tax Code of the Russian Federation.

- Money from both forms of payment goes to the state treasury.

- Any of them, if established by law, can be specified at the regional or local level.

10 main differences between taxes and fees

Let's look at how these types of payments differ. To do this, we compare them on various grounds given in the table.

Comparison of tax and fee

| Taxes in Russia | Federal taxes and fees | Regional taxes | Local taxes | Special tax regimes | Other | Taxes in the world | Direct taxes | Indirect taxes | Historical taxes | Tribute | Collection | Contribution | Other | Are not taxes | ||

| № | Base | Tax | Collection | |||||||||||||

| 1 | Purpose of budget revenue | Does not have a specific purpose | Designed to ensure the activities of government bodies that provide certain rights or services to entrepreneurs | |||||||||||||

| 2 | Legislative Establishment | A tax is considered introduced if a legal act defines its payers, establishes a base, rate and other mandatory elements | The elements of the collection are determined on an individual basis, depending on its nature. | |||||||||||||

| 3 | Regularity of payment | The tax is paid with one or another regularity, periodicity and systematicity established by law | It is one-time in nature, paid in specifically necessary situations, when the payer himself is interested in this | |||||||||||||

| 4 | Payment time | Tied to a specific period - tax and reporting, which is a necessary element of the tax; payment deadlines are strictly regulated | Not related to a specific time, due to the need of the entrepreneur to receive a service or enter into legal relations with a representative of the state | |||||||||||||

| 5 | End of payments | Until the entrepreneur liquidates the company, he will constantly pay the established taxes | Paid once | |||||||||||||

| 6 | Calculation of the amount | Depends on the product of the tax base by the established rate, special regimes may be applied - benefits | The amount is fixed and is equal for everyone | |||||||||||||

| 7 | Legislator's approach | When introducing a tax, legislation seeks to take into account the real capabilities of payers and can establish a differentiated approach | The individual characteristics of the entrepreneur and his activities do not matter for the amount of the fee: it is a fixed price for the service | |||||||||||||

| 8 | Consequences of payment | Paying a tax only guarantees the absence of unpleasant consequences; otherwise, this action is free of charge. | Payment of the fee provides for individual remuneration: by transferring the fee, the payer receives a certain right | |||||||||||||

| 9 | Consequences of non-payment | Forced collection of the missing amount, penalty for late payment, fine for late payment or problems with the declaration | The government body simply will not perform the action required by the payer for which payment has not been transferred | |||||||||||||

| 10 | Form | Purely monetary | If the legislation expressly provides, the fee may take another form, in addition to monetary | |||||||||||||

Fees and duties

The difference between state duty and tax

The main difference between a state duty and a tax is its target orientation. Despite this, it should be noted that, being a federal tax, the state duty is payable throughout the entire territory of a single state. The funds received from such payment are used to replenish the federal budget, regional budgets, as well as the budgets of subjects of state importance.

When performing most actions of legal significance, it is necessary to complete the mandatory procedure for paying state duty. The list of specific events is quite wide and is noted in the legislation. There is also a closed list of objects for collecting duties, which can be found in the Tax Code.

Regarding transactions involving individuals, the above list may be somewhat shortened. Most often, payment must be made when performing notarial transactions, applying to arbitration courts and courts of general jurisdiction, issuing driver's licenses and registering vehicles, as well as when registering acts of civil status. This list is not complete and is provided as an example only.

Prerequisites

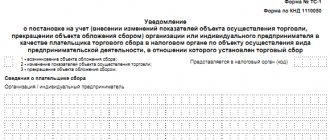

The authorities that issued a permit for the extraction of wildlife and/or a permit for the extraction (catch) of aquatic biological resources, no later than the 5th day of each month, submit to the tax authorities at the place of their registration the following information:

- about issued permits;

- the amount of the fee payable for each permit;

- about the deadlines for paying the fee.

Information is presented according to approved forms (Orders of the Federal Tax Service of the Russian Federation dated 02/26/2006 N SAE-3-21/ [email protected] , dated 02/26/2006 N SAE-3-21/ [email protected] ).

Organizations and individual entrepreneurs that have received the appropriate permit, no later than 10 days from the date of its receipt, submit to the tax authority at the location of the body that issued the said permit the following information:

- about received permits for the extraction of wildlife objects;

- about the amounts of fees to be paid;

- on the amounts of fees actually paid.

Information is presented according to approved forms (Orders of the Federal Tax Service of the Russian Federation dated 02/26/2006 N SAE-3-21/ [email protected] , dated 02/26/2006 N SAE-3-21/ [email protected] ).

After the expiration of the permit for the extraction of wildlife objects, organizations and individual entrepreneurs have the right to apply for a credit or refund of the fees for unsold permits.

Offset or refund of collection amounts is carried out in the manner established by Chapter. 12 of the Tax Code of the Russian Federation, subject to the submission of relevant documents.

The procedure for distributing quotas for catching (harvesting) aquatic biological resources for research, educational, cultural and educational purposes was approved by Decree of the Government of the Russian Federation of November 26, 2008 N 887.

The distribution of total permissible catches of aquatic biological resources in relation to the types of quotas for their production (catch) is established by Decree of the Government of the Russian Federation of December 15, 2005 N 768.