Personal income tax rate on dividends

Until 2020, the tax on dividends had to be withheld at a rate of 9%. Since the beginning of 2020, the personal income tax rate has increased, regardless of the period in which payments to the founders are distributed. The tax rate on dividends depends on the status of the recipient of the founders' payments. If he is a resident of the Russian Federation, then a rate of 13% should be applied; if the recipient is not a resident, then the rate is 15%. The exception applies only to double taxation avoidance agreements concluded with foreign countries. It is necessary to determine what status the recipient of the founding payment belongs to at the time of its distribution.

Important! For residents of the Russian Federation, the personal income tax rate on dividends is 13%, for non-residents – 15%.

What taxes are payable by legal entities

According to the current legislation of the Russian Federation, all legal entities. individuals are required to pay tax on profits received from investments in other companies.

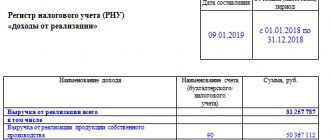

The amount of dividend tax liability is determined by the formula:

H = K x CH x (D1 - D2), where

N - tax amount;

K is the ratio of the amount of payments to a specific investor and the total amount of profit to be distributed among all recipients;

Сн - tax rate;

D1 - the amount of profit to be distributed among all shareholders;

D2 - the amount of profit in the form of dividends received by the tax agent himself in the current and reporting period, from which the tax was previously paid.

What taxes are paid to founders?

Taxation of dividends transferred to founders depends on the status of the latter:

- an individual who is a resident of the Russian Federation is obliged to pay personal income tax at a rate of 13%;

- an individual who is not a resident of the Russian Federation transfers to the budget personal income tax amounts withheld at a rate of 15%;

- a Russian company pays income tax at a rate of 13%;

- a foreign legal entity is subject to income tax at a rate of 15%.

Let’s say the founders of a joint stock company are two individuals and an LLC. In this case, when paying dividends to them, the company must transfer personal income tax withheld from the income of the first two participants, and pay income tax to the budget for the third founder.

Insurance premiums are not deducted from the amount of accrued dividends, because These payments do not apply to employment or civil contracts.

Income tax rates on dividends due to Russian companies

When withholding income tax amounts from dividends received by Russian companies, the rate established by law in the amount of 13% is applied. But in some cases, the retention rate may be 0%.

To be exempt from paying tax obligations, a company that is a recipient of profits from investments must continuously (for 365 calendar days or more) own:

- a share in the issuer's authorized capital of 50% or more;

- depositary receipts providing for the payment of dividends in an amount of at least 50% of the total amount of these payments to the company’s shareholders.

To take advantage of this benefit, a legal entity must provide the tax office with documents confirming the right to own a sufficient share of the capital of the company of which it is a shareholder.

If the paying company decides to increase its share capital, the shareholder's shareholding percentage may drop to below 50%. In this case, the right to receive benefits is lost until the specified conditions are met.

Founder status

A resident in our country is a person who stays on the territory of the Russian Federation for at least 183 calendar days within 12 consecutive months. The time spent by a person in the Russian Federation is not interrupted if leaving the Russian Federation is due to the following reasons: (click to expand)

- Training or treatment, the duration of which is less than 6 months;

- Performing duties related to work (services) on offshore hydrocarbon deposits.

In addition, the following persons are also recognized as residents, regardless of the time of their stay in the Russian Federation:

- Russian military personnel who serve abroad;

- Officials who were sent abroad.

Determine the status of the organization's participants at the time of each dividend payment. The same participant can become both a resident and a non-resident within one year only. After a tax period of 12 months, companies must find out the exact status of the recipient of the “founder’s payment”, in accordance with which the personal income tax rate is determined. When changing the status, personal income tax is recalculated for the full tax period (

Features of paying taxes if the shareholder is not a resident

When calculating tax on dividends paid to shareholders who are not residents of the Russian Federation, a rate of 15% is applied.

To apply the preferential rate established by an agreement between partner countries, the taxpayer is required to provide evidence of his permanent location in the territory of the state with which this agreement has been concluded.

If a shareholder has different tax statuses (resident and non-resident) on the day of accrual and the day of payment of dividends, when withholding tax, the rate that corresponds to his status in effect on the date of receipt of income is applied.

Personal income tax on dividends in 2020

Personal income tax is calculated and withheld on the day when the “founding” funds are paid out. In this case, dividends must be accrued earlier than this day, namely, based on the date of the founders’ decision to accrue dividends. Each payment is calculated separately. Depending on the tax rate (13% or 15%), the calculation of dividends may be different. If dividends are paid to company participants in kind, personal income tax should also be withheld, and the tax rate will not change. The procedure for determining the tax rate will be the same.

Payment of dividends by property

The LLC Law does not establish any restrictions on the distribution of profits. Although the possibility of paying income with property is not directly provided for, there is no prohibition on this form. If the general meeting of participants decides on the distribution of income in non-monetary form, this must be reflected in the minutes, as well as information that will reflect the share of each participant in kind.

The Law on JSC establishes that part of the profit is paid in money, and property can be transferred only in cases provided for in the charter. That is, shareholders also have this opportunity.

If property is transferred as dividends, its value must be determined to calculate tax. The assessment can be made by the company participants themselves and the price can be set by agreement of the parties. But it is important that it is not lower than the book value, otherwise tax authorities may challenge the transaction.

| ☑ To determine the market price, it is necessary to take into account that transactions between related parties (including with the founders of the company) are considered controlled in accordance with Art. 105.14 Tax Code of the Russian Federation. This means that prices in such transactions are subject to special tax controls. |

Once the price is determined and the property is transferred to the participants, taxes on dividends can be withheld and transferred. The rate is determined in the same way as when paying dividends in cash.

Procedure for calculating personal income tax on dividends to residents

The calculation of personal income tax on payments to residents will depend on whether the organization making the payments received the same type of payments from other companies.

For example, the organization has no income in the form of dividends. In this case, the calculation procedure will be as follows:

Personal income tax = D x 13%, where

D – dividends accrued to the resident.

13% – tax rate.

The calculation will be more complicated if the organization is the founder of another company from which it received any amounts for participation in the current or previous year. To calculate the tax, you will have to check whether dividends received from another company were taken into account in payments to the founders or not. If such receipts have already been taken into account in the calculations, then personal income tax must be calculated as usual, that is, the payment is multiplied by 13%. If income from another company has been received, but dividends have not yet been paid, the calculation will be as follows:

Personal income tax = DPR / DR x DR – DP x 13%, where

DNR – dividends that are accrued;

DR – dividends to be distributed;

DP – dividends received, excluding amounts taxed at a 0% rate.

It should be remembered that you will not need to withhold personal income tax if the dividends received by the company are equal to or greater than the amount paid to the participants.

Procedure for calculating personal income tax on dividends to non-residents

For non-residents, the formula for calculating personal income tax will differ only in the size of the rate:

Personal income tax = D x 15%

Are dividends subject to taxation?

The date of receipt of dividends is considered the day of actual payment. It does not matter how exactly interest will be calculated and paid: in cash through the company’s cash desk, by bank transfer, or given in kind.

According to Article 43 of the Tax Code of the Russian Federation, any income received by a shareholder when distributing profits after paying taxes on them is considered dividends.

The following are entitled to receive dividends:

- Members of a joint stock company. Interest on dividends is paid to these persons based on the results of a certain period of the company’s operation, for example, quarterly, twice a year or annually. The timing and amount of payments are determined by the company’s Board of Directors. If the meeting decides not to pay dividends, shareholders will not receive income for a certain period of the enterprise's activity.

- Investors carrying out transactions with shares. The total amount of income received is determined at the end of the year.

Articles 275 and 226.1 of the Tax Code of the Russian Federation determine that tax on dividends must be transferred to the budget no later than the first working day following the date of payment. Contributions to the Federal Tax Service are withheld automatically by the tax agent when dividends are deposited into the investor's account. The calculation is made separately for each taxpayer with each payment of income.

The joint stock company issuing the securities for which payments are made acts as a tax agent. In some exceptional cases, this responsibility falls on the investor himself, for example, if the company paying the dividends for some reason has not fulfilled its obligations to the Federal Tax Service.

When dividends are not payable

Although dividends are subject to taxation, there are exceptions to this rule. An example of this is stocks. This organization receives profit in the form of dividends from investments in shares of other legal entities. The company, in turn, also uses these funds to make payments to investors. In this case, no tax is withheld from these amounts.

Mutual funds do not pay income tax on dividends.

Deadline for transferring personal income tax on dividends in 2020

The period for paying personal income tax on founder's payments depends on the legal form of the organization making the payments.

For LLCs, the following rule has been established for determining the deadline for paying personal income tax: the tax must be transferred no later than the day following the day of payment of dividends. It does not matter where the money was issued from, from the cash register or transferred to the founder’s card. Dividends, by the way, can even be transferred to a third party indicated by the founder.

An organization must transfer personal income tax at the place of its registration, regardless of where the recipient of the dividends is registered.

Important! The BCC for paying personal income tax on dividends is the same as for paying income tax on other income. KBK 182 1 0100 110.

Let's look at an example:

Let’s assume that the organization paid dividends to one of the participants on April 10, 2020. Personal income tax from this payment must be transferred on the same day or the next, that is, April 11, 2020. If the payment occurs on Friday, April 13, 2020, then personal income tax must be transferred no later than April 16, 2020. This rule applies to LLCs. For JSC, the rules are different. Tax on dividends on shares of a Russian company is paid to the budget within up to 1 month from the date of payment.

Let’s summarize the deadlines for paying personal income tax on dividends in 2020 into a table (click to expand)

| Entity | Deadline for paying personal income tax on dividends |

| OOO | The deadline for paying personal income tax is the next day after the payment of dividends |

| JSC | Personal income tax is paid within 1 month from the date of payment of dividends |

Important! If the deadline for paying personal income tax on dividends falls on a weekend or holiday, it is postponed to the next working day.

What is the difference between dividends under the simplified tax system and the special tax system?

Dividends under the simplified tax system and the special tax system differ in the method of their calculation. In the second case, the corresponding calculations are made on the basis of the balance sheet.

When a legal entity uses the simplified tax system, this procedure becomes more complicated. For companies that have chosen this method of maintaining tax accounting, the provisions of paragraph 2 of Art. 346.11 Tax Code of the Russian Federation. Despite the fact that business entities operating under a simplified taxation system are exempt from paying income tax, this rule does not apply to dividends.

To determine the amount of net profit by issuers using the simplified tax system, the following formula is used:

PP = V - R - Z - N, where

PE - net profit;

B - revenue received to the account of a business entity in the reporting period;

P - expenses incurred in the same period of time;

Z - current debt that arose in the reporting period and is outstanding;

N - taxes that are payable.

All of the above indicators are taken over the same period of time.

Expenses that are not documented cannot be included in the calculation of net profit. This often causes the actual value of this indicator to be overestimated.

The legislative framework

| Legislative act | Content |

| Chapter 23 of the Tax Code of the Russian Federation | “Income tax for individuals” |

| Article 7 of the Tax Code of the Russian Federation | "International treaties on taxation issues" |

| Article 275 of the Tax Code of the Russian Federation | “Features of determining the tax base for income received from equity participation in other organizations” |

| Letter of the Ministry of Finance of Russia dated No. 03-04-06/1951 01/23/2015 | “On the calculation and payment of personal income tax by a tax agent - a depository when paying dividends to a shareholder, including if they are returned to the tax agent” |

| Article 123 of the Tax Code of the Russian Federation | “Failure of a tax agent to fulfill the obligation to withhold and (or) transfer taxes” |

Results

The tax on dividends is transferred to the budget by the legal entity paying them, withholding the amount of tax from the amounts accrued for payment. To calculate the amount of tax on payments to residents of the Russian Federation, a special formula is used that allows you to reduce the distributed amount of dividends by the amount received by the distributing person in a similar quality. When determining the amount of tax on payments to non-residents, such a reduction is not made. The rates applied to dividends paid to residents (13%) and non-residents (15%) also differ. Information about payments made is included in the profit declaration (for legal entities always, and for individuals if the tax agent is recognized as such under Article 226.1 of the Tax Code of the Russian Federation) and in 2-NDFL certificates (for individuals, if information about payments is not submitted in the declaration).

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Profit distribution decision

At the general meeting of LLC participants, a decision is made to allocate retained earnings or part of it to pay dividends. Dividends can be paid both from the profit of the reporting year and from the profit of previous years. The results of the meeting are recorded in the minutes of the general meeting of participants (clause 6, article 37 of Federal Law No. 14-FZ).

If the Company consists of one participant (sole founder), the decision to pay dividends is drawn up in any form (Article 39 of Federal Law No. 14-FZ).

Each participant in the company receives dividends according to their share in the authorized capital.

The protocol (decision) on the payment of dividends should indicate:

- for what period is profit distributed (last year, quarter, etc.);

- the amount of profit to be distributed;

- share of each participant (in% and rubles);

- timing of dividend payments;

- form of payment of dividends (money or property).

Participants can also indicate other clarifying information in the protocol. A detailed calculation procedure will help avoid controversial situations in the future.

Insurance premiums are not paid on the amount of forgiven debt

Insurance premiums cover payments and other remuneration accrued in favor of individuals under employment and civil law contracts. This is the rule of subparagraph 1 of paragraph 1 of Article 420 of the Tax Code of the Russian Federation. The list of income that is not subject to contributions is given in Article 422 of the Tax Code

If payments to an employee are not remuneration for his work, they are not subject to insurance premiums. In itself, a loan of funds issued to an employee by a company is not payment for labor and, therefore, it does not fall under the payments from which insurance premiums must be calculated.

Possible penalties due to reclassification of the loan as dividends

Your risks may cost you the following amount:

1) A fine of 40 percent of the unpaid tax amount. According to paragraph 3 of Article 122 of the Tax Code of the Russian Federation “Non-payment or incomplete payment of taxes or fees.” Since signing a loan agreement is an action committed quite intentionally.

Practical encyclopedia of an accountant

All changes for 2020 have already been made to the berator by experts.

In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents.

Share

We write useful articles to help you understand complex accounting problems, and translate complex documents “from bureaucratic into Russian.” You can help us with this. It's easy.

*By clicking the give back button you are making a voluntary donation

Personal income tax agents

Individuals only rarely pay their taxes themselves. Usually tax agents do this for them: organizations and entrepreneurs. Also, the functions of tax agents for personal income tax are performed by:

- private notaries;

- lawyers who have established law offices;

- separate divisions of foreign organizations paying income to individuals;

- organizations paying remuneration to military and civilian employees in the Russian Armed Forces.

What does the law require from tax agents? Calculate, withhold and transfer personal income tax on income paid to individuals to the state budget (clause 1, article 24, clause 1, 7.1, article 226 of the Tax Code of the Russian Federation). In this article, we will talk about the timing of transferring personal income tax on dividends.