What is trading in simple words

Quite simply, stock trading is the buying and selling of assets to profit from price fluctuations. Bought cheaper, sold more expensive - classic speculation. You can also make money on falling markets using margin trading.

Where do they sell?

Regular traders trade securities through brokers or other intermediaries. They either trade stocks on their own behalf using clients' money, or they become intermediaries and connect the trader with a liquidity provider for a certain percentage.

Today, trading has completely gone online. To join trading, you need to enter into an agreement with a broker and download special software to enter the market.

How traders work

Investing and trading are two completely different methods of making a profit in the financial markets. Both seek to make a profit by participating in trade.

But if investors strive for greater profits in the long term, traders, on the contrary, are content with relatively small profits, but get results quickly.

Required skills and knowledge

A trader candidate will need a variety of skills to succeed in this highly competitive and high-risk trading field.

My personal rating of must-have skills for trading includes the following:

- Analytics. The ability to quickly and accurately analyze data is a skill every trader needs. 80% of trading consists of analyzing price charts. Therefore, a trader needs to develop his analytical skills in order to recognize trends in charts more effectively.

- Observation. The desire and ability to search for information that affects the quotes of securities and currencies is another necessary condition. A smart trader creates a personal calendar of economic releases that may affect the price of his exchange assets. Technical indicators always lag the market. Without the ability to correctly interpret news in order to accurately predict price movements, you won’t be able to trade much.

- Control. In trading, composure and the ability to abstract from emotions are important. And emotional trading is a casino.

Simply put, becoming a trader requires the ability to analyze. Formal education in economics/business/finance does not make you successful at trading.

The lion's share of success is personal analytical skills, as well as the ability to concentrate and concentrate. And, of course, the ability to regulate emotions so as not to lose your head in tense moments.

Who can become a trader

Expert opinion

Vladimir Silchenko

Private investor, stock market expert and author of the Capitalist blog

Ask a Question

Advertising says everywhere: “Anyone can do it!” Anyone can register with a broker, deposit money into their account and start earning money. This is wrong. Everyone can invest. There are ready-made analytics and examples of portfolios that will work for everyone. But this is an investment. Active trading has different specifics.

Let's take Michael Berry for example. This is one of the people who predicted the collapse of the housing market and the crisis that followed it in 2008. Everything was clear on the price charts - growth, a nice bullish trend and all that. But after doing his research, Burry noticed something was wrong and opened several extremely profitable short trades at the right time.

What I'm getting at: I am the average level, you are the average level; Michael Burry is not your average trader. The average trader keeps up with the trend, Michael Berry is looking for his own ways. This must be taken into account when choosing a trading strategy.

The most famous traders in Russia and the world

Considering the peculiarities of the formation of the Russian stock market, there are not very many stars here.

Although some have achieved good success in trading, for example:

- Alexander Elder. One of the richest Russians. Today he is mainly engaged in paid consultations and conducting seminars and trainings, but he began his career as a trader. Using the proceeds from trading, he founded the organization Financial Trading Seminars Inc, with which he later moved into the field of education.

- Alexander Gerchik. Started trading in 2003 while in the States. Soon he moved to Russia, where he continued to trade, and later joined the management team of the Finam holding. In 2020, he founded his own brokerage office, Gerchik&Co, and began trading seriously.

- Alexander Rezvyakov. He started investing in mutual funds in 2003, but later realized that this was not for him and became interested in active trading. He is famous for the fact that in 2011 he earned almost 1,367,666 rubles in one trading day.

Among the Western meters of stock speculation, I would like to note the following trading characters:

- Paul Tudor Jones. A precursor to the infamous Black Monday, the stock market crash of 1987. Predicting a price crash, he dumped the losing stocks and rode the bear market, earning about $100 million. Contemporaries and colleagues appreciated his merits so much that five years after this event they appointed him chairman of the New York Stock Exchange (NYSE).

- George Soros. Conspiracy theorists consider him one of the most influential members of the planet's shadow government, but in trading circles he has earned the nickname "The Man Who Bankrupted the Bank of England." In 1992, he collapsed the pound, opening short bets totaling $10 billion. Earned $1 billion net.

- Jesse Livermore. Old school trader. Predicted the Great Depression and the stock market crash of 1929, earning what was then a whopping $100 million, equivalent to billions today. One of the forefathers of technical analysis.

Books that a novice trader should read

People always want secret wisdom. They had heard stories of private libraries buried deep underground, guarded by genetically enhanced ninja monks, where only a select few were allowed to enter.

Whether it’s one of the forums, or VK, or another social network, you can always find a corner where gurus share secret secrets with their followers. These trading monks jealously guard their trading secrets, revealing them only to those who are worthy or have brought money to the master.

But 99.9% of what forum gurus will tell you about trading is in these books:

- Burton Malkiel A Random Walk Down Wall Street. A great guide for beginners." The book has gone through 10 reprints, and this in itself speaks of its usefulness and relevance. Everything about trading is well explained and accessible to any level of understanding.

- John J. Murphy, Technical Analysis of Futures Markets. A classic of trader's reading. One of the most comprehensive books on technical analysis that I have ever come across. It's chock full of prepared patterns. Of course, out of habit, your eyes may bleed, but I still recommend reading it from cover to cover.

- Kurtis Face "Way of the Turtles. From amateurs to legendary traders." This is a masterpiece of understanding market psychology. It is not enough to master the skill of reading technical indicators in order to find the right entry and exit points. It is equally important to master your emotions and understand what feelings govern other market participants. The psychological factor of trading is an unknown variable that instantly breaks all logical structures. To master trading, you need to learn how to read moods.

- Jack Schwager "The New Market Wizards" An interesting collection of interviews and debriefings from the coolest traders of our time. Each interview is a separate example of a successful and unsuccessful deal, where everything is discussed - from prerequisites to consequences.

- Steve Neeson, Beyond Candlesticks. New Japanese methods of graphical analysis". Top material. In the simplest and most accessible language, the author consistently teaches how to work with a bare price chart, ahead of technical analysis indicators. It sounds scary, but it is described in a very accessible and understandable way.

Trader - who is it?

A trader is involved in trading operations in financial markets.

If translated literally from English, then a trader is a trader. In relation to financial markets, a trader of financial instruments. Those. trader - a person who carries out trading operations with securities, currencies, and exchange commodities on the exchange and over-the-counter markets.

A trader can carry out trading operations with his own funds, or with the client’s funds, or with the funds of the company whose interests he represents. Thus, a trader is a market participant who carries out trading operations with financial instruments in order to make a profit.

Types of trading

The main ones are below.

Financial

Financial trading is no different from any other form of trading. It is about buying and selling assets in the hope of making a profit.

Financial trading is the buying and selling of financial assets. Trading is carried out in one of two ways: through the exchange or through the cash desk of a commercial structure (bank, management company).

Algorithmic

Computers and all kinds of artificial intelligence today are actively launching their silicon tentacles into all spheres of human life. Investments are no exception. An algorithm is a set of specific patterns or rules that trigger a particular scenario of the trading process.

Simply put, in algorithmic trading, a computer trading program thinks instead of the trader. It analyzes prices and opens/closes orders in predetermined volumes. In theory, a trader can sit back and relax while his trades trade themselves.

However, I don’t yet see a bunch of people suddenly becoming millionaires from such trading. This means that the bots perform not so well.

Internet trading

Online trading is basically the process of buying and selling financial products through an online trading platform that we are talking about today. The view of the stock exchange as a trading pavilion, where everyone is shouting, calling and receiving faxes - this is footage from the distant past. Now there are server blocks there, and traders trade through PCs and mobile gadgets.

TOP 9 most common beginner mistakes

In trading, as in life, it is worth learning from the mistakes of others. The trader has the Internet at his disposal, so there are no difficulties in learning. The accumulated experience helps in analyzing errors on the stock exchange. In the future, it remains not to repeat them.

Here are the nine most common:

- Continuous operation. It is important to consider that greed in trading is a bad advisor. Many beginners, in pursuit of earning money, forget about breaks. They open positions with every price movement in hopes of making a profit in the future. As a result, the opposite result occurs (money goes “through your fingers”). It is important to understand that a trader must be diligent and work confidently and with minimal risk. Sometimes you have to wait several hours, or even days, for the right moment.

- Quickly close a position. Beginning traders often close transactions when receiving even small profits. With this approach, it is difficult to expect that the deposit will increase by at least 10 percent per year. Statistically, a correctly opened position brings in five times more profit than the trader initially invested.

- The desire to use several assets simultaneously. Trading using five or six instruments leads to scattered attention and missing the optimal time to open a position. Experts assure that one or two instruments are enough to get a stable profit.

READ How a beginner makes money on the stock exchange without investments

- Untimely closing of a position. When the market turns, beginners often hope that the price curve will soon turn around and go in the desired direction. If this does not happen, the user's money quickly burns out. To avoid losses, it is recommended to set a stop loss - a command that ensures automatic closing of a transaction at a specific level.

- Trading by intuition. A common mistake traders make is working at random. This happens in a situation when a person does not know what and how to do. Having a strategy is important to make a profit. Working on intuition, if it brings success, is short-lived. The result is always the same - loss of deposit. In such a situation, trading is no different from playing roulette.

- Lack of analysis. Having a trader’s diary and its control is an invariable condition for a trader’s success. Without this, it is unlikely that it will be possible to formulate a reliable strategy. With the help of the journal, the market participant sees what he did wrong and where he made a mistake. Analysis helps create a reliable trading system.

- Excessive enthusiasm. Beginners often forget that there is real life with its entertainment, communication, reading books and other pleasures. It is important to immediately determine for yourself the time you spend at the PC and strictly follow this rule.

- Work without rest. In an effort to increase capital and earn more money, traders forget about rest and spend 12–14 hours a day near the computer. This mode is exhausting, and trading efficiency is reduced to zero. Successful trading requires concentration, a fresh perspective and attention. A sleepy, tired person does not have these characteristics.

- Trading without a strategy. This error was touched upon above, but one more mention would be helpful. According to statistics, having a strategy increases the probability of a successful transaction by 2–3 times, and the annual profit reaches 60–70%.

Many traders perceive working on the stock exchange as a game, which is considered the main mistake. This is the same work with risks, pros and cons, requiring training and attention. If you do not follow the given rules, the trader quickly ends with the new practice and forgets about a promising form of income.

Features of online trading

Online trading is fast and easy. But due to the low threshold, a lot of amateurs fall into it, who do not take into account the peculiarities of online trading and suffer losses.

By the mid-to-late 2000s, most financial businesses finally moved online. This is how the virtual stock market that we all love today was formed.

Advantages and disadvantages

Advantages of online trading:

- Convenience and flexibility. Online trading is very convenient. We can place buy and sell orders even from our smartphone. You can trade from anywhere in the world where there is internet with a more or less decent ping.

- There is no dependence on the broker. The times of office managers have sunk into oblivion. Today, a good broker is an intermediary who directly brings together a trader and a liquidity provider. Quotes are drawn on the exchange in real time. Everything is done in a split second. If you don’t like the conditions or quality, choose another broker. So both residents of megacities and residents of distant fly-by-night towns (no offense for being rude) - everyone has equal access to the market and trading.

- Benefit. Competition among brokers today is high, so they are literally forced to compete with each other. One lures with narrow spreads, another with low commissions, a third with a low minimum deposit, a fourth with long leverage, and a fifth with bonus money and preferential conditions.

Disadvantages of online trading:

- Risk. Online trading is not perceived as something serious at first. Of course, sweating in the manager’s office, squeezed into a business suit, and sitting at the computer in a robe and tattered underpants are different degrees of risk awareness. Therefore, it is often difficult for a poet to stop; many quickly merge.

- Errors and connection problems. A purely technical problem, which, however, can ruin more than one successful transaction or prevents you from exiting an unsuccessful one in time. Broker's server, Internet provider, PC or gadget - at any moment one of the links can fail. And then all the copper basin trade.

As can be seen from the above, online trading has both advantages and disadvantages, and if you are slightly familiar with technological progress and have a little understanding of finance, then you have no contraindications for trading.

What types of traders are there - four types

When considering the features of the trader profession, what it is and how to earn money, it is important to take into account the classification of market players. Such market participants are conventionally divided into four categories (based on the time of opening positions). Below we discuss what a trader does in each option and what the intricacies of the work are.

Scalper

Scalpers are speculators who work on short time periods. The duration of opening a position is usually one or five minutes. In other words, this is short-term trading that requires experience, endurance and the ability to cope with psychological stress. The difficulty of the analysis lies in the high level of error and problems in forecasting. As for the level of earnings, scalpers have the highest due to opening a large number of transactions.

Day

It is difficult to understand what a day trader is, because the principle of operation is hidden in the name. The speculator opens positions with a limit during the trading session. Transactions of such users are never carried over to the next day. In the case of cryptocurrency exchanges, the duration of an open position reaches 24 hours due to the absence of time restrictions. This approach is used in the securities market, where the value of an asset outside the trading session is unpredictable.

Medium term

Medium-term players make trades for several days and work on small time frames (one or four hours). The value of assets managed by traders is analyzed on a daily schedule, which is most convenient. Increasing the duration of the transaction helps reduce the error and more accurately predict the price.

Long term

Such players are often called investors. They earn the same as the traders discussed above, but on long-term investments. The position is closed for an extended period of time and held for several weeks or months. With this method of earning money, it is worth remembering that there must be a commensurate amount in the account. In the event of a sharp movement of an asset in the opposite direction and a shortage of funds, the transaction is closed automatically by the broker. The work is based on two types of analysis - fundamental and technical.

READ Stock trading – what a beginner and an experienced trader needs to know

Types of software for online trading

To trade on the stock exchange, you need a web terminal. There is everything from trading tools to analytics. All trading programs can be divided into 3 main groups.

Software for beginners

First of all, these are built-in indicators and oscillators. They are easy to use and provide a fairly accurate picture of the market, accessible even to beginners. This group can also include various advisors. Not those that open positions for the trader, but those that simply advise, give signals when it is better to enter and exit the market.

Software for professionals

Professional trading software often consists of complex proprietary indicators. Traders develop them, customizing them for a specific trading asset, trading time, time frame and other narrow parameters.

Automated trading software

Guided by the classification of professional trader Alexander Elder, I will divide software of this type into two groups:

- Black boxes. They analyze quotes, open and close transactions independently, or issue signals for the trader. In this case, the program will find exhausts in the logs. That is, then you won’t be able to take a debriefing to optimize your strategy. The choice of amateurs who want to make money by trading, but do not want to get involved in analysis.

- Gray boxes. They do the same as blacks, but at the same time write explanations for their actions in the log. After the end of the trading session, the trader can analyze the logs of successful and unsuccessful transactions to understand the causes and consequences.

Of course, with the right approach, third-party software can increase profits from transactions. But if you can’t even read the gray box log and comprehend this information, it’s better to postpone getting acquainted with it until later and brush up on your trading theory.

Trading Process

In the minds of many, a trader is a person who looks at screens with green and red numbers in a huge stock exchange hall, shouts something into the phone and looks puzzled. This is how it was until all trade switched to electronic form. A modern trader sits in a chair in front of a computer monitor, and financial management occurs through the click of a mouse. You can buy Yandex shares in two clicks in the morning, and also sell them in two clicks in the evening. Or in a week. Everything is determined by the trader himself; there are many different trading options.

All the same can be done even from a mobile phone or tablet. If you have Internet access, you can simply go to a special application and see all the necessary information:

- Market conditions and trading progress.

- Your own positions, results on them.

- Open new transactions or close existing ones.

- Give trading orders to buy or sell at a certain price a security, currency pair, etc.

- Read the news report.

In general, the trader almost completely creates his own working conditions. The only thing he cannot influence is the trading schedule, that is, when news publications occur. There are many trading platforms in the world, therefore, news is published around the clock, including when it is night. At the same time, it is not at all necessary to follow all the news; you can only look at publications on the trading instruments of interest. Or choose only those that are suitable for trading time. For example, the Japanese yen is active during the Asian trading session, which is night in Moscow. But Gazprom is active during the day in Moscow, and in Vladivostok at this time it is evening.

All trade is carried out through special intermediaries who have the appropriate licenses . They are called brokers. Previously, these were specific people, but now transactions on the market go through organizations. All brokers are more or less unified, but there are differences, usually in details, but sometimes significant. In general, brokers can be divided into two large groups:

- stock brokers;

- forex brokers.

Stock brokers are all similar, but forex brokers have big differences. The trader contacts the broker through a special program (, it gives access to the market. For all other questions, contact an employee of the broker company.

What is social trading

Social trading, as the name suggests, works on a social network model. The only difference is that instead of sending each other selfies or food photos, people share their ideas.

Here traders interact, observe the trading results of other professionals and brainstorm market situations in real time.

Social trading scheme

Being not a very experienced trader, we can study the open statistics of the “Tops”, choose our “racing horse” and, by paying a small commission to the platform, copy its transactions.

Simply put, a pro trades, and the system copies his trades and invites us to repeat after him. Our task is to find a successful trader and follow them, copying their transactions.

TOP best platforms for social trading

Personal rating of trading platforms below.

eToro

Perhaps a top tip for a novice Russian-speaking trader. The minimum deposit is $200, it has its own web platform and applications for iOS and Android.

Working instruments: CFDs on indices, shares, ETFs, commodities, bonds, cryptocurrency. eToro is not a market pioneer, but its Copy Trading trading system is the benchmark for what we call social trading.

MyDigiTrade

Another interesting platform for trading futures, options and CFDs, founded in 2010. This is a copycat platform created by independent traders. The structure is similar to eToro's Copy Trading.

There are tools for analyzing the success of signal providers, as well as many proprietary options for money management. The downside is the small number of signal providers (a little more than 200 so far).

Naga Trader

An interesting social trading platform that works with CFDs on stocks, ETFs, indices, commodities, futures, cryptocurrency and even in-game items. It is simultaneously a social network, a social trading platform, its own transaction copying system, and even its own Naga cryptocurrency (NGC).

TradingView

I would especially like to mention the TradingView cloud platform for trading. Here you can trade futures and currencies. It has its own tools for price analysis and charting.

The terminal is closely integrated with the forum, allowing you to quickly copy indicator indicators and immediately exchange ideas with other traders in a common thread or personal chat in real time.

Advantages and disadvantages

In my opinion, the main benefits of social trading include:

- Quick access to reliable trading information. Platforms like Social Trading bring together traders from all over the world who monitor the market around the clock, find relevant information and sort it out piece by piece. Official analytics will be released later.

- Quick understanding of the trading market. The advantage of social trading is that from the first moment you learn from a live example and watch the work of real investors.

- You study and earn at the same time. Social trading platforms allow you to learn from experienced investors and at the same time copy their trades to make money yourself. In this case, the specialist himself gives permission for people to copy his trading signals. The risks, however, are entirely on the shoulders of the copyer.

Disadvantages of trading:

- Addiction. When you receive relatively easy money that another pro actually earns, you involuntarily relax and begin to consider yourself a successful trader. There is a temptation to invest the money you earn in something. And then it turns out that in fact you are not trading very well, the market outside of social trading platforms is inaccessible to you.

- Taking someone else's risk. Pros make mistakes too. But they move huge sums, so they can withstand drawdowns. This is acceptable and part of their plan. On the other hand, a trader who copies a trade usually replenishes the deposit with the minimum amount and, if unsuccessful, loses everything.

How does a trader work?

So, in the age of the Internet, any adult citizen can choose a brokerage company or dealing center with which he enters into an agreement for the provision of services. It is through it that your money will be withdrawn to the exchange, and you will gain access to quotes and be able to conduct transactions.

When the issue with the dealer is resolved, download the trading platform to your computer, where the broker will supply quotes, and deposit funds.

Now you have a price chart and assets in front of you. We remember that in Forex these are currency pairs, cryptocurrencies, indices, etc. Information is provided in real time, 24 hours a day, 5 days a week, since Saturday and Sunday are holidays on world exchanges.

In other words, what you see on the monitor at the moment is what other participants see, no matter where they are.

When the investor has decided on the instrument and thought about the strategy, he gives a command (opens an order) to the broker about the desire to open a position to increase or decrease the asset, that is, he makes a transaction.

The DC takes a commission or the size of the spread (the difference between the purchase and sale prices, for example, of a currency pair). In addition, the DC takes as collateral a part of the deposit in the form of margin.

There is a golden rule that says: always close a losing trade. In other words, do not go against the trend, and if this happens, then do not wait for the price to turn around and go in your direction.

Lose the minimum and close down - it’s better than losing most of it. In the foreign exchange market, unlike binary options, it is possible to close a transaction at any time.

With binary options, you specify the expiration (closing) time along with the purchase of the contract and cannot stop the process ahead of time. Therefore, in every publication I remind you of the difference between Forex and binary options.

If you're interested, here's a video of how binaries are traded.

You can also try it using the button below.

In simple words, the essence of trading is to buy a financial instrument cheaper and sell it more expensive. But predicting the rise or fall in value is not easy, and relying solely on intuition or luck is useless here.

Professionals use various methods of market analysis, of which many have been developed, but everything can be divided into two groups - technical and fundamental analysis.

- The fundamental one draws attention to one of the basic parameters that influence price fluctuations - the economy of individual states. Based on the premise that the market takes everything into account, proponents of this type of analysis carefully examine the financial world, taking into account many parameters and conditions, which allows them to build an overall picture.

- Against this background, technical analysis

But here, too, not everything is so simple. For example, on the daily chart you can see a steady increase in price, while on the weekly chart of the same asset there will be a decrease. Therefore, technical analysis may seem simple only at first glance.

Ways to gain trading knowledge for a beginner

Everything works - I tested it myself.

Self-study of trading basics

Read books and articles about trading that are available on the Internet. Seriously, Google search is a great way to find educational reading material today.

This is more than enough to master the basics and start trading on a demo account. This simulation of real trading will allow you to identify your gaps in education, after which it will become clear where to move next in trading.

Online training

Online courses and educational webinars on trading usually cost money, sometimes a lot, but can be very useful.

Mainly due to the fact that the speaker can answer questions or messages in the chat, clarifying difficult points and focusing on what is important in trading.

Attending in-person classes

Seminars can provide valuable information about the general market and specific types of investments. Most seminars focus on one specific aspect of the market and how the speaker has achieved success using his or her own strategies over the years.

Examples of classes from Dan Zanger and Mark Minervini that I have attended and reviewed in detail here on the site. Not all trading seminars have to be paid for. Some are provided for free, which can be a useful trading experience, just be very careful about what they sell.

What you need to work as a trader - six steps to success, instructions for beginners

There is nothing difficult about trading that could scare away a beginner. The main thing is not to grab everything at once and act gradually. Below are six steps that, if followed, will help you quickly achieve success and understand what traders do and how they work.

Selecting a trading type

The first step is to determine the method of earning money, choosing a trading instrument, a suitable time frame and type of analysis. For novice traders, it is better to start with the foreign exchange or cryptocurrency market. The last proposal is explained by the high volatility of digital coins and the possibility of earning money over short time periods.

You can leave the earned coins in your wallet and wait for their price to rise. Useful information about cryptocurrencies is provided on the website cryptonyka.com, where the principles and features of cryptocurrencies are outlined in accessible language. At the trader's fingertips are prices of digital coins, charts and more. Over time, it is worth moving to the securities market or commodity exchanges.

Search for a brokerage company

Traders claim that for successful trading you will need a reliable broker - an intermediary between the exchange and an individual.

When choosing, it is important to consider the following factors:

- Availability of a license that allows you to operate on the territory of Russia (licenses are issued by the Central Bank of the Russian Federation). It is important to take into account that the guarantees of EU regulators in the Russian Federation are useless.

- Capital. The broker must have a fund of 100,000,000 rubles or more at his disposal. This indicates that the company is designed for long-term activity and will not disappear.

- Rating. There are dozens of ratings on the Internet looking at the best brokers for Russia. It is worth focusing on the TOP 5 companies.

- Experience. When working through a manager (trader), it is important to take into account experience, the percentage of successful operations and the trading strategy used. It is important to choose traders who work simultaneously in several directions - with long-term and short-term trading.

- Availability of a demo account and training program. Many intermediaries are interested in attracting newcomers, so they train them and offer them to try their hand at a virtual account. The lack of educational information indicates that the site is focused on big players, so it is dangerous for beginners.

The best brokers with training include:

- Alpari (alpari.com) is a financial company that has been providing brokerage services for about 20 years.

It offers comprehensive training, regularly organizes webinars, and has free videos and literature. Nine out of 10 courses offered are free. Some classes open after topping up your account with a certain amount and you don’t need to pay extra for them. Additional advantages are the presence of a demo account, minimal commissions, reliability and timeliness of payments.

- Teletrade (teletrade.com) is the largest broker with a Russian-language interface and a good training program. There are several types of information available here - in the office, remotely, using video tutorials. It’s worth taking advanced training courses, downloading training materials, or watching master classes live. As for useful articles, there is plenty of it here, and there is a section for beginners. Free Forex articles, market information, glossary of terms, step-by-step instructions and more are available.

- Roboforex (roboforex.com) is a universal brokerage company that has been operating on the market for about nine years. What sets it apart from its competitors is its large number of users, the availability of cryptocurrencies for trading, and the availability of free information to educate beginners. There are training instructions and videos that allow you to start making money online.

It is worth noting that there are hundreds of brokerage companies operating on the market, so it is important to be careful when choosing.

Completion of training

When planning to make money from trading, it is important to remember that success does not come without learning and acquiring the necessary skills. You should not expect that earnings will come on the first day or even month of trading. It is important to set yourself up for long-term work aimed at gaining experience and creating your own trading strategy. Over time, stability appears, and annual capital growth reaches 60–70%. This is an excellent indicator, subject to initial investment in trading.

Trading on a demo account

Having a demo account is a plus for a beginner, because with its help it is easier to test your strengths, understand the tools and even sketch out an approximate strategy for making money. It is recommended to start working with real money only after a few days on a virtual account. For greater efficiency, it is worth uploading the full history of quotes to the terminal, which allows you to analyze the chart and select entry/exit points. At this stage, it is important to choose a tool, decide on a strategy and optimize it.

Opening a trading account

Once you feel confident in your abilities, you can move on to opening a real account. To get started, it is enough to deposit a minimum amount, which will allow you to open positions and try your luck with minimal risk. The minimum deposit amount for many brokers is different and ranges from $10 and above. At the initial stage, it is better to focus on sites with a small threshold of up to $100.

Real trading

After replenishing your account, you need to open a terminal (usually MetaTrader series 4 or 5) and buy/sell assets of interest. For statistics, it is important for a trader to keep a trading journal and record transactions in it. The diary indicates entry and exit points, stop loss and take profit parameters. Many traders forget that convenient electronic services exist.

How to complete trading training for beginners: step-by-step instructions

Millions of neophytes try their hand at the stock market every year. But most leave a little poorer and a little wiser, never reaching their potential.

Most of those who fail at trading have one thing in common: they have not mastered the basic skills needed to tilt the odds in their favor. Take enough time to study them, you will have everything in your hands to make a profit on the exchange.

Choosing a learning method

Learn to choose what you need about trading:

- accelerated online courses;

- financial items;

- books about the stock market;

- textbooks for universities and colleges.

There is a lot of useful information about trading there. Don't get hung up on one thing. If you can’t master the textbooks, read books with examples. If it’s not clear, sign up for an online course.

Everything is clear with the basics and if you want specifics, choose articles from professional traders. Now you understand the language they are written in, you can use the trading information to your advantage.

Mastering the market and the main concepts of stock trading

Learn the basics of technical analysis, support and resistance levels. Apply them to real price charts. Learn the basics of fundamental analysis. Just for yourself, try to predict where the price of several assets you like will go.

At first it seems that all this is chaos, which can be influenced by magical rituals. But there is a system. And guys like Warren Buffett and Peter Lynch guarantee that.

Studying the trading terminal

Find a good online broker, open a brokerage account. Deposit money and go to the trading platform (the broker may provide a desktop version for PC, programs for Android and iOS, and a web platform).

Familiarize yourself with the account interface and select the desired tool. You can visit Youtube to watch videos and read live comments about the trading terminal that interests us.

Learning the basics of risk management

Risk management in trading helps reduce losses. Risk is the likelihood of losing a lot of money in pursuit of greater gains. Each trading asset has its own return/risk ratio. Plus, there must be trading rules regulating what to do in certain cases.

By properly managing risk, a trader builds a foundation of low-risk, low-yield assets, gradually increasing the percentage of risky trades in order to trade more often and earn more money to reinvest. Although specific measures largely depend on the trading style.

Introduction to the basics of fundamental analysis

Fundamental analysis is a way of looking at the market as a system of economic, social and political factors that influence the supply and demand of an asset. In other words, once we master fundamental analysis, we will be able to determine which economies will collapse and which will grow.

For those who operate only using technical analysis methods, such global trend reversals often come as a surprise. Otherwise there would not have been so many victims of economic crises.

Study of technical analysis

Unlike fundamental analysis, which evaluates an asset or an entire market from a global perspective, technical analysis focuses on price movement patterns, trading signals, and assessment of the current strength or weakness of a security or other asset.

Opening a demo account and applying the acquired knowledge in practice

To practice trading without risking real money, you need an online account. Not all brokers provide this service. Therefore, when studying broker ratings, we look to see if our candidate has a demo account.

Although it doesn’t really matter where you train. Of course, it’s convenient that you don’t have to retrain later, but in general you can train on a demo account with one broker and trade with another. No one will punish you for this.

Main types

There are several types of trading:

- scalping;

- mid-term;

- long-term;

- technical;

- fundamental;

- swing trading;

- moment.

Each of these types has its own characteristics, which every professional, amateur or insider simply must know about. A novice trader must first understand them and choose the most suitable one for himself, and then start real trading.

Scalping (pips)

The fastest high frequency trading.

This is the most profitable, but also the most risky and nervous type.

Scalper traders, using one-minute or five-minute charts, take a “scalp” (profit) from almost every significant price movement.

The algorithm for such trading is simple - determine the direction of the trend and open a trade in the direction of its movement. If you notice signs of a trend fading, close the deal and earn some profit. Even when trading one asset per day, you can conclude several dozen transactions, the total profit of which will be significant.

But there is a rule in trading: the shorter the time period, the more difficult it is to predict price movements. Therefore, only real professionals with strong nerves can find pips profitably, since the price on short-term timeframes twitches like crazy and often goes in the opposite direction from the forecast.

Medium term

Medium-term trading on Forex is considered to be from 1 hour to 1 day. The trading algorithm is the same as in scalping, but the duration of transactions increases significantly and their number decreases. But the fuss and nervousness when concluding transactions also decreases, the trader has the opportunity to thoroughly analyze the market, curb his emotions, and calmly decide on the levels of taking profit or loss. Therefore, it is better for beginners to start working on medium-term trading.

Long term

Long-term trading includes all time intervals greater than 1 day. This is the most reliable, but also the slowest way to make a profit. The most popular among long-term traders is the 1 week timeframe, since only large banks or investment funds can afford to wait for profits from investments for 1 month, 6 months or 1 year.

Read more: Harmonic patterns - accurate trading decisions and stable profits

To successfully trade over the long term, you need to understand the underlying causes of economic and political events and their impact on price behavior. Traders who use technical analysis for trading rarely use it, giving way to supporters of fundamental analytics.

Technical

This type involves the use of price movement charts, sales and purchase volume charts for analysis. The main postulate of technical trading is that the balance of supply and demand has a direct impact on price movement.

For successful trading using technical trading, many trading strategies and even more different indicators have been developed. The main task of this type of trading is to monitor market dynamics and identify various patterns in it

In technical trading, it is popular to use support and resistance levels, price and level channels, moving averages and other technical analysis tools. There are also strategies that allow you to trade using the so-called. patterns that periodically appear on the chart of figures: Pinocchio, flag, head and shoulders, etc.

Using technical trading, there is no need to delve into the study of financial reports, rates of Central banks, or constantly monitor important economic and political events. Technicians work only with price, professing the principle “price includes everything.” Therefore, this type of trading is popular among solo traders.

Fundamental trading

Unlike “techies,” fundamental traders believe that economic and political events occurring in the world have a direct impact on price movements. For example, if a company announced the start of production of its new development, then we can expect an increase in the value of its shares. If a high-profile political or financial scandal erupts in a country, then one can expect a weakening of its currency, etc.

Fundamental trading requires constant monitoring of important company reports, brokerage reviews, government statistics, important political and economic meetings and press conferences. Its supporters believe that technical analysis is too complex and does not provide a real understanding of the mechanisms of price movement.

But in practice, collecting and analyzing a large amount of information about various events is much more difficult. Therefore, many supporters of fundamental trading prefer not to track it themselves, but to use analytical reports and recommendations of companies specially engaged in this for trading.

The second difficulty of fundamental trading is that the collected facts cannot always be interpreted unambiguously. It often happens that important economic data released, contrary to expectations, have virtually no impact on the price of an asset. Traders often unload short sellers - those who were short sellers. This is called a squeeze.

Swing

Swing trading is a type of technical trading. Trading is carried out using support levels. The trader's task is simple: find a trend, determine support and resistance levels and lines, and then open positions only from support levels. In an uptrend, they open to buy, and in a downtrend, they open to sell.

Moment

This type of trading is relatively rare because it involves simultaneous trading on several time frames. For example, while trading on an asset, a trader noticed a good entry signal on the 5-minute, hourly and daily timeframes. I don’t want to miss the profit, he “seizes the moment” and opens 3 trades: for 1 hour, for 1 day and for 1 week. Those. in fact, he uses scalping, medium-term trading, and long-term trading.

Where to start as a trader

Brief instructions on trading below.

Choosing a broker

There has never been a better time to be an investor. Competition among online brokers is fierce, which means costs are falling and quality of service is increasing. But choosing the right brokerage account depends on our individual priorities.

Some investors are willing to pay higher trading fees for a modern platform with unique trading signals and technical analysis indicators; others consider the costs unnecessary and trade on minimal accounts, without personal advisors and insider analytics.

To evaluate a broker, you should consider the following factors:

- expenses (spreads, commissions, additional services);

- minimum deposit;

- leverage (is there any at all and how long);

- your trading style.

Many brokers have their own promotions and personal trading conditions.

Rating of the best brokers for new traders

There is no ideal broker for trading. It cannot be by definition. Some people need narrow spreads, some need top analytics, others need a fancy terminal.

If a trader is a complete beginner and wants to quickly start making money on low-risk assets, so that during training the money does not just sit there, but also brings in some income, then here is my top tip:

- VTB;

- Tinkoff;

- Alpha.

In my opinion, these are the most optimal brokers for starting investments. Perhaps I missed someone and there are better offers. Then write about it in the comments.

Opening a trading account

Opening a brokerage account may seem like a complicated process, but it is actually the easiest step in trading.

On the main page of the selected online platform, you will not miss the offer to register an account. This is followed by step-by-step instructions, where everything is written, chewed and illustrated.

The main responsibility at this stage is to choose the type of trading account (DD, where all orders are executed by the broker, or NDD, where the client trades without the direct participation of the broker). Accounts are also divided according to the minimum deposit and the type of remuneration that the broker receives.

Typically, the larger the deposit, the less you pay. The broker can take his money in the form of a spread or a fixed amount from each transaction.

Gaining access to start trading

After choosing a broker and account type for trading, you can register. By filling out the form and submitting the application, we get access to your personal account. Usually, the first thing the broker suggests is to top up the deposit and authorize the account. After this, you can freely deposit and withdraw a day directly from your bank card.

Download and install special software

Everything you need for trading is on the broker's website. The broker can provide standard software based on MT4/MT5 or its own programs such as ROX or Takion. The former are usually free and are used more often. The latter are available in the form of demos or stripped-down versions, but you have to pay for the full version.

Analysis of information about exchange rate dynamics

Most traders start with a thorough analysis of a company, looking at publicly available information, including earnings reports, financial statements and SEC filings, as well as external research reports from professional analysts.

Much of this is provided by the broker itself, along with the latest company news and risk ratings. To begin with, it is better to avoid assets that are too volatile and work slowly, choosing one or two stocks and investing the amount of money we are willing to lose.

Generating a request to open a deal

Don’t despair if all the trading numbers and charts with their meaningless phrases don’t make sense to you. Refer to this cheat sheet:

- Ask Price: The price a buyer is willing to give for one share.

- Offer price: the price at which the issuer is willing to part with the stock.

- Spread: The difference between the highest bid price and the lowest bid price.

- Market order. A request to buy or sell shares at the best available price.

Trading for growth is a Buy order or a green arrow up. Short (margin) trading is a Sell order or a red arrow. Thanks to the efforts of the broker, we do not see how it all works. We simply indicate in the window the amount of the asset to be purchased (usually traded in lots) and select the direction.

Fixing the financial result of the transaction

It is not always possible to control price movements in the terminal constantly until the transaction is closed.

Therefore, control tools were created:

- Stop loss. It turns on as soon as losses reach a certain number of price points and closes the deal. There is also such a variation as a floating stop loss. It follows the price up, and after it goes down, it starts counting points.

- There is also a take profit. He closes the deal and takes the money when the trader's desired number of price points has been passed. Simply put, we risk not fully squeezing the trend in order to get a bird in the hand instead of a pie in the sky. This is often more practical in trading.

How much does a trader earn?

This is perhaps the most frequently asked question after a person finds out who a trader is.

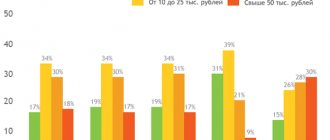

The difference between this profession and all others is that a trader’s earnings are not limited in any way . It is customary to calculate it as a percentage, which gives rise to several opportunities to evaluate the results. You can have a small capital, but at the same time triple it every month. Or you can have a huge account, but trade slowly and get a modest profit. So everything is quite conditional. We will look at the most typical options, which fit 99% of all traders:

- Negative yield . This is almost inevitable for all beginners. There is not a single successful trader who would not lose a deposit at the beginning of his journey. And not even one deposit. This is usually associated with psychology and loss aversion, passion. A gambling person cannot become a professional trader.

- Profitability within 2-4% per month . Calm trading without unnecessary risks, this is exactly how most experienced traders work, who have moved away from the idea of getting rich quickly and simply work for their own pleasure. The lack of nerves completely compensates for the not very high profit margin. We remember that if the deposit is $100,000, then the income will be significant in monetary terms.

- Profitability of 10-15% . These are either traders who are prone to relatively small risks, or those who focus on certain indicators; for some reason, it is 10% that attracts the attention of many and they strive to approach exactly this mark.

- 50-500%. Yes, there are such unique ones. True, with such trading there can be no question of money management rules at all. Usually these are real lucky people or such professionals that they catch all the movements on a variety of instruments. You need to spend dozens of years working on charts to achieve such mastery.

You can count on a small percentage per month, but it definitely significantly exceeds everything that conservative investment methods offer. But it also takes time. Since there are no ideal and very profitable options, everyone must decide for themselves how to act. Trading provides unlimited earning opportunities.

Trading Strategies

The analysis process and trading style largely depend on the chosen instrument and the time period on which we trade. I will focus on the main trading strategies.

Scalping

Scalping is one of the fastest and most aggressive strategies. It is based on the use of various price impulses caused by surges in supply and demand. Scalpers try to hold their positions for a short period, thereby reducing the risks associated with fundamental factors.

In addition, the scalper does not try to trade in large volumes. He trades small amounts, but often (for example, closing up to a dozen or more orders within one hour). Since the profit margin per trade is low, scalpers tend to the most liquid markets to increase the frequency of trades.

Intraday

Day trading is perhaps the most popular style of trading. This is a method of buying and selling securities within one day. There is only one condition - positions cannot be transferred to the next day (this is a potential risk of a price reversal against us if something important happens between sessions and can affect the quotes).

More often than not, traders start with intraday trading, although (if you want my opinion) this style still works better for experienced traders. For beginners, it is better to take longer graphs.

Medium term

Medium-term trading - buying and selling shares for a period from several weeks to several months. The result will take longer, but the risks are much lower. In assets with average volatility, it is easy to identify a stable trend and make money on it. There is only one downside to this style: sometimes you have to wait a long time for suitable trading signals.

Long term

Long-term trading is actually investing. This style involves fundamental analysis and identifying major ebbs and flows. On average, traders follow a trend from several months to a year or more.

Prop trading

In this case, a financial company or commercial bank trades on the exchange. Only she invests directly in the market, and does not live on commissions from clients, trading on their behalf.

A prop trading company employs professional traders who trade not their own money, but the money of this company. Or the trader can make a basic security deposit, and the prop firm increases it. In this case, the trader’s loss is limited to the amount of the deposit.

Technical

Technical trading is primarily about focusing on price charts and technical indicators. The main indicators are price patterns, price convergence and divergence, as well as market volumes and overbought/oversold levels.

Fundamental

Fundamentalists ignore ripples and waves. If they see in their forecast that the market or company will be successful in 20 years, they will buy these shares, even if they are worthless ballast for the next 10 years.

Traders analyze corporate events, management efficiency, personnel appointments, general market conditions, the prospects of the industry as such, and other similar data.

Swing trading

Swing traders hold their positions from several days to several weeks. In this time window, you can catch a more or less stable trend, and the frequency of trading signals remains at a more or less acceptable level. The risk is still quite high, but you can earn more often in order to reinvest more efficiently.

Moment

Momentum trading is a technique in which traders buy and sell in response to price impulses. The pulse can be timed for hours, days, weeks or months.

The first step that traders usually take is to determine the direction of the trend they want to trade in, and then, using an economic calendar or a classic momentum indicator, set an entry point.

What is trading for?

Earnings. This is an activity as a result of which you can increase your financial resources many times over. Of course, you need to act skillfully - fools with money will not survive there.

There are two options :

- trade on your own

- give money to management

Money to manage is essentially the same risks - which specialist will get. After all, a trader is, essentially, an ordinary trader . The one that buys cheaper and sells more expensive. But since trading is trading on the stock exchange, without a direct agreement with the client, the task becomes seriously more complicated. The trader conducts a constant analysis of the cost of a product, which today, according to forecasts, should sell well, finds a way to invest as little money as possible in this product and, by the end of a given period, receive the maximum amount of profit after the sale.

However, for those who are at least a little familiar with exchanges, it has long been no secret that trading is a job that is increasingly penetrating the network and, like a computer, will soon be in every home. After all, access to the exchange is provided via the Internet, which allows any experienced Internet user to try himself in this area. Previously, access to a closed trading network could be obtained through brokers , who, in turn, opened it only upon request and, naturally, for good money. Of course, financial trading was something unattainable for normal people. Brokers played mostly for high stakes or were useless (profitability went negative if the profit from a long-term trade was less than $15 thousand). This is how the need for traders arose. They invest their savings in the goods they deem necessary. The trader himself determines the time period in which he will trade and takes his profit himself. There is no intermediation other than the exchange itself.

How to make money from trading: expert advice

Various guides and advice on trading are a dime a dozen. Here are my TOP 5 simple tips for investing in the stock market:

- Leave your emotions at the door.

- Choose companies, not stocks.

- Plan in advance how to trade during calm periods and during periods of peak volatility.

- Always prefer positions with minimal risk - leave high risks for now for experienced traders

- Avoid excessive trading - trade only according to plan, even if the planets suddenly align and it’s unrealistic.

What are the advantages of working as a trader - 3 positive points

Let's consider the positive aspects of trading - what will give you income from speculation when you achieve high professionalism in it.

To become a trader, you will have to devote a lot of time to the market, so don’t expect quick victories and success.

Moment 1. Independence

There is no boss who dictates working conditions, nothing prevents you from moving from one city to another or even traveling between states. A laptop and an Internet connection are all you need to make money.

If you are not a particularly sociable person, trading will generally be your favorite activity, because you will not have to contact anyone other than the financial market. And he is taciturn.

Point 2. Unlimited income

Profit depends on the size of the deposit and the aggressiveness of the trading strategy. The more money you have in your account, the larger amounts you begin to risk on each trade, without increasing the percentage of risk in relation to the total amount.

The more aggressive the strategy, the higher the risk, but the greater the profitability.

How to understand whether you are trading aggressively or not? A conservative approach involves speculation with a risk of no more than 2% in each transaction . Profit per month – from 7 to 20% .

At the Alpari office in my city, the teacher said this: if your profit is less than 50% per month, you trade without the risk of losing your deposit. If 50% or more , you risk losing all your money.

Point 3. No need for compulsory education

Many professional traders are self-taught. Their main profession is far from economics. I especially often encounter speculators who have received a medical education and have even worked in the healthcare industry for many years.

There are also many who have studied specifically. Most of the traders and analysts speaking on the RBC TV channel have higher education diplomas in one or another economic sector.

These are the main advantages of stock trading. If we add a fly in the ointment and talk about the disadvantages, instability will come to the fore. Even players with many years of experience sometimes have negative returns.

Well, one more moment...

Opinion

Once the modern theologian Alexei Ilyich Osipov was asked: “Trading on the currency exchange is a sin?” He replied: “In my opinion (in my personal opinion, the Patriarch may say differently), this is a sin. Because this work does not create any material values.”

In general, it’s correct that trading is partly parasitic.

Real reviews

There are so many people, so many opinions about trading. And if we learn trading, then it is better to listen to those who ate the dog at it.

You don’t have to be a rocket scientist to trade,” the Oracle of Omaha said about the stock market. Warren Buffett emphasized that investing is not an intellectual game in which a guy with 160 IQ beats a guy with 130 IQ. And that's the beauty of it."

He also owns another phrase that I really like: “Rule number one: don’t lose money. Rule number two: don't forget rule number one."

A certain George Soros (maybe you've heard of this) said this about the stock market:

“Markets are constantly in a state of uncertainty and money is created by investing in the obvious and betting on the unexpected.”

And the master of the American stock market, Benjamin Graham, said that on the stock exchange, an intelligent investor sells to optimists and buys from pessimists.

Internet trading: what is its peculiarity?

Nowadays, many exchanges have convenient access via the World Wide Web. This provides more effective monitoring of prices and trade turnover, opens up new opportunities for novice traders and simply enormous ones for professionals. Since the main tool of a trader is technical and fundamental analysis, the Internet is the best environment for timely collection of information and prompt forecasting of charts necessary for accurately determining goods and prices. Analysis, in turn, is needed for the most profitable investment and subsequent extraction of maximum profit. And only online trading is an opportunity to make a profit remotely and in the shortest possible time.

For example, if Europe tomorrow introduces sanctions on the import of agricultural products into Russia, then there will be a shortage of this product in Russia. What does this mean? The fact is that if a trader immediately invests in the agricultural sector, prices in which have not yet had time to soar, then tomorrow, when they have already risen, he will receive his profit. What needed to be done? Follow the news, turn on logic, have free funds and react quickly on the stock exchange. That’s all the work, and Internet trading is a universal tool, because it was on the Internet that effective trading became possible, the complex procedures of which so frightened early brokers before its existence online.

How to choose a trader to invest in - 6 practical tips

Almost every major brokerage firm operates a PAMM account service. Its principle is that we choose a successful trader, transfer money to him, then divide the profit from trading.

To prevent traders from draining investors' capital, they are required to invest their own funds. The ideal ratio of own and invested capital is 50 to 50. If a speculator loses a million rubles, then it turns out that he loses 500,000 client money and 500,000 of his own.

Therefore, the amount of money owned by a trader is an important indicator of reliability. A number of other recommendations for selection are presented below.

Tip 1. Analyze traders' ratings

If you go to the Alpari PAMM accounts page, you will find a great variety of traders there. Analyze the rating and choose the most suitable option.

Please note that aggressive speculators are usually at the top; they earn a lot, but risk their entire deposit. It is advisable to choose conservative managers.

The accounts in the screenshot above do not suit us.

Tip 2. Give preference to experienced traders

Sometimes even amateurs demonstrate high profitability within a few days. But then they still lose money. To make the right choice, be sure to consider trading time and total profitability.

Tip 3. Study the trader’s trading strategy

To study strategies and understand the difference between scalping and medium-term trading, you need basic knowledge about the market. Do not invest real money until you have completed the training. Otherwise, you will not be able to distinguish a good manager from a loser.

The profit graph shows the effectiveness of the strategy. The ideal is the most flat ascending line of profitability.

This option is no good.

Tip 4. Check the availability of the trader’s guarantee capital

Said above. It is important not only the availability of guarantee capital, but also the size of its share in relation to the capital of investors.

Normal brokers always provide information about the trader’s investments. If it is not there, look for another broker.

Tip 5. Choose traders in companies that are members of NAUFOR

The National Association of Stock Market Participants closely monitors the work of brokerage firms. If you are planning to invest in a trader of a particular broker, pay attention to NAUFOR’s assessments.

On the company’s website there is an entry dated August 26, 2015 about joining NAUFOR - it’s not for nothing that we consider investing using its example.

Tip 6. Sign an agreement with several brokers

No one has canceled diversification. Transferring your money to several traders will protect your money if some of them lose their entrusted capital.

But the bankruptcy of the broker through whom traders work will still put your money in great danger. Therefore, it is necessary to distribute investments not only between individual traders, but also between brokerage firms.

Trader - who is it and what does he do?

Trader translated from English is “trader”. The essence of the profession in one translation. As soon as they are not called: speculators and gamblers, resellers and intermediaries. This confusion is due to ignorance of the specifics of the profession. Yes, and myths about fabulous and, most importantly, lightning-fast income add fog.

In fact, this is a financial specialist who buys and sells assets, making money on the difference in price. We are talking about trading on a financial exchange.

Traders work with a variety of assets (or financial instruments):

- Currency;

- Cryptocurrency;

- Precious metals (and non-precious);

- Stock;

- Bonds;

- Futures;

- Options;

The popularity of the trading profession is growing exponentially. About 25 years ago, no one even thought that it was possible to trade on the financial exchange without leaving home. But with the development of the Internet and the popularization of remote Internet professions, there are more and more people wanting to learn trading every day.

And it is not always possible to figure out what is true and what is not.

So what skills and character traits should a future trader have?