What is fuel and lubricants

Fuel and lubricants is an abbreviation for fuels and lubricants. They include: gasoline, kerosene, diesel, engine oils, antifreeze, etc. They represent all products made from oil.

It is important to consider that such products are used primarily in the industrial sector, which means they are purchased exclusively by specialized companies.

What is the basis document for writing off fuel and lubricants?

The act of writing off fuel and lubricants is a primary balance sheet document containing information from the main documents of receipt and consumption of fuels and lubricants.

The purpose of the document in solving a whole list of assigned tasks:

- Putting order in accounting documentation. Here you will learn how to write off accounts payable with an expired statute of limitations;

- Appropriate reflection of information in financial documentation;

- Reducing the possibility of erroneous data in financial statements;

- Justification of costs for the acquisition of fixed assets, assets and other things.

Important: this paper is related to strict reporting documentation, as it is the basis for checking various write-offs of fuel and lubricants.

This kind of documentation is under the constant control of the Federal Tax Service, since it is often used for various types of fraud, so the indication of any erroneous data in it arouses suspicion and additional checks.

The direct purpose of the act is to control fuel consumption within the enterprise.

How fuel and lubricants are accounted for and written off at an enterprise - see this video:

By whom, when is the document drawn up and signed?

The ideal option for generating such a document is monthly. Participating in its formation:

- Chief Accountant. In what order the job description of the chief accountant is drawn up - find out in the article at the link;

- Driver of the vehicle;

- Specialist responsible for compliance and development of regulations.

Important: a document is legally significant if it contains the signatures of all persons involved in its preparation.

What is fuel and lubricants and what is the procedure for writing it off

The following are related to fuels and lubricants:

- Diesel fuel;

- Petrol;

- Natural gas;

- Other fuels;

- Engine oil;

- Various types of lubricants.

Fuel and lubricants are written off mainly using 2 main standards for carrying out this process:

- Based on the actual consumption of material, taking into account official sources of confirmation of the amount of gasoline in the tanks;

- In accordance with the standards developed at the enterprise, plus comparing them with legally established standards, taking into account all the features - the make of the car, its wear, the amount of mileage.

Important: in order to write off a certain item of fuel consumption, an economic justification for such a write-off is necessary for the tax authorities.

Also, to write off fuel and lubricants, the following documentation is taken as a basis:

- Accounting statement;

- Waybill (for example, waybill for a passenger car according to Form 3);

- A receipt or invoice for the purchase of fuel.

Details of the act for writing off fuel and lubricants.

The procedure for writing off fuel

To write off excess fuel you must:

- Form a commission - the basis for this may be an inspection of the vehicle;

- A reconciliation is carried out with the waybill - which is the basis for the calculation;

- A write-off act is generated in the appropriate format. Here you will learn how to correctly draw up an act of write-off of fixed assets in the OS-3 form;

- An order for write-off is drawn up, also in compliance with the law.

Wherein:

- To draw up an order, the signature of the chief accountant and the executive body of the organization is required;

- The composition of the commission must be no less than 2 persons, one of whom is the chairman;

Important: the order and act are drawn up in compliance with the law, otherwise this will be a reason for questions from the Federal Tax Service.

- Basic consumption rates and list of transport

To draw up the correct standards for fuel consumption, you should make a list of transport at the enterprise, this could be:

- Trucks, cars, buses;

- Cranes on truck and crawler chassis;

- ICE loaders;

- Tractors, graders;

- Autonomous generators – gas, diesel, gasoline;

- Heating devices whose operation is carried out on the basis of filling with various types of fuel;

- Lawn mowers, chainsaws and other technical devices.

In this case, it is possible to use the basic standards established by specialists at the enterprise, taking into account the characteristics and type of transport:

- For cars and trucks, the basic rate is based on mileage;

- For equipment that performs heavy work, the basic rate is taken from the calculation of the work performed;

- For autonomous electric generators, depending on the amount of electricity generated;

- For heating devices - on the amount of generated thermal energy.

Write-off procedure

Write-offs also vary depending on the type of accounting: accounting or tax (see table 1).

| Accounting type | Description |

| Accounting | It uses a count of 10 and in some cases a special sub-count of 10-3. Debit is fully responsible for receipts, and credit is fully responsible for write-offs. In accordance with these algorithms, the fuel and lubricants that were used are calculated, and the resulting value is multiplied by the cost of the unit. |

| Tax | In the case of tax accounting, everything is different. The first thing that needs to be determined is the classification of fuel and lubricants as expenses - material or other. They fall under the first class if they are used for technological needs; the second applies to the case when it is used for official transport. Now regarding the need to standardize expenses for tax accounting. The legislation does not directly answer this question, as a result of which a generally accepted practice has developed: if the standards for fuel and lubricants are established personally by the organization, and they are exceeded by it, then the tax office does not recognize them as expenses. This makes it possible to additionally charge income tax. Judicial practice demonstrates that the court supports the inspection in such matters. |

Video about accounting for fuel and lubricants in the program:

Who is involved in drawing up the Act?

As for the employee who is directly involved in entering information into the document, he is appointed by the manager. As a rule, this responsibility is assigned to the chief accountant. An employee of the logistics department, who is responsible for all expenses of the company, can also draw up the act. In large corporations, specially appointed employees are engaged in drawing up write-off acts. Here the manager has the right to choose who exactly to entrust this procedure to.

Commission approval

The procedure for writing off fuel and lubricants, like any other property that is owned by an enterprise, begins with the creation of a special commission. There must be more than two people here. As a rule, the inspection group consists of employees who are appointed by the director using the appropriate order. Typically, the audit team includes representatives from various departments. There must also be an employee who is financially responsible for the property being written off. It is highly desirable that the chairman of the commission be appointed as the head.

Members of the inspection team, having received all the necessary documents, perform a reconciliation of expenses. Here they use certain norms that are enshrined in the organization’s charter. You also need to know that these standards may vary for different modes of transport. Naturally, they are all approved separately. If necessary, the commission carries out control visits in order to determine the real costs of fuel and lubricants as accurately as possible.

It is worth noting that if it is necessary to write off materials in a small company that is classified as a small business, there is no urgent need to create a commission. In this case, the director of the company has the right to independently register the write-off by filling out the appropriate act.

There are certain standards for each car. Based on them, responsible persons can calculate how much fuel is consumed at a specific distance. These standards were drawn up taking into account the quality of roads, climatic conditions, type of vehicle and other conditions under which operation was carried out. Typically, these norms are used in budgetary institutions and organizations that are taxpayers under the general system. In addition, managers have the right to make adjustments to the standards within certain limits. In such situations, decreasing or increasing coefficients are used. Adjustments are necessary to obtain truthful information in non-standard situations. For example, with frequent stops included in the route, more fuel is consumed. The same situation is observed in the cold season.

( Video : “Write-off of gasoline using fuel cards”)

Rules for drawing up an act for writing off fuel and lubricants in 2020

As already mentioned, there is no unified form for drawing up this act. Many people refuse to draw up a document in free form, as it is inconvenient. Companies prefer to develop their own templates for these purposes. Computer typing is usually used for filling out, although information can also be entered by hand. In this case, you need to pay attention to the readability of the text. You should try to make your handwriting as legible as possible.

Do not forget that entering false information can lead to serious problems. Troubles can arise not only for the employee who draws up the document, but also for the responsible persons. If the act contains false information, supervisory authorities may punish the head of the organization. The process of filling out the document can be considered step by step:

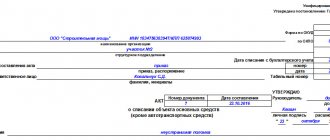

- In the corner of the page there should be a statement indicating that the write-off is carried out with the consent of the manager. The details of the manager, company name, and date of compilation are also indicated here.

- The title of the document is written in the center, which should briefly convey its essence.

- The members of the inspection committee are listed below. If its chairman is appointed as a director, this must also be reflected in the document. Not only the names of the commission members are indicated, but also their positions.

- It is noted in connection with which fuels and lubricants are written off, for example, “Operation of a ZIL vehicle.” The period of use of the equipment is also noted here; accordingly, write-off will occur during this period. Not only the make of the vehicle is indicated, but also its license plate number.

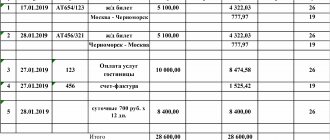

Next, complete information about the materials being written off is entered. Of course, you can describe each of the consumables on a new line, but for greater convenience it is recommended to use a table for this. The first column indicates consumables that are written off. The following columns are intended to display the rate and actual consumption of fuel and lubricants, their cost. A note is also made as to whether there were savings or none. In addition, information about the distance traveled by the vehicle is entered into the table. There are situations in which some lines are left blank. You need to know that you cannot leave them empty in order to avoid illegally entering any additional information. It is recommended to put dashes here.

( Video : “Fuel decommissioning: is it beyond the norm? / Fuel decommissioning: according to the norm or without?”)

Below the table you need to write the reason for the expense. As a rule, when writing off fuel and lubricants, it is indicated that these are the needs of the enterprise. It was said above that a waybill must be attached to the act. It also needs to be mentioned. So, all attached documents are entered under the table. If there are several of them, they are entered according to the date of issue. Their numbers are also indicated.

The final stage of registration of the act is the signing of autographs by members of the commission. Do not forget that if at least one signature is missing, this document will be considered invalid. In addition to the inspectors, the driver must also sign with a transcript. This way he will confirm that all the information specified in the document is correct.

Write-off act: what rules for drawing up exist

There is no standard form in which the act must be filled out. As a result, this opens up two options for companies: either use a free form each time, which is extremely inconvenient, or create their own template, which will be approved within the framework of the internal Charter.

One way or another, regardless of the form, the act should always indicate:

full name of the organization- calendar date of compilation

- driver information

- car information: number and make

- goods used: name, quantity and cost

As one of the rules of business practice, it is recommended to indicate all data on fuels and lubricants in the form of a table.

Special act for writing off gasoline

Rationale

Write-off of fuel and lubricants is a business transaction that must be taken into account by drawing up a special primary document. It’s more convenient to formalize it in the form of a fuel and lubricants write-off report, collecting in it data from all waybills for the month (a sample is on this page above). It is impossible to take into account spent fuel only on the basis of vouchers - they do not stipulate the content of a business transaction, such as writing off expenses (clause 4, part 2, article 9 of the Federal Law of December 6, 2011 No. 402-FZ).

By the way, the write-off act helps some companies do without waybills at all (resolution of the Moscow District Federal Antimonopoly Service dated September 18, 2013 in case No. A40-19421/13-99-60). The judges noted that organizations whose main activities are not directly related to road transport are not required to issue waybills.

After all, Order No. 152 of the Ministry of Transport of Russia dated September 18, 2008 (it approved the mandatory details and procedure for filling out vouchers) is intended exclusively for transport companies. All other organizations have the right to take into account gasoline costs based on fuel write-off acts. The act can be drawn up in any form. But it must include the date of preparation of the document and all the details of the primary document (see sample below).

List the composition of the commission (it will be approved by the head by order) with a breakdown of positions and full name. Signatures of commission members will also be required. As a rule, this commission includes an accountant, a driver, and a garage manager. Indicate the reason for writing off the materials (for example, for use for production purposes or for business trips of the director). Then you should list the name of the materials being written off, their quantity and amount. It is convenient to present this information in the form of a table.

The act must contain the signature of the financially responsible person. The document is approved by the manager with his signature. It is necessary to indicate his position, decipher the signature and put the date of approval of the act. Fix the form in the accounting policy.

| Dt | CT | Amount, rub. | Operation (document) |

| 26 | 10 | 800 | Write-off of gasoline (accounting statement-calculation) |

Option 2. Accounting for fuel and lubricants when writing off according to standards

Mileage marks are made in the PL: at the beginning of the voyage - 2,500 km, at the end - 2,550 km. This means that 50 km have been covered.

Qн= 0.01 × Hs × S × (1 0.01 × D),

where: Qн — standard fuel consumption, l;

Hs - basic fuel consumption rate (l/100 km);

S—vehicle mileage, km;

D is the correction factor (its values are given in Appendix 2 to Order No. AM-23-r).

According to the table in sub. 7.1 by car make we find Hs. It is equal to 8 liters.

According to Appendix 2, coefficient D = 10% (for the Moscow region).

We calculate gasoline consumption: 0.01 × 8 × 50 × (1 0.01 × 10) = 4.4 l

Amount to be written off: 4.4 l × 40 rub. = 176 rub.

| Dt | CT | Amount, rub. | Operation (document) |

| 26 | 10 | 176 | Write-off of gasoline (accounting statement-calculation) |

Since the car is used as a company car, the cost of accounting for fuel and lubricants in the tax accounting of fuel and lubricants will be recognized as other expenses. The amount of expenses will be equal to the amounts recorded in the accounting records.

Main purpose of the act

The main purpose of the document is to calculate the expenses incurred by the company. This is necessary for accounting and tax purposes. It is thanks to them that costs for fuel and lubricants can be excluded from profits, while simultaneously reducing the tax base.

An important element in the preparation of this document is the presence of a waybill, which is issued to drivers. Thus, it allows for daily monitoring of how much material was spent per day.

Using waybills

In the forms of sheets that are approved by the 78th Resolution, there are columns intended for entering information about how much fuel the driver actually used during the trip: the balance before its start, consumption when completing the travel task indicated in the document, the balance upon the return of the vehicle to garage.

Those who use vouchers based on Order No. 152 are not required to include data on the movement of fuel and lubricants. The actual amount of fuel consumed is the difference between the speedometer readings at the time of departure and return, that is, based on the mileage.

If the PL form is developed at the enterprise, the standard volume of materials consumed is also calculated using the methodology established by the Ministry of Transport at the disposal of AM-23-r. They set standards for fuel consumption by vehicles of various brands and models.

That is, for write-offs for inclusion in primary accounting as expenses of the period for which the report is compiled, two methods are used to calculate the amount of fuel used:

- actual;

- normative.

The exception is the use of specialized equipment (chainsaws, walk-behind tractors, etc.) for refueling. In this case, instead of a waybill, a write-off act is drawn up.

Design rules

The requirements for the design rules are the same as for the content - there are none. It can be compiled on any medium, be it an organization form or an A4 sheet. The handwritten or printed nature of the document also does not matter. The affixing of stamps on documents has been abolished since 2020 - now legal entities are not burdened with this need.

The only rule that must be complied with is the original signatures of the management or those responsible for the write-off.

Video with write-off rules:

Acceptance of a document - is it necessary to collect a commission?

Write-off in accordance with the law and established standards of business custom is possible only when the act is approved by the commission. It is formed within the company and includes at least two people - approved by the commission. Her appointment must necessarily be marked by the issuance of a separate order.

According to the composition of participants: it includes employees from several departments, and a separate leadership is assigned to each department.

The main tasks of the commission:

- reconciliation of the presented information with the actual

- visits with drivers to check expenses

- collection of waybills

It is also worth noting the fact that the commission can be created and is indeed needed exclusively within large enterprises. In small organizations it will not make sense.

How to avoid mistakes when drafting

To avoid errors that may be made during compilation, it is worth considering a number of rules:

- always use a prepared template: to do this, the company must put it into circulation through an internal decree

- always check actual data and established standards

- take into account external factors in the calculation that could or may affect the volumes

One way or another, an important rule that will always help to avoid mistakes is qualified personnel.

Registration of a certificate of fuel consumption

Let's look at an example of compiling a certificate:

Now that all the nuances taking into account fuels and lubricants have been considered, it will not be difficult to devote time to optimizing costs. In addition, you should always remember about changing legislation, which establishes the procedure for generating reports, and adapt documents to it.

Top

Write your question in the form below