In the course of business activities of any business entity, the need periodically arises to provide contractors or clients with the information necessary for the execution of contracts. Individual entrepreneurs are no exception to this situation. Experienced businessmen know well which details will be in demand by their counterparties, but newcomers to business may experience some difficulties at the initial stage of work. However, determining the necessary details for an individual entrepreneur is quite simple, just as it is not at all difficult to use them correctly.

What is included in the details of an individual entrepreneur

Individual entrepreneur details are needed to characterize a person as an economic entity. If the agreement in the future develops from oral to written, it becomes necessary to request the basic details. They are required to make any payments when executing agreements.

Example details

In the case of an individual entrepreneur, the standard list will include the following documents:

- Email;

- telephone number by which communication is established;

- bank details of individual entrepreneurs, samples of which can be easily obtained from the bank itself;

- OKPO;

- OKVED;

- OGRNIP;

- TIN;

- legal address, if officially registered. May look different;

- Full name of the entrepreneur.

If necessary, the list can be expanded by the individual entrepreneur himself or his partners. Strict regulation in this regard is not introduced. Mandatory information that is always indicated includes:

- OGRNIP;

- legal address;

- TIN;

- FULL NAME.

All other information is allowed to be omitted unless serious demands are made on it. Not every private entrepreneur even agrees to open a bank account. The actual address of the individual entrepreneur is also not considered mandatory. The legal address is always indicated. The actual one can be adjusted depending on the counterparty and the purposes of the document being drawn up. This sometimes changes the BIC of the individual entrepreneur; anyone can figure out how to find out the information.

Example. Suppliers are interested in the place of shipment, but customers are more interested in where the office for selling products is located. There will be no mandatory information regarding the power of attorney issued to certain individuals representing the interests of business owners.

For your information! If the amount of payments with partners does not exceed 100 thousand rubles.

within the framework of one contract, legislation allows individual entrepreneurs to work without bank accounts. In principle, they are not assigned a checkpoint upon registration, but at the same time there is cash discipline, the requirements of which often contradict each other. In practice, opening an account is often a more convenient solution. Any type of agreement is easier to process.

Individual entrepreneur bank details

Banking details are usually separated into a separate subtype of details. They are intended to ensure that the other party to the contract makes the necessary payment as payment for goods, work or services. The information contained in the bank details is transferred to the payment order and the buyer's bank makes a payment using them.

Another purpose of the details is the ability to seize the accounts of an unscrupulous counterparty, seller or performer who, having taken the funds, did not fulfill the obligations under the contract. In this case, the interested party can apply in court for interim measures in the form of seizure of a bank account. When the current account number and the bank in which such an account is opened are known to the applicant, then, accordingly, this procedure is simplified.

Bank details include:

- current account number (name “account” and 20 digits of the number),

- the bank where the account is opened,

- location of the bank,

- bank correspondent account number (name “c/s” and 20 digits of the number),

- bank identification number (BIC) containing nine characters,

- TIN and KPP of the bank (optional).

Please note: The last three digits of the BIC and the correspondent account must match. If this is not the case, then there is an error in the details provided. In addition, in banking institutions the correctness of the current account number is checked automatically by the value of the control key present in the number.

It is worth considering that an entrepreneur is not required to open a bank account. Therefore, the implementation of its activities can occur without opening a bank account. This usually happens in cases where the scale of the entrepreneur’s activities is insignificant, and the entrepreneur himself works alone without hiring employees. All financial transactions take place using cash, and even taxes are paid through the bank's cash desk. In such a situation, the entrepreneur naturally does not indicate information about the bank account in his details.

What details should the contract contain?

When concluding any type of agreement, the document includes the following information:

- OGRNIP;

- TIN should not change throughout the entire work;

- legal address, drawing up documents for it is important;

- Full name of the entrepreneur.

How to find out the registration number in the FSS using the individual entrepreneur’s TIN - where you can get it

Other information can be indicated or omitted at the request of the business owner and the other party involved in the transaction.

Note! Often without contact information it is difficult to establish a quick connection for exchanging messages. This can also be important some time after the contract is concluded. Therefore, it is important to save all account details for individual entrepreneurs.

What is considered non-mandatory information?

Let's consider what details of an individual entrepreneur are indicated in the contract at personal discretion or at the request of the counterparty.

We recommend you study! Follow the link:

Does an individual entrepreneur need to indicate a certificate of state registration in the header of the contract?

This list includes:

- bank information (the bank account number may not be indicated);

- OKPO code;

- OKATO code.

In 2020, some optional information may also include:

- a power of attorney issued by the business owner to the representative. If this detail is indicated, it includes the power of attorney number, date of execution, full name of the representative;

- the actual address is the place of registration of the entrepreneur. For contracts, it is not necessary to indicate this address, since during deliveries it is not entirely convenient to accept goods at the businessman’s place of residence. It is best to indicate the address of a warehouse or store where it will be convenient to do this;

- A contact telephone number is often considered optional information, but if it is missing, then it is impossible to contact the entrepreneur, which causes a number of problems in the process of carrying out work.

The information listed is indicated in full or in part. This will depend on the specific situation and the type of documentation at which they will be present. For example, if contracts for the supply of goods or an employment contract are drawn up, then the details must be indicated in full. For payment documents, it will be enough to indicate only the details of the banking institution.

The same information helps to identify the entrepreneur when paying state duties or income taxes. It is for this reason that all information about the entrepreneur is present on the receipts.

Where can I find them?

Find out OKTMO by TIN for individual entrepreneurs - is it possible and where to look

Tax authorities continue to actively work to make the scope of any business interaction more transparent. Every day there are more and more specialized services that help with checking the integrity of partners. One of the possibilities is to obtain information from the Unified State Register of Individual Entrepreneurs and the Unified State Register of Legal Entities. Here are a couple of addresses that you can contact to solve the problem:

- Egrul.nalog.ru;

- Service.nalog.ru/vyp/. The site will also help those who have a lease.

Sample details in an agreement between an organization and an individual

The list of data for the company will not change. The organization indicates information by which it can be identified and contacts can be maintained with it. A similar set of information will be required from an individual entrepreneur:

- Name;

- TIN;

- registration address;

- Contact details;

- information about the account and the bank in which it is opened, if payment for goods, services, or work is expected.

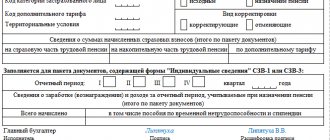

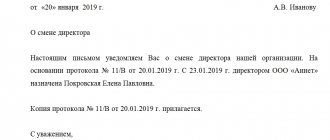

The picture below demonstrates how the last section of the contract between an LLC and an individual entrepreneur is most often drawn up.

If one of the parties is an individual who does not have the status of an individual entrepreneur, then the contract will contain data identifying a specific citizen. In particular, they write down information from an identity document. Most often, this is passport data, including information not only about the passport itself, but also about registration and place of temporary registration (if registration does not coincide with the place of residence).

Additionally, the individual’s TIN and SNILS can be registered, if both numbers are available. Numbers will be needed, first of all, when concluding an employment contract or a work contract. Employers need these identifiers mainly for reporting to tax authorities and the Pension Fund.

When signing cooperation agreements, organizations are also asked to provide bank card information for transferring payments (salaries). Such information can be compared with bank details, which are specified in the contracts of individual entrepreneurs and organizations.

For a template for clarifying the information in an agreement between a company and a citizen who is not an individual entrepreneur, see below. The sample demonstrates how the final part of an employment agreement can be drawn up.

Taking into account the norms of regional legislation and national customs, the name may include other elements and components or exclude those provided for above (for example, patronymic). For proper execution of the contract, it is enough to have information about the name and surname of the counterparty.

Please note that the absence of an obligation to indicate the details of an identity document in the contract does not relieve an individual from the obligation to present a passport to the counterparty in order to establish the identity’s compliance with the information specified in the agreement. Indicating passport data in the contract avoids possible confusion if the full name matches.

To communicate with a counterparty, including sending various types of notifications and proposals, information about the citizen’s postal address is required. In addition, to identify an individual, the contract may indicate his TIN.

Ivanov Ivan Ivanovich

Series 9543 passport No. 123121,

issued by the department of the Federal Migration Service of Russia in Moscow on March 12, 2012, division code - 123-123

Registration address: 101000, Moscow, st. Sidorova, house 1, apartment 1

account: 12312454125123, opened at Sberbank of Russia PJSC

Organizations and individual entrepreneurs entering into agreements with individuals, within the framework of which it is intended to carry out transactions with funds or property on a large scale, in accordance with Art. 7 of the Law “On Counteracting Legalization...” dated 08/07/2001 No. 115-FZ are required to identify citizens.

The following information is subject to verification:

- FULL NAME.;

- citizenship;

- Date of Birth;

- details of a passport or other identity document;

- address of place of residence or stay;

- TIN.

Let us note that providing information about an individual to the second party, as well as including them in the contract as details, will make it possible to unambiguously establish the identity of the counterparty and prevent the possibility of the agreement being declared invalid through the court.

Tips for using Federal Tax Service services

You don't even need to register in advance to access the information. To check the details you will need to enter the initial data in the appropriate form:

- TIN;

- FULL NAME. If only such personal information is known, verification usually takes longer. To save time, you need to additionally enter the region where the bank account is approximately opened.

Note! The result of the request is brief information regarding the individual entrepreneur and changes in its status, if any. More detailed information is contained in a pdf file, which is also provided to the user.

“Providing information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs” is a service for those who are more interested in receiving documents with official legal force. In this case, you cannot do without registration, but all the necessary tips are provided on the main page. After registration, sending a request for an extract takes a couple of minutes, the registration is standard.

As a result, the extract is certified with an electronic digital signature.

Important! Only from the entrepreneur can you obtain information regarding the status of the current account. No special services have yet been developed specifically for this action.

Special cards about individual entrepreneurs with information for future and current partners are also issued. In the future, the card can be used to process various business information.

Briefly about the main thing

IP details are a condensed form of providing personal data about the individual entrepreneur in question.

At the stage of establishing relationships between the parties, an agreement (and not only) is signed, reflecting basic information about authorized persons. In addition to their role in legal manipulations, the details are used when processing tax payments and contributions.

A special place in the peculiar “hierarchy” is occupied by the banking variety. The information reflected in them makes it possible to make a non-cash payment option for the final product or service.

To carry out a transaction, it is not enough to provide a twenty-digit current account number; it is important to provide complete information about the financial structure.

It is important to know! The main information contained in the details simplifies the process of studying a potential partner and the professional activities of the person in question.

General details of individual entrepreneurs are discussed in detail in this video: