Revenue concept

What is revenue

Revenue is the money that was received as a result of the sale of goods or services of the company.

The main purpose of receiving revenue is to cover all the costs of the enterprise, namely the funds that were used for the functioning and conduct of the company’s business activities. If the revenue is received within the required period, then the company is ensured continuity of operation and funds are always in circulation.

The proceeds are used to pay employees, thanks to it it is possible to compensate for the depreciation of fixed assets and pay all the company’s bills. Also, the money received from the sale of goods is used to purchase materials and parts for the production of a new batch of goods.

What is gross revenue from product sales

So, revenue from the sale of products (goods and services) represents the amount of income received during the sale of goods or provision of services, which is important - without subtracting the amount of the cost of production. That is, revenue is measured in the prices of final products at which the goods were sold.

It follows that a large amount of revenue will not always indicate high project efficiency and high profitability. But despite this, revenue is the main indicator that allows you to get a general idea of the company. In order to better understand the essence of this concept, let’s look at the difference between revenue and profit. But first, let's present a formula for calculating revenue .

Company turnover, trade turnover and revenue

Confusion often arises in the concepts of “turnover” and “turnover”. We have already found out that turnover is the money that an enterprise has; this term refers to economics. Trade turnover is a concept from the field of accounting; it denotes the amount of funds received from the sale of goods or services.

Trade turnover should be distinguished from revenue - in addition to direct income from trade, it may include other types of income and income from the sale of property. Thus, revenue can be either greater than turnover or equal to it.

Photo: Unsplash

It also matters whether you calculate revenue on an accrual or cash basis. As mentioned earlier, in the first case, income or expenses are taken into account in the period to which they relate, in the second - when they are directly paid. If the sale is made in installments or deferred payment, then, in the case of cash settlement, revenue and turnover may also differ.

Types of revenue

Revenue is the basis for determining the financial results of an enterprise; it is the largest cash flow that a company receives. Revenue may vary depending on the type of activity of the enterprise. Activities include:

- The main one is the activity that is prescribed in the Charter and corresponds to the specialization of the enterprise.

- Investment is an activity that allows an enterprise to develop or capitalize the income received. We are talking about the purchase or sale of securities (stocks, bonds, bills).

- Credit is the activity of an enterprise that is associated with obtaining additional financial resources in order to expand the enterprise (use of short- and long-term loans).

Thus, going beyond the types of activities, there are the following types of revenue:

Revenue growth

- Revenue from core activities

- Revenue from investment activities

- Revenue from the use of loans

The concept of revenue also includes the following types:

- Sales revenue is the result of the company’s economic activities

- Profit from pawnshop services is money received as a result of storing certain property that was received as collateral

- Gross revenue – income received from the sale of goods or services

- Foreign exchange earnings are funds received from the sale of goods abroad, that is, their export

- Marginal income is the additional income that an enterprise receives by reducing fixed costs

- Hidden profit – funds that are not shown in accounting records

- Average revenue – profit from the sale of goods divided by the number of products sold

What is revenue in a business?

The revenue of a commercial enterprise is usually understood as the amount (or a list of property in value terms) that it received as a result of sales or provision of services within a certain period of time. Based on the difference between revenue and expenses (and sometimes only on the basis of the value of the first indicator), the amount of taxes that the company must pay to the state is determined. The exception is the taxation mechanism, in which the corresponding cash receipts to the enterprise account are not taken into account: such schemes include, for example, the UTII system provided for by Russian legislation.

It is worth noting that, in accordance with some financial analysis methods, revenue as an economically significant indicator can be reduced by taxes (in this case it is called “net revenue”).

A common approach according to which revenue is classified is:

- on cash receipts from the main type of commercial activity of the company;

- on proceeds from investments (for example, in the form of proceeds from the sale of securities);

- on revenue generated as a result of changes in exchange rates (for example, when exporting goods).

All three types of financial income are combined into total revenue. But, as a rule, business efficiency is assessed based on the income that is associated with the main activities of the enterprise.

A company's revenue can be calculated using two methods: cash and accrual. In the first case, it is recorded upon the fact that the enterprise accepts funds into its current account or cash register. In the second, it is calculated when the buyer of goods or consumer of services has obligations confirmed by contract or law related to payment for delivered products or services.

The main condition for receiving revenue from the main activity, regardless of the specific method of its calculation, is the sale of goods or services. Let's consider its specifics in more detail.

Factors influencing revenue and methods for calculating it

Since each enterprise independently decides how to use the proceeds received, there are also factors that directly affect the amount of revenue received:

- Quantity of products produced

- Impact on revenue

- Price

To calculate the revenue received by the enterprise, the following methods are used:

- Cash - cash receipts are calculated based on the cash receipt order and documents that indicate the accounting entry of cash through the cash register. In this case, cash, which is confirmed by cash documents, is considered revenue.

- For shipment - revenue is the number of documents that confirm products that have not yet been paid for. Thus, revenue can be calculated based on wholesale trade, because immediate payment for shipped goods may not occur. In this case, the document that evidences the sale of products is the consignment note.

main sources

To date, revenue can be received from:

- main activity - selling products, performing work or providing services. So, for a store it will be the sale of goods, for a law office it will be the provision of legal services;

- investment activity , which includes work with company shares, securities and even enterprise assets that are not involved in trade turnover. For example, a large corporation may sell part of its shares in order to receive investment;

- financial activity of the enterprise . For example, the owner of an enterprise invests money in a particular project with the aim of making a profit, puts money on deposit in a bank, and so on.

If you add up the funds received in these three areas, you can ultimately get the total profit of the enterprise.

For example, profit from core activities is 920,789 rubles per month, investment activities - 34,000 rubles, financial activities - 265,000, therefore, the total profit for the month will be: 920,789 + 34,000 + 265,000 = 1,219,789 rubles.

In accounting, this concept refers to funds received from the main activities of the company, while the remaining funds are usually called “other income” or “interest income.”

What is the difference between revenue and profit

As they say, revenue and profit are always somewhere nearby. But despite this, they are fundamentally different concepts. The fact is that revenue includes both profit and cost. In order to understand this, let's look at how the unit price is formed.

Price = Cost (Expenses) + Trade margin.

The trade margin in this formula is the source of profit. Profit is formed by multiplying the trade margin by the number of products sold.

Revenue is formed by multiplying the price by the quantity of products sold. Based on this, you can modify the form of profit as follows:

Profit = Revenue - Cost amount = (Price - Cost) x Number of goods sold.

In this case, the profit formula may also vary depending on the availability of data for calculation. In the simplest case, profit is the difference between revenue and cost. But, if we remember that the cost includes only costs associated with production (raw materials, water supply and electricity for production purposes, wages of production personnel), then you can see that the formula looks slightly unrealistic. In most cases, the sale of products is also accompanied by the need to incur commercial and administrative expenses, advertising and promotion costs, rental of premises and other types of costs, which are also deducted from the cost of products sold when determining the amount of profit.

Calculation example

The store sells washing machines for 5,000 rubles. 100 washing machines were sold within a month. The cost of household appliances is multiplied by the number of units sold. That is, the store’s revenue will be 500,000 rubles per month.

The amount of revenue must be indicated in accounting. This indicator is recorded in stanza 2110 “Revenue”.

IMPORTANT! Revenue is subject to tax, and therefore tax deductions must be subtracted from this value.

What is the difference between revenue and income

The relationship between revenue and income is in many ways similar to the profit example discussed above. Let us note once again that the amount of revenue does not mean that the amount of income will be similar. Thus, income is a more “purified” concept.

Let's look at this with an example.

You produced 100 units of products and then sold them at a price of 50 rubles per unit. Then the revenue amounted to 5,000 rubles. But this does not mean that the income is the same amount.

Firstly, the unit cost of production was 15 rubles per unit. And for the entire sales volume this is 15 x 100 = 1500 rubles.

Secondly, during the sale of products the following types of expenses were also incurred (in total):

- Management costs = 150 rubles;

- Commercial expenses = 350 rubles.

Thus, we subtract the above-mentioned areas of costs from Revenue and find that the profit is:

Profit = Revenue - Cost - Selling expenses - Administrative expenses = 5000 - 1500 - 150 - 350 = 3000 rubles.

But, again, a profit of 3,000 rubles does not mean that the profitability of the enterprise was 3,000 rubles. For example, an entrepreneur also had temporarily free funds and decided to invest them in another project on the condition of receiving a percentage of the profit from this project. During the investment, he received interest income in the amount of 1000 rubles.

Then the total income of the enterprise from commercial and investment activities amounted to 4,000 rubles (profit + interest income). Thus, income is a concept interrelated with revenue , and to some extent more “narrow”. But more “broad” than profit. Although in many cases these values are identical.

In general, the total income of an enterprise in accordance with international financial reporting standards is formed from three areas of activity:

- Commercial;

- Financial;

- Investment.

Is one concept different from another in some way or not?

So what is the difference between all these definitions? Below is a comparative table of differences, an entrepreneurial chain of related concepts for successfully running a business:

| Revenue | Turnover | Trade turnover |

|

|

|

Revenue is a central concept when running small, medium and large businesses. Its goal is the same everywhere:

- control of all enterprise income;

- analysis of demand for the products or services provided;

- formation of a holistic picture of the stability of the enterprise.

Based on it, the manufacturer indicates the pricing policy and the volume of goods produced. Its main difference in comparison with turnover and turnover is that not a single component is subtracted from the taken revenue indicator. It is designed for business development and correct operation without supply disruptions.

How to calculate sales revenue

Gross revenue can be calculated based on the financial statements of the enterprise. To do this, it is necessary to subtract the cost of the goods sold from the revenue received. But it must be remembered that there may be slight deviations in the financial statements.

You can calculate the revenue received from the sale of products in this way: multiply the quantity of products sold by the unit price of the product. For this, the formula is used:

B = K*C,

where K is the quantity of products sold, C is the price per unit of goods.

Revenue functions

The main function of revenue is to compensate for expenses, funds that were spent on the purchase of goods or their production. Financial resources received from the activities of the enterprise are transferred to accounts. Timely translations are ensured by:

- stability of the company's activities;

- continuity of turnover of goods.

Typically, proceeds are spent on the following purposes:

- payment for services of suppliers;

- acquisition of products or materials for their production;

- payment of salaries to employees;

- payment of taxes;

- expansion of the enterprise.

That is, funds are usually invested in developing the business and maintaining its viability.

Delayed revenue receipts lead to negative effects:

- enterprise losses;

- decrease in profit indicators;

- payment of fines accrued for failure to meet deadlines for loan payments;

- violation of contractual obligations to business partners;

- inability to pay all bills.

The head of the organization must ensure uninterrupted receipt of revenue. Without regular and timely receipt of funds, a business cannot exist.

the costs of paying for revenue collection services by the bank's collection reflected in accounting ?

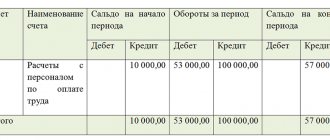

Revenue indicator in accounting (financial) statements

Let's talk about the balance sheet. For small businesses, it consists of Form No. 1 “Balance Sheet” and Form No. 2 “Profit and Loss Statement.”

The balance sheet contains indicators of the enterprise’s property – “Asset” and sources of formation of property – “Liability”. The balance sheet shows the summary (balance) as of the reporting date. Form 2 describes the movement (turnover) during this period.

When registering an enterprise, in addition to the main type of activity (according to OKVED), you indicated other, additional types.

Then your revenue will be collected from:

- Revenue from the main activity;

- Proceeds from investments;

- Revenues from financial activities.

And in the accounting (financial) statements (including form 2), revenue from the main type of activity and other income (income from other, additional types of commercial activities) will be taken into account separately.

Example. A retail chain company leased a temporarily empty store premises and provided a cash loan to its employee. The main type of activity in this example will be retail trade (revenue from the sale of goods will go to revenue column f.2). Payment for the rental of premises and interest under the loan agreement will be revenue from additional types of activities (in accounting and Form No. 2 - this will be additional income).

Finally, let’s go through Form 2 to understand the relationship between the revenue indicator and other financial parameters:

- Sales revenue (net) - cost of goods sold = gross profit;

- Gross profit - selling expenses = profit (loss) from sales;

- Profit from sales -(+) operating and non-operating expenses (income) = profit (loss) before tax;

- Profit before tax - income tax (if you are on the main tax system) = profit (loss) from ordinary activities;

- Profit from ordinary activities - (+) extraordinary expenses (income) = retained earnings (uncovered loss).

So, now we understand for sure that equating the concepts of revenue, income and profit is completely wrong. However, revenue has a significant impact on these two metrics.

Table

| Revenue | Implementation |

| What do they have in common? | |

| The successful sale of a product or service is the main condition for the generation of revenue from the company’s main activity | |

| What is the difference between them? | |

| Represents the amount of money received by an organization as a result of commercial activities | Represents the direction of the company’s commercial activity, which is associated with the sale of goods and services |

| Not always related to the sale of goods and services (maybe, for example, investment) | Almost always associated with the sale of goods and services |

Company revenue and profit. The principle of profit maximization

Profit and revenue are two different concepts, but they constantly accompany the activities of any company. Their meanings are quite close to each other, as they are often used in the same context. But there is a difference between them.

Company revenue is cash receipts from the sale of goods, services or work on the market. It represents the result of the activities of the entire company over a certain period of time. In other words, revenue is called the company's gross income.

Revenue is reflected in accounting under account 90 “Revenue” and is used to determine the amount of tax paid by companies operating under a simplified tax regime.

Revenue is the most general indicator of a company's performance. However, not everything can be considered revenue. As a rule, these are revenues from the main activity. When drawing up a balance sheet, revenue is taken into account minus indirect taxes, in particular VAT, which is actually withheld from the buyer.