OKVED rolled metal

Taxpayers who use the simplified tax system are, as a general rule, exempt from the obligations of VAT payers.

The participation of “simplifiers” in intermediary transactions (when the seller and buyer apply a common tax regime) obliges them to issue invoices with the allocation of indirect tax. The order of their registration in this case has some peculiarities. In addition, “simplified” intermediaries have the obligation to maintain a tax register - a journal of invoices. All mandatory non-tax payments in our country must be inventoried. This proposal was made by the Accounts Chamber of the Russian Federation. Now, at the federal level alone, there are several hundred fees that are not taxes, but businesses and citizens have no right to refuse to pay them. The rates for some payments have long since lost relevance; many have no economic justification. The result of the inventory should be a single register - ineffective and duplicating positions should not be included there.

OKVED for retail trade in construction materials, equipment (the so-called

Retail sales of various construction products do not allow their transformation, however, as with wholesale trade, you can package the product, sort it according to any criteria, repackage, mix, etc. Entrepreneurs can make these sales in the following ways:

- deliver goods to shops, department stores, trays, tents, etc. or open your own retail outlet of any type;

- sell via mail;

- create an online store;

- place advertisements on various trading resources in the media and on the Internet;

- use courier delivery of goods;

- organize a consumer cooperative;

- trade in specialized markets;

- through auctions;

- using sales agents.

Polymer sand paving slabs

This is an absolute innovation in the building materials market. And yet, it has already managed to create an excellent reputation for itself, becoming a full-fledged replacement for classic cement paving slabs. To master the production of this type of paving slabs, you will need the following equipment for the production of alternative polymer-sand paving slabs:

- mixer for preparing the initial mixture;

- Press forms;

- professional press;

- melting and heating unit.

The niche for the production of polymer sand tiles has not yet been filled. Therefore, you can always be among the first to produce polymer-sand paving slabs.

The streets of even provincial towns are decorated with paving slabs. Therefore, there is no need to be afraid of a lack of customers. Business will always flourish. Your task is to establish the production of high-quality products, in which the correctly selected equipment for the production of paving slabs will help you. And think about the still free niche for the production of polymer sand tiles. Good luck!

OKVED - Wholesale trade of metals and ores - decoding

Natural resources in our country have always attracted many people. Since past centuries, the gold rush has forced people to leave their homes, abandon their families and go to the gold mines. But everything comes to an end, and those days are gone, now minerals are extracted in a more civilized way, and the main thing is that it is all legalized .

For many types, activities in Russia, in addition to the usual procedure for registering an individual entrepreneur or LLC, OJSC, require additional permission. Mining of natural resources is one of the attractive ideas for small and medium-sized businesses. And many beginners decide to start this activity, despite the fact that this niche has already been filled.

OKVED table for retail trade in 2020

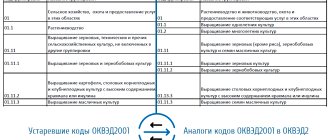

OKVED-2 came into force only in 2020 and is valid until today. A code assigned to a title associated with the revision number included in it. Before this, there were codes 1 and 1.1, which are still valid until this time.

In 2020, the latest amendment was made to the OKVED code. Thanks to this, editions 1 and 1.1 will be canceled this year, and the appearance of the second edition is completely different from the previous ones, which introduces some difficulties in the preparation of documentation among entrepreneurs.

What equipment to choose for making paving slabs?

The Russian market is simply overflowing with various offers from numerous manufacturers. There will be no problems with choosing a machine. But what equipment should you give preference to?

There are especially many offers from Chinese companies. China's products stand out for their budget price, but if we talk about quality, it is far from up to par. If the machine suddenly breaks down, it will be almost impossible to find a Chinese specialist, for example, in the outback.

Therefore, when choosing imported equipment, pay attention to the following points:

- The performance of foreign equipment is sometimes significantly inferior to Russian-made models, and the price is significantly higher. So think about whether it’s worth paying extra just for the name.

- Spare parts for imported machines are always very expensive. And it is extremely difficult to find specialists who are capable of performing quality repair work. Therefore, a long downtime is practically guaranteed.

Types of polymer-sand paving slabs

What is a vibrating table?

What is a vibrating table? In essence, this is a machine for the production of paving slabs of various configurations. When purchasing it, you need to focus not only on your financial capabilities, but also on the expected production volumes. After all, you can choose a multifunctional machine that will work independently, producing finished high-quality products in a short period of time. But economy class models also have a right to exist.

Lightweight vibrating table for paving slabs

Although, when choosing the latter, you should be prepared for their obvious shortcomings. And this:

- narrow technological capabilities;

- high energy consumption;

- small output volumes;

- not very good quality;

- manual labor.

The only positive point is the low price of the equipment, and therefore a quick payback. But in reality, equipment of this class quite often fails, requiring additional investments. Don’t forget about downtime, which already threatens obvious losses.

Wholesale trade okved 2020

This group includes: - wholesale trade in iron and non-ferrous metal ores; — wholesale trade in ferrous and non-ferrous metals in primary forms; — wholesale trade in iron and non-ferrous semi-finished products, not included in other groups; - wholesale trade in gold and other precious metals This class does not include: - wholesale trade in scrap metal, see 46.77

This group includes: - wholesale trade in clothing, including sportswear; — wholesale trade in accessories such as gloves, ties and suspenders; — wholesale trade in footwear; — wholesale trade in fur products; - wholesale trade of umbrellas This class does not include: - wholesale trade of jewelry, see 46.48; - wholesale trade of leather goods, see 46.49; - wholesale of specialized sports footwear such as ski boots, see 46.49

OKVED rolled metal trade 2020

Online cash register for wholesale trade. OKVED: public catering. OKVED: maintenance and repair of motor vehicles. When registering a business in the field of wholesale sales of food and non-food products with the Federal Tax Service, the entrepreneur will be required not only to indicate the general OKVED of the main type of activity, but also to specify the activity by type of goods and the trade format in which they will be sold. What codes are used to designate trade and purchasing activities by the OKVED classifier, how to accurately determine the OKVED code taking into account the specifics of the products being sold, and which version of the directory should be used annually, we will tell you in this article.

This definition of wholesale trade is written in paragraph 2 of Article 2 of the Federal Law from the Company and entrepreneurs with the type of economic activity wholesale trade must use in their work new codes from the OKVED classifier 2 approved.

How to choose the type of activity of an individual entrepreneur according to OKVED codes

One of the OKVED codes, according to which the maximum income is expected to be received, must be selected as the main one. The main code is important when choosing the rate of insurance premiums for employee insurance in the Social Insurance Fund for injuries. The higher the risk of injury at work or occupational disease, the higher the rate of contributions established by law.

Please note that some areas of business are not available to an individual entrepreneur. For example, in order to sell strong alcohol, open a pawnshop, or engage in microfinance or insurance activities, you need to register a commercial organization (LLC or JSC).

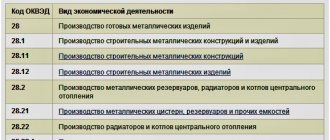

OKVED code 28 - Production of finished metal products

This group includes: - production of rivets, washers and other non-threaded products - production of threaded products: bolts, screws, nuts - production of springs: flat, plate, sheet, screw, torsion bars, springs, etc., sheets for springs

This group includes: - production of prefabricated building structures, mainly made of metal: - utility rooms on construction sites, modular elements of exhibition pavilions, etc. - production of metal load-bearing structures (frames) of buildings and structures - production of metal load-bearing structures (frames) of industrial structures and equipment (load-bearing structures of furnaces, handling equipment, etc.) - installation of building metal structures of our own production

OKVED wholesale trade in rolled metal

This type of material always sells well; at the moment, ferrous metal products are one of the top positions in the construction industry. In terms of price and quality, it simply has no competitors. For this reason, investments in metal trading, or rather products that are manufactured by cold or hot processing of this material, will be very profitable at any time.

A metal trading business will not be an exception, since this is precisely why an entrepreneur invests money and spends his energy. The main thing in this matter is to choose the most suitable field of activity for yourself, draw up a clear business plan and take into account various factors that can negatively or positively affect on further work and income generation.

Step-by-step plan for opening the production of paving slabs

Every entrepreneur can afford to open a paving slab production business with sufficient start-up capital. Its main advantage is that it does not require special licenses or permits. It is enough to register as an individual entrepreneur or LLC, and you can implement a business plan, which must include the following points:

- Rent of a suitable production workshop.

- Purchase and installation of necessary equipment. Here it is worth deciding in advance on the manufacturing technology (vibrocompression or vibration casting) of paving slabs. The cost of the equipment will depend on its choice.

- Concluding contracts for the supply of raw materials.

- Concluding agreements for the sale of products with sales representatives.

If you have a large start-up capital, a good option would be to purchase a ready-made production facility, which will save time on launching and implementing a business.

Please tell me about OKVED and the situation in general

51.52.2

Wholesale trade of metals in primary forms This class also includes: - wholesale trade of semi-finished and rolled ferrous and non-ferrous metals, not included in other groups. This class does not include: - wholesale trade of metal waste and scrap, see 51.57

- retail trade - business activity related to the trade of goods (including in cash, as well as using payment cards) on the basis of retail purchase and sale agreements (Tax Code of the Russian Federation, Article 346.27) Under a retail purchase and sale agreement, the seller carrying out entrepreneurial activity for the sale of goods at retail, undertakes to transfer to the buyer goods intended for personal, family, household or other use not related to entrepreneurial activity. (Civil Code of the Russian Federation, Art. 492) ¶

OKVED: logging 2020

Those whose activities include forestry or logging are classified by the OKVED classifier into a separate group. Let's take a closer look at the process of choosing the right codes for a given industry in order to avoid mistakes when registering your activities with the state.

How to choose OKVED – logging in 2020

When determining the current codes, you should refer to the OKVED2 classifier, officially called OK 029-2014 (NACE Rev. 2), approved. by order of Rosstandart dated January 31, 2014 No. 14-st, as amended. dated 02/20/2019. The classifier consists of sections, subsections, groups and subgroups. First, it is determined which industry and, accordingly, section the planned activity may belong to, and then more specific types of work and services are selected.

The number of selected codes is not limited. The first code indicated in the application for state registration is considered the main one, and all other OKVED codes are additional. The main code means that this activity is a priority for the individual entrepreneur or company.

The group of OKVED codes “Forestry and logging” is located in section “A” of the classifier under the general code “02”. At the same time, the forestry industry and other forestry activities are separated into a separate group 02.1, and logging is included in group 02.2. Also separately grouped are activities for the collection and procurement of non-timber and food forest resources (02.3), and the provision of services in the field of logging and forestry (02.4).

Activities in the field of forestry are carried out in natural or artificially grown forests and include: forest cultivation, incl. for firewood, activities of tree nurseries, growing forest seedlings, etc. products (code 02.10.1), other forestry activities (02.10.2).

Code 02.20 OKVED (logging and wood processing) involves: production of logs or firewood (round timber), timber for the energy industry, production of charcoal using traditional methods.

Regarding the collection of food and non-timber resources, OKVED codes for “logging” include: collection of wild mushrooms (02.30.11), berries, fruits (02.30.12), nuts (02.30.13), resin, mosses, lichens (02.30.2), medicinal plants (02.30.14), etc.

OKVED codes “Logging and forestry” in the field of auxiliary services provide for activities performed on a paid or contract basis: inventory, assessment of timber, consultations on forest management, application of fire safety measures and extinguishing forest fires, protection of forests from pests, transportation logs within forest boundaries, etc. When providing similar services in the field of forestry, code 02.40.1 is used, and in the field of logging - 02.40.2.

The sawing and further processing of timber does not apply to activities in the field of logging and forestry.

The following is a detailed table with which you can select the required OKVED logging code for 2020:

Forestry and logging - OKVED codes

02 — Forestry and logging

This grouping includes:

- production of round timber, as well as extraction and collection of wild and non-timber forest products.

In addition to timber production, forestry activities produce products that undergo little processing, such as firewood, charcoal and round timber used in unprocessed form (eg mine stands, pulpwood, etc.). Such activities can be carried out in natural or artificially planted forests.

This group does not include:

- further processing of timber, starting from sawing and technological preparation of timber, see 16

02.1 Silviculture and other forestry activities

02.10 Forestry and other forestry activities

This grouping includes:

- forest cultivation: planting, replanting, transplanting seedlings, thinning and protection of forests and cutting areas;

- growing coppice, pulpwood and timber for firewood;

- functioning of forest nurseries.

This activity can be implemented in natural or artificially planted forests.

This group does not include:

- growing Christmas trees, see 01.29;

- operation of forest nurseries, with the exception of forest trees, see 01.30;

- procurement and collection of food forest resources, non-timber forest resources and medicinal plants, see 02.30;

- production of wood chips and chipboard, see 16.10

02.10.1 Activities of tree nurseries

02.10.11 Growing planting material of forest plants (seedlings, seedlings)

02.10.19 Cultivation of other products by tree nurseries

02.10.2 Other forestry activities

02.2 Logging

02.20 Logging

This grouping includes:

- production of round timber for the timber processing industry;

- production of round timber used in unprocessed form, such as mine posts, fencing and utility posts;

- collection and production of timber for the energy industry;

- production of charcoal in the forest using traditional methods

The products obtained from this activity may be in the form of logs or firewood.

This group does not include:

- growing Christmas trees, see 01.29;

- forest cultivation: planting, replanting, transplanting seedlings, thinning and protection of forests and cutting areas, see 02.10;

- procurement and collection of food forest resources, non-timber forest resources and medicinal plants, see 02.30;

- production of wood chips and chipboard, see 16.10;

- production of charcoal by distillation of wood, see 20.14

02.3 Collection and procurement of food forest resources, non-timber forest resources and medicinal plants

02.30 Collection and procurement of food forest resources, non-timber forest resources and medicinal plants.

This grouping includes:

- collection of wild materials: mushrooms, truffles, berries, nuts, balata and other rubber-like resins, cork bark, shellac (natural varnish) and resins, balms, vegetable dye, sea grass, acorns, horse chestnut, mosses and lichens.

This group does not include:

- management of the production of any of these products (except the cultivation of cork trees), see 01;

- cultivation of mushrooms or truffles, see 01.13;

- cultivation of berries or nuts, see 01.25;

- collection of firewood, see 02.20;

- production of wood chips, see 16.10

02.30.1 Collection and procurement of food forest resources

02.30.11 Collection and preparation of wild mushrooms

02.30.12 Collection and preparation of wild fruits and berries

02.30.13 Collection and preparation of wild nuts

02.30.14 Collection of medicinal plants

02.30.2 Collection and harvesting of non-timber forest resources

02.4 Provision of forestry and logging services

02.40 Provision of services in the field of forestry and logging.

This grouping includes:

- performing a share of forestry activities on a fee or contract basis.

This group also includes:

- provision of services in the field of forestry, such as: inventory of forestry, provision of consulting services on forest management, assessment of timber, implementation of fire safety measures in forests, extinguishing fires in forests and protecting forests from pests;

- transportation of logs within the forest.

This group does not include:

- work of forest nurseries, see 02.10;

- drainage of forest lands, see 43.12;

- clearing of sites for construction, see 43.12

02.40.1 Provision of forestry services

02.40.2 Provision of logging services

OKVED for metal trade

Inside the warehouses, you will need to equip special racks and shelves on which metal, its scraps and all kinds of metal products will be stored. It is imperative to have several scales, including for trucks. You also need to purchase hand-held mechanical and power tools, protective and safety equipment for working personnel. For metal trading, industrial warehouses and personnel workplaces must be inspected by fire inspectors and the appropriate permit is issued. It is also required to conclude agreements with transport companies for the transportation of metal, with utility companies for garbage removal, solid waste, recycling of fluorescent lamps, etc.

- wholesale and retail trade (i.e. sale without transformation) of any type of goods, as well as various types of services accompanying the sale of goods. Wholesale and retail trade are the final stages of distribution of goods. This group also includes car and motorcycle repairs. Selling without transformation is usually understood as standard actions (operations) associated with trade, such as sorting, classifying, arranging goods, mixing (stirring) goods (for example, sand), bottling (with or without previous washing of bottles), packaging, separating bulk lots, repackaging into smaller lots for distribution, storage (chilled or frozen products) Wholesale is the resale (without conversion) of new or used goods to retailers, sales to legal entities such as manufacturing, commercial, institutional or professional users, or resale to other wholesalers, or using agents or brokers to buy or sell goods

Vlya metal rolling purchase of a sandblasting machine

Thus, the preliminary mixing of paints carried out by an organization for subsequent retail trade of this product for cash through a retail facility, subject to the conditions listed above, is subject to taxation in the form of a single tax on imputed income for business activities in the field of retail trade.

We recommend reading: One-time payment for maternity capital in 2020

The taxation system in the form of a single tax on imputed income is applied by decision of a constituent entity of the Russian Federation in relation, in particular, to retail trade carried out through shops and pavilions with a sales floor area for each trade organization of no more than 150 square meters. m, tents, trays and other objects of trade organization, including those that do not have a stationary retail space (clause 4, clause 2, article 346.26 of the Code).

OKVED for Rolled Metal Trade

- wholesale trade in machine tools for metalworking industries (drills, cutters, cutters, etc.);

- wholesale trade in abrasive materials;

- wholesale trade in special tools and technological equipment, manufactured according to customer drawings. Thank you.

Good afternoon, Igor. 51.15.2 “Activities of agents in the wholesale trade of hardware, knives and other household metal products.” In the latter case, if you are engaged in the manufacture of special tools and technological equipment before sale, then code 28.62 “Production of tools” must also be indicated in the application.

Selecting OKVED codes for wholesale trade

When choosing an OKVED code, you need to take into account that in addition to the general direction, the classification of entrepreneurial activity implies detail indicating the specifics. Below we will describe in more detail the individual subparagraphs and the mechanism for determining the specialization of the OKVED code for wholesale trade.

- Class 46 is a common OKVED code for wholesale trade for all types, including trade in batches of goods or large volumes at one’s own expense, remuneration and on a contractual basis on the foreign and domestic markets.

- Subclass 90 is part of the OKVED code for other wholesale trade. In 2020, product categories in the classifier are divided into narrow groups by subclasses. If you did not find your specialization in these groups or your activity is related to a universal assortment, you can indicate this particular subclass in the code.

Nuances of choosing OKVED for activities related to scrap metal

In order to choose the right OKVED, it is very important to know which processes performed with scrap metal relate to licensed activities:

- Procurement of scrap metal is the purchase of non-ferrous and ferrous scrap on a paid basis, both from individuals and legal entities. And you can also receive it free of charge. The procurement process also includes transportation of scrap to the place of its subsequent storage, sale and processing;

- storage means the maintenance of scrap for the purpose of its subsequent sale and processing;

- processing includes scrap sorting, selection, cutting, pressing and other similar procedures;

- Sale (or disposal) is the alienation of scrap metal, both on a paid basis and free of charge.

Why is this classification important for the OKVED search? The fact that these processes are not separate types of activities, but components of one activity, the purpose of which is to make a profit. Therefore, when determining OKVED, you should not look for all these works separately in the Classifier.

In addition, in order to correctly determine the OKVED code for accepting scrap metal , you should know that scrap metal from non-ferrous and ferrous metals only includes:

- products that have become unusable and have lost their consumer qualities;

- a manufacturing defect that cannot be corrected;

- waste obtained during the production of products from ferrous and (or) non-ferrous metals.

This characteristic is important in that it allows one to determine whether there is a need for further processing of these resources to obtain secondary raw materials or to sell them without such processing. And this, in turn, is important because these areas of working with scrap metal have different activity codes!

And one more very important point for organizing the circulation of scrap metal: the activity of processing non-ferrous and ferrous scrap has a different OKVED for each type of scrap! Therefore, when accepting scrap, you must immediately ensure that it is received separately, but taking into account the following:

- individuals can hand over non-ferrous metal scrap to collection points if it belongs to them by right of ownership, is obtained from products used in everyday life, and is included in the list of those types of non-ferrous scrap that are legally permitted to be accepted from individuals. Organizations and entrepreneurs working in this area should know this;

- Legal entities and entrepreneurs, in order to be able to freely circulate non-ferrous metal scrap, including its sale, must also have documents that clearly show the ownership of these objects. Thus, filling out documents when accepting scrap is a licensing obligation, and not just an accounting requirement! And this is stated in the relevant regulations. For example, in Decree of the Government of the Russian Federation No. 1287 dated December 12, 2012. Its paragraph 6 states that gross violations of licensed scrap handling activities include, in particular, working with scrap metal without issuing acceptance certificates for it.

Thus, activities related to the circulation of non-ferrous scrap require not only a correctly selected code, but also organization.

Wholesale trade of rolled metal okved 2020

- retail trade of a large range of goods, predominantly food, beverages or tobacco products, among which the predominant activity is: the activities of general purpose stores which, in addition to their main sales of food, beverages or tobacco products, have a number of other non-food products, such as clothing, furniture, appliances, hardware, beauty products, etc.

The permanent transfer of an employee to another position is used quite often, for example, when promoted, for medical reasons. Questions arise when an employee who wants to be transferred has a fixed-term employment contract, but is transferred to an open-ended one, or an employee works under an employment contract for an indefinite period, and now a fixed-term contract is concluded. What to do in such situations? What documents should I fill out? Let's figure it out.

OKVED for 2020 with breakdown by type of activity

An economic entity is allowed to carry out both one and several types of activities . The basic direction is the main part of the GVA of a legal entity or individual entrepreneur. Secondary group – any other area of commercial work.

The OKVED classifier, which will be used in 2020, includes 21 sections . Each of them has a direct correspondence to a specific industry. For example, this could be trading activities, catering, agriculture, construction. The sections include 99 subsections , including the names of areas of activity and their code correspondence. the following entries can be made :

Wholesale trade of okved rolled metal in Tomsk

In conjunction with the sale of rolled metal wholesale and retail, we offer a number of related services. At your request, cutting to size, galvanizing of rolled metal, as well as thermal diffusion and galvanic coating of any product are possible. These services are provided at all metal rolling bases of the company.

Ensuring an uninterrupted supply of high-quality rolled metal, wholesale trade in okved rolled metal in Tomsk and the regions, we continuously improve our pricing policy and always try to provide customers with special offers and discounts on various metal products. To buy rolled metal at a profit, check out our prices in the “Price List” section, or contact the company’s managers by phone.

OKVED: retail trade of non-food products

Retail sales of goods are carried out through retail enterprises. For their operation, a large staff is required, as well as significant areas associated with the dense display of a large number of goods in the hall and large warehouse stocks.

Products that are not intended for human consumption are called non-food products. Such goods include everything that cannot be used for food by animals or people, or everything that is unsuitable for cooking.

OKVED codes for retail and wholesale trade are not indicated - can I sell concrete without a fine?

Responsibility for providing false information to the Federal Tax Service is regulated by the Code of the Russian Federation on Administrative Offenses (CAO), paragraph 3 of Article 14.25 of which states: Failure to provide, or untimely provision, or provision of false information about a legal entity or an individual entrepreneur to the body carrying out state registration of legal entities and individual entrepreneurs, in cases where such provision is provided for by law, entails a warning or the imposition of an administrative fine on officials in the amount of fifty times the minimum wage.

If in the information submitted to the Federal Tax Service there is a discrepancy between the OKVED code and the corresponding name of the type of activity, or there is a discrepancy between the submitted data and the types of activity specified in the constituent documents, then an administrative fine of 5,000 rubles is quite possible. To rectify the situation, you should submit to the registering Federal Tax Service an application for state registration of changes made to the constituent documents of a legal entity in the form P13001 indicating information about the types of economic activities that are subject to inclusion in the Unified State Register of Legal Entities (Sheet E).”

What activities are included in group 96.03:

- Preparing the deceased for burial or cremation.

- Embalming.

- Undertaker services.

- Burial and cremation of human and animal bodies.

- Maintenance of graves and mausoleums.

- Manufacturing of memorial complexes, crypts.

- Sculptural works.

- Carving of bas-reliefs, etc.

Group 96.03 does not include the following activities:

- Provision of religious ritual services (code 94.91 is used).

- Landscaping of burial sites (code 81.30 is used).

If an entrepreneur decides to engage in a new type of activity, he needs to submit a corresponding application to the tax office to add OKVED codes. The current OKVED code must be indicated in all tax returns, calculations and reports. Also, this code, if it relates to the main activity, will be needed when determining the contribution rate for “injuries”.