OKVED codes for peasant farms (peasant farms)

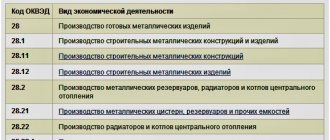

| OKVED codes (All-Russian Classifier of Types of Economic Activities) – same for LLC, individual entrepreneur, non-profit organization and any other organizational and legal form of a legal entity. The first thing you need to pay attention to is that now according to the law OKVED codes can consist of at least 4 digits. This is one of the common mistakes when filling out registration applications. For example:

The second common mistake is using an outdated OKVED code directory. In 2020, the OKVED 2 directory is in effect (introduced by Order of Rosstandart dated January 31, 2014 N 14-st) (as amended on July 17, 2019). The third important thing to pay attention to: there can only be one main type of activity , all other types will be secondary. It is better to choose the OKVED code according to which the greatest revenue is planned. And in conclusion, we recommend adding the following phrase to the charter: “In addition to the listed types of activities, the Company may carry out other types of activities not prohibited by law . This article will help you choose from the directory what type of economic activity you need. |

In order to start farming and make a profit from it, you need to register this type of business activity with the Federal Tax Service, in accordance with all the norms of Russian legislation.

A peasant farm allows an entrepreneur to grow plants and livestock and help people in an advisory manner. At the same time, the owner of all farming activities can be either an individual entrepreneur or a legal entity.

General rules for using OKVED

The process of using data from the All-Russian Classifier is associated with the following features:

1. Any business entity can change OKVED codes an unlimited number of times. There are no restrictions on the number of types of work, but registration authorities recommend not to exceed 50 items.

2. The presence of a particular code does not oblige you to engage in the activity designated by it. For example, the presence of an OKVED code for vegetable growing at a construction organization does not mean an immediate requirement to organize a vegetable garden or greenhouse. The current situation is such that enterprises are forming a large range of activities, providing in advance for additional areas of work in the future or having in mind their own subsidiary farming.

3. The description of the business direction must be as specific as possible - at least 4 digital characters.

4. The descriptions of the types of activities given in the organization’s constituent documents must coincide with the transcript from OKVED.

OKVED code for peasant farms

In order to write an application to the Federal Tax Service to register a business, you must indicate the type of OKVED, according to the classifier encoding the permitted areas of business, in this case, for peasant farms.

The OKVED code is a specific sequence of numbers, each of which indicates a type of business activity and its characteristics. This simplifies the control of the Federal Tax Service over entrepreneurs.

As a rule, when writing an application, it is best to indicate the first four digits of the type of future employment, without any clarification. This will help avoid details.

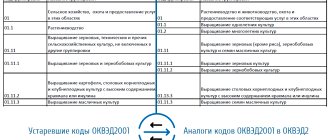

It is worth noting that a year ago a new form of classifier appeared in Russia - “OKVED-2”, containing an updated list of types of activities of entrepreneurs. Codes for peasant farms are also displayed.

The classification of activities for peasant farming is located in section “A”. According to Rosstat, this section is designated by a digital coding such as “01”. At the same time, clarifying subtypes are specified in each numerical value.

Section “A” – Agriculture, forestry, hunting, fishing and fish farming (OKVED 2).

It is important to understand that if you indicate the OKVED code incorrectly, the Federal Tax Service will issue a fine for non-compliance.

The various types of entrepreneurial activities in the field of agriculture presented in the classifier can be divided into 3 groups: crop farming, livestock farming, forestry and fishing.

All OKVED 2020 codes with breakdown by type of activity

To decide on a code, first select the section that matches your field of activity. For example, section C “Manufacturing” is suitable for clothing and paper factories, and for courier factories. Next, determine the required class (two-digit code). And find a suitable type of activity in it. The OKVED classifier consists of 21 sections. Each section corresponds to one industry: trade, catering, agriculture, construction, etc. Sections include 99 subsections. They contain the names of activities and their codes in the format. The OKVED 2020 code with decoding looks like this:

Crop production

The plant growing group contains a large number of codes that are related to the cultivation of various types of plants. Therefore, if you plan to grow crops, then one of the presented subgroups of OKVED (crop production) is suitable for you:

- OKVED code 01 – Plant and animal husbandry, hunting and the provision of related services in these areas.

- OKVED code 01.10 – Growing annual crops.

This is suitable for those who breed crops with a short life cycle.

- OKVED code 01.11 - Growing grains (except rice), leguminous crops and oilseeds.

- OKVED code 01.12 - Rice cultivation.

- OKVED code 01.13 - Growing vegetables, melons, root and tuber crops, mushrooms and truffles.

- OKVED code 01.14 - Growing sugar cane.

- OKVED code 01.15 - Growing tobacco and shag.

- OKVED code 01.16 - Growing fiber spinning crops.

- OKVED code 01.19 - Growing other annual crops.

- OKVED code 01.20 – Growing perennial crops.

- OKVED code 01.21 – Growing grapes.

- OKVED code 01.22 – Growing tropical and subtropical crops.

- OKVED code 01.23 – Growing citrus fruits.

- OKVED code 01.24 – Growing pome and stone fruit crops.

- OKVED code 01.25 – Growing other fruitful trees, shrubs and nuts.

- OKVED code 01.26 – Growing oilseeds.

- OKVED code 01.27 – Growing crops for the production of beverages.

- OKVED code 01.28 – Growing spices, aromatic, essential oil and medicinal crops.

- OKVED code 01.29 – Growing other perennial crops.

All this is suitable for farmers who breed crops with a long life cycle.

- OKVED code 01.30 – Growing seedlings.

The same code is suitable for those who breed seedlings.

- OKVED code 01.50 – Mixed agriculture.

- OKVED code 01.60 – Support activities in the field of production of agricultural crops and post-harvest processing of agricultural products.

- OKVED code 01.61 – Provision of services in the field of crop production.

That is, harvesting crops, pruning trees, etc.

- OKVED code 01.63 – Agricultural activities after harvest.

This includes work on collecting fruits, grains with the provision of storage space, as well as separation by variety and conducting various studies on seeds.

- OKVED code 01.64 – Seed treatment for planting.

You can contact us to register an LLC or individual entrepreneur and then our lawyer will select your OKVED documents. Consultation is free!

Classifier for peasant farm representatives

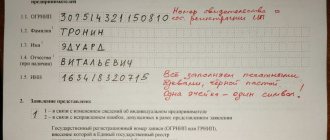

If you are planning to start farming for the purpose of making a profit, then you need to register your business officially, in accordance with legal regulations.

Peasant farms allow you to carry out activities for raising livestock, various plant crops, as well as provide consultations and other assistance to the population. Both legal entities and legal entities can register this form of business.

When opening a peasant farm, you will need to indicate the types of OKVED in your tax application. This is a special classifier that encodes all permitted types of activities.

A sequence of 6 digits reflects the direction of the business and is reflected in tax reporting. The introduction of a classifier is associated with the simplification of control over taxpayers, as well as with the accelerated entry of information: it is enough just to indicate a few numbers, and not to rewrite long phrases indicating the type of activity.

You have the right to choose several codes or one main one. When registering a business, you can only write down the first 4 digits from OKVED. The more numbers in the classifier, the more detailed the direction of the company’s work is described.

In 2020, a new form of classifier appeared, called “OKVED-2“. It contains an updated list of activities. The changes occurred in connection with new directions for business development in the country.

The years 2017-2019 did not introduce any innovations to the current OKVED, and therefore KFK representatives can use the OKVED-2 classifier to select their field of activity.

In the new classifier, types of activities for peasant farms are in section “A”. Rosstat assigned a digital coding to this section - “01”. Each numerical designation has several subtypes with values from 1 to 9.

The correct choice of OKVED will save you from further problems. If you specify a classifier that is not related to your activity, you may earn a fine.

All forms of activity available to peasant farms can be divided into three areas:

- Plant growing;

- Livestock;

- Other activities.

Next, we will analyze which OKVED codes relate to each of the listed sections.

Codes for those involved in plant growing

The classifier contains a large number of codes related to crop production. Numerical designations reflect the classification of vegetables, fruits, mushrooms, grains, etc. You can select from the classifier the cultivation, harvesting or primary processing of the crop.

If your main activity is related to the cultivation of plant crops, then you have the right to choose one of the OKVED groups:

- 01.1 – for those who deal with crops with a short life cycle (annual);

- 01.2 – for farmers growing plants with a long life cycle (perennial);

- 01.3 – suitable for those who deal with seedlings.

Decoding OKVED for annual plants includes the following areas of activity:

- from 01.11.1 to 01.11.19 – suitable for those who are going to grow plants for grain production;

- 01.11.2 – for growing grain legumes;

- 01.11.3 to 01.11.39 – when growing crops for subsequent production of vegetable oil;

- 01.12 – for those who grow rice crops;

- from 01.13.1 to 01.14 – growing all kinds of vegetables, mushrooms, as well as cane to obtain sugar;

- 01.15 – removal of tobacco with shag;

- from 01.16.1 to 01.16.9 – cultivation of various spinning plants;

- from 01.19.1 to 01.19.9 – for breeding various flowering plants and their seeds.

For activities related to the cultivation of perennial crops, it is necessary to select OKVED from the following:

- from 01.21 to 01.26 – for growing fruits (including exotic ones), nuts and berries;

- from 01.27 to 01.28 – for growing all types of tea and coffee trees, spices and plants with medicinal properties.

OKVED for livestock farming

The activity of raising animals to obtain further profit must be reflected in official documents for the tax authorities. Here you will also need to indicate the OKVED codes that will appear in your line of business.

If the main activity is related to livestock farming, then the following codes are offered for the choice of entrepreneurs:

- from 01.41.1 to 01.41.29 – breeding of animals for the purpose of production and sale of dairy products;

- from 01.42.1 to 01.42.12 – breeding of animals for further sale of meat products;

- from 01.43.1 to 01.43.3 – include the breeding of horses of any breed, mules, donkeys and other artiodactyls, as well as the production of milk from these animals;

- from 01.44 to 01.46.2 – breeding of animals such as camels, sheep, goats and pigs for the purpose of further sale of dairy and meat products of these animals;

- from 01.47.1 to 01.47.3 – breeding of poultry (chickens, ducks, turkeys and others) to produce meat products and eggs;

- from 01.49.11 to 01.49.13 – breeding bees to produce honey;

- from 01.49.21 to 01.49.22 – breeding of various fur-bearing animals, including rabbits kept on the farm;

- from 01.49.32 to 01.49.32 – breeding silkworms, as well as obtaining their cocoons;

- from 01.49.41 to 01.49.44 – breeding of domestic deer breeds;

- from 01.49.5 to 01.49.9 – breeding of breeds of domestic animals and those intended for laboratory research. This also includes the removal of earthworms.

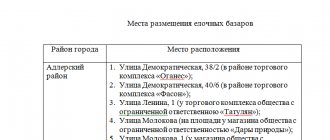

Other classifier codes for farmers

If your activity is not directly related to raising animals or growing crops, you can use other classifiers. They are suitable for those farmers who combine these two areas, or provide additional services to the population.

Other activities are designated by the following OKVED:

- from 01.61 to 01.62 - means carrying out activities in the field of crop production (harvesting, tree pruning, etc.) and livestock husbandry (transportation of livestock, vaccination, inspection, etc.);

- from 01.63 to 01.64 - include services after harvesting fruits, grain (providing storage facilities, cleaning before further processing, drying in special conditions, etc.) and processing of the resulting seeds before planting (separation by variety, various studies, etc. .);

- 01.70 – intended for hunters (catching animals and shooting them to obtain meat products for sale, leather, skins, etc.);

- from 02.1 to 02.40.2 - includes activities related to forestry (growing various trees, harvesting timber, collecting wild berries, nuts, fruits, etc.);

- from 03.1 to 03.22.9 - intended for those who are engaged in fishing or fish farming in the seas and fresh water sources.

Livestock

If you are going to make a profit from raising animals, then this must be reflected in the application to the Federal Tax Service using the following OKVED codes:

- OKVED code 01.40 – Livestock.

- OKVED code 01.41 – Breeding dairy cattle, production of raw milk.

- OKVED code 01.42 – breeding of other breeds of cattle and buffaloes, sperm production.

- OKVED code 01.43 – Breeding horses and other animals of the equine family.

- OKVED code 01.44 – Breeding camels and other animals of the camelid family.

- OKVED code 01.45 – Breeding sheep and goats.

- OKVED code 01.46 – Pig breeding.

- OKVED code 01.47 – Breeding poultry.

- OKVED code 01.49 – Breeding of other animals.

- OKVED code 01.50 – Mixed agriculture.

- OKVED code 01.62 – Provision of services in the field of livestock farming.

That is, cattle driving, vaccination, inspection, etc.

- OKVED code 01.70 – Hunting, trapping and shooting of wild animals, including the provision of services in these areas.

This includes the capture of animals and their shooting for various products: parts of the animal intended for commerce.

OKVED 2 2020 - ALL-RUSSIAN CLASSIFIER OF TYPES OF ECONOMIC ACTIVITY

VIDEO ON THE TOPIC: Science. Deep grain processing

In the process of such activities, semi-finished products are often produced that vary in value, for example, obtaining leather from slaughter or oil cake from oil production. This group describes activities that are associated with various types of food products, such as: meat, fish, fruits and vegetables, fats and oils, dairy products, flour and cereal products, animal feed and other food products.

Production can be carried out at your own expense, at the expense of third parties, as well as in a regular slaughterhouse. Some activities are considered manufacturing, for example, bakeries, confectioneries, etc. However, in cases where the processing is minimal and does not lead to actual transformation, the activity is classified as wholesale and retail trade, Section G. Preparation of food for consumption on the premises is classified in Class OKVED 56 sale of culinary products and drinks.

In the process of such activities, semi-finished products are often produced, varying in value, for example, leather from slaughter or cake flour from oil production. This group does not include:. Processing and preservation of meat and meat food products. Meat processing and preservation. This group includes:.

This group also includes:. Production of chilled meat. Production of chilled food by-products. Production of frozen meat and food by-products. Production of plucked wool, raw hides and skins of cattle, animals of the equine and deer families, sheep and goats. Production of animal fats. Production of by-products unsuitable for human consumption. Production and canning of poultry meat. Production of chilled poultry meat.

Production of frozen poultry meat. Production of poultry fats. Production of poultry by-products suitable for human consumption. Production of feathers and down. Production of products from slaughtered animals and poultry meat. Production of salted, boiled, baked, smoked, dried and other meats.

Production of sausages. Production of canned meat containing meat. Production of meat-containing semi-finished products. Production of culinary meat products. Production of other food products from meat or meat by-products.

Production of flour and pellets from meat and meat by-products unsuitable for human consumption. Providing services for heat treatment and other methods of processing meat products. Processing and canning of fish, crustaceans and molluscs.

Fish processing and canning. Processing and preservation of crustaceans and molluscs. Production of edible fishmeal or animal feed meal. Production of whole meal and instant ingredients from fish and other aquatic animals unfit for human consumption.

Activities related to the processing of seaweed, including seaweed. Production of other products from fish, crustaceans, mollusks and other aquatic invertebrates unfit for human consumption. Processing and canning of fruits and vegetables. Potato processing and canning.

Production of juice products from fruits and vegetables. Other types of processing and canning of fruits and vegetables. Processing and canning of vegetables except potatoes and mushrooms. Processing and canning of fruits and nuts. Providing services for heat treatment and other methods of preparing vegetables and fruits for canning.

Production of vegetable and animal oils and fats. Production of oils and fats. Production of unrefined animal oils and fats, their fractions. Production of unrefined vegetable oils and their fractions. Production of unrefined soybean oil and its fractions. Production of unrefined peanut oil and its fractions. Production of unrefined olive oil and its fractions.

Production of unrefined sunflower oil and its fractions. Production of unrefined cottonseed oil and its fractions.

Production of unrefined rapeseed rape and mustard oil and their fractions. Production of unrefined palm oil and its fractions. Production of unrefined coconut oil and its fractions. Production of other unrefined vegetable oils and their fractions.

Production of cotton linters. Production of cake and fine and coarse flour from seeds or fruits of oilseeds. Production of refined vegetable oils and their fractions. Production of refined soybean oil and its fractions. Production of refined peanut oil and its fractions. Production of refined olive oil and its fractions.

Production of refined sunflower oil and its fractions. Production of refined cottonseed oil and its fractions. Production of refined rapeseed, rapeseed, mustard oils and their fractions. Production of refined palm oil and its fractions.

Production of refined coconut oil and its fractions. Production of other refined vegetable oils and their fractions. Production of hydrogenated and interesterified animal and vegetable fats and oils and their fractions.

Production of vegetable waxes and degras. Production of margarine products. Production of dairy products. Production of milk except raw milk and dairy products. Production of drinking milk and drinking cream. Production of butter, ghee, butter paste, milk fat, spreads and melted cream-vegetable mixtures. Production of cheese and cheese products. Production of milk and cream in solid form. Production of other dairy products. Ice cream production.

Production of flour and cereal industry products, starch and starch-containing products. Production of flour and cereal industry products. Processed rice production. Production of flour from grain crops. Production of cereals and granules from grain crops. Production of flour mixtures and preparation of flour mixtures or dough for bread, cakes, biscuits and pancakes.

Production of starch and starch-containing products. Starch production. Production of unrefined corn oil and its fractions. Production of refined corn oil and its fractions. Production of other starch-containing products. Production of bakery and flour confectionery products. Production of bread and flour confectionery products, cakes and pastries for non-durable storage. Production of bread and non-durable bakery products.

Production of flour confectionery products, cakes and pastries for non-durable storage. Production of chilled semi-finished bakery products.

This is an invalid edition. It ceased to operate on July 11 of this year. Do not use these codes.

In the process of such activities, semi-finished products are often produced that vary in value, for example, obtaining leather from slaughter or oil cake from oil production. This group describes activities that are associated with various types of food products, such as: meat, fish, fruits and vegetables, fats and oils, dairy products, flour and cereal products, animal feed and other food products. Production can be carried out at your own expense, at the expense of third parties, as well as in a regular slaughterhouse. Some activities are considered manufacturing, for example, bakeries, confectioneries, etc. However, in cases where the processing is minimal and does not lead to actual transformation, the activity is classified as wholesale and retail trade, Section G. Preparation of food for consumption on the premises is classified in Class OKVED 56 sale of culinary products and drinks.

Forestry

If you plan to grow and breed various trees, and then harvest them for further production, then the following OKVED codes are suitable for you:

- OKVED code 02 – Forestry and logging.

- OKVED code 02.10 – Forestry and other forestry activities.

- OKVED code 02.20 – Logging.

- OKVED code 02.30 – Collection and procurement of food forest resources, non-timber forest resources and medicinal plants.

- OKVED code 02.40 – Provision of services in the field of forestry and logging.

Fishing

For those persons engaged in commercial fishing in sea and fresh water, the following OKVED codes are suitable:

- OKVED code 03 – Fishing and fish farming.

- OKVED code 03.10 – Fishing.

- OKVED code 03.11 – Marine fishing.

- OKVED code 03.12 – Freshwater fishing.

- OKVED code 03.20 – Fish farming.

- OKVED code 03.21 – Marine fish farming.

- OKVED code 03.22 – Freshwater fish farming.

Most peasant farms are complex in nature. Therefore, to cover them it is necessary to refer to OKVED codes.

The selection of codes for peasant farms according to the type of activity of the future individual entrepreneur or legal entity has some specific features, for example, legislative nuances of this type of business. Therefore, when planning your future business, it is best to approach the issue of choosing the type of peasant farm functionality carefully. Yes, farming is not easy work, but since ancient times it has been considered the most profitable. Thus, recently many individual entrepreneurs and legal entities are eager to register their personal business in the field of peasant farming.