Accounting for customer-supplied raw materials - postings to the customer

The customer who transfers customer-supplied raw materials for processing retains ownership of the raw materials, therefore, the raw materials are reflected in subaccount 10.07 “Materials transferred for processing to third parties” of account 10.

When transferring customer-supplied raw materials to a processor, only an Invoice is issued, since transfer for processing is not a sale and will not be subject to VAT.

Example

LLC "Customer" purchased construction materials in the amount of 295,000 rubles, incl. VAT 18% - 45,000 rubles, and transferred it to the furniture factory Pererabotchik LLC for the manufacture of tables. Under the terms of the contract, the manufactured tables were transferred to LLC “Customer”. The cost of work by Processor LLC is 41,300 rubles, incl. 18% - 6,300 rub.

The customer transfers customer-supplied raw materials to the processor and receives finished products from the processor, which he sells. Wherein:

- The cost of raw materials (materials) is written off as production costs upon receipt of finished products from the processor;

- The cost of processing work is included in production costs and is taken into account in the cost of finished products.

The following entries are generated in the customer’s accounting:

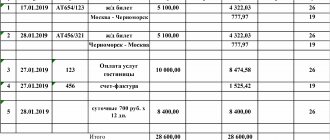

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 10.01 | 60 | 250 000 | Construction materials accepted for accounting | Consignment note TORG-12, Acceptance certificate |

| 19 | 60 | 45 000 | VAT allocated on purchased building materials | Invoice - invoice received |

| 60 | 51 | 295 000 | Payment for purchased building materials | Bank statement |

| 68 | 19 | 45 000 | VAT is accepted for deduction | Book of purchases |

| 10.07 | 10.01 | 250 000 | Transfer of building materials for recycling | Invoice for the release of materials to the M-15 side |

| 20 | 60 | 35 000 | Write-off of processing costs | Receipt from processing (Invoice for transfer of finished products to storage locations MX-18 |

| 19 | 60 | 6 300 | VAT allocated for processing | |

| 20 | 10.07 | 250 000 | The cost of building materials has been written off | |

| 43 | 20 | 285 000 | Finished products accepted for accounting | |

| 60 | 51 | 41 300 | Payment for processing work | Bank statement |

| 68 | 19 | 6 300 | VAT is accepted for deduction | Book of purchases |

The cost of finished products is equal to the cost of materials plus all costs associated with processing (cost of work, transportation costs, travel expenses, etc.).

Reflection of transactions on accounting accounts

Here are the main accounting entries that are used to reflect business transactions under DS.

Accounting for the performer:

| Business transaction | Debit | Credit |

| Receiving advance payment under the contract | 50 (51) | 62.02 |

| Charge VAT on the amount received | 76 (AB) | 68.02 |

| Capitalization of DS | 003 | — |

| Transfer of raw materials for processing | — | 003 |

| Reflection of product output and formation of cost | 20.02 | 20.01 |

| Write-off of consumed raw materials, return of DS to the supplier | — | 003 |

| Closing cost into sales expenses | 90.02 | 20.02 |

| Revenue | 62.01 | 90.01 |

| Offset of prepayment | 62.02 | 62.01 |

| VAT on sales | 90.03 | 68.02 |

| VAT deduction on previously received advance payment | 68.02 | 76 (AB) |

| Payment for services from the customer | 51 | 62.01 |

Postings from the owner of raw materials:

| Business transactions | Debit | Credit |

| Transfer of prepayment | 62.01 | 50 (51) |

| VAT deduction from advance payment issued | 68.02 | 76 (BA) |

| Transfer of goods and materials for processing | 10.07 | 10.01 |

| DS spent on production of GP was written off | 20.01 | 10.07 |

| Reflection of the cost of processing services | 20.01 | 60.01 |

| Input VAT to be deducted | 19 | 60.01 |

| Other costs for the release of GP | 20.01 | 10, 02, 70, 69, etc. |

| Finished products | 43 | 20.01 |

Accounting for customer-supplied raw materials - postings to the processor

Let's look at the same example now from the perspective of a processor:

The furniture factory Pererabotchik LLC received from Customer LLC raw materials in the amount of 250,000 rubles. for making tables. According to the terms of the contract, the cost of work is 41,300 rubles, incl. 18% - 6,300 rub.

Receipt of materials to the warehouse is formalized by receipt order M-4 with a note that the materials are capitalized on tolling terms.

For the processor, transactions with customer-supplied raw materials are reflected in off-balance sheet account 003 “Materials accepted for processing” without double entry.

The following entries are generated in the processor's accounting records:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 003.01 | 250 000 | The cost of building materials accepted for processing is reflected | Purchase Invoice | |

| 003.02 | 003.01 | 250 000 | Transfer of building materials to production | Requirement-invoice (M-11) |

| 20 | 70 — 69 | 50 000 | Costs for processing building materials are taken into account | Sales of processing services (Service Provision Act) |

| 62 | 90.01 | 41 300 | The cost of processing work is taken into account according to the terms of the contract | |

| 90.02 | 68.02 | 6 300 | VAT on the cost of work performed | |

| 90.02 | 20 | 50 000 | Write-off of actual processing costs | |

| 003 | 250 000 | Write-off of the cost of building materials upon transfer of finished products | ||

| 51 | 62 | 41 300 | Payment for the cost of processing work performed | Bank statement |

If, under the terms of the processing agreement, the generated waste remains with the processor, then the following entries are generated:

- By crediting account 003 for the amount of the cost of customer-supplied raw materials with simultaneous acceptance for accounting into account 10.01;

- Record the amount of waste at market prices Dt 10.06 Kt 98.02.

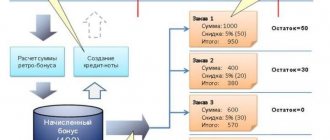

Display of processing company services

In the process of using customer-supplied raw materials and performing various works, the processor incurs its own costs, which include the price of its own inventory, depreciation, staff salaries and other expenses. These costs are subject to VAT and are recorded in the debit and credit of certain accounts. The customer's raw materials used are not included in the costs.

Accounting for materials or raw materials received from the customer-vendor is carried out in 1C 8.3 on the basis of the following documents:

- “Receipt order” - a special document about the receipt of services and inventory items, which displays the receipt of raw materials from the customer-vendor.

- “Requirements-invoice” document, which reflects the fact of transfer of raw materials to the customer-supplier for processing, etc.

- A document on the provision of services is drawn up in the form of an Act, which displays the entire process of processing and use of customer-supplied raw materials to fulfill the order.

- “Consignment note” - a document confirming the return of products to the customer indicating information about the return of unused raw materials.

Next, to obtain the value of actual costs, it is necessary to calculate depreciation of equipment, wages to employees and close the month.

Contract for processing of raw materials supplied by customers

When providing services, the customer and the processor enter into an agreement for the processing of customer-supplied raw materials. When concluding a contract, the customer and processor are guided by the provisions of: Chapter 37 “Contracting” of the Civil Code of the Russian Federation, Articles 702, 703 of the Civil Code of the Russian Federation.

You can download a sample contract for the processing of customer-supplied raw materials for free here ˃˃˃

- Postings for the receipt and purchase of materials using practical examples

- Postings for the release of finished products

- Account 10 Materials in accounting: postings, examples, subaccounts

- Accounting 20 in accounting: examples and postings for dummies

BASIC: income tax

The executing organization should not include materials received for processing in income or expenses. This is explained by the fact that the transfer of ownership does not occur during such a transfer, which means that there is no object of taxation either for VAT or for income tax (Clause 1, Article 713 of the Civil Code of the Russian Federation, Articles 39, 146, 247 of the Tax Code of the Russian Federation).

When calculating income tax, consider:

- in income - the amount transferred by the seller for the performance of work (Article 249 of the Tax Code of the Russian Federation);

- in expenses - the amount of costs associated with the performance of work (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Situation: how should a processing organization evaluate tolling operations when calculating income tax: as work or as services?

Consider operations for processing raw materials as work execution.

The procedure for tax accounting of expenses depends on how raw material processing operations will be taken into account. Organizations providing services can take into account direct expenses without distribution in the period to which they relate (clause 2 of Article 318 of the Tax Code of the Russian Federation). Organizations performing the work are not granted this right.

From a civil legal point of view, when formalizing relations for processing materials, a contract is concluded, not a contract for the provision of services. A significant difference between these two contracts is that the result of the contract is some material object in the form of processed materials (finished products). Things are not the result of the provision of services (this could be, for example, consultations or an audit report). This conclusion can be made based on the provisions of Chapters 37 and 39 of the Civil Code of the Russian Federation.

It is about works, and not about services, when mentioning tolling operations that are discussed in such documents as:

- Resolution of Rosstat dated December 28, 2007 No. 106;

- Resolution of the State Statistics Committee of Russia dated October 26, 2001 No. 77, etc.

At the same time, in some regulatory documents, tolling operations are regarded as services:

- OKUN, approved by Decree of the State Standard of Russia dated June 28, 1993 No. 163;

- paragraph 62 of the instructions approved by Rosstat order No. 314 dated December 23, 2009;

- paragraph 15 of Article 200 of the Tax Code of the Russian Federation - regarding the deduction of excise tax amounts accrued upon receipt of straight-run gasoline.

When considering individual business situations, the same term is used by regulatory agencies (letter of the Ministry of Finance of Russia dated May 4, 2006 No. 03-04-13/1/03, letter of the Federal Tax Service of Russia for Moscow dated August 2, 2005 No. 20-12 /54798).

In such circumstances, the organization can independently decide whether to classify the tolling operations it carries out as works or services. At the same time, it is more prudent from a taxation point of view to take them into account according to the rules established for work.

Situation: when calculating income tax, is it necessary to include in non-operating income the cost of the remaining raw materials (processed products) that are not returned to the supplier?

Yes need.

Remains of customer-supplied raw materials (processed products) not returned to the customer are recognized as non-operating income of the contractor.

The amount of income is determined based on market prices, taking into account the provisions of Article 105.3 of the Tax Code of the Russian Federation (clause 8 of Article 250 of the Tax Code of the Russian Federation). Depending on the terms of the transaction and the specific circumstances that caused the non-return of balances, the resulting income is accounted for either as property received free of charge, or as unclaimed accounts payable, or as other non-operating income.

This conclusion is confirmed by arbitration practice (see, for example, decisions of the FAS Moscow District dated January 27, 2006 No. KA-A40/9756-05-D4, dated November 11, 2005 No. KA-A40/9756-05, Volga District dated November 15, 2005 No. A65-27608/2004-SA2-34).

The dates of recognition of income and expenses when calculating income tax depend on the tax accounting method used by the organization.

If an organization determines income and expenses using the accrual method, then recognize income after signing the acceptance certificate for the work performed (clause 3 of Article 271 of the Tax Code of the Russian Federation). Costs associated with the processing of customer-supplied materials are divided into direct and indirect (Article 318 of the Tax Code of the Russian Federation). In this case, take into account indirect costs at the time of accrual (clause 2 of Article 318, clause 4 of Article 272 of the Tax Code of the Russian Federation). Take into account direct costs as the work is implemented, in the cost of which they are taken into account (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation). If the organization qualifies these operations as services and classifies their cost as direct expenses, there is no need to distribute them to the balances of work in progress (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

If the organization uses the cash method, record income and expenses after they are paid. The costs of materials used in processing the customer's raw materials can be included in expenses if two conditions are met: they are paid for and used in production. Such rules are established by paragraphs 2 and 3 of Article 273 and paragraph 5 of Article 254 of the Tax Code of the Russian Federation.

An example of how to reflect in accounting and taxation the processing of materials received from a supplier. The organization applies a general taxation system

Alpha LLC purchased materials in the amount of 236,000 rubles. (including VAT - 36,000 rubles) for use in production. Due to the fact that its own equipment is being repaired, Production LLC was hired to process the materials and pays income tax on a monthly basis, using the accrual method.

The work was started and completed in February, the cost of the work was 118,000 rubles. (including VAT – 18,000 rubles). “Master”’s expenses for processing amounted to 80,000 rubles.

In Master's accounting, processing operations were reflected as follows:

Debit 003 – 236,000 rub. – materials were received from the customer (in the assessment provided for in the contract);

Debit 20 Credit 02, 10, 25, 26, 68, 69, 70 – 80,000 rub. – the costs of processing materials are taken into account;

Debit 90-2 Credit 20 – 80,000 rub. – the cost of work performed is formed;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 18,000 rubles. – VAT is charged on work performed;

Debit 62 Credit 90-1 – 118,000 rub. – the customer’s debt is reflected on the basis of the acceptance certificate for the work performed;

Debit 51 Credit 62 – 118,000 rub. – received money from the customer for work performed;

Loan 003 – 236,000 rub. – the cost of materials received from the customer is written off based on the contractor’s report.

In tax accounting, Master's accountant reflected expenses in the amount of 80,000 rubles in February. and income in the amount of 100,000 rubles.

Tax treatment of transactions with customer-supplied raw materials

The requirements of the first part of the Tax Code of the Russian Federation, which form the tax content of transactions with raw materials supplied by customers, are largely determined by their civil legal interpretation, which we discussed above.

The absence of the fact of sale of products to the customer organization, that is, the fact of transfer of ownership of the product from the contractor to the customer, allows us to classify operations for the manufacture of products from customer-supplied raw materials as work for tax purposes. Let us recall that according to paragraph 4 of Article 38 of the Tax Code of the Russian Federation, work is understood as “activity, the results of which have a material expression and can be implemented to meet the needs of the organization and (or) individuals.”

Accordingly, according to Article 39 of the Tax Code of the Russian Federation, the implementation of work on the production of products from customer-supplied raw materials is recognized as the transfer on a reimbursable basis (including the exchange of goods, work or services) of the results of work performed by the contractor to the customer, and in cases provided for by the Tax Code of the Russian Federation, the transfer of the results of work performed contractor to customer - free of charge.

The fact of transfer of products manufactured from customer-supplied raw materials is formalized by the corresponding act of acceptance of work performed (Article 720 of the Civil Code of the Russian Federation).

The transfer by the customer to the contractor of materials for processing and the transfer by the contractor to the customer of finished products, as not entailing a transfer of ownership of this property, do not constitute a sale of goods in accordance with Article 39 of the Tax Code of the Russian Federation. Therefore, these transactions are not subject to VAT.