Is it possible to open an individual entrepreneur if you are officially employed? People looking for additional sources of income often ask. At the same time, they do not want to lose a reliable rear in the form of official work, so as not to be left without a livelihood if the business “does not work” in other situations. The prospects are interesting, but the main thing is: it is not prohibited by law, but there are a number of restrictions and features. You need to know about them before you start registering your business.

Opening an individual entrepreneur during official employment

Any resident of the Russian Federation can open his own business in the form of an individual entrepreneur; he will not have to quit his permanent job. The only exceptions are certain categories of civil servants, more on that later. In the status of an individual entrepreneur, the businessman will continue to fulfill the terms of the employment contract concluded with the employer and at the same time engage in business.

Many people wonder whether it is possible to officially work and be an individual entrepreneur without notifying management about it. Answer: yes. By law, a company employee is not required to inform the employer that he has registered an individual entrepreneur and is running his own business during non-working hours. Such information is not entered into the work book, since registration data is in the Unified Register and is presented upon request.

Some employers are interested in hiring such workers in order to offer a different format of cooperation. It’s all about the current taxation; if some function is performed by an individual entrepreneur, a legal entity can save on taxes, since a private entrepreneur pays insurance premiums on his own. An employee with individual entrepreneur status does not need to provide social security. package and pay for vacation, maternity leave, etc. The absence of such guarantees cannot be called a benefit for individual entrepreneurs; on the other hand, earnings will be higher due to the lack of standard deductions. For example, for a full-time employee individuals, the organization is required to pay 13% income tax, while for individual entrepreneurs it is 6%.

Important! After registering your status, you should not immediately quit in order to leave the state and conclude an agreement with the employer on new terms. Such actions are often considered by the tax inspectorate as attempts to circumvent taxes by replacing labor relations.

The Federal Tax Service is often loyal to individual entrepreneurs in such matters; it is not worth abusing the location of the tax authorities.

To the question of whether it is possible to register an individual entrepreneur if one is officially employed, it should be added that work in the status of an enterprise with the execution of an employment contract is also allowed. In this case, the businessman receives wages, bonuses, vacation pay and benefits in case of job reduction. However, if an individual entrepreneur works under an employment contract, he must comply with the established labor regulations.

When is it worth working officially and registering an individual entrepreneur?

Combining official work and your own business is not easy. You want to develop your business, and the employer wants you to do your work on time and efficiently. With a five-day work week, finding a balance between business and work is difficult. It is more comfortable to switch to a shift schedule, part-time work or remote work under a contract.

If you find time for an individual entrepreneur while officially employed, you will receive additional income in the form of a salary, maintain your social package and labor guarantees, and accumulate an impressive insurance record for calculating your pension.

When it's done

Before starting your own business, you need to analyze the advantages and disadvantages, and then decide whether it is worth it.

The status of an individual entrepreneur obliges you to submit reports to the tax office (declaration) and deduct part of the profit, regardless of the chosen taxation system. An employee does not experience such difficulties; everything is simpler for him. At the same time, you can earn additional income without additional actions.

There are a number of factors due to which a citizen is required to register himself as a private entrepreneur:

- the activity involves obtaining a patent or license that cannot be obtained as an individual;

- for carrying out advertising and marketing events;

- settlements with clients are carried out exclusively by non-cash form through a bank account (you must provide a check (receipt) for the transaction).

Reasons for registering as an individual entrepreneur

Any businessman or employee who wants to start his own business at the same time must clearly understand the motives that prompted him to take this step, the strength of these motives and the possible consequences (both opportunities and threats) from the decision made.

In general, there are four motives:

- earn more than I earn now in order to have a decent life;

- do what you love without violating established norms and rules in society, enjoying yourself and benefiting others, without harming yourself;

- ensure the future well-being of someone else (family, loved ones, friends);

- increase social status and occupy an advantageous position in society.

Some motives stimulate a person more than others. A creative person who wants to do what he loves in his free time from his main job and asks himself whether a working person can open an individual entrepreneur will definitely say yes. The very occupation to which he has a soul will compensate him for the lengthened working day, and the need to understand the intricacies of the new profession, and bureaucratic delays, etc.

Those who want to combine individual entrepreneurship and current work simply to improve their financial situation should seriously weigh the pros and cons and only then make the final choice. Entrepreneurship is a risky activity that depends on a number of factors, and in the case of individual entrepreneurs, all business risks fall on one specific person.

Possible restrictions

The legislation defines a number of obstacles for an officially employed citizen to open his own business. Lacks full legal capacity. A citizen who has not reached the age of majority cannot become an entrepreneur (work is officially permitted from the age of 16).

Note! This restriction can be easily circumvented if you enter into a marriage or undergo emancipation as a minor.

This is also prohibited for persons declared incompetent by a court decision or there are restrictions. Such people cannot work under labor contracts, because they require outside help and supervision. This category includes people who abuse alcohol, drugs and gambling. However, they can work, but are not able to open an individual entrepreneur until the judicial authorities recognize them as capable.

There are a number of other restrictions:

- official and other crimes proven in court related to the theft of material and financial assets;

- It is prohibited for persons who are members of the AUP (administrative and managerial personnel) employed in the civil service to become individual entrepreneurs;

- Advocates, lawyers and other specialists engaged in specific work activities in a state institution cannot become individual entrepreneurs (this is not prohibited for employees of private law firms);

- Deputies of all levels are also prohibited from engaging in entrepreneurial activities.

Is it possible to register as an individual entrepreneur and combine work officially with some types of employment?

- Staying in an elected position.

The following cannot engage in entrepreneurial activity:

- deputies of the State Duma of the Russian Federation;

- heads of municipalities;

- deputies of the Federal Assembly of the Russian Federation and deputies of all levels performing duties on a permanent basis (deputies, deputy chairmen, secretaries).

The rest of the deputies are allowed to do this.

- Lack of Russian citizenship . Citizens of other states and stateless persons can engage in entrepreneurial activity only with the permission of the Federal Migration Service.

Registration procedure

Registration of an individual entrepreneur is practically no different from the same procedure for an unemployed citizen and entails a number of additional responsibilities. The basis for registration actions is a receipt of payment of the state fee and an application.

First you need to decide in which field of activity the entrepreneur will work, then choose a taxation system and collect all the necessary documents:

- Identity document (passport).

- TIN.

- Personal statement on form P21001.

- Receipt of payment of state duty (800 rubles).

- A statement of the established form on the transition to a different taxation system so that general rules do not apply to individual entrepreneurs.

A simplified system is chosen with filing a declaration once a year. Areas of activity are selected according to OKVED codes, and then indicated in the application. After all these steps, the package of documentation must be submitted to the tax service at the place of residence (registration). The registration period takes no more than three days, then the citizen receives documentary confirmation of registration and an extract from the Unified Register, which confirm the assignment of the status of an individual entrepreneur.

Important! In 2020, when registering an individual entrepreneur, citizens are sent directly to multifunctional centers (MFC). There will be no differences in the procedure, and for some this option is even more convenient.

PDF file

When filling out the documents, do not make mistakes, otherwise registration will be denied; one free attempt is given to re-register, after which you will have to pay the state fee again.

Differences between individual entrepreneurs and other forms of business and how this can affect the main work

An individual entrepreneur is not a form of business, but the status of a citizen, and individual entrepreneurship is an activity associated with risk, aimed at generating revenue and income. However, not all goals become achievable, while responsibility always comes in full.

When asked whether it is possible to work and be an individual entrepreneur at the same time, a person will immediately answer yes, but if you ask him whether he is ready to risk all his property in case of failure, the answer will be ambiguous. Individual entrepreneur, unlike other organizational and legal forms of business, assumes that an individual entrepreneur bears responsibility for the obligations assumed in full.

This is a well-known fact, but when it comes to the seizure of private property, the entrepreneur feels that he has been cruelly deceived.

Also, when combining work with an individual entrepreneur, an employee may face certain risks.

We recommend you study! Follow the link:

Is it possible to open an individual entrepreneur for two people?

Here are just a few of them:

- Controlling employers prefer that their employees devote all their free time to the organization and will not tolerate any of their employees doing distracted work on the side, especially without notifying their superiors.

- An individual entrepreneur requires constant participation and control from the entrepreneur at any time of the day or night, seven out of seven days a week. If the type of activity itself has a high risk, then a businessman who combines an individual entrepreneur with his main job will be forced to constantly be torn between two fires. This, on the one hand, threatens him with failure in both areas of activity, and on the other hand, it may negatively affect his work and future performance.

- Since the responsibilities of an individual entrepreneur are inseparable from his finances, there is a risk that with the loss of a permanent source of income (salary) and low business growth rates, bankruptcy of an individual may occur very soon.

- Individual entrepreneurs, unlike other forms of business, do not have broad opportunities for delegation of authority. There is a high risk that when occupying an administrative position at your main place of work and managing your own business, control in one of the places may be lost, and irreversibly.

- If the type of activity you do at your main job and your individual business are similar or the same, management may consider this an attempt at dishonesty and even sabotage. In this case, not only your job will be lost, but also your reputation.

- Regardless of the receipt of income from business activities, the individual entrepreneur pays a single social contribution from available sources. If the main source of income becomes such a source, the very idea of creating a business loses its meaning. Expenses will be at double rates, and revenues will disappear altogether, depriving the businessman of the opportunity to develop the business in the future.

Thus, is it possible to work officially and still open an individual entrepreneur, having overcome all the difficulties - yes.

You need to approach the issue of creating a business with all responsibility and common sense, thoroughly study all the requirements for registering an individual entrepreneur, as well as issues of tax and pension policy.

The impact of individual entrepreneurs on labor relations

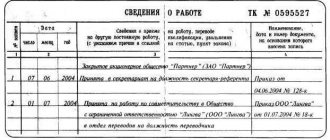

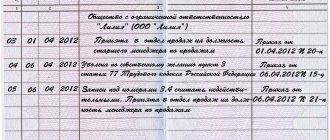

In practice, the status of a private businessman does not affect employment in any way. A private entrepreneur can work as part of a hired staff; he does not have any new responsibilities. No records of labor activity appear in the labor record.

Working as an employee and working as an individual entrepreneur are different systems and do not intersect with each other. Taxes are assessed by both the employer and the entrepreneur, and the same applies to the calculation of length of service. In fact, a person can find out that his employee works for himself in the official status of a private business from advertising brochures, advertisements and other sources. It is impossible to find out during the fulfillment of the terms of the employment contract.

All information about citizens registered as individual entrepreneurs is located in the Unified State Register in the tax department. To obtain this information, you must submit an appropriate application, pay a state fee and wait for an official response.

From the employer's point of view

Let's assume you have opened an individual entrepreneur. But have you ever wondered how the employer at your main place of work will look at this? Actually, this should not bother you much and there are a number of reasons for this:

- A “newly created” individual entrepreneur is not required to provide any information to the company about a change of status. He can do this at will;

- From the point of view of the Civil Code, you have the right to engage in entrepreneurial activity on an equal basis with other citizens of the Russian Federation, therefore, the employer has no right to create obstacles for you. Why then create them for yourself?

- Only information about employment is entered into the work book (exactly your case), and information about the formation of a legal entity is entered into the Unified State Register of Legal Entities. These are completely different spheres that do not come into contact with each other in this case. Moreover, this information will only be available based on an official request, which means that your status does not have to be public knowledge.

The director of the organization in which you work may “not like” only the quality of the work you perform on his territory. Imagine you work in the classic case 5 days a week from 9 to 18 o'clock with a lunch break, say, from 13 to 14 o'clock. A break from work during this period of time (9 hours) is hardly possible. Consequently, you have very little time left for entrepreneurial activity, and this is provided that you have no health problems (and it will come in handy when you are trying to “sit on two chairs”). If this difficulty can be overcome, then the employer can only be happy for you and for his budget. The fact is that an individual entrepreneur is obliged to independently pay insurance premiums and sick leave, which significantly reduces the “cost” of an employee for the company.

How can you combine individual entrepreneurs with official work?

It is possible to combine an individual entrepreneur and a main job, but it is quite problematic. Business, especially at the development stage, requires constant monitoring of what is happening. If an individual entrepreneur runs his own business and has an employment relationship at the same time, then he needs to plan his time so that productivity at his main job does not suffer. Otherwise, difficulties may arise with your superiors.

It is convenient to combine individual entrepreneurs and main work for those who have a free or shift work schedule. If an entrepreneur is employed full-time in official labor relations, then it is advisable for him to employ a person who will keep records. An alternative to this option is to search for a remote accountant.

Features of paying taxes and insurance premiums

Having registered as an individual entrepreneur, you are required to pay your own insurance contributions to the Pension Fund of Russia and the Federal Compulsory Medical Insurance Fund. In addition, an individual entrepreneur can make social insurance contributions for further payments for sick leave and maternity leave, but on his own initiative - these payments are optional.

According to the employment contract, the company also pays insurance premiums for you to the Pension Fund and the Federal Compulsory Medical Insurance Fund, but this fact does not relieve you of the obligation to pay “entrepreneurial” contributions. All these payments will be credited to your account and subsequently taken into account when forming your pension.

The activities of individual entrepreneurs also include the payment of taxes to the budget. There are two tax regimes; for small businesses, the most convenient will be a special tax regime that provides for a simplified taxation system. According to this system, the tax percentage is 6% on the amount of income or 15% on the amount of income reduced by the amount of expenses incurred.

You can learn more about the methods for calculating taxes for individual entrepreneurs on the official website of the Federal Tax Service.

Choosing a tax regime is an important step for any individual entrepreneur, so at this stage it makes sense to get advice from specialists from the Federal Tax Service.

Can an individual entrepreneur work for hire?

For hired employees of enterprises, the right to open an individual entrepreneur is provided. These individuals will not be required to leave their current employment. At the same time, employees can either retain their employment or switch to civil law relations with the employer. Likewise, persons who created an individual entrepreneur earlier are allowed to be hired by a company under an employment contract.

When obtaining this status, there is no difference in the package of documents required from a person working for hire and from any other person.

Is it possible for a working person to register an individual entrepreneur?

Quite often the question arises: is it possible to open an individual entrepreneur if you work officially?

The requirements for registering entrepreneurs do not include a requirement that a businessman must be unemployed.

An individual entrepreneur, unlike an LLC or OJSC, is not a legal form of organization, but a special status of an individual. A citizen who has received the status of an individual entrepreneur can carry out commercial activities legally. In addition to this right, the status of individual entrepreneur imposes a number of responsibilities on its owner. These include:

- payment of mandatory contributions to the Pension Fund and the Federal Tax Service;

- maintaining reports for submission to government agencies;

- bearing responsibility for assigned obligations.

After registering as an individual entrepreneur, the entrepreneur still remains an individual and does not lose the rights and responsibilities of an ordinary citizen of the Russian Federation. He retains the right to work.

Who can and cannot open their own business?

The Civil and Tax Code of the Russian Federation does not prohibit opening individual entrepreneurship to persons who:

- are citizens of the Russian Federation;

- have reached the age of majority;

- do not have direct prohibitions by court decision on the implementation of certain types of activities;

- are not civil servants and notary workers;

- persons with limited legal capacity by a court decision (people suffering from various forms of drug addiction, mentally unstable, dangerous to society and requiring specialized care) are not incompetent.

In fact, any citizen, regardless of the presence or absence of employment, who meets all of the above requirements, can register an individual part-time business without interrupting his main work activity.

A special category includes prohibitions on opening individual entrepreneurs for civil servants, municipal employees, directors of state enterprises or their divisions, as well as those who are serving in the military.

The reasons for the ban are due to both economic and political, as well as universal human risks.

It will be quite difficult for a budget employee and an elected deputy to refuse the temptation to lobby for the interests of their own business. To an employee of a law firm, the interests of his own business will most likely seem more important than a number of letters of the law.

On the other hand, working in public services in responsible positions obviously involves a high share of workload, which cannot be combined with the activities of creating and maintaining a newly created business.

The ban on opening your own business by law applies only to civil servants, the list of whom is signed by the Decree of the President of the Russian Federation.

If you do not know for sure whether your position is included in the special list or not, it is better to consult with competent specialists.

If your immediate boss is loyal to your employment outside your main job, you can discuss this issue with him. If not, the HR department and the notary know the answer to a sensitive question and can contact you with this question.

At the same time, you will get the opportunity to find out in advance how your colleagues and bosses will react to the idea of you opening an individual entrepreneur. And the lawyer will advise on other important issues related to opening a private business.

We recommend you study! Follow the link:

Can a pensioner open an individual entrepreneur and does this affect the size of the pension?