What is an investment portfolio? This question is mainly asked by all novice investors who want to get maximum income from investing while reducing the risk of losses. In addition, the formation and management of an investment portfolio is an important, necessary and primary task for all investors, on which, first of all, the size of their income depends. Therefore, the fate of your investments will depend on how competently you create your investment portfolio.

And, if you want to know how to properly build an investment portfolio, read this article to the end. From it you will learn all the necessary information regarding the investment portfolio. Starting from what an investment portfolio is, its types, types and qualifications, ending with how to optimize it and manage it effectively.

Content

What is an investment portfolio Advantages and disadvantages of forming an investment portfolio Types of investment portfolios 1. Conservative investment portfolio (reduced risk + reliable income) 2. Aggressive investment portfolio (maximum income + high risk) 3. Combined mixed or moderate investment portfolio 4. Ineffective investment portfolio (high risk + low income) Types of investment portfolio Principles of forming an investment portfolio 1. Target orientation 2. Balance of risks and returns 3. Liquidity 4. Diversification What an investment portfolio can be formed from Formation of an investment portfolio - step-by-step instructions for beginners Step 1. Set the correct investment goal Step 2. Select an investment strategy Step 3. Select a broker Step 4. Conduct market analysis and select investment objects Step 5. Optimize the investment portfolio Step 6. Make a profit Investment portfolio management 1. Active method of investment portfolio management 2. Passive investment portfolio management Optimization of the investment portfolio 1. Diversification of the investment portfolio 2. Investing money in a bank 3. Investing in real estate Instead of a conclusion

Portfolio amount

Depending on how much you are willing to involve in the investment process, the depth of portfolio diversification will depend. Conditions for an investor with 50 thousand rubles. and from 5 million rubles. will be fundamentally different. An investor with a small amount of money will need to keep the cost limit in mind to meet the diversification requirement when selecting financial assets, along with the issuer's reliability and fundamental growth prospects. Let us remind you that the standard denomination of the bond is 1000 rubles. If we consider shares of Russian issuers, the price range is much wider. The price for a share in the authorized capital of a company starts from hundredths of a Russian ruble per share, but taking into account the sale of shares in lots of 10, 100, 1000, 10,000 securities, when buying a share you should focus on investments in the amount of 56.5 rubles. (Share GTL jsc) up to 151,850 (Share Transnf ap). These are examples of minimum and maximum price thresholds at the time of writing. Within the specified range there are more than 270 securities with their own liquidity indicators, beta coefficient, consensus forecast, drawdown and dividend yield. Prices for the most liquid Russian shares at the time of publication of the article (price indicated per lot):

- Sberbank - 2333.6 rubles,

- Gazprom-AO - 2026.5 rubles,

- Lukoil - 5699.5 rubles,

- Magnit-AO – 3160.5 rubles,

- Rosneft-JSC - 4034 rubles,

- Tatneft-JSC – 671.6 rubles.

In a portfolio worth 50 thousand rubles. for example, there may be 15 types of bonds worth 30 thousand rubles, 2 thousand per bond and 4-5 shares worth 20 thousand rubles. 1 lot with an average price of 4-5 thousand per 1 lot.

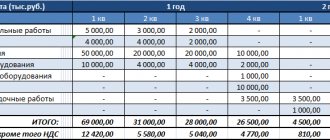

As for the portfolio for a more serious amount, this is what our public portfolio looks like from:

This portfolio consists of 33 shares with a total amount of 2.7 million rubles. Over the past 4.7 years, the portfolio has grown 2.59 times excluding dividends. The average dividend for the portfolio is 7.5% per year. The average annual growth of the portfolio is 41%. Information on the portfolio structure is available to clients.

The above example clearly demonstrates the advantages of a portfolio with a larger amount - more opportunities for diversification, greater freedom in choosing interesting investment ideas and a high level of protection against the risk of an individual issuer. But we also see that investing is suitable not only for owners of large capital - it is quite possible to make a portfolio for 50 thousand rubles.

What is an investment portfolio

In order to make it more clear what we are talking about in this article, let’s understand what an investment portfolio is.

An investment portfolio is a set of various investment assets in which an investor invests his money in order to make a profit.

Portfolio investments can be securities, commodities, real estate, gold, options and other financial assets, which are selected depending on the investment period and the investment portfolio formation model.

The main and main task of an investment portfolio is to bring profit to its owner. Moreover, simply by being in this portfolio.

The main feature of the investment portfolio is that:

- the investor can convert investment assets into money at any time;

- and low level of risk: in case of loss of capital in one investment instrument, others will remain.

Despite this, it is simply impossible to completely eliminate investment risks. And the most common of these risks are:

- The wrong investment instrument has been selected. Which, first of all, is associated with investing in the assets of dubious companies or companies with dubious prospects.

- Inflation not taken into account

- Incorrect timing of acquisition of investment assets. For example, experienced investors buy stocks when everyone else is selling them, and not vice versa, as many do.

Be that as it may, each experienced investor has his own approach to forming an investment portfolio. And they are guided by their own rules and principles acquired over time. For example, Warren Buffett purchased stocks that other investors considered unpromising. And, as often happened, he was right and made a decent profit from such shares.

Common mistakes when creating an investment portfolio

- Poor diversification. For example, invest all your money in one sector of the economy. This may not have any impact on the outcome until the industry falls on hard times.

- Too much diversification. There is no point in buying too many assets for your portfolio. You can limit yourself to 7-10. If there are 20 or more of them, then, firstly, the effect of diversification may, on the contrary, begin to fall. Secondly, it is difficult to keep track of so many assets. Thirdly, we will not buy the best in our industry, because... Usually there are few such securities. Therefore, it is worth sticking to reasonableness in quantity.

- A large percentage of one asset. For example, invest 50% in one company. This will cause a strong dependence on its course. You may get it right and even earn significantly more than if you bought other stocks. But we consider the risks and mistakes. Such an overweight of one share would be too risky.

- Bad time to invest. For example, you decided to invest at the peak of growth in 2008. That year, the stock index collapsed by 70% (some stocks fell by 90-95%). And no matter how the investor redistributes the funds, the losses would still be very significant. And if, on the contrary, he had invested in 2009 at the very bottom, then the profit for the year could have been 100% or even 300% per annum. The time factor played a strong role. The difference is only 1 year, and some will receive -70%, and others +100%, using the same principles for forming their set.

- No stop loss is used. Despite the fact that with a long-term approach it is not customary to place protective orders, you still need to limit your losses in the event of a crisis. For example, if a security falls by 5%, then perhaps it should be sold because it could fall further.

- Poor liquidity. One of the important principles of investing is maintaining a high liquidity ratio. In the event of an unfavorable trend development, there will always be an opportunity to quickly close the transaction. If we neglect this, a situation may arise that the investor wants to sell the asset, but cannot do so due to the lack of a buyer at an acceptable price.

- Conservative. There's no point in taking a lot of risk just to "maybe" get a little more return. Such investments more often produce losses than profits.

Advantages and disadvantages of forming an investment portfolio

The advantages of forming an investment portfolio include:

- Liquidity

For the most part, investors invest their funds in highly liquid investment assets, which gives them the opportunity to quickly sell them without much loss. It even turns out that with a good profit.

True, not all investment assets can be quickly sold. For example, shares of little-known companies are more difficult to sell, since investors are wary of them. But, as a rule, such investments often bring good profits.

- Openness

Today the stock market is quite open for anyone who wants to invest their money in shares. In addition, there is no longer any need to study and search for the necessary information, everything is publicly available on the exchange website.

It is because of this publicity of information that even the most ignorant person can get all the information they need, from price dynamics from period to period, to the volume of investments in a particular security and the spread.

- Profitability

As a rule, most investors have an investment portfolio consisting of securities that are classified as highly profitable investment assets. In addition, shares can generate income in two cases: the first - in the form of dividends, the second - when securities increase in price.

- Easy to use

In cases of purchasing securities, you can purchase them and forget about them for a while. You buy and receive dividends, and if you manage your investments correctly, you can increase their profitability many times over.

The disadvantages of the investment portfolio include:

- Riskiness

This minus, however, is relative. And, basically, it depends on what investment assets you will use to form your investment portfolio. If the investment portfolio consists only of highly profitable assets, then the risks of losing everything at once will be very high. And, if you wisely and correctly distribute your funds across various investment instruments, you will significantly reduce the risk of losing your investments.

- Availability of necessary knowledge

There is no point in starting to invest without certain and special knowledge. Even a novice investor should know what investments are, know the principles of investing and be able to calculate risks. Otherwise, you will not only be left without income, but also lose all your invested capital.

- Ability to conduct analysis

Failure to analyze can lead to very sad consequences. An investor without this skill simply runs a very high risk of losing his capital. When investing, it is not so important to have enormous knowledge and skills; it is much more important to be able to correctly establish cause-and-effect relationships. A properly conducted analysis can identify a negative trend in the market in advance, minimize risks and make a profit even under very unfavorable conditions.

Conservative part

To assemble an optimal investment portfolio, it is imperative to include a conservative part. Its size depends on your goals. If you just want to save what you have accumulated, do about 60-70%. If the goal is to make money, then reduce the conservative part to 40%, or even to 30%. Adjusting the proportion of conservative assets in a portfolio shifts the risk/return ratio on the curve, allowing you to earn more with greater risks, and vice versa.

And here’s another interesting article: What to do if the ETF closes: detailed instructions for investors

There is a theory that the ratio of the income and conservative parts should repeat your age in the following proportion:

- conservative – the number of your years;

- income – 100 minus the number of years.

For example, if you are 25 years old, then the conservative part should be 25%, and the profitable part should be 75%. Consider this before putting together an investment portfolio.

Conservative assets include:

- bank deposits;

- federal loan bonds;

- OFZ-n;

- subfederal and municipal bonds (their yield is not guaranteed by the state, unlike OFZs, keep this point in mind);

- blue chip bonds;

- US government IOUs (very expensive to buy directly, so use ETFs);

- gold and coins.

Conservative assets also include:

- units of mutual funds, but not all, but only bond and mixed ones;

- Stock ETFs – Typically, index investing beats active management, especially if the fund follows a conservative or balanced benchmark.

The main thing is to ensure that the number of each asset is approximately the same. And don't forget about diversification. You should not include bonds of Russian companies in your portfolio and immediately buy an ETF for the Russian index together with a mutual fund investing in the domestic stock market. This is not the most correct way to build an investment portfolio.

Revenue part

This is the most interesting and varied part. If conservative assets are intended mainly for preserving funds, then income assets (surprise!) for increasing income.

This part includes:

- Russian and foreign shares;

- bonds – with a yield of 10% per annum, but they can be subject to default and all sorts of other garbage (remember “Home Money” or “Live Office”);

- Eurobonds (it is better to invest in them through ETFs or mutual funds);

- industry and commodity mutual funds and ETFs;

- investments in existing businesses.

Complementing how to compile an investment portfolio, we can highlight the speculative part, which includes investments:

- in PAMM accounts;

- to startups;

- into cryptocurrency.

There is no need to take unnecessary risks here - you invested 5-10%, and that’s fine. With the thought that you might lose them altogether.

The main part of the investment portfolio will be shares, which is not surprising. Select issuers carefully. Place a bet, for example, on dividend stocks. But don't get carried away.

Cash portion

When wondering how to create an investment portfolio, do not forget that you must buy assets for something. I mean, leave some cache. Then, when a suitable asset appears for purchase, you will not frantically rush around, thinking about what you don’t need to sell or where to get the money - everything will be at your fingertips.

And here’s another interesting article: Unipro dividends: stability for the next 4 years

What currency to store in is generally a bullshit question. The best answer: the one in which you are going to buy assets. If you are targeting shares of Small Soft or Bitten Apple, then transfer money into dollars and wait for the drawdown for the selected securities.

And it doesn’t matter how much the dollar will grow there. Your task is not to speculate on exchange rates (although this is also an asset).

Protective part

Well, don’t forget that creating an investment portfolio means insuring your backside of your assets. This can be done in different ways:

- purchase options and hedge your risks - but here you need to approach the matter skillfully so as not to get caught with leverage, margin calls and other trader’s nightmares;

- draw up an ILI or an ILS - if something happens to you, you will receive an insurance payment, if not, then the money invested in the policy;

- buy a structured product with capital protection;

- transfer part of the funds to trust management.

But the best defense is a diversification offense. If you have it, no black swan will be scary for you.

Types of investment portfolios

The types of investment portfolios are information that any investor, especially a beginner, should know. It is this knowledge that forms the basis for the formation of our own investment principles.

Now, let's look at the general and basic qualifications of investment portfolios.

1.Conservative investment portfolio (reduced risk + reliable income)

This investment portfolio is characterized by minimal risks and guaranteed average income. The main investment assets of this portfolio are highly reliable securities with a slow increase in market value. As a rule, these are shares of large companies, securities issued by the state, bonds of issuers with a high degree of reliability and have been present on the market for a long time.

A conservative portfolio is mainly formed by people who find it easier to receive less money than to lose it completely. Also, beginners who do not have enough necessary knowledge and experience begin to form such a portfolio. But this investment portfolio allows you to gain all this without huge losses.

2.Aggressive investment portfolio (maximum income + high risk)

As a rule, this type of investment portfolio consists of highly profitable investment assets. And, as is already known, where the expected income is higher, there is a higher risk of capital loss. Typically, such a portfolio consists of stocks and securities with large price fluctuations over a short period, which provides high returns from interest or dividends.

An aggressive investment portfolio is suitable for experienced investors who have sufficient knowledge and experience. And also those who know how to analyze the market situation and can predict its behavior. It is better not to use this type of portfolio for beginners.

3. Combined mixed or moderate investment portfolio

This is an investment portfolio where risks and returns are at the same level. As a rule, these are long-term profitable investments taking into account their growth, which include most securities: shares and bonds of reliable issuers that have been present on the market for a long time.

You can read how to trade in the stock market in this article .

4. Ineffective investment portfolio (high risk + low income)

This type of portfolio is rarely mentioned due to its unpopularity. Typically, such a portfolio is formed only by novice investors or investors who invest irregularly, without market monitoring or news analysis. Securities and other assets in this case are chosen arbitrarily, without a plan or strategy.

As has long been noted by investment experts, the age of an investor has a direct bearing on the formation of an investment portfolio. The younger generation usually builds its portfolio of high-yield and riskiest investment assets. On the contrary, older people prefer to invest their funds in long-term, stable projects with less risk and, as a result, lower profitability.

How to create and select the best securities portfolio

Investing is a lifelong process. Warren Buffett

Compiling the best securities portfolio is an eternal challenge and debate among various analysts. Let's look at step-by-step instructions for beginners on how to independently create a balanced investment portfolio.

Step 1. Decide on investment goals

Why are you investing money? For how long? What do you expect from your investment? What risks are you willing to take?

There are many similar questions that will help you in the future with achieving your goals. In fact, the first step is thinking about “what is all this for?” After all, there is always the option of putting money in a bank deposit and just waiting.

Examples of goals could be:

- Save 5 million rubles for an apartment (3 years);

- Increase your capital by 15 million rubles in order to live on the interest on its income (10-year period). For example, living on dividends;

- Save enough for retirement so that you can receive 30 thousand rubles a month in passive income (for a period of 20 years);

Most people pursue the goal of saving up for some purchase or simply amassing a fortune. Many people have heard about “rentiers” who live on interest from investments. But since this task is quite long-term and complex, few ordinary citizens strive for it.

Step 2: Choose your approach

Based on the goal you are pursuing from the previous step, you can choose a strategy. I recommend navigating like this:

1 If you are investing for a period of 3 years or more, then you can safely buy shares of blue chips and promising companies. You can dilute such a portfolio with 40-60% bonds. You can also buy a dollar (for example, at 10%) and use it to buy Eurobonds. This diversifies your portfolio well.

2 If you invest for up to 3 years, then in this case you will have to engage in trading (buy/sell), otherwise the return on shares will no longer be great. I would stick to the following tactic: 60% bonds and 40% stocks. When investing for short periods, it is impossible to predict the movement of stock prices, so it is recommended to use bonds that are guaranteed to generate income.

Step 3. Choosing a broker

To trade on the stock exchange, you need to open a brokerage account. To do this, you need to use the services of one of the brokers. I recommend working with the following brokers:

- Finam

- BCS Broker

These are the best brokers for trading on the Moscow Exchange. They have the best conditions, the lowest commissions for trading, and have offices throughout Russia. Depositing and withdrawing money without commission.

You can open a special IIS account, through which you can receive tax benefits. This is 52 thousand rubles of tax refund if you top up 400 thousand rubles for the year (13% of this amount will be 52 thousand). This way, you can save money much faster. Another plus is that income tax is taken from this account not at the end of each year, but at the time the account is closed. Read more in the articles:

- IIS - what is it;

- How to get a tax deduction for IIS;

- IIS - answers to questions;

- Which is better? IIS or brokerage account;

How to trade in the stock market can be read in the articles:

- How to buy shares for an individual;

- How to make money on stocks;

- How to buy bonds for an individual;

- Stock Exchange Trading for Beginners - A Detailed Guide;

Step 4. Selecting investment objects

Choosing the right tools to buy is the most important component of success. Remember billionaire Warren Buffett. He simply bought undervalued stocks and became the first on the Forbes list. Moreover, he started from scratch (he had no fortune).

- How to create an investment portfolio;

- How to choose stocks;

- Passive investments;

- How to choose undervalued stocks;

- Factors influencing stock prices;

- How investors lose money on the stock market;

- Warren Buffett's portfolio;

Analyzing the situation and making the right choice of investment object is always very difficult for beginners. To do this, you need experience both in trading and simply in some basic economic things. In principle, it is enough for an economist to analyze the financial statements of a company to draw conclusions about how well things are going.

Since there are not many economists among the population, and there is not much time to study reports and monitor the company’s activities. Therefore, I suggest you use the free services of brokers. Typically, they provide information about the most promising stocks for free. Others say that relying solely on their forecasts would be too naive. You also need to independently analyze the charts and make decisions.

Sometimes it happens that a stock with poor statistical data is expensive, which means it is overvalued. A company with great profits and potential, on the contrary, is at its minimum. Naturally, it is better to take an undervalued company. True, there is one nuance here. There are also sometimes unnoticed factors that can greatly influence quotes. In each case they are different and only an experienced expert can find them.

Types of investment portfolio

Based on the method of generating income, it is fashionable to distinguish the following types:

- A growth portfolio is an investment portfolio aimed at purchasing investment assets whose value is expected to grow.

- Income portfolio – aimed at purchasing investment assets that will generate income (from redemption, dividends, etc.).

- Short-term portfolio – aimed at purchasing highly liquid investment assets in order to subsequently sell them.

- Long-term portfolio – aimed at acquiring investment assets (regardless of their liquidity) to obtain a stable income.

- A regional portfolio is the acquisition of securities of one specific region, allowing you to concentrate on a narrower segment of the market.

- Industry portfolio - the acquisition of investment assets of one industry to narrow the field of investment.

Any investor should know the classification of investment portfolios, regardless of whether he is a beginner or not. This will allow you to better navigate the investment market and help you make better choices.

Aggressive portfolio

This is the exact opposite of a defensive portfolio with a significant bias in the structure in favor of risky assets - 50% or more. Risky assets include growth stocks and undervalued stocks. The risks in this portfolio are partially covered by coupon income from bonds, but if the maximum risk events occur, the portfolio may go into a significant minus. Many people call portfolios consisting entirely of stocks aggressive, but in our opinion, such portfolios are inferior, since they are in no way protected from general market risks.

We have built an aggressive portfolio in our Radar service. The portfolio amount is 400 thousand rubles, we distributed it between 20 assets with an equal share of the investment amount between stocks and bonds.

*Note: link to portfolio in Radar service

The potential return of the formed portfolio is 32.2%. Potential drawdown (loss on shares) - 28.77% of the initial investment in shares. If such a negative forecast is fully realized, the income from bonds does not cover the amount of losses - on the chart we see that the red dotted line of the drawdown goes into the “body” of the investment. That is, in essence, the investor loses part of the initially invested capital. As a result, the total risk of the portfolio is a loss of 7.9%.

Principles of investment portfolio formation

In addition to knowledge of qualifications, to competently form an investment portfolio, you need to have a good understanding of the principles of portfolio investment. The most basic and important ones are listed below.

1. Target orientation

This is the most important and main principle concerning, in general, all investing in general. The essence of this principle is that:

Before investing your money, you need to know why you need it.

There are many purposes for investing your money, the most common of which include:

- saving money, indexing for inflation;

- getting a lot of income;

- gaining experience in investing and acquiring real-time analysis skills;

- creating passive income;

- etc., there are many investment goals, and everyone has their own.

The main thing is that your goals should be precise, clear and specific. There may be many of them, but they must be there.

2. Balance of risks and returns

This is precisely the point about which controversy continues to this day. Some believe that it is more important to obtain a high income, while having a high risk of capital loss. Others believe that the main thing is a stable, although not large, but still income.

Here, everyone must decide for themselves the balance of risk and return, without relying on the opinions of other, even very experienced, investors. That is, a person must decide for himself how much he is psychologically ready to lose, given the corresponding risk and income.

3.Liquidity

This is a very important indicator that needs to be emphasized when forming an investment portfolio. It is typically created from investment assets that can be bought and sold regularly. This is what makes them very attractive, especially for experienced investors.

True, there are also low-liquid assets that ultimately bring huge profits to their owners. Everything is relative here. Therefore, it is so important to have an analytical mind in order to be able to predict the behavior of investment assets in response to changes in the economic situation in the financial market.

4.Diversification

Without this, but without diversifying investment assets, it is almost impossible to reduce the risks of losing your capital. Therefore, when forming an investment portfolio, you need to distribute your capital into investment assets in such a way that if one asset becomes unprofitable, there are others left from which you could make a profit. Then the loss of capital will not be perceived very painfully, and you will not lose all your money.

When is an investment portfolio not required?

- When income is less than expenses. The user’s task is to establish a family budget, that is, to bring order to personal finances. See where you can cut expenses and increase income. Only then can you ask yourself how to properly create an investment portfolio.

- There are loans, especially consumer loans. Initially, we deal with debts, then invest.

- There is no financial cushion that will cover spending goals in the next three months.

- There is no long-term goal. Since investment portfolios are created for a period of 5 years or more. At the same time, five years is the shortest planning horizon.

Remember that investing with the goal of withdrawing money in 1 year is the wrong approach, especially when it comes to stocks. It should be taken into account that the portfolio can be volatile, and in a year it will show a significant drawdown, and if after a year you want to withdraw funds, the user will simply lose on the investment.

Imagine that you freeze investments for a long period, then on the horizon 5, 10 and 20 years will show significant growth.

What can an investment portfolio be formed from?

When forming an investment portfolio, it is necessary that it meets the following requirements:

- bring maximum profit;

- have the least risks;

- All assets must be liquid to ensure quick exit from a position if necessary.

The most common and popular components of an investment portfolio include:

Stocks are risky securities that can bring very large profits, some of which can make a person rich in a short period of time.

Bonds are a more conservative type of security and are not suitable for short-term investments. Designed for passive investors. who prefer to make profits slowly but surely.

Futures and options are a type of investment on the securities market, which can be called in another way as bets on economic events in the country. With such investments, it is imperative to have special knowledge and skills. But despite this, this method of investing is an excellent option for beginners.

Bank deposits and deposits. Investing money in a bank, as it was, remains the most reliable way to invest your money. Here the investor is almost guaranteed to get back the invested amount with a small income that only covers inflation.

This financial instrument is ideal for accumulating the required amount of funds and for creating a “safety cushion”.

Currency of other countries. Here you need to be able to soberly assess the economic situation in the country in whose currency you are going to invest your funds, and its future prospects. That is, the investor must have a good understanding of the economy, be able to analyze and make further forecasts. Beginners who do not have sufficient knowledge and skills for this have nothing to do here.

Investments in precious metals. For several centuries, precious metals have been a currency that is guaranteed to bring good income to its investors. True, in order to get tangible profits, you need to invest your funds for a relatively long time.

You can read how to invest in gold correctly in this article.

Particular attention should be paid here to the compulsory medical insurance (non-personal - metal account) - a very interesting investment instrument in which the investor is issued a certificate of ownership of a certain amount of precious metals. They accrue interest, which, together with the invested amount, can be withdrawn at any time. And as the value of the metal increases, your bill will increase accordingly.

Real investment is investing your money in real estate, business, startup share and other similar assets. That is, something that can at least somehow be touched.

This is the main and most common set of financial instruments in which investors invest their funds. True, there is no specific and defined set of assets from which an investment portfolio is formed. Everyone chooses them for themselves. But, nevertheless, the basis of most investment portfolios are securities, mainly bonds. And for more conservative investors, the lion's share is made up of deposits in banks.

You can read how to open a bank deposit in this article, and how to open an online deposit in this article .

Aggressive (risky) part of the investment portfolio

From the remaining 30% of the money we form the aggressive part of the investment portfolio. Assets in this part of the portfolio have higher risks, which are offset by high potential rewards.

First of all, you should give preference to dividend stocks . Since we are buying these shares not for speculation, but for profit in the form of dividends, their current price does not matter. However, before purchasing them, you need to study the dividend payment calendar, and it is better to make the purchase itself when the price of these shares is corrected.

You should not chase the promise of high dividends, preferring shares of large Russian companies whose payments are not the highest, but stable.

Secondly, this part of the portfolio can include promising shares of developing companies , which, if successful, can bring a profit of several hundred percent per annum. You should choose shares of this type wisely: hundreds of percent income per year is, of course, excellent, but it would be wiser to choose shares of those companies that will bring profit approximately 20-30% higher than the income from the conservative part of the portfolio.

If you find it difficult to choose, just contact your broker, who will help you select the companies you need.

Forming an investment portfolio - step-by-step instructions for beginners

We have dealt with the theory, now we can move on to practical actions. Namely, we will consider a step-by-step plan for forming an investment portfolio.

Step 1. Set the right investment goal

Any investor should always know why he is investing his money in a particular investment instrument, and what he ultimately wants to get. The clearer and more specific the goal, the more effective his investment activities will be. If an investor has vague thoughts in his head, and he does not know exactly what he wants, then his actions will be corresponding: vague, inaccurate and inarticulate.

In addition, your investment goal must be realistic. That is, you don’t need to “jump over your head” and try to achieve the unattainable, you still won’t make it, you’ll only overstrain yourself and be disappointed.

It is better for beginners to seek help from a professional consultant, listen to the wise advice of experienced investors and follow them.

Step 2. Choose an investment strategy

The investment strategy is chosen based on the investor’s personal considerations and what he ultimately wants to achieve.

In fact, there are three main investment strategies:

- An aggressive strategy is a strategy that involves getting a lot of income in a short time. With this strategy, an investor must be active and constantly buy. sell and reinvest. This strategy requires time, knowledge and money.

- A conservative strategy is a strategy that assumes a passive approach to investing, that is, waiting. Its goal is to obtain a stable income with a minimum of risk. mainly chosen by people who do not want to risk their funds, and by beginners without the necessary knowledge and skills.

- A moderate strategy involves a combination of aggressive and conservative strategies. Here risks and returns are at the same level. Usually. This is a long-term investment.

Step 3. Choose a broker

It will be better if you choose a reliable broker who will help you and guide you on the right path. To do this, analyze the activities of several brokerage companies, read reviews about them and ask experienced investors.

Step 4. We analyze the market and select investment objects

Here you will need to conduct a market analysis and select investment assets that match your investment goals and chosen strategy.

To begin with, you will need to obtain all the necessary information about the available investment objects: read specialized sites, articles, books, etc. Once you begin to understand them and distinguish them from each other, you can move on to practice.

Especially at the very beginning of your investment activity, it is better to form an investment portfolio primarily from conservative investment assets. For beginners, their share should be about 50%. As you improve your financial literacy and gain the necessary experience, you will be able to reduce the share of conservative investments, gradually increasing moderate and aggressive ones.

In any case, you need to choose only those investment objects in which you understand at least a little. And you need to take on only those risks in the form of loss of capital that you are psychologically ready to endure.

Step 5. We optimize the investment portfolio

It is not enough to create an investment portfolio; it still needs to be constantly optimized. For example, if it contains shares of a company whose performance is regularly falling, you need to get rid of them. You can, of course, leave them, but here you need to have a firm belief that they will rise in price again.

In any case, each investor himself chooses how often to optimize his portfolio. Conservatives, for example, rarely change their investment objects, but aggressive investors do this with enviable regularity.

Step 6. Making a profit

Making a profit is the ultimate goal of any investor. Each investor has the right to decide for himself how to manage it. Some use it as a permanent source of passive income, while others use it to expand their investment portfolio.

The role of shares in the investment portfolio and selection criteria

As for stocks, the potential return on them can be several times or tens of times higher than on bonds. But the word “may” in this context is key. The profitability of shares is formed due to the growth of market value and dividends. Price movements can be a consequence of factors related to the company itself, as well as market factors (see the article “What affects the price of shares”). In short-term time periods, the exchange rate chart can have both an upward trend and a steep decline. This reveals the risky component of shares as an investment instrument. It is worth understanding that fundamentally strong stocks that have sources of growth will tend to grow in the long term, no matter how much their prices fluctuate in the short term under the influence of speculative factors.

There are 3 fundamental sources of growth in the price of a company and its stock price:

- Undervaluation of the company and, in the future, its desire to achieve its fair value (this criterion can be measured in different ways, but the most popular indicator of undervaluation is the investment P/E multiplier).

- Growth (development) of the company and, accordingly, an increase in its value.

- Dividend yield.

The presence of one of the factors or their combined combination in the medium or long term is a driver of stock price growth.

The risks of shares can also be assessed according to various criteria: the statistical value of the drawdown, the beta coefficient, technical support levels, the presence of fundamental problems in the company, etc.

Investment portfolio management

A well-formed investment portfolio, if managed effectively, can bring the owner impressive profits. investment portfolio management is . Now let's try to figure this out in order.

Investment portfolio management is a series of sequential actions aimed at preserving and increasing capital invested in investment assets.

Moreover, these actions should help reduce the risk of losing invested funds and help increase income.

Today there are two methods of investment portfolio management :

- active;

- passive.

1. Active method of investment portfolio management

This method involves constant analysis of the investment market with the aim of purchasing profitable assets and selling low-income ones. Thus, the investor constantly monitors, observes and acquires the most interesting offers for various investment assets, which leads to a quick and dramatic change in the composition of the investment portfolio depending on the state of the investment market.

There are three main ways to actively manage an investment portfolio :

- comparing the profits of old investments with new ones;

- sale of unprofitable assets and purchase of profitable ones;

- constant updating of the investment portfolio, its restructuring.

The general meaning of active management is that the investor must continuously monitor the economic situation in the country, monitor the financial market, analyze quotes, stock prices and anticipate possible changes.

So it turns out that this management method requires extensive knowledge, decent experience and understanding of the laws of economics.

2.Passive investment portfolio management

This method involves the formation of an investment portfolio using diversification and taking into account possible risks. In such a portfolio, it is rare for there to be a change in its composition.

Passive control includes:

- diversification of the investment portfolio;

- determining the minimum profitability of assets;

- selection of investment assets taking into account diversification and profitability;

- formation of an investment portfolio;

- monitoring the profitability of assets, and updating the investment portfolio in the event of a decrease in the profitability of its minimum.

Thus, with passive management, the investor prepares a well-risk-protected, diversified portfolio in advance and updates or collects assets into a new portfolio only in the event of a large drop in the yield of securities and other investment instruments.

Algori

Now let's start looking at the instructions on how to create a portfolio yourself.

Investment term

Let’s look at an example right away: the goal is to save for a child’s education. It is important to consider where you are at the moment. If the child is 2 years old, then he is about 17 years old, in which case it is possible to create an investment portfolio, there is a high probability that after a certain period of time the goal will be achieved. When your child is already 15 years old, there is little point in creating a portfolio. In this case, it is better to pay attention to instruments that will help you preserve capital, these could be bank deposits, short-term bonds.

Determine clear investment terms. Visualize a lock that closes these attachments. If you get funds ahead of time, you can only lose.

Investment goals

Depending on the goals, portfolios are divided into three types:

- Aggressive - includes shares, can bring high returns, but is associated with high risks. This option is ideal for those. who intend to increase capital and are willing to take risks.

- Conservative - based on bonds, based on moderate returns with minimal risks. Suitable for those who already have capital, and the task is to preserve funds and protect against inflation.

- Balanced, which combines stocks and bonds, gives a correspondingly average result.

Risk appetite

Most often, it is difficult for a person to determine for himself what kind of drawdown he can withstand. It is important to take into account the personal characteristics of each investor. Someone is able to behave calmly, even if the portfolio loses up to 50% in value. Of course, one should not discard life circumstances, because everyone begins to create a portfolio with a specific goal, which is formed as a result of life processes. It’s enough to simply ask yourself the question of what percentage you are willing to lose. It is important to answer it as honestly as possible.

Portfolio formation

In this case, it is important to understand that asset allocation is based not only on the selection of different groups of assets, but also on diversification according to certain criteria: country, currency.

Regarding the latter, it should be noted that if an investor aims to save funds for a period of 1-2 years, while spending in rubles, there is no point in transferring money into foreign currency. Since the currency is volatile and may fall in price over a short period of time, there is therefore no point in converting rubles into foreign currency for a short period of time. But, if we are talking about planning investments for 5 years and above, then you can transfer part of the capital, this will allow you to diversify risks.

Regarding the country, it is better to choose countries with a developed market or those that are in the developing group. The first option is reliability, but a small profit, the second option is increased profitability and high risks.

A few words need to be said regarding shares; they are further divided into subsections:

- growth, purchased by investors in the expectation of higher prices;

- profits that are bought for a good dividend yield.

There is no such group in the Russian Federation yet - companies paying interest for over 30 years in a row. But, there are organizations that gradually increase dividend payments. The following statistics are present here:

- LUKOIL, over 19 years;

- Alrosa - seven years;

- Moscow Exchange - six years;

- TGK-1 - about five years.

In reality, for new investors it is more correct to purchase not shares and bonds of individual organizations, but ETF funds for stocks, bonds and other groups of assets.

Investment portfolio optimization

In order for the formed investment portfolio to be profitable and bring profit to its owner, it is necessary to regularly optimize it. There are many optimization methods. The main and most effective ones will be discussed below.

1. Diversification of the investment portfolio

This is the most important and main rule of an investor. Another way they say is: “Don’t put all your eggs in one basket.” If there are a lot of eggs, then there should be more than one basket. The more investment assets are in the investment portfolio, the lower the risks will be. True, its profitability must be calculated so that it covers the existing inflation.

Approximately the diversification of an investment portfolio can be shown as follows:

- 50-70% are low-risk investments;

- up to 20% - highly profitable investments with a high degree of risk;

- the rest goes to reserve needs and is placed in bank deposits or, for example, in unallocated metal accounts.

This is the classic composition of an investment portfolio. It may be different. Each investor has the right to form its structure himself.

2.Investing money in a bank

Investing money in bank deposits is a method suitable for those who prefer a more reliable investment. You can distribute your funds among the largest banks in the country.

In addition, today many banks offer their clients the opening of investment deposits and an individual investment account. Their reliability is close to bank deposits, and their profitability is higher.

3. Investments in real estate

Investments in real estate were, are and most likely will be practically the most reliable way to invest your funds (besides bank deposits, of course). Here the investor is almost guaranteed to receive a decent income. At least the inflation rate will definitely overlap.

How to build a conservative portfolio

Any investor faces an important question: save or increase? Any investment carries risks. The only difference is how prepared you are for them. If your investment goal is to get a return higher than in a bank and save your nerves, create a conservative portfolio.

In this article we tell you how to save money while minimizing losses. You will learn what to pay attention to and with which assets to diversify risks.

Don't put all your eggs in one basket

The main advice for a novice investor: “Remember to diversify!”

Any investment is always associated with risks, so first of all, try to protect your personal capital as much as possible. This can be achieved by building a diversified portfolio.

Ok Google, how to do this?

To diversify risks means to distribute investments within a portfolio into different markets, industries, and instruments. The goal is to reduce their dependence on each other as much as possible. Dependency in financial theory is called “correlation”. In simple words, this is how equally or differently the prices of selected assets move depending on the situation on the markets.

How to calculate correlation

Let us explain with examples why it is important to create a portfolio of non-correlated instruments.

When oil prices fall, oil company stocks also fall because they have a positive correlation and similar industry risks. If your portfolio consists only of oil assets, then in this situation it will sag. To reduce the drawdown, other instruments are added to the portfolio that are less susceptible to the situation on the oil market.

An employee of the energy company Enron invested all her retirement savings in its shares. The woman was sure that nothing would happen to such a successful company. It later turned out that the company manipulated its statements, and its shares became worthless. And the woman lost not only her job, but also all her savings.

In an ideal world, a diversified portfolio would include stocks, bonds, metals, currencies and cryptocurrencies, and real estate. Unfortunately, such diversification is difficult and expensive to achieve, so a portfolio is usually made up of uncorrelated stocks, bonds and currencies.

Don't be fooled into thinking that drawdowns can be completely avoided if you diversify effectively enough. The market is influenced by a huge number of indicators; it is impossible to take them all into account. Just remember not to put all your eggs in one basket.

Risk and return are the two pillars of an investor

Any investor works with two indicators - risk and profitability. In the case of a conservative portfolio, we will talk about minimizing losses - it is permissible to lose about 3% of the total amount. This is the figure for which people who invest in order to preserve their savings are mentally prepared. In monetary terms, this is approximately 30 thousand rubles per one million.

Remember that low risks mean low returns. The question arises: why invest at all if you can just put the money in a deposit and forget about it? The answer is that even low investment returns are higher than bank returns. Investors receive a risk premium. If you optimally create a diversified portfolio, the return on average will be higher than on deposits.

Read how to manage risks and create a portfolio yourself:

- A. Burenina in “Securities Portfolio Management”,

- D. Murphy in “Intermarket Analysis. Principles of interaction of financial markets",

- W. Sharpe in “Portfolio Theory and Capital Markets.”

If you don’t want to figure it out yourself, entrust it to the management company - they will take a commission, but will do everything for you.

Opening an account with a foreign broker

People are exposed to the economic risks of the country in which they live.

If you live in Russia and receive your salary in rubles, you have currency risk. Most likely, you still have some real estate in Russia, ruble bank accounts, and other assets. By choosing the Russian stock market with such baggage, you are putting all your eggs in one basket: you have all your assets in rubles, and you also want to expose your available funds to currency and country risk, which is now quite large.

The situation on Russian markets after the introduction of US sanctions in April

At the same time, there are few public companies in Russia. Less than 300 shares of Russian companies and more than 500 foreign ones are traded on the Moscow and St. Petersburg stock exchanges. For comparison, on one of the US exchanges, the NYSE, more than 3 thousand shares of non-Russian issuers are traded.

Most Russian issuers are associated with raw materials, so their shares are moving in the same direction. At the same time, many of them do not behave in a market-like manner—they react poorly to the release of financial statements and other corporate events. This means that even without sanctions, it is difficult to create a diversified portfolio in the Russian market .

Therefore, we recommend opening an account with a foreign broker. It’s better to go straight to the American one.

Which American brokers work with Russians

Building a conservative portfolio

A novice investor can choose the following proportions of instruments for a conservative portfolio:

- 55% bonds;

- 25% shares;

- 20% cash.

Let's look at each of them in more detail and tell you what to look for when choosing.

55% - in bonds

Investment in bonds is a loan to the government or company. When you buy a bond, you become a creditor. When such a security expires, you will receive not only its face value, but also the established interest.

Take a closer look at bonds of reliable states. Reliability is assessed by international rating agencies. The largest are Moody's, Standard & Poor's (S&P), Fitch. The ratings they give to states are published on tradingseconomics.com. Alternatively, you can invest 45% of your portfolio in American Treasuries and another 10% in bonds of other reliable countries.

When choosing bonds, pay attention to the financial condition of the issuer, its ratings, yield, and terms to maturity. You should not take bonds that are too long - the economic situation may change, and the current yield may not be sufficient. It is convenient to filter bonds in Thomson Reuters or Bloomberg terminals.

25% - in shares

Shares are the purchase of a share in a company. You can select stocks yourself or buy a share in a ready-made diversified portfolio of stocks. Such portfolios are called Exchange Traded Funds (ETFs).

What are the benefits of ETFs? For example, let's say you believe in the electric power industry and decide to invest in companies in this industry. You can find them yourself, choose the ones that suit you and put them together in a portfolio. However, one share of such a company can cost several thousand dollars, and with a limited budget it will not be possible to invest in the selected electric power companies. Plus it can take a lot of time. Do not forget also that after some time you will have to perform the opposite operation - sell the portfolio, getting rid of previously purchased instruments one by one. ETFs solve all these complexities.

What are ETFs and how to invest in them

The most convenient way to select them is on etf.com. First filter ETFs by liquidity, trading volume and capitalization. Further settings depend on your wishes.

20% - cash

No one can accurately predict when the market will have a good time to enter. It may come in a month, a year or two. To use it, leave 20 percent of your portfolio in cash.

Cash can be kept on:

- broker's balance. Prompt response to market signals, no time wasted transferring funds to the broker. Also, many American brokers (list of them) provide insurance for client funds by the Securities Investor Protection Corporation. As a bonus, some brokers charge interest on the account balance - for example, Interactive Brokers (1.68% on the balance).

- bank deposit. Efficient management of money; you can quickly withdraw it from the bank. In the Russian Federation, dollar deposits can be opened in a subsidiary of the American Citibank, and euro deposits can be opened in subsidiaries of the Italian UniCredit and the Austrian Raiffeisen. If you still want an account in rubles, do it at Sberbank or VTB. Why is that? The point is reliability - America issues dollars, Europe issues euros, Russia issues rubles. In case of any problems, the state of this credit institution will provide it with a currency swap line.

What is a currency swap

Remember

- The market is dynamic and losses cannot be completely avoided.

- To minimize losses, diversify your risks by investing in different markets, industries and non-correlated instruments.

- Typically, a diversified portfolio consists of bonds, stocks and currencies. In the case of a conservative one, most of its share will be in bonds of reliable companies or states.

- It is difficult to assemble a diversified portfolio in the Russian market, so open an account with a foreign broker. Ideally, American.

- And again: diversify your risks.

Disclaimer. The information offered by DTI Algorithmic should not be considered an offer, invitation or inducement to invest; this information does not contain and does not constitute advice or a recommendation to make any investment decision. Before making any investment decision, you should obtain the advice of a financial advisor who is familiar with your financial situation and investment goals.

More articles on blog.dti.team

Investment Portfolio David Tepper

“I, like everyone else, am an animal in some kind of herd. Either I'll get eaten, or I'll get the juiciest prey." David Tepper

Portfolio value return: 107% over 5 years (S&P 500 47%)

Capitalization: 3 266 018 000$

25th place according to Forbes among fund managers

It can be noted that at present, portfolios composed of rapidly growing companies in the IT sector bring great profitability; their profitability over the past 5 years often exceeds 70-100%. Thus, the return on David Tepper’s investment portfolio over the past 5 years has been more than 107%.

David Alan Tepper is the founder of Appaloosa Management, which manages over $3 billion in investments. Tepper has established himself as one of the most successful investors on Wall Street. The main shares of the portfolio are shares of telecommunications companies (34%), producers of consumer goods (29%), IT technologies (18.9%). In the list of shares you can see shares of such giants as Amazon, Alibaba, Alphabet, Facebook, Twitter.

| Ticker | Name | Capitalization in millions | Portfolio share % |

| AMZN | Amazon.com, Inc. | 487.4 | 14.9% |

| BABA | Alibaba Group Holding Limited | 440.5 | 13.5% |

| GOOG | Alphabet Inc. | 419.8 | 12.9% |

| FB | Facebook, Inc. | 402.5 | 12.3% |

| M.U. | Micron Technology, Inc. | 372.7 | 11.4% |

| TWTR | Twitter, Inc. | 135.8 | 4.2% |

| AGNN | Allergan Plc | 123.1 | 3.8% |

| PCG | PG&E Corporation | 101.9 | 3.1% |

| NFLX | Netflix, Inc. | 95.8 | 2.9% |

| ET | Energy Transfer LP | 74.9 | 2.3% |

Portfolio return dynamics

Telecommunications companies occupy more than 35% of the portfolio

The figure below shows the capitalization of Tepper's portfolio of individual stocks and the composition of the portfolio.

The emphasis is on the “big” 4. Three companies are included in the portfolio: Amazon, Google, Alibaba

Study in more detail what changes in the assets of Tepper's portfolio → assets of D. Tepper's investment portfolio

Ray Dalio's Investment Portfolio (All Seasonal)

Portfolio value return: 67% over 5 years (S&P 500 47%)

Max. Loss for the year : -3,25%

Max. Drawdawn -11.98%

Capitalization: 5 039 633 000 $

The portfolio is managed by his hedge fund, Bridgewater, which manages more than $160 billion in assets. $. His portfolio is called “seasonal” because it aims to generate profits during different phases of the economic cycle. Let's consider which assets create profitability at different stages of the cycle:

- The economy is growing (increasing demand) . Developed market stocks are rising, ↑ emerging market bond yields are rising ↑ corporate bonds ↑ commodities ↑

- The economy is falling (falling demand) . Profitability is obtained through inflation-protected bonds (these are available in the USA) ↑ and government bonds ↑.

- Inflation is rising (money is getting cheaper) . Inflation-protected bonds are rising ↑ emerging market bonds ↑ commodities ↑.

- Inflation falls (money becomes more expensive) . Developed market stocks are rising ↑ government bonds ↑.

As a result of this investment policy, his portfolio has the following proportions:

- 30% in shares

- 40% in long-term bonds

- 15% in medium-term bonds

- 5% in gold

- 5% in commodities, metals, sugar, cattle, oil, etc.

This strategy is aimed at diversifying between different asset classes in order to smooth out and reduce fluctuations in profitability as much as possible.

TOP 10 stocks from Ray Dalio's portfolio

If we compare the portfolio with other investors, then there is greater smoothness in the weights than that of W. Buffett, K. Aiken or B. Gates, in whom some asset dominated more than 50%. As you can see, the share of gold in the portfolio increased to 11.9% - this is due to the crisis and an increase in the share of protective assets. You can also see that there is investment in Brazil's emerging markets (EWZ).

| Ticker | Name | Capitalization in millions | Portfolio share % |

| SPY | SPDR S&P 500 ETF Trust | 918.6 | 18.2% |

| GLD | SPDR Gold Trust | 600.6 | 11.9% |

| VWO | Vanguard International Equity Index Funds – Vanguard FTSE Emerging Markets ETF | 465.5 | 9.2% |

| IVV | iShares Trust – iShares Core S&P 500 ETF | 332.0 | 6.6% |

| TLT | iShares Trust – iShares 20+ Year Treasury Bond ETF | 279.1 | 5.5% |

| LQD | iShares Trust – iShares iBoxx $ Investment Grade Corporate Bond ETF | 227.0 | 4.5% |

| EWZ | iShares, Inc. – iShares MSCI Brazil ETF | 192.6 | 3.8% |

| IAU | iShares Gold Trust | 176.0 | 3.5% |

| IEMG | iShares, Inc. – iShares Core MSCI Emerging Markets ETF | 134.6 | 2.7% |

| HYG | iShares Trust – iShares iBoxx $ High Yield Corporate Bond ETF | 115.2 | 2.3% |

Portfolio return over 12 years

A heavily hedged portfolio that generates income at any stage of the economic cycle. The portfolio is suitable for conservative investors

The figure below shows an absolute comparison by ETF exposure.

Exponential distribution of portfolio asset shares

ETF Portfolio

You can build a simulated portfolio of R. Dalio from ETFs (traded funds). Many ETFs include many different types of assets and are widely diversified. The table below offers a portfolio of ETFs↓

| Asset name | Weight in IP | ETF ( ticker) |

| Long-term bonds | 40% | TLT |

| Stock | 30% | VTI |

| Medium-term bonds | 15% | IEF |

| Gold | 7,5% | GLD |

| Goods | 7,5% | DBC |

The portfolio returned 170% over 12 years, compared with 180% for the S&P 500. Despite this, the risks if we invested in R. Dalio’s portfolio and the S&P 500 index differed by 5 times! The IP drawdown in the worst year was -3.25%, while the index was -37%.

During periods of active growth, the index will generate higher returns, but during periods of crisis, distribution between different classes smoothes out balance drawdowns. In times of increasingly frequent crises and economic instability, Ray Dalio's portfolio is performing well.

Portfolio management procedure

Creating a portfolio is painstaking work. Depending on many conditions, you can spend from one evening to a month on it. But the process of forming a portfolio and physically purchasing assets is not the final point, after which you can completely relax and take the position of an outside observer.

Afterwards, the portfolio management process begins, which is more labor-intensive in terms of time spent compared to previously completed stages. The task of portfolio management is relevant for both short-term and long-term investors. At the same time, it is important to understand that portfolio management is not about daily monitoring the account status in the stock exchange terminal and falling into depression every time a minus appears in the portfolio. Market volatility and short- and medium-term market drawdowns are normal.

Portfolio management is tracking signals for the portfolio (how well the minus/plus that appears fits within the boundaries of the scenario defined at the time of its formation) and for individual securities in particular. The performance of the portfolio can be assessed, as in the case of a back test, by comparing the dynamics with the Moscow Exchange index. If the index is outperforming your portfolio, then you need to evaluate: “what is it?”, “the long-term nature and specificity of ideas that at the current phase of the market show lagging dynamics, but should be realized over long investment horizons?”, “maybe it is worth carrying out a serious rebalancing?” .

It is worth remembering that portfolio formation is just the tip of the iceberg.

The main work in portfolio management should be based on monitoring the market behavior of individual securities. In this direction it is important to monitor:

Fundamental Factors

(when the company/stock has exhausted its growth drivers).

Technical factors.

Here, attention should be focused on reversal signals for closing positions, signals of optimal entry points for new interesting investment ideas or increasing the share of existing fundamental ideas in the portfolio.

Force majeure events.

These could be local force majeure events associated with an individual issuer or crisis phenomena in the economy that directly affect the securities market. An example of the former could be the pre-bankruptcy state and the reorganization procedure of the bank Opening, the accident and mothballing of the production of the unique non-ferrous metallurgy enterprise Electrozinc. Unfavorable events are immediately reflected in securities quotes, and the investor’s task is to assess the risk of being in these positions and quickly make a decision - to continue holding the shares or to close the positions. The risks in the event of force majeure situations are great: in a further favorable scenario, share prices may recover the drop that occurred over a long period, or may not return to their original levels; in the end, delisting is not ruled out. A striking example of a crisis phenomenon in the economy as a whole can be called the financial crisis of 2008, when the stock market “collapsed”; the Moscow Exchange Index during that period fell by more than 3 times. What signals could there be for investors here? Taking profits, moving to other asset classes, or vice versa, is an ideal opportunity to enter into investment ideas with strong fundamental potential.