Cash payments, despite the many options for non-cash payments, remain as relevant as ever. They are accounted for in organizations on the active account 50 “Cashier”. An accountant, in addition to standard postings and the usual forms of primary documents for the cash register, has to take into account changes in legislation, and the introduction of technical innovations into everyday use of cash transactions - online cash registers (by the way, we recently collected the hot TOP 10 questions about online cash registers), pay attention to the nuances that arise in accounting: compliance with cash discipline is always strictly controlled by the state.

The procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses.

General provisions and nuances

The procedure for conducting cash transactions is determined to be the same, regardless of the type of activity and legal form of the business entity. It is contained in instruction No. 3210-U dated 11/03/14 of the Bank of the Russian Federation.

For some market participants, a simplified cash accounting procedure has been established. This:

- small business and micro-business firms;

- IP.

Both are exempt from the obligation to calculate the cash limit, and entrepreneurs may not keep cash records at all, i.e. do not draw up cash receipts and expenses, do not fill out the cash book. Nevertheless, experts advise entrepreneurs to keep cash records, since in practice this data is often used (for example, when applying for a bank loan, in case of controversial situations related to the issuance of cash). At the same time, individual entrepreneurs must keep records of income (expenses) and physical indicators for NU purposes (letter of the Federal Tax Service No. ED-4-2/13338 dated 9/07/14).

Question: How many cash books should an organization keep when performing cash transactions if a separate division has five cash register machines registered and is located in another region of the Russian Federation? View answer

Cash accounting consists of:

- accounting for receipts and expenses at the cash register with filling out receipt and expense cash orders (forms KO-1, KO-2);

- cash storage;

- establishing and maintaining a cash limit;

- filling out the cash book (form KO-4);

- depositing cash at the bank.

Cash desk documents are signed by an accountant, and if he is not there, by management, with the obligatory affixing of a seal. When accepting cash, you must give the person who deposited the money a PKO counterfoil.

If a company has several cash registers and the cashiers interact with the senior cashier and transfer money to him, the KO-5 accounting form is used, which takes into account funds received and issued during the day.

If a company has separate divisions, they maintain cash books, and send copies of sheets of the cash book to the head office for compilation of data. Cash can be issued not only to the citizen personally, but also to his representative by proxy. In both cases, the cashier will check the recipient's passport details before dispensing money. The issuance documents must indicate that the money was issued by proxy.

Salaries are issued from the cash desk according to settlement (settlement and payment) statements; an expense order for payment can also be issued. For the amount issued according to the statement, a general cash settlement is also drawn up. The issuance of funds to the “accountable” is possible either at his request or by order of management.

How to arrange the release of deposited wages from the cash desk by proxy?

When paying cash under one agreement from the cash register, there is a limit of 100 thousand rubles, but it does not apply to settlements with individuals (instruction No. 3073-U of the Bank of the Russian Federation dated 7/10/13).

Cash book

Document number according to the General Classifier is 0310005. The cash book is kept by the senior cashier of the enterprise. This documentation records cash transactions carried out between the senior cashier and his junior colleagues during one working day. But if the company is small, then you can completely refuse to maintain such a book.

Procedure for using the cash ledger:

- Before the start of the working day, the senior cashier or other person authorized by the order of the manager issues cash to the junior cashiers. Money is issued strictly against signature.

- After a working day, all the money remaining in the cash register is also given away against signature in the accounting book. If it is necessary to give part of the funds as salaries to employees, then the authorized person must report for them before the deadline specified in the statement expires.

The senior cashier transfers all funds remaining at the end of the day into a special envelope. On it, the employee writes the exact amount of the balance, and then hands it over against signature. In cases where, at the end of the period specified in the payroll, any balance remains, it is returned in full to the central cash office. In this case, it is necessary to make an entry in the accounting book about the completed transaction.

As a rule, the responsibility for registration and control of the accounting book is entrusted to the chief accountant. But often in companies, responsibilities are transferred to other employees. Individual entrepreneurs are allowed to entrust the maintenance of the accounting book to themselves or to another employee who enjoys special confidence from the manager.

How to calculate the cash limit

The appendix to document No. 3210-U dated 11/03/14 of the Bank of the Russian Federation offers two options for calculating the cash limit:

- by the volume of cash received at the cash desk;

- by the volume of cash dispensed from the cash register.

The calculation formulas are as follows:

- L1 = V / P * Nc – “according to the volume of receipt”;

- L2 = R / P * Nn – “according to the volume of issue.”

Here L1 and L2 are the calculated limits, V and R are the amount of cash receipts and withdrawals, Nc and Nn are the time period in the river. days between the moments of depositing proceeds and receiving money from the bank by check, respectively. It cannot exceed 14 rubles. days; P – settlement period for which the amount of cash receipts or withdrawals is taken into account. It cannot be higher than 92 rubles. days. The calculation “by volume of issue” excludes days and amounts of salary payments and other payments to employees of a “salary” nature.

Example. The organization sets a cash limit. The calculation period was December of last year. It has 21 working days. The limit is calculated according to the first option, the amount of cash proceeds received is 550,000 rubles. Proceeds, by agreement with the bank, are surrendered every 3 days.

550000 / 21 * 3= 78571 rubles – cash register limit.

The limit on the issuance volume is calculated in the same way.

Over-limit amounts at the end of the day are calculated by subtracting the established limit and unpaid wages from the actual cash balance.

The excess balance may be exceeded on the following days:

- issuing wages (no more than 5 days);

- weekends and holidays (cash is deposited on the first day).

If a legal entity has separate divisions, the total limit is calculated taking into account the limits in separate divisions.

The cash limit may not be calculated by individual entrepreneurs and representatives of small businesses.

How can a small company organize cash accounting ?

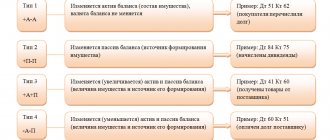

Postings

The standard, most frequently used cash account correspondence in accounting is given below.

Coming:

- 50/51 – money has been capitalized from the current account.

- 50/62 – the buyer made payment (advance payment for supplies).

- 50/66.67 – the cash desk received funds for the loan (short-term, long-term).

- 50/75 – the founders made a contribution to the authorized capital in cash.

Consumption:

- 51/50 – the excess amount was deposited with the bank.

- 70/50 – salary paid in cash.

- 71/50 – cash issuance to the “accountable”.

- 60/50 – cash paid to the supplier for goods, services (advance paid).

- 66.67/50 – loan repaid in cash (short-term, long-term).

- 75/50 – dividends paid in cash.

When using an online cash register, transactions may have the following features:

- 50/90-1 – retail revenue. If the revenue is from a specific counterparty, use Kt 62, and then post 62/90-1. When making payments by card, instead of account 50, account 57 “Transfers in transit” is used. In this case, funds for the goods have been deposited, but are considered not yet received in the company’s account.

- 41/76 (or 62), 76/50 (or 51) – the goods were accepted from the buyer and the money was returned to him; debits and credits are formed taking into account the company's working chart of accounts. Here you also need to reverse postings 76/90-1 and 90-2/76, i.e. adjust revenue and cost of goods sold.

- 76/50 and reverse posting 50/76 are used for various outgoing and incoming transactions. Instead of 76, account 60 can be used. Note that expenses and returns can be made, in addition to the cash register, to a current account (51) and to a card (57).

Payment by payment cards

acquiring in other words, is a currently widespread method of payment for goods or services. Let's consider the procedure for carrying out such an operation in 1C.

Menu path: Bank and cash desk => Cash desk => Payment card transactions.

Figure 32. Menu path - Payment card transactions

By clicking the Create , three document options are possible. We select Payment from the buyer, because... this document is configured to reflect payments from legal entities and individual entrepreneurs. Retail payment card transactions are beyond the scope of this article.

Figure 33. Selecting a document option

We fill out the document, everything is quite simple here.

Figure 34. Completed Payment Card Transactions document

Let's look at the wiring. Cash is reflected in account 57.03.

Figure 35. Postings according to the Transactions on payment card document

To reflect the receipt of funds to the current account, you can create a document Receipt to the current account based on the transaction performed.

Figure 36. Creating a document Receipt to current account

Without a bank commission, payments are unlikely to be made, so we break the payment into the payment amount and the bank commission, and indicate the cost account for this commission.

Figure 37. Completed document Receipt to current account

Let's look at the wiring.

Figure 38. Postings according to the document Receipt to the current account

Online cash register transactions

On July 1, 2019, the last stage of introducing online cash registers into the cash payment system, which began on July 1, 2017, is completed (FZ-54 dated May 22, 2003). It should be said right away that there have been no changes in accounting for the operating cash desk in connection with the introduction of online cash services. The procedure for documenting and conducting cash transactions, as before, is regulated by document No. 3210-U.

At the same time, significant changes and additions to the previously existing order have been introduced. The use of online cash registers is regulated by Federal Law 54 itself and by-laws adopted on the basis of its provisions.

Rules for cash payments established by the Central Bank of the Russian Federation.

Today there is no need to maintain:

- acts KM1-KM3, KM9 (on transferring cash meter readings to zero, on taking meter readings when transferring the cash register for repairs, on returning money, on checking cash);

- logs KM4, KM5, KM8 (cashier-operator, recording meter readings, recording calls from technical specialists);

- reports and references KM6, KM7 (cashier-operator, about meter readings and revenue).

According to Federal Law-54, the following are formed (Article 4.1-4):

- shift opening/closing reports;

- report on closing the fiscal drive;

- cash correction check;

- operator confirmation, etc.

Transactions of cash receipts, issuance and receipt of money, and their returns are recorded. Cash revenue is credited to the operating cash register by issuing PKO on the basis of the shift closure report, an analogue of the previously used z-report.

Important! There are organizations and entrepreneurs that are completely exempt from the obligation to use an online cash register. Their list contains Article 2 of Federal Law-54.

Briefly

- Accounting for cash transactions is carried out on account 50, in correspondence with the cash receipts and expenses accounts.

- The main documents of the cash register are incoming and outgoing cash orders and a cash book.

- With the introduction of new technical means into economic circulation - online cash registers, cash accounting has not undergone significant changes, but the possibilities for cash accounting have expanded.

- For small businesses and individual entrepreneurs, the legislator provides the opportunity not to set a cash limit, and entrepreneurs may not maintain cash documents. This is possible if, for the purposes of financial accounting, they keep records of the indicators required in accounting for financial accounting - physical or monetary.