A non-profit organization has a number of distinctive features, namely:

- is not created for the purpose of making a profit;

- Even if the profit was received, then under no circumstances is it subject to division between the founders or other investors.

Despite the goals, in some cases the authorized capital of a non-profit organization is formed.

Purposes of creation

The main goal of any non-profit enterprise is to serve the interests of society and achieve certain benefits in their interests. In fact, such an organization should bring certain benefits, for example cultural, perform a social or educational function, help people in need, sometimes even animals. The organization can carry out an educational function.

Often an NPO is created to perform the function of developing and introducing a healthy lifestyle. There are many societies that provide free legal assistance or help resolve conflict situations.

As can be seen from the purposes of creating a legal entity, its activities do not imply the presence of business risks, therefore, the authorized capital of a non-profit organization should not be formed.

We analyze the tax consequences of transactions involving non-profit organizations

The main difference follows from the very name “non-profit”.

based on its market valuation (clause 5 of Article 50 of the Civil Code). Such property can be conventionally called the authorized capital of an NPO. IMPORTANT! The exception does not apply to state-owned and private institutions, as well as religious organizations (Article 8 of the Law “On Freedom of Conscience...” dated September 26, 1997 No. 125-FZ).

This means that making a profit for these organizations is not the main goal of activity (whereas for LLCs and CJSC, making profit is the main goal of activity, and this fact is recorded in their charters).

All other differences follow from the main one. Thus, non-profit organizations are not at all prohibited from making transactions, including those generating profit. However, non-profit organizations can enter into profit-making transactions only to achieve the goals and objectives specified in the charter. Having received “commercial” profit, NPOs do not have the right to distribute it among participants, but must use it for their statutory, non-commercial purposes.

According to Article 2 of the Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations”, NPOs are created to achieve social, charitable, cultural, educational, scientific and managerial

Authorized capital or fund

At the legislative level, there is no requirement for the formation of the authorized capital of a non-profit organization.

At the same time, at the level of legislative acts, sources of financing are established for charitable foundations that belong to non-profit organizations:

- founders' contributions;

- other contributions;

- revenues from sales;

- income from the organization’s own property;

- dividends, interest on deposits;

- donations;

- other sources.

The same Civil Code establishes that all non-profit organizations formed from the contributions of the founders are required to form an authorized capital.

And a conflict immediately appears: if an NPO does not carry out entrepreneurial activities, then some of these points directly permit its conduct. Consequently, a non-profit organization has the right to enter into transactions that will make a profit. Naturally, entrepreneurial activity should have an ultimate goal - charity.

The size of the authorized capital of a non-profit organization must be less than the market value of the enterprise's property.

However, if the authorized capital is formed, then the company’s participants and founders do not have the right to demand payments from profits or payment of a certain percentage of income, but the founders are not liable for the company’s obligations.

MANAGEMENT BODIES OF THE FUND

PRESIDIUM OF THE FUND

3.1. The highest governing body of the Foundation is the Presidium of the Foundation (hereinafter referred to as the Presidium). The initial composition of the Presidium is formed by the Founders of the Foundation. Subsequently, the composition of the Presidium is formed by decision of the Presidium itself. The term of office of the Presidium is five years.

3.2. The Director of the Foundation is an ex-officio member of the Presidium and presides over its meetings. In the absence of the Foundation Director at the meeting of the Presidium, the remaining members of the Presidium, by a simple majority of votes, elect from among their members the chairman of this meeting.

3.3. A member of the Presidium may be excluded from its composition by decision of the remaining members of the Presidium on the basis of a personal application of the expelled member or in the event of his absence from meetings of the Presidium for 1 (One) year.

By decision of the Presidium, adopted by a simple majority of votes, new members may be admitted to its composition.

3.4. The procedure for the activities of the Presidium of the Foundation is determined by this Charter and internal documents of the Foundation.

3.5. Meetings of the Presidium are held at least once a year. An extraordinary meeting is held at the request of the Director of the Fund, or the Board of Trustees of the Fund, or the auditor of the Fund.

3.6. Decisions of the Presidium are made by a simple majority of votes of the members present at the meeting, except for cases specifically established by this charter.

3.7. The Presidium of the Foundation is authorized to make decisions if more than half of its members are present at the meeting.

3.8. The main function of the Presidium is to ensure that the Fund adheres to the goals for which it was created.

3.9. The exclusive competence of the Presidium includes:

- amendment of the Foundation's Charter;

- determination of priority areas of the Fund’s activities, principles of formation and use of its property;

- appointment of the Director of the Fund, members of the Board of Trustees and the Audit Commission of the Fund and early termination of their powers;

- approval of the annual report and annual balance sheet of the Fund;

- approval of the annual plan of the Fund, the budget of the Fund and amendments to them;

- formation of the Presidium (admission/exclusion of new members to the Presidium);

- creation of branches and opening representative offices of the Fund;

- making decisions on the creation of business companies and non-profit organizations and on participation in such organizations;

- reorganization of the Fund;

- approval of charitable programs;

- approval of the Regulations on the Presidium of the Foundation, on the Director of the Foundation, on the Audit Commission of the Foundation and the Board of Trustees of the Foundation.

3.10. Issues within the exclusive competence of the Presidium cannot be transferred for decision to other management bodies of the Foundation. Decisions on issues of the exclusive competence of the Presidium are made by a qualified majority of 2/3 votes of the members of the Presidium, subject to a quorum.

3.11. Members of the Foundation's Board of Trustees have the right to attend meetings of the Foundation's Presidium.

3.12. All decisions of the Presidium of the Foundation are documented in a protocol, which is signed by the person chairing the meeting and the secretary. The person presiding at the meeting ensures the maintenance and execution of minutes of the Presidium.

3.13. The Director of the Foundation organizes preparations for the meeting of the Presidium, notifies its members about the date and place of its holding, issues proposed for inclusion on the agenda, ensures that its members are familiar with the documents and materials submitted for consideration by the Presidium.

3.14. Members of the supreme management body perform their duties voluntarily and free of charge.

DIRECTOR OF THE FUND

4.1. The Director of the Foundation carries out the current management of the activities of the Foundation and is accountable to the Presidium of the Foundation. The term of office of the Director of the Fund is 5 (five) years. A person may be elected to the position of director an unlimited number of times.

4.2. When deciding to create the Fund, the Directors of the Fund are elected by the Founders. After state registration of the Foundation, the Director of the Foundation is elected to the position and dismissed from it by the Presidium of the Foundation.

4.3. Decisions of the Director of the Fund on issues within the competence of this Charter are formalized in the form of orders of the Director of the Fund.

4.4. Director of the Foundation:

- is accountable to the Presidium of the Fund, is responsible for the conduct of financial, economic and other activities of the Fund and is authorized to resolve all issues of the Fund’s activities that are not within the exclusive competence of the Presidium;

- acts on behalf of the Foundation without a power of attorney, represents it in all government bodies, local governments, institutions and organizations;

- makes decisions and issues orders on operational issues of the Fund’s activities;

- manages, within the limits established by this Charter, decisions of the Presidium the funds of the Fund, enters into contracts, carries out other legal actions on behalf of the Fund, acquires property and manages it, opens and closes bank accounts;

- approves the organizational structure of the Fund, staffing and wages of the Fund's employees;

- hires and fires employees of the Foundation, approves their job responsibilities in accordance with the staffing table;

- exercises control over the activities of branches and representative offices of the Fund;

- organizes accounting and reporting of the Fund;

- approves the internal documents of the Foundation, with the exception of internal documents, the approval of which is referred by this Charter to the competence of the Presidium of the Foundation.

- makes decisions and issues orders on other issues within the competence of the Director by this Charter, internal documents of the Foundation, approved by the Presidium of the Foundation.

4.5. The Director of the Fund is obliged:

- in accordance with this Charter, conscientiously and wisely exercise their powers in the interests of the Foundation, ensuring that the Foundation achieves its goals;

- if there is a conflict of interests of him as an interested party with the interests of the Foundation, within a reasonable time, notify the Presidium of the Foundation about the conflict of interests.

4.6. The procedure for the activities of the Director of the Fund is determined by this Charter and internal documents of the Fund.

AUDIT COMMISSION OF THE FUND

5.1. The Audit Commission is the control and audit body of the Fund. The Audit Commission of the Foundation is elected by the Presidium of the Foundation from persons who are not members of the Presidium and the Board of Trustees of the Foundation. The term of office of the Audit Commission (Auditor) of the Fund is 3 (three) years.

5.2. The Audit Commission exercises control over the financial and economic activities of the Fund.

5.3. The Fund's Audit Commission must review the Fund's annual financial statements and submit an annual report to the Fund's Presidium.

5.4. The Fund's Audit Commission has the right to:

- have access to all documentation related to the activities of the Foundation;

- require persons included in the governing bodies of the Fund, the Director and employees of the Fund to provide the necessary explanations orally or in writing;

- if necessary, demand the convening of the Presidium of the Fund's participants and make proposals to its agenda.

5.5. The procedure for the activities of the Fund's Audit Commission is determined by this Charter and internal documents of the Fund.

BOARD OF TRUSTEES OF THE FOUNDATION

6.1. The Board of Trustees of the Fund is a body that supervises the activities of the Fund, the adoption of decisions by other bodies of the Fund and ensuring their execution, the use of the Fund’s funds, and the Fund’s compliance with legislation.

6.2. The first composition of the Board of Trustees is formed by the founders of the Foundation within a month from the moment of state registration of the Foundation. Subsequently, Members of the Foundation's Board of Trustees are elected by the Foundation's Presidium from among well-known, authoritative and respected citizens who contribute to the activities of the Foundation, upon the proposal of one of the members of the Presidium. The term of office of the Board of Trustees is 5 years.

6.3. The Foundation's Board of Trustees acts in accordance with the Regulations on the Board of Trustees, approved by the Presidium of the Foundation and the charter.

6.4. To carry out its supervisory functions, the Board of Trustees has the right to:

- have access to all documentation related to the activities of the Fund and require an audit of the financial and economic activities of the Fund;

- monitor the implementation of their powers by the governing and control and audit bodies of the Fund;

- check decisions made by the governing and control and audit bodies of the Fund for compliance with the current legislation of the Russian Federation;

- monitor the correct execution of decisions made by the governing and control and audit bodies of the Fund;

- exercise supervision over the Fund’s compliance with the current legislation of the Russian Federation and international treaties of the Russian Federation;

- exercise supervision over the use of property and other funds of the Fund;

- if necessary, demand the convening of the Presidium of the Foundation and make proposals to its agenda.

6.5. The Board of Trustees carries out its activities on a voluntary basis.

6.6. The Director of the Foundation, as well as persons included in other management bodies of the Foundation, cannot be members of the Board of Trustees.

6.7. The procedure for the activities of the Foundation's Board of Trustees is determined by this Charter and internal documents of the Foundation.

PROPERTY OF THE FUND

7.1. The Foundation has the right to own land plots, buildings, structures, structures, housing stock, transport, equipment, inventory, property for cultural, educational, sports, recreational and other purposes, cash, shares, shares, securities, information resources, results of intellectual activity and other property necessary to materially support the activities of the Foundation, in accordance with this Charter.

7.2. The Foundation has the right to use its property for the purposes determined by this Charter.

7.3. The Foundation, as an owner, exercises ownership, use and disposal of its property in accordance with the current legislation of the Russian Federation and this Charter. Participants of the Fund do not have real or obligatory rights in relation to the property transferred to the Fund in the form of deposits.

7.4. The Foundation may own institutions, publishing houses, and mass media created and acquired at the expense of the Foundation in accordance with the current legislation of the Russian Federation and this Charter.

7.5. The sources of formation of the Fund’s property may be:

- contributions from the founders of a charitable organization;

- charitable donations, including those of a targeted nature (charitable grants), provided by citizens and legal entities in cash or in kind;

- income from non-operating transactions, including income from securities;

- receipts from activities to attract resources (conducting campaigns to attract philanthropists and volunteers, including organizing entertainment, cultural, sports and other public events, conducting campaigns to collect charitable donations, holding lotteries and auctions in accordance with the legislation of the Russian Federation, selling property and donations, received from benefactors, in accordance with their wishes);

- income from legally permitted business activities;

- income from the activities of business entities established by the Fund;

- volunteer labor;

- other sources not prohibited by law.

7.6. The Foundation has the right to make any transactions in relation to property owned by it or under other proprietary rights in accordance with the current legislation of the Russian Federation, this Charter and the wishes of benefactors.

7.7. The Fund does not have the right to use more than 20 percent of the financial resources spent by the Fund for the financial year to pay for the administrative and managerial staff of the Fund. This restriction does not apply to the remuneration of persons participating in the implementation of charitable programs.

Unless otherwise specified by the benefactor or charitable program, at least 80 percent of a charitable cash donation must be used for charitable purposes within a year from the date the Fund receives the donation. Charitable donations in kind are directed to charitable purposes within one year from the date of their receipt, unless otherwise established by the benefactor or the charitable program.

STORAGE OF FOUNDATION DOCUMENTS AND PROVIDING INFORMATION ABOUT THE FUND'S ACTIVITIES

8.1. The Foundation is obliged to keep the following documents:

- Charter of the Foundation;

- decision of the Founder of the Fund on its creation;

- a document confirming the state registration of the Foundation;

- documents confirming the Fund’s rights to property on its balance sheet;

- internal documents of the Foundation;

- minutes of meetings of the Foundation's Board of Trustees:

- reports of the Audit Commission, conclusions of state financial control bodies based on the results of audits of the Fund’s activities;

- orders of the Director of the Foundation;

- accounting documents in accordance with the current legislation of the Russian Federation;

- other documents provided for by the current legislation of the Russian Federation.

8.2. The Fund, in cases, on the terms, in the composition and within the time limits established by the current legislation of the Russian Federation, is obliged, at the request of authorized government bodies, to provide them with information and documents about its activities for review. Information and documents about the activities of the Fund are provided to other persons in accordance with the current legislation of the Russian Federation, this Charter and internal documents of the Fund.

8.3. Information on the use of the Fund's property is made available to the public in the manner established by the current legislation of the Russian Federation.

8.4. The Fund ensures the recording and preservation of documents regarding the type of work, length of service and payment of employees hired under labor contracts or civil contracts. In the event of reorganization or liquidation of the Fund, these documents are promptly transferred to state storage in the prescribed manner.

REORGANIZATION AND LIQUIDATION OF THE FUND

9.1. The Fund may be reorganized by merger, accession, division, separation and transformation in the manner prescribed by the current legislation of the Russian Federation.

9.2. The Fund can be liquidated only by a court decision on the grounds and in the manner provided for by the current legislation of the Russian Federation.

9.3. The property and funds remaining after the liquidation of the Foundation are used for the purposes specified in this Charter.

PROCEDURE FOR MAKING CHANGES AND ADDITIONS TO THE CHARTER OF THE FUND.

10.1. The Charter of the Foundation may be amended by decision of the Presidium of the Foundation in the manner prescribed by current legislation.

10.2. Changes to the Foundation's charter are subject to state registration in the manner prescribed by current legislation.

Download the document “Charity Fund Charter”

Property fund and its formation

In practice, if an NPO is engaged in business, then the formation of property capital is its right, not its obligation. In such cases, the authorized capital of a non-profit organization is formed, the property of which still does not give the right to dispose of the profit received for further business activities or is not distributed among the founders of the company. That is, in fact, all profits should go to charity and to cover the expenses of the enterprise.

How does a non-profit foundation function? Features of his activities

Conducting activities is a very big issue.

I think it will be useful if I describe the activities of the foundation, using the example of a charitable foundation. I will break this voluminous topic into subsections. The founders created a non-profit foundation, appointed a director, opened a current account and are ready to start operating, hurray. Next, a program is developed, or goals for which funds need to be raised are determined. Let this be help for needy children for treatment. The first section appears:

Obtaining funding for the implementation of the fund's goals

I will list the main sources of funding for the fund, starting with the most popular:

- Charitable donations from individuals

- Charitable donations from legal entities

- Grants and targeted financing under agreements

- Income from income-generating activities

- Replenishment of property by founders or fund participants

These are the main sources of funding for the fund. It must immediately be said that at the stage of the fund receiving funds, it is necessary to determine their ownership. It is determined according to the basis of the payment, and accordingly it can go to a specific program (targeted funds) or to the statutory purposes of the fund. Receipts for the statutory purposes of the foundation are distributed by the foundation itself; the program or goals can be selected after receipt. Targeted funds initially go to the goals formed and often published on the website or in the media, and must be spent precisely on these goals.

In the case of Grants and targeted financing under agreements, it is described not only where the funds should be spent, but also how. Up to the indication of counterparties and specific recipients.

Next, the fund develops activities that would attract this same funding. At the first stage, the fund is financed by the founders, using these funds the following activities are already formed:

- Creation of a website for a Charitable Foundation, describing its activities and goals. We try to convey in an accessible form what the foundation has already done and what it wants to do.

- On the created website, a page is created with the fund’s payment details and a block for instant charitable payments (from plastic cards to all types of electronic currencies)

- Events are held that draw attention to the foundation and the problem it is trying to solve.

- Placing charity boxes, for example near store checkouts or in shopping centers.

- Volunteers and people who are ready to assist the foundation with deeds are invited.

- After a year of successful activity, the foundation is preparing to participate in grants.

- Negotiations are being held with large commercial and non-profit organizations on issues of targeted financing of the fund or joint implementation of common tasks.

It is not necessary to solve all these problems right away; in the opinion of the founders, the most interesting and promising ones are determined, after which they begin with them.

Distribution of collected funds by the fund

It’s worth saying right away that charitable foundations are subject to the law on charitable activities. They are required to transfer at least 80% of the donations received according to statutory purposes, for example, to help. Up to 20% is allowed to be spent on administrative and business expenses:

- Salary of director and staff

- Insurance contributions from salary

- Office rent and costs associated with its maintenance

- Accounting and legal expenses

- Bank fees associated with servicing a current account

- other administrative and business expenses

If administrative and business expenses amount to more than 20%, the founders are recommended to replenish the organization’s property. The founders contribute their own funds on the basis of “Founder’s contribution to replenish the organization’s property.” This contribution is not a charitable contribution and may be spent entirely on administrative expenses. It is important to remember that only the founders of the fund can do this.

Other foundations, such as development funds or defense funds, are not subject to charity law. It is important for them that the funds are fully spent within the framework of the foundation’s statutory activities, on targeted expenses.

Capital Accounting

The authorized capital of a non-profit organization is subject to accounting according to the same rules of accounting and tax rules and standards that are adopted for all enterprises in the country.

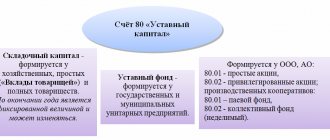

Capital formation is carried out using the 80th account, which is in the Chart of Accounts. The procedure for distributing property and money in the management company must be stipulated by local documents (Charter). Once the registration of an NPO is completed, all contributions received to the enterprise must be reflected in this account.

If contributions to the management company are made in kind (real estate or other property), then its value is determined by an agreement between the founders of the NPO. If the property is transferred for use, its value is determined in the amount of the rent.

All NPOs are required to report in the prescribed form on the annual movement of property. And non-profit enterprises belonging to state property must publish reports on property in the media.

Registration procedure and required documents

Step-by-step instructions for registering a fund consist of the following steps:

- Preparation, completion and signing of required documents.

- Payment of state duty.

- Notarization of the registration application.

- Submission of a package of documents to the local authorized body of the Ministry of Justice.

- Decision-making by the registration authority.

- Issuance of documents that are official confirmation of state registration.

The average duration of the procedure is one month. The fee charged for registration is 4,000 rubles.

Package of documents required for fund registration:

- Application RN0001 with signature, full name, permanent residence address and telephone number of the applicant (two copies). One copy must be notarized, the second must be bound and certified by the founder. Since the main activity of the fund is to receive and direct funds for statutory purposes, the OKVED code in the application is indicated as 65.23.

- Constituent documentation of the foundation (charter) in three copies. The charter of a registered fund, in addition to basic information, must include the name (directly using the word “fund”), the purpose of creating the organization, information about the governing bodies of the fund, reflecting the procedure for appointment to managerial positions and the procedure for dismissal from them, and the location of the registered fund. on the distribution of property in the event that a liquidation procedure is launched, Protocol on the founding of the organization (two copies): if there are two or more founders, it must be drawn up as a protocol of the meeting of founders; in the case of one founder, it must be drawn up as a decision of the sole founder.

- Address of the organization (two copies) - in the form of a lease agreement with copies of the certificate of ownership or letter of guarantee attached.

- Information about the founders of the organization (two copies), including the following information for an individual - full name, registration address and telephone number, for a legal entity - OGRN, TIN, full name, location address and telephone number.

- Original and copy of fee payment receipt.

All documentation submitted to the Ministry for registration must be stitched, numbered and signed on the firmware by the applicant. Submission of documents can be carried out either personally by the applicant or through an authorized representative (using a power of attorney executed in accordance with current legislation).

The fund registration process takes about 30 days. After this period, appropriate changes are made to the Unified State Register of Legal Entities, a certificate is issued and the fund is officially considered registered.

Further steps consist of registering with extra-budgetary funds, resolving issues with opening accounts, obtaining a seal and statistical codes and implementing other organizational measures.

Founders of funds, procedure for creating funds

The founders and participants of the fund are individuals and legal entities who, according to the law, have the right to form this type of non-profit organization. A fund can be created by a commercial or non-profit organization or a public legal entity.

Restrictions for certain categories of persons on the right to create a fund are set out in the laws and are mandatory. Local governments and state authorities cannot create funds. Also, they cannot be members of the organization, regardless of the type of fund.

The Law “On Charitable Organizations” fixes the provision according to which state authorities and local governments cannot be founders.

Since one of the properties of the foundation is the absence of the concept of membership, the composition of the founders of this organization cannot change. The creators of a legal entity can also be a single participant.