What it is?

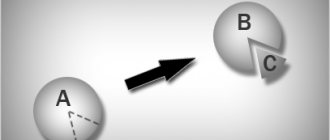

Transformation is a special type of reorganization, which is a change in the organizational and legal form of a company, while another legal entity is created, and the old one ceases its activities, the constituent documents and charter are changed, but all rights and obligations are retained after the procedure.

A significant difference from other types of reorganization, that is, merger, separation, accession, is that one legal entity begins to participate in the procedure and, as a result, one company is also formed .

The process has some features:

- From an economic point of view, the transformed organization is one and the same company, which has only changed its management structure and legal status, and no changes have occurred in other areas of the company’s life.

- From a macroeconomic point of view, such a reorganization is a neutral action in relation to capital, since there is no division or merger of the authorized capital of several companies. This nuance is the most significant difference. In other cases, assets and liabilities are either combined into one fund or divided among several organizations.

- From a legal point of view, during the transformation, a completely new enterprise is created, which is a complete successor to the obligations and rights of its predecessor. The book value of the property does not change.

There are two types of transformation:

- Voluntary . Carried out only on the initiative of the company owners. For example, the procedure can be carried out if the owners or founders come to the conclusion that the enterprise will operate most effectively in a different legal form. Most often, for this reason, an LLC is transformed into a joint stock company.

- Mandatory . It is carried out upon the occurrence of certain circumstances defined by law. There are several such cases: participants in a non-profit organization intend to conduct business, and it is transformed into a partnership or society;

- the number of participants in an LLC or CJSC exceeds 50 people, and it is necessary to reorganize the enterprise into an OJSC or cooperative.

Reorganization does not include a change in the type of joint stock company, for example, a transition from an OJSC to a CJSC. This action is recorded as a name change.

Peculiarities

The enterprise transformation procedure includes some features that should be taken into account before starting the reorganization:

| Reorganization in the form of transformation |

|

| The Civil Code of the Russian Federation establishes restrictions on changing the form of an enterprise |

|

| Change of ownership of the enterprise | Cannot be produced during enterprise reform. The composition is changed by a separate order. |

Also, a legal entity of any organizational and legal form must comply with the following requirements established by the Civil Code of the Russian Federation:

- name of the company;

- number of founders;

- minimum amount of authorized capital.

Regulation by law

The most important documents regulating the procedure are:

- Civil Code of the Russian Federation. The main types of reorganization, definitions, and features are established by Article 57 of the Civil Code of the Russian Federation.

- Federal Law No. 129-FZ of August 8, 2001 “On state registration of legal entities and individual entrepreneurs.” The procedure, necessary documents, nuances are indicated in Chapter V.

Other regulations establish some restrictions on the choice of legal form into which an existing enterprise can be transformed:

- LLC - into a partnership, a company of another type, a cooperative;

- private institution - to a foundation, non-profit organization, society;

- production cooperative - into a partnership, society;

- CJSC and OJSC - into LLC, non-profit partnership, cooperative.

When determining a new form, it is worth taking into account the requirements established by law for the amount of capital, the number of founders, etc.:

- A company cannot have one legal entity as its founder, which also has a single owner.

- The founder of a partnership must be registered as an individual entrepreneur if he is an individual.

- Minimum size of the capital: LLCs and CJSCs owe more than 10 thousand rubles;

- For OJSC this amount is equal to 100 thousand rubles.

- for partnerships - 2 or more;

"Primary" in the transition period

At the transformation stage, organizations are faced with the following problem: contracts with counterparties were signed by the predecessor, and the successor will have to work on them. Does this mean that new agreements or additions to them need to be concluded? Or is it enough to send out information letters indicating the name and details of the new organization?

We believe that such letters are quite sufficient. The fact is that when the organizational and legal form changes, the rights and obligations of the reorganized company are transferred to the newly emerged legal entity under a transfer deed (Clause 5 of Article 58 of the Civil Code of the Russian Federation). This also applies to contractual relationships. It turns out that no additional agreements signed by counterparties are required.

Acts of work performed, invoices and invoices should ideally be written out like this: up to the day of reorganization on behalf of the predecessor, on the date of reorganization and further on on behalf of the successor. But given that after the transformation, the terms of the contracts actually remained the same, it is permissible to begin drawing up a “primary agreement” on behalf of the new organization from the first day of the month in which the reorganization took place. At the same time, in our opinion, the numbering of primary documents can not be interrupted.

Step-by-step registration instructions

The procedure occurs in several stages in a certain order. Actions of the founders:

- Making a decision on reorganization . At the general meeting of all owners of the enterprise, the following issues are discussed: conditions of transformation;

- exchange of shares of participants or contributions to the authorized capital of a future enterprise;

- the charter of the new organization is agreed upon.

- receive creditors' claims for repayment of obligations, draw up a register of counterparties, amounts payable, etc.;

draw up and sign reconciliation reports with partners;

Based on this data, the founders draw up and approve the transfer deed. The absence of a document is the reason for refusal of state registration of the reorganization. The act states:

- general information about the enterprise;

- income statement;

- gear balance;

- explanations.

After all these documents are completed, they are submitted for state registration.

- deregister with the tax office, the statistics body, and extra-budgetary funds;

You can find out more detailed information about the stages of the procedure in the following video:

Waiting stage: we wait for the tax authorities’ decision and act on our own

Law No. 129-FZ obliges the “imputed” (as well as any reorganized legal entity), after making an entry in the Unified State Register of Legal Entities about the beginning of the reorganization procedure, twice with a frequency of once a month in the media (in which data on state registration of legal entities is published) notification of your reorganization. This rule is enshrined in paragraph 2 of Art. 13.1 of the said law.

Information contained in the Unified State Register of Legal Entities is published in the journal “Bulletin of State Registration” (Order of the Federal Tax Service of Russia dated June 16, 2006 No. SAE-3-09 / [email protected] “On ensuring the publication and publication of information on state registration of legal entities in accordance with the legislation of the Russian Federation on state registration").

The notice of reorganization should indicate information about each legal entity participating in the reorganization, the form of reorganization, and also describe the procedure and conditions for creditors to submit their claims. In addition, the “imputed” person must, within five working days after the date of sending the message about the start of the reorganization procedure to the Federal Tax Service, notify in writing the creditors known to him about the start of the reorganization.

State registration of the reorganized legal entity is carried out within the period provided for in Art. 8Law No. 129-FZ: no more than five working days from the date of submission of documents to the registration authority.

Required documents

The legislation establishes a list of documentation required for submission to the tax service. To register the transformation, the following documents of the liquidated enterprise must be submitted:

- Application on form P12001. The document must be signed by the applicant. Provided for each emerging company.

- A set of documents of the reorganized organization. It includes:

- TIN;

- charter;

- extract from the Unified State Register of Legal Entities;

- OGRN certificate.

statistics codes;

Originals or notarized copies are submitted to the Federal Tax Service. Documents are provided in two copies.

For a newly created company, the following information is needed:

- full and abbreviated name;

- activity codes;

- legal address;

- size of the authorized capital indicating the form of payment;

- details of the manager, name of his position;

- data of the chief accountant;

- data of the founders indicating their shares in the authorized capital;

- information about the bank in which the account will be opened;

- The contact person.

If these documents and information are available, the tax authorities register the reorganization of the enterprise.

Does the TIN change?

From a legal point of view, during reorganization, the enterprise ceases to exist and a completely new company is created. In this regard, all company details are changing.

During the procedure, the taxpayer number of the converted company is removed from the register. In the future, this TIN will no longer be used. The newly created enterprise is assigned a different number .

If the legal form changes without reorganization, the TIN remains the same. For example, when an OJSC is transferred to a CJSC, no changes are made in the tax service register.

Features of reorganization through transformation

The reorganization of a company in the form of transformation can be considered from three different points of view - economic, macroeconomic and legal. From an economic point of view, the transformed company is no different from the previous one.

The organizational and legal structure of the company, its internal structure, and management are changing.

Other areas of the organization's activities remain unchanged. From a macroeconomics perspective, transformation is a neutral process. The company's balance sheet remains unchanged. From a legal point of view, reorganization through transformation results in the formation of a new enterprise that inherits the assets and liabilities of the previous company.

Other nuances

Conversion is a rather complex procedure. There are a few more nuances, knowledge of which will allow you to carry it out without violations:

- The liquidated enterprise must draw up final financial statements as of the date preceding the day the reorganization was recorded.

- The new organization must provide introductory reports. It is compiled by transferring indicators from the final one.

- If an enterprise used a special tax regime, then after reorganization it can apply the simplified tax system or UTII only if it submits an application to the tax authorities.

- Small organizations wishing to switch to the simplified tax system or UTII can submit a corresponding application within five days from the date of creation.

- The duration of the procedure is approximately 2-3 months .

- To implement this, you can use the services of specialized companies.