general information

Financial operating activities can be carried out by: state, central, commercial and investment banks, currency and stock exchanges, non-state and state pension funds, electronic markets, insurance, trading and commercial companies, as well as individual individuals, both residents of the country and guests from abroad. If we analyze the activities of all of the above, we can derive two directions:

- Issue of securities (bonds and shares) and money (treasury bills and banknotes).

- Provision of financial services.

To carry out activities at the international level, a financial business partner is needed from the Russian Federation. Who is it? This is an institution that will act as an intermediary between the person conducting the activity and the international market. But enough talking in general, let's move on to specifics and look at examples.

Commercial Bank

This is an organization that engages in lending and depository activities. It accepts free funds from the population for safekeeping and gives them to those who need them (subject to the availability of opportunities to give away the money). The main income of banks is the difference between the interest received from loans and deposited on deposits. The activities of this structure can be divided into three categories: passive, active and intermediary. In the first case, the institution is engaged in raising funds. Active activities involve the placement of funds. And with intermediation, the bank simply carries out a series of transactions through its accounts.

Unfortunately, such knowledge is not enough to open your own financial institution. Now for this you still need to obtain a license, have 180 million rubles and approval from many structures. Nobody said it was cheap and easy - this financial business. Examples of the activities of commercial banks can be found almost everywhere in the Russian Federation.

Rule 1

Separate personal finances from your business

This rule is perhaps the first one that needs to be taken as a rule and which even experienced entrepreneurs do not always adhere to. It is important to separate cash flows when purchasing things needed for business and for personal use, cash for entertainment expenses and paying for dinner at a restaurant with friends.

Most often, this situation occurs when an entrepreneur works alone. "Who cares? Everything comes from one pocket and then ends up there!” Formally, yes, because you invest personal funds and take profits for personal needs. However, if you do not keep separate records, you cannot correctly assess the work of capital in your business, analyze costs, forecast expenses worse and, moreover, increase the risk that you will not even notice how the financial difficulties of the business become personal.

Stock Exchange

In theory, their main purpose is to determine the real value of assets, as well as to facilitate capital mobility. The basis for stock exchanges is supply and demand. Moreover, these are extremely sensitive indicators. Brokers closely monitor even the most minor changes.

In the case of a stock exchange, you can be either a participant (broker) or the owner of a representative company. And it is still unknown what is more difficult. In the case of a broker, you have to constantly monitor the price. After all, when we are talking about thousands or millions of shares, even the smallest fluctuation matters. To facilitate their own work, they unite under the banner of a brokerage firm. The owner’s task is to ensure the selection of highly qualified and experienced employees who will not allow the company to go bankrupt, and will also ensure an influx of customers.

Financial consulting of the company - main tasks

The service may be in demand if it is necessary to resolve the following issues:

- maximizing the efficiency of using the company’s financial resources;

- creation of a reserve fund necessary both for the current activities of the organization and for its future development;

- optimization of the distribution of financial flows in the revenue and expenditure parts of the company’s budget;

- reorganization or liquidation of internal departments that demonstrate the worst performance results;

- solving problems associated with ineffective management processes, building a new management paradigm;

- minimizing any potential risks related to the financial side of the company’s activities (in particular, the fight against possible bankruptcy);

- increasing profitability, ensuring stable growth rates of economic potential;

- searching for new promising areas for the company’s activities to replace current ineffective ones;

- assessment of already made financial decisions based on their effectiveness, correction of mistakes.

Thus, all consulting tasks can be grouped into two large categories - issues of finding external and internal financial resources and issues of the most effective use of these resources to achieve the tactical and strategic goals of the company. It is worth listing the specific tools used to solve these problems.

Some universal features

Each organizational structure has its own specific activities. But there is one thing that unites any financial business. Examples of this will now be given. These are profitability, high risks and computerization. It should also be noted that more and more sections of the population are being attracted to this activity. Thus, according to some data, approximately 45% of the population participates in stock exchanges in the United States. In the Russian Federation, such a contingent is limited to two to three thousand people. But the lending market is more developed. And although it is more difficult to get money now than it was, say, in 2007, it is still possible. In this regard, the coverage of the population of the Russian Federation is more significant. But let's continue to look at the financial business, examples of activities, as well as its strengths and weaknesses.

Consultant's blog

Content

hide

1 What is accounting and finance?

2 Evolution of financial management

3 Basic business processes of the enterprise

4 Automation of accounting and financial tasks

5 What makes companies think about financial automation?

6 When should you start automation?

7 How to evaluate the effectiveness of financial automation

What is accounting and finance?

One of the main goals of doing business is to make a profit. Simply put, profit is the difference between income and expenses for a certain period. How can you find out how the enterprise worked and whether it is profitable?

The answer to this question is provided by accounting and finance, which are an important part of the activities of any enterprise.

Accounting involves collecting, analyzing and presenting financial information to users. This information is needed by those who make decisions and develop plans for the development of companies, as well as those who manage these companies.

For example, business executives use accounting information when deciding whether they should:

• develop new products or services (for example, a computer manufacturer may analyze this information and decide to develop a new line of computers); • raise or lower the price of its products, or increase or decrease production (for example, a telecommunications company may change the rates for calls and text messages sent to cell phones); • take out a loan to expand the business (for example, a supermarket can take out a loan to expand its network of stores); • increase or decrease production capacity (for example, an agricultural enterprise may change the size of its herd); • change purchasing, production or distribution methods (for example, a clothing manufacturer might change from UK to overseas suppliers).

Accounting information allows you to identify and evaluate the financial consequences of such decisions.

Important consumers of accounting information about a company are its managers. Of course, this information is of interest not only to them. And there are users outside the company who need this information to decide:

• whether to invest your funds in this company or, conversely, get rid of its shares; • whether to provide her with a loan; • whether to enter into a supply contract with her. Sometimes it seems that the main task of accounting is to produce financial statements on a regular basis. Accountants do do this kind of work, but it is by no means an end in itself.

The ultimate goal of an accountant's job is to provide users with quality information that can be used when making decisions.

Like accounting, finance (or financial management) exists to facilitate decision making.

Finance is the study of how companies raise capital and make investments. Finance relates to all the most important aspects of a company's operations. After all, companies, in essence, are created to attract capital from investors (their owners and creditors) and its further investment (in equipment, buildings, inventory, etc.) in order to make a profit and enrich their owners. It is important that a company can raise capital in a way that suits its needs. Knowledge of finance helps determine:

• possible types of financing; • costs and results for each type of financing; • risks associated with each type of financing; • the role of financial markets in financing companies.

Having received capital, the company must invest it in such a way as to generate income. Knowledge of finance allows you to evaluate: • return on investment; • risks associated with these investments.

One of the most common misconceptions of entrepreneurs is that they believe that everything related to numbers, any indicator that they need, should be known and calculated by an accountant. That's understandable. An accountant is the first financial specialist a business encounters. He appears in the company at the very early stages of business and accompanies all its activities. But the problem is that it has a slightly different function. He is not obliged to consider, plan and analyze what is not within his direct competence.

As a result of this, management very often reproaches their accountants for being incompetent and they cannot find a terminator accountant who will do everything management needs for his small salary and do it efficiently.

But it must be remembered that finance is not accounting. Finance is planning, management accounting, control and analysis of the economic condition of the company. Accounting is only a part of finance.

Read: How to analyze a company's solvency?

It is not the accountant or even the financial director who is generally responsible for the company's finances. The direct management of the company is responsible for this. A financier is simply a hired employee who does what you tell him and he will give you the information you ask for.

The manager’s task is to formulate and set the task, monitor and accept the result.

Evolution of financial management

Any business goes through several stages in its development. At each of these stages, finance and accounting are present, regardless of how they are organized.

Any organism: it is born, develops, reaches the peak of its growth and decays, in other words, it goes through certain stages of its life cycle.

Together with the company, the company’s financial management grows and develops, which also goes through certain stages of development:

Stage 1. Startup.

At this stage, few people think about finances. The business is just beginning, forming, and earning its first money. At this stage, the main thing is to record cash transactions.

Stage 2. Small business

Since the company is already operating, there is a need to start maintaining accounting records. An accountant appears at the company, whose main goal is to submit reports to regulatory authorities.

Stage 3. Small and medium businesses.

The company is growing and developing and there is already a need to prepare financial statements, in order, for example, to be able to attract financing. Here the need to do financial planning already arises. Although few people do it.

Stage 4. Medium and large business

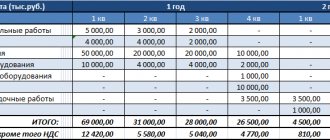

In order to effectively manage a business, full financial management, including budgeting and drawing up payment calendars, becomes a prerequisite.

You need to start establishing a system and order in finance as early as possible, in which case finance will scale and develop along with the business.

Basic business processes of the enterprise

Any business is a set of business processes.

A business process is a set of interrelated activities or work aimed at creating a specific product or service for consumers.

There are three types of business processes:

Managers are business processes that control the functioning of the system. An example of a management process is Corporate Governance and Strategic Management. Operational - business processes that constitute the company's core business and create the main revenue stream. Examples of operational business processes are Procurement, Manufacturing, Marketing, Sales and Debt Collection. Supporting - business processes that serve the main business. For example, Accounting, Recruitment, Technical support, administrative department.

“Financial” business processes in most companies are auxiliary or servicing. Their task is to help the sales, production, logistics, supply, and administration functions generate maximum profits by rationally using the company’s working and fixed assets, that is, to facilitate the process of making money. The assistance consists of assessing the impact on profits of certain management decisions, ensuring the optimal amount of financing for operating activities at an acceptable cost, controlling the amount of costs and working capital, and monitoring indicators of achieving strategic goals.

To perform these tasks, several basic processes must be established in the financial function:

- long-term planning of the company's cash flow and profit;

- current financial planning and working capital management;

- operational cash flow management;

- management operational accounting;

- costing, cost management, controlling;

- providing financing for operating activities, investment projects, working with lenders and investors;

- analysis of economic activities.

- accounting.

This is a very broad classification. Each of these processes consists of many subprocesses, which also consist of their own processes.

Automation of accounting and financial tasks

For a long time now, no one has been keeping accounting records manually, and for many enterprises it is automated, which cannot be said about company finances.

There are now many solutions for automating finance and accounting on the market. Moreover, such solutions can be classified as follows:

- solutions for automating certain areas - for example, budgeting or drawing up a payment calendar;

- accounting automation solutions – software for accountants, which is intended primarily for accounting and reporting, but some companies are trying to adapt it for financial management;

- ERP systems that are designed to automate the entire business, including accounting and financial management.

Automation is now almost a mandatory condition for the activities of companies and sooner or later everyone thinks about it. As a rule, the first step of automation is either the implementation of accounting programs or the implementation of CRM systems, of which there are a great many on the market now.

Read: Break-even analysis (CVP analysis) and profit planning

Probably the most popular accounting program in the CIS is 1C, to which almost all accountants are accustomed. But modern trends, especially in Ukraine, force business owners and managers to look for alternatives. And the first thing their eyes fall on is ERP systems, of which there are also many on the market now.

The first thing that stops you from implementing ERP is their price, which is especially prohibitive for small businesses.

But even if ERP is free or shareware, this does not eliminate other problems when implementing such systems.

Such problems are:

- The clients themselves;

- Poor ERP system;

- Errors on the part of consultants during implementation.

If we talk about clients , then the success of implementation is influenced by the form of ownership and the number of employees.

At state-owned enterprises, for example, the chances of successful implementation are very low, since no one there is essentially interested in the new software. And how this happens is known to everyone, and who wins the tenders too.

As a rule, the more employees there are in an enterprise, the lower the chances of successful implementation. The chances increase with a decrease in the number of employees, since the smaller the company, the more time the company’s immediate management can devote to implementation issues.

Another problem is low-quality ERP systems, especially for little-known systems, which, however, according to their developers, are unique and solve all the problems of the enterprise. Owners are attracted by the price of such systems, but as practice shows, they later greatly regret their decision to implement them.

Environments and ERP systems that have shown their viability, for example, include Oracle, SAP, Microsoft Dynamix, ODOO, which are generally recognized world leaders.

The cost of implementing some ERP systems can be very high - this is the main reason for refusal of implementation among many business representatives.

Among the free (or shareware) ERP systems, we can highlight ODOO, which is distributed completely free of charge and can even be installed on your local computer. You can download it from the link – https://www.odoo.com/uk_UA/page/download

But one way or another, you will have to incur some expenses, which include renting a server, paying consultants, paying developers, especially if you want to “finish” the existing functionality, make some kind of report or printed form of a document. In addition, since ODOO is Open Source, developers from all over the world make a bunch of modules for it that expand the functionality of the system, but you shouldn’t mindlessly install everything on your system, since some modules can simply ruin your system.

In Ukraine, this system is becoming more and more popular every year and attracts more and more attention. In 2020, an association was even organized that united developers, business analysts and people who were simply interested in this system. One of the reasons for creating this association is to give confidence to businesses that they will not be left alone with an ERP system during or after implementation.

So, the advertising minute is over, let's now move on to automation of accounting and finance