What form of salary certificate is valid in 2020? Many people mistakenly believe that

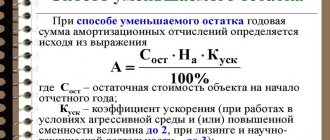

Scope of application of the method The reducing balance method of depreciation is a technique that allows you to measure the cost

Legal basis The Labor Code regulates such an event as a reduction in the number or staff of employees in

Hello to all my readers! Today I'm answering a question from several readers, but I'm doing this

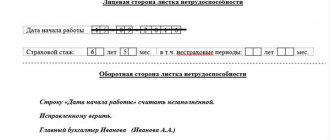

Why are codes written on sick leave? The certificate of incapacity for work contains a lot of data, without which

Writing and selling articles is one of the popular ways to make money online. Everything, that

Despite the abundance of financial institutions, banks are still the most popular place where

The 21st century has seen rapid development of the entire digital industry. Business in the field of IT technologies

In this material: Description and relevance of the business idea Description of the product and its varieties Production technology

Who should pay the simplified tax system for 2020? You need to pay a single tax according to the simplified tax system.